How to Buy Netflix Shares in South Africa – Beginner’s Guide

Netflix has been one of the top performing growth stocks of the last two decades. It’s also in an enviable position as the leading streaming video platform in the world, with a large budget for content.

If you would like to know how to buy Netflix Shares in South Africa, this guide will take you through the process of choosing a broker and investing in Netflix shares. It also gives you an overview of Netflix and its business and the prospects for the share price.

How to Buy Netflix Shares CFDs in South Africa – Step by Step Guide 2022

If you are wanting to know how to buy Netflix Shares CFDs in South Africa in less than 10 minutes, follow these steps and you will be a shareholder in no time.

- ✅ Step 1: Open an Account with Libertex

Libertex is reputable for its sizable collection of popular stocks and offers competitive prices. To sign up, head over to the Libertex website and click on ‘Open an account to create a new account. - 🔎 Step 2: Verify your account

Before you fund your Libertex account you will need to verify your identity by uploading a copy of an official identity document. You will also need to verify your address by uploading a copy of a utility bill. The team will then verify your account in a matter of minutes. - 💳 Deposit Funds

Before you can make an investment you will need to deposit funds into your account. You can fund your account with a credit card, debit card, e-wallet or bank transfer. - 🛒 Buy Netflix Shares CFDs

Search for Netflix using the search bar at the top of the home page. When you find it, click on ‘Buy’ and you will be directed to an order entry page. You can enter a cash amount or the number of shares you want to buy. Then click on ‘Open Trade’ and your order will be executed. You are now an NFLX shareholder, and you know how to buy Netflix shares CFDs in South Africa.

74% of retail investors lose money when trading CFDs at this site

Step 1: Choose a Stock Broker

If you want to buy shares of global companies like Netflix, your first step is to choose a stockbroker.

When choosing a broker, you will want to consider the range of trading instruments available, the safety of the platform, and the trading costs you will be charged. Since Netflix trades on the NASDAQ exchange in the US, you will need a stock broker with NASDAQ shares.

We have reviewed all the top brokers and recommend the following two brokers for buying Netflix shares or CFDs in South Africa

