Best Robo Advisor in South Africa 2022 – Cheapest Robo Advisors Revealed

If you’re looking to invest money into the financial markets but lack the required time or experience to build a risk-averse portfolio yourself – it might be worth considering a robo advisor platform. In this guide, we review the Best Robo Advisor Platform South Africa for 2022 .

These platforms will buy and sell assets on your behalf – based on your preference for risk and long-term financial goals. Read on to learn more and we show you how to get started with an investment today.

Best Robo Advisor 2022 List

Below you will find a list of the best robo advisors South Africa in the market right now. We review each of the following platforms in the sections below.

- eToro: Overall Best Robo Advisor Platform South Africa

- Moneyfarm: Popular Robo Advisor Platform for Beginners

- Sygnia: Best South Africa-Based Robo Advisor Platform

- Personal Capital: Combines Financial Advisor Services With Cutting-Edge Technologies

- Wealthsimple: Best Robo Advisor Platform South Africa for Small Investments

- Betterment: Best Robo Advisor App in South Africa for Mobile Investments

- Nutmeg: Trusted Robo Advisor Platform With a Great Reputation

- Vanguard: Best Robo Advisor Platform South Africa for Low Fees

- Charles Schwab: Best Robo Advisor Platform South Africa for Low Fees

- Sanlam: Personalized Investment Plans With a Financial Advisor

Best Robo Advisor Platforms Reviewed

There are many considerations that need to be made in your search for the best robo advisor platform South Africa. For example, you need to explore what assets the robo advisor will give you exposure to and what fees are charged. You should also spend some time looking at the past performance of the robo advisor in question.

To help you separate the wheat from the chaff, below you will find the best robo advisor platform South Africa for 2022.

