How to Buy TymeBank Shares in South Africa – With 0% Commission

TymeBank is the first-ever digital-only South African bank and one of the most innovative modern banks in the world. With more than 3 million customers and a license from the Prudential Authority of the SA Reserve Bank, this bank continues to grow at an exponential rate and attract new investors. That said, buying TymeBank shares is not that easy as the bank is not yet listed as a public company on any stock exchange.

So, in this guide, we’ll show you to easiest way to get exposure and buy TymeBank shares in South Africa. We’ll also explain why you might want to buy TymeBank shares today.

How to Buy TymeBank Shares in South Africa – Step by Step Guide 2022

If you’re looking to buy TymeBank shares in South Africa, then you first need to find an online trading platform that supports its parent company AIL. To do that instantly without reading our full guide, simply follow the four steps below:

- Step 1: Open an account with Capital.com – Visit the Capital.com website and click on the ‘Sign Up’ button to register for an online account. Then, submit your email address and choose a password to create your trading account.

- Step 2: Verify your Account – As part of the KYC process you’ll be required to upload proof of ID (a copy of your passport or driver’s license) and proof of address (a copy of a bank statement or utility bill) in order to verify your account.

- Step 3: Deposit Funds – Make a minimum deposit of just $20. This can be done via credit/debit card, bank transfer, or other e-wallet services.

- Step 4: Buy TymeBank Shares – Search for TymeBank using the search bar within the ‘Markets’ section of the trading platform. Then, click on the relevant result from the drop-down menu and you will be redirected to an order entry page. As you’ll be trading stock CFDs you can either go long or short depending on your market speculations. Then click on ‘Open Trade’ and your order will be executed. You are now an AIL shareholder, and you know how to buy TymeBank share CFDs in South Africa.

75.26% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Step 1: Choose a Stock Broker

At the time of writing, shares of TymeBank are not yet listed on any stock exchange, which means the only way to invest in this company is to buy shares in its parent company, African Rainbow Capital Investments Ltd.

African Rainbow Capital is listed on the Johannesburg Stock Exchange under the ticker symbol AIL – meaning you need to find a South African brokerage firm that allows you to buy AIL shares. Below, we suggest several trusted trading platforms that enable you to buy shares in South Africa.

1. Capital.com – Overall Best Broker in South Africa to Buy TymeBank Shares

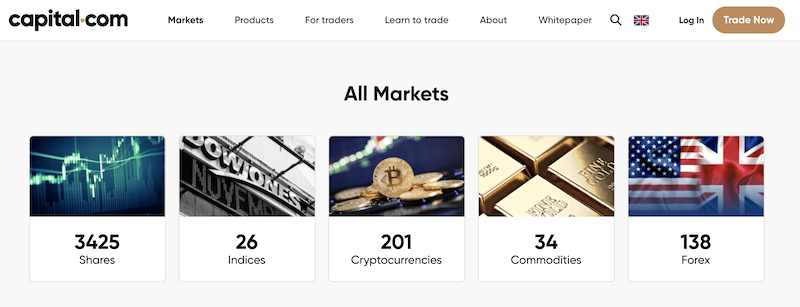

Capital.com is our top choice for buying and selling shares of TymeBank in South Africa and for several reasons. The broker is authorized and regulated by two of the most reputable regulatory organizations in the world – the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC) in Europe. As for the range of assets, Capital.com offers over 3700 financial instruments including a huge selection of 3425 shares from various stock markets around the world.

Being a CFD broker, Capital.com offers commission-free trading and a leverage ratio of 5:1 for shares. This means that with the amount of $1000 in your account balance, you can control $5000. When it comes to pricing, the broker has no fixed fees at all – no trading fees, deposit and withdrawal, or inactivity fees. The only factor you need to take into consideration when you make a transaction is a buy and sell spread.

