Cheapest Share Trading Platform South Africa 2022

If you want to buy and sell stocks online, you will need to use an online share trading platform. Although there are many platforms for South Africans to choose from, pricing can be a bit ‘hit and miss’.

By this, we mean that some brokers are known to charge excessive fees. This is especially the case if you are planning to invest small amounts – as a lot of platforms charge a flat fee.

With this in mind, this article reveals the cheapest share trading platform South Africa. We also give you some handy tips on what fees to look out for when choosing a platform yourself.

Key Points on Share Trading Platforms in South Africa

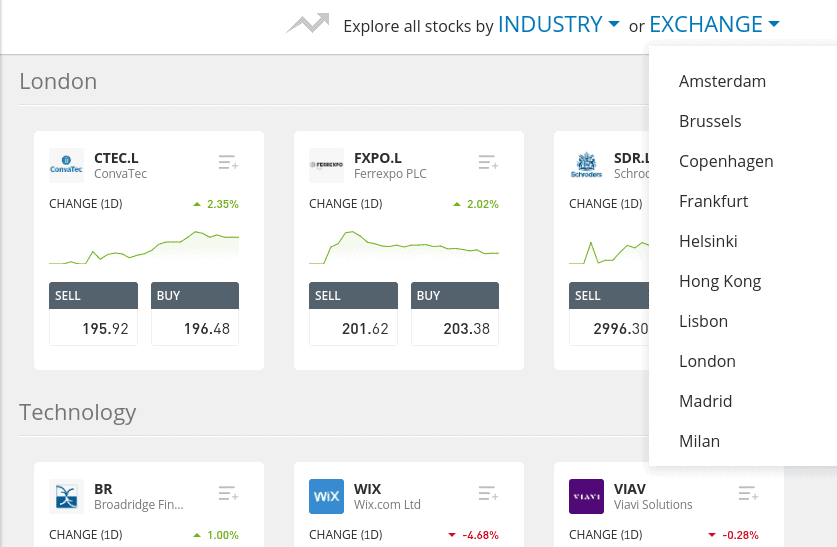

- Share trading platforms give you exposure to stocks and shares listed on major exchanges such as the NYSE, NASDAQ, LSE, and the Johannesburg Stock Exchange.

- To start trading shares you need to open an account with a trusted and regulated stock broker. Nowadays the account opening process is straightforward and fast.

- Some of the most important factors to consider when selecting a share trading platform include fees, payment options, tradable assets, and account types.

- After reviewing heaps of providers we found that Capital.com offers the best service in South Africa. This includes licenses from multiple financial authorities, a wide asset portfolio of CFDs and forex, and a user-friendly demo trading account.

Cheapest Share Trading Platform South Africa Revealed

Before we take an in-depth look at the top share trading platforms, here’s a list of the best and cheapest share trading platform South Africa and some other good brokers to consider.

- Capital.com – Overall Best Share Trading Platform in South Africa – 0% Commission

- AvaTrade – Trade Share CFDs with Tight Spreads

- VantageFX – Trade Share CFDs with 20:1 Leverage

- Plus500 – Share CFD Platform with Tight Spreads

- FXCM – Reputable Platform for Share CFDs

- IG – Best Share Trading Platform in South Africa for Diversity

The Cheapest Share Trading Platforms 2022 Reviewed

It is important to note that you should never join a share trading platform just because it offers ‘cheap’ fees and commissions. On the contrary, there are several factors that need to play a part in the decision-making process.

For example, you need to ensure that the platform is regulated and that it supports your preferred payment method. You also need to look at mobile trading features, technical indicators, customer support, and much more.

Taking all of the above into account, here we discuss the cheapest online share trading platforms in South Africa that also meet our strict criteria.

Note: The best online share trading platforms typically have a global presence. This means that they often denominate deposits, withdrawals, and commissions in US dollars. With this in mind, all monetary figures below are based on USD unless otherwise stated.

1. Capital.com – Overall Best Share Trading Platform in South Africa – 0% Commission

Capital.com’s trading platform is custom-built and has a handful of features that we love. For example, it includes AI software to analyse your trades and improve your win rate. The software analyses patterns in your trading and identifies common themes around your winning and losing trades. From that, the AI will suggest ways you can change your trading behavior.

On top of that, Capital.com’s platform includes a news feed, economic calendar, and price alerts. You can even trade on the go thanks to mobile apps for iOS and Android devices.

