How to Buy City Lodge Shares in South Africa – With 0% Commission

Launched in 1985 in Randburg, City Lodge Hotel Group (JSE: CLH) is a multi-brand hotel chain with a portfolio of more than 55 hotels, located in South Africa, Kenya and Botswana. The company is one of the top 250 hotel chains in the world, with over 7,000 rooms and suites. But, with the hospitality industry taking a hard hit from the recent pandemic, are City Lodge shares a good investment in 2022?

In this article, we explore how to buy City Lodge shares in South Africa, looking closely at the company’s market performance and how you can invest in City Lodge without paying a penny in commission today!

How to Buy City Lodge Shares in South Africa – Step by Step Guide 2022

If you want to buy City Lodge shares in South Africa without delay, then these easy four steps will show you how to do so in a matter of minutes from the comfort of your own home.

- Step 1: Open an account with Capital.com – Navigate to Capital.com’s website and click on the ‘Trade Now’ button. Enter your email address and select a password for your brokerage account.

- Step 2: Upload ID – As part of the KYC regulations, you will need to provide proof of identity and address such as your passport and a recent utility bill.

- Step 3: Deposit Funds – Deposit funds via credit/debit card, bank transfer, or e-wallet.

- Step 4: Buy City Lodge Shares – Search for ‘City Lodge’ in the search bar and click ‘Buy’. Enter your preferred investment amount and click ‘Place Order’.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Step 1: Choose a Stock Broker

With such an array of online stock brokers to browse through, choosing the right trading platform to suit your trading needs and goals can be challenging. To help you, we’ve reviewed two of the top-rated and regulated brokers for investing in City Lodge shares below. With either of these widely popular stock trading brokers you can buy City Lodge shares with 0% commission anytime and anywhere from your mobile smartphone.