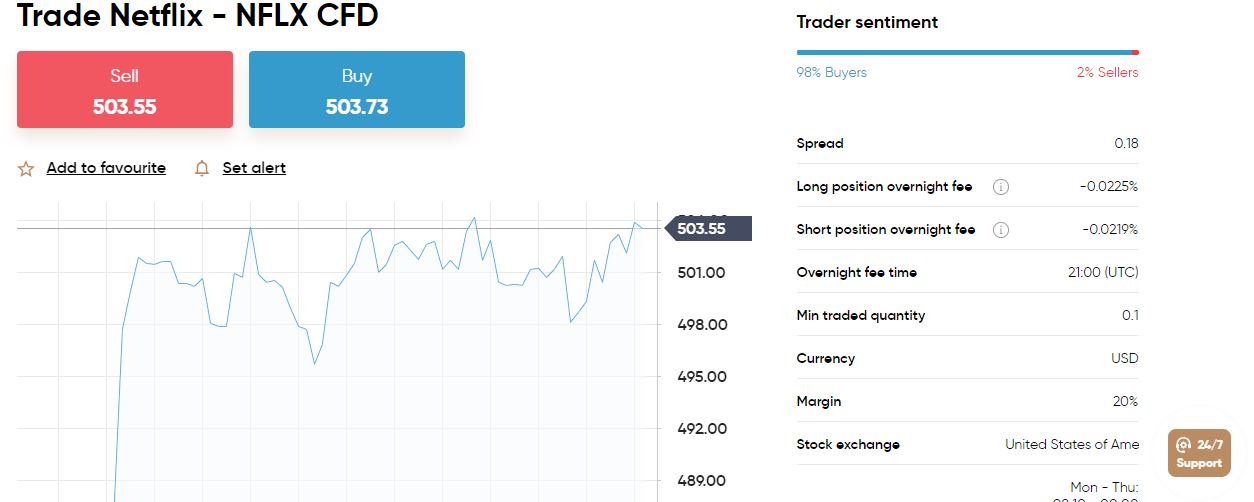

1. Capital.com – Best CFD Broker to Buy Netflix Shares in South Africa

Our number one recommended broker in South Africa is Capital.com. Strictly speaking, Capital.com is a CFD broker rather than a share trading platform because all positions are held in the form of CFDs, or contracts for difference. From the point of view of investing or trading there is little practical difference between holding shares or CFDs on shares. However, CFDs do allow you to use leverage of up to 5 to 1 on stocks, and short sell shares very easily. So Capital.com is a good choice if you are wondering how to buy Netflix shares in South Africa using leverage.

The Capital.com trading platform lists a wide array of stocks, ETFs, currencies, cryptocurrencies, commodities and indices. Crypto traders will find one of the widest ranges of digital coins that can be trades as CFDs. Trades are also commission free, and the platform is well known for its competitive spreads.

Capital.com gives you several trading platforms to choose from. There’s a browser-based platform and a mobile app which are both easy to navigate around. For more advanced trading, the platform can also be integrated with MetaTrader4. And for advanced technical analysis, clients have access to the Trading View website.

For clients in South Africa, the minimum deposit is just $20, which is about R300. Capital.com is regulated by the FCA in the UK and by CySec in Cyprus.

Pros:

- Get started with just $20.

- Tight spreads on all products.

- Leverage of 1:5 available on stocks.

- Regulated by the FCA and CySec.

- Integrates with MetaTrader 4 and Tradingview.

- Great educational resources, including a web app.

Cons:

- Can’t buy shares directly.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