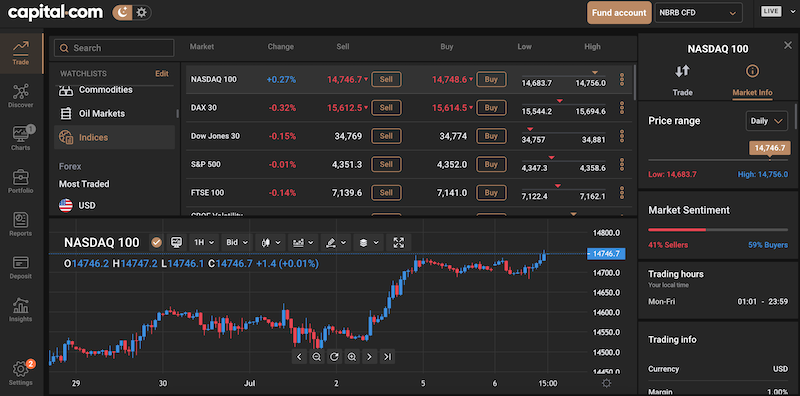

Apart from the pricing, what makes Capital.com our top choice broker is the range of two of the best trading platforms in the market. At first, you can trade the MetaTrader4 that is known as the most stable and advanced trading platform in the CFD market. But while the MT4 platform offers a good place to trade the markets, we really like Capital.com’s proprietary in-house trading platform. This platform has a great user interface, extensive charting capabilities, and built-in trading tools that include a news section, market sentiment tool, and market and fallers screen. Further, it is the first-ever trading platform that uses artificial intelligence technology to help users get trading insights.

All in all, Capital.com is the ideal platform for South African investors that want to buy shares and other assets. To get started, the broker requires only $20, which is around 285 South African Rands.

Pros:

- Trade shares with no trading fees

- Suitable for both beginners and pro traders

- Zero inactivity fees

- Over 3,400 shares available from various stock markets around the world

- Supports the MetaTrader4

- Excellent in house trading platform that is available on a web browser or a mobile device

- Low minimum deposit amount

- You can test the platform on a free demo account

Cons:

- Only offers CFDs

75.26% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

2. Libertex – Top-rated CFD Broker with Zero Spread Trading

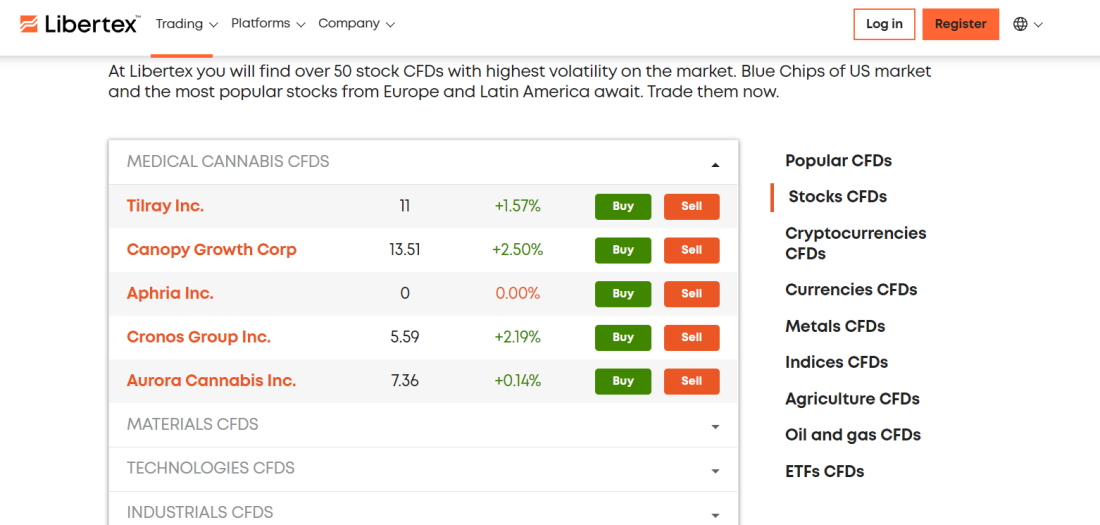

Libertex is a hugely popular option for CFD trading in South Africa that’s been in business for over 20 years. This is a CFD broker, which means you can quickly and easily trade on the price of top stocks without having to actually own the underlying asset. Libertex offers a whole range of top stocks from around the world, as well as cryptos, forex, ETFs and commodities.

