Best FSCA Regulated Brokers in South Africa 2022

The Financial Sector Conduct Authority (FSCA) regulates the financial industry in South Africa. As such, it’s a wise idea to choose an online broker that is authorized and regulated by the licensing body.

You do, however, also need to look at other metrics in your search for an FSCA broker – such as tradable markets, commissions, payments, and user-friendliness. In this guide, we review the best FSCA regulated brokers for 2022.

Best FSCA Regulated Brokers South Africa 2022

Strapped for time and looking to start trading with the best FSCA regulated brokers right now? If so, below you’ll find which FSCA brokers made the cut.

- AvaTrade – Best FSCA Broker for Technical Analysis

- Plus500 – FSCA Trading Platform with Thousands of Markets

- FXCM – Reputable FSCA Broker with Leverage of 1:200

- FXTM – One of the Best FSCA Regulated Brokers Offering ECN Accounts

- Tickmill – Best FSCA Broker for Trading Forex (0 Pip Spreads)

- Blackstone Futures – Best FSCA Broker for Commission-Free ZAR Accounts

- Libertex – Overall Best FSCA Broker for 2022

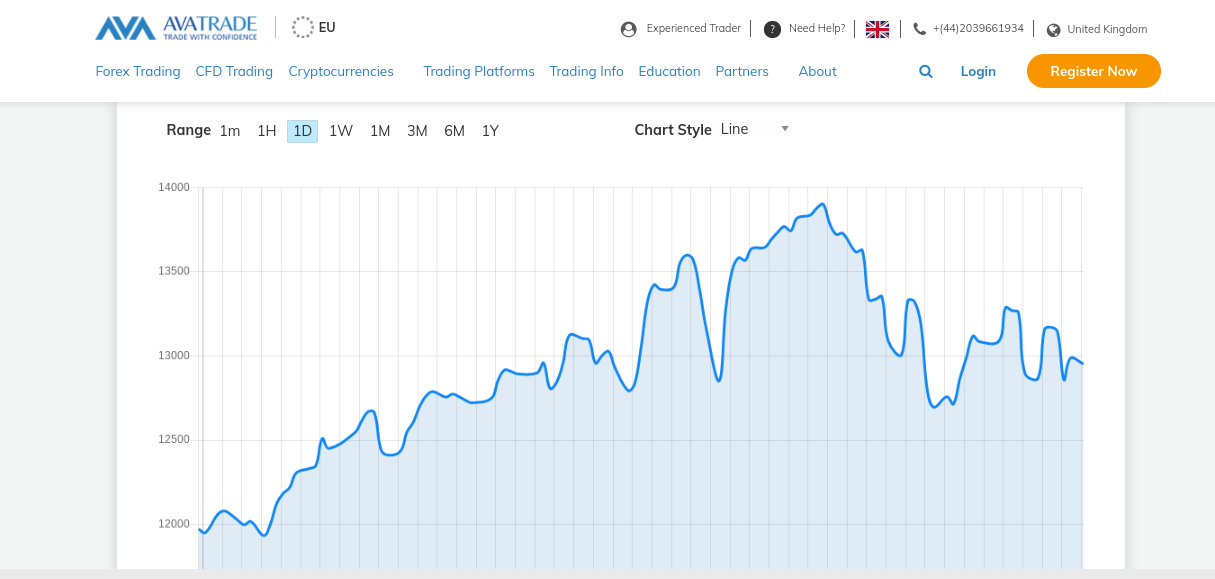

1. AvaTrade – Best FSCA Broker for Technical Analysis

If you’re a skilled technical trader seeking advanced charting tools – we think that AvaTrade is worth a look. The online platform is not only regulated by the FSCA – but five other financial bodies. As such, your capital is safe at all times.

You can trade plenty of financial markets at AvaTrade – all of which come via CFDs. This includes stocks, indices, commodities, futures, options, cryptocurrencies, forex, and more. Regardless of your chosen market, all CFD instruments can be traded commission-free at AvaTrade.

