How to Buy Facebook Shares in South Africa – With 0% Commission

Buying Facebook shares in South Africa could not be easier. You simply need to open an account with a low-cost brokerage site, deposit some funds, and choose how many stocks you wish to purchase.

If you’re new to online stock investment – this guide will show you how to buy Facebook shares in South Africa without paying any commission.

How to Buy Facebook Shares South Africa – Quick Guide 2022

If you don’t have time to read our guide in full, here’s a quickfire overview of how to buy Facebook shares in South Africa.

- Step 1: Open an account with Capital.com – The best broker to buy Facebook shares in South Africa is Capital.com – not least because it allows you to do so on a 0% commission basis. As such, head over to the broker’s website and open an account.

- Step 2: Upload ID – Capital.com will ask you to upload a copy of your government-issued ID. This is a minimum requirement with all regulated brokers.

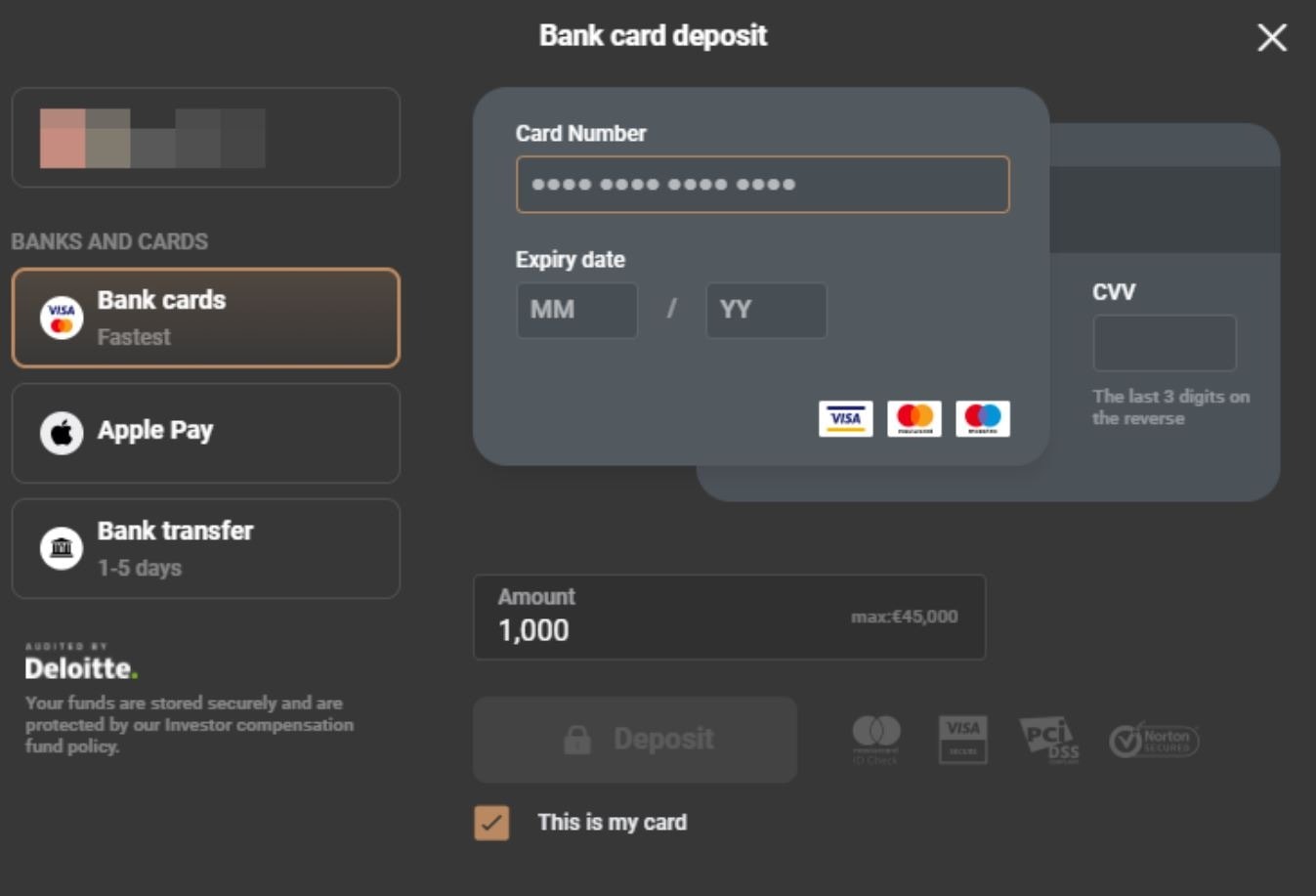

- Step 3: Deposit – Deposit funds into your account via a bank transfer, e-wallet, or debit/credit card.

