How to Buy Uniswap – Invest with Low Fees Today

Uniswap is one of the best performing digital assets of 2021. Although the Defi coin was launched as recently as September 2020 – the project has since breached a market capitalization of over $22 billion. In this guide, we show you how to buy Uniswap in South Africa in less than 10 minutes.

How to Buy Uniswap in South Africa – Quick Guide

Don’t have time to read this guide in full? Follow the simple steps below to buy Uniswap in South Africa with a top-rated broker.

- Open an account: In order to buy Uniswap safely, you will need to sign up with a regulated cryptocurrency broker. Capital.com is a great option, as the platform allows you to buy Uniswap with super-low fees.

- Upload ID: Upload a copy of your government-issued ID to verify your newly created account.

- Deposit: Deposit funds into your Capital.com account with a credit/debit card, bank transfer, or e-wallet.

- Buy Uniswap: Enter ‘Uniswap’ into the search box and click on the ‘Trade’ button. Enter the amount of Uniswap you want to buy and click on the ‘Open Trade’ button.

Once you confirm the order, this will be executed within a couple of seconds. Then, the Uniswap tokens will be added to your portfolio.

How to Buy Uniswap South Africa – eToro Tutorial

In this section of our how to buy Uniswap guide, we are going to walk you through the investment process step-by-step. This will be of particular use if you are buying digital currency online for the very first time.

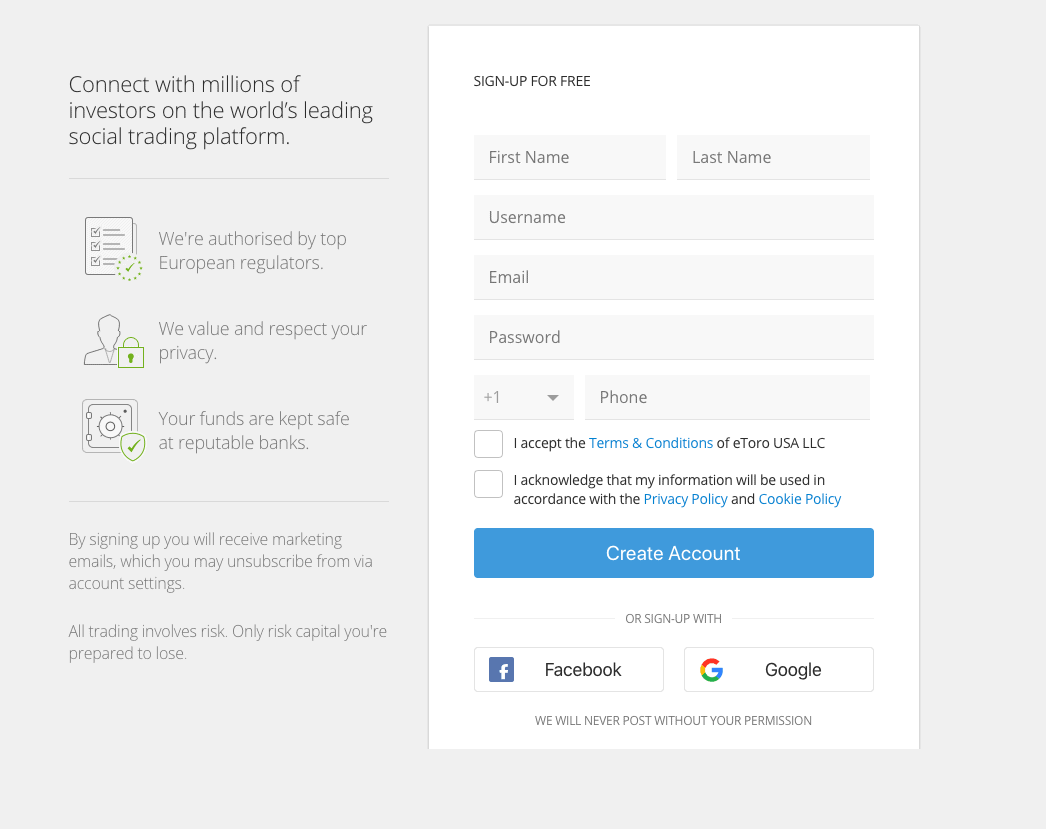

Step 1: Open an Account

You will first need to visit the eToro homepage to get the account opening process started. End-to-end, this shouldn’t take you more than a few minutes. Once you click on the ‘Join Now’ button, you will be prompted to enter some personal information.

This covers the basics – such as your name, date of birth, and home address. You will also need to provide and confirm your contact details – which is inclusive of your mobile number and email address.

Step 2: Upload ID

eToro is regulated by several tier-one financial bodies – so it needs to comply with anti-money laundering laws. This simply means that you will be asked to upload a copy of your passport, driver’s license, or national ID card.

To verify your home address, you also need to provide a utility bill or bank account statement. Once you have uploaded the documents, eToro should be able to validate them instantly.