1. Avatrade – Trade City Lodge Shares in South Africa with 0% Commission

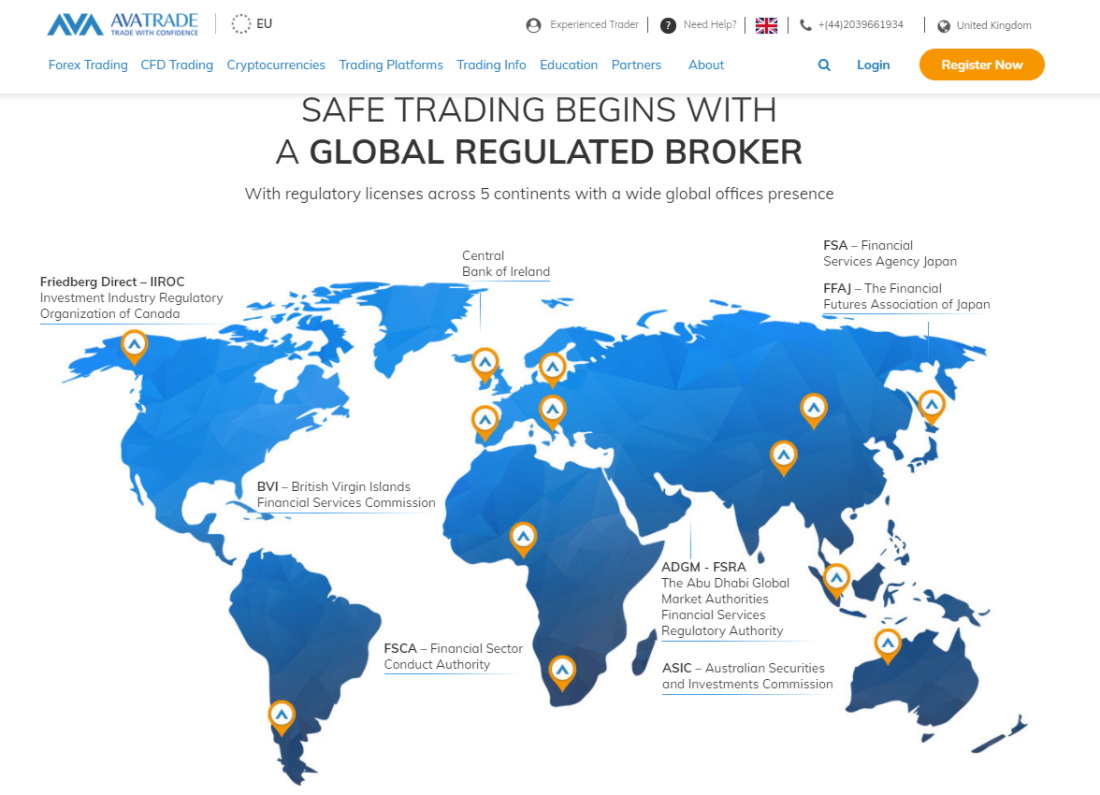

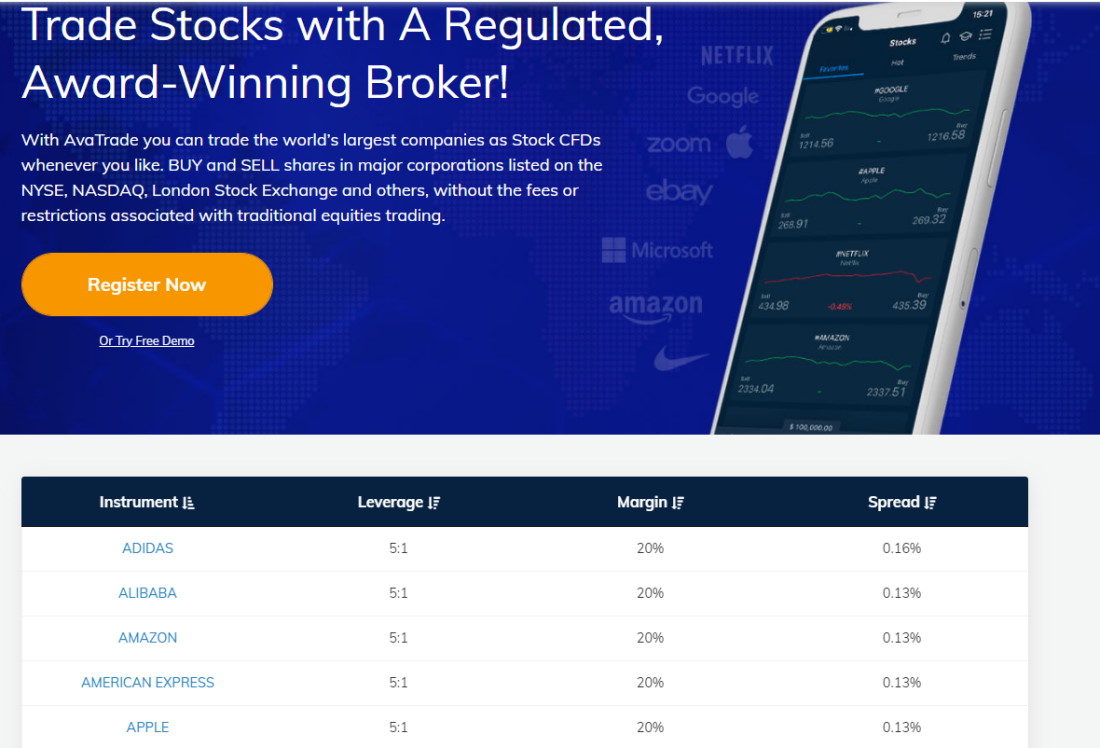

Founded in 2006, AvaTrade is a popular forex and CFD broker that is authorized and regulated by several top-tier financial bodies including ASIC and the Central Bank of Ireland, and South Africa’s FSCA, to name a few. At AvaTrade you can buy and sell CFDs, forex, and cryptos on a $0 commission basis.

AvaTrade users have access to a wide range of CFD products including stocks, bonds, commodities, ETFs, and indices. This online broker also supports forex trading and crypto CFDs. Given the fact that AvaTrade is a global CFD broker, you will be able to speculate on the future price of the underlying stock, with 0% commission and some of the industry’s tightest spreads.

If you’re looking to trade via multiple trading platforms then you’ll be pleased to learn that AvaTrade supports a myriad of the most popular platforms such as MT4 and MT5, AvaSocial, AvaTradeGo, mobile trading and more.

