How to Buy Apple Shares in South Africa – With 0% Commission

Based in South Africa and wish to buy Apple shares? If so, the process should only take you a few minutes end-to-end – as it’s just a case of opening an account with a trusted online broker that gives you access to the NASDAQ.

nike air max 90 sale

nike air max 90

new nike air max

nike air max sale

nike air max sc

nike air max cb 94 release dates 2023

nike air max sale outlet

nike air max 1

nike air max plus

nike air max sale mens

mens nike air max 90 sale

nike air max excee women’s

nike air max sale outlet

nike air max 97

nike air max 270

nike air max plus black

cheap nike air max shoes

nike air max 97

nike air max 270 women’s sale

mens nike air max

nike air max 270 mens

nike air max 270 sale

nike air max 97 womens sale

nike air max mens shoes

cheap nike air max

all nike air max shoes

nike air maxes 97

cheap nike air max shoes

nike air max sale mens

nike air max 270 womens

nike air max 90 womens for sale

best nike air max shoes

nike air max 270 kids

mens nike air max 90 sale

nike air max 95

nike air max 90

nike air max 270 women’s sale

nike air max 270 womens

nike air max black and white

nike air max 97 mens

womens nike air max 270

If you’re to online investing – this guide will show you how to buy Apple shares in South Africa in a simple and low-cost way.

How to Buy Apple Shares South Africa – Quick Guide 2021

The easiest and most cost-effective way of gaining access to Apple shares is via Capital.com. If you’re strapped for time – below you will find a quickfire guide on how to buy Apple shares in South Africa right now.

- Step 1: Open an account with Capital.com – You will first need to open an account with Capital.com – which will simply require some personal details from you.

- Step 2: Upload ID – As a regulated broker that does things by the book – Capital.com will ask you to upload a copy of your ID.

- Step 3: Deposit – You can instantly deposit funds with a debit/credit card or e-wallet. The minimum is just $20 at Capital.com.

- Step 4: Buy Apple Shares – Now you can search for Apple and click on the ‘Buy’ button. Enter your stake and confirm the trade.

And that’s it – you’ve just bought Apple share CFDs at Capital.com without paying any commission!

Step 1: Find a South Africa Stock Broker That Offers Apple Shares

It goes without saying that Apple is one of the largest and most recognized companies in the world – so it makes sense that hundreds of online stock brokers give you access to this technology giant.

You do, however, need to assess how much your chosen broker charges in fees and what payment methods are supported. You also need to consider regulation, minimum account balances, customer support, and more. In addition you’ll have to register to a broker with NASDAQ, as Apple stock is traded only on the NASDAQ.

Below you will find a vetted selection of top-rated brokers that allow you to buy Apple shares in South Africa.

1. AvaTrade – Advanced Trading Platform to Buy Apple Shares

AvaTrade is an online trading platform that is particularly popular with seasoned pros. The platform is compatible with both MT4 and MT5 – which come packed to the rafters with advanced trading tools and features.

Much like Capital.com, AvaTrade specializes in CFD instruments. As a result, you can easily speculate on the future value of Apple shares without needing to take ownership. Leverage is offered too – so you can trade Apple shares with more money than you have in your AvaTrade account. When it comes to fees, AvaTrade doesn’t charge any commissions. Instead, it builds all trading fees into the spread. At the time of writing, the spread on Apple shares is just 0.13%.

In terms of getting started, AvaTrade requires a minimum deposit of just $100. The platform supports debit and credit cards for an instant deposit, or a bank wire. The latter will delay the process by a couple of days. You should have no concerns in the safety department, as AvaTrade is regulated in six different jurisdictions. This includes a fully-fledged license with the Financial Sector

Conduct Authority (FSCA) in South Africa.

Pros:

- Supports MetaTrader 4 and 5 platforms

- Trade over 600 global share CFDs

- User-friendly mobile app

- Analysis tools and news feed

- Regulated in South Africa

Cons:

- MetaTrader can be complex for beginners

Your capital is at risk.