Step 3: Fund Your eToro Account

When it comes to making a deposit, eToro allows you to choose from a debit or credit card, bank transfer, or an e-wallet like Paypal. You can deposit funds in ZAR, albeit, this will be converted to USD.

This will cost you a very reasonable 0.5% in deposit fees – which is much lower than the likes of Coinbase – which charges 3.99%. The minimum deposit for first-time users is $200 – which is about 2,800 rands.

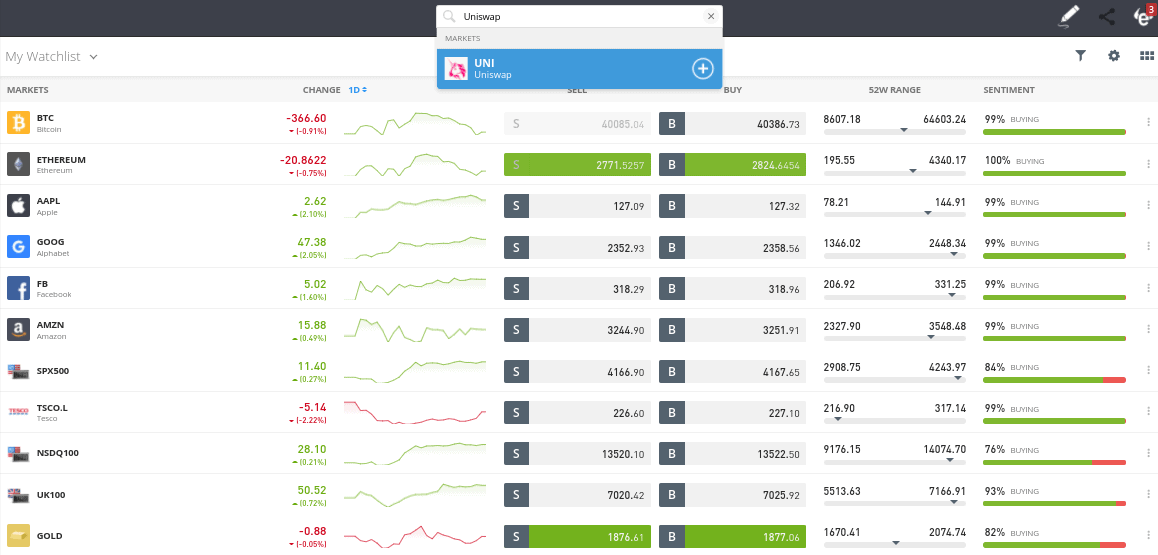

Step 4: Search for Uniswap

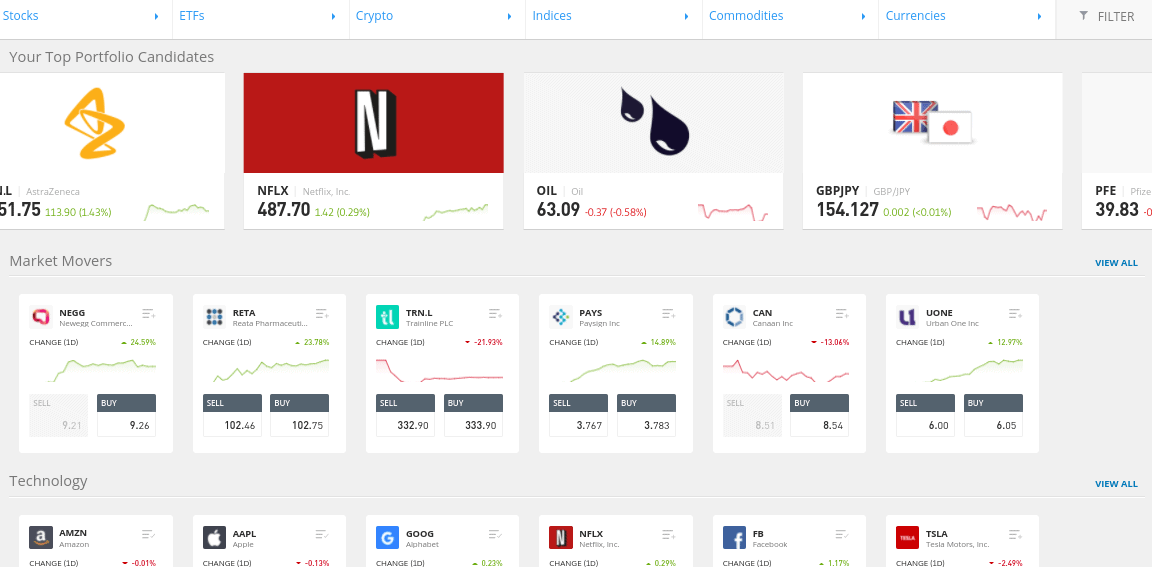

eToro is a multi-asset broker – meaning that it hosts thousands of financial instruments across stocks, ETFs, forex, indices, commodities, and of course – cryptocurrencies. As such, the easiest way to find Uniswap is to search for it.