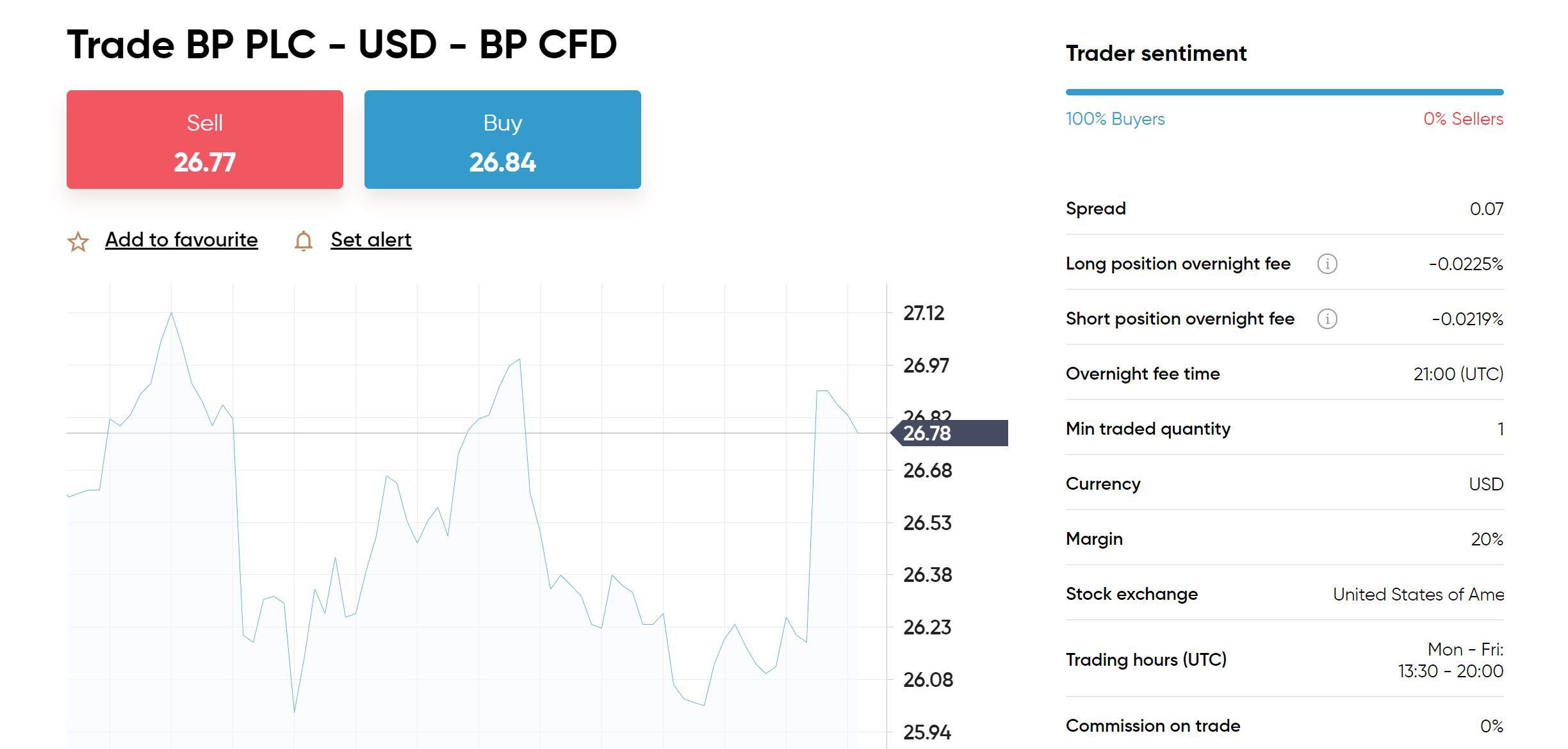

Share trading with Capital.com is 100% commission-free and the broker’s spreads are typically well below the industry average. Even better, there are no deposit, withdrawal, or inactivity fees to cut into your profits from trading.

