How to Buy Cryptocurrency South Africa – Beginner’s Guide

If you’re based in South Africa and looking to get your hands on a cryptocurrency like Bitcoin, Ethereum, or EOS – the process can now be completed from the comfort of your home.

All you need is a top-rated crypto broker that offers competitive fees and your preferred South African payment.

In this guide, we explain the ins and outs of How to Buy Cryptocurrency South Africa in 2022. On top of explaining the potential risks and rewards, we also walk you through the process of buying your first crypto-asset online!

How to Buy Cryptocurrency South Africa – Step by Step Guide 2022

If you already know which cryptocurrency you wish to buy and want to complete the investment process right now – follow the steps outlined below. In doing so, you’ll be able to buy cryptocurrency in South Africa in minutes!

- 1. Open an Account with Libertex

- 2. Upload ID

- 3. Deposit

- 4. Buy Cryptocurrency

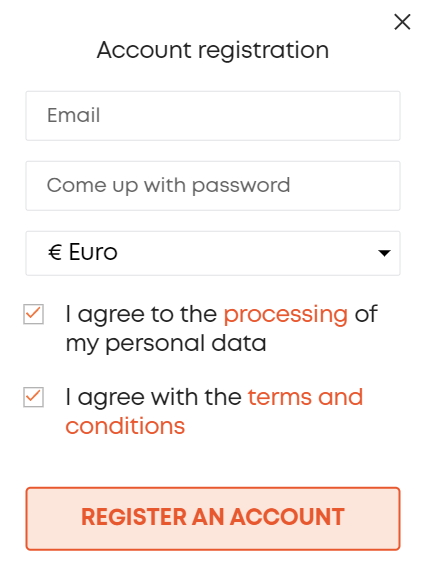

1. Open an Account with Libertex – Pay 0% Commission on Crypto

Your first port of call will be to open an account with a safe and low-cost crypto broker. We found that Libertex is by far the best option, as you can instantly buy more than 70 different cryptocurrencies CFDs with a debit/credit card or e-wallet without paying a single rand in spreads.

Here, you’ll need to provide some personal information and contact details.

This includes:

- First and Last Name

- Nationality

- Home Address

- Date of Birth

- Tax Identification Number

- Email Address

- Mobile Number

To complete the first stage of the Libertex registration process, you’ll need to confirm your email address and mobile number.

2. Upload ID

As heavily regulated cryptocurrency and stock brokers – Libertex will also need to collect a couple of verification documents from you. The good news is that the platform will verify them instantly.

The two documents that you need to upload are:

- Valid passport or driver’s license

- Recently-issued bank account statement or utility bill

Once you upload the above two documents, you can freely deposit and withdraw funds into and out of your Libertex account.

3. Deposit

If you’re wondering how to buy crypto South Africa with a convenient payment method – Libertex has you covered. This is because the platform supports debit cards, credit cards, bank transfers, and even e-wallets like you can buy bitcoin with Paypal, Skrill, and Neteller.

4. Buy Cryptocurrency

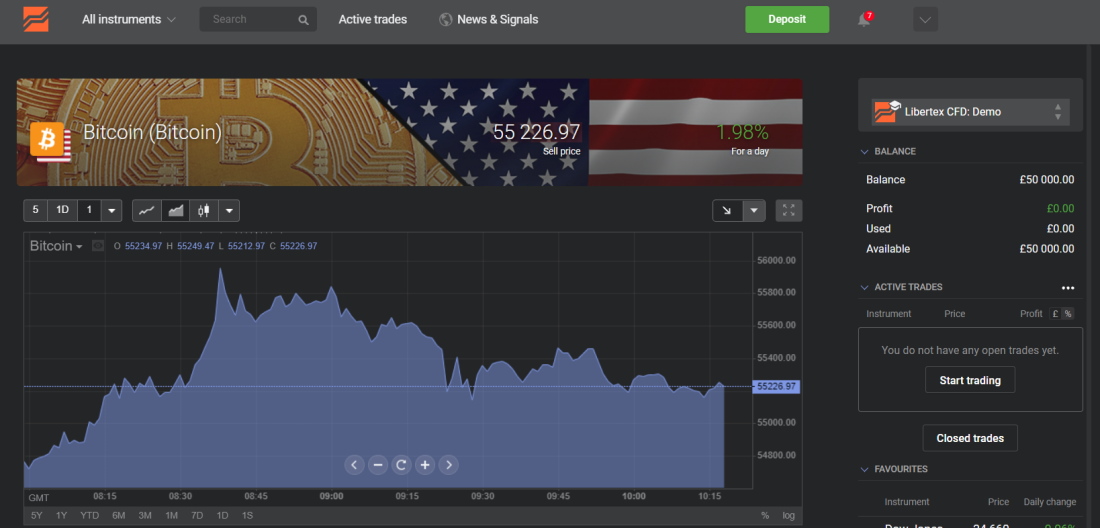

As long as you opted for an instantly-processed deposit method (debit/credit cards and e-wallets), the funds will now be situated in your Libertex account. As such, you can proceed to buy cryptocurrency.

First, click on the ‘Markets’ button, which you will find on the left-hand side of the page. Then, click on ‘Crypto’ to view the full range of supported digital currencies that you can buy.

In our example, we are looking to buy Bitcoin, so click on the ‘Buy’ button. In the order box, all you need to do is enter the amount of leverage and choose how many BTC/USD CFDs you want to trade. You can also place a stop-loss order.

Finally, click on the ‘Open Trade’ button to complete your spread-free cryptocurrency CFD investment!

What is Cryptocurrency?

One thing is for sure – although most people in South Africa have at the very least heard of cryptocurrencies like Bitcoin, very few understand what this digital asset class is or how it works. If this sounds like you – it’s absolutely crucial that you do a bit of research before you make a financial commitment.

After all, by buying cryptocurrency in South Africa, you are investing in a highly speculative and volatile asset.