Once you click on the relevant result that pops up from the search box, hit the ‘Trade’ button.

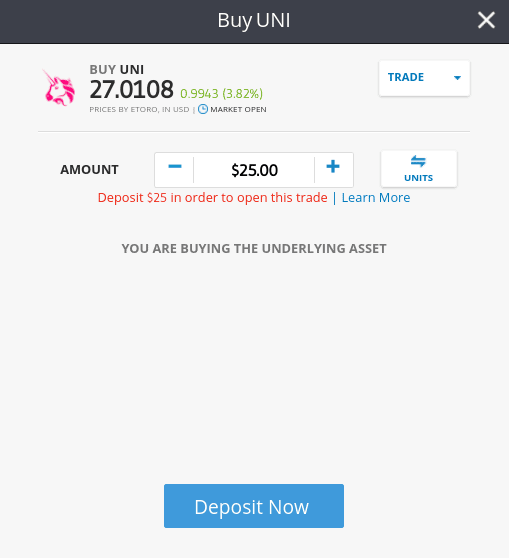

Step 5: Buy Uniswap

To complete the process, you will need to fill in an order box – which is standard across all cryptocurrency trading sites. To keep things simple, leave this set as a ‘limit’ order. For those unaware, this means that eToro will execute your Uniswap order at the next best available price. In other words, you’ll be buying Uniswap instantly.

Then, enter the size of your Uniswap investment into the ‘Amount’ box. This needs to meet a $25 minimum.

Finally, click on the ‘Open Trade’ button and your Uniswap tokens will be added to your eToro portfolio!

Step 6: How to Sell Uniswap

eToro doesn’t charge any ongoing platform or wallet fees – so you can safely store your crypto funds for as long as you want. When it comes to selling your Uniswap tokens, head over to your eToro portfolio and click on the ‘Sell’ button.

You can do this 24/7 and when you confirm the sell order – the funds will be added to your account balance. You can then request a withdrawal or use the funds to make other investments!

Where to Buy Uniswap in South Africa

When you consider that Uniswap is now a multi-billion dollar digital asset and thus – one of the most popular cryptocurrencies to buy in South Africa, it makes sense that heaps of online brokers give you access. It’s important to remember that many Bitcoin trading platforms are unregulated, so you do need to tread with caution.

To ensure you buy Uniswap from a legitimate and low-cost broker – below you will find a selection of the best cryptocurrency platforms currently in the market.

1. eToro – Best Broker to Buy Uniswap in South Africa

This popular trading site offers a super low-cost pricing structure – whereby you will only pay the ‘spread’. This is simply the difference between the buy and sell price of Uniswap – so it’s more of an indirect fee. eToro will allow you to buy cryptocurrency from just $25 upwards through its fractional ownership tool. This means that you can invest in Uniswap at a small stake of just 350-ish rands.

If you have a broader interest in the digital asset arena, you might consider a fully managed eToro cryptocurrency portfolio. This will give access to a full range of cryptocurrencies at different weights. The eToro team will rebalance the portfolio on a regular basis to ensure this mirrors the wider digital currency industry. There is also a copy trading feature on the platform, which is particularly popular with investors in South Africa that seek a passive investment strategy.

All you need to do is choose a skilled eToro trade that you like (based on past performance, risk, etc.), decide how much you want to invest, and then all future positions will be mirrored in your own portfolio. If you like the sound of eToro, you can open an account and deposit funds in minutes. Supported payment types include Paypal, debit/credit cards, Skrill, Neteller, and bank transfers. The broker is authorized and regulated by ASIC, CySEC, and the FCA.

Pros:

- Buy shares and ETFs without paying any commission or dealing charges

- 2,400+ shares listed on 17 international markets

- More than 20 million clients

- Perfect for beginners

- Social and copy trading

- Mobile trading app

- Regulated by the FCA, CySEC, and ASIC

Cons:

- Not suitable for advanced traders that like to perform technical analysis

67% of retail investors lose money trading CFDs at this site

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

2. Binance – Largest Crypto Exchange for Uniswap Trading

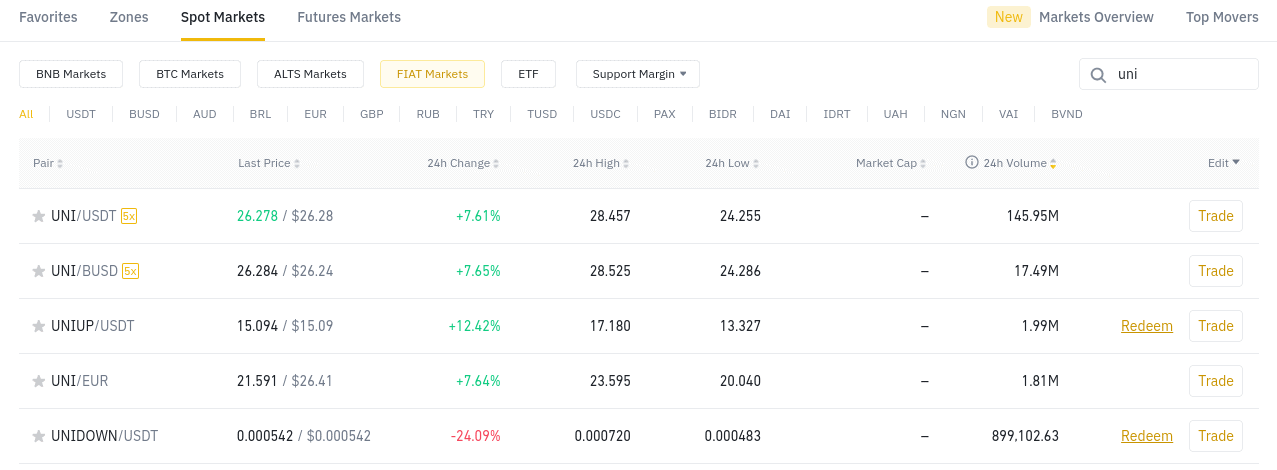

With that said, the vast majority of trading activity is found on UNI/USDT – with more than $145 million changing hands in the past 24 hours alone. Each and every Uniswap trading market can be accessed at a commission rate of just 0.1% per slide. With that said, you will need to pay more if you plan on depositing funds with fiat currency. For example, you will pay a flat fee of $10 (about 140 rands) to use a debit or credit card.

Although this is reasonably competitive, this can work out to be expensive if you are only planning to buy a small amount of Uniswap. We should note that unlike eToro and Capital.com – Binance is best suited for advanced traders that have experience in the cryptocurrency scene. Even in the case of its ‘Classic’ platform – which is aimed at beginners, this can be somewhat complex to navigate. For example, you’ll be inundated with pricing charts, market depth, order book volumes, drawing tools, and more.

Binance also offers a number of notable features that can enhance your end-to-end cryptocurrency investment endeavours. For example, there is a savings account tool that allows you to lend out your cryptocurrency and earn interest in return. There is also markets offered on Bitcoin futures and options, and even a Binance Visa card. If you decide to fund your account with a digital asset, you won’t be asked for any personal information – thus allowing you to trade anonymously.

Pros

Cons

Your capital is at risk.

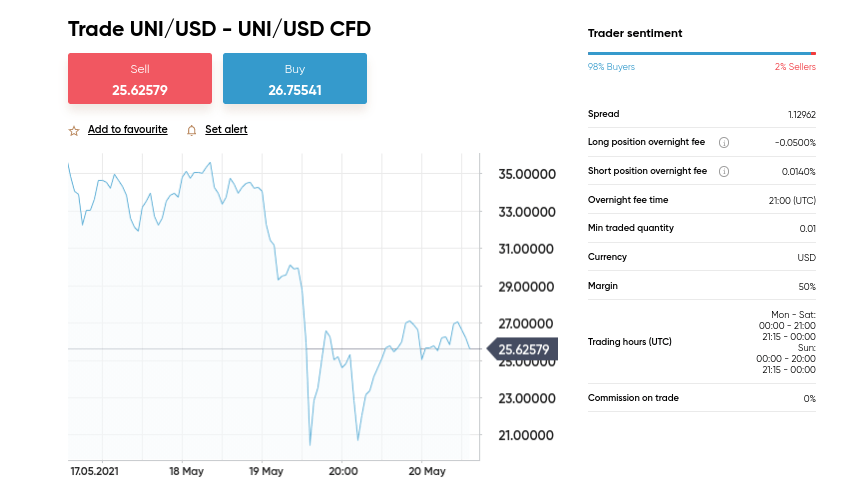

3. Capital.com – Trade Uniswap via CFDs at 0% Commission

This means that you don’t need to worry about storing the tokens in a private wallet. By trading Uniswap CFDs at Capital.com, you will also have access to leverage facilities. This allows you to trade with more money than you have in your account – with limits depending on whether you are a retail client or a professional trader. Capital.com also offers long or short markets – meaning that you can attempt to profit from both rising and falling Uniswap token prices.

When it comes to trading fees, Capital.com is a 0% commission broker. Much like eToro, this means that you only need to factor the spread into your costs. There are no fees to deposit or withdraw funds either, nor is there any ongoing platform charges. Capital.com is typically preferred by inexperienced traders that are looking to enter the CFD space for the first time. You will find a plethora of educational tools – such as guides, webinars, economic calendars, and videos.

You will also find a free demo trading account. This allows you to trade Uniswap CFDs in a risk-free manner. As such, you can try out new cryptocurrency trading strategies without needing to deposit any funds. When you are ready to start trading Uniswap in live market conditions, Capital.com requires a minimum deposit of just $20 when using a debit/credit card or e-wallet. This amounts to just 280-ish rands. Finally, the broker is regulated by the FCA and CySEC.