As for non-trading fees, AvaTrade does not charge account, withdrawal, or deposit fees. However, AvaTrade account holders are subject to a $50 inactivity fee after three consecutive months of inactivity. There is a wide range of payment methods to choose from when depositing funds as AvaTrade accepts credit cards, wire transfers, and e-payments including Skrill, WebMoney, and Neteller.

Is AvaTrade safe? This top-rated CFD broker has a strong international presence and is regulated by several top-level financial regulators including ASIC, CySEC, the Central Bank of Ireland, the Financial Sector Conduct Authority in South Africa, and more. Clients’ funds and personal data are protected by 256-bit SSL encryption throughout the site, and all customers’ funds are held in segregated bank accounts.

Pros:

Cons:

71% of retail investor accounts lose money when trading CFDs with this provider.

2. Capital.com – Popular CFD Broker to Buy City Lodge Shares in South Africa

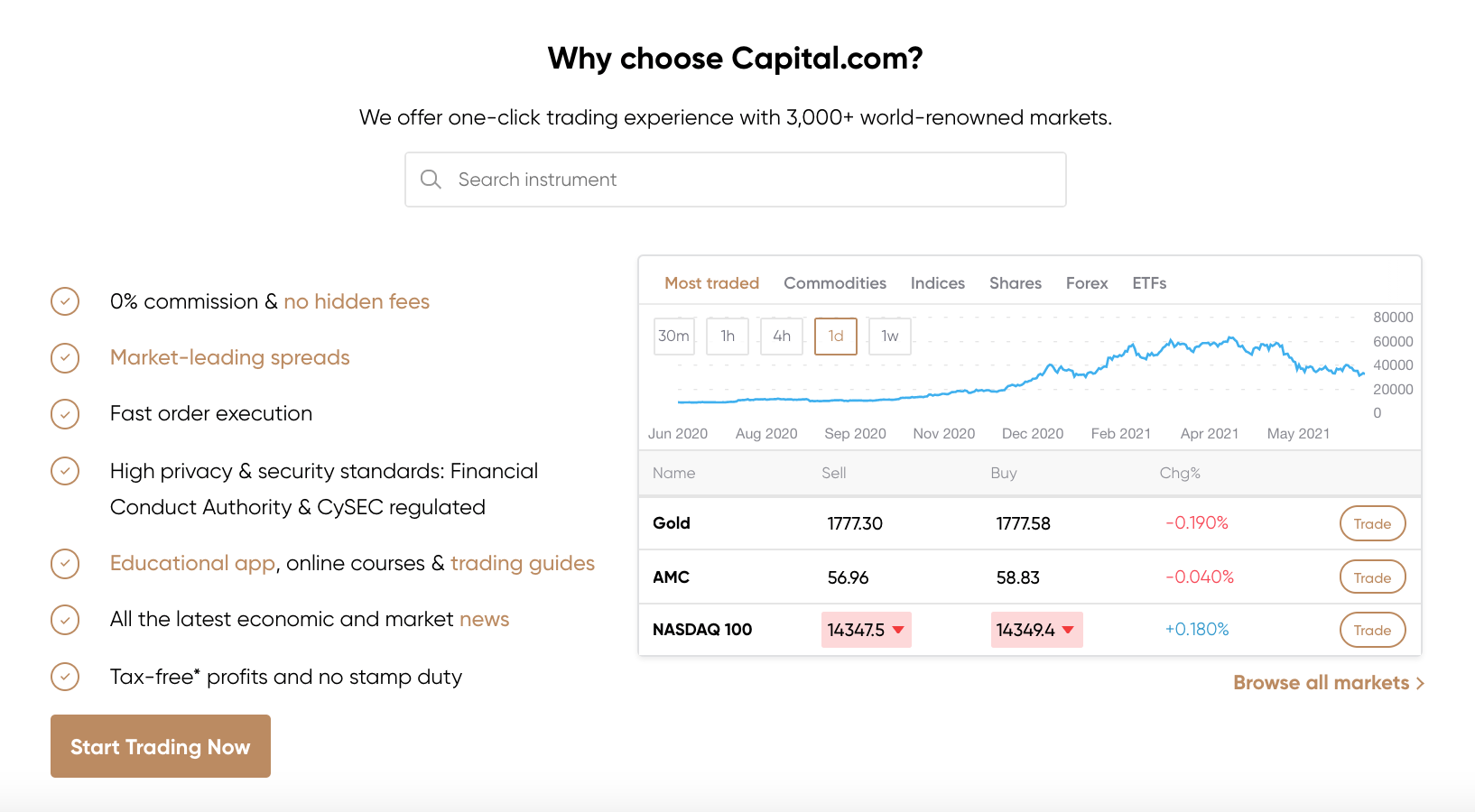

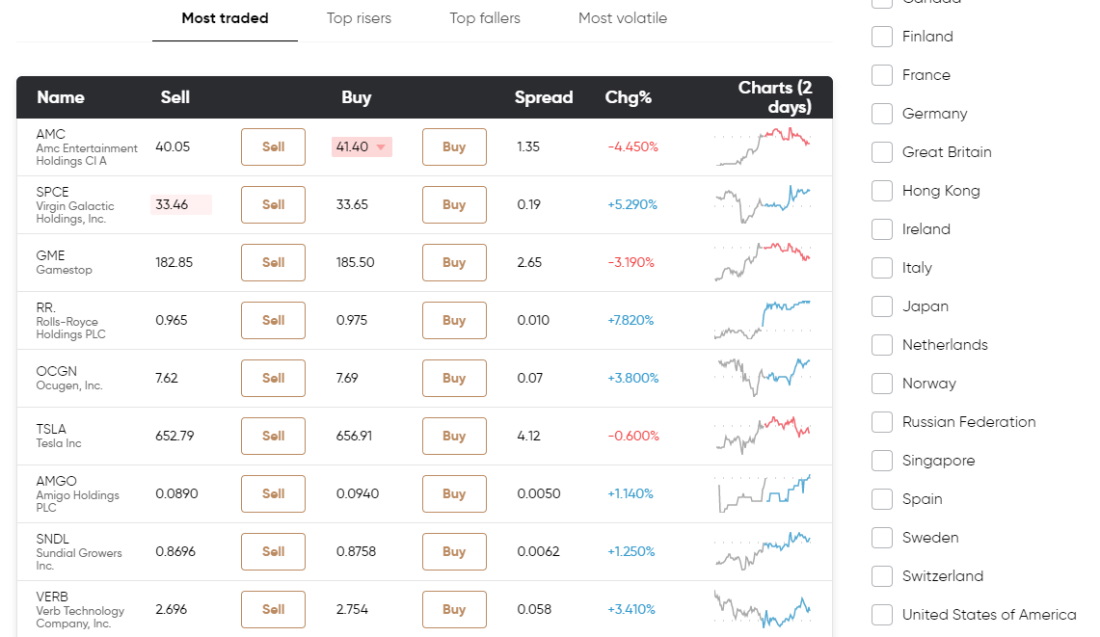

Capital.com is another one of the best CFD brokers to buy City Lodge shares in South Africa. This CFD and forex broker was established in 2016 and has a variety of CFD products on offer such as 3,000+ stock CFDs, and 140+ forex CFDs. In terms of supported trading platforms, Capital.com traders can use MetaTrader 4, a fully-fledged mobile stock trading app, TradingView and Investmate. Capital.com provides a user-friendly trading platform, with tons of useful features including webinars, an economic calendar, as well as real-time financial news.

One of Capital.com’s best selling points is its low-cost trading fee rates. This means you can buy stock CFDs with 0% commission and market-leading spreads, which is the difference between the bid and ask prices. Furthermore, when it comes to non-trading fees, there are no deposit, inactivity, account, or withdrawal fees to worry about.

At Capital.com you can choose from three CFD account types all with leverage of up to 30:1 and negative balance protection. Also, the minimum deposit when using a debit card, credit card, or e-wallet is just $20 or 274 ZAR.

Despite not being able to invest in stocks in the traditional sense, at Capital.com you can speculate on the price movements of over 2,000 shares with leverage of up to 5:1, and identify unique trading opportunities with 75+ technical indicators. You can also stay updated with regards to recent price movements and economic events by setting convenient price alerts on the Capital.com mobile trading app that sends real-time push notifications straight to your mobile device.