Before we get to the nitty-gritty, let’s start with the basics:

- Cryptocurrencies are digital assets – meaning that they only exist in a non-tangible form

- In most cases, cryptocurrencies are decentralized. This means that no central bank or government owns or controls the technology.

- Instead, cryptocurrencies are stored on the blockchain – which is like a public account ledger that keeps track of each and every transaction

- Cryptocurrencies go up and down in value – in a similar nature to stocks

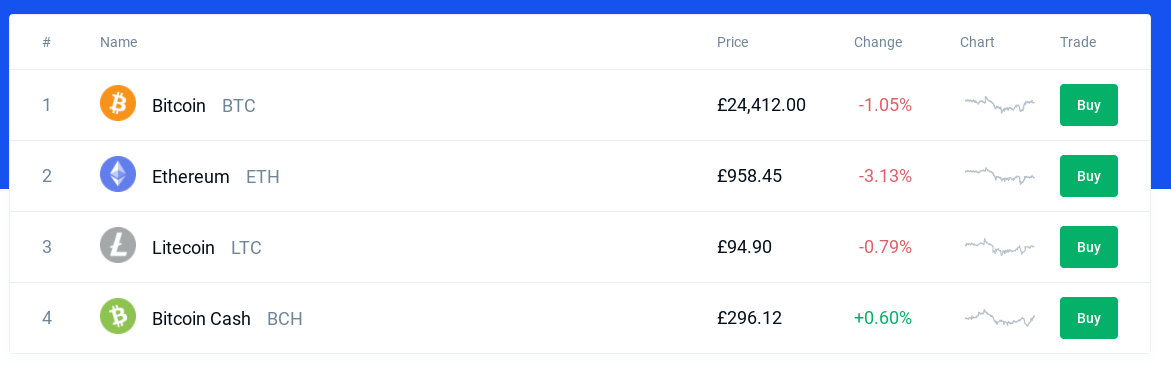

Now, Bitcoin is still the largest cryptocurrency in terms of market capitalization. It is also the most widely used and holds a status as the de-facto crypto-asset of choice.

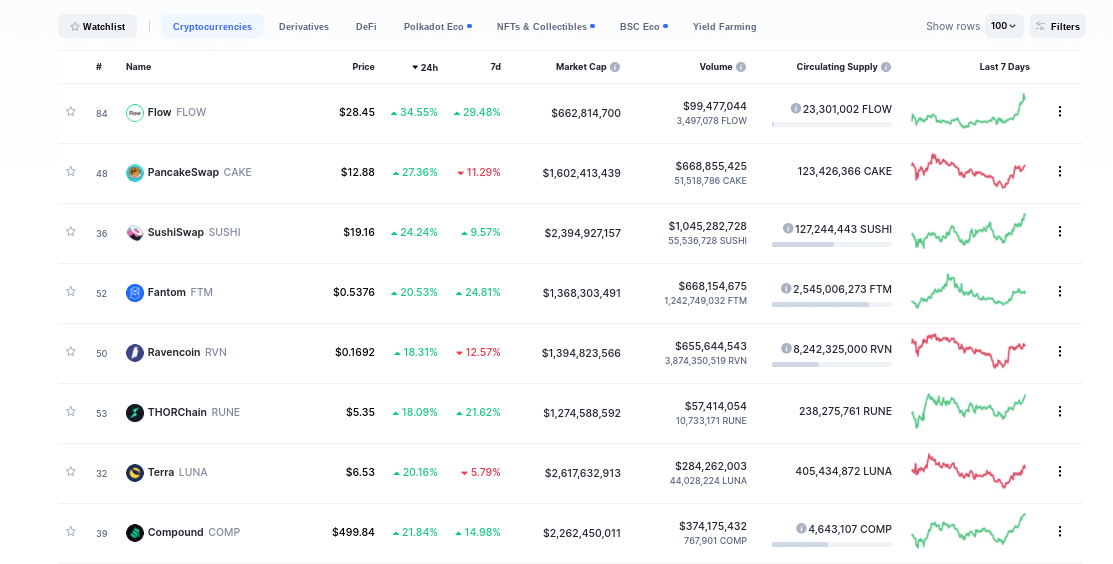

However, Bitcoin isn’t the only digital currency that people in South Africa are looking to buy. On the contrary, CoinMarketCap tells us that as of early 2021 – there are more than 8,600 cryptocurrencies that can be bought, sold, and traded online.

However, you are probably best to focus on cryptocurrencies that fall within the top-20 in terms of market capitalization. In doing so, you’ll be able to reduce your exposure somewhat, as these digital currency projects are established.

How Does Cryptocurrency Investment Work in South Africa?

Each and every cryptocurrency in the market has a specific purpose. For example, while Bitcoin was built to challenge the global banking industry, Ethereum is focused on smart contracts. You then have Ripple, which allows financial institutions to send and receive funds in a fast and low-cost environment.

However, it is important to recognize that very people in South Africa buy cryptocurrency to engage with the respective project or network. Instead, purchases are made with the view of making money. This means that when you buy cryptocurrency, you are doing so on a speculative basis.

Nevertheless, if you’re wondering how to buy cryptocurrency South Africa to make financial returns, the process works as follows:

- Let’s supposed that you invest 3,000 rands in Bitcoin

- When you make the purchase, Bitcoin is worth $40,000

- A couple of years later, Bitcoin is worth $70,000

- In percentage terms, this means that your 3,000 rands cryptocurrency investment is now worth 75% more

- You sell your cryptocurrency back to rands at your chosen exchange

As per the above, you invested 3,000 rands and made gains of 75%. As such, you sold your investment at a nominal value of 5,250 rands – representing a profit of 2,250 rands.

Crucially, the cryptocurrency market in South Africa is best viewed in the same light as penny shares. Not only is this because crypto asset prices change on a second-by-second basis – but they often do so in a volatile manner.