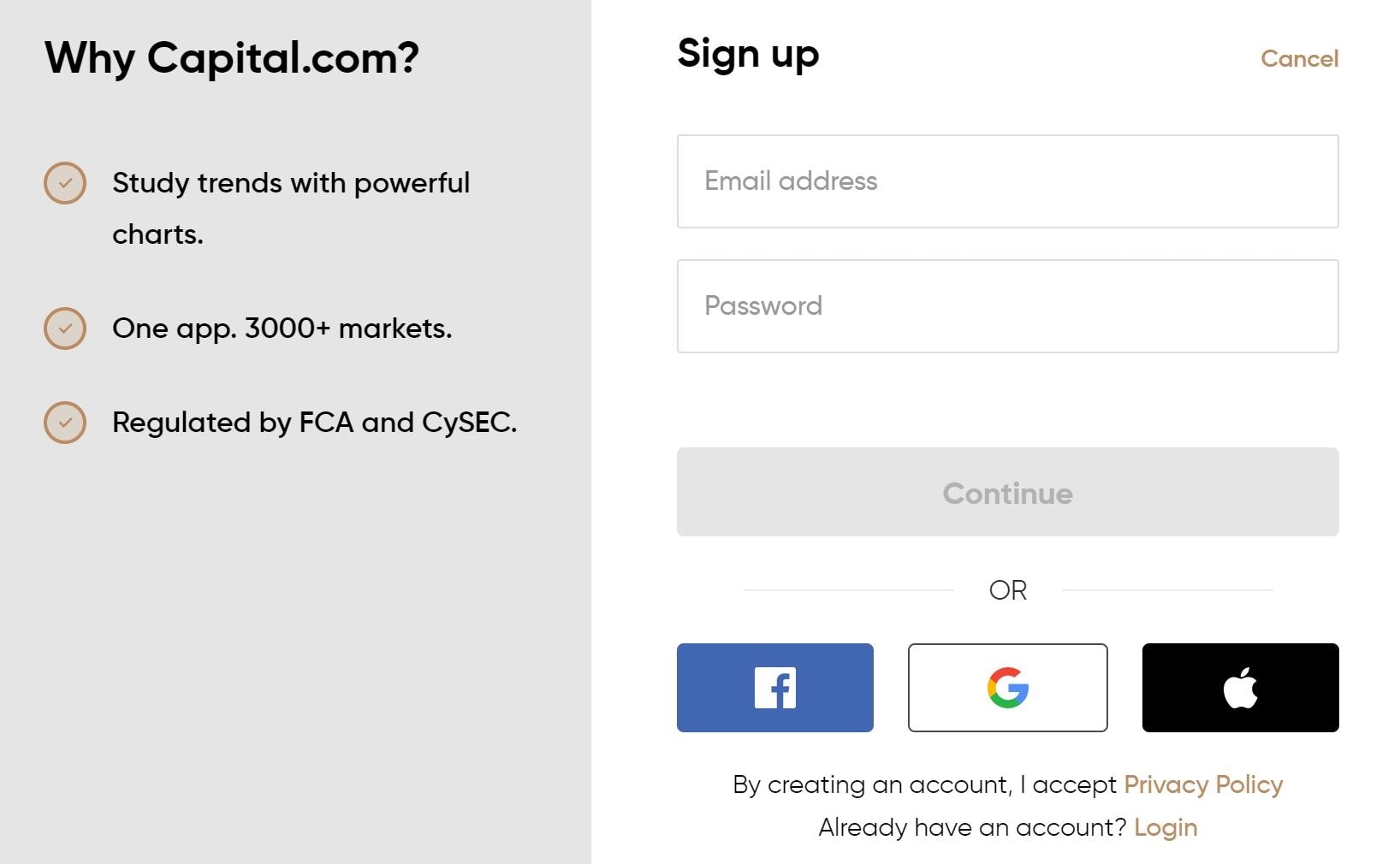

Capital.com is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the UK Financial Conduct Authority (FCA). The platform offers 24/7 customer support by phone, email, and live chat. Best of all, you can open a new account with just a $20 minimum deposit and pay by credit card, debit card, or bank transfer.

Capital.com fees:

| Commission | 0% |

| Deposit Fee | Free |

| Withdrawal fee | Free |

| Inactivity fees | None |

Pros:

- Buy shares without paying any commission

- 3,000+ shares from the US, UK, and Europe

- Custom trading platform with AI software

- Mobile trading apps for iOS and Android

- Regulated by the FCA and CySEC

- 24/7 customer support available

Cons:

- Not suitable for advanced traders that like to perform technical analysis

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

2. AvaTrade – Best Online Share Trading Platform South Africa for CFDs

Part of what makes this broker stand out is that it offers its own custom trading platform as well as integrations with MetaTrader 4 and MetaTrader 5. The AvaTrade platform is quite comprehensive while still being easy to use. It’s packed with technical studies and helpful extras like a news feed and economic calendar. Of course, the platform also comes with a mobile app for iOS and Android.