Is Capital.com regulated? Capital.com is regulated and authorized by multiple top-level financial authorities including the UK’s Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). This ensures that your funds are covered should the broker go into insolvency and that anti-money laundering and anti-fraud measures are adhered to.

Pros:

Cons:

75.26% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Step 2: Research City Lodge Shares

To buy shares in City Lodge, its standard practice amongst the top investors and traders to conduct thorough research into the company’s fundamentals and past performance to weigh up the risk to reward ratios and moreover, to determine whether it’s a good investment material for the long term.

What is City Lodge Hotels Ltd (CLH)?

Currently priced at 366.00 ZAR with a market cap of 2.23B ZAR, City Lodge Hotels Ltd was founded in 1985 and is listed on the Johannesburg Stock Exchange (JSE). City Lodge Hotel Group is a multi-brand hotel groupthat owns 57 hotels, the majority of which are in South Africa, with two in Kenya and one in Botswana. The company is one of the world’s top 250 hotel chains, with more than 7,000 rooms and suites.

Hans Enderle, a Swiss-born entrepreneur, founded the company with the launch of City Lodge Randburg, with a focus on quality accommodations, a welcoming atmosphere, and pleasant service. After opening additional City Lodges, the company introduced the hugely successful second-tier Town Lodge project in 1990. Since 1992, City Lodge shares have been traded on the floor of the Johannesburg Stock Exchange (JSE).

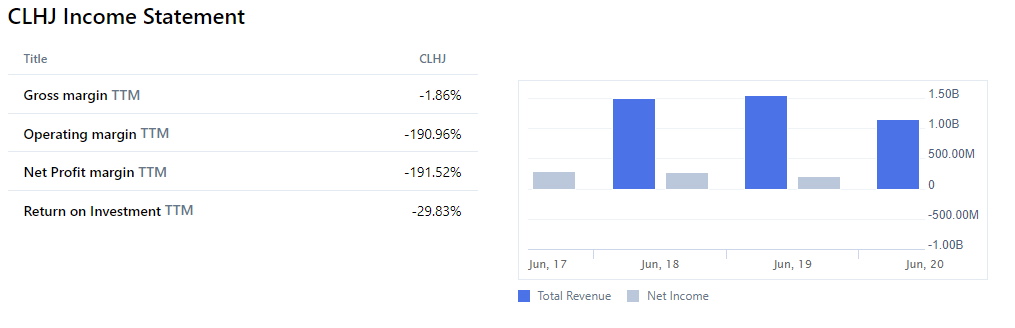

City Lodge owns 17 City Lodge hotels, 12 Town Lodge hotels, 22 Road Lodge hotels, 5 Courtyard hotels, and the Fairview Hotel. In 2016, the company had a total revenue of ZAR 1,493.16 million. Since then, the company’s total revenue has been increasing with the figure reaching ZAR 1,547.98 million in June 2019. However, as the Covid-19 pandemic continues to disrupt tourism and travel sectors, City Lodge’s total revenue fell to ZAR 1,159.28 million, representing a drop of -25.11014% from the same period last year.

City Lodge Share Price

When researching the best shares to buy in 2022, you must take a look at past performance and other fundamental data to see where the market price’s highs and lows. This way you can better gauge where the price could potentially reach in both the short and long-term. At the time of writing, City Lodge’s market price is 366.00 ZAR which represents an increase of +0.55% from the previous market price.

Since the fourth fiscal quarter of 2020, City Lodge Hotels Ltd’s revenue fell 73 percent to RAN 215.6 million. The net loss was RAN 550.4 million, compared to a profit of RAN 46.3 million. Revenues indicate a 74 percent drop in the City Lodge segment to RAN 109.1 million.

On the 3rd of August 2020 City Lodge split its stock by a ratio of 4.865:1. The all-time high City Lodge stock price was recorded on the 1st of February 2018 at 3,512 ZAR. When we compare this to the current market price of 366.00 ZAR we can conclude that CLH stock market price has plummeted by -89.5786% in the space of just three years. Given its steady rate of growth, in the last three years the stock price of City Lodge Hotels Ltd has suffered a huge landslide with many investors opting to sell their shares rather than hold and risk losing more money.