2. Capital.com – Buy Apple Shares in South Africa at 0% Commission

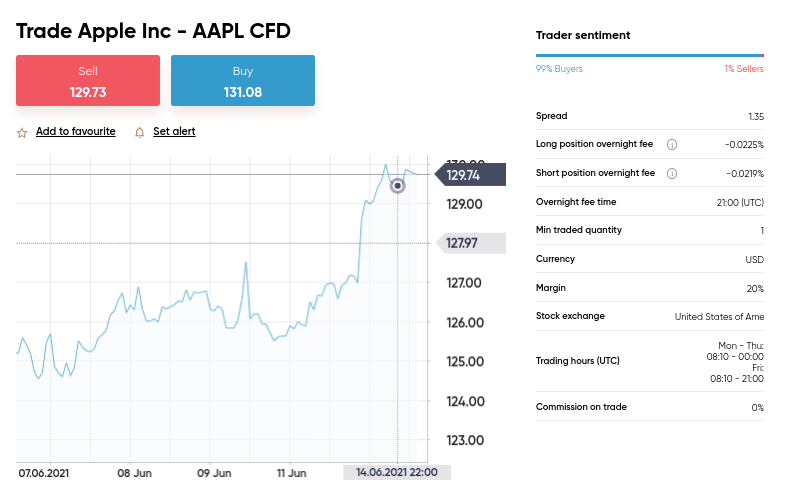

Best of all, Capital.com is a 0% commission broker. This means that you can trade Apple stocks without getting hit with unnecessary international share fees. Plus, spreads are very competitive too – so this lowers your trading costs even further. You might also be pleased to learn that Capital.com allows you to buy Apple shares with leverage. If you are a retail client, you can apply up to 1:5 when trading shares.

This means that a $50 trade translates into an open position worth $250. Additionally, if at some point in the future you think that Apple shares are overvalued, you can place a sell order at Capital.com. In doing so, you will make a profit if the shares go down in value. On top of Apple shares, Capital.com gives you access to thousands of other stocks. This includes markets and exchanges in the US, Europe, Asia, and more.

Capital.com is suitable for both newbie and experienced traders. If you’re a beginner, you can use the main Capital.com web-trading platform – which is really simple and free of complex jargon. You might also consider using the free demo account facility – which permits risk-free trading with paper funds. If you’re a seasoned pro, Capital.com offers support for MT4. The minimum deposit at Capital.com is just $20 and you can instantly fund your account with a debit/credit card or e-wallet.

Pros:

- Educational app for new traders

- AI assistant identifies your weak points

- Trade ideas generated daily

- Excellent charting and analysis interface

- No inactivity fees

- Thousands of UK and US shares

- 100% commission free trading

Cons:

- Cannot build custom trading strategies

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Step 2: Open a Share Dealing Account and Make a Deposit

In order to buy Apple shares in South Africa from the comfort of your home – you will need to open a brokerage account. As we covered in our reviews above, Capital.com is the best platform for the job – as you’ll benefit from 0% commission, tight spreads, and the ability to get started with a small deposit of just $20.