On top of that, AvaTrade has an app for social trading called AvaSocial. With this app, you can find other share traders from around the world and copy their moves. This is a great way to automate your trades while learning from more experienced traders along the way.

Trading with AvaTrade is 100% commission-free. The broker charges a spread for every trade, but it’s typically in line with or slightly better than the industry average. Deposits and withdrawals are free, but you will want to watch out for the inactivity fee. At $50 per quarter after 3 months of inactivity, it’s one of the steeper fees we’ve seen.

AvaTrade is regulated in numerous countries, including South Africa, Australia, Japan, and Ireland. The broker offers 24/5 customer support by phone, email, and live chat. If you’re ready to open an account, you can get started with just a $100 minimum deposit.

AvaTrade fees:

| Commission | 0% |

| Deposit Fee | Free |

| Withdrawal fee | Free |

| Inactivity fees | $50 per quarter after 3 months of inactivity |

Pros:

- Zero commissions for stock trading

- Integrates with MetaTrader 4 and 5

- Mobile trading app

- Social and copy trading

- Regulated in South Africa

Cons:

- Only has share CFDs

Your capital is at risk.

3. VantageFX – Trade Share CFDs with 20:1 Leverage

VantageFX is another flexible and powerful share trading platform available in South Africa. With this broker, you can trade over 50 US stocks, 50+ Australian stocks, and 70+ European stocks (including the UK). All shares trade as CFDs, so you can leverage your positions up to 20:1. That makes VantageFX ideal for staking out big positions in top companies.

VantageFX offers several trading platforms, including MetaTrader 4 and MetaTrader 5. These platforms can be difficult to get started with, but they enable you to create fully custom technical studies and backtest your strategies against historical price data.

In addition, VantageFX has its own web trading platform and mobile apps for iOS and Android devices. These are comprehensive enough for most share traders since they come packed with technical studies. The broker also integrates with Zulutrade, Duplitrade, and Myfxbook for social trading and copy trading.

One notable downside to VantageFX is that trading with this platform can be pricey. The platform charges fixed commissions of $6 per trade for US stocks and €10 per trade for UK and EU stocks. There’s no added spread to worry about and no inactivity fees, but these commissions are relatively expensive already.

VantageFX is regulated in Australia and the UK. To open an account, you’ll need to make a $200 minimum deposit.

VantageFX fees:

| Commission | $6 for US stocks |

| Deposit Fee | Free |

| Withdrawal fee | Free |

| Inactivity fees | None |

Pros:

Cons:

Your capital is at risk. Plus500 is an online trading platform that offers CFDs in the form of shares, indices, bonds, commodities, and cryptocurrencies. In the share department, this covers more than 2,000+ stock CFD instruments. As such, you will have access to heaps of international stock markets such as those found in the US, Australia, UK, and New Zealand. Best of all, Plus500 also offers stock CFDs that track South African companies. This is great if you want to gain exposure to the Johannesburg Stock Exchange (JSE). Regardless of what marketplace you decide to trade, Plus500 does not charge any trading commissions. Much like eToro, it’s only the spread and overnight financing fees that you need to factor in. Regarding the latter, this can be avoided by ensuring that you close your position before the end of the trading day. In fact, this is often common practice for stock day traders anyway. Plus500 gives you the option of going long and short on all of its financial instruments. This allows you to profit from the rise and fall of your chosen share CFD. The trading platform also offers leverage facilities. As a South African resident, this can go as high as 1:300, which is huge. In terms of funding fees, Plus500 does not charge anything on deposits or withdrawals. You will, however, need to pay a 0.5% currency conversion charge when trading non-South African instruments. This is essentially anything outside for the JSE. Plus500 fees: Pros: Cons: This means that you will be able to access large-scale firms such as Amazon, Facebook, Apple, and Netflix shares. Regardless of what shares you decide to trade, everything at FXCM is commission-free. You will also benefit from attractive spreads. You will need to meet a $50 minimum deposit at the platform, which you can fund with a debit/credit card, bank account, or e-wallet. There are no fees to deposit or withdraw funds at FXCM, which is great. The broker charges an inactivity fee of $50 per year. However, this only comes into play if your account is inactive for 12 months. FXCM gives you lots of options when it comes to choosing a trading platform. For example, it supports some of the most popular third-party providers in the trading space – such as MetaTrader 4, NinjaTrader, and ZuluTrade. Not only does this mean that you will have access to an abundance of drawing tools and technical indicators, but you can also install automated robots. You can also engage with copy trading indirectly at FXCM when using MT4. FXCM is also a notable option if you are looking for a platform that offers market insights. This will ensure that you are armed with the required knowledge to trade shares effectively. FXCM fees: Pros: Cons: 73.05% of retail investors lose money when trading CFDs at this site IG is an online share dealing platform that also offers CFD and spread betting facilities. Launched back in the early-1970s, the broker is highly trusted in the investment scene. This is evident in the fact it now hosts over 239,000 traders across most corners of the world – including that of South Africa. One of the most appealing aspects of IG is the sheer size of its share library. For example, you will have access to over 10,000 companies when buying and selling shares in the traditional sense. You can do this at a flat rate of £8 per trade – which amounts to approximately 180 rands. If you buy or sell shares more than three times in the prior month, this is reduced to £3 per trade – or 70 rands. If you are more interested in trading shares, the CFD and spread betting facility covers over 13,000 stock CFDs. Much like in the case of the share dealing suite, this covers dozens of stock exchanges. Best of all, this also includes the JSE – so you can buy and sell South African shares at the click of a button. If opting for the CFD option, your fees will depend on the specific exchange that you are trading. If it’s South African firms you are interested in, then this stands at 0.20% per trade. With that said, you will need to meet a 100 rands minimum. Most European exchanges can be traded at 0.10%. US-listed shares – such as those based on the NYSE or NASDAQ, can be traded at $0.02 per stock, at a minimum commission of $15 minimum. You will need to meet as £250 minimum deposit at IG -which is about 5,700 rands. You can fund your account with a South African debit/credit card or bank account. Take note, credit card transactions attract a fee of 0.5% (MasterCard) or 1% (Visa) IG fees: Pros: Cons: If you need more help finding the best online share trading platform South Africa for you, use the table below to see how the cheapest brokers compare in terms of fees. Put simply, share trading platforms are online brokers that allow you to buy, sell, and trade stocks from the comfort of your home. In other words, by opening an account with a trusted broker, you will be in possession of a share trading account. Then, you will have the ability to make investments at the click of a button. In the vast majority of cases, you will be required to pick shares on a do-it-yourself basis. This means that you will be 100% responsible for selecting the companies that you wish to buy stocks in. If this sounds somewhat daunting, then you might be more suited for a share dealing platform that also offers ETFs or mutual funds. This way, the provider in question will determine which shares to buy on your behalf. Nevertheless, below we outline a quick example of how a share trading platform works in South Africa. Once the above transactions have been made, there is nothing