When it comes to supported platforms, both MT4 and MT5 can be connected to your AvaTrade account with ease. You can also trade via the platform’s native web platform – which is equally great for advanced technical analysis. The minimum deposit is just $100 to get started, albeit, the platform also offers a free demo account for those wishing to practice a new strategy.

Pros:

- Trade CFDs on stocks, forex, and commodities

- All fees built into the spread

- Includes paper trading with MetaTrader 4

- Copy and social trading features

- Great reputation

- Heavily regulated

Cons:

- Very high inactivity fee

73.05% of retail investors lose money when trading CFDs at this site

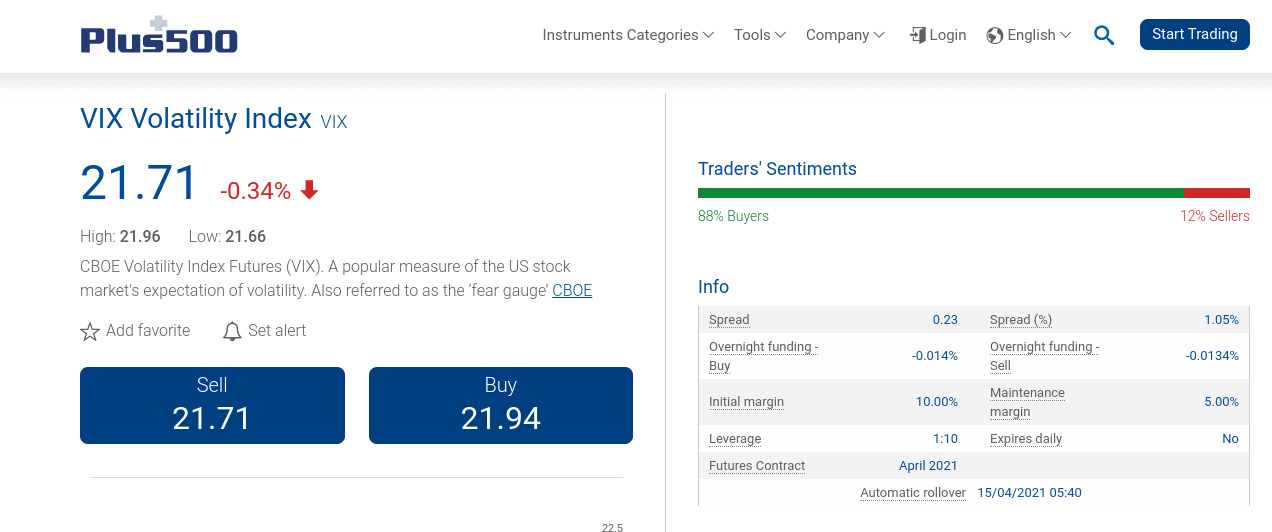

2. Plus500 – FSCA Trading Platform With Thousands of Markets

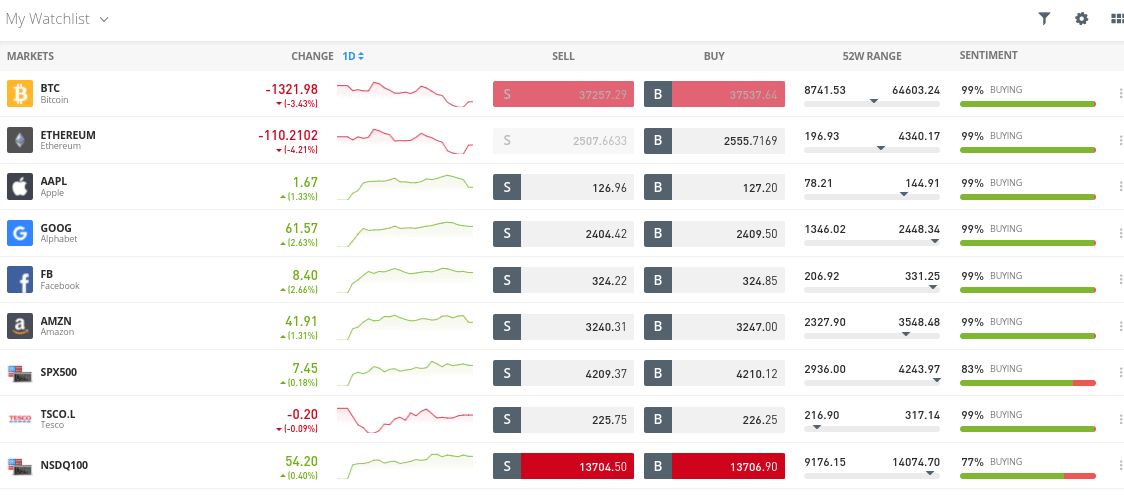

Plus500 is also an online trading platform that specializes in CFD instruments. The platform is home to thousands of financial markets – so you will never be short of options. This includes a significant number of stock trading CFDs from a wide range of exchanges.

For example, you can trade stocks from the US, UK, Japan, Hong Kong, Italy, Germany, and even South Africa. This means that you can speculate on the future value of stock CFDs like Sasol, Northam Platinum, Gold Fields, and AngloGold Ashanti.