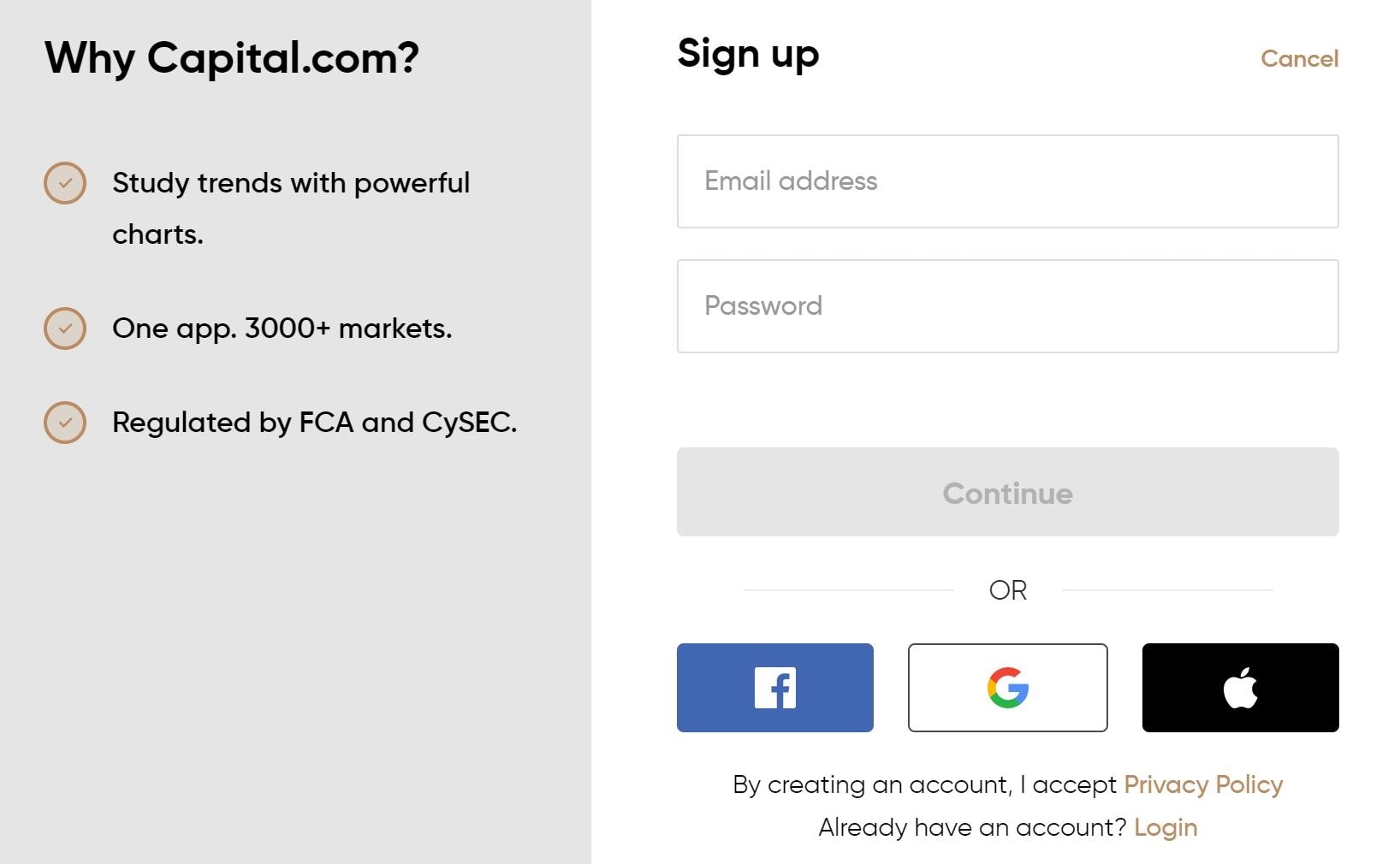

To get the ball rolling, visit Capital.com and elect to open an account. You’ll need to provide some personal information so that the broker knows who you are.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