City Lodge Shares Dividends

Investing in shares of a dividend-paying company is an effective way to invest money to generate a regular flow of income. Typically, City Lodge would pay a dividend twice per annum to its shareholders – once in March and again in September. Nonetheless, its last dividend payout was on March 11th, 2020, with no dividend payments made in September 2020, or March 2021.

On the 11th of March 2020 the dividend was 31.45, with an EPS payout ratio of 0% and a dividend yield of 9.14%.

When browsing for dividend stocks, it’s important to remember that a high dividend yield alone does not necessarily constitute a good investment. Before you buy into any dividend-paying stocks, there are a few things you need to bear in mind:

- Rate of dividend growth – You need to ask yourself if the company has a reputable history of rising earnings with regular dividend payouts to its stakeholders.

- Financial flexibility – Another important factor to consider is whether the company has a reasonable debt load compared to its competitors and whether it has an investment-grade credit rating.

- Contingency plans and funding – Is there enough cash reserved for economic downturns and other political or natural events that impact investor sentiment and the financial markets?

Many investment analysts are closely monitoring whether City Lodge will resume its dividend payments in September 2021.

Are City Lodge Shares a Good Buy?

In December 2020, global hotel chain City Lodge, which raised R1.2bn via a rights offer, announced that its hotels were running at 37% capacity, which marked a huge turnaround from the low 7% occupancy levels it experienced in Q2 2020.

The company said that it is confident as it has been seeing steady growth in the aftermath of the pandemic-driven lockdown which brought the hospitality sector to a grinding halt. The company has told its shareholders that it has been paying 70% of pre-pandemic salaries since Q4 2020.

Step 3: Open an Account & Buy Shares

To buy City Lodge shares in South Africa with 0% commission you are going to need to open an account with a trusted and regulated online broker. We recommend Capital.com as it supports a wide range of payment methods, is fully regulated by several financial authorities and offers market-leading spreads on its CFD instruments. In this section, we’ll show you how to open an account and buy City Lodge shares from the comfort of your own home!