1. eToro – Overall Best Robo Advisor Platform South Africa

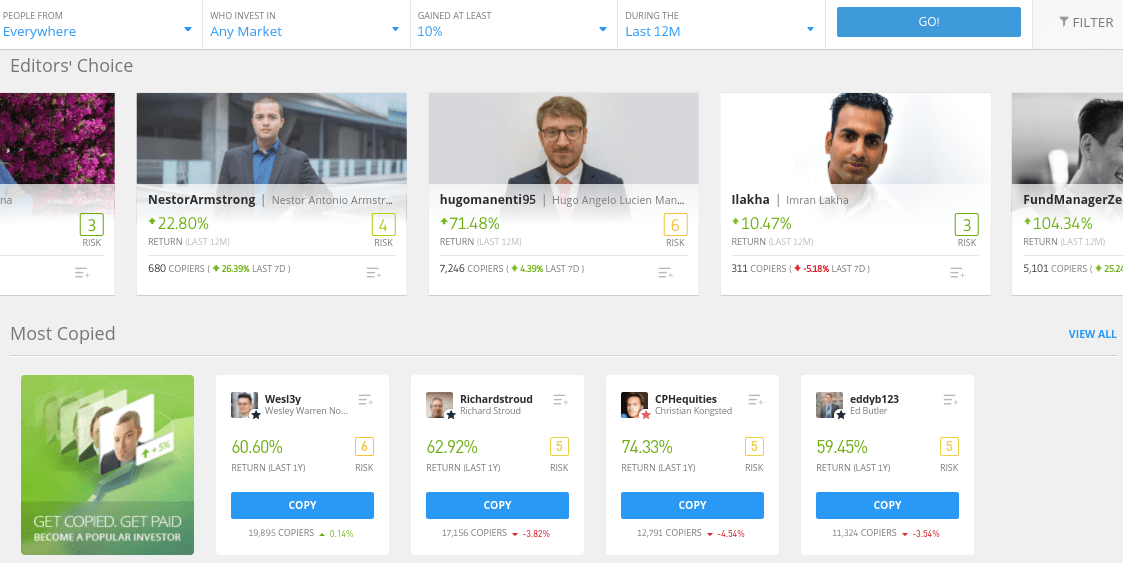

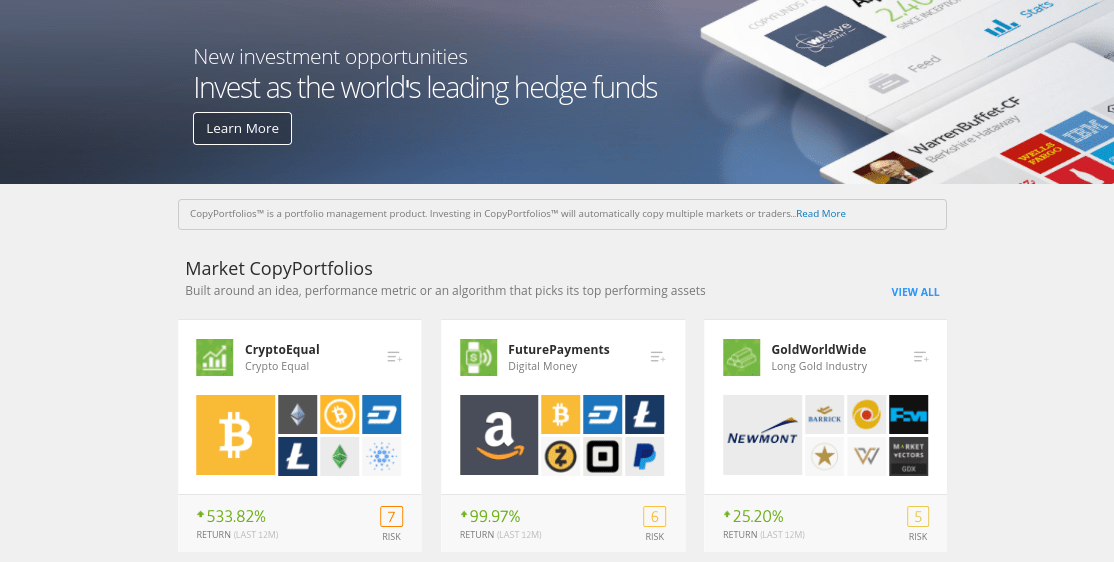

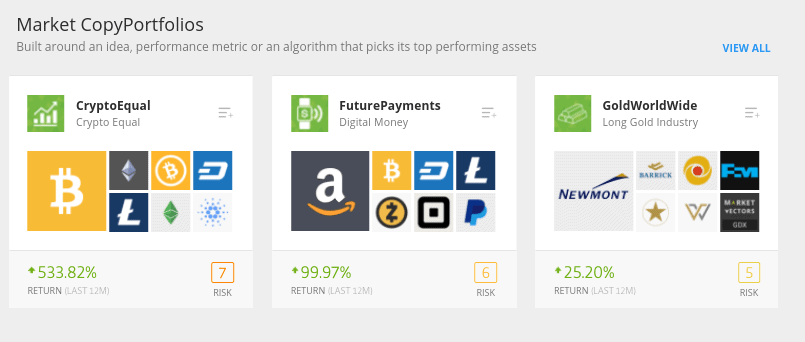

With that said, eToro also offers a number of automated trading services that allow you to invest in a 100% passive nature. First and foremost, you have the eToro CopyPortfolio feature. This allows you to invest in professionally managed portfolios. There are numerous options and strategies to choose from, which ensures you are able to select a CopyPortfolio that meets your needs. For example, there are portfolios that focus on high-yield dividend stocks, Big Tech, renewable energy, and the gaming industry.

67% of retail investors lose money trading CFDs at this site

Past performance is not an indication of future results

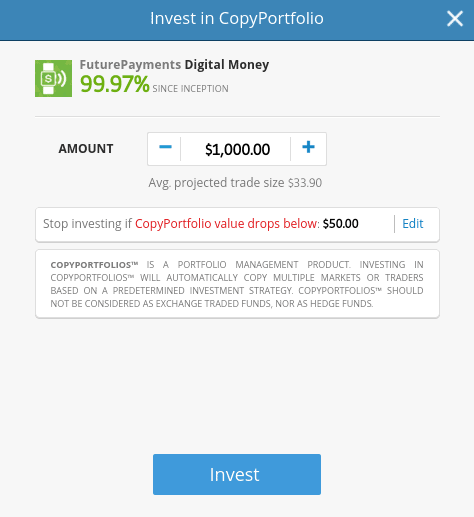

There is even a CopyPortfolio that gives you access to a diverse portfolio of cryptocurrencies. Although there are no management fees or commissions to invest in CopyPortfolios on eToro, each strategy comes with a minimum deposit. This starts at $1,000 (about 14,000 ZAR) but can be higher depending on the portfolio. In a similar nature to conventional robo advisor platforms, eToro will rebalance your chosen CopyPortfolio regularly – ensuring that you can sit back and let your money work for you.