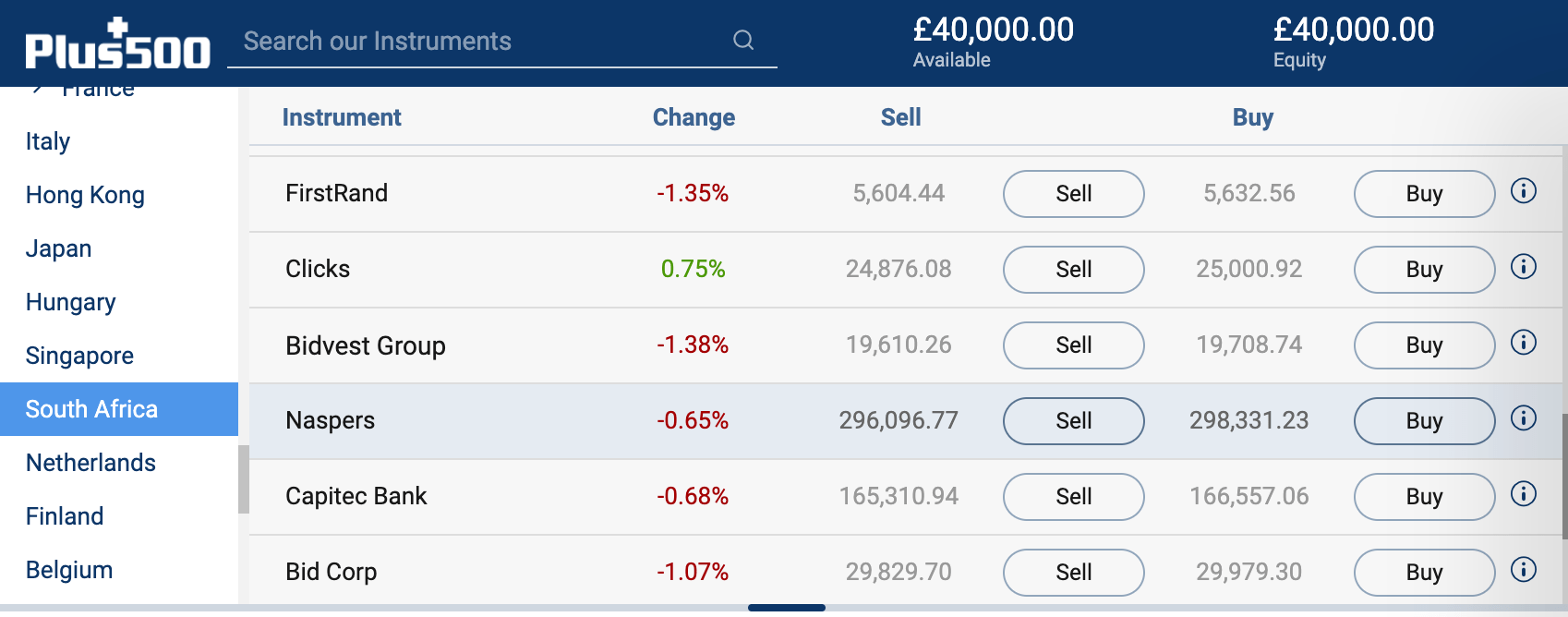

2. Plus500 – Buy or Sell Netflix Shares CFDs With No Commission

One of the best things about Plus500 is that trading with this online broker is very affordable. Plus500 charges 0% commissions on every trade and there are no account fees, save for an inactivity fee that kicks in after a year without trading. The spreads on share trades are also generally much lower than the industry average.

The Plus trading platform and charting interface are straightforward to use, for example. You get access to nearly 100 technical indicators, but customization is limited so you can just plug and play with the studies. Plus500 also offers a mobile app and price alerts so you can easily trade on the go.

Pros:

Cons:

CFD Service. Your capital is at risk.

Step 2: Research Netflix Shares

In this next section, we will give you an overview of Netflix. We will cover the business model, subscriber growth, the competitive environment, and the company’s financials. This should help you make an informed decision about investing in the company.

What is Netflix?

Netflix is the world’s leading streaming video platform. In fact, Netflix pioneered streaming video and changed the way the world consumes movies, TV series, and documentaries at home. The company was founded in 1997 and went public in 2002. The streaming video service was launched in 2007. Prior to that, Netflix was a DVD rental and sales by mail business.

Netflix’s culture of innovation goes all the way back to its early days. Even when it was a DVD rental business, it introduced a subscription model. This meant customers paid a monthly fee for unlimited DVD rentals. This is the same model used by streaming services today and gives the company more predictable cash flows.

Since launching the streaming service in 2007, Netflix has built up a subscriber base of 207 million users, with each paying between $9 and $15 per month. The company now spends over $17 billion a year buying and producing content.

Netflix Share Price – How Much Are Netflix Shares?

Netflix shares began trading in May 2002 at an adjusted price of $1.21. In January this year, they traded at a new all-time high of $593. This represents a gain of over 48,000%. In fact, $1,000 invested in May 2002 would be worth over $400,000 at the current price. By contrast, $1,000 invested in an S&P 500 index fund would be worth about $4,000 today.

It is worth noting that to achieve these staggering gains, investors would have had to endure serious volatility over the last 19 years. Nevertheless, the gains are amongst the best an investor could have earned over the past two decades.

The share price performed very well between September 2019 and July 2020, apart from a sharp correction in March 2020 when the Covid-19 pandemic began. Netflix benefited from ‘stay at home’ orders, which resulted in record revenue growth.

During the last 10 months, the share price has traded in a range between $470 and $590 as the market weighs up the next move. Netflix was so successful in 2020, that it set a very high bar for itself for growth in 2021. However, once the economy normalizes, the price should begin to move higher again.