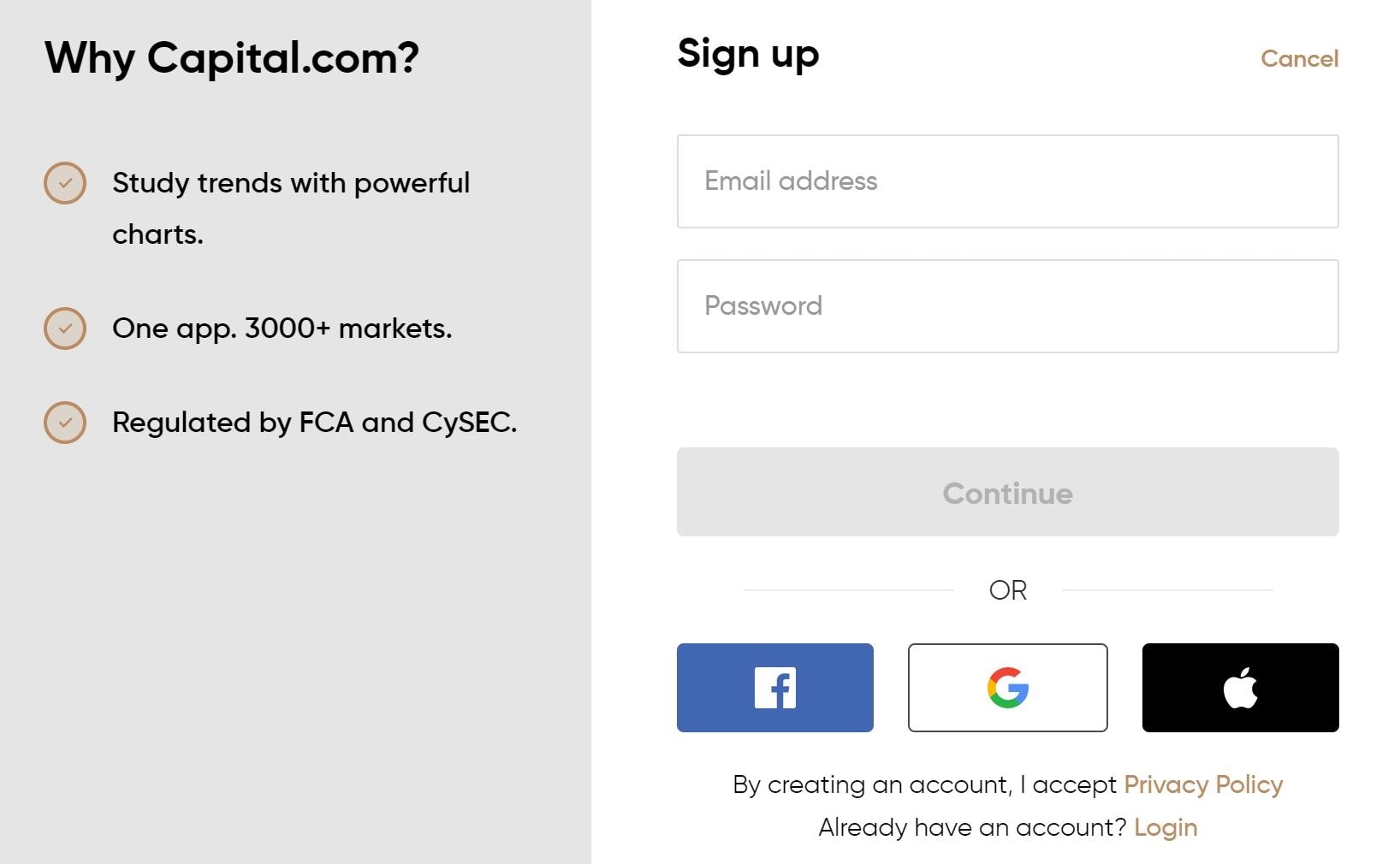

Step 1: Open a Capital.com Account

Go to Capital.com’s official page and click the ‘Trade Now’ option in the top right-hand corner of the screen. Fill in the required information with your email address along with an account password. You can also open an account with the user-friendly Capital.com mobile app which is one of the best trading apps available for beginner traders.

75.26% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Step 2: Verify your Account

As Capital.com complies with regulations set by financial authorities you will need to undergo a KYC (know your customer) process which involves uploading copies of your passport and bank statements to verify both your identity and address. Capital.com typically reviews the documents within 48 hours, and you will receive a confirmation email once the process is complete.