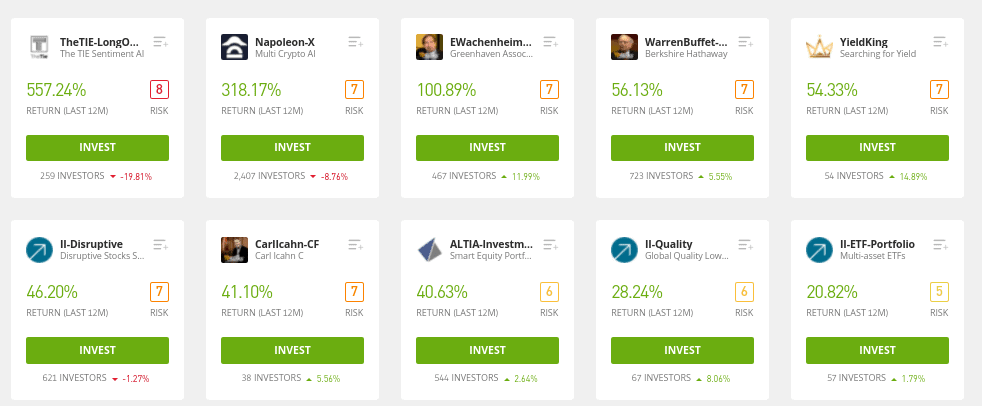

The second option you have at eToro to invest utilizes the Copy Trading tool. This is different from the previously discussed CopyPortfolios, as you will be investing capital into a proven eToro trader. There are thousands of traders to choose from and you can base your decision on anything from preferred asset classes and past performance, to risk rating and maximum drawdown. Once you select a trader to invest in, you will copy their current portfolio of assets.

Past performance is not an indication of future results

You can also elect to copy all ongoing trades, meaning that you will be actively investing without needing to do any of the work. There are no fees to use the Copy Trading feature and the minimum investment is just $500 (about 7,000 ZAR). What we also like about the Copy Trading tool is that you can add or remove assets any time you wish. For example, you might decide to invest in a seasoned stock trading pro – but then also add some commodities to your portfolio.

When it comes to the fundamentals, your money is in safe hands at eToro. This is because the broker is regulated on three fronts – namely by the FCA (UK), ASIC (Australia), and CySEC (Cyprus). You can deposit funds into your eToro with a variety of payment methods – which include debit/credit cards, bank transfers, and e-wallets like Paypal, Skrill, and Neteller. Finally, eToro also offers a top-rated trading app – so you can access your investment portfolio while on the move.

Pros:

- Buy shares and ETFs without paying any commission or dealing charges

- 2,400+ shares listed on 17 international markets

- More than 20 million clients

- Perfect for beginners

- Social and copy trading

- Mobile trading app

- Regulated by the FCA, CySEC, and ASIC

Cons:

- Not suitable for advanced traders that like to perform technical analysis

67% of retail investors lose money trading CFDs at this site

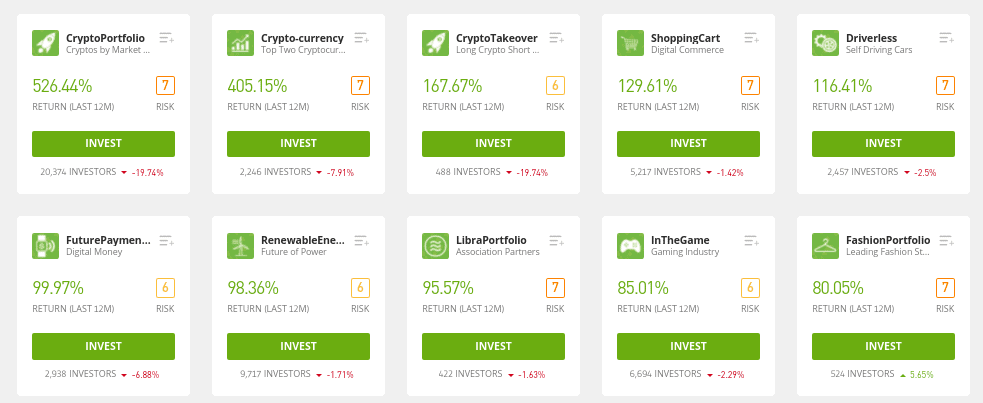

2. MoneyFarm – Popular Robo Advisor Platform for Beginners

In total, there are seven ready-made portfolios available at the Moneyfarm, each of which comes with varying risk levels. For example, the lowest risk portfolio allocates 52% of its funds into cash and short-term government bonds and 17% in investment-grade corporate bonds. This portfolio has averaged growth of just 1.1% per year since 2016.

At the other end of the scale, the highest risk portfolio on Moneyfarm has averaged annual returns of 10.3% per year. This portfolio allocates 72% into developed market stocks, and the rest balanced between government, corporate, and emerging bonds. Irrespective of the portfolio you opt for, unlike eToro, Moneyfarm charges management fees. This stands at 0.68% per year, which is considered expensive.

You will also need to pay an underlying fund fee of 0.20% and a market spread of 0.09%. This takes your overall annual fees to 0.97%. We should also note that Moneyfarm requires a minimum monthly investment of £5,000 – which is about 100,000 ZAR. Alternatively, if you are able to commit to recurring monthly investments, the initial lump is reduced to £1,500 – or about 30,000 ZAR. Finally, Moneyfarm is authorized and regulated by the FCA.

Pros:

Cons:

Your capital is at risk

3. Sygnia – South Africa-Based Robo Advisor Platform

For example, if you are just starting out in life and looking to build a long-term investment portfolio over several decades, the Sygnia Direct Investment portfolio gives you access to a diversified portfolio of ETFs and index funds. There are also portfolios for those that are mid-career or transitioning into retirement. These portfolios will get you access to lower-risk asset classes.

If you’re not sure which plan is best for you and your financial goals, Sygnia can also build a custom portfolio that alligns with your appetite for risk. We also like the fact that Synnia offers tax-free savings accounts, preservation funds, and even retirement annuities. When it comes to fees, this starts at 0.35% per year (excluding VAT). The specific fee that you pay will depend on the investment product you opt for – so it’s best to have a browse of what is available before signing up.

Pros:

Cons:

Your capital is at risk

4. Personal Capital – Combines Financial Advisor Services With Cutting-Edge Technologies

For example, you will initially have a portfolio built for you by an experienced financial advisor. This will be based on your personal needs – such as how long you wish to invest and how much risk you are willing to take. Once your portfolio is live, it will then be rebalanced and reweighted automatically via automated technologies.

This will ensure that your portfolio continues to align with your stated financial goals. Perhaps the main drawback with Personal Capital is that the platform does not outline its fees and charges on its website. Instead, this will be discussed with you over the telephone.

Pros:

Cons:

Your capital is at risk

5. Wealthsimple – Best Robo Advisor Platform South Africa for Small Investments

This is because the robo advisor platform is super easy to use and thus – requires no prior investment experience. When you first sign up, you will be asked a series of questions pertaining to your financial objectives and tolerance for risk. Then, you will be shown a ‘suggested’ portfolio based on your answers.

Depending on your stated risk level, your portfolio might contain a balance of blue-chip stocks from the US, emerging equities, government bonds, or high-grade corporate bonds. In terms of fees. Wealthsimple charges 0.7% per year. This is in addition to an average investment fund fee of 0.2% annually. Although Wealthsimple is on the side of expensive, we do like the fact that there is no minimum deposit.

Pros:

Cons:

Your capital is at risk

6. Betterment – Best Robo Advisor App in South Africa for Mobile Investments

Betterment offers personalized investment portfolios that are built for your tolerance of risk and long-term financial goals. For example, if you’re a risk-averse investor, then your portfolio might have a 90/10 split of high-grade bonds and stocks, respectively. If you’re happy to take on more risk and wish to target larger financial returns – Betterment might suggest an 80/20 split in favour of stocks.

We also like the fact that you can set investment goals and Betterment will let you whether or not you are on track. For example, you might be investing towards your first home and have a specific financial goal and timeframe in mind. You can adjust your financial goals and strategies at any given time from within the app. When it comes to fees, you won’t be charged anything to open an account and there is no minimum deposit.