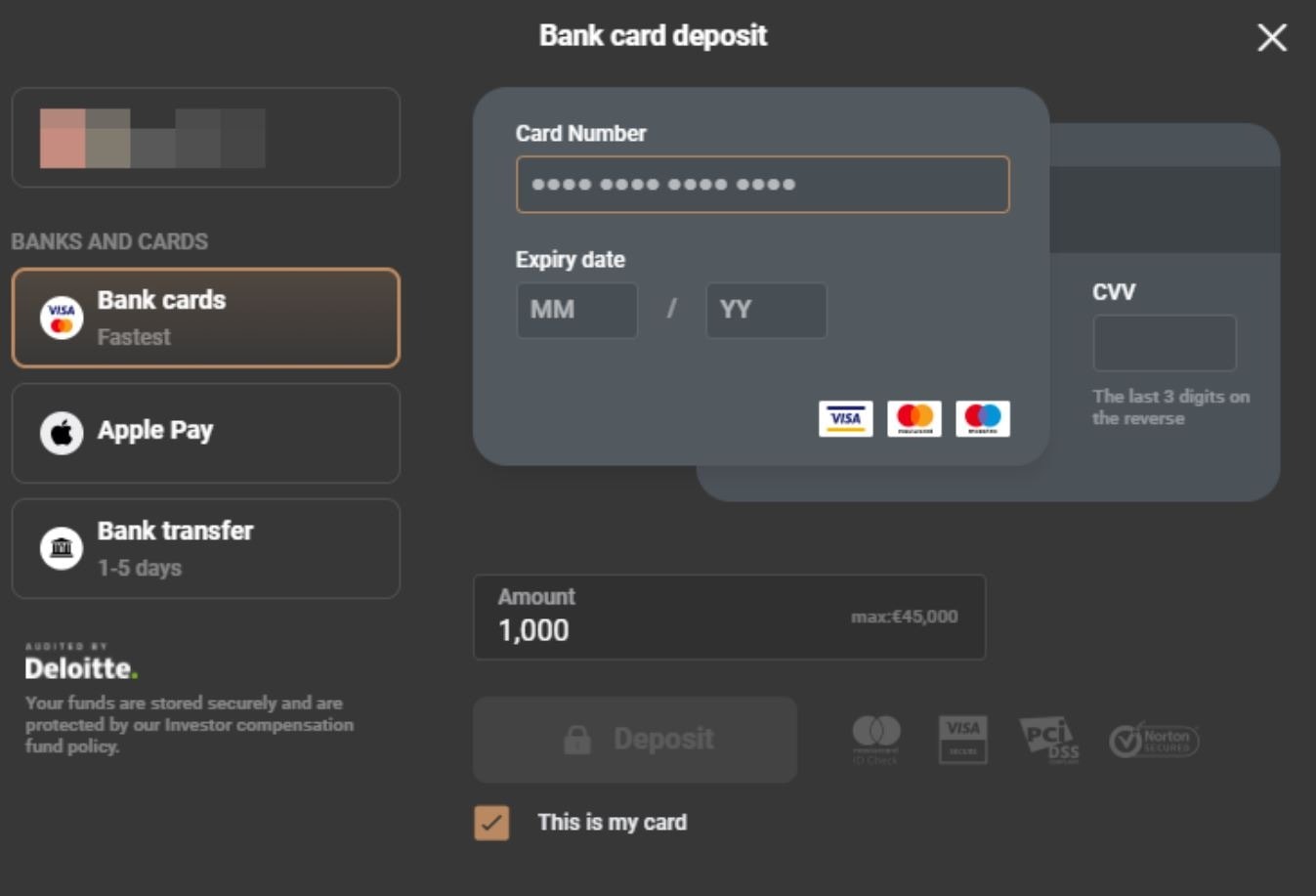

To complete the KYC (Know Your Customer) process, you will need to upload a copy of your passport, driver’s license, or national ID card. In most cases, Capital.com will automatically verify the document – so you don’t need to wait around. Instead, you can proceed to make a deposit.

The easiest and fastest way to deposit funds is with a debit or credit card. Several e-wallets – such as Apple Pay, are also supported. If you elect to transfer funds from your bank account, expect to wait 1-5 working days.

Step 3: Buy Apple Shares

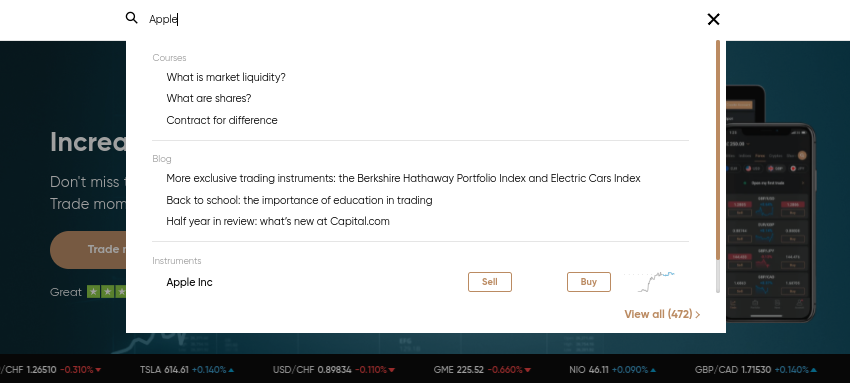

Now that you have made a deposit into your Capital.com brokerage account – you can proceed to buy Apple shares. At the top of the screen, you should see a search box. Type in ‘Apple’ and when the market loads – click on ‘Buy’.

Finally, enter the amount of money that you want to risk on the trade and confirm the order. You can cash out your position at any time – as long as the NASDAQ exchange is open.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Overview of Apple Shares