On top of stocks, you can also trade CFDs in the form of forex, indices, ETFs, and commodities. Best of all, this top-rated platform doesn’t charge any trading commissions and spreads are typically super-tight. The minimum deposit on Plus500 is $100 – and the platform supports debit/credit cards and Paypal.

Pros:

- Commission-free CFD platform – only pay the spread

- Thousands of financial instruments across heaps of markets

- Leverage of up to 1:5

- Ability to enter buy and sell positions

- Takes just minutes to open an account and deposit funds

Cons:

- CFDs only

- Only suitable for experienced traders

3. FXCM – Reputable FSCA Broker for With Leverage of 1:200

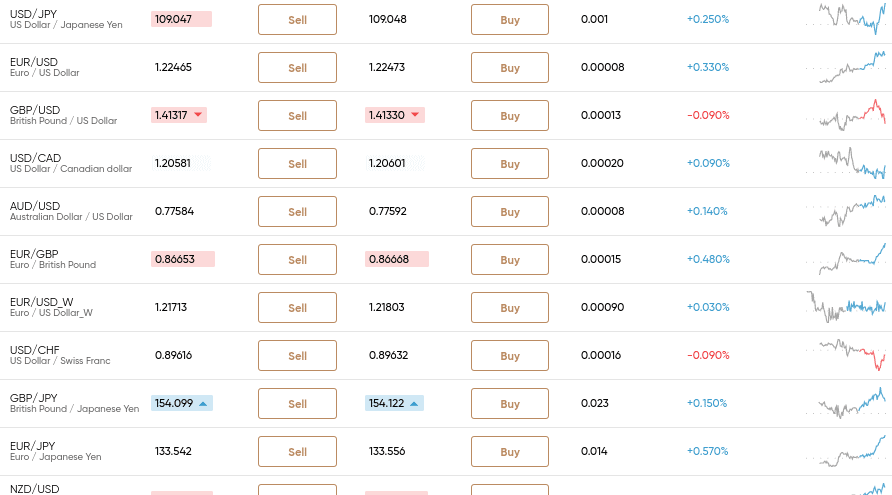

In fact, leverage of up to 1:200 is on offer when trading major currency pairs. Other markets – such as major/exotic pairs, stocks, and commodities, come with lower limits. Either way, FXCM doesn’t charge trading commissions – so it’s only the spread that you need to cover.

You can access your FXCM account in many ways – both online and via an Android/iOS mobile app. You can also trade on FXCM via third-party platforms such as MT4, NinjaTrader, and ZuluTrade. The minimum deposit is a very reasonable $50 here – which can be facilitated with a debit/credit card or bank transfer.