You will, however, pay 0.25% per year – which is based on the amount of capital you have invested. If you want to take things to the next level, there is also a premium investing plan that gets you access to unlimited telephone calls and emails with a financial advisor. For this, not only will you need to meet a minimum investment of $100,000 (about 1.4 million ZAR ) but the annual fee rises to 0.40%.

Pros:

Cons:

Your capital is at risk

7. Nutmeg – Trusted Robo Advisor Platform With a Great Reputation

You will then need to choose from a fixed allocation or a fully managed plan. The former will see your investment portfolio regularly rebalanced by automated robo advisor technology. This is the cheaper option and will cost you 0.45% per year. If opting for a fully managed plan, this is more expensive at 0.75% annually. However, this comes with the benefit of having your investment portfolio overseen by the team at Nutmeg.

Irrespective of which plan you go with, all pre-made portfolios on the platform consist of ETFs. This ensures that you have the chance to grow your money in two forms – capital gains and dividends. The main drawback with Nutmeg is that you need to invest at least £5,000 (about 100,000 ZAR) if you only want to deposit a one-time lump sum. Anything less than this will require a monthly commitment of £100 (about 2,000 ZAR).

Pros:

Cons:

Your capital is at risk

8. Vanguard – Best Robo Advisor Platform South Africa for Low Fees

To get the ball rolling, you’ll be asked some questions about what you are looking to achieve from the investment world. This consists of financial goals and acceptable levels of risk. Then, you will be shown a suitable portfolio – all of which consist of Vanguard funds.

This means that you will have access to a global pool of investments – ranging from stock market index funds to emerging economy bonds. Take note, Vanguard requires a minimum investment amount of $3,000 – which is about 41,000 ZAR. Nevertheless, Vanguard provides ongoing management of your portfolio via automated technology.

If the underlying algorithm feels that the portfolio needs rebalancing, it will automatically add or remove assets based on your financial goals. The main drawback with Vanguard is that the account opening and verification process can be a bit long-winded. With that said, once you are set up, keeping tabs on your robo advisor investment is simple and burden-free.

Pros:

Cons:

Your capital is at risk

9. Charles Schwab – Best Robo Advisor Platform South Africa for Low Fees

In fact, like most of the best robo advisors South Africa discussed today, your portfolio will be built for you based on your tolerance for risk. Each and every portfolio consists of ETFs, albeit, you will have access to thousands of potential funds. This includes ETFs that track everything from stock index funds and government bonds to commodities and emerging markets.

All portfolios also come with a small allocation of cash – which is deposited in an FDIC-insured account. The minimum deposit required to use Schwab Intelligent Portfolios is $5,000 – or about 70,000 ZAR. When it comes to pricing, there is no commission or advisor fee applicable.

You will, however, need to pay the expense ratio of the respective ETFs that are added to your portfolio. Of course, this will vary depending on the fund in question. Additionally, you also have the option of receiving a one-on-one session with a certified financial planner. This will cost you an initial fee of $300 and then $30 per month moving forward.

Pros:

Cons:

Your capital is at risk

10. Sanlam – Personalized Investment Plans With a Financial Advisor

This includes everything from insurance and home loans to savings accounts and financial planning. Regarding the latter, your financial goals and tolerance for risk will be determined by a Sanlam advisor. You will be given the option of choosing from several potential plans – each of which will appeal to a certain type of investor. For example, if you choose to invest in unit trusts, there is no minimum investment period – meaning you can access your funds at any given time.

This requires a minimum lump sum of 10,000 ZAR or an ongoing commitment of 500 ZAR per month. You then have the Sanlam Wealth Edge Endowment plan, which requires a minimum lock-up period of five years and an investment of at least 100,000 ZAR. This comes with the benefit of having the Sanlam team keep a closer eye on how your investments are performing. When it comes to fees, this will vary depending on the investment plan that you are put on and how much assistance you require.