else for you to do until you decide to sell the shares. Once you do, the shares will be converted back to rands. You can then withdraw the funds out of your chosen stock broker, or re-invest the cash into other shares. In the above example, you bought 8,000 rands worth of shares in MTN and Sanlam. You did so with the view of holding on to the stocks for several years. This is known as a traditional ‘buy and hold’ strategy. However, some South Africans prefer to engage with an active trading strategy. For example, some stock traders will place dozens of buy/sell orders throughout the day. In order to do this in a cost-effective manner, you will need to trade share CFDs (contracts for difference). These are financial products that track the real-world stock price of a company, so you won’t own the underlying asset. However, you will typically benefit from commission-free trading, the ability to short-sell, meaning you can speculate on prices going down, and have access to leverage facilities so that you can make larger trades. Although we have discussed the cheapest share trading platforms currently in the South African marketplace, it is crucial that you have the required tools to find a broker yourself. This will ensure that you avoid paying hidden fees that you were otherwise unaware of. To help you along the way, below we have listed the most common fees that you will come across when choosing the cheapest online share trading platform. The most important fee that you need to take into account when looking for the best share trading platform in South Africa is that of your trading commission. Crucially, this is a fee that you will pay every time you place a buy or sell order. As such, this will have a direct impact on your profit margins. In other words, it’s all good and well if you are able to consistently make gains, but you don’t want to be in a position where your profits are being eaten away at by excessive commissions. So, there are typically two manners in which you will be charged a commission by the broker – a variable fee or a flat fee. In most cases, your chosen stock trading platform will charge you a variable commission that is calculated against the size of your position. For example: However, you will also need to pay a commission when you exit your position. In this case, this will be charged again when you place a sell order on your Facebook stocks. In terms of calculating your profit – you first need to work out the difference between the buy and sell value, which is $100 ($1,100 – $1,100). Then, you need to subtract the two commissions that you paid, which leaves you with $83.20 ($100 – $8 – $8.80). As such, your net profit on the above Facebook trade amounts to 8.32%. If your chosen broker doesn’t offer a variable commission, then it’s likely that you will need to pay a flat commission. This simply means that the fee remains the same irrespective of how much you trade. In particular, this is highly condusive for trading large volumes, as your commission will remain low. One such stock trading platform that charges a flat fee is that of IG. As we covered earlier, this starts at £8 and reduces to £3 when you trade at least three times in a 30-day period. Nevertheless, here’s how it works: As you can see from the above, the fact that your shares had increased in value from £2,000 to £3,000 was irrelevant with respect to your commissions. This is because you paid £8 at both ends of the order. In terms of your net profits, you simply need to subtract £16 from your gains of £1,000 – which leaves you with £984. In percentage terms, this works out at net gains of 49.2%. Although most share trading platforms charge either a flat or variable commission, some actually allow you to trade without paying any commissions at all. In fact, the likes of Capital.com, Plus500, AvaTrade, and FXCM all allow you to trade shares on a commission-free basis. This is why they each made our list of the cheapest share trading platforms in South Africa! Newbie stock traders in South Africa often make the cardinal mistake of forgetting to include the spread within their costs. This is understandable, as the spread isn’t a fee charged directly by the broker. On the contrary, it represents the gap in pricing between the buy and sell price of a share. This is how stock trading sites ensure they always make money. In most cases, seasoned traders will calculate the spread in ‘pips’. For those unaware, pips represent the number of units that an asset moves by. For example: With that being said, it might be best to calculate the spread in percentage terms if you’re a beginner, as this will give you a much clearer picture of what you are paying. Once you know what spread you are paying, you then know how much money you need to make just to get to the break-even price. That is to say, because you are paying a spread of 0.10%, this means that you need your Disney trade to make gains of over 0.10% to get into the green. Things start to get a bit more complex in the case of overnight financing fees – so let us break down the fundamentals in Layman’s terms. In its most basic form, you will pay overnight financing fees when you keep a ‘leveraged’ position open overnight. All share CFDs are classed as leverage positions – even you don’t apply leverage. As a result, any share CFD trade that you don’t exit before the respective market closes will attract an overnight financing fee. This is why stock CFD trading is more conducive for short-term positions. The good news for you is that share trading