How to Buy Litecoin South Africa – Beginner’s Guide

Being nearly identical to Bitcoin, Litecoin is the biggest rival of the most popular cryptocurrency in the world and one of the largest digital coins with a market cap of slightly above $17 billion as of May 2021. This peer-to-peer cryptocurrency is considered by many as a better currency for exchanging goods and the number one alternative to Bitcoin.

Since its foundation in 2011, Litecoin has seen exponential growth in adoption as well as in value. So, if you are based in South Africa and looking at how to buy Litecoin South Africa, this guide will help you find the answer. We’ll explain the technology behind Litecoin, analyze the Litecoin historical price performance and suggest top UK brokers that allow you to buy Litecoin.

How to Buy Litecoin South Africa – Step by Step Guide 2021

If you want to instantly buy Litecoin in South Africa without reading our full guide, simply follow the 4 steps below.

- Open an account with Capital.com – To buy Litecoin in South Africa, you first need to open an account with Capital.com.

- Upload ID and Verify Your ID – Before you can deposit funds and trade on Capital.com’s platform, you need to verify your identity by uploading your passport or any other national ID.

- Deposit Funds – Add funds to your online trading account by choosing one of Capital.com’s supported payment methods.

- Buy Litecoin – Navigate to the crypto section, search for Litecoin and place an order to buy Litecoin.

What is Litecoin?

When we compare the two coins – there are several reasons why many analysts and crypto fans think Litecoin is better than bitcoin. First and foremost, Litecoin transaction speed is much faster than Bitcoin. In other words, Litecoin is four times faster than Bitcoin as it generates a new block every 2.5 minutes while Bitcoin generates a new block every 10 minutes.

Further, in all opinions, Litecoin is much safer than Bitcoin. This is primarily because Litecoin blocks are created more quickly via the mining process on the Litecoin PoW algorithm (known as Scrypt) as compared to Bitcoin’s SHA-256. And, much like bitcoin, Litecoin has a total supply that cannot be altered by any authority of 84 million coins, quadruple the total supply of bitcoin which stands on 21 million coins.

Why Buy Litecoin? Litecoin Analysis

Over the past decade, Litecoin has been in the shadow of Bitcoin and other popular crypto coins like Ethereum, and Ripple. After all, Litecoin is not the first cryptocurrency that was created, nor the first to go mainstream. By all means, Litecoin is simply a ‘copy’ of Bitcoin and as such, it hasn’t received the same attention and interest from the media and crypto community.

Nonetheless, much like Bitcoin – Litecoin is the only cryptocurrency that can be used as a coin for payments like any other fiat currency. But Litecoin was created with one goal – to become a better alternative to Bitcoin. And, indeed, in all aspects, Litecoin has much better technology than bitcoin. For example, some of the main advantages of Litecoin over Bitcoin include:

- The Litecoin Blockchain Technology – Litecoin’s blockchain network is capable of handling a higher volume of transactions than bitcoin.

- Mining Rewards – Litecoin miners are awarded 12.5 new Litecoins per block, which is 4 times higher than Bitcoin.

- A Faster Speed of Transactions – On the Litecoin network, blocks are mined approximately every 2.5 minutes compared to 10 minutes on Bitcoin’s network. As such, Litecoin is four times faster than its counterpart, Bitcoin.

- Security – Due to the fact that Litecoin transaction process is shorter, then Litecoin is also much more secure than Bitcoin.

- A Decentralized PoW (Proof of Work) Algorithm – Litecoin has a different Proof of Work algorithm that is known as Scrypt. This PoW algorithm makes Litecoin more accessible for those who want to mine Litecoin and thus, makes the network much more decentralized than Bitcoin.

Litecoin Price

Litecoin’s price has been on a wild journey since its inception, with lots of extreme ups and downs and high volatility. And, like the vast majority of leading cryptocurrencies, Litecoin is currently trading near all-time high levels. As a matter of fact, Litecoin is seeing, once again, a very positive uptrend since the founder Charlie Lee cashed out in December 2017.

After it was trading near-zero levels for almost three years, Litecoin reached its all-time high of $360 during the crypto boom in 2017 before falling down to around $20-25 in 2018. Then, the coin has had another bounce in 2019 and another drop in late 2019-early 2020. But, ever since the crypto craze started again in 2020, Litecoin has been on an explosive run with a return of nearly 700% in just one year.

When we analyze the price of Litecoin, it is often correlated to Bitcoin and the crypto market in general. This is somewhat surprising as these two coins have some sort of competition, but right now, all crypto projects have a shared goal which is the adoption of cryptocurrencies in the global economy.

Litecoin to Rand

Being one of the most popular crypto coins in the world, it is no wonder that you can find many Litecoin to South African Rand charts and converter tools. However, finding an exchange that supports LTC/ZAR currency pair as a financial instrument is not something that currently exists in the market. This means you’ll have to trade LTC/USD, LTC/BTC, or LTC versus other widely used fiat currency.

Crucially, if you decide to buy Litecoin with Bitcoin on a crypto exchange, you first need to buy Bitcoin in South Africa and then exchange your Bitcoins to Litecoin.