Pros:

Cons:

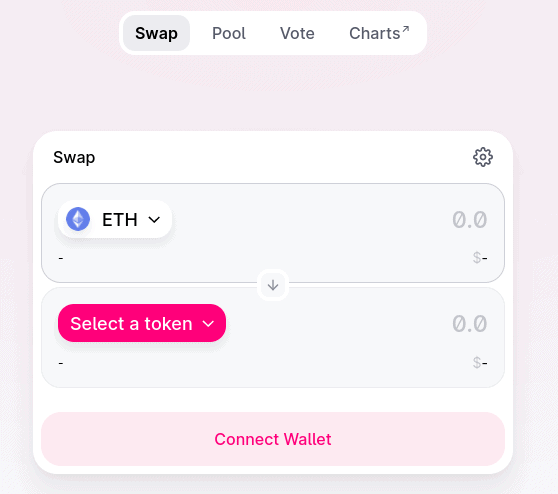

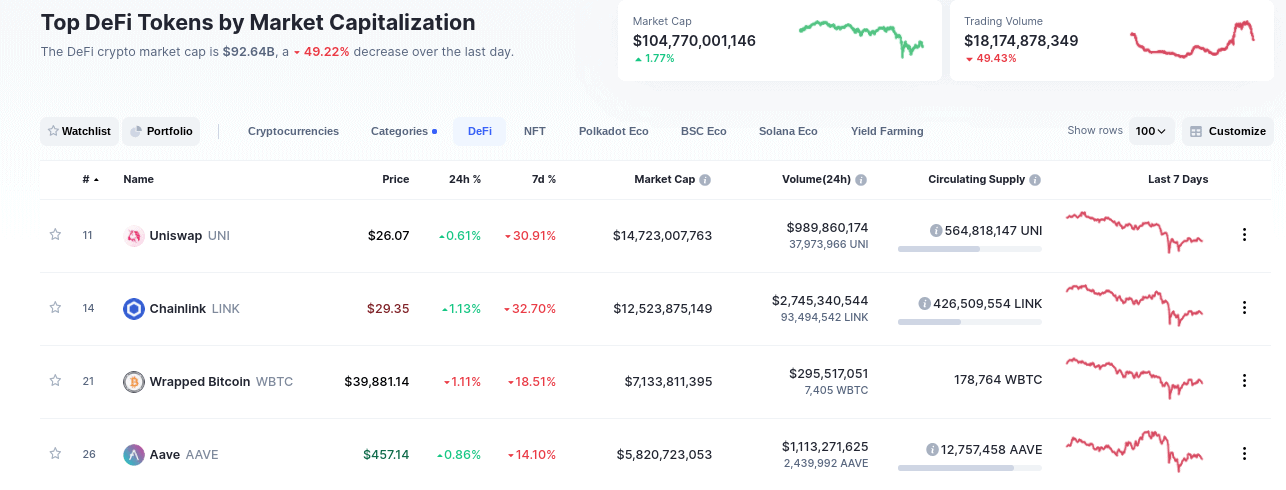

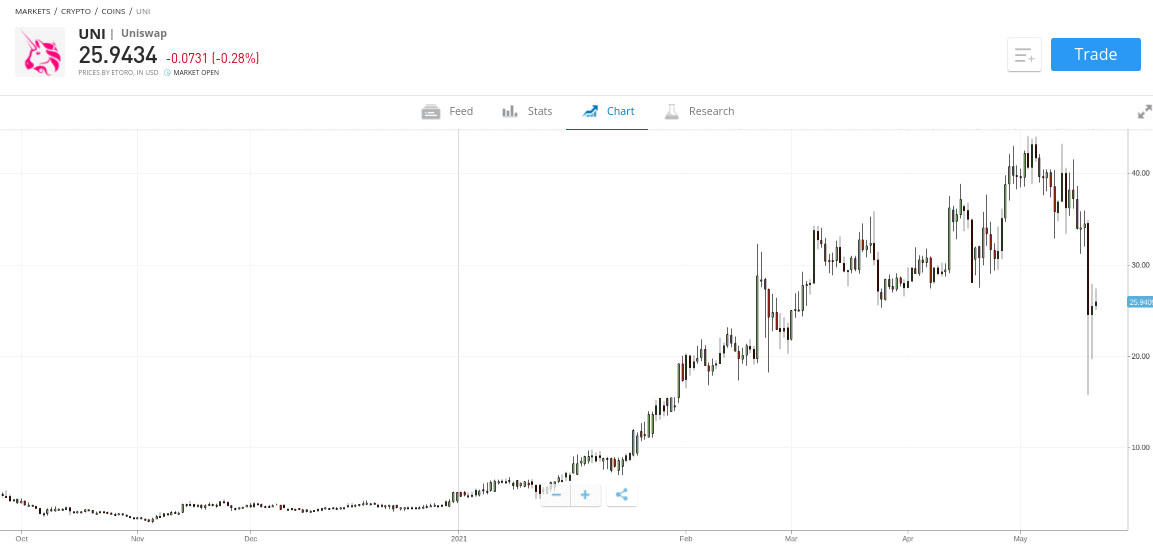

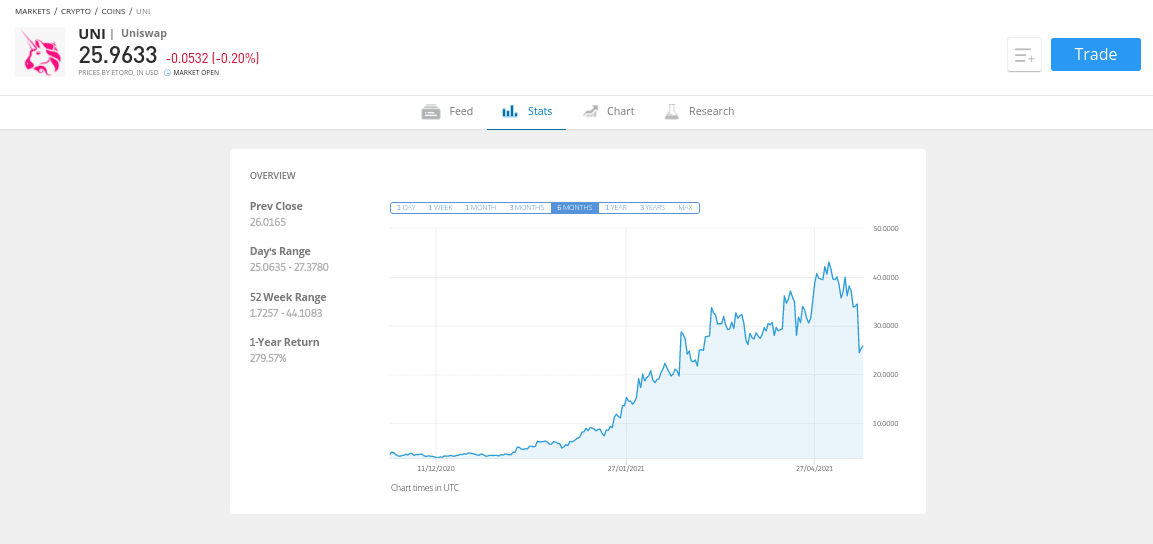

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. As such, this section of our guide on how to buy Uniswap in South Africa will explain the basics of how this digital currency functions. In a nutshell, Uniswap is a decentralized finance (Defi) platform that aims to streamline the cryptocurrency exchange industry away from centralized entities. While Uniswap isn’t the only Defi platform that offers peer-to-peer trading, the project stands out for its liquidity services. This is because the vast majority of decentralized exchanges struggle for liquidity – meaning that traders will often find it difficult to buy or sell a digital asset at a favourable price. This is because a lack of liquidity results in sub-par spreads and prices that do not reflect the wider markets. Uniswap solves this issue by creating liquidity pools – which are funded by users that wish to earn interest on their cryptocurrency holdings. In other words, people can lend their digital assets to the Uniswap liquidity pool – which is then used to facilitate decentralized trading. In addition to its proprietary liquidity services, Uniswap has its own native digital currency. This is what you will be speculating on if you decide to buy Uniswap. Much like any other cryptocurrency, the value of Uniswap tokens will rise and fall throughout the day. It is therefore hoped that when you buy Uniswap, you can sell the tokens for a higher price further down the line. Uniswap is one digital currency out of almost 10,000 that are currently in circulation. As a result, you need to be sure that Uniswap is the right crypto asset for your portfolio before making a purchase. In the sections below, we discuss some of the reason why so many investors in South Africa are looking at how to buy Uniswap. Make no mistake about it – the vast majority of people buy Uniswap as a speculative investment. This is because the digital currency has performed extremely well in recent months. For example: As such, many investors in South Africa are looking at these rapid, short-term gains as motivation to buy Uniswap. Irrespective of the asset class – the most successful investors are those that enter the market when a financial instrument is undervalued. This can occur when the markets are going through a brief correction – like the cryptocurrency industry is at the time of writing. For example, we mentioned above that in May 2021 – Uniswap tokens hit all-time highs of $44. However, just a couple of weeks after hitting these highs, Uniswap has since dropped to $26. This is a rapid decline of over 40%. Those that are bullish on decentralized finance platforms like Uniswap will look at this and enter the market. After all, why buy Uniswap tokens when they are priced at $44 – when you can instead pay $26? Assuming that you believe in the long-term vision of Uniswap, this offers a huge discount. Although the first cryptocurrency – Bitcoin, was launched back in 2009, Defi coins like Uniswap are still a relatively new phenomena. This is because decentralized finance can be applied to so many sectors and industries. Whether that’s in the shape of decentralized lending and borrowing, savings accounts, trading, insurance, or brokerage services – Defi coins potentially have a huge role to play. If you are on par with this vision, now could be the time to enter the market. In the case of Uniswap specifically, it is true that its native token was only launched on public exchanges in September 2020. However, the project itself was first founded in 2018 – meaning that it has a heads start over most of its industry rivals. Furthermore, and based on a price of $26 per token at the time of writing, this translates into a market capitalization of just under $15 billion. In the grand scheme of things – this is actually somewhat modest and thus – there is still plenty of upside potential in the making. Another reason why so many investors in South Africa are looking to buy Uniswap is that at current prices – the cryptocurrency could be viewed as cheap. This is especially the case when you consider how expensive Bitcoin is – with the digital asset recently