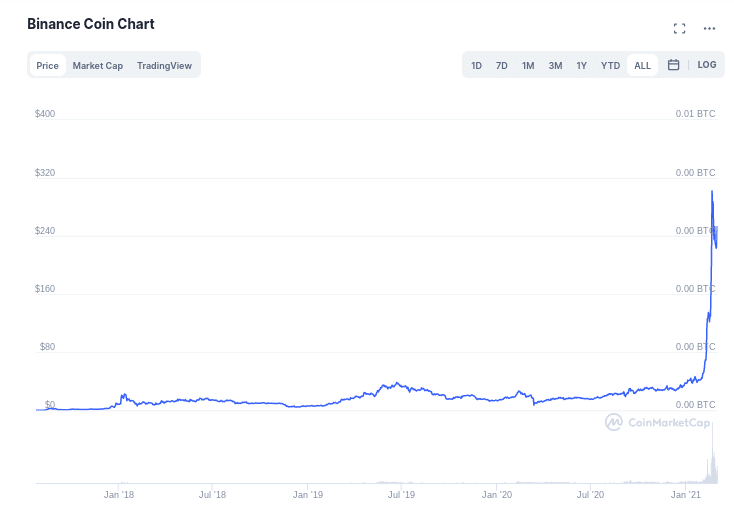

- For example, in the 24 hours prior to writing this guide, the likes of Binance Coin and Vechain have increased in value by 16% and 11%, respectively.

- However, zooming out to the 7-day charts, the same cryptocurrencies have actually dropped in value by 3% and 9%.

As such, you should only buy cryptocurrency in South Africa if you are comfortable with the associated volatility levels.

Why Buy Cryptocurrency?

As noted in the section above, the overarching reason for buying cryptocurrency in South Africa is to make financial gains. This is no different from buying JSE-listed stocks or investing in a mutual fund.

However, to be more specific, South Africans are now considering digital currencies as an investment vehicle for one clear reason – the upside potential. That is to say, cryptocurrencies like Bitcoin and Ethereum have been the best-performing asset classes in recent years, although altcoins such as Tron are really starting to gain momentum.

Cryptocurrencies vs the JSE 40

When people in South Africa have a bit of spare cash to invest in the financial markets – they often turn to the JSE 40. For those unaware, this is the primary stock market index in South Africa – and it tracks the value of the 40th largest companies that are domestically listed.

This is viewed as a risk-averse way to invest money – as you are diversifying across 40 different stocks from varying sectors and industries. On the one hand, the JSE 40 index has increased by 31% over the past five years. But, in comparison to cryptocurrencies like Bitcoin – these returns are minute.

- For example, five years prior to writing this article, Bitcoin was priced at just $438. Fast forward to its recent highs of $58,000 – this means that Bitcoin has increased in value by over 13,000% – compared to just 31% with the JSE 40 index.

- Bitcoin isn’t the only digital currency that has experienced rapid growth in recent years.

- Another example of many would be Binance Coin – which was worth just $0.10 back when it was first launched in 2017. At the time of writing in early 2021, the same cryptocurrency is worth over $250 – translating into gains of more than 250,000%.

Ultimately, this is the main driving force behind so many South Africans considering a cryptocurrency investment.

Cryptocurrencies Could be the Next Internet Boom

Taking a brief trip down memory lane to the mid 1990s, nobody could have imagined just how vital the internet would eventually become. With that said, if you got into internet stocks early – you’d now be a millionaire.

- Think along the lines of Apple, Amazon, and Microsoft – all of which could have been invested in at just a small fraction of today’s prices.

- The key point here is that many believe that cryptocurrency could be the next internet boom.

- That is to say, in two or three decades’ time, cryptocurrencies could have just as much as a say in our lives as the internet does now.

If this is the case, then this will all-but-certainly be reflected in the value of digital currencies over the course of time. Sure, there are over 8,600 such projects in the market right now – and most will likely fade away. However, the likes of Bitcoin and Ethereum are arguably worth just a fraction of their true potential – especially when you consider their global and borderless reach.

You Don’t Need to go Crazy With Stakes

Although cryptocurrencies could be the next big thing, equally, digital assets are highly volatile and speculative. Don’t forget, Bitcoin went from $20,000 to just $4,000 in the space of 12 months after peaking in late 2017. Although the digital currency has since surpassed this prior high, it remained in a bearish trend for several years.

As such, you are best advised to keep your stakes modest. The good news is that you don’t need a lot of money to buy cryptocurrency these days. In a similar nature to fractional shares, you can buy a ‘fraction’ of one digital currency.

This is especially beneficial when investing in top-rated crypto assets like Bitcoin – which now cost tens of thousands of dollars. This is one of the primary reasons why so many South Africans are using Libertex to trade cryptocurrency CFDs. As such, you can gain exposure to this innovative asset class without taking ownership of the underlying digital asset.

You can now Earn Interest on Cryptocurrency in South Africa

Many newbies are under the impression that the only way you make money from a cryptocurrency investment is when the respective coin increases in value. Although this is somewhat true – as digital assets do not pay dividends, there is an additional revenue stream that you might consider – crypto savings accounts.

There are several trusted providers active in this space – and the process works as follows:

- You open an account with a crypto savings provider like YouHodler or Binance

- You deposit your cryptocurrency holdings into the platform

- The platform will use this to fund crypto loans – which are secured by collateral

- In turn, you will be paid a rate of interest for as long as your funds are kept in the crypto savings account

As such, this allows you to keep your cryptocurrency investment stored safely for as long as you wish, while at the same time, generate an annual yield on your holdings. In turn, you’ll still benefit if and when the value of your cryptocurrency increases in the open marketplace.

Hedge Against a Depreciating Rand

You may or may not be aware that the South African rand has continued to depreciate in recent years. When you factor in the wider economic impact of the coronavirus pandemic, there is every chance that this will continue to be the case. This is yet another reason why so many South Africans are turning to cryptocurrency.

