How to Buy Alibaba Shares in South Africa – With 0% Commission

Alibaba is now one of the biggest companies in the world. Although the firm is based in China, Alibaba shares are listed on the New York Stock Exchange (NYSE).

In this guide, we show you how to buy Alibaba shares in South Africa with a 0% commission broker.

How to Buy Alibaba Shares in South Africa – Quick Guide 2021

Here’s a quick guide on how to buy Alibaba shares in South Africa.

- Step 1: Open an account with Capital.com – You will first need to open an account with a low-cost share trading platform. Capital.com is the best option on the table as the broker allows you to buy Alibaba shares without paying any commission. You can open an account in minutes by providing some personal information and contact details.

- Step 2: Upload ID – As a regulated broker, Capital.com will need to verify your identity. All you need to do is upload a copy of your government-issued ID and proof of residency – such as a bank statement or utility bill.

- Step 3: Deposit – You can now deposit funds with a debit/credit card, e-wallet, or bank account transfer.

- Step 4: Buy Alibaba Shares – Search for ‘Alibaba’, click on the ‘Trade’ button, and enter the amount of money that you wish to invest in the firm. This needs to be entered in US dollars.

Once you click on the ‘Open Trade’ button, your 0% commission purchase of Alibaba shares is complete!

Step 1: Choose a Stock Broker

If this is your first time buying stocks online, you might need a more comprehensive walkthrough. If so, the first part of the process is to choose a suitable stock broker. Not only should your chosen platform give you access to the NYSE, but it must do so in a cost-effective manner.

To point you in the right direction, below you will find a selection of brokers that allow you to buy Alibaba shares in South Africa.