If you’re familiar with CFD brokers, you’ll know that they make most their money by charging spreads on each trade which can fluctuate depending on liquidity. Libertex is different, though – it doesn’t charge any spreads at all! Instead, it just charges a very small commission, so it works out as cheaper and more consistent in terms of pricing.

Libertex offers its own proprietary web trader platform, which is very user friendly. If you’re a more advanced trader, you can also access the MT4 and MT5 trading platforms through your Libertex account and make sure of the wide variety of technical analysis tools on offer.

You can easily make payments into your Libertex account using credit cards, debit cards, e-wallets, and bank transfers. There are no deposit fees, though withdrawal costs differ depending on your preferred method of payment, but they’re still very low. Withdrawing payments from PayPal, for example, is free.

Libertex is an extremely secure broker that’s a registered South African financial services company (FSP Number 47381) and is regulated by the Financial Sector Conduct Authority (FSCA). There’s no doubt this popular platform is one of the best FSCA brokers.

Libertex Fees:

| Bid-Ask Spread | 0% |

| Deposit Fee | Free |

| Withdrawal fee | Varies depending on payment method |

| Inactivity fees | 10 EUR per month after 180 days |

Pros:

- Zero spreads and low commissions

- User-friendly mobile app

- Access to 250+ tradable CFD assets

- Supports MT4 and MT5

- Regulated by FSCA

Cons:

- Only supports CFD trading

75.3% of retail investor accounts lose money when trading CFDs with this provider.

3. AvaTrade – Low-Cost CFD Broker to Trade TymeBank shares

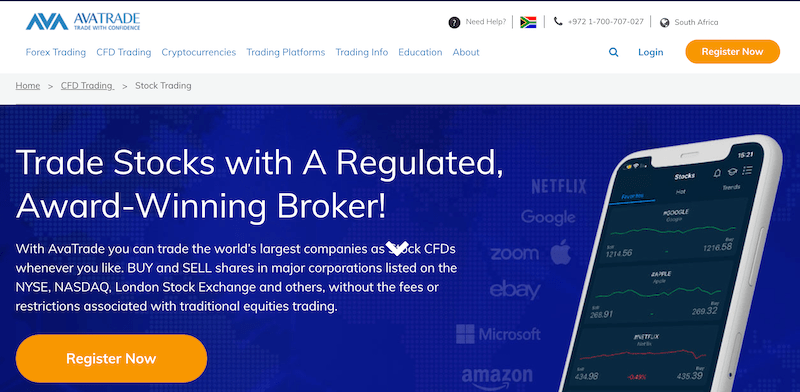

AvaTrade is another top-notch trading platform to buy shares in South Africa and other financial instruments via CFDs. This brokerage firm that was founded way back in 2007 is one of the few online trading platforms in South Africa that is regulated and authorized by the Financial Sector Conduct Authority (FSCA).

Much like Capital.com, AvaTrade offers investors to buy and sell shares commission-free and by using margin trading. But while other brokers are authorized to offer a maximum leverage of 5:1 for stocks, AvaTrade offers a 5.00% margin requirement or a leverage ratio of 20:1. Another reason to choose AvaTrade over any other online trading platform is the selection of trading platforms and tools it provides. As a matter of fact, AvaTrade covers almost every aspect of trading. With this broker, you get access to beginners platform, advanced platform, automated trading solutions, social trading app, options trading, and MetaTrader solutions for Mac (not very common among other brokerage firms).

Finally, AvaTrade keeps things simple when it comes to the registration and account creation process. Moreover, if you would like to test the platform and the broker’s trading conditions before you make a deposit, AvaTrade also offers you the possibility to open an unlimited demo account. Then, once you are ready to make a deposit, the broker requires to make an initial deposit of at least $100.