breaching highs of over $62,000. Sure, you can buy Bitcoin at a broker like eToro that offers fractional ownership from just $25, but you will be buying a tiny fraction of a single coin. On the contrary, at the time of writing, you can purchase a full Uniswap token for just $26 – or about 360 rands. This means that a total outlay of 36,000 rands would entitle you to 1,000 Uniswap tokens. We should also note that by buying Uniswap tokens – you have the chance to earn interest on your investment. You can do this by using a third-party crypto lending platform like YouHodler – which is currently offering 7% per year on Uniswap deposits. This operates much like a conventional savings account, as your Uniswap tokens will be used to fund loans. You can withdraw your capital at any time – so your Uniswap tokens are never locked up. Most importantly, you will still benefit from the rise of Uniswap tokens – meaning that you can earn and grow your investment via regular interest and capital gains. In this part of our guide on how to buy Uniswap in South Africa – we are going to cover some of the many ways as such you can enter the market. After reviewing dozens of cryptocurrency exchanges and brokers – we found that the only reliable way of buying Uniswap with Paypal is to use eToro. This heavily regulated broker permits instant Paypal deposits and you will only pay 0.5%. When you are ready to cash out your Uniswap investment, you can request for the funds to be transferred back to your Paypal account. If you want to use a credit card to buy Uniswap – this can be achieved at a regulated online broker. Some traders in South Africa will use a site like Coinmama – which allows you to purchase funds with a credit card with ease. However, you are looking at deposit fees of over 5% at Coinmama, so eToro is by far the most competitive option. As noted above, this will cost you just 0.5%. With that said, it’s wise to contact your credit card company before making a deposit, as you might find that a ‘cash advance’ fee applies. This is because some issuers define brokerage deposits in the same way as withdrawing money from an ATM, which can attract an additional fee of 3-5%. Buying Uniswap with a debit card is the preferred way to enter this marketplace. You will benefit from an instant transaction that in many cases – can be executed with low fees. Once again, you will pay just 0.5% at eToro – which is substantially lower than the 3.99% required by Coinbase! If you want to invest in a company – you will need to buy shares from an online stock broker. However, in the case of Uniswap, the project allows people to invest by purchasing digital tokens. As such, there is no option to buy Uniswap stock. Instead, you’ll need to use an online broker or trading platform to buy Uniswap tokens and then store the funds in a digital wallet. The Uniswap price is determined by market forces – meaning that this will increase when sentiment is good. In other words, when more and more investors buy Uniswap, this will have the desired impact of increasing its value. At all but a few exchanges, Uniswap is traded and quoted in US dollars. As we noted earlier, the current Uniswap price at the time of writing is $26 per token. Being based in South Africa, you might be used to investing in assets with rands. This isn’t a problem per-say, as brokers like eToro accept a wide range of South African payment types. As soon as you complete the deposit, the funds will be converted into US dollars. As a result, this then gets you unfettered access not only to Uniswap – but heaps of other popular digital currencies. Like the vast majority of Defi coins – it’s too early to say with any certainty whether or not the industry will eventually reach the mass markets. By this, we mean people moving away from centralized exchanges and instead of trading on Defi platforms like Uniswap. On the other hand, we mentioned earlier that at current prices, Uniswap is trading at a market capitalization of just under $15 billion. When you consider the potential size of the Defi marketplace, this could be a drop in the ocean. Furthermore, and perhaps most importantly, Uniswap recently hit a peak valuation of over $22 billion – meaning that in the short term – there is an upside potential of apprimxately 46%. As we