Pros:

- Supports MetaTrader 4, NinjaTrader, and ZuluTrade

- A long-established and reputable broker

- Lots of supported markets

- Minimum deposit just $50

- Mobile trading app

- No commission and tight spreads

Cons:

- CFDs only

- Limited share markets

73.05% of retail investors lose money when trading CFDs at this site

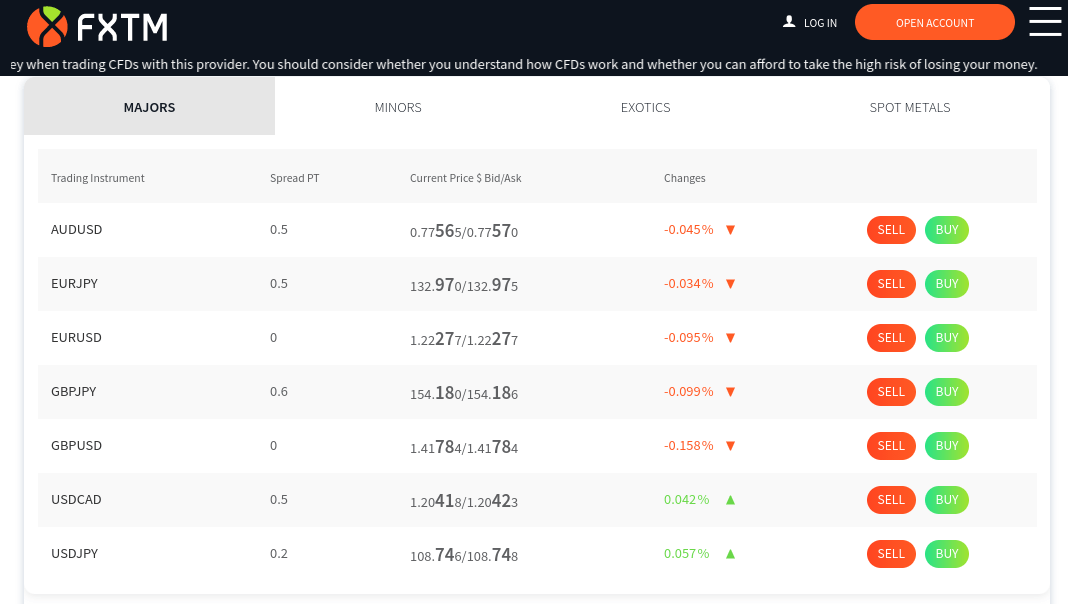

4. FXTM – One of the Best FSCA Regulated Brokers Offering ECN Accounts

There are three ECN accounts available at this broker and the best rates are reserved for larger deposits. For example, while the FXTM Pro Account gets you 0% and 0 pip spreads, the minimum deposit is $25,000.

If, however, you meet a $500 deposit, the Basic ECN account will get you spreads from 0.1 pips and a reasonable commission of just $2 per slide. In terms of non-forex trading markets, FXTM also offers CFDs in the form of spot metals, energies, indices, and stocks. Both MT4 and MT5 are supported and you’ll have access to demo trading facilities upon opening an account.

Pros:

- Very tight spreads on ECN accounts

- Several asset classes to choose from

- Heaps of everyday deposit and withdrawal options

- Regulated in South Africa

- Easy registration process

- Supports MT4 and MT5

Cons:

- Limited number of stock CFDs

Your capital is at risk.

5. Tickmill – Best FSCA Broker for Trading Forex (0 Pip Spreads)

In doing so, you will get ECN-like spreads that start from 0 pips on major currency pairs. For this, you will pay just $2 in commission at both ends of the trade. Tickmill offers leverage of up to 1:30 on this account too – which is great if you want to boost your trading capital at the click of a button.

On top of currencies, Tickmill also allows you to trade stock indices, bonds, metals, and oil. Supported payment types at this online brokerage firm include e-wallets like Skrill and Neteller, bank transfer, and a debit/credit card. When it comes to supported platforms, Tickmill is compatible with MT4 – both online and via desktop software.

Pros:

- Minimum deposit just $100

- Spreads start from 0 pips

- Commission of $2 per $100,000 traded

- Heaps of supported markets

- Leverage offered on all financial instruments

Cons:

- No ZAR accounts

Your capital is at risk.