Pros:

- AvaTrade offers to trade shares, forex, commodities, indices, cryptocurrencies, and FX options.

- Huge range of trading platforms and tools

- Commission-free

- Features social and automated trading solutions – AvaSocial, DupliTrade, ZuluTrade, and ExpertAdvisors (MT4 and MT5)

- Regulated in South Africa by the Financial Sector Conduct Authority (FSCA)

- 24/5 customer support

Cons:

- A limited selection of shares and other financial assets when compared to other online trading platforms

71% of retail investor accounts lose money when trading CFDs with this provider.

Step 2: Research TymeBank

As mentioned previously, the best way to invest in TymeBank is to buy shares of its parent company, African Rainbow Capital. As such, before you buy TymeBank shares, it’s important that you make in-depth research on the financial situation of TyemBank and the biggest owner of this digital bank – African Rainbow Capital Investments (AIL).

With that in mind, in this section of our guide, we’ll explain everything you need to know about TymeBank and African Rainbow Capital and help you decide whether you should make this investment right now.

What is TymeBank?

Additionally, one of the main attractions of TymeBank is called GoalSave – a free savings tool linked to a user banking account. With this feature, it is possible to earn a fixed interest of up to 8% per year.

The bank was initially acquired by the Commonwealth Bank of Australia (CBA) in 2015, and three years later, the first South African digital bank was acquired by African Rainbow Capital Financial Services Holdings (a Mauritius-based investment holding company that is owned by South African billionaire Patrice Motsepe.

As of July 2021, TymeBnak has over three million South African customers. TymeBank is a part of the Tyme group of companies that is based in Singapore.

TymeBank (African Rainbow Capital) Share Price

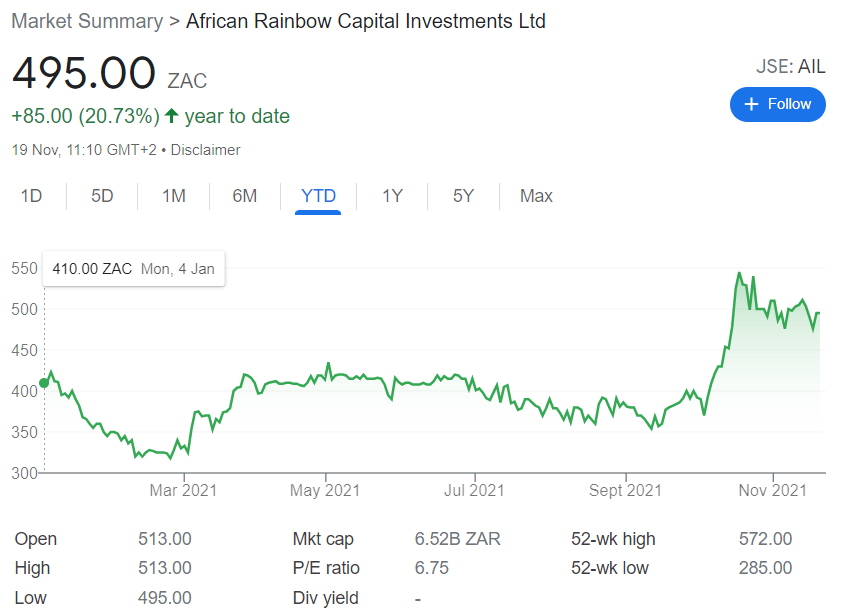

A quick look at the chart of African Rainbow Capital tells us that the share price fell drastically over the last few years. In fact, just three years ago, the AIL share price was trading at around 840 ZAR, and since then, the stock is trading in a long downward trajectory. At the time of writing, AIL shares are trading at a price of 495 ZAC, which represents a significant decrease of more than 40% since the high levels it was trading in 2017.