mentioned earlier when discussing eToro, Capital.com, and Binance – there are several ways in which you can speculate on the future value of Uniswap. To recap, if using eToro, you will be able to ‘invest’ in Uniswap tokens directly – meaning that you own 100% of the digital asset. You will be buying the coins with a debit/credit card, e-wallet, or bank account – and then storing them in a digital wallet. As such, you can keep hold of your Uniswap investment for as long as you wish – whether that’s a matter of months or years. At the other end of the spectrum, platforms like Capital.com allow you to ‘trade’ Uniswap tokens. You will be doing this via leveraged CFDs – meaning that you can speculate on the Uniswap price rising or falling – based on your own market research. Plus, you can also apply leverage when trading Uniswap CFDs. With that said, when trading CFDs – you will need to pay a fee for each day that you keep the position open. This is because CFDs are leveraged financial instruments, meaning that are best suited for short-term strategies. Once again, when buying Uniswap tokens you will need to think about storage. As the token operates on top of the Ethereum blockchain – there are dozens of wallets to choose from. To save you from having to the legwork, below we review the best Uniswap wallets for 2021. eToro is the best broker to buy Uniswap – so it makes sense that the platform offers top-notch storage facilities. In fact, most investors in South Africa will elect to keep their coins in the eToro web wallet. This means that eToro will look after your Uniswap tokens on your behalf. While ordinally this might be considered risky – not least because you don’t have access to your private keys, don’t forget that eToro is heavily regulated. As such, not only can you store your Uniswap tokens in a convenient and safe manner, but you will have the option of cashing out at the click of a button. Alternatively, you might decide to download the native eToro wallet to your iOS and Android phone. This gives you more control over your Uniswap tokens, as you have the option of transferring them to an external wallet. The eToro wallet supports more than 120+ cryptocurrencies in total and more than 500+ pairs. This means that you have the ability to convert cryptocurrencies without needing to leave the wallet app. When it comes to safety, the eToro mobile wallet is the only option that we have come across that is directly regulated by a financial body – the Guernsey Financial Services Commission (GFSC). The other option is to download the Trust wallet app – which is also compatible with iOS and Android devices. This is a decentralized wallet, so you are the only person that will have access to your private keys. For those unaware, this means that nobody can access your wallet without having access to your private keys and thus – you retain full control over your funds. The main drawback with this is that you won’t be able to recover your Uniswap tokens in the event you misplace your private keys. Nevertheless, the Trust wallet is highly rated on both the Google Play and App Store – and you will have access to a number of core features. This includes Binance savings accounts, decentralized exchanges, and support for NFT (Non-Fungible Tokens). It can be challenging to keep up to date with crucial Uniswap news and developments. The best way of doing this is to join the Uniswap Reddit group – which is now home to over 43,000 like-minded members. The group attracts a lot of posts throughout the day – with subjects ranging from Uniswap price predictions to user-friendly explainers in the Defi protocol itself. If you’re wondering how to buy Uniswap in South Africa right now – we found that eToro is the best platform for the job. You’ll be able to get your hands on this innovative Defi coin in minutes – as it’s just a case of signing up and making an instant deposit with your debit/credit card or e-wallet. The minimum investment per Uniswap trade is just $25 – or about 350 rands. This allows you to invest with small amounts and ultimately – diversify into other crypto assets to ensure you are not overexposed to a single token. Most importantly, eToro is regulated by the FCA, CySEC, and ASIC – so you can rest assured that you are using a legitimate brokerage firm.