platforms will typically display your funding rates when you open the position. Capital.com goes one step further by listing the rate in dollars and cents, so it’s clear to see exactly what you are paying. Nevertheless, if you want to avoid paying overnight financing fees, you can close your CFD position before the markets closes. Of course, the time that you need to close the position by will depend on what exchange you are trading. For example, standard operating hours on the JSE are 09:15 am – 16:40 pm Monday to Friday. Inactivity fees are charged by most online brokers, so it’s important that you understand how they work. As the name suggests, share trading platforms will charge you a fee if your account becomes ‘inactive’. There are two metrics in particular that you need to look out for – the size of the fee and when it kicks in. It is important to note that your share trading account will continue to be deducted until you place an order, or your balance goes to zero. You will also avoid paying an inactivity fee if you have a position open with the broker. For example, if you are planning to take a long-term ‘buy and hold’ approach at Capital.com, you can keep hold of the stocks for as long as you wish without needing to worry about inactivity fees. Some, but not all, share trading platforms in South Africa will charge you a fee when you attempt to deposit or withdraw funds. This might vary depending on your choice of payment method, and can be either a flat or variable fee. Most of the share trading platforms we reviewed don’t charge withdrawal fees. Of course, if you are using a domestic platform that exclusively serves South Africans, then everything will be denominated in rands. As such, you will not need to pay a currency conversion fee as long as you only trade South African stocks. However, you will find that domestic platforms are often overly expensive in the commission and spread departments – so even though you are avoiding a conversion fee, you will still find that you are paying more in comparison to the international brokers we have discussed. Crucially, this is why you need to consider multiple fees in your search for the cheapest share trading platforms. In some cases, online share trading sites will charge you an account opening fee. Although this is somewhat of a rarity, you still need to look out for this. Additionally, you might find that your chosen share trading platform charges a maintenance fee. Otherwise referred to a management fee or platform fee, you will need to pay this simply for having an account with the broker. In other words, maintenance fees are payable even if you do not trade. Here’s an example of how it might work: As you can see from the above example, your 50% gains no longer look as impressive. On the contrary, your $500 gross profit now translates into just $20 – as you paid a total of $480 in maintenance fees! To clarify, none of the cheapest share trading platforms that we have discussed on this page charges a monthly maintenance fee. So now that you have a 360-degree overview of each and every fee that you are likely to come across when trading online, we are now going to show you how to get started with an account today. We are going to show you the process with Capital.com, as it ranks number one for the cheapest share trading platform that supports South Africans in 2022. First and foremost, you’ll need to head over to the Capital.com homepage and open an account. All you need to do here is enter some personal information so that the broker knows who you are. Make sure you confirm your email address and mobile phone number before proceeding to the next step. In order to remain compliant with its licensing bodies, Capital.com will ask you to upload a copy of your South Africa passport or driver’s license. It always requires proof of residency. This can be a utility bill or bank account statement that was issued in the past 3 months. Now you will be asked to deposit some funds into your share trading account. As noted earlier, you will need to factor in a 0.5% fee, and minimum deposits start at $200. Supported payment methods include: Your deposit will be credited instantly when using a debit/credit card or e-wallet, but bank transfers can take several days. As soon as you have funded your account, you can begin trading stocks. The easiest way to get started is to search for the company that you wish to trade. In our example, we are looking to trade the hot US carmaker Tesla. As such, we enter ‘Tesla’ into the search box and click on the result that pops up. Then, we need to click on the ‘Buy’ button. You will now see an order box. This is where you need to set your trade specifics: Finally, click on the ‘Open Trade’ button to place your order! With hundreds of share trading platforms to choose from, finding a broker can be time-consuming. On top of looking at metrics like regulation, payment methods, and customer support – you also need to have a firm understanding of what the broker charges in fees, commissions, and other trading costs. With this in mind, we have discussed the cheapest share trading platforms currently servicing South African traders. As per our findings, not only did Capital.com come out as the most competitively-priced online broker, but it excels in most of the other areas that we look out for. If you want to trade shares commission-free at Capital.com at the best online share trading platform South Africa, simply click the link below to get started! 75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