Pros:

Cons:

Your capital is at risk

Best Robo Advisor Fee Comparison

Below you will find a table that outlines the main fees charged by the best robo advisors South Africa.

| Management Fee | Average Fund Fee | |

| eToro | 0% | Depends on fund |

| Moneyfarm | 0.68% | 0.29% |

| Sygnia | From 0.35% + VAT | Depends on fund |

| Personal Capital | Call required | Call required |

| Wealthsimple | 0.70% | 0.20% |

| Betterment | From 0.25% | 0.11% |

| Nutmeg | From 0.45% | From 0.14% |

| Vanguard | 0.20% | 0% |

| Charles Schwab | 0% | Depends on fund |

| Sanlam | Call required | Call required |

The above fee table is correct at the time of writing, albeit, you are advised to check yourself as robo advisor charges can and will change on a regular basis.

What Is a Robo Advisor?

In a nutshell, a robo advisor platform allows you to invest in a passive manner. The underlying technology – which is based on advanced artificial intelligence and machine learning, will initially build you a ready-made portfolio of investments. It achieves this by asking you a series of questions regarding your financial goals and tolerance for risk.

Once you proceed to invest in the portfolio that has been suggested for you, the robo advisor takes care of the rest. By this, we mean that the robo advisor will continuously scan the financial markets to ensure that your portfolio still alligns with your stated financial objectives.

If the robo advisor feels that your portfolio needs adjusting, it might decide to add or remove assets. It might also decide to reweight some of the assets that you currently hold. For example, if the technology makes an assumption that the wider stock markets are on bearish, it might decide to increase your exposure to bonds.

How Does a Robo Advisor Work?

Like any investment product, it is important that you understand how the best robo advisors work before parting with any money. First and foremost, we should note that robo advisors are offered by regulated online investment platforms.

- The underlying technology is built and managed by the platform in question – so performance will depend on how well the robo advisor has been designed.

- After all, there is no guarantee that the robo advisor will be able to make you money.

- Additionally, we should also note that the vast majority of robo advisors invest in exchange-traded funds (ETFs)

This means that each ETF will contain a wide variety of financial instruments, which helps you reduce your exposure to risk through diversification. This also means that robo advisors do not pick and choose individual stocks or bonds. In terms of what your portfolio will look like, this ultimately depends on how you answered the initial question set.

For example:

- If you have a low tolerance of risk, then it’s likely that most of your portfolio will be allocated to government bonds and blue-chip stocks.

- If you are prepared to take on more risk to target higher financial returns, then expect some exposure to growth stocks, corporate bonds, and the emerging markets.

Robo advisors come with both benefits and drawbacks that need to be considered before you invest. Regarding the former, the overarching advantage of investing in a robo advisor, is that you don’t need to do any of the legwork. On the contrary, not only will your portfolio be built based on your financial goals, but it will be automatically rebalanced on an ongoing basis.

On the other hand, robo advisors do not allow you to add or remove assets yourself. In fact, very few robo advisors allow you to make individual investments anyway – as they are not technically brokers. This is why we like eToro, as the platform not only offers passive tools in the shape of CopyPortfolios and Copy Trading – but you can also invest on a self-directed basis.

Robo Advisor vs Human Advisor

If you’re wondering whether you should go with a robo advisor or a financial advisor – this will ultimately boil down to cost. For example, while human advisors might be the best option on the table – this can be super expensive. After all, you are essentially receiving one-on-one advice with an experienced and qualified investor – so naturally, this will be costly.

At the other end of the scale, robo advisors are much cheaper. This is because everything is automated by the underlying technology – so human interference is rarely required. With that said, paying a premium for a human advisor doesn’t guarantee success – so do bear this in mind.

How to Choose the Right Robo Advisor for You

This guide has discussed ten of the best robo advisors South Africa in the market right now. However, there are many other providers in the online space – so knowing which robo advisor to go for can be a daunting task.

To help clear the mist, below we discuss the main considerations that need to be made in your search for the best robo advisor South Africa for 2022.

Minimum Investment

Perhaps the first consideration that you need to make is whether or not you have the required investment budget to meet the provider’s account minimum. As we covered in our reviews earlier, most robo advisors will have a minimum investment requirement that in many cases – can be a lot of money.

Past performance is not an indication of future results

For example, Charles Schwab requires a minimum investment of $5,000 – or about 70,000 rands. If opting for a one-time lump sum, Nutmeg is even higher at £5,000 – or 100,000 ZAR. You then have platforms like eToro – which require a minimum investment of just $500 to use its Copy Trading tool – which is about 7,000 ZAR.