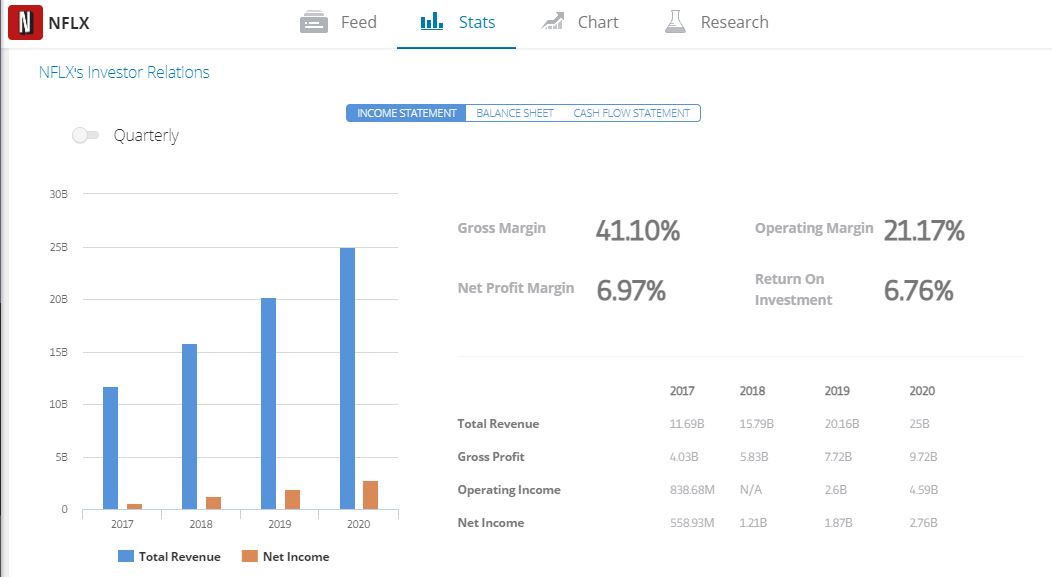

Over the last five years, annual revenues have increased 273% from $6.7 billion to $25 billion. In the same time period, earnings per share have increased from 28 cents to $6.08 – a 2,000 increase.

The PE multiple, which is the price divided by annual EPS, is currently about 60. While this appears high, the PE over the last five years has averaged well above 100 and been as high as 400.

Analysts are expecting EPS of $10.65 for 2021, $13.12 for 2022, and $16.97 for 2023. This would imply that the share price is at 30 times 2023’s EPS.

Netflix Shares Dividends

Netflix is a company that prioritizes growth and reinvests its profits to achieve that growth. For this reason, the company doesn’t currently pay a dividend. At some point in the future, Netflix may begin paying dividends – until then the share is better suited to investors wanting capital growth rather than income.

Are Netflix Shares a Good Buy?

By now you are probably getting a good idea of how to buy Netflix shares in South Africa. Before you go ahead and invest, it’s worth considering whether Netflix shares are in fact a good investment. We can consider this in terms of the valuation and profitability, competitive environment, and growth.

Valuation

There are some concerns about the valuation, which is arguably high. The share is currently trading on a price/earnings multiple of 61 and the PE multiple based on estimated earnings for the next year is 47.

The current valuation is actually a lot lower than it’s been in the past – although revenue growth is expected to be lower in the future than it has been in the past.

It’s also worth bearing in mind that Netflix has only recently become cash flow positive. And this means that going forward, more revenue will flow to the bottom line. So even if revenue growth slows down, earnings can grow quite rapidly.

Competitive Environment

In 2019, Disney launched its streaming video platform, Disney+. Disney’s big advantage is that it already owns a lot of content, so it can compete on price and still turn a profit. At the time there was a lot of concern that Disney would win customers away from Netflix.

The reality is that Disney+ and Netflix can co-exist. They offer different types of content, and the subscription prices they offer make it affordable for a lot of households to subscribe to both. Disney+ grew very quickly in its first year in business, growing its subscriber numbers to 100 million. During the same period, Netflix was able to grow its subscriber base from 167 million to 204 million.

Netflix has also been able to increase prices while increasing subscriber numbers which is a sign of a strong competitive position. There are lots of other streaming services competing – but none of them have the budget available to buy and produce enough content to be a threat to Netflix.

Growth

Netflix reached a point some time ago where it has so many subscriber numbers in North America that the market was saturated. It now relies on international markets for growth. In developing countries, the middle class is growing rapidly, meaning Netflix is selling into a market that is itself growing. The company will struggle to grow at the same rate it has in the last ten years, but there is still plenty of room for steady growth.