Where to Buy Litecoin in South Africa

Buying cryptocurrencies involves setting up an online trading account on a crypto exchange, verifying your identity, and funding your account. To get the most of trading in the crypto market, investors often search for a certain exchange as each platform offers a different range of assets, pricing structure, and trading tools and features.

Essentially, there are two methods to buy Litecoin in South Africa – via traditional exchanges or via CFDs. The latest is a form of derivative investment that enables you to purchase an asset and simply speculate on the price of the asset without owning it.

To help you find the best choices in South Africa to buy Litecoin, we’ll review two of the best CFD brokers that are authorized in SA and support Litecoin.

1. eToro – Best Cryptocurrency Platform in South Africa to Buy Litecoin

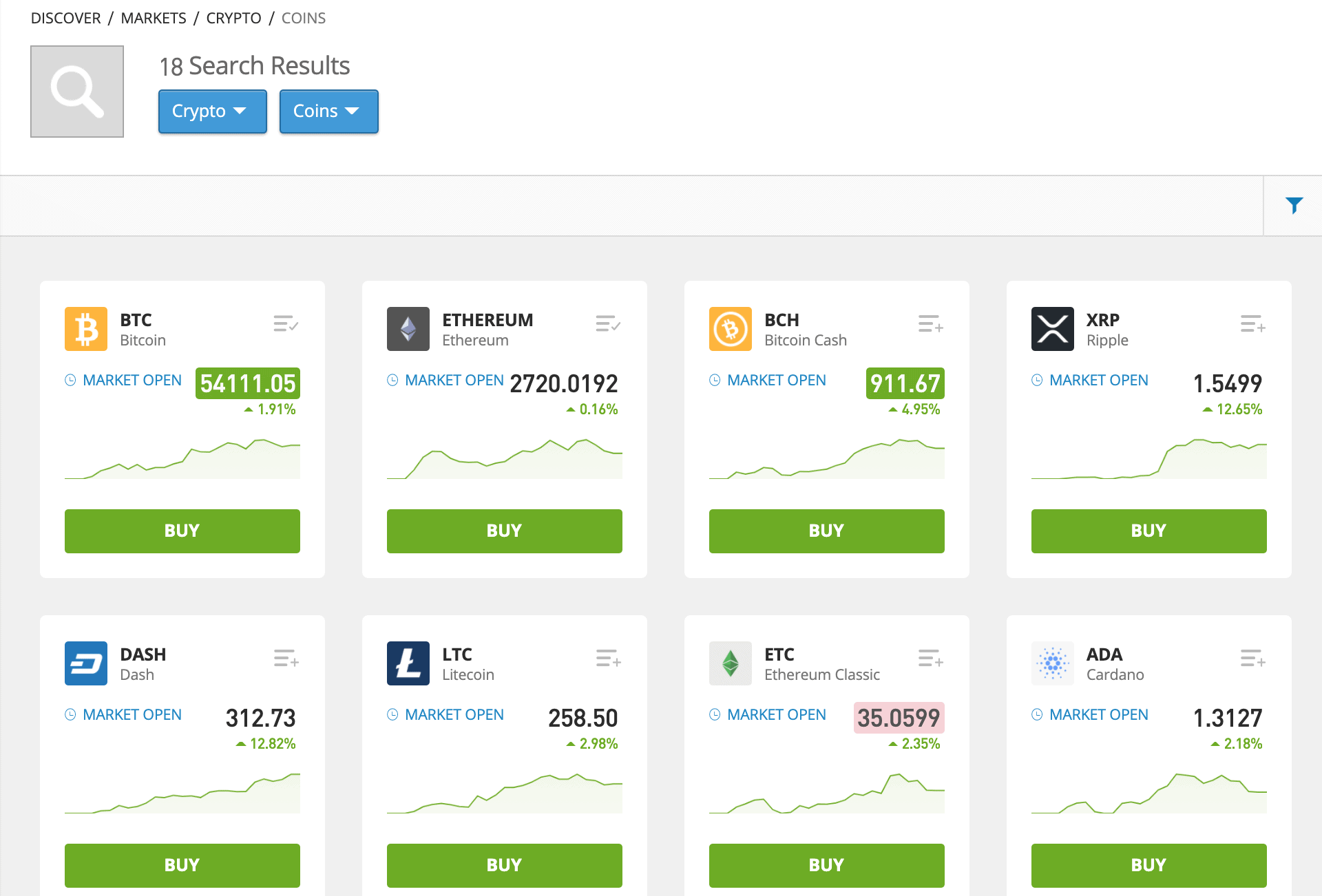

To be honest, eToro is not offering a wide range of digital assets on its platform. In fact, it offers just 18 digital currency pairs that include Bitcoin, Ethereum, Litecoin, Bitcoin Cash, Ripple, Dash, Ethereum Classic, Cardano, IOTA, Stellar, EOS, NEO, Tron, Zcash, Binance Coin, Tezos, Chainlink, and Uniswap.