6. Blackstone Futures – Best FSCA Broker for Commission-Free ZAR Accounts

We found that this starts from just 0.6 pips on major currency pairs – which is very competitive. Expect to pay more on minor/exotic pairs and other asset classes. In total, you will find over 750 financial instruments on the Blackstone Futures platform – which is inclusive of indices, commodities, and stocks.

The latter includes both domestic and international companies. Leverage of up to 1:400 is offered by this FSCA regulated broker and payment methods include debit/credit cards, e-wallets, and local bank transfers. All withdrawal requests are processed on a same-day basis when the request is made before 1 pm.

Pros:

- Located in South Africa – ZAR accounts

- 0% commission and spreads from 0.6 pips

- Multiple asset classes supported

- Accepts debit/credit cards, wallets, and local bank transfers

- Leverage of up to 1:400

Cons:

- Support only offered 24/5

Your capital is at risk.

7. Libertex – Overall Best FSCA Broker for 2022

After reviewing dozens of FSCA brokers, we found that Libertex is the best option on the table. This top-rated platform specializes in CFD trading markets across hundreds of financial instruments.

This includes everything from stocks, ETFs, and index funds to forex, cryptocurrencies, and commodities. In terms of stand-out features, Libertex allows you to trade without paying any spreads. Instead, you will pay a small commission every time you enter and exit the market.

With that said, this is usually below 0.1% and some assets come with no commission at all. As such, Libertext is a super low-cost FSCA broker. Once you have opened an account, you will have three trading platforms to choose from.

This includes both MT4 and MT5 – which is the best option for seasoned traders looking to deploy advanced trading strategies and analysis. If you’re a beginner, the native Libertex platform is the best option. This can be accessed directly from the Libertex website – so there is no requirement to download or install any software.

Pros:

- ZERO spreads on all markets

- 0% commissions on some stocks

- Leverage available

- Educational guides and webinars

- Accepts PayPal

- MT4 supported

- Mobile trading app

- Regulated and trustworthy broker

Cons:

- Only offers CFDs

75.3% of retail investor accounts lose money when trading CFDs with this provider.

FSCA Regulated Brokers Fees Comparison

The fees charged by the best FSCA regulated brokers reviewed on this page vary quite considerably. As such, below you will find an overview of the main charges to look out for.

| Standard Commission | Spread | |

| Libertex | From 0% | ZERO |

| Plus500 | 0% | Variable |

| AvaTrade | 0% | 0.9 pips on EUR/USD |

| FXCM | 0% | Variable |

| FXTM | 0% | From 0 pips |

| Tickmill | 0% | From 0 pips |

|

Blackstone Futures

|

0% | From 0.6 pips |

It is important to note that that the fees that you pay will depend on the respective account type that you open. For example, those offering ECN broker accounts will charge you a commission – but you’ll get the best spreads in the market. On the other hand, those offering 0% commissions will charge you a less favourable spread.

What is an FSCA Regulated Broker?

After all, the FSCA regulated platform in question will need to go through a comprehensive process to receive a domestic brokerage license.

In order to retain its regulated status, the broker will need to ensure that retail clients are able to trade in safe and fair conditions. The broker will also need to keep client funds in segregated bank accounts and have its books audited on a regular basis.

Benefits of Choosing an FSCA Regulated Broker

The FSCA isn’t the most reputable financial body globally, albeit, licensing still presents a number of benefits for you as a trader.

This includes:

- KYC: All new clients that open an account with an FSCA regulated broker must go through a KYC process. This will require you to upload a copy of your government-issued ID and provide some personal and contact information.

- Client Funds: All FSCA regulated brokers must keep client money separate from its own operational capital. This means that if the broker went bust, your capital cannot be used to fund its debts.

- Negative Balance Protection: The best FSCA regulated brokers will install a feature known as negative balance protection. This ensures that unsuccessful leveraged positions do not result in you getting into debt with the broker.

- Fee Transparency: FSCA regulated forex brokers must be crystal clear on the fees that they charge. This also means that they cannot increase fees without first letting you know.