There is also speculation that Netflix is going to introduce gaming on its platform. This would give the company a new market for growth.

Step 3: Open an Account & Buy Shares

You probably now have a good idea of how to buy Netflix Shares in South Africa. But, in case you are still unsure you can follow this more detailed step-by-step guide to trading with Capital.com. Once you have your account set up and are familiar with the platform, you will be able to buy any of the world’s best shares whenever you want to.

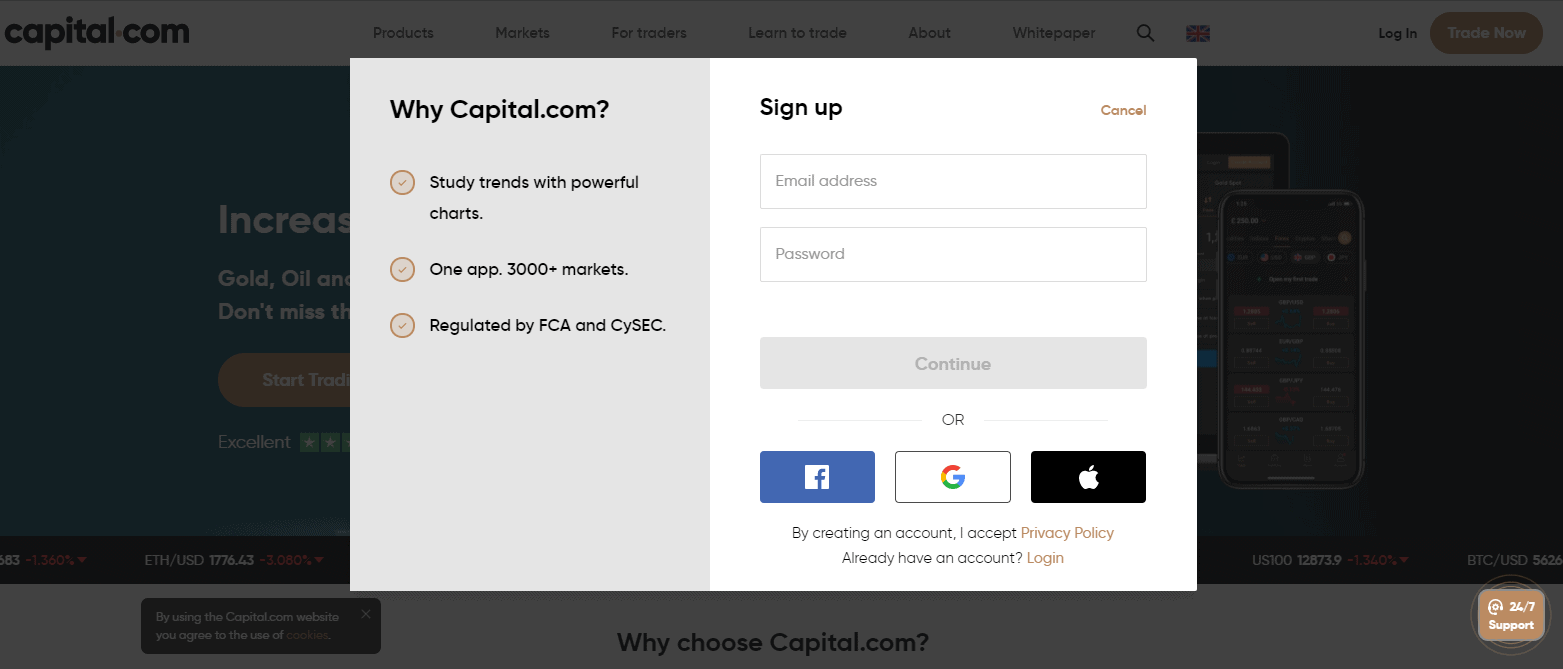

Open a Capital.com Account

To open your account, head to the Capital.com website and click the ‘Sign Up’ button. Initially, you will just need to enter your email address and a password. You will then be directed to another page where you will need to supply a few more details about yourself. You will then receive an email and SMS to verify your email address and your mobile phone number.