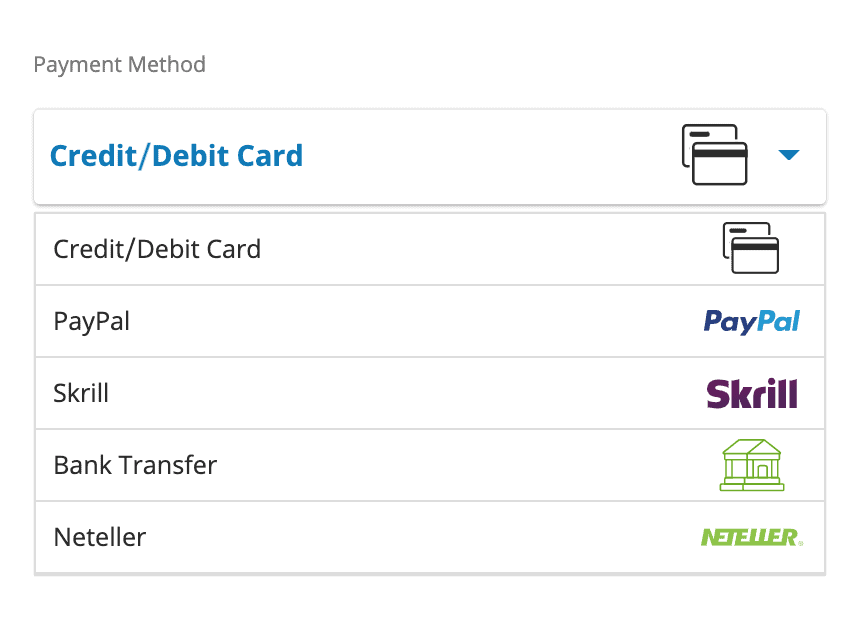

However, while the selection of crypto coins is obviously lower than what you can get on other platforms like Binance, and Poloniex – there are reasons why eToro is one of the most popular platforms in the world for cryptocurrency trading. The first and most important reason is the fee structure at eToro, that unlike traditional exchanges, enables users to buy and sell any asset on the platform without paying trading fees. Moreover, the process of buying and selling digital assets on eToro is very simple and this brokerage firm supports a variety of payment methods including credit and debit cards, PayPal, bank wire transfer, Skrill and Neteller.