Fees

Once you have established that you have the financial means to meet the minimum investment amount, you then need to look at fees. This can be a bit complicated in the case of robo advisor platforms, as there are often several different charges that are in play.

First, you will likely need to pay a management fee – which is calculated against the size of your investment. For example, Nutmeg charges 0.75% when utilizing its fully managed plan. eToro, however, doesn’t charge any management fees on either its CopyPortfolio or Copy Trading tool – which is why the platform is so popular in South Africa.

In addition to the aforementioned management fee, you will also need to cover the expense ratio of the respective ETF provider. This will vary depending on the respective ETF, albeit, the robo advisor platform will pass this charge on to you. You might also need to cover a spread, which is the markup between the bid and ask price of the ETF instrument.

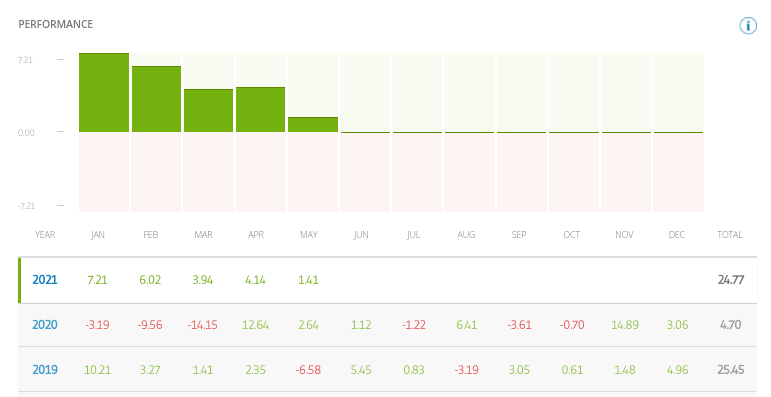

Past Performance

We found that the best robo advisors South Africa are super-transparent when it comes to past performance. By this, we mean that you are provided verifiable data as to how each robo advisor portfolio has performed since inception.

This gives you a good idea of how much your portfolio could make in the future. On the flip side, just remember that past performance is never a guarantee of future returns – so do tread with caution.

Payments

You also need to consider the payments department in your search for the best robo advisor platform South Africa. In most cases, you will be required to deposit funds by initiating a bank account transfer.

With that said, platforms like eToro not only allow you to fund your account with a debit/credit card but e-wallets too. The latter includes Paypal, Skrill, and Neteller. You should also look at whether or not any deposit/withdrawal fees will be charged on your chosen payment method.

Minimum Redemption

Most of the platforms discussed today give you unfettered access to your investment capital. This means that at any given time, you can exit your robo advisor position and withdraw the funds back to your bank account.

However, we also came across providers that require you to lock up your money for a certain period of time. For example, the Sanlam Wealth Edge Endowment plan has a minimum investment period of five years. This can be problematic if you need access to your money.

How to Get Started with the Best Robo Advisor

Ready to start automating your investment endeavours by getting set up with an account today? If so, the guide below will walk you through the process of how to invest money step-by-step.