That is to say, should you wish to hedge against a depreciating rand, cryptocurrencies like Bitcoin are worth considering. Although this is yet to be proven beyond doubt, there is growing evidence that large-scale financial institutions are taking the same route to hedge against falling bond yields. If this is the case, this can only boost the value of Bitcoin further.

What is the Best Cryptocurrency to Buy Now in South Africa?

Not only do you need to learn how to buy cryptocurrency South Africa, but you also need to think about which digital assets you wish to add to your portfolio. After all, there are thousands of digital currencies in the market – most of which you can buy with ease in South Africa.

Although you are best advised to perform your own research – below we discuss the best cryptocurrency to buy now.

Bitcoin

It likely won’t surprise you to see that Bitcoin is overwhelming the best cryptocurrency to buy in South Africa. Not only is Bitcoin the first and original cryptocurrency to grace its presence – but it is still the largest. In fact, at the time of writing, Bitcoin carries a market capitalization of just under $1 trillion.

- This makes it more valuable than any company listed in South Africa, and most stocks listed in the US.

- Additionally, when you consider that there are over 8,600 cryptocurrencies, it’s super-impressive that Bitcoin still holds a market share of more than 60%.

- Bitcoin is also the most recognized cryptocurrency globally – meaning that it is often the go-to digital coin for first-time investors.

- The de-facto cryptocurrency has since made its way to Wall Street, too.

- This is because institutional investors can now buy, sell, and trade Bitcoin futures. A Bitcoin ETF is also expected to get the green light in the coming years.

Ultimately, not only is Bitcoin a great medium of exchange – but it’s also viewed as a store of value. Regarding the former, the Bitcoin network facilitates borderless transactions in just 10 minutes, at a cost that is often less than $1. And the latter – Bitcoin carries similar characteristics to gold – insofar that it is a finite asset class.

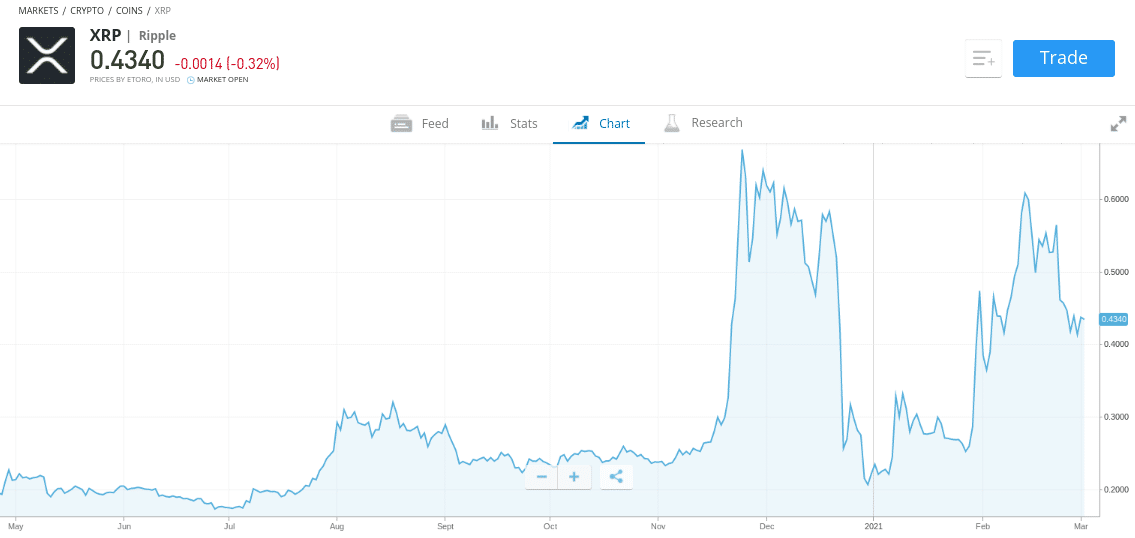

Ripple

Ripple is still somewhat of a sleeping giant when you consider the marketplace that it is looking to dominate. For those unaware, Ripple is a digital currency project, that seeks to revolutionize the interbank transaction arena. Trillions of dollars currently go through the SWIFT network each and every day – so this is a big marketplace.

However, SWIFT transactions often take days to settle and are super expensive. This is especially the case when an emerging currency like the rand is involved. In the case of Ripple, the underlying technology allows banks and financial institutions to transfer funds overseas in seconds – and at a price of just a couple of cents.

Crucially, Ripple’s native cryptocurrency – XRP, forms the bridge between two competing currencies – providing all of the liquidity that senders and receivers need. In turn, there is every likelihood that as more and more banks use the Ripple technology – this will have a positive impact on the value of XRP.

Binance Coin

This particular cryptocurrency may be a controversial selection for some, but Binance Coin (BNB) has held its own since launching in 2017. As we briefly covered earlier, the digital currency has since increased in value by over 250,000%. This means that a 100 rand investment back then would now be worth over 2.5 million rands.

At first glance, you might be underwhelmed when you learn that the primary purpose of the Binance Coin is to offer reduced trading commissions on the provider’s exchange. However, Binance attracts tens of billions of dollars in daily trading volume – meaning that large-scale investors will often hold a quantity of BNB Coins to benefit from lower fees.

And most importantly – management at Binance is now engaged in a ‘burning’ program. This operates in a similar nature to a traditional share buyback, insofar that Binance will use generated profits to purchase BNB Coins from the open marketplace, and then burn them from the circulating supply.

In turn, this reduces the overall supply and thus – has the desired impact to increase the coin’s value. Ultimately, it’s important to remember that in many ways, Binance makes money irrespective of how well the wider cryptocurrency market is performing. After all, its core revenue stream is driven by trading commissions.

Is it Legal to Buy Cryptocurrency in South Africa?