4. Plus500 – CFD Broker with Tight Spreads

Commission

0%

Deposit Fee

Free

Withdrawal fee

Free

Inactivity fees

$10 per quarter after 3 months inactivity

5. FXCM – Reputable Share Trading Platform with MetaTrader 4

Commission

0%

Deposit Fee

Free

Withdrawal fee

Free

Inactivity fees

$50 a year after 12 months inactivity

6. IG – Best Share Trading Platform in South Africa for Diversity

Commission

£8 per trade. Reduced to £3 when you place 3 or more trades in the previous month.

Deposit Fee

Free

Withdrawal fee

Free

Inactivity fees

£12 a month after 2 years inactivity

Cheapest Share Trading Brokers South Africa Fees Comparison

Trading Platform

Spread or commission?

Amazon

Overnight fees

Capital.com

Spread

1.83 pips

Yes.

AvaTrade

Spread

13 pips

Yes.

VantageFX

Commission

$6

Yes.

Plus500

Spread

23.51 pips

Yes.

FXCM

Spread

21.82 pips

Yes.

IG

Commission

2 cents per share for all US stocks, 0.10% for all UK and EU stocks

Yes.

What are Share Trading Platforms?

Share CFD Trading

How to Choose the Right Cheapest Share Trading Platform South Africa for You

Commissions

Variable Commission

Flat Commission

0% Commission

Spreads

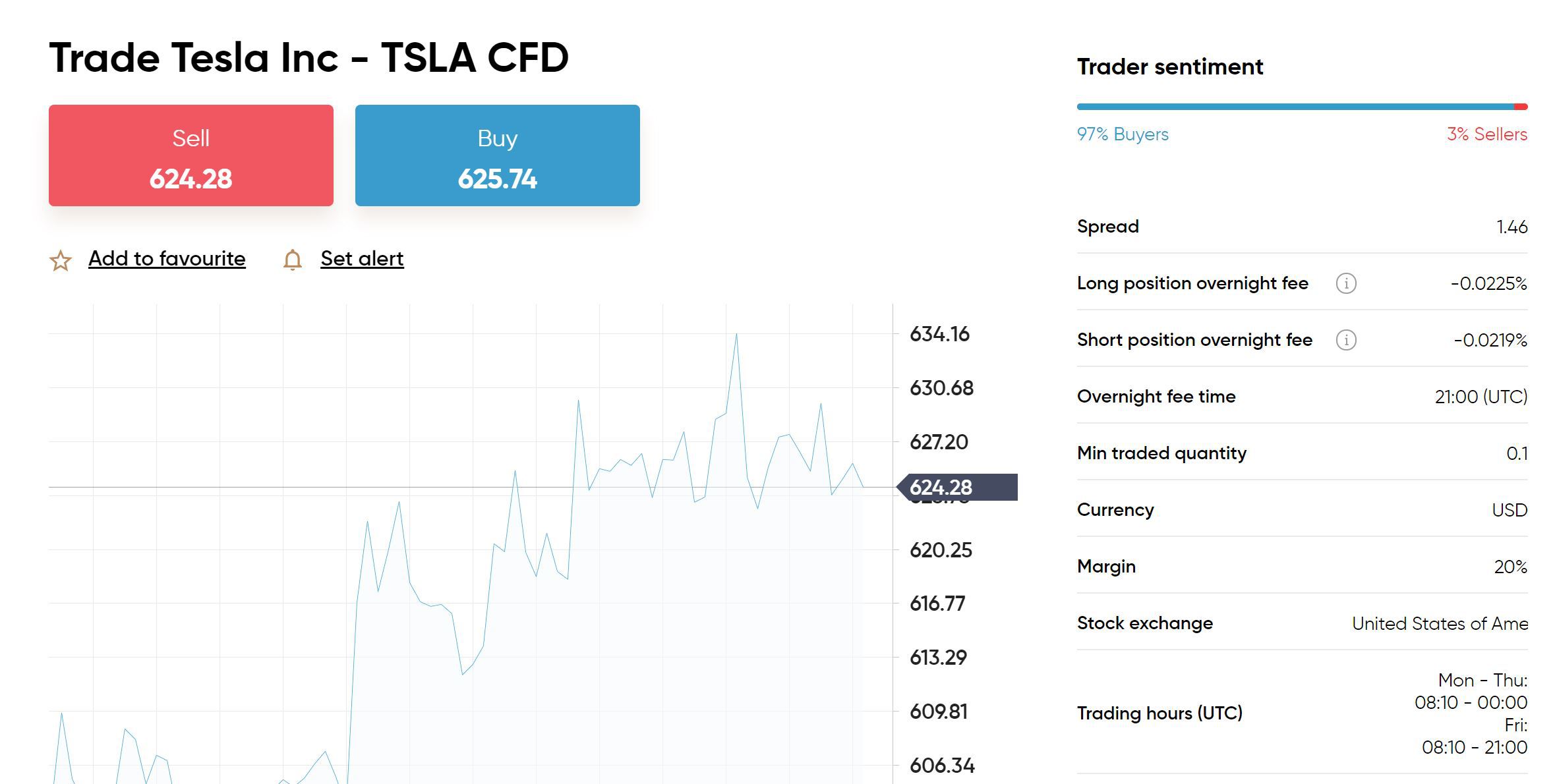

Overnight Fees

Inactivity Fees

Deposit/Withdrawal Fees

Currency Conversion Fees

Account Opening/Maintenance Fees

Get Started with the Cheapest Share Trading Platform South Africa – Tutorial

Step 1: Open a Share Trading Account

Step 2: Identity Verification

Step 3: Deposit Funds

Step 4: Trade Shares

Conclusion

Capital.com – Best Share Trading Platform in South Africa With Zero Commission

Frequently Asked Questions on Share Trading Platforms in South Africa

How does a commission-free share trading platform work?

What is the cheapest share trading platform in South Africa?

Do share trading platforms charge fees to deposit and withdraw?

What is a currency conversion fee?

How do I check what fees my share trading platform charges?

What is the best share dealing platform in South Africa?