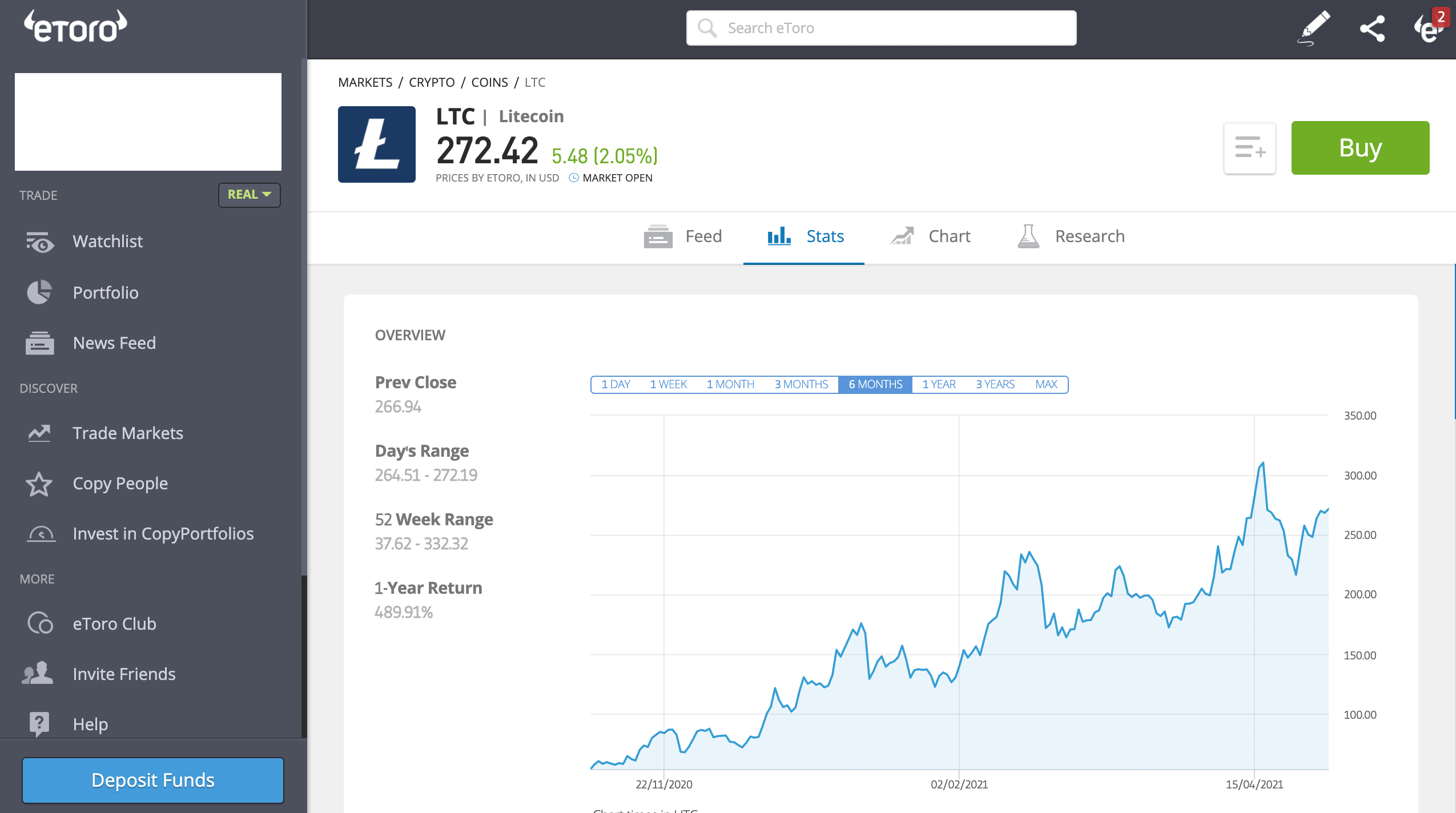

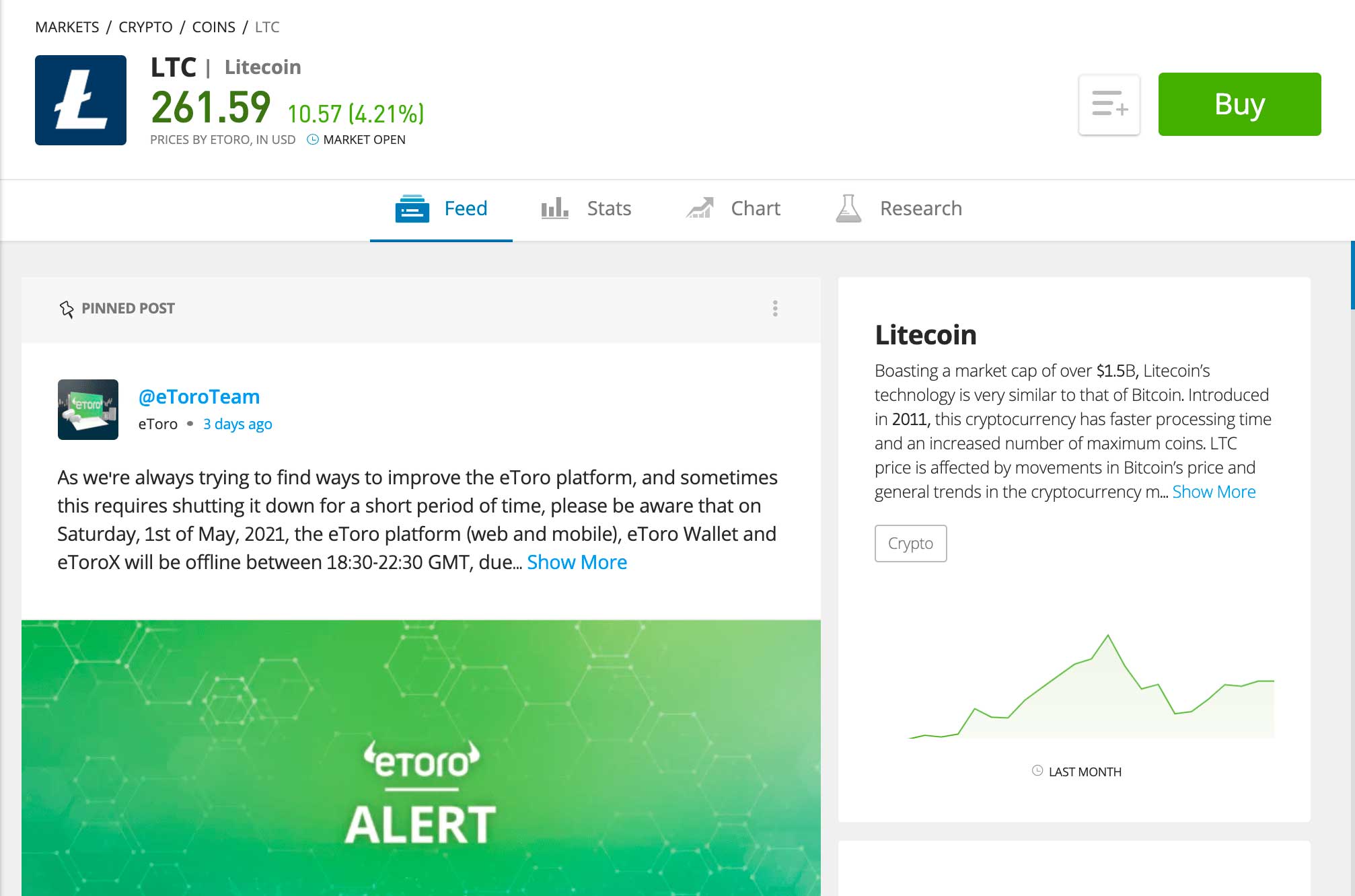

Also, eToro offers a variety of features and tools that help you analyze Litecoin’s price and easily place an order in the market. While on other platforms, you need to learn and get familiar with a somehow complex trading platform, eToro’s platform is something else in terms of design and functionality. If you want to buy and sell Litecoin, you simply have to go to the LTC page where you can analyze the coin, view the Twitter feed, stats, and get access to the Research Tab.