If you’re wondering how to buy cryptocurrency South Africa in a safe and legal manner – you should have no concerns. This is because the process of buying, selling, and trading cryptocurrencies is perfectly legal.

In fact, there is still a lack of crypto-specific legislation in South Africa, albeit, this is something that the government plans to introduce in the near future. With that said – there is one area of the cryptocurrency scene that domestic law covers – and that’s taxation.

Crucially, any profits that you make by selling your cryptocurrency holdings are liable for tax – much in the same way that you pay capital gains on stock investments. For more information about your tax obligations when buying cryptocurrency – speak with a qualified professional.

Buying Cryptocurrency Safely

Make no mistake about it, although cryptocurrencies no longer have a murky reputation in South Africa, the industry is still prone to scam artists. After all, digital currencies largely operate in an anonymous arena, transactions are not tied to the identity of the sender or receiver. In turn, this means that crypto-assets like Bitcoin are often the currency of choice for scammers.

With this in mind, there are several safeguards that you can take to ensure you buy cryptocurrency safely in South Africa.

Only use a Regulated Broker

If you’re looking at how to buy cryptocurrency South Africa in the safest way possible – it’s imperative that only make a purchase through a regulated broker. The biggest and most trusted cryptocurrency and Bitcoin exchanges are actually based overseas – as they are backed by reputable financial bodies that have a global presence.

For example, our top-rated CFD broker Libertex is regulated by the FSCA. This means that you can buy cryptocurrencies CFDs in South Africa in a safe and secure way. You will benefit from several investor protections – such as the broker keeping your money in bank accounts that are separate from its own.

Avoid Peer-to-Peer Transactions

Peer-to-peer cryptocurrency transactions are getting more and more popular in South Africa. In its most basic form, this refers to the process of buying digital currency directly from the seller – subsequently cutting out the middle man.

You can do this online via a P2P website or in person. Either way, this is a very risky way of buying cryptocurrency in South Africa – as you won’t have the backing of a regulated provider. Instead, you need to trust the other person in the transaction is acting honestly.

Don’t Forget About Storage

Being able to buy cryptocurrency in South Africa safely isn’t just about the initial transaction process. On the contrary, you also need to think about storage. After all, cryptocurrencies are stored in private digital wallets.

- By choosing a trusted crypto wallet provider and having a firm understanding of core security practices – you can ensure that your cryptocurrency is kept out of the wrong hands.

- But, if you’re a newbie – you might not understand the ins and outs of wallet security and thus – your funds are at risk of being exposed to a remote hacker.

With this in mind – and as long as your chosen broker is regulated by a reputable body, it could be worth leaving your cryptocurrency investment at the platform in question. In doing so, the broker will safeguard your digital coins until you are ready to cash out.

Cryptocurrency Wallets

Once you have decided to invest in cryptocurrency, you will need a wallet to store it.These can come in all forms from hardware, software and mobile crypto wallets. You can see our full list of recommendations here:

What Payment Methods Can You Use to Buy Cryptocurrency?

If you’re thinking about how to buy cryptocurrency South Africa with an everyday payment method – you’ll need to use a regulated broker. This is because unlicensed exchanges do not have the legal remit to accept or touch fiat currency. Instead, they facilitate deposits and withdrawals in crypto assets only.

With that said, if using our top-rated cryptocurrency trading platform Libertex, you’ll be able to buy your chosen digital asset with the following payment methods:

- Debit Card

- Credit Card

- Paypal

- Neteller

- Skrill

- Bank Wire

As per the above, this allows you to buy cryptocurrency in South Africa with a convenient and fast payment method. In fact, other than a conventional bank wire, all of the above payment options are credited instantly.

Best Cryptocurrency Brokers – Where to Buy Cryptocurrency

Just like when it comes to stock trading, you need to choose a good broker before you can buy cryptocurrency, so if you’re wondering where to buy cryptocurrency in South Africa, there are many options on the table. As we briefly noted earlier, the safest option is to use a best bitcoin broker. There are dozens of such platforms that you might consider, so it’s important to do your homework.

To fast-track the process for you, below we discuss where to buy cryptocurrency in South Africa in a safe and low-cost manner.

