Best Automated Trading Software 2022 – Cheapest Platform Revealed

Automated trading software allows you to buy and sell assets without needing to do any research or place any orders. Instead. you can sit back and allow the software to trade on your behalf.

nike air max new

nike air max 90 mens

nike air max 270 sale

nike air max 97 womens

nike air max 95s

nike air max men’s

nike air max 90 online

nike air maxes 270

nike air max black and white

nike air max shoes

nike air max 270 women

nike air max 270 react

nike air max 270 womens sale

nike air max cb 94 release dates 2023

nike air max plus sale

new nike air max

nike air max sc

nike air max 90

nike air maxes

nike air max sale

nike air max sale

men’s nike air max terrascape 90 casual shoes

cheap nike air max

nike air max 90 black

nike air max 90 mens

nike air max 90 black

cheap nike air max

nike 270 air max

nike air max 270

nike air max 95

nike air max 270 womens

nike air max 95 sale mens

nike air max 95 white

nike air max terrascape 90 men’s shoes

nike air max pre-day

nike air max 270

men nike air max 90

nike air max 97 black

nike air max womens

cheap nike air max

mens nike air max 97

In this guide, we review the Best Automated Trading Software for 2022 and walk you through the process of getting set up today.

-

- 1. Learn2Trade – Best Semi-Automated Trading System for Signals

- 2. MT4 (via AvaTrade) – Best Auto Trading Software for Forex EAs

- 3. MT5 (via AvaTrade) – Access a Huge Pool of Successful Day Traders

- 4. ZuluTrade via Vantage FX – Best Automated Trading Forex System for Beginners

- 5. Duplitrade via Vantage FX – Best Automated Trading Software for Backtested Strategies

- 6. NinjaTrader – Best Automated Software Platform for Experienced Traders

-

- 1. Learn2Trade – Best Semi-Automated Trading System for Signals

- 2. MT4 (via AvaTrade) – Best Auto Trading Software for Forex EAs

- 3. MT5 (via AvaTrade) – Access a Huge Pool of Successful Day Traders

- 4. ZuluTrade via Vantage FX – Best Automated Trading Forex System for Beginners

- 5. Duplitrade via Vantage FX – Best Automated Trading Software for Backtested Strategies

- 6. NinjaTrader – Best Automated Software Platform for Experienced Traders

Best Automated Trading Software List

Below you will find a list of the best automated trading software platforms that we will be reviewing today.

- Learn2Trade – Best Semi-Automated Trading System for Signals – Trade now

- MT4 (via AvaTrade) – Best Auto Trading Software for Forex EAs – Trade now

- MT5 (via AvaTrade) – Access a Huge Pool of Successful Day Traders – Trade now

- ZuluTrade via Vantage FX – Best Automated Trading Forex System for Beginners

- Duplitrade via Vantage FX – Best Automated Trading Software for Backtested Strategies

- NinjaTrader – Best Automated Software Platform for Experienced Traders

Best Auto Trading Software Reviewed

There is a variety of automated trading software platforms available in South Africa. For example, some come in the shape of software files that you install into the likes of MT4 or MT5 while others can be accessed directly through your broker.

To ensure you choose a provider that meets your needs, below we review the very best automated trading software platforms in South Africa right now

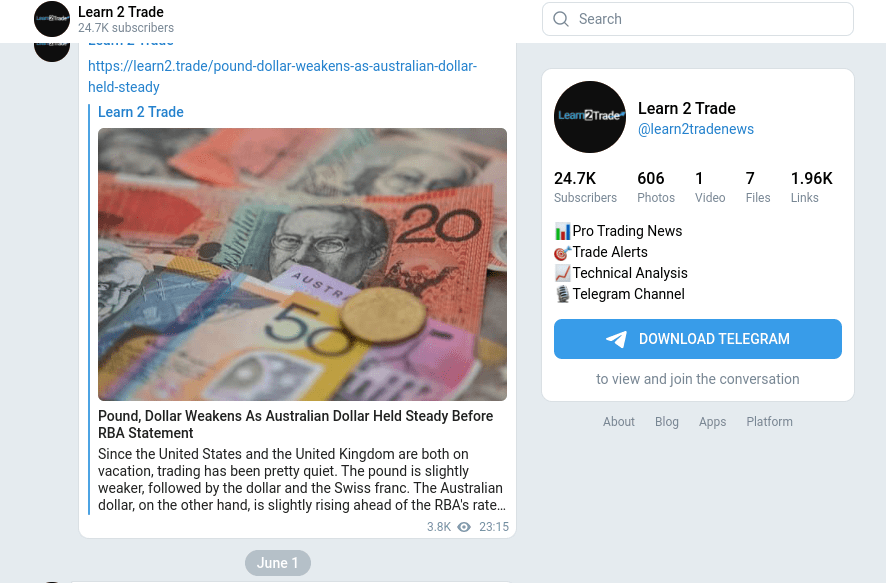

1. Learn2Trade – Best Semi-Automated Trading System for Signals

Some investors in South Africa seek automated trading systems that allow them to trade without lifting a finger. However, if you’re the type of investor that wants a little more control over where your capital is utilized, you might want to consider a semi-automated trading system that focuses on signals.