Additionally, eToro has a variety of social trading tools like the CopyTrade and the CopyPortfolios. As such, you’ll be able to copy other investors and invest in built-in managed cryptocurrency portfolios that include, among other cryptocurrencies, Litecoin. This will allow you to diversify your overall investment and at the same time, get exposure to Litecoin.

Finally, eToro has a minimum deposit requirement of just $200 and is fully regulated by the FCA, CySEC, and ASiC. It also a protection scheme of up to 1 million Euro, GBP, or AUD if the broker fails to meet its financial obligations.

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

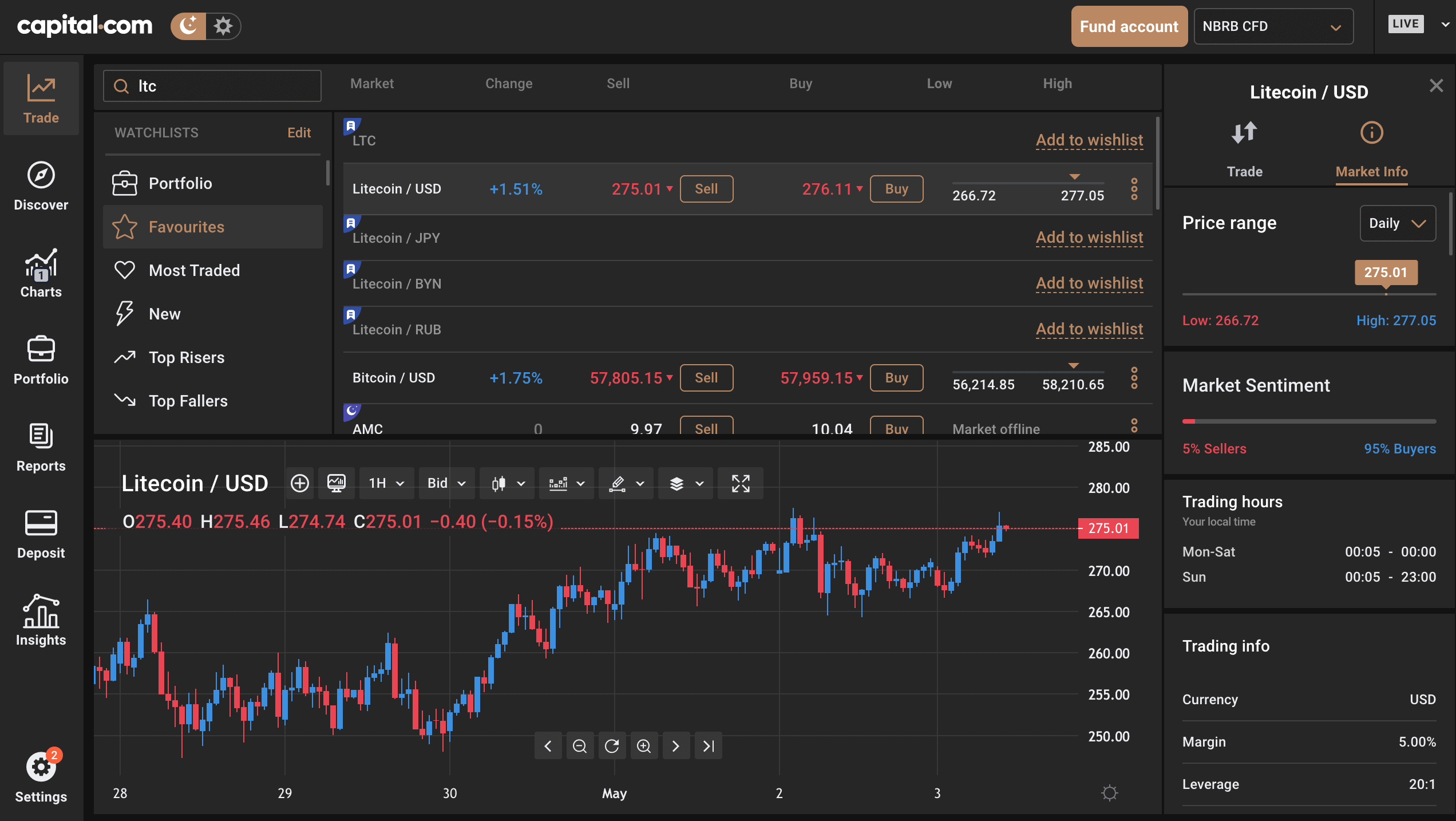

2. Capital.com – Buy Litecoin CFDs with Zero Trading Fees

There are several benefits when you buy CFDs at Capital.com. First, you do not pay fixed trading fees as you would have to pay on traditional stockbrokers and cryptocurrency exchanges. Then, another key point is the ability to leverage your Litecoin position. Capital.com offers leverage of 2:1 on cryptocurrencies, meaning you need to use 50% of the position size as margin. Moreover, Capital.com maintains a spread of only 1.1 for Litecoin/USD pair, which is very low when compared to other CFD platforms in the market, and is much cheaper than any crypto exchange. Further, you can also buy and short sell Litecoin CFDs and other crypto assets, and as such, you’ll be able to make a profit when the price of Litecoin rises or falls.