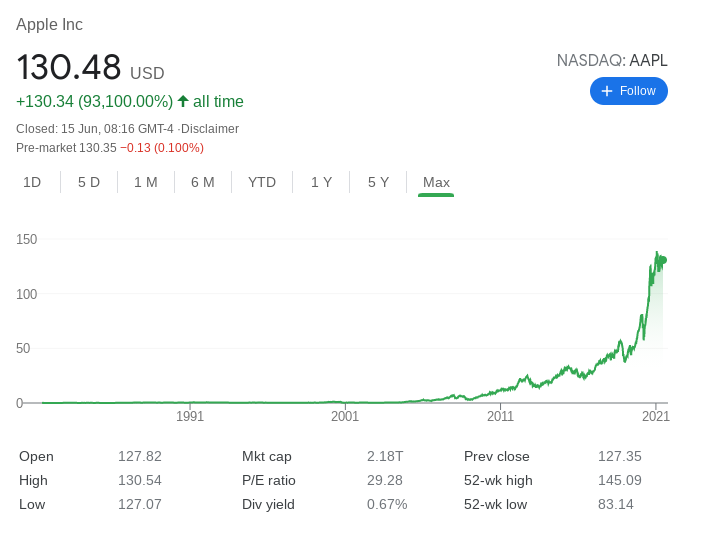

You might be surprised to learn that Apple first became a public company way back in 1980. Opting for the tech-focused NASDAQ exchange – its IPO originally priced Apple shares at $22 each. However, as Apple has executed a stock split five times since its IPO – this should be adjusted to an initial share price of just $0.14.

At the time of writing in June 2021 – the very same shares are now priced at over $130 each. In comparison to its IPO listing price, this represents an increase of almost 93,000%. Put simply, had you invested $5,000 during the Apple IPO – your capital would now be worth over $4.6 million.

Although Apple has since entered the $2 trillion club – the rate at which its shares have increased in recent years is indicative of a growth stock. For example, in the midst of the pandemic in March 2020 – Apple shares were priced at $57. Baring in mind that the stocks hit all-time highs of $145 in January 2021, that’s a share price increase of over 154% in less than a year of trading.

This is why so many investors in South Africa are looking to buy Apple shares. In addition to its stock price increase, Apple is also the only FAANG stock to pay dividends. With that said, its most recent dividend yield amounted to just 0.67% – which is one of the lowest on the S&P 500.

Reasons to Buy Apple Shares

To point you in the right direction, below you will find some of the main reasons why you might decide to take the financial plunge.

Cash Levels

Much like other technology stocks in this space – namely Amazon and Facebook – Apple is sitting on a substantial amount of cash. According to its most recent quarterly report – Apple is now holding over $195 billion in cash – which is up 2% from the prior three months.

This is crucial for two key reasons. Firstly, Apple has the financial means to weather any economic storm that might be coming our way. This is especially the case when you consider its low debt levels. Secondly, this gives Apple the freedom to continue its growth program. Whether that’s in the form of research and development or company acquisitions – Apple is more than covered.

Services Continue to Lead the way

Many market commentators argue that based on recent figures – iPhone sales are starting to hit a ceiling. With that said, that shouldn’t concern investors, as Apple’s services dividend continues to lead the way.

Once again, revenues smashed through market expectations – with income rising by 27% to just under $17 billion. This covers a wide variety of Apple services – from Apple Pay and the iCloud to Apple TV+ and Apple Music.

Management are Willing to Spend

We mentioned just a moment ago that Apple is sitting on a significant pile of cash. It appears that management at the tech giant is ready to dig deep – with several big-money projects in the pipeline. At the forefront of this is the ongoing rumors that Apple is looking to enter the driverless car industry.

As per several market murmurs, Apple has already been in talks with Nissan and Hyundai about potential partnerships. Apple has also committed to spending in excess of $430 billion over the next five YEARS to meet several investment objectives. This includes a new research and development plant to focus exclusively on 5g technology and AI.

Continued Share Buyback Scheme

Another reason why you might decide to buy Apple shares in South Africa is that management continues to fuel their aggressive buyback program. That is to say, management is using excess cash to purchase Apple shares and thus – this reduces the overall circulating supply. In turn, this increases your stake in Apple – as there are fewer shares in existence.

Apple Shares Buy or Sell?

Although Apple is a multi-trillion dollar company, share price growth levels continue to outperform the wider markets. As we noted earlier, the shares increased by over 154% between March 2020 and January 2021 – which is incredible when you consider the sheer size of its market capitalization.

Although iPhone sales are slightly sluggish at present times, growth in its services division is more than making up for this. Plus, with a small dividend policy in place alongside its quarterly buyback program – the future certainly looks bright for those holding Apple shares.

The Verdict

Buying Apple shares in South Africa has never been easier – especially when you have regulated brokers like Capital.com giving you access at a commission rate of 0%. You can buy Apple shares with this broker in a matter of minutes by quickly opening an account, making an instant deposit, and confirm your buy order!

Capital.com – Buy Apple Shares in South Africa With 0% Commission

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.