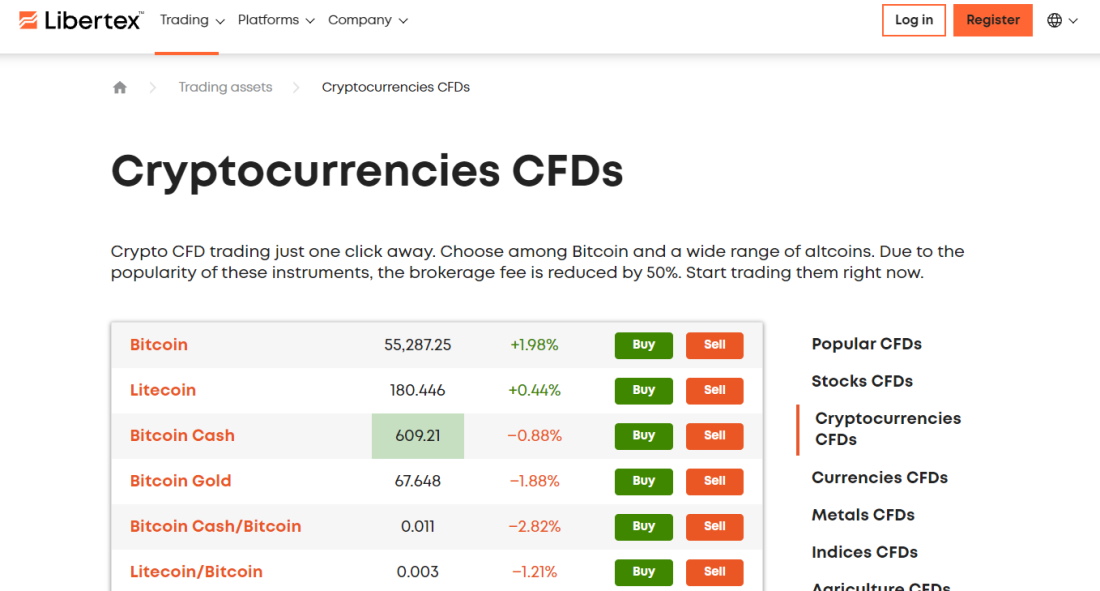

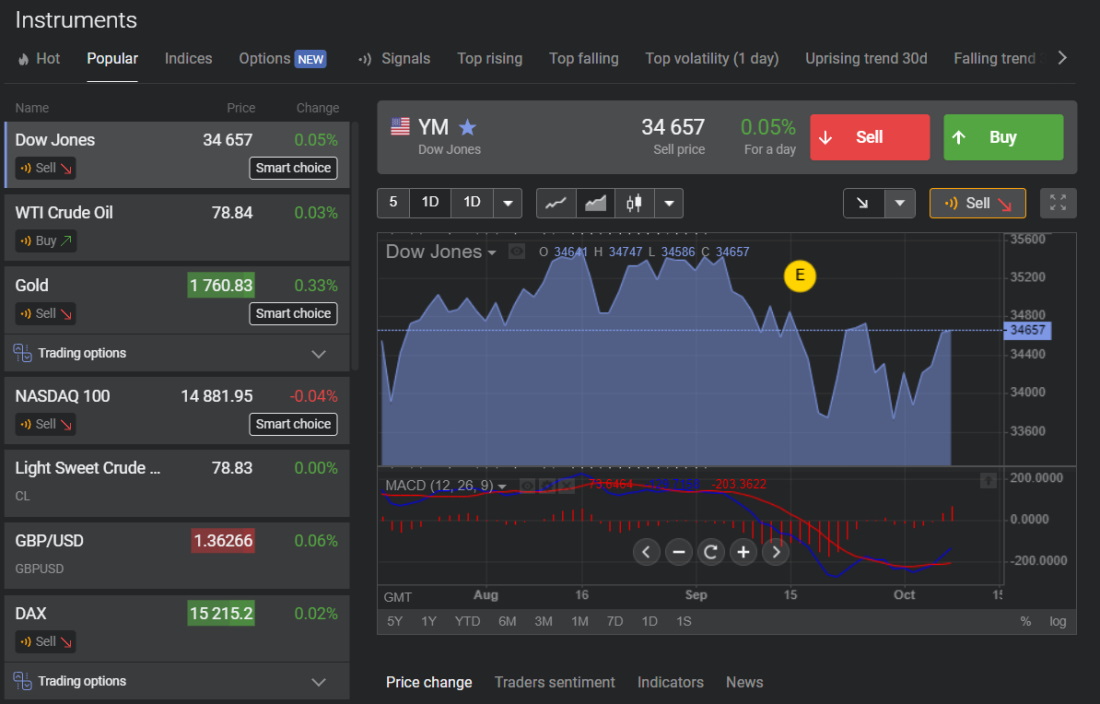

1. Libertex – Best Global CFD Broker with Zero Spreads

If you’re interested in CFD trading and want to speculate on the price movements of underlying assets such as cryptocurrencies, stocks and forex then Libertex has you covered. This CFD trading platform offers a variety of CFD asset classes such as stocks, cryptos, indices, commodities, forex, ETFs and more. One of its best selling points is that you can buy and sell CFDs with virtually zero bid-ask spreads and low commissions per trade.

Founded in 1997, Libertex is an online CFD broker with a strong track record that spans over two decades. The provider boasts a client base of more than 2.2 million. Unlike a lot of its competitors, Libertex offers a seamless service that comes with 250+ tradable assets. At Libertex, you can access leveraged CFD instruments allowing you to stretch your investing capital. For key insights into the best high leverage brokers in South Africa be sure to also read our comprehensive guide. Beginner traders will feel more comfortable with the Libertex web trading platform, while more advanced investors can gain access to MT4 and MT5.

You can buy and sell a range of cryptocurrency CFDs with the click of a button. Depending on what your speculations are you can either go long or short on popular crypto CFDs with leverage. You can choose among Bitcoin and a broad range of altcoins such as Arweave and Loopring.

Libertex makes it simple to deposit money. Credit cards, debit cards, e-wallets, and bank transfers are just a few of the payment options available to you. While there are no deposit fees, withdrawal fees vary depending on the payment method you use. For instance, withdrawing funds via PayPal and Skrill incurs no fees. The free trading platform levies a commission per trade as a result of the broker’s spread-free offering.

When it comes to security and regulations, Libertex Pty., is a South African financial services company (FSP Number 47381) and is regulated and supervised by the Financial Sector Conduct Authority (FSCA). If you’re looking for the best FSCA brokers, be sure to check out our comprehensive guide.

Pros

Cons

75.3% of retail investor accounts lose money when trading CFDs with this provider.