As previously mentioned, the main benefit of trading with Capital.com is the trading platform it offers. This is a more advanced trading platform with a market sentiment tool, average daily price range, and a very effective and easy-to-use charting package. Best of all, Capital.com is the world’s first AI-powered trading platform and has the technology to send users personalized trading insights based on the previous trading activity.

In addition to Litecoin, Capital.com offers a huge range of digital currencies CFDs that include bitcoin and popular altcoins like Dogecoin, Cardano, Chainlink, Polkadot, Ripple, Bitcoin Cash, IOTA, and many more. Plus, unlike traditional crypto exchanges that give you access to the cryptocurrency market only, Capital.com also offers you to trade other markets such as stocks, ETFs, fiat currency pairs, commodities, indices, and IPOs.

Finally, besides its proprietary platform that is available as a web platform and as a mobile application, this brokerage firm offers a variety of trading tools and platforms for traders. This includes the popular MetaTrader4, TradingView charting package, the Investmate app, helpful news and analysis section, and a demo account. To get started, you need to meet a minimum deposit requirement of just 20 EUR/USD/GBP, or 100PLN, which is around 290 ZAR. In terms of regulation, Capital.com is regulated by the FCA, CySEC, and complies with the requirements of MiFID.

Pros:

- Offers a wide range of trading tools including MT4, and a demo account

- It provides lots of educational materials and a news and analysis section;

- AI-generated trading platform

- A leverage ratio of 2:1 on Litecoin

- Extremely competitive spreads

- Traders can speculate on different types of instruments like shares, FX currency pairs, indices, commodities, and ETFs;

- No trading commission

Cons:

- Only CFDs

- Charges an overnight fee

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

How to Buy Litecoin (LTC) Tutorial

So now that we have covered everything you need to know before buying Litecoin and suggested the best brokerage firms that support Litecoin in South Africa, in the next section of our guide we are going to show you the process of opening an account with eToro and place a buying order in the market.

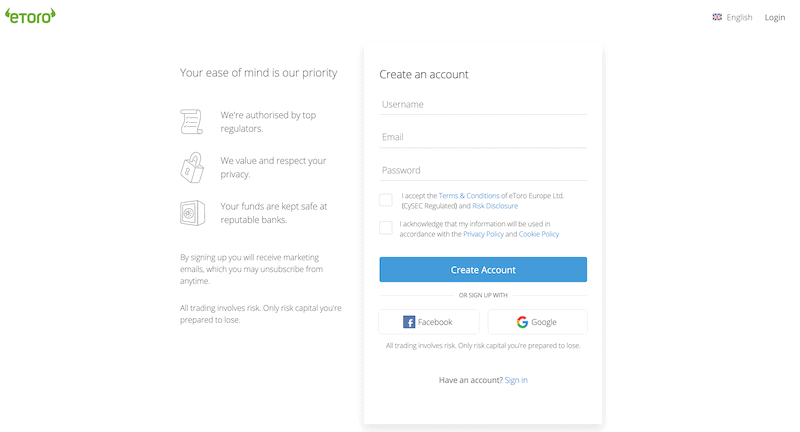

Step 1: Open an Account

To get started, the first you need to do is to visit eToro’s website and sign up for an online account. At first, you are asked to enter your email address and create a username and password. Then, you need to activate your account by verifying your email address in the email sent by eToro and you’ll immediately be transferred to eToro’s trading dashboard.

Step 2: Verify Your Identity

Even though eToro is not directly regulated in South Africa by the FSCA, it is regulated by the FCA, CySEC, and ASIC and complies with all the rules and regulations in SA. Therefore, you’ll have to verify your identity before you are allowed to deposit funds and buying Litecoin.

To verify your account, click on the Pending Verification button below your profile logo. Then, you are required to provide additional information about your trading experience and knowledge, the trading strategy you plan to apply, the purpose of trading, and your financial status. Once you have completed the questionnaire, you need to upload both a proof of identity (POI) and proof of address (POA).

Step 3: Add Funds to Your Online Account

Next, you need to add funds to your online account. For investors in South Africa, eToro has a minimum deposit requirement of $200, which is around 1900 South African Rand. However, if you want to transfer funds with a bank wire transfer, you need to meet the minimum deposit requirement of $500.

To make a deposit, you’ll have to click on the Deposit button on eToro’s dashboard and choose one of the following payment methods: credit or debit card, PayPal, Skrill, Neteller, and bank wire transfer.

Step 4: Buy Litecoin

At this point, your account is approved and funded and you can start trading on eToro’s platform. Bear in mind that the dashboard has a similar design to many other social media networks so you’ll likely find your way around very quickly.