75.26% of retail investor accounts lose money when trading CFDs with this provider.

Verify Your Account and Your Identity

At this point, you can make a limited deposit and begin trading. However, you will need to verify your identity at a later stage or to deposit a higher amount. To verify your identity, you can upload a copy of any official identity document and a utility bill or bank statement. The customer support team will then verify your account which should only take a few minutes.

Deposit Funds into Your Account

The last step before you actually make any trades is to fund your new account. Capital.com provides several alternatives to fund your account.

South African investors need to deposit EUR 20 to trade on the Capital.complatform. The fastest way to deposit cash into your account is with a credit card. You can also use e-wallets like Neteller and Skill, as well as bank transfers.

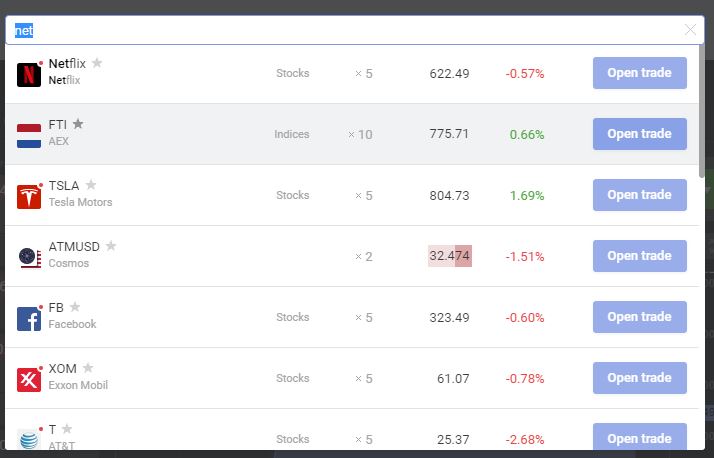

Find Netflix shares on the Platform

The easiest way to find Netflix shares on the Capital.com platform is to simply type the name (or the ticker code ‘NFLX’) into the search bar at the top of the page.