67% of retail investor accounts lose money when trading CFDs with this provider. Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

The best place to buy Uniswap in South Africa is through a regulated online broker. We like eToro, which is not only heavily regulated - but it allows you to buy Uniswap on a spread-only basis.

At the time of writing, the Uniswap price is just above $26 per token. This amounts to approximately 360 rands.

Uniswap is a decentralized platform that allows you to convert and trade cryptocurrencies without going through a third party. The platform also offers liquidity pools - ensuring that decentralized exchanges take place at favourable prices, volumes, and spreads.

This depends on the broker or exchange you decide to use and whether you are making a deposit with fiat currency. For example, if you use a platform like Binance and decide to fund your account with another digital asset, you can buy Uniswap anonymously. However, if you want to use a regulated online broker (which you should) and use a debit/credit card, e-wallet, or bank account to buy Uniswap, you will need to provide personal information alongside a government-issued ID.

At the time of writing, there is a circulating supply of just over 564 million Uniswap tokens. This amounts to 56% of the total supply - which will be capped at 1 billion tokens.

Uniswap has generated huge returns since the token hit public exchanges in September 2020. This amounts to gains of over 9,000% in just 8 months of trading. However, like all speculative digital currencies, there is no guarantee that you will make money when you buy Uniswap. As such, make sure you only invest if you have a full understanding of the risks.

What is Uniswap?

Why Buy Uniswap in South Africa? Uniswap Analysis

Financial Returns

Drop-Off From All-Time High

Decentralized Finance Could be the Next Big Thing

Cheap Cryptocurrency to Own

Earn 7% Interest on Uniswap Investments

Ways of Buying Uniswap

Buy Uniswap with PayPal

Buy Uniswap with Credit Card

Buy Uniswap with Debit Card

How to Buy Uniswap Stock

Uniswap Price

Uniswap Price Prediction

Investing in Uniswap vs Trading Uniswap

Best Uniswap Wallet

eToro Uniswap Wallet

Binance Uniswap Wallet

Uniswap Reddit – Keep Up to Date with Uniswap News

eToro – Best Place to Buy Uniswap in South Africa

FAQs

Where is the best place to buy Uniswap in South Africa?

What is the Uniswap price?

What is Uniswap?

Can you buy Uniswap anonymously?

How many Uniswap tokens are there?

Should I buy Uniswap?