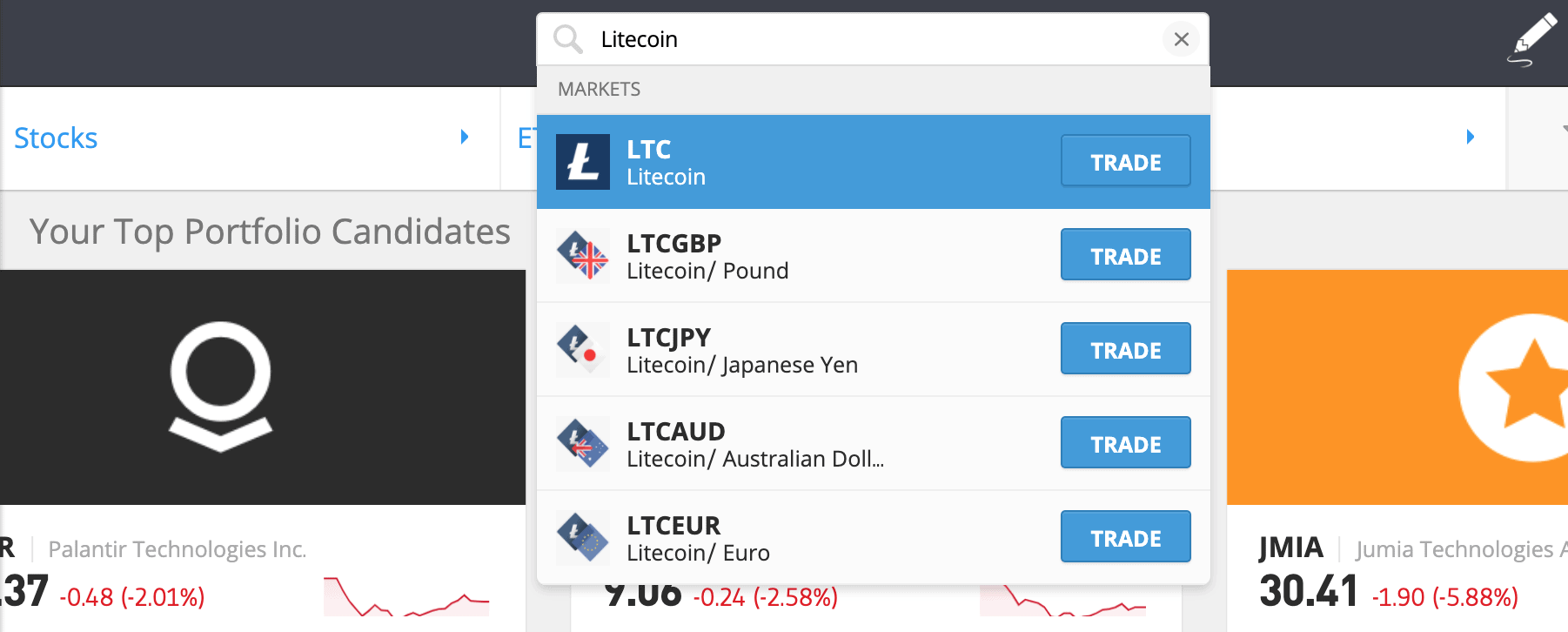

From the dashboard, you can navigate to the crypto section and find Litecoin or enter Litecoin/LTC in the search bar at the top of your screen. As you can see, eToro offers you to trade Litecoin versus different fiat currencies including the British Pound, Japanese Yen, Australian Dollar, Euro, and the US Dollar.

Once you click on the pair you wish to trade, you’ll be transferred to an instrument page. From there, you can analyze the coin using the live feed, charts, stats, and research tools.