1. Capital.com – Trade Alibaba Share CFDs in South Africa at 0% Commission

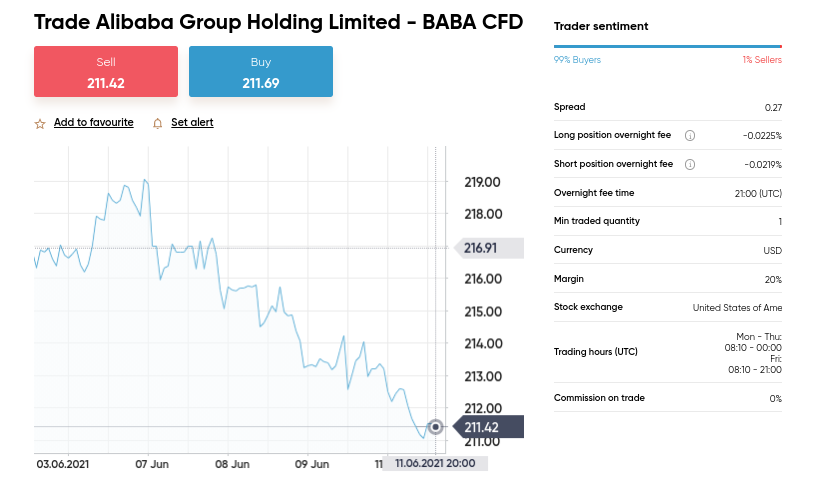

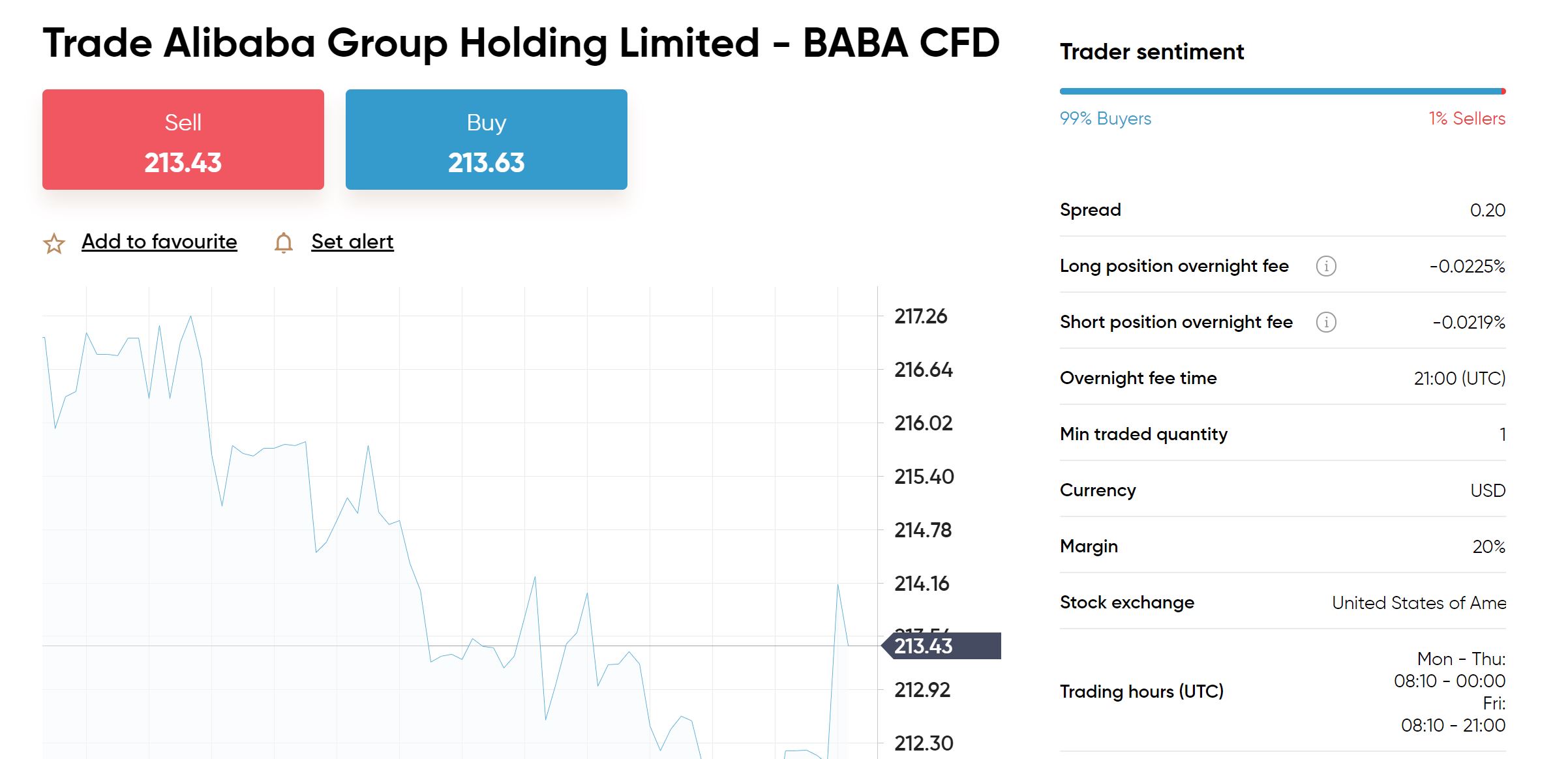

In trading Alibaba shares via CFDs, you won’t need to pay any commissions. Instead, it’s only the spread that needs to be taken into account. Capital.com also allows you to trade Alibaba CFDs with leverage. In most cases, you will be offered 1:5, meaning that you can multiply the value of your stake by 5 times. If there comes a time when you think that Alibaba shares will go down in value, Capital.com also allows you to go short via a sell order.

On top of shares CFDs, this popular CFD trading site also supports cryptocurrencies, ETFs, indices, forex, and more. If you’re interested in automated trading features, you can install a robot via MT4 and then connect it to your Capital.com account. Other core features that we like include the free Capital.com demo account. This allows you to trade in live market conditions without risking any money.