- Step 4: Buy Facebook Shares – Search for ‘Facebook’ and click on the ‘Trade’ button on the next page. Finally, enter your stake into the ‘Amount’ box and confirm the order.

You’ve just bought Facebook shares at Capital.com without paying any dealing commission!

Step 1: Find a South Africa Stock Broker That Offers US Stocks

The main requirement in your search for Facebook shares is that you find a broker with NASDAQ shares. You also need to assess how much the broker charges in fees and commissions, not least because you are investing in a non-South African company.

To save you from having to find a platform yourself, below you will find the best stock brokers in South Africa that allow you to buy Facebook shares.

1. Capital.com – Buy Facebook Shares in South Africa at 0% Commission

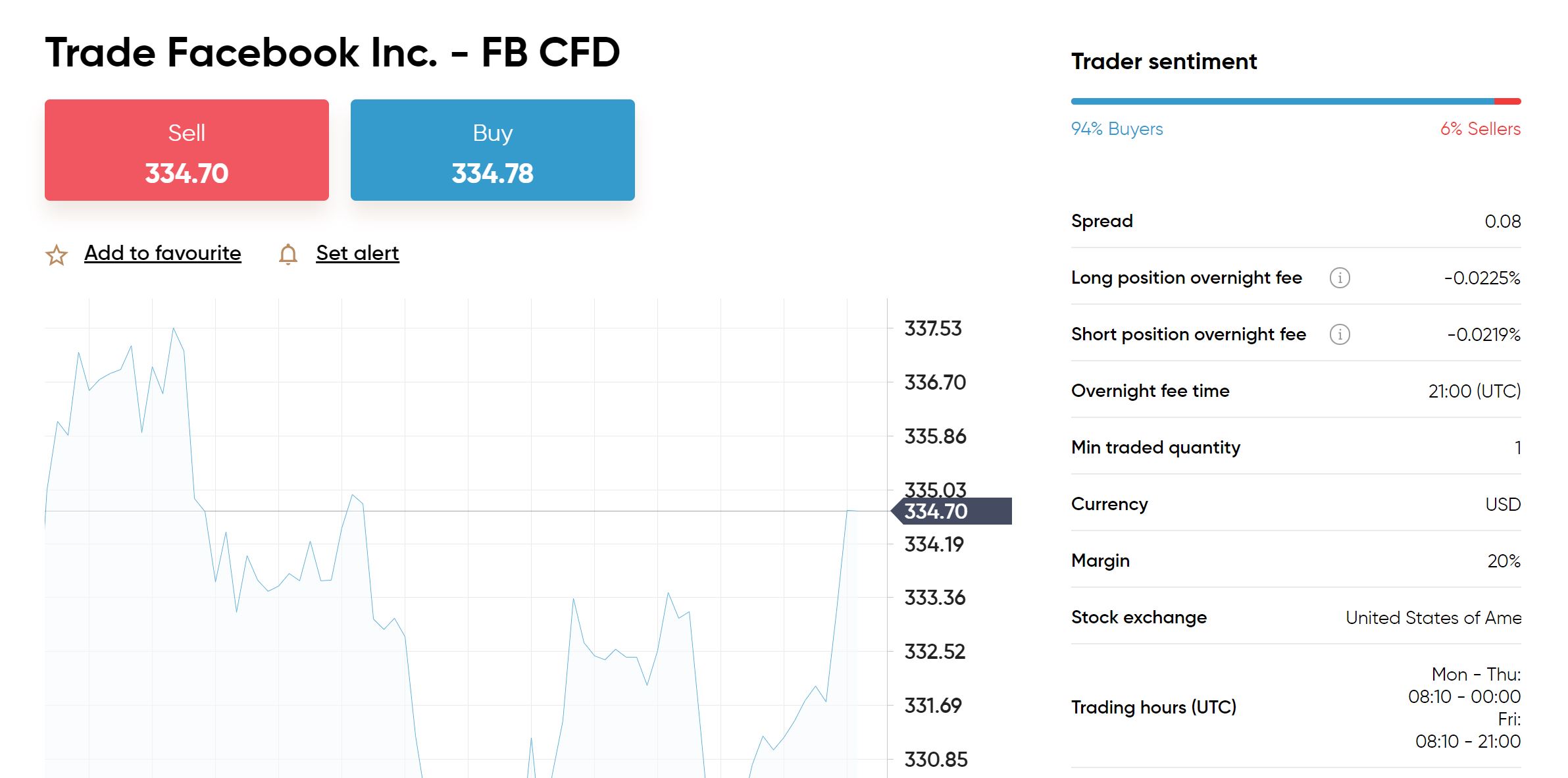

In other words, a deposit of $200 would get you access to $1,000 in trading capital. As a CFD provider, Capital.com also permits short-selling. This gives you the opportunity to make a profit a profit in the event you think that Facebook shares will go down in value. Irrespective of whether you go long or short, Capital.com offers 0% commission on all of its markets.

The broker is regulated by the FCA and CySEC and it supports debit/credit cards, e-wallets, and bank transfers. The minimum deposit to get started is just $20 – or about 275 rands. Capital.com has over 3,000 share CFDs, covering companies in the US, UK, and Europe. The platform also offers trading on forex, commodities, cryptocurrency, and more, making it a one-stop shop for traders of all stripes.

The platform offers tons of educational resources, so it’s easy to learn more about CFD trading and popular trading strategies. Capital.com is regulated by the UK’s Financial Conduct Authority. In addition, the brokerage offers 24/7 customer support by phone, email, and live chat. So, it’s easy to get in touch if you ever need help.

Pros:

- Educational app for new traders

- AI assistant identifies your weak points

- Trade ideas generated daily

- Excellent charting and analysis interface

- No inactivity fees

- Thousands of UK and US shares

- 100% commission free trading

Cons:

- Cannot build custom trading strategies

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Step 2: Open a Share Dealing Account and Make a Deposit

The next part of the process is to open a share dealing account with your chosen trading site. As we covered just a moment ago, Capital.com is the best stock broker to buy Facebook shares in South Africa. As such, we’ll show you how to complete the process with Capital.com.

To get the ball rolling, visit the Capital.com website and click on the ‘Trade Now’ button. You will need to provider some personal information – such as your name, home address, date of birth, and mobile number.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Next, you will be asked to upload a couple of documents so that Capital.com can verify your identity. This will require a copy of your government-issued ID and a document that verifies your address.

In order to buy Facebook shares, you will now need to add some money to your account. If you want to complete the deposit process instantly, Capital.com supports debit and credit cards. You can also deposit funds via bank transfer.

As we covered earlier, the minimum first-time deposit is $20.

Step 3: Buy Facebook Shares

At this stage of our guide, you should have a verified and funded account with Capital.com. To complete the investment process, enter ‘Facebook’ into the search box at the top of the screen.

Once you click on the ‘Trade’ button, you will then see an order box appear like in the image below. In the ‘Amount’ box, enter the price of your Facebook investment in US dollars. Finally, click on the ‘Open Trade’ button to buy Facebook shares at 0% commission.

Note: You will instead need to click on the ‘Set Order’ button if you are attempting to buy Facebook shares when the NASDAQ exchange is closed.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

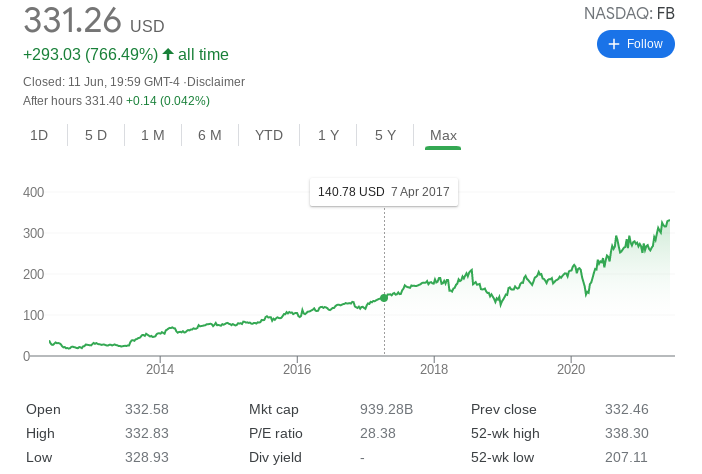

Overview of Facebook Shares

Facebook went through its initial public offering (IPO) in 2012 – opting for the NASDAQ exchange. Those that invested in Facebook would have paid an initial price of $38 per share. The stocks initially performed below market expectations, hitting an all-time low of $17 per share just 16 months later.