Notably, the AIL share price recovered before the Covid-19 pandemic started last year, rising to 505 ZAR in October 2019. But, as soon as the Covid-19 pandemic began, the stock fell to its lowest level of 254 ZAR in March 2020. Since then, however, AIL stock is trading in positive territory, gaining around 54% in the last 15 months.

In terms of the fundamentals, AIL has a market capitalization of 6.52B ZAR. It has a Price per Earnings (P/E) ratio of 6.75, which is below the average in the industry of around 11, and the general South Africa stock market of approximately 12. With that in mind, AIL is considered a fairly low-risk investment as it is debt-free and has a very strong balance sheet. This company focuses on strategic asset allocations to achieve high returns, especially in start-ups and high-growth companies such as TymeBank and Rain.

According to some market analysts, the AIL share price is expected to reach around 600 ZAR by the end of 2022 and 760 by the end of 2023.

TymeBank (African Rainbow Capital) Shares Dividends

If you decide to buy shares of TymeBank’s majority shareholder, African Rainbow Capital Investments Ltd (JSE: AIL) – then right now you won’t be able to a fixed annual return in the form of dividends. However, you might be able to get dividends from AIL in the near future. This is because the management has recently announced that it is going to distribute some of the earnings to shareholders following claims from shareholders that AIL is paying high fees for the company’s managers. Consequently, the company co-Chief Executive Johan van der Merwe said: “We’re going to start paying dividends and show that there’s real value in this business.”

Are TyemBank (African Rainbow Capital) Shares a Good Buy?

For the time being, the best way to get exposure to the TymeBank hype is to buy AIL shares. As such, when you make this investment, you need to analyze both TymeBank and the fund that owns it, African Rainbow Capital. In this section of our guide, we’ll mention some key points why AIL (TymeBank) is a good long-term investment right now.

TymeBank Attracts R1.6 Billion In Foreign Investment From Global Investors

Earlier this year in February, TymeBank announced a new investment from UK and Philippines investors amounting to R1.6 billion. The investors, Apis Growth Fund II and JG Summit Holdings (JG Summit), said they are committed to helping TymeBank grow into a top-tier retail bank in South Africa. Overall, so far TymeBank has raised $169 million from 5 private equity firms that include: African Rainbow Capital, JG Summit Holdings, Apis Partners, Serendipity Capital, and Ethos Private Equity.

TymeBank is One of the Fastest Growing Digital Banks in the World

According to the South African digital bank, an average of between 3000 and 5000 new customers join the digital banking platform every day – an average of 110,000 new customers per month! As a matter of fact, the bank which was officially launched just 28 months ago, is one of the world’s fastest-growing digital banks after it reached the magic number of three million clients in February 2021.

AIL Investments Predicts Rain Could Boost Profits

Despite investors’ opposition to AIL management fees, there’s a reason for investors to stick with the fund due to the success of one of AIL’s main holdings, Rain mobile operator. According to reports, Rain is growing exponentially and is currently valued at R3.493 billion. In case these projections are accurate, then AIL, which holds 20.4% of Rain’s shares, could get a strong boost from the growth of the South African data-only network.

Step 3: Open an Account & Buy Shares

If you’ve decided you’d like to invest in TymeBank, then you’ll need to find an online brokerage firm that supports its parent company, African Rainbow Capital. To help you get started with the process, below we’ll walk you through the process of buying shares using Capital.com, which is one of the cheapest share trading platforms in South Africa.

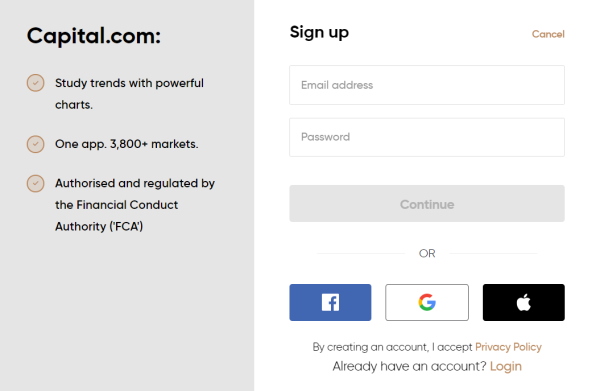

Step 1: Open a Capital.com Trading Account

Firstly, visit the Capital.com website and create a new brokerage account. On the broker’s homepage, click on the Trade Now button and submit your email address and then create a password. Another way to register is by using your Facebook, Google, or Apple account.