FSB Brokers

If you’re on the hunt for the best FSB regulated brokers, you should know that the Financial Services Board no longer exists. Instead, FSB brokers are now regulated by the FSCA. The FSB actually governed the South African financial services industry for almost two decades.

As such, in a time not so long ago, there were a large number of FSB brokers to choose from. Then, in 2018, the FSB was replaced by the FSCA.

How to Get Started with an FSCA Regulated Broker

If you have never traded before and need a little help getting started with an account today – we are now going to walk you through the process with Libertex.

As we discussed earlier in our Libertex review – the platform is the best FSCA regulated broker in the space. Not only will you get ZERO spreads and super-low commissions on all markets – but you will have access to hundreds of assets.

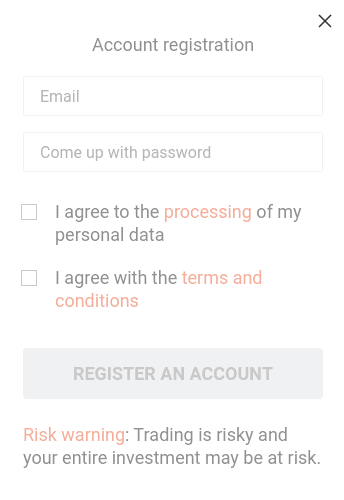

Step 1: Join Libertex

The process of opening an account at Libertex should take you no more than a few minutes. First, visit the Libertex website and click on the ‘Register’ button. You will initially be asked to enter your email address, choose a password, and agree to its terms and conditions.

On the next page, you’ll be asked to enter your personal information – such as your name, home address, and date of birth. You also need to enter your email address and mobile telephone number.

Step 2: Upload ID

As an FSCA approved broker, you will need to upload a copy of your government-issued ID. This ensures that Libertex complies with the rules outlined by the FSCA. You can do this with a valid driver’s license, passport, or national ID card.

Step 3: Deposit Funds

You can deposit funds into your Libertex account. The broker offers plenty of supported payment methods – including debit/credit cards and e-wallets. Bank transfers are also supported, but this can delay the process by a day or two.

Step 4: Choose Platform

You can start trading now that you have funds in your account. You will, however, first need to choose which trading platform you wish to use. Libertex allows you to choose from its own native web-trading platform, MT4, or MT5.

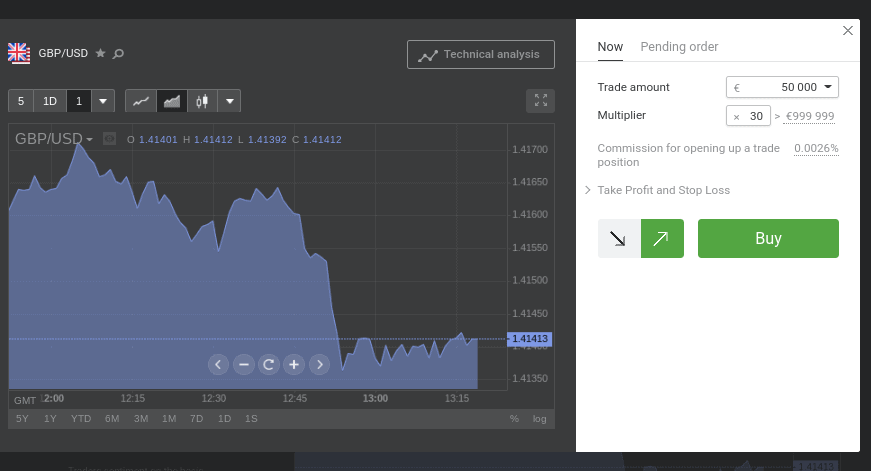

Step 5: Place Trade

Once you have loaded up your preferred platform, you can search for the financial instrument that you want to trade. To execute your position, you will need to set up a trading order. At a minimum, you need to select from a buy/sell order and a limit/market order. You also need to enter your stake.

Once you confirm your order, Libertex will execute.