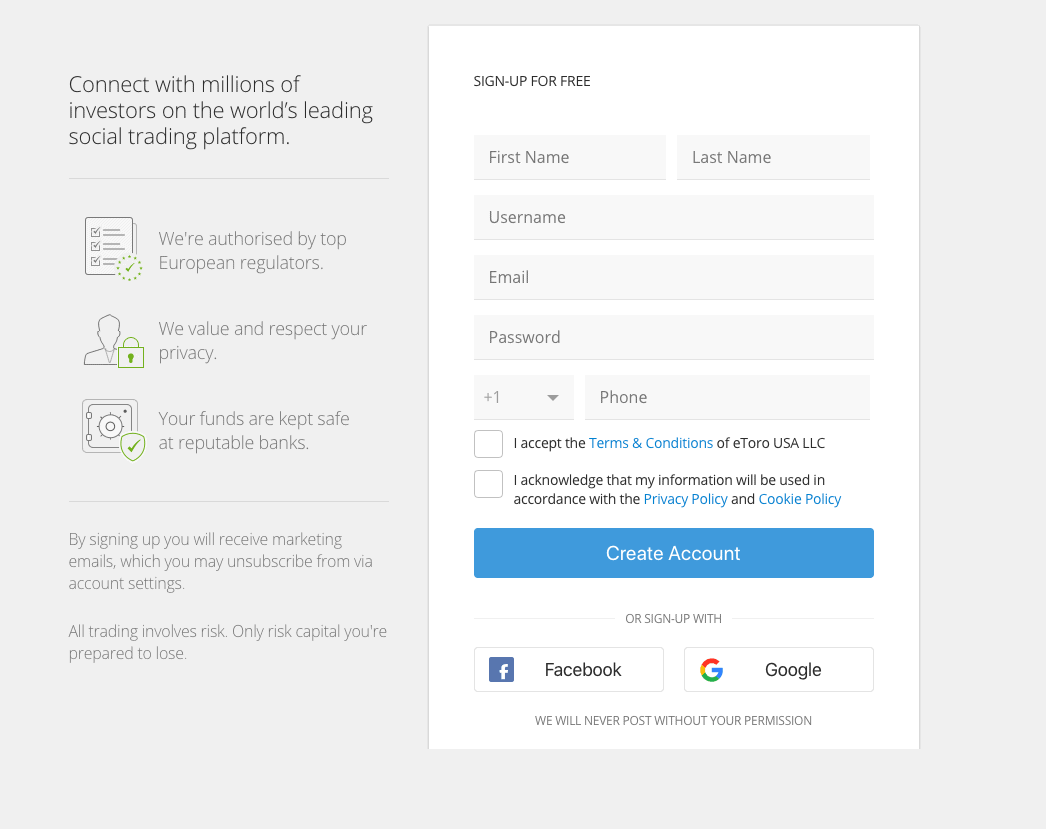

Step 1: Open an eToro Account

As eToro came out as the best robo advisor platform South Africa for 2022, the first step is to head over to the provider’s website and open an account. You will need to prove your name, home address, date of birth, and contact details. You will then need to verify your email address and mobile number.

67% of retail investor accounts lose money when trading CFDs with this provider.

eToro takes regulation seriously, so you will also be asked to upload a copy of your government-issued ID. This can be a passport, driver’s license, or national ID card. You also need to provide a valid proof of address – which can be a bank statement or utility bill issued within the last three months.

Step 2: Make a Deposit

Before you can invest at eToro, you will need to deposit some funds into your newly created account. You can choose from a debit/credit card, e-wallet, or bank transfer.

Take note, the minimum deposit to use the Copy Trading tool is $500. The minimum deposit for CopyPortoflios starts at $1,000 – but can be higher depending on the strategy. As such, just make sure your deposit covers the passive investment product that interests you.

Step 3: Choose CopyPortfolio

Most investors in South Africa will opt for a CopyPortoflio – as these are professionally managed by the team at eToro. As such, you will now need to select a CopyPortfolio strategy that interests you. There are heaps on offer – ranging from renewable energy and dividend stocks to cryptocurrency and growth stocks.

Note: If you want to utilize the Copy Trading tool, click on the ‘Copy People’ button, choose an investor, and follow the on-screen instructions.

67% of retail investor accounts lose money when trading CFDs with this provider.

Step 4: Confirm Investment

Once you have found a CopyPortfolio that takes your interest – it’s then just a case of entering your stake and confirming the investment. In doing so – there is nothing else for you to do until you decide to cash out.

Take note, CopyPortfolios should be viewed as a long-term investment. As such, most will keep their investment open for at least five years. This will give you the best chance possible of avoiding shorter-term volatility.

Best Robo Advisor Platform South Africa – Conclusion

In summary, robo advisors can be a great tool if you have an interest in the financial markets but don’t have the required time or knowledge to make decisions yourself. The robo advisor platform that you choose will take care of everything – meaning that you can sit back and let your money work for you.

Perhaps the main challenge is knowing which provider to sign up with. We found that eToro is the best robo advisor platform South Africa – as you will have access to a number of low-cost passive investment tools. This includes both Copy Trading and CopyPortfolios – both of which allow you to invest in a 100% passive nature.

eToro – Best Robo Advisor Platform South Africa – 0% Commission to Trade Stocks

67% of retail investor accounts lose money when trading CFDs with this provider.