If you want to start off with a real-money account, you only need to meet a minimum deposit of $20 – or about 275 rands. This is an inconsequential amount that allows you to experience the world of share CFD trading without breaking the bank. Supported payment types at Capital.com are plentiful – which is inclusive of debit/credit cards, e-wallets, and bank account transfers. The platform is regulated by CySEC and the FCA – so your capital is safe at all times.

Pros:

- Educational app for new traders

- AI assistant identifies your weak points

- Trade ideas generated daily

- Excellent charting and analysis interface

- No inactivity fees

- 100% commission free trading

Cons:

- Cannot build custom trading strategies on the native platform

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Research Alibaba Shares

As is the case with any stock investment you are planning to make, it’s a wise idea to research Alibaba shares before proceeding. This will allow you to make an informed decision as to whether or not the stocks are right for your financial goals and tolerance for risk.

What is Alibaba?

Alibaba Group is one of the largest companies in the world. The firm is headquartered in China and was the brainchild of Jack Ma. Although Alibaba is behind a number of diversified products and services, its primary revenue stream comes from its online marketplace.

Across its three main platforms – Alibaba.com, Taobao, and Tmall, the firm is home to hundreds of millions of active customers. These platforms operate in a similar nature to Amazon, insofar Alibaba matches buyers and sellers.

Alibaba Share Price?

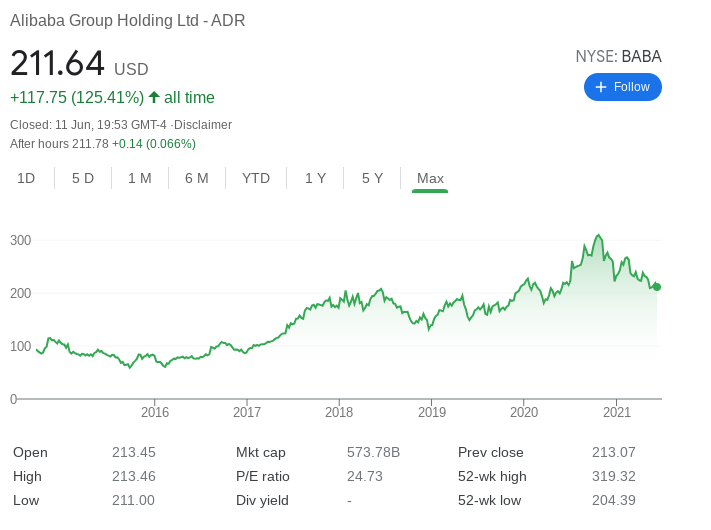

Alibaba is actually listed on two stock exchanges. The first is the NYSE, where Alibaba first held its IPO in 2014. The second listing – which took place in 2019, was on the Hong Kong Stock Exchange. As an investor based in South Africa, you will find it much easier and cost-effective to buy Alibaba shares that are listed on the NYSE – as per the walkthrough we gave you earlier.

In terms of its share price history, Alibaba stocks were initially priced at $68 each. This raised $25 billion – making it the largest IPO of all time. In late 2020, Alibaba shares hit an all-time high of over $319. This means that in just 7 years of trading, the shares returned gains of almost 370%.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

As per the firm’s investigation by the Chinese government for breaching anti-monopoly laws, Alibaba shares have since retreated in value. At the time of writing in June 2021, Alibaba stocks are trading at $211 each. This translates into a fall of 33% from the highs achieved 8 months previously.

Alibaba Shares Dividends

Like many other large-scale companies listed in the US – such as Amazon, Tesla, and Facebook – Alibaba does not pay dividends. The firm is still within its growth stages, meaning that as an investor your primary focus should be on capital gains.

Are Alibaba Shares a Good Buy?

In the sections below, we are going to discuss some of the key considerations that you need to make before you buy Alibaba shares in South Africa.

Anti-Monopoly Investigation

Up until the end of 2020, Alibaba shares were performing very well. However, when the Chinese government announced that it would be investigating the firm for a potential breach of anti-monopoly laws, this resulted in a market sell-off. As such, Alibaba has since lost more than 33% in market value.