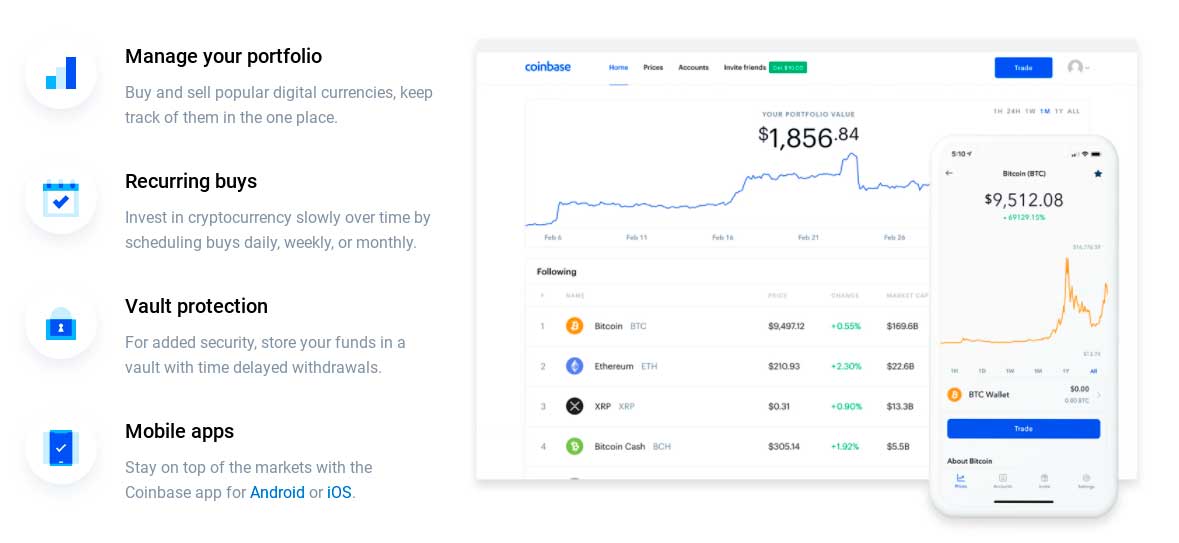

2. Coinbase – User-Friendly Bitcoin Exchange With Over 35 Million Customers

The main attraction of Coinbase is that it offers casual investors the chance to buy cryptocurrency in a simple and safe environment.

For example, it takes just minutes to open an account and get your ID verified. Then, you’ll have access to dozens of different crypto assets. You can invest in Bitcoin, Ripple, and Ethereum – you can also choose from a good selection of ERC-20 tokens. Furthermore, you can also buy Solana, which has been a hot crypto nowadays in the sphere.

In terms of safety, Coinbase has an excellent reputation in the crypto asset arena. As a buyer, you’ll have access to safeguards like two-factor authentication, address whitelisting, email notifications, and the option of locking all withdrawal requests for 48-hour via the Coinbase Vault. The broker also has a great reputation with regulators in the US – such as the SEC.

However, while Coinbase stands out for simplicity and security – it falls very short in the fee department. For example, if you were to buy cryptocurrency with a debit card, Coinbase would charge you an Instant Buy fee of 3.99%. This means that a 5,000 rand deposit would result in a charge of just under 200 rands.

The cheaper option is to deposit funds via bank wire. However, once the funds arrive, you will then be subjected to a 1.49% trading commission. You will need to pay this when you buy cryptocurrency and again when you sell. When you factor in that CFD brokers like Libertex allow you to trade spread-free, Coinbase is rather expensive.