However, it’s been up, up, and away ever since for the global social media giant. In fact, at the time of writing in June 2021, Facebook shares have never been worth more at $330 each. The firm’s rapid upward trajectory began in March 2020 in response to the COVID-19 pandemic.

Back then, the shares hit lows of $156. Since then, Facebook shares have grown in value by over 112% to hit a market capitalization of almost $1 trillion. Although Facebook shares have performed very well since the company’s 2012 IPO, it should be noted that the firm does not pay dividends. Instead, Facebook reinvests its retained profits back into the growth of the firm.

Reasons to Buy Facebook Shares

If you’re still undecided on whether Facebook shares make a good addition to your investment portfolio – we are now going to discuss some of the reasons why Wall Street is bullish on the social media giant.

Market Leader in Social Media

When considering an investment in Facebook – it is important to remember that you are gaining exposure to the parent company. By this, we mean that the parent firm’s portfolio of companies goes beyond just the Facebook platform.

On the contrary, Facebook also owns the likes of Instagram and Whatsapp. Both of the aforementioned are home to a significant number of users, with the latest estimates putting this at 1 billion and 2.5 billion respectively.

Monthly Active Users

When discussing the performance of social media companies like Facebook – one of the most important metrics that investors look at is the MAU – or monthly active users. This figure tells us how many people have logged into the respective platform at least once over the course of the month.

In the case of Facebook, the firm noted in its Q1 2021 report that its MAU now stands at 2.8 billion. This is up from the 2.7 billion figure it reported in Q4 2020. It goes without saying that this is where the true value of Facebook lies, not least because the more active users it has, the more it can generate in advertising revenues.

Cash on Hand

When it comes to cash on hand, Facebook has followed its fellow tech giants by becoming a huge hoarder. As per its most recent earnings report of Q1 2021, cash and cash equivalents stood at over $64 billion.

While some would argue that this capital should be could to initiate a dividend policy, management at Facebook are more interested in pursuing its aggressive acquisition program. While we have already discussed Instagram and Whatsapp – which cost Facebook $1 billion and $21 billion respectively, plenty of other major acquisitions have also taken place.

For example, Facebook spent $2.3 billion for leading virtual reality provider Oculus in 2014. You then have the likes of video monetization platform LiveRail, which Facebook paid an estimated $500 million for.

Facebook Shares Buy or Sell?

In summary, the general consensus on Wall Street is that Facebook still represents a viable long-term buy. While there is only so much further that its MAU figures can go, Facebook continues to smash through market expectations. For example, while most US-listed companies struggled in 2020 – Facebook reported a 22% increase in revenue.

Proponents of the stock are also quick to note that Facebook remains virtually untouched by its market competitors. Not only does it boast billions of users on its native Facebook platform, but also Instagram and Whatsapp. With more than $64 billion in cash and cash equivalents, expect Facebook to continue its ever-growing acquisition program.

The Verdict

If you’re looking to buy Facebook shares in South Africa, the process at Capital.com can be completed in minutes. The regulated online broker allows you to buy Facebook shares without paying any commission. Capital.com also allows you to deposit funds instantly with a debit/credit card – either online or through its mobile app.

Capital.com – Buy Facebook Shares in South Africa With 0% Commission

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

FAQs

What was the IPO price for Facebook?

When Facebook went through its IPO in 2012 - its shares were priced at $38 each.

Is Facebook a good investment?

Facebook is one of the best-performing stocks of the past 18 months. Since hitting lows of $156 in March 2020 - the stocks have hit all-time highs of over $330 each.

How much does it cost to buy Facebook shares in South Africa?

The fees that you need to pay to buy Facebook shares in South Africa will depend on your chosen broker. Capital.com, for example, allows you to buy the shares without paying any commission. The only fee you need to be aware of is the 0.5% FX charge on ZAR deposits.

Does Facebook pay dividends?

Although Facebook has been a public company since 2012 and it continues to smash through market expectations, Facebook is yet to pay a dividend. Whether or not it will ever pay a dividend remains to be seen. After all, fellow tech giant Amazon has never paid a dividend either - and it has been a public company since 1997.

How many active monthly users does Facebook have?

According to its earnings report in Q1 2021, Facebook now boasts over 2.8 billion monthly active users (MAU).