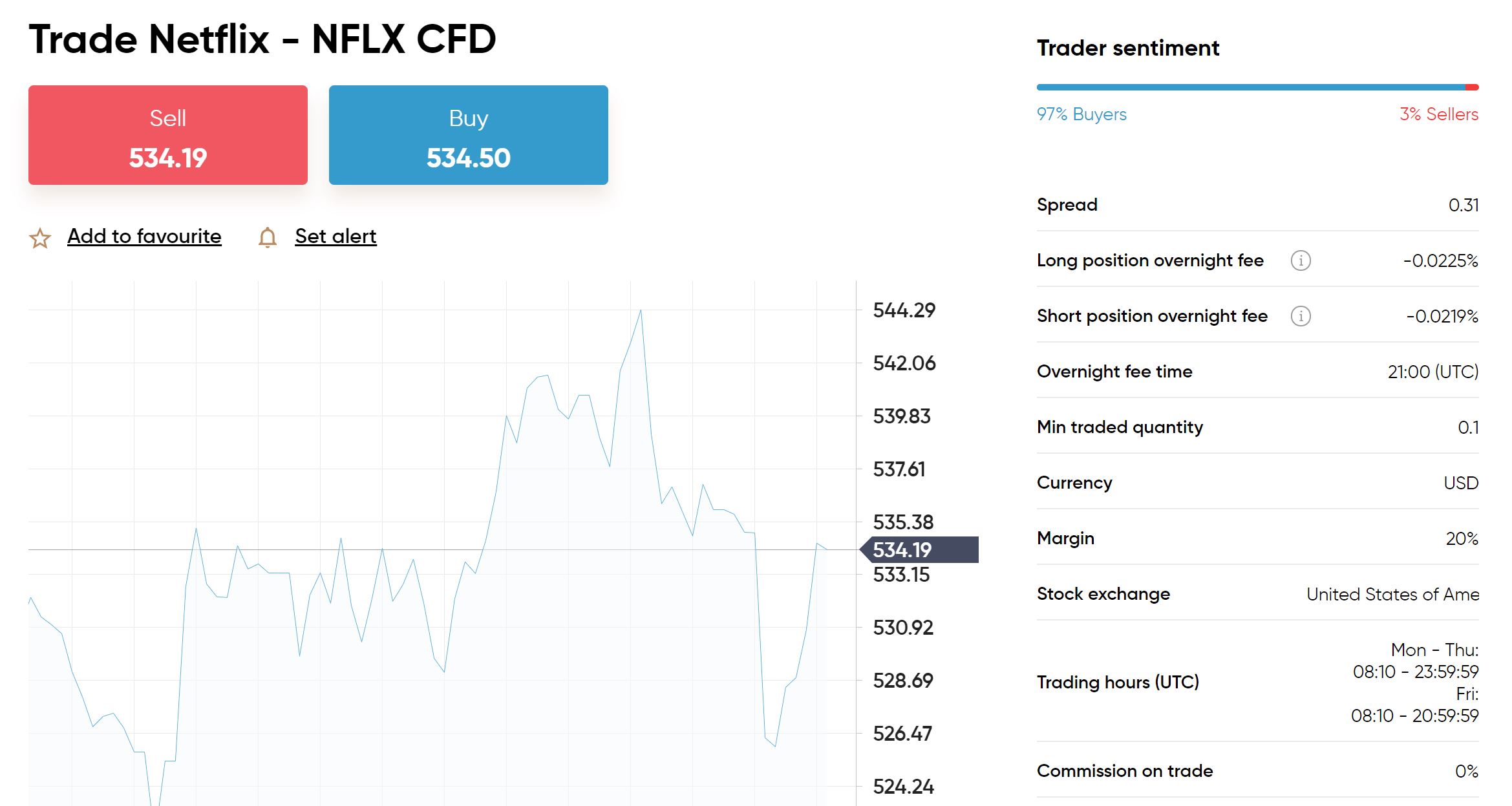

Buy Netflix Shares

Once you are on the Netflix page, click ‘Trade’ to open an order entry ticket. Click on ‘Buy’ at the top of the page, and select ‘Trade’ or ‘Order’ just below that.

If you enter an order, you will be able to specify the price you want to trade at. If you enter a trade, your trade will be executed at the current price.

You also specify the value of the trade, the amount of leverage to use, and your stop loss and take profit levels. You can also add a trailing stop loss to protect profits as the price rises.

Once you have filled everything in, hit the ‘Set Order’ button. When the order has been filled you will see it on the Portfolio page.

Netflix Shares Buy or Sell?

So, does all of this make Netflix a buy or a sell?

The Netflix share price is currently trading at the lower edge of a wide trading range. This means there is good support at $470, the lower edge of the trading range. The long-term trend suggests the price will eventually break out to the upside. The share is also reasonably valued based on long-term growth and profitability forecasts.

The risk in the medium term is that there may be further weakness in growth stocks which would put pressure on Netflix’s share price. There is no reason to sell the stock, but investors may want to use $470 as a stop loss until the price breaks $600.

Conclusion

Hopefully, you will now know more about Netflix shares and why you may want to invest in this streaming video giant. Now that you know how to buy Netflix shares in South Africa, you can easily invest in other shares and asset classes.

If you are wanting to buy Netflix shares in South Africa, we recommend Capital.com as the best broker to choose. You will have access to a very large range of shares and forex pairs listed around the world, as well as indices, cryptocurrencies, and commodities. The bid-ask spreads are also very competitive. Our comprehensive research found that Capital.com is one of the leading and most popular CFD brokers out there. This is because the broker is fully regulated, offers heaps of CFD securities, and allows you to buy share CFDs on a low-cost basis. If you want to start building your CFD portfolio today, simply click on the link below!

75.26% of retail investor accounts lose money when trading CFDs with this provider.