Pros

Cons

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

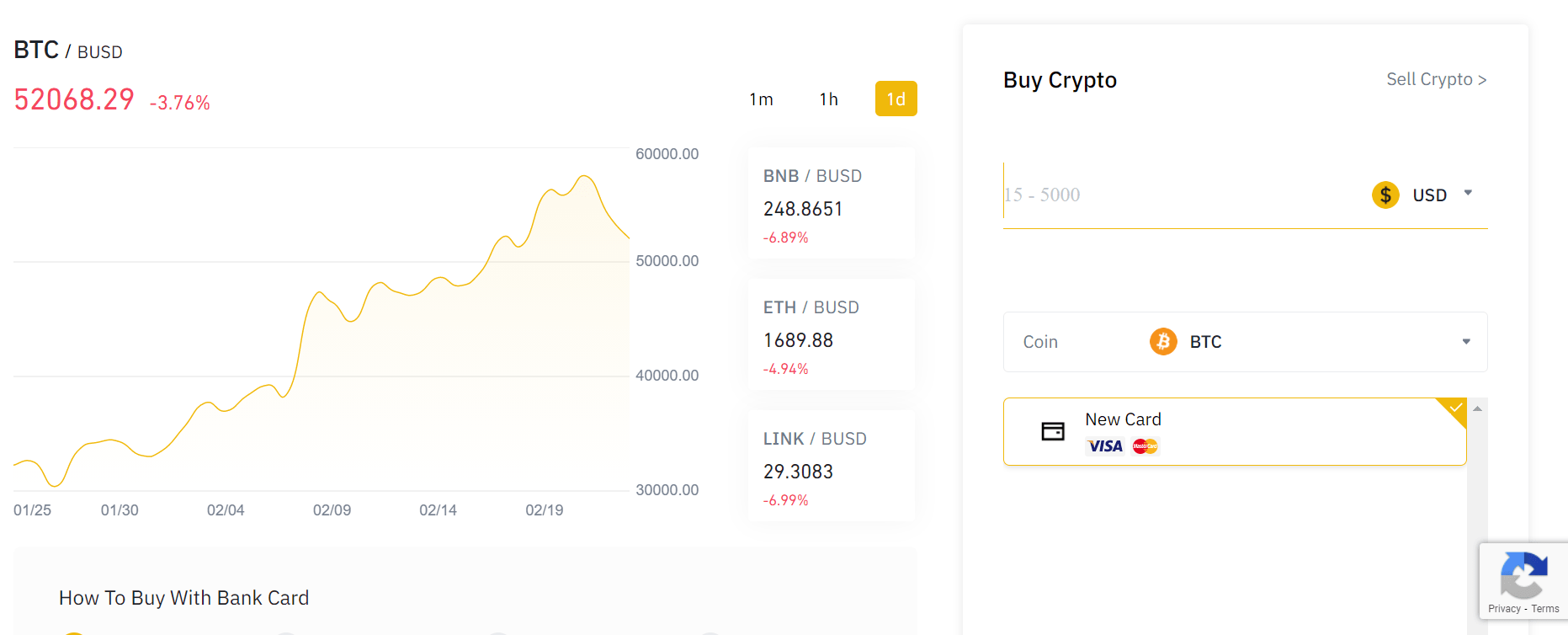

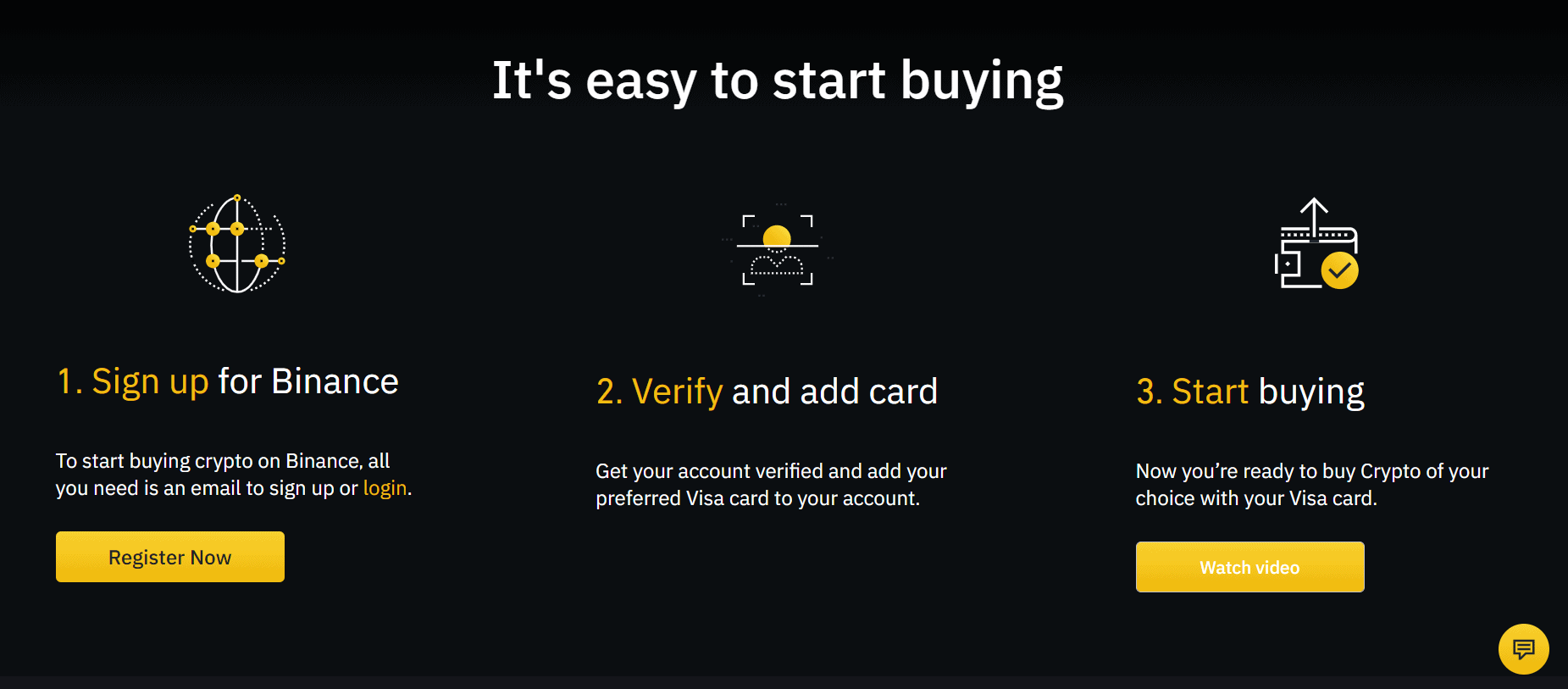

3. Binance – Largest Cryptocurrency Exchange for Trading Volume and Liquidity

After all, it facilitates billions of dollars of trading activity each and every day. In terms of the positives, Binance is home to hundreds of digital currencies including popular altcoins like Polkadot, Chainlink and Uniswap. Naturally, this includes heaps of small-cap projects that are rarely listed on other Bitcoin trading platforms.

On top of crypto-asset diversity, Binance is also a great option as it charges just 0.1% in trading commissions. This is significantly cheaper than the 1.49% charged by Coinbase and 2% at Altcointrader but not quite as competitive as Libertex – which is spread-free.

Nevertheless, Binance also offers a variety of ‘alternative’ cryptocurrencies that may interest you, for instance if you want to buy cardano, our buy monero as you may wish to access this marketplace in a more supplicated manner. For example, Binance allows you to trade cryptocurrency futures and options – offering leverage of up to 125x on perpetual contracts.

Additionally, Binance even offers a Crypto Savings Account that allows you to earn interest on any digital assets that you store. However, in a similar nature to Coinbase, the major drawback with Binance is that you will be charged handsomely to deposit funds with a debit card. Costing 3% of the transaction amount, cheaper options are certainly available.

Pros

Cons

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

How to Buy Cryptocurrency South Africa – Conclusion

This guide has covered the nuts and bolts of how to buy cryptocurrency South Africa. This includes the process of choosing a suitable broker or exchange, which cryptocurrencies are hot at the moment, and what risks and potential rewards you need to consider.

If you are ready to take the cryptocurrency plunge and wish to get started right now – the FSCA-regulated broker Libertex gives you access to a wide range of cryptocurrency CFDs – all of which can be bought and sold spread-free.

Opening an account takes just minutes and you can instantly deposit funds with a South African debit/credit card, bank account, and even an e-wallet! This means you can easily buy BItcoin with credit card or your preferred method.

Libertex – Best CFD Broker to Buy Cryptocurrency CFDs South Africa – Spread-Free & Regulated

75.3% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

Can I buy cryptocurrency with South African rands?

How much does it cost to buy 1 Bitcoin in South Africa?

Where can I buy cryptocurrency online in South Africa?

Is it legal to buy crypto South Africa?

Where to buy cryptocurrency South Africa with Paypal?

What is the best cryptocurrency to buy now?