The best signal provider in this space is Learn2Trade – which has had a solid reputation over the past few years. In a nutshell, Learn2Trade offers signals on both forex and cryptocurrency trading markets – meaning you will receive suggestions on what orders to place. The provider has a team of in-house traders that actively research the financial markets to find trading opportunities for their members.

For example, let’s suppose a Learn2Trade analyst spots a potential upwards trend on Bitcoin. In turn, the analysts might send a signal that tells you to place a buy order on BTC/USD at an entry price of $40,000. Additionally, the signal might tell you to enter a stop-loss at $38,000 and a take-profit at $42,000. As such, you are provided with all the required orders to then go and place the trade at your chosen broker.

This allows you to be a bit more selective over which trades you place – rather than allowing an automated trading software to operate on your behalf. Plus, the signal option at Learn2Trade allows you to learn the ins and outs of fundamental and technical analysis while you trade. This is because most signals come with a pricing chart and a simple explanation as to why the analyst believes a profit-making opportunity has been identified.

In addition to this, the Learn2Trade website itself is packed with hundreds of guides and explainers on all-things trading. In terms of the specifics, Learn2Trade sends all of its signals in real-time via its popular Telegram group. In fact, at the time of writing, the Learn2Trade Telegram channel is now home to almost 25,000 members. As the team at Learn2Trade work around the clock to cater to all global timezones, they do, of course, charge for their services.

The Premium plan – which will get you between 3 and 5 signals per day, starts at just £35 per month. Cheaper Premium plans are available if you sign up for a 3, 6, or 12-month subscription. Alternatively, Learn2Trade also offers a Free plan that will get you 3 signals per week. With that said, the Premium plan comes with a 30-day moneyback guarantee – meaning you can try Learn2Trade out risk-free.

Pros:

- 3 x free forex signals per week

- The premium plan offers 3-5 forex signals per day

- 30-day money-back guarantee

- Signals generated by a team of highly experienced forex traders

- Receive signals in real-time via Telegram

- Trade forex without needing to perform any research

- Great reputation in the global forex signal space

Cons:

- You will need to act on the forex signal as soon as it arrives to ensure you do not miss the opportunity

There are no guarantees that you will make money with this forex signal provider

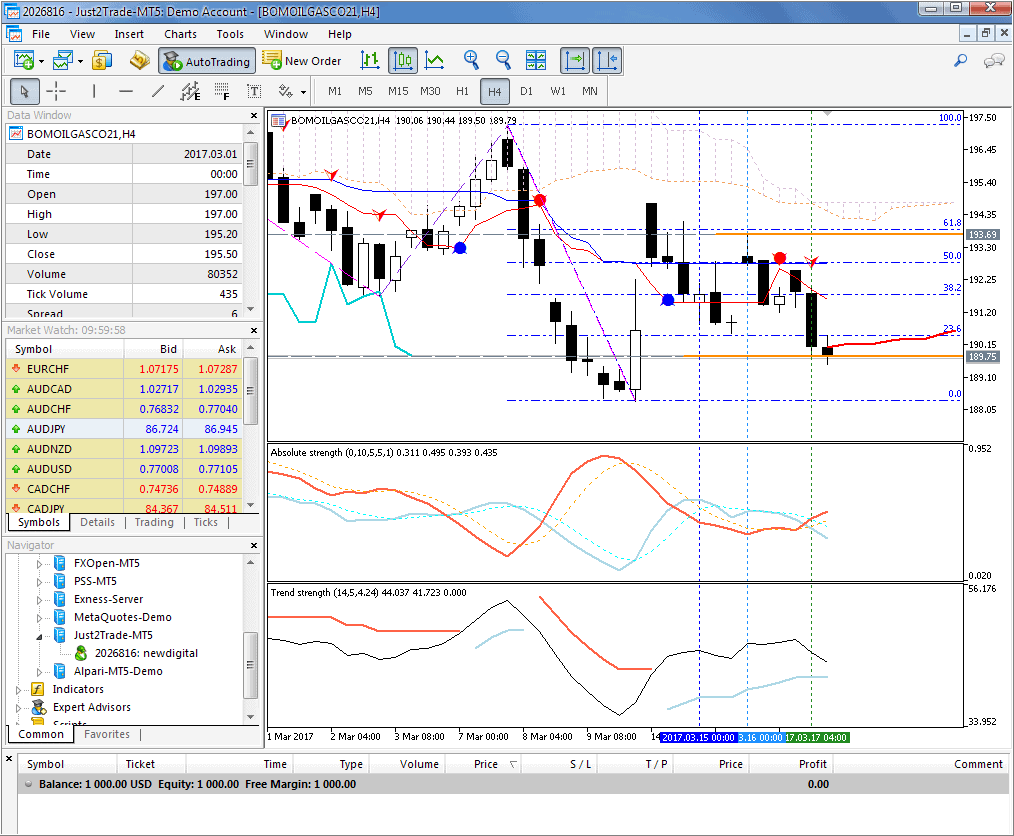