The outcome of the investigation was decided in April 2021 – whereby Alibaba received a fine of over $2.8 billion. Management at the company has accepted the fine and thus – investors can now focus on what the future holds.

Potentially Undervalued

As noted above, the ongoing anti-monopoly investigation has resulted in Alibaba losing in excess of 33% of its share value. However, now the investigation is over – it could be argued that the shares are undervalued. After all, Alibaba not only has a solid business model but significant dominance in the Chinese e-commerce industry.

At the time of writing, Alibaba shares are trading at just over $211 each. A medium-term target of its prior all-time high of $319 would require a stock price increase of 51%. Current prices translate into a price-to-earnings (P/E) of just over 24 times – which again, does appear somewhat undervalued. After all, its US-based counterpart – Amazon, is carrying a P/E ratio of 63 times.

Market Dominance

Make no mistake about it – Alibaba dominates the Chinese e-commerce space by some distance. Current estimates put this figure at just over 50%, while its nearest competitor – JD.com, stands at just under 16%. This is crucial, as the Chinese e-commerce industry is expected to overtake retail sales later this year – making it the first country in the world to do so.

Open an Account & Buy Shares

If you have performed independent research on Alibaba and wish to continue with your share purchase, the next step is to open an account with a trusted brokerage site.

We are going to walk you through the process with Capital.com – as the platform allows you to buy Alibaba shares on a 0% commission basis. Plus, the end-to-end account opening and investment process shouldn’t take you more than 10 minutes.