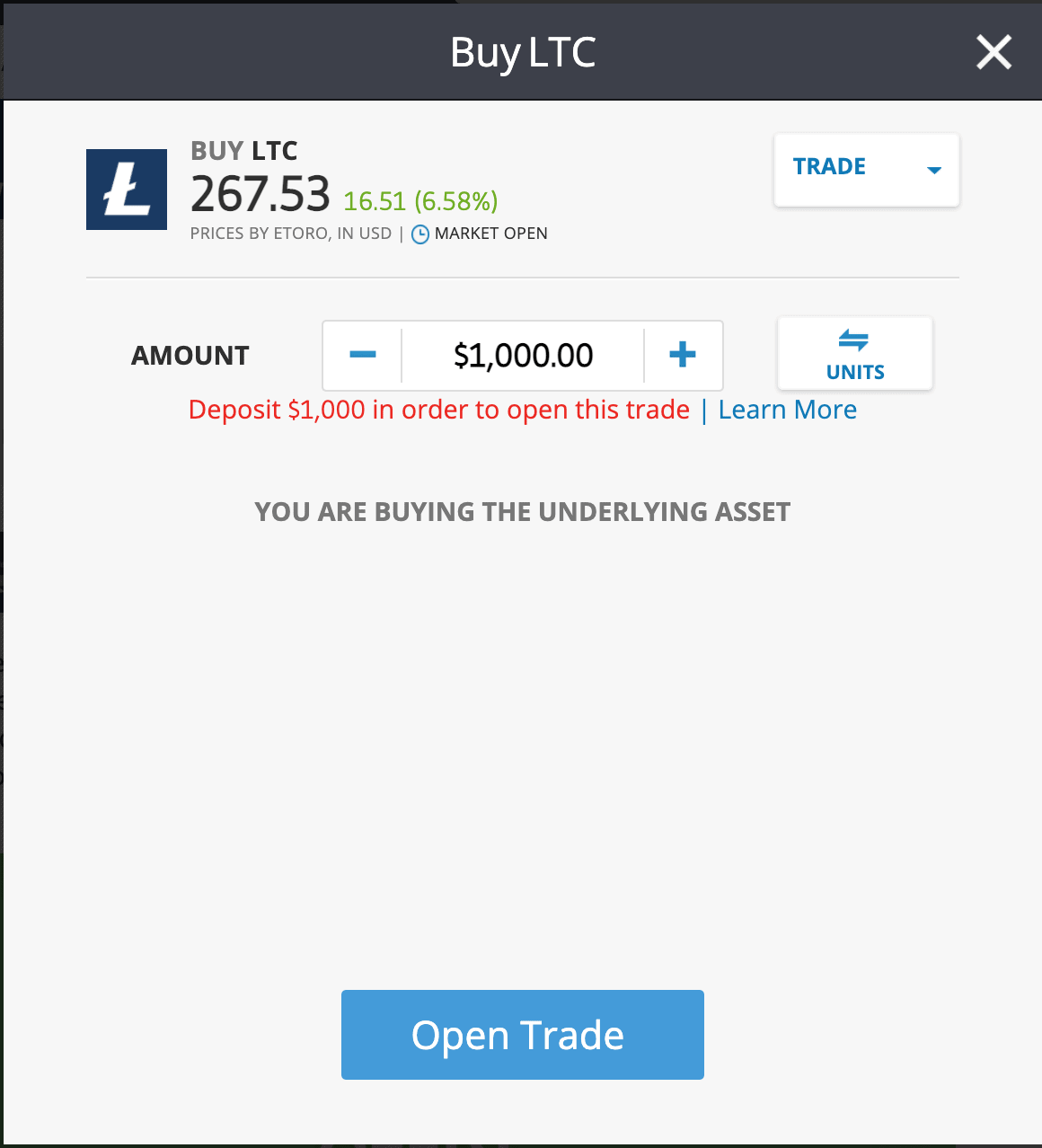

Then, whenever you are ready to make a trade, click on the buy button and you’ll be taken to an order form. You have two options to place an order – an instant market execution (Trade) or a limit order that enables you to set a price in which you want to get the execution. Regardless, you need to insert the amount of investment and click on the ‘Open Trade’ button.

eToro – Best Broker to Buy Litecoin South Africa

Above all, Litecoin is branded as the cryptocurrency for payments that has the technology to take over the most widely used and popular digital currency in the world – Bitcoin. If Litecoin succeeds in grabbing a greater share of the cryptocurrency market and the total global supply of money in the world, then the predictions of Litecoin’s price reaching $10,000 in 2025 is a possible scenario.

From our research, there are many ways to buy Litecoin in South Africa. However, as buying cryptocurrencies on exchanges still requires difficult signup and buying process and is often might be very expensive – the best option to buy Litecoin in South Africa is to find a regulated CFD brokerage firm like eToro that allows you to speculate on the price of crypto-assets without paying any trading commission and by using a leverage ratio of 2:1.

67% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

What is the best Litecoin exchange south Africa?

Generally, Litecoin is one of the most popular crypto coins in the market so you can buy and sell the coin on any exchange that is authorized in South Africa. But, if you are looking for a cost-effective and an easy to use trading platform, then eToro is without a doubt the ideal exchange to trade Litecoin.

What is the best Litecoin wallet south Africa?

This depends on how you decide to buy Litecoin. If you are buying Litecoin directly from a cryptocurrency exchange, you will need to find one of the best digital wallets like Exodus, Ledger, or Trezor to store your coins. Otherwise, if you are buying Litecoin CFDs, you do not need a wallet to store your coins as you simply speculate on the price of the asset without owning the coin.

How to mine Litecoin in South Africa?

In order to mine Litecoin, you first need to decide if you you want to solo mining or pool mining. The difference is that in solo mining, you are mining new blocks alone and thus get your rewards alone. In pool mining, on the other hand, you'd be mining Litecoin for the block rewards together with other users. Bear in mind that while solo mining is more profitable, the cost and risk are relatively higher than pool mining. Then, once you decide the method in which you want to mine Litecoin, you need to find a litecoin mining software like EasyMiner, CGMiner, BFGMiner, MultiMiner, or Awesome Miner.

How much is a Litecoin worth?

At the time of writing, 1 Litecoin is worth 275 USD, which is nearly 4000 ZAR.

How to sell Litecoin in South Africa?

In case you already own Litecoin and want to sell your coins, you need to find a crypto exchange in South Africa that supports Litecoin. Then, you need to transfer the coins to the exchange and sell it in the marketplace to another user. Otherwise, if you are not owning Litecoin and you are looking to short sell the coin with the goal of making a profit when the price of the asset falls, then eToro or Capital.com are the best option to short sell Litecoin in South Africa. This is because they maintain low margin requirement and fees, and don't charge any fixed trading fees when you make transactions.