Other Regulated Brokers

As we briefly noted earlier, the FSCA isn’t the most stringent of regulators that license online brokers. On the contrary, the likes of the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC) are more respected in this space – not least because they put greater pressure on brokers to provide fair and transparent trading conditions.

With this in mind, below you will find a selection of online brokers that offer a far better experience for traders in South Africa than those licensed by the FSCA.

1. eToro – Overall Best Regulated Broker

eToro offers a user-friendly experience, which makes the broker perfect for inexperienced traders. You can buy stocks and ETFs without paying any commission – and will own the underlying asset outright. This means that you will be entitled to dividend payments as and when they are distributed. Supported markets include 17 exchanges – inclusive of the US, Germany, Hong Kong, France, the UK, Italy, Spain, and more.

You can also engage in cryptocurrency trading – which includes both fiat-to-crypto and crypto-cross pairs. Other marketplaces include indices, forex, and commodities. We also like the fractional ownership tool on eToro, which allows you to buy a small portion of an asset. This starts at just $25 on cryptocurrencies and $50 on stocks and ETFs. You can also trade passively via the Copy Trading feature – which allows you to mirror the buy and sell positions of an expert investor.

Pros:

- Trade forex, stocks, commodities, cryptos, and more

- Web and mobile trading platform with dozens of technical tools

- Social trading network allows you to follow other forex traders

- Supports copy trading to automate your positions

- Regulated by the FCA and CySEC

- Live chat support

Cons:

- Small $5 withdrawal fee

- Too basic for technical traders

67% of retail investors lose money trading CFDs at this site.

2. Capital.com – Best CFD Broker for Beginners

When you feel that you are ready to start trading with real capital, the minimum deposit amounts to just $20. Although Capital.com is compatible with MT4, beginners will much prefer its own native platform. This is crisp, clean, and super easy-to-navigate – making it ideal for newbies.

Capital.com allows you to trade thousands of financial instruments from a variety of asset classes. This includes forex, indices, hard metals, energies, crypto, ETFs, and stocks from 18 international markets. When it comes to regulation, the platform is licensed by the FCA and CySEC.

Pros:

- Trade forex, crypto, commodities, stocks, indices, and more

- 0% commission and tight spreads

- AI software helps you improve your trading profits

- Tons of educational resources, including a mobile app

- Open an account with a $20 minimum deposit

- Regulated by the FCA and CySEC

Cons:

- Native trading platform is too basic for experienced traders

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Capital.com – Best FSCA Regulated Broker in South Africa

After reviewing many of the best FSCA regulated brokers in South Africa – we found that Capital.com stands out from the crowd. The forex and CFD trading site allows you to enter buy and sell positions without any spreads, and commissions start from 0% upwards.

This FSCA broker supports plenty of tradable markets – covering stocks, indices, forex, ETFs, hard metals, energies, and cryptocurrencies. Getting started at this top-rated FSCA platform takes minutes and you can instantly fund your trading account with a debit/credit card or e-wallet.

78.79% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

FAQs

Do South Africans need to be with an FSCA broker?

Although the domestic brokerage and financial services industries are regulated by the FSCS - South Africans are free to use an international trading platform that is licensed by an alternative body. In fact, we found that the best online brokers are not regulated by the FSCA anyway. Instead, the likes of eToro and Capital.com - both of which are popular in South Africa, are regulated by the FCA (UK) and CySEC (Cyprus).

What does the FSCA do?

The FSCA regulates the South African financial services industry. Entities that fall within its remit include banks, financial institutions, insurers, and brokerage firms.

Which is the best FSCA broker?

We found that the overall best FSCA broker is Libertex. The provider offers ZERO spread trading across its supported markets - which includes forex, stocks, crypto, ETFs, indices, commodities, and more.

How much leverage can you get at FSCA brokers?

Unlike regulatory bodies in Europe, Australia, and the US - the FSCA does not put limits on the amount of leverage that can be offered. This is why some FSCA regulated forex brokers offered up to 1:1000 - even to retail client accounts.

When did FSB change to FSCA?

The FSCA replaced the FSB in 2018 - as per the Financial Sector Regulation Act (FSRA) of 2017.