Step 1: Open a Share Dealing Account

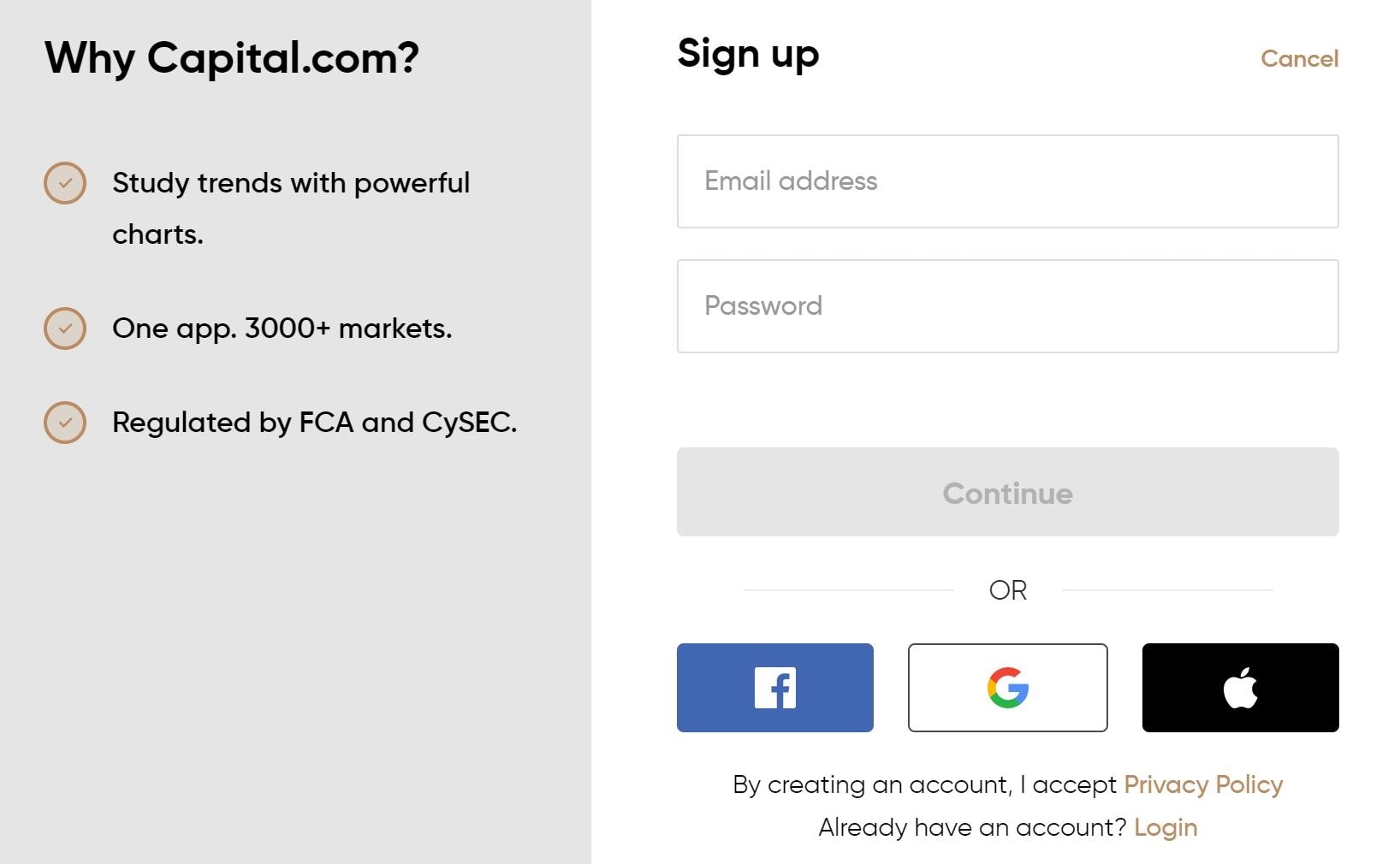

To open an account with Capital.com, visit the platform’s homepage and click on the ‘Join Now’ button. Follow the on-screen instructions by entering your personal information.

Step 2: Verify Account

Capital.com is a heavily regulated broker – so you will need to upload a couple of verification documents.

This includes:

- A valid copy of your passport, driver’s license, or national ID card

- A recently-issued copy of a utility bill or bank account statement

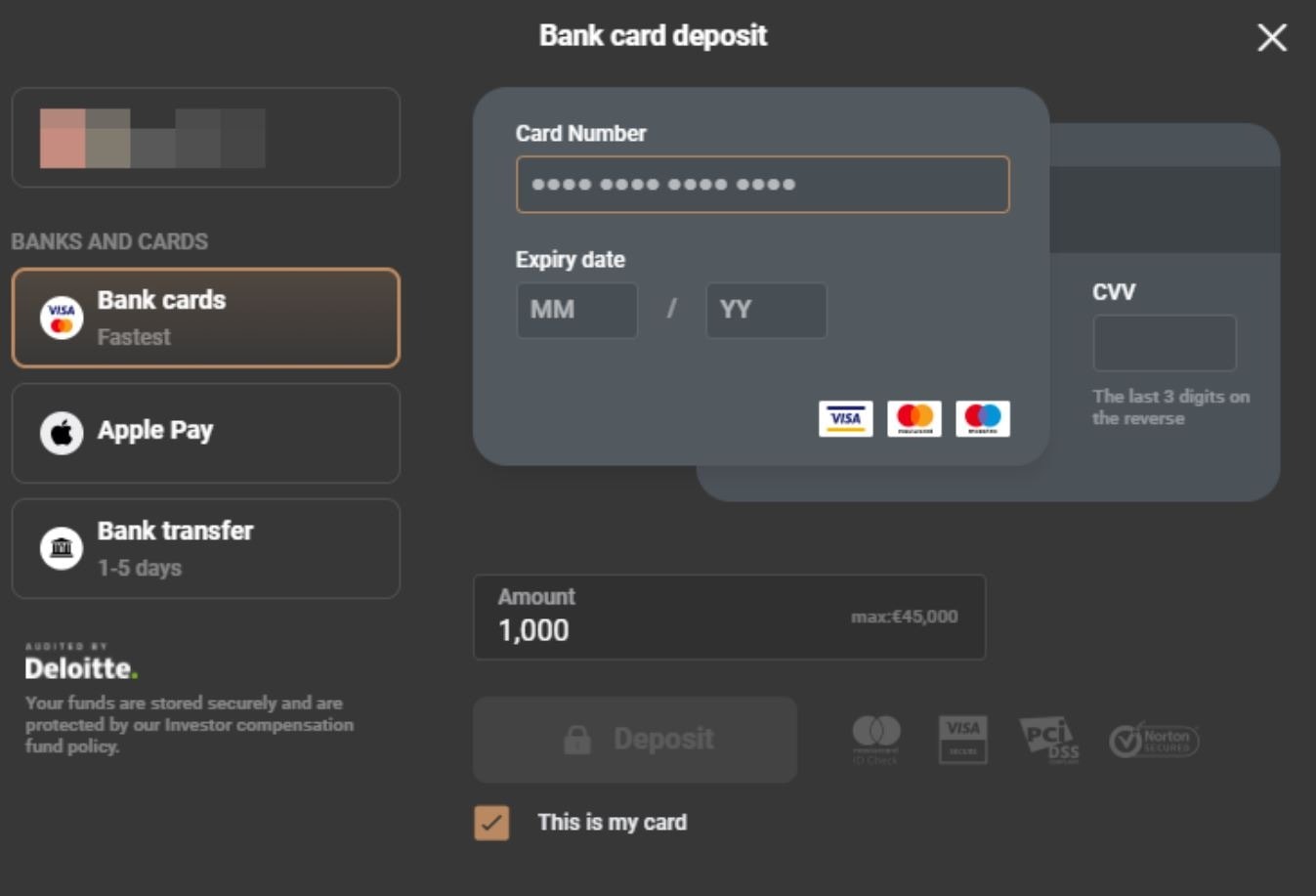

Step 3: Deposit Funds

Now you can proceed to make a deposit into your Capital.com account. The fastest way to do this is to use a debit or credit card. The minimum deposit is $20 – or about 750 rands.

Step 4: Buy Alibaba Shares in South Africa

The final step at Capital.com is to buy Alibaba shares. You can go straight to the respective purchase page by searching for ‘Alibaba’ and clicking on the ‘Trade’ button. In the order box, enter the amount that you wish to invest in US dollars. To confirm your commission-free Alibaba share purchase – click on the ‘Open Trade’ button.

Alibaba Shares Buy or Sell?

It appears that Wall Street is divided on whether or not Alibaba is a buy or sell. Proponents of the company will point to the fact that Alibaba is by far the dominant market leader in the Chinese e-commerce space – which will soon be larger than the conventional retail sector.

Plus Alibaba is still well within its growth stages and at current prices – the shares could be undervalued. On the other hand, those that are bearish on Alibaba will point to the firm’s ongoing issues with national regulators.

Although the anti-monopoly case with the Chinese government has been settled, US authorities are also investigating the firm. As such, it’s important that you make your own decision on whether or not to buy Alibaba shares through independent research.

Capital.com – Buy Alibaba Shares South Africa With 0% Commission

If you’re based in South Africa and want to buy Alibaba shares online – Capital.com is the best brokerage site for the job. Once you register an account – which should take you no more than a few minutes, you’ll be able to buy Alibaba shares on a 0% commission basis.

You can instantly deposit funds with a debit/credit card or e-wallet to pay for your purchase and the minimum stake per trade is just $50!

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

FAQs

Are Alibaba shares undervalued?

Some analysts believe that at current prices - Alibaba shares are undervalued. Not only is the anti-monopoly case with Chinese regulators over - but the stocks are trading at a P/E ratio of just 24 times.

Does Alibaba pay dividends?

No, Alibaba does not pay dividends. Like a lot of relatively new US-listed companies, Alibaba has no plans to pay dividends any time soon.

What is the minimum number of Alibaba shares I can buy in South Africa?

At the time of writing, a single Alibaba share is trading at over $211.

What is the Alibaba all-time high stock price?

Alibaba last hit an all-time high stock price in October 2020 - where the shares breached $319.

When did Alibaba go public?