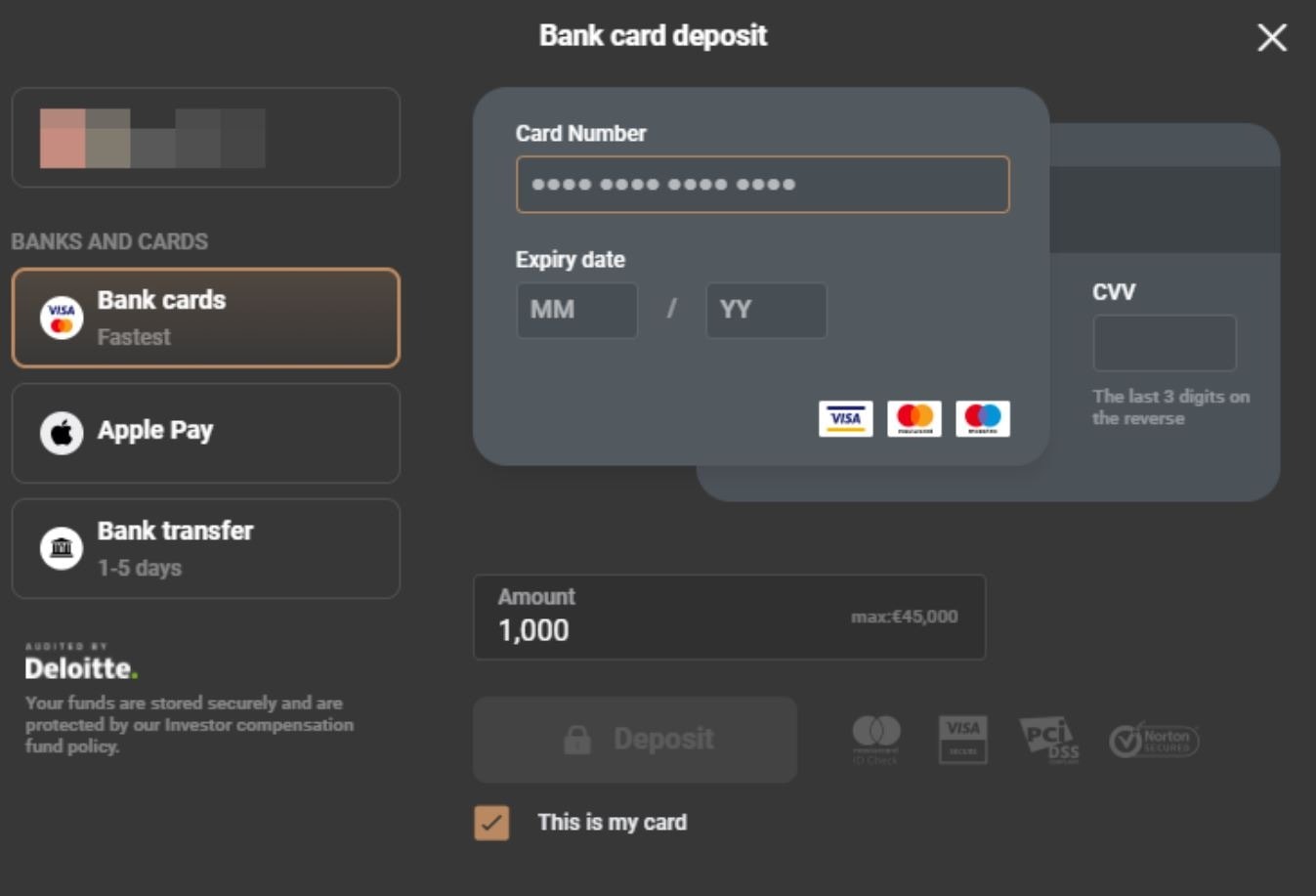

Step 3: Fund your Account

The next step involves depositing funds into your account. With a minimum deposit of just $20 or 274 ZAR, the deposit process is simple and easy at Capital.com, not the least because this globally renowned CFD broker supports a huge selection of payment methods including debit cards, credit cards, Bank Wire Transfer, Sofort, iDeal, Giropay, Multibanko, Przelewy24, QIWI, Webmoney, ApplePay, Trustly, 2c2p, or AstropayTEF.

Step 4: Search for City Lodge Hotels Ltd (CLH)

Type ‘City Lodge’ or CLH into the search bar in the top left corner of the page and click ‘Buy’ when the company appears in the list of relevant results.

Step 5: Buy City Lodge Shares

Using the order window you can now enter the amount you want to invest in City Lodge shares and choose to use up to 5:1 leverage.

After you’ve double-checked everything, click ‘Place Order’ to invest in City Lodge shares with a Capital.com live trading account. And the best part is you don’t have to pay a single penny in commissions!

75.26% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

City Lodge Shares Buy or Sell?

Despite declining business sentiment in South Africa, City Lodge has increased occupancy and hopes that this trend will continue as the economy begins to find a foothold. In summary, City Lodge claims to have outstanding cost management and regular profit growth, which should give investors enough incentive to invest in City Lodge shares in South Africa.

In terms of the company’s plans for development and expansion, the hotel chain has its sights set on Kenya, Namibia, Tanzania, Mozambique, and Uganda as key areas where it wants to build new hotels to capitalize on the slow but steady recovery of the global economy.

According to Morningstar, City Lodge Hotels Ltd (JSE: CLH) also has an ESG risk rating of 28.23.

How to Buy City Lodge Shares in South Africa – Conclusion

In summary, City Lodge’s share price seems to be on a recovery path as the economy steadies amidst the aftermath of the pandemic. With tourism and travel slowly picking up pace, and the hotel chain reporting higher rates of occupancy this could lead to improved revenues for the company and potential dividend payouts for shareholders.

If you’re interested in buying City Lodge shares today, we suggest signing up for a Capital.com trading account. With competitive fees and zero commission, Capital.com is the best trading platform to buy stock CFDs for beginners.

Capital.com – Buy City Lodge Shares With Zero Commission

75.26% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.