Best Stock Brokers in South Africa 2022 Revealed

Are you based in South Africa and wish to buy and sell stocks from the comfort of your home? If so, you will need to find a South Africa stock broker that meets your needs. In this guide, we explore the best stock brokers in South Africa of 2022. We also discuss some tips on how to find an online stock broker that is suited to your long-term investing goals.

Key Takeaways on Stock Brokers in South Africa

- There are many different stock brokers that South Africans can choose to trade global stocks. Our preferred choice is FXVC.

- Stocks can be traded either directly or via derivatives like contracts for difference (CFDs).

- Each broker charges different fees and commissions. CFD brokers typically charge a percentage commission or a spread on the bid/ask price.

- The best stock brokers in South Africa are those that are regulated by a top-tier agency like the FCA (UK) or the ASIC (Australia).

Best Stock Brokers in South Africa

If you’re just after a quick summary of the best stock brokers in South Africa, take a look at the list of top-rated brokers below.

- Capital.com – Impressive MT4 Broker with AI Trading Tools

- Libertex – Top-rated CFD Broker with Zero Spread Trading

- Plus500 – Low-cost CFD trading platform known for its low spreads

- AvaTrade – CFD stock broker with high leverage

- Absa Stockbrokers – Top South Africa-based stock broker

- Interactive Brokers – Shares from over 130 markets

- IG – Share dealing broker with over 10,000 shares

- FXCM – Long-standing stock broker with MetaTrader 4

- FXTM – High leverage broker with tight spreads

What is a Stock Broker?

This would require you to call your broker up over the phone and tell them which shares you wanted to purchase. Then, the broker would need to personally locate the shares for you from the secondary markets.

Fast forward to 2022 and South Africans can now pick and choose which shares they wish to buy at the click of a button.

In fact, the best stock brokers in South Africa allow you to open an account, deposit funds, and buy shares in a matter of minutes. As such, the end-to-end investment process has never been easier. Everything is facilitated via your brokerage account, so you have the flexibility to deposit and withdraw funds, buy and sell stocks, and research companies as and when you see fit.

Best Stock Brokers in South Africa for 2022

Buying shares online in South Africa has never been more popular. After all, you simply need to open an account with a trusted share dealing site, deposit some funds, and then pick which stocks you want to buy. But, the difficult part is knowing which platform to sign up with.

To help point you in the right direction, below you will find a selection of the best stock brokers in South Africa. Each platform is heavily regulated, gives you access to heaps of shares, and allows you to easily deposit funds with a local payment method.

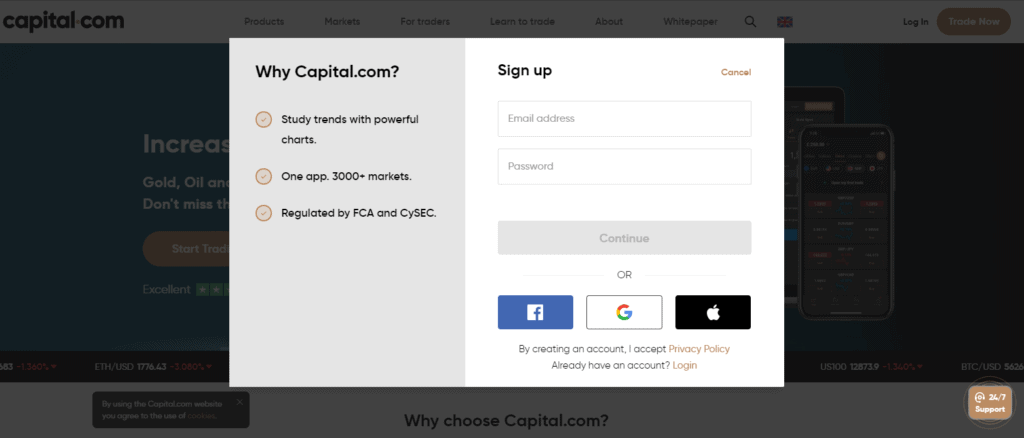

Capital.com – Low Cost Broker with AI Trading Tools

One of the best things about this broker is that stock trading is 100% commission-free. Capital.com’s share trading spreads are typically below the industry average, and there are no deposit or withdrawal fees to worry about. Even better, Capital.com doesn’t have an inactivity fee – so you won’t be charged if you want to buy and hold or take a break from trading for a few months.

Capital.com has its own custom trading platform that’s available on the web or as a mobile app for iOS and Android. It’s very easy to use and includes dozens of built-in technical studies to help you decide when to trade. The platform also has helpful tools like a news feed and economic calendar, so you can stay ahead of the market.

Another cool feature Capital.com’s platform offers is AI to help you trade better. The software analyses patterns in your trading and identifies common themes around your winning and losing trades. From that, the AI will suggest ways you can change your trading behavior to boost your win rate.

Capital.com is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the UK Financial Conduct Authority (FCA). The platform offers 24/7 customer support by phone, email, and live chat. You can open a new account with just a $20 minimum deposit.

Capital.com fees:

| Commission | 0% |

| Deposit Fee | Free |

| Withdrawal fee | Free |

| Inactivity fees | None |

Pros:

- Super user-friendly online stock broker

- Buy shares without paying any commission

- 3,000+ shares to trade

- Mobile trading app

- Regulated by the FCA and CySEC

- 24/7 customer support

Cons:

- Trading platform has limited technical analysis tools

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

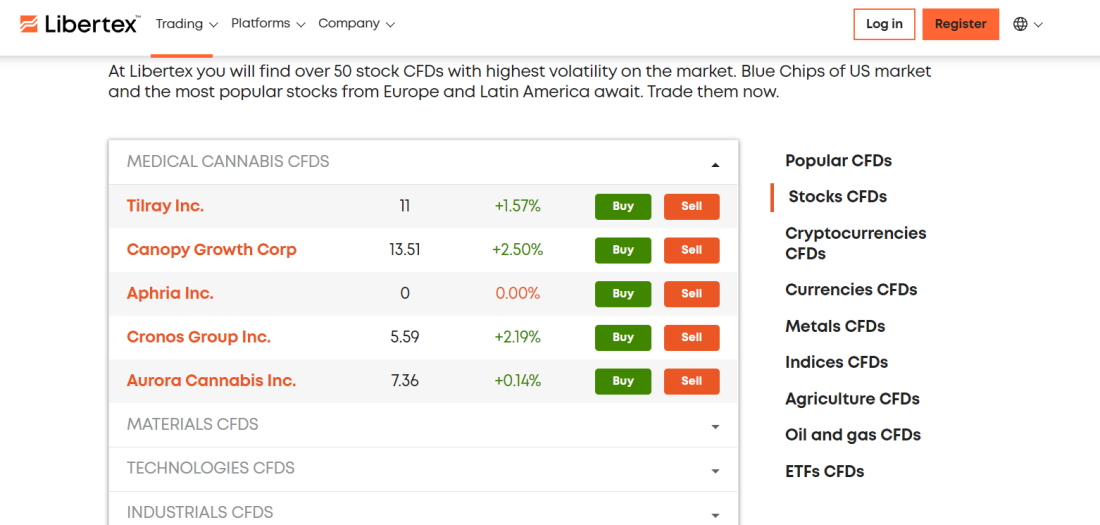

Libertex – Top-rated CFD Broker with Zero Spread Trading

Libertex is a brand that most investors are familiar with nowadays. If you want to speculate on the price movements of underlying assets such as forex, commodities, stocks, cryptos, ETFs, and more then this low-cost CFD trading platform is worth considering. Libertex was founded in 1997 and has been providing CFD trading services to its clients ever since. It has more than 20 years of experience in the financial markets and online trading scene. Libertex offers CFD trading on over 250 tradable assets.

Customers can choose between two trading platforms: MT4 or MT5 and the Libertex native platform. Libertex’s proprietary web trader platform is ideal for new traders who want a straightforward online trading platform with no technical jargon. Advanced traders can use the popular MetaTrader trading suite, which includes technical indicators, customizable charts, drawing tools, and robo-advisory services, to automate their trading. For those interested in forex trading, MT4 is the best option.

When it comes to tradable assets, it’s important to remember that CFD trading is not the same as traditional investing. Simply put, you are not the owner of the underlying asset. Instead, you trade CFD derivatives based on an asset’s intrinsic price, such as FX, stocks, ETFs, commodities, and so on. As previously stated, a contract for difference (CFD) is a type of financial derivative that allows you to trade market price changes without owning the underlying security.

Libertex makes it simple to deposit funds into your account. Credit cards, debit cards, e-wallets, and bank transfers are just a few of the payment options available to you. While there are no deposit fees, withdrawal costs differ depending on your preferred method of payment. Withdrawing payments from PayPal and Skrill, for example, incurs no fees. The free trading platform levies a commission per trade as a result of the broker’s spread-free offering.

In terms of security and regulations, Libertex Pty., is a South African financial services company (FSP Number 47381) and is regulated and supervised by the Financial Sector Conduct Authority (FSCA). If you’re looking for the best FSCA brokers, be sure to check out our comprehensive guide.

Libertex Fees:

| Bid-Ask Spread | 0% |

| Deposit Fee | Free |

| Withdrawal fee | Varies depending on payment method |

| Inactivity fees | 10 EUR per month after 180 days |

Pros:

- Zero spreads and low commissions

- User-friendly mobile app

- Access to 250+ tradable CFD assets

- Supports MT4 and MT5

- Regulated by FSCA

Cons:

- Only supports CFD trading

74% of retail investor accounts lose money when trading CFDs with this provider.