Step 2: Verify Your Identity

The next thing you need to do is to verify your identity. This is a mandatory step in the creation of your online trading account though you’ll be able to access the account and trade on a demo account before you complete the verification process. However, once you are ready to make a deposit and start trading in the real-live markets, you are required to upload a copy of your passport or driver’s license and a copy of a bank statement or utility bill.

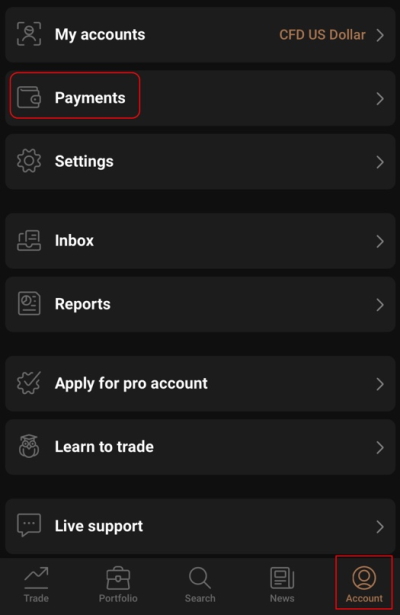

Step 3: Deposit Funds

Next, you can deposit funds into your new CFD trading account. Capital.com has a low minimum deposit of only $20 or equivalent in the local currency of the investor’s home country. In terms of payment methods, the broker offers a huge range of funding options including a debit card, credit card, Bank Wire Transfer, Neteller or Skrill.

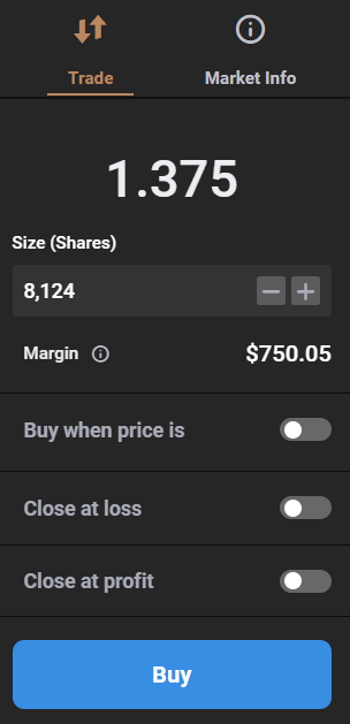

Step 4: Buy Shares

Now you can buy stock CFDs on Capital.com trading platform. To do that, you need to type in AIL in the search bar on the broker’s platform. Then, you’ll see an order form on the right side of the screen where you need to insert the number of shares CFDs you want to buy and the type of order (market or limit order). Finally, to complete your purchase, click on the ‘Open Trade’ button.

TymeBank Shares Buy or Sell?

In summary, there are some good reasons why TymeBank makes an interesting investment opportunity right now. Not only it is one of the world’s fastest-growing digital banks, but it also has the potential to grow into a top-tier retail bank in South Africa in the coming years. Unfortunately, right now it is not possible to invest directly in TymeBank shares, however, there’s still a solution – you can buy shares of TymeBank’s parent company, African Rainbow Capital.

To do that, you need to find an online trading platform that supports South African shares. We recommend using Capital.com for buying share CFDs of TymeBank (AIL) as this broker charges low spreads and allows you to trade on an advanced and easy-to-use trading platform.

Capital.com – Buy TymeBank (African Rainbow Capital) Shares CFDs With Low Spreads

75.26% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.