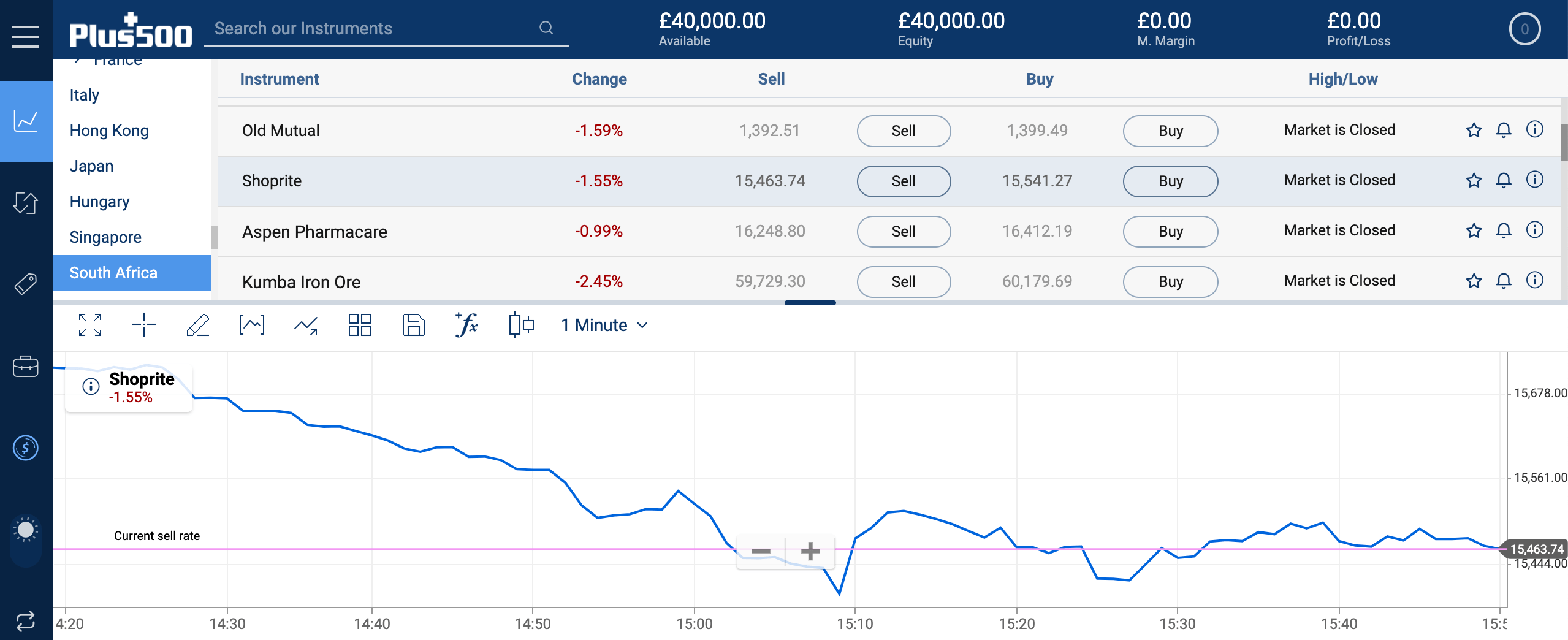

Plus500 – Commission-Free Share CFD Broker

While the other providers on one of the stock brokers in South Africa focusing on traditional stock investments, some of you might be looking to ‘trade’. By this, we mean that you will be trading share CFDs with the view of speculating which direction the markets will move. Plus500 is a market leader in this respect – with thousands of financial instruments available to trade.

This includes a whopping 2,000+ instruments from heaps of markets. In fact, you can even trade share CFDs from the JSE. For example, you can speculate on the short-term price movement of Gold Fields, Anglo American, Sasol, Impala Platinum, Clicks, and many others. Regardless of which share CFDs you decide to trade, you will always the option of going long (buy order) or going short (sell order).

Plus500 also offers leverage facilities, meaning that you can trade with more than you have in your account. This stands at 1:30 – albeit, your limits will be dictated by the asset class and your trading status (professional or retail client). The most appealing aspect of trading share CFDs at Plus500 is that the platform charges no commissions. Instead, it’s only the spread that you will pay.

Outside of share CFDs, Plus500 also offers markets on indices, hard metals (like gold and silver), energies (like oil and gas), interest rates, and even cryptocurrencies. Once again, the aforementioned asset classes are also represented via CFDs. There is no requirement to download or install any software to trade at Plus500, as everything is facilitated via its website. You can also trade on your mobile phone via the Plus500 app.

If you do like the sound of share CFD trading, you can open an account for just £100 – which is about 1,500 rands. The trading platform supports South African debit/credit cards and bank wires. You can also deposit funds with your Paypal account. There are zero fees attached to deposits and withdrawals – no matter which payment method you use. Finally, Plus500AU Pty Ltd holds AFSL #417727 issued by ASIC, FSP No. 486026 issued by the FMA in New Zealand, and Authorised Financial Services Provider #47546 issued by the FSCA in South Africa.

Plus500 fees:

| Commission | 0% (spreads on CFDs) |

| Deposit Fee | Free |

| Withdrawal fee | $5 |

| Inactivity fees | $10 per quarter after 3 months inactivity |

Pros:

- Commission-free CFD platform – only pay the spread

- Thousands of financial instruments across heaps of markets

- Leverage of up to 1:30

- Ability to enter buy and sell positions

- Takes just minutes to open an account and deposit funds

Cons:

- CFDs only

- Only suitable for experienced traders

AvaTrade – CFD Stock Broker with High Leverage

AvaTrade is another top stock broker in South Africa. This platform offers trading on more than 600 share CFDs from the US, UK, and Europe. Even better, all share CFDs on AvaTrade trade 100% commission-free and the broker has some of the tightest spreads in South Africa.

Part of what makes AvaTrade stand out is that you can trade most US-listed stocks with up to 10:1 leverage. While that might not sounds like a huge amount, most competing brokers let you use a maximum of 5:1 leverage for share trading or none at all. So, with just $100 at AvaTrade, you can take a stock position worth up to $1,000.

We also think traders will love AvaTrade’s trading platforms. The broker offers a standalone trading platform for web and mobile, which includes advanced charting tools, a stock news feed, alerts, watchlists, and more. AvaTrade also supports automated trading and has a calendar to help you monitor upcoming stock earnings reports.

Even better, AvaTrade offers a social trading app – AvaSocial – for iOS and Android devices. With this app, you can follow other traders and start discussions about the market or new trading strategies. You can also copy the positions of more experienced stock traders, which makes it easy to build a highly diversified and actively traded portfolio in minutes.

AvaTrade is regulated by top-tier watchdogs in the UK and Australia as well as by South Africa’s Financial Services Conduct Authority. All accounts include negative balance protection, so you can never lose more than you deposited to your account when trading with leverage. AvaTrade requires a $100 minimum deposit to open a new account.

AvaTrade Stockbrokers fees:

| Commission | Spread, 0.13% for US stocks |

| Deposit Fee | Free |

| Withdrawal fee | Free |

| Inactivity fees | 700 rands after 90 days |

Pros:

- Trade over 600 US, UK, and European stocks

- Leverage up to 10:1

- 0% commission trading with low spreads

- Social trading mobile app

- Negative balance protection

Cons:

- High inactivity fee after 3 months

Your capital is at risk.

Absa Stockbrokers – One of the Best JSE Stock Brokers

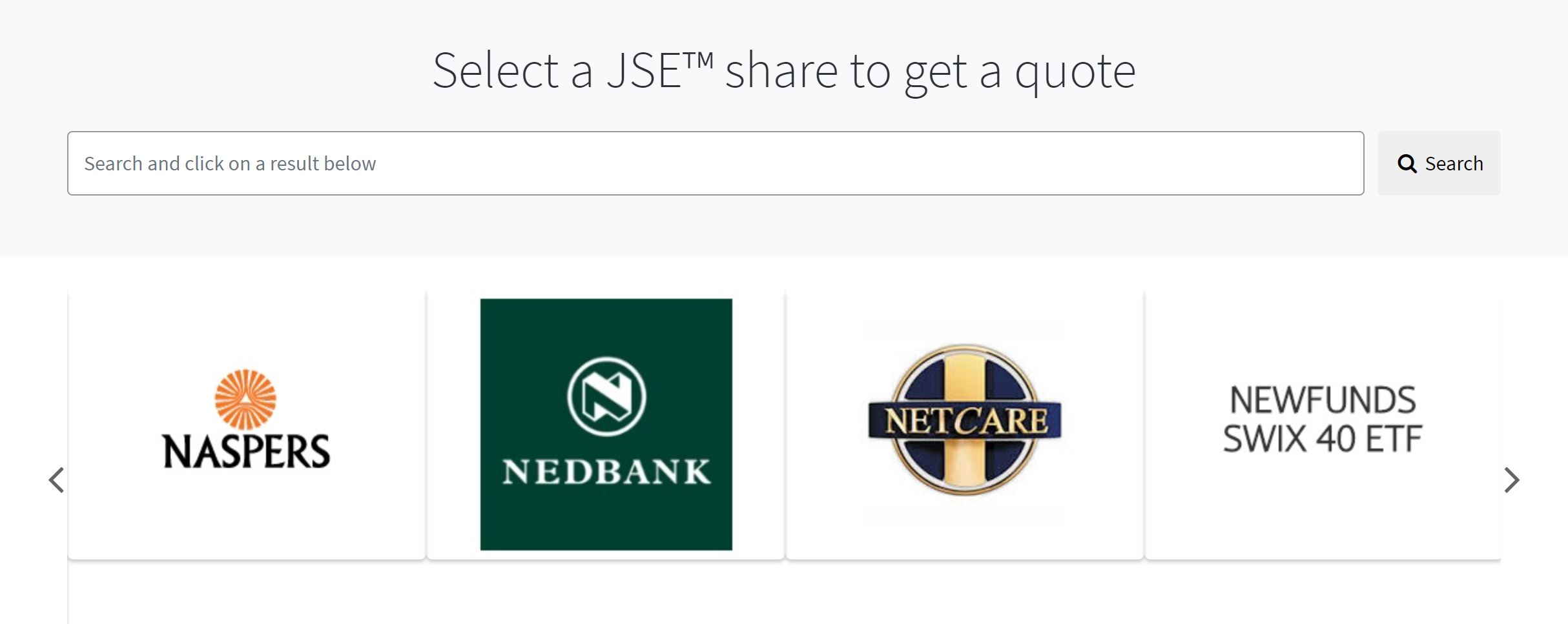

If you are searching specifically for JSE stock brokers, then you might want to consider Absa Stockbrokers. Crucially, the South African platform gives you access to the domestic stock exchange – meaning that you can buy shares in some of your favourite South African companies.

This includes everything from BHP Billiton, Discover, Richemont, Investec, Firstrand, and Mindi. Absa is also popular with South Africans because you will be able to invest in a variety of JSE indexes. This allows you to speculate on the wider stock markets as opposed to buying shares in individual companies. ETFs are also supported, which is great for diversification purposes.

In terms of buying shares in JSE companies, you will be charged a brokerage fee of 0.4% at a minimum of 120 rands. Then, you also need to take into account a monthly administration fee of 75 rands plus VAT. The good news is that you can waive the administration fee for the remainder of the respective month when you place 3 or more traders. In terms of ETF fees, this stands at 0.2% with a minimum of 60 rands. We should also note that Absa Stockbrokers gives you access to a plethora of international stock markets.

Absa Stockbrokers fees:

| Commission | 0.4%, minimum of 120 rands for JSE shares, $25 per trade for offshore shares |

| Deposit Fee | Free |

| Withdrawal fee | Free |

| Inactivity fees | 35 rands every 60 days |

Pros:

- Domestic JSE stock broker for South Africans

- Buy shares in South African companies

- South African indexes and ETFs supported

- Access heaps of international stocks

- Easily deposit funds with a local payment method

- Simple platform to use

Cons:

- The website looks very outdated

- Access to international shares is costly

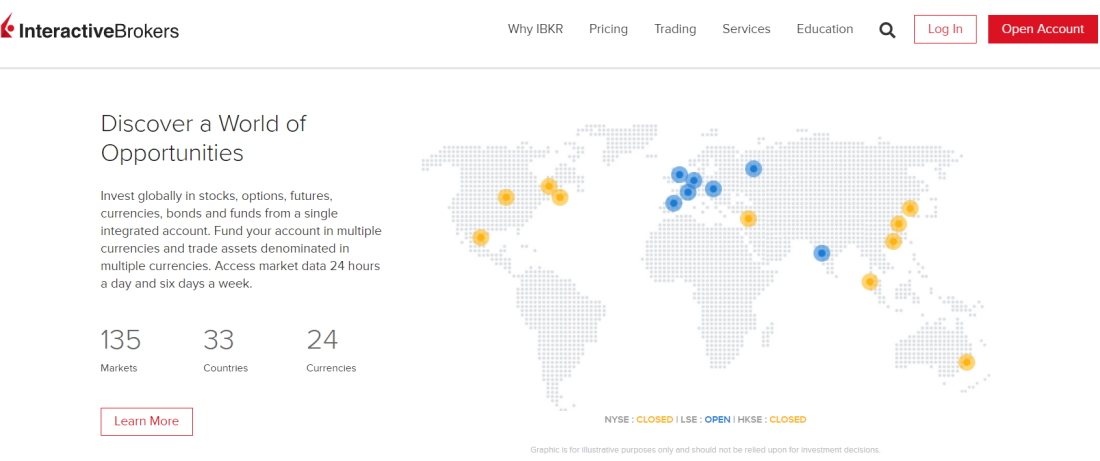

Interactive Brokers – Best Stock Broker for Diversification and Low Fees

Interactive Brokers is a market leader in the global investment space. Being a US-based brokerage firm, Interactive Brokers is heavily regulated. It does, however, provide full support for South African traders – meaning that you will have access to thousands of shares across 135 different markets. On top of stocks, you will also be able to invest in ETFs and funds.

Interactive Brokers is also useful if you require access to more sophisticated financial products. This includes CFD and forex trading – meaning that you can also apply leverage to your orders. We should note that Interactive Brokers is actually more suitable for those of you with experience in the online investment space – even if you simply want to buy shares.

This is because its in-house trading platform is highly advanced, so newbies are best advised to stick with a user-friendly broker like Capital.com. Nevertheless, one of the stand-out selling points of using Interactive Brokers is that you will benefit from some of the lowest South African stock broker fees in the space. In fact, this works out at just $0.005 per share that you buy. There is a $1 minimum commission in place, but this is minute.

If you want to invest in mutual funds to benefit from a passive trading strategy, this costs $14.95 at Interactive Brokers (minimum investment $3,000).In terms of getting started, you will need ot go through a brief account opening process that will require some documentation from you.

Once you have verified your identity, you can deposit funds from your South African bank account. Minimum deposits stand at $2,000. When it comes to regulation, Interactive Brokers holds licenses in multiple countries. This includes the US, Australia, Singapore, Hong Kong, Japan, and the UK. As such, you should have no concerns about the safety of your funds.

IG fees:

| Commission | $0.005 per share, minimum $1 commission |

| Deposit Fee | Free |

| Withdrawal fee | The first withdrawal of each month is free, then $1 – $10 depending on the withdrawal method |

| Inactivity fees | $20 per month if you have less than a $2,000 account balance and don’t generate a minimum of $20 in commissions |

Pros:

- Super-cheap trading fees

- Thousands of equities on offer

- Perfect for experienced investors

- Trade heaps of other asset classes

- Leverage available

- Strong regulatory standing

Cons:

- Not suitable for newbie investors

- JSE shares not supported

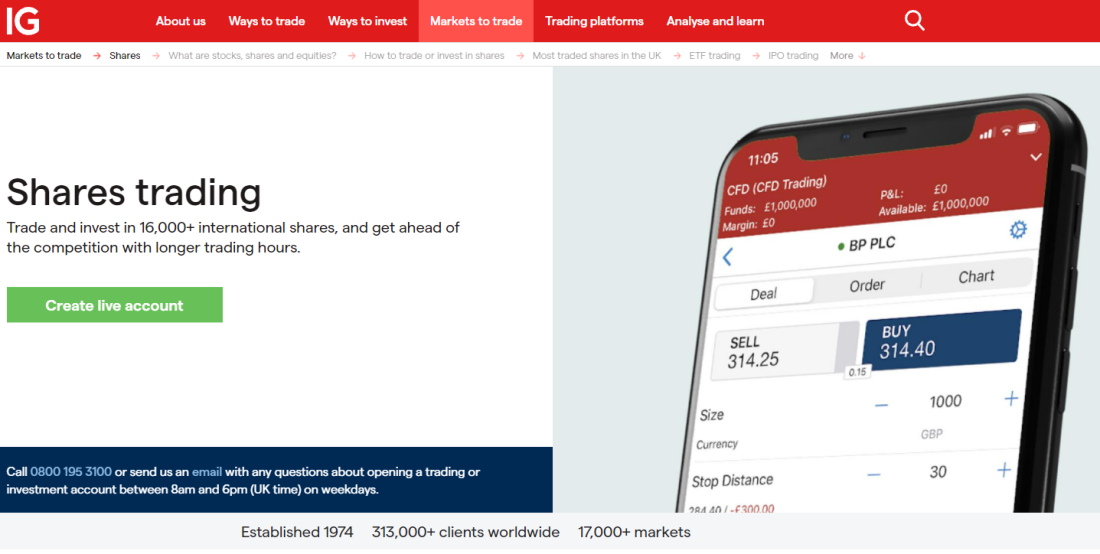

IG – Trusted Stock Broker Platform With Access to the JSE

IG is a UK-based brokerage firm with over 178,000 clients across dozens of countries – including South Africa. The platform offers share dealing services and CFD stock trading facilities. If you want to gain exposure to the South African financial markets from the comfort of your home, IG allows you to do this through its CFD facilities.

This includes the vast majority of companies that form the JSE 40 index. For example, you can trade Naspers, BHP Group, Richemont, Anglo American, and Sasol. Much like Plus500 – you will be able to enter buy and sell positions and access leverage facilities. IG also gives you access to the previously mentioned JSE 40 – so you can speculate on the short-term price movement of the domestic exchange.

When it comes to fees, IG is actually very competitive. However, this is only on the proviso that you are trading reasonably large volumes. This is because there is a minimum commission in play. So, IG has a commission trade of 0.20% of the total order value. But, this stands at a minimum of 100 rands. On the flip side, IG offers some of the most competitive spreads in the space when trading share CFDs. As such, should also be taking into account when assessing the firm’s fees.

If you want to get started with IG today, you will need to meet a minimum deposit of £250. This amounts to about 5,200 rands. You can fund your account with a South African debit card, credit card, or bank account. If using a credit card, a fee of 0.5% is charged on MasterCard deposits, and 1% with Visa. Finally, IG is regulated in several countries – so you should have no issues regarding trust.

IG fees:

| Commission | UK shares £3 if more than 3 trades made in the previous month, £8 if 2 or fewer trades

US shares free if more than 3 trades made in the previous month, £10 if 2 or fewer trades All other shares 0.1% with a minimum of EUR 10 |

| Deposit Fee | Free |

| Withdrawal fee | Free |

| Inactivity fees | £12 a month after 2 years of inactivity |

Pros:

- Trusted broker with a long-standing reputation

- Good value share dealing services

- Leverage and short-selling also available

- Spread betting and CFD products

- Access to dozens of international markets

- Great research department

Cons:

- Minimum deposit of £250 – or 5,200 rands

- Stock CFDs on the JSE have a minimum commission of 100 rands

How do Stock Brokers in South Africa Work?

The actual process of using an online stock broker could not be easier. Irrespective of which platform you use, you will typically need to do the following:

- Open an account with your chosen share broker

- Upload some ID to confirm your identity

- Deposit some funds with your debit/credit card or bank account

- Choose which shares you want to buy

- Complete the investment

At this stage, you will be the proud owner of your chosen stocks. You do not need to anything else until you decide to cash out your shares. You can typically do this whenever you see fit – during standard market hours. This makes South African stock brokers a good option if you want to invest in a liquid asset class, as you can easily sell your shares back to rands.

As you likely know, lots of companies – both in South Africa and overseas, pay dividends. If you hold at least one share in a dividend-paying company, the cash will be paid into your brokerage account. You can then withdraw the funds back to your South African debit/credit card or bank account. Alternatively, you might decide to re-invest the dividend payments into other shares.

South Africa Stock Broker Fees: What you Need to Know

It will come as no surprise to learn that you will need to pay a fee of some sort when buying shares online. After all, the brokerage firm in question offers its services to make a profit. The specific fees can vary quite considerably, which is why you need to check this before opening an account. Not only does this include a variation in commission rates, but also the nature in which the transaction is charged.

For example:

- Some South Africa stock brokers charge a flat fee. Irrespective of how much you invest, you will always pay the same fee. This is beneficial if you are looking to trade large volumes.

- In other cases, South African stock brokers will charge a variable commission. For example, if the commission stands at 0.5% and you buy 10,000 rands worth of shares, then you will pay a fee of 50 rands. This is more beneficial if you want to trade small volumes.

- In much rarer cases, platforms like Capital.com charge neither a flat or variable fee. Instead, you can buy shares on a commission-free basis.

On top of trading fees, you also need to check whether or not a monthly dealing or administration fee is in play.

To give you an idea of what you are likely going to pay in 2022 – check out the comparison table below.

| Stock Broker | Charge Per Trade | Annual Fee | Conversion Fee |

| Libertex | Commission | None | 0.0001% |

| Plus500 | 0% Commission | Free | 0.50% |

| AvaTrade | 0% Commission, 0.13% Spread | Free | 0.50% |

| IG | 100 ZAR minimum on SA Stock CFDs | About 500 ZAR per quarter (less than 3 trades) | 0.50% |

| Interactive Brokers | $0.005 per share ($1 minimum) | $10 per month – fewer commissions paid | 0.1 – 0.2 basis points, minimum of $2 |

| Absa Stockbrokers | 0.4% (120 ZAR minimum) | 75 ZAR + VAT per month (less than 3 trades) | 0% on JSE trades |

| Capital.com | Free | Free | 0.50% |

Currency Conversion Fee

If you have read our stock broker guide up to this point, then you might have noticed that non-domestic platforms charge a currency conversion fee. This is because you will be accessing international stock markets that are traded in a currency other than the rand. If using a popular broker like Capital.com or Plus500, this stands at just 0.5%.

For example:

- Let’s suppose that you deposit 15,000 rands into Capital.com

- At the point of the deposit, you will pay a currency conversion fee of 0.5%

- This amounts to a fee of 75 rands

- After that – it doesn’t matter if you buy shares in companies listed in the US, UK, Australia, Suadi Arabia – or any other marketplace for that matter, you will not need to pay any additional fees

In other cases, platforms like Absa Stockbrokers will charge you a flat fee when accessing international markets. This can actually work out very expensive when investing smaller amounts. For example, Absa charges $25 to buy shares listed on the NYSE or NASDAQ – which is huge.

Investing in Stocks vs Share CFD Trading

You might have noticed from our list of the best stock brokers in South Africa that there are two options when it comes to gaining exposure to the stock markets. This includes ‘investing’ in shares and ‘trading’ share CFDs. It is important for you to understand the difference.

Investing in Shares

Put simply, if you want to buy shares and hold on to them for several years, you will be ‘investing’. This means that you will own a small percentage of the company in question – proportionate to the size of your investment.

You will also be entitled to vote in shareholder meetings and receive dividends. This particular avenue is ideal for long-term investments, as you can keep hold of your shares for as long as you see fit.

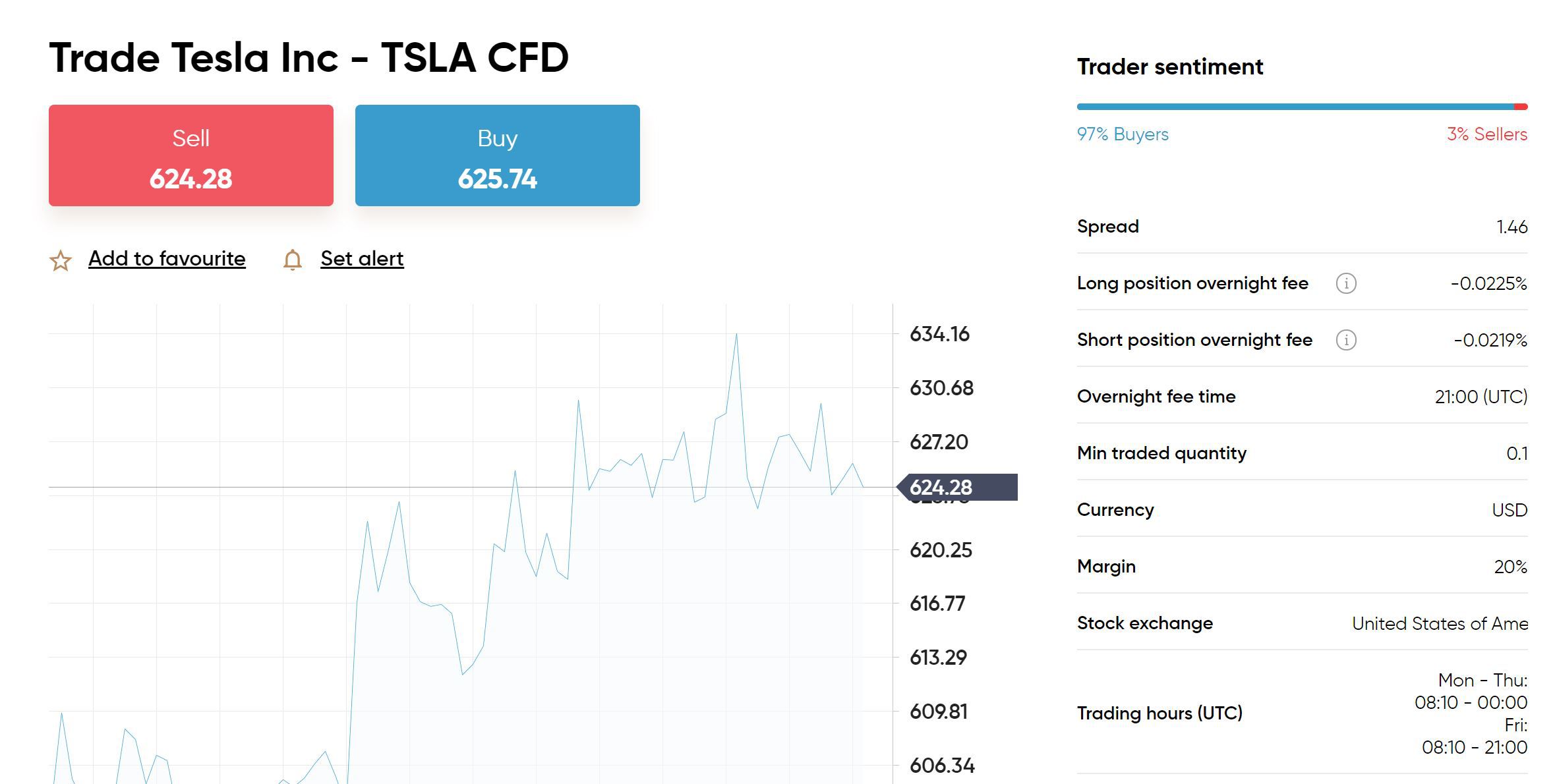

Share CFD Trading

Share ‘trading’ will give you exposure to the stock markets, but it is more of a short-term strategy. That is to say, you will be speculating on the short-term price movement of a company – with the view of making small, but frequent profits. This might come in the form of day trading or swing trading.

This particular option offers much more in terms of flexibility, as you can apply leverage and even short-sell a company. But, overnight financing fees are charged for each day that you keep your position open, which is why share trading is only suitable for short-term speculation.

The good news is that the best CFD brokers in the space allow you to trade shares without paying any commissions. Furthermore, the best South Africa CFD brokers, such as FXVC, will adjust your account balance when dividends are distributed by a firm. If going long, this means that you will receive a positive amount.

How Safe are South Africa Stock Brokers?

In our view, this is why you should only consider joining a share broker if it is in possession of a tier-one license. In fact, this is one of the main reasons that South Africans opt for an international platform, as the likes of the FCA (UK), ASIC (Australia), and CySEC (Cyprus) are highly reputable.

By opting for a stock broker that holds at least one of the aforementioned licenses, you will benefit from:

- Segregated Bank Accounts: All client funds are held in bank accounts that are separate from the broker’s working capital. In theory, this means that were the platform to go bust, your funds should be safe.

- Anti-Money Laundering: As per national and regional anti-money laundering regulations, platforms are required to verify all registered users. This is done through an upload of your passport/driver’s license and proof of address.

- Risk Warnings: All brokers licensed by a tier-one body are required to make the risks of investing super-clear. This ensures that you do not invest more than you can afford to lose.

If using a domestic brokerage firm, then you must ensure that the platform is licensed by the Financial Sector Conduct Authority (FSCA).

How to Find the Best Stock Brokers in South Africa

Although we have already discussed some of the best stock brokers in South Africa, there might come a time where you come across a new platform that we haven’t reviewed. If this is the case, there are several metrics that you need to explore before joining the broker in question.

This includes:

- Regulation: As discussed in the section above, it is crucial that you only join a share broker if it regulated. In fact, we would suggest looking out for reputable licensing bodies like the FCA or ASIC. Once again, if you opt for a domestic-based broker, then you will need to ensure it is regulated by the FSCA.

- Low Fees and Commissions: Brokerage fees can begin to add up very quickly – especially if you are looking to build a vast portfolio of stocks. As such, be sure to assess what share dealing fees you will be required to pay. In an ideal world, you will be using a commission-free stock broker like Capital.com

- Tradable Markets: You then need to explore what shares the broker offers. For example, as you looking to buy shares in JSE-listed companies, or those based overseas? You can check this out before signing up.

- Tools: The available trading tools vary widely from broker to broker. For example, Libertex has tools like a news feed, economic calendar, and AI to analyse your trades. On the flip side, brokers like IG support MetaTrader 4, which provides access to a wide range of advanced charting and analysis tools.

- User-Friendliness: Some brokers are best suited for advanced traders, while others are conducive for those of you with little experience. You can generally get a feel for the target audience by browsing the South African share brokers’ website.

- Customer Support: Having access to a dedicated customer support team is crucial. After all, you will be investing your hard-earned money. The most convenient support channel is that of live chat, albeit, some South Africans prefer to obtain guidance over the phone.

The above list of important metrics is not exhaustive. Ultimately, you need to be prepared to spend ample time researching your chosen stock broker before making a commitment.

How to Trade Stocks with Capital.com

Now that you are more familiar with what stock trading is and which provider you can use to buy stocks in South Africa, the following is a step-by-step guide to complete your first stock purchase using our preferred stock broker – Capital.com

Step 1: Open an Account with Capital.com

Opening an account with this provider is quite simple. Go to their official website and click on the “Open an account” button located at the upper right corner of the site. You will be prompted to provide some basic information and then you will be directed to the trading platform upon completing your registration.

Step 2: Verify Your Identity

Step 2: Verify Your Identity

Once you access the trading interface, you can click on the icon that has your initials, which is located at the upper right corner of the screen. There you will find an option that says “KYC”. Once you click there, you’ll find an area where you can upload a valid ID and proof of residence to verify your identity. The team at Capital.vom will typically take 24 hours or less to confirm you are who you say you are and then they will activate your account.

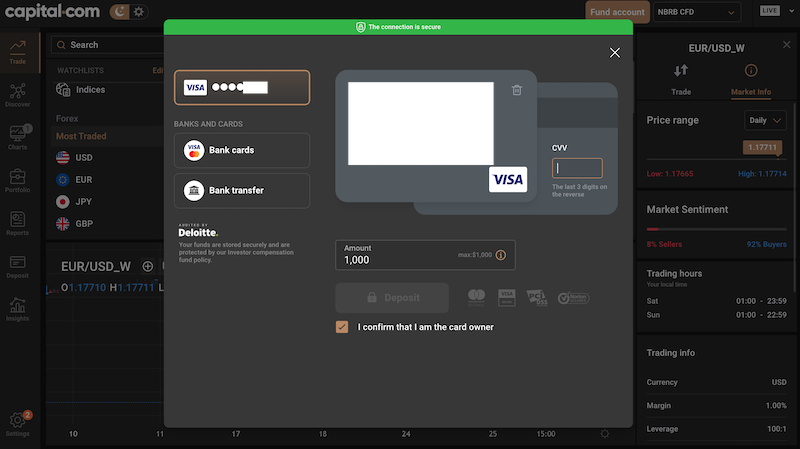

Step 3: Deposit Funds

Now that you have an active account, it is time to deposit some funds so you can buy your first shares. Capital.com accepts deposits via debit or credit card (MasterCard/Visa/Maestro), electronic wallets (Astropay, PayO, Neteller, Webmoney) or via wire transfer. If you use the first and second method, your deposit will be cleared instantly.

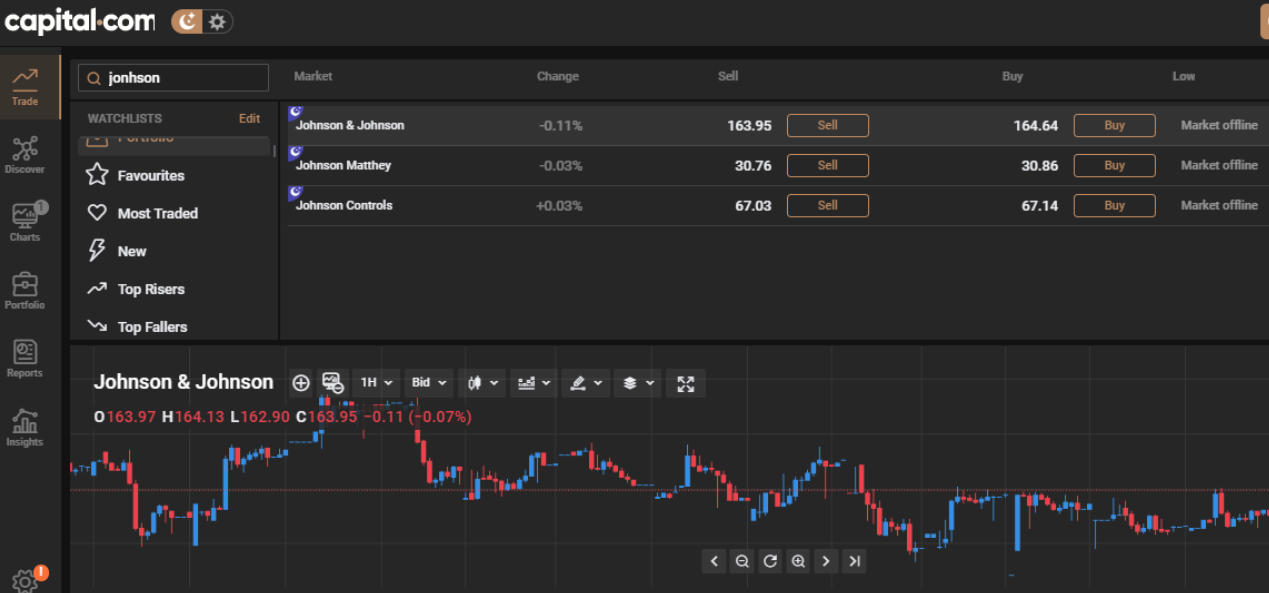

Step 4: Buy Your First Stock

Once the funds are cleared, you can click on the Trade button – the first one located at the left panel of the trading interface – and you will easily find all the stocks supported by the platform by clicking on the “Stocks” label. Once there, you can filter the stocks by country, sector, and market sentiment by clicking on the different hashtags available as shown in the picture below.

Capital.com – Best South Africa Stock Broker 2022

In conclusion, South Africans now have access to a vast number of online stock brokers. This includes platforms that offer traditional share dealing services, as well as more sophisticated instruments like stock CFDs. Either way, you need to ensure that your choice of stock broker is right for your individual needs before signing up. This should look at everything from fees and commissions, tradable shares, supported payment methods, and of course, regulation.

Our in-depth research concluded that Capital.com is leading the way across most of the aforementioned metrics. This is because the broker is heavily regulated, offers heaps of shares, and allows you to buy shares on a commission-free basis. If you want to start building your share portfolio today, simply click on the link below!

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Step 2: Verify Your Identity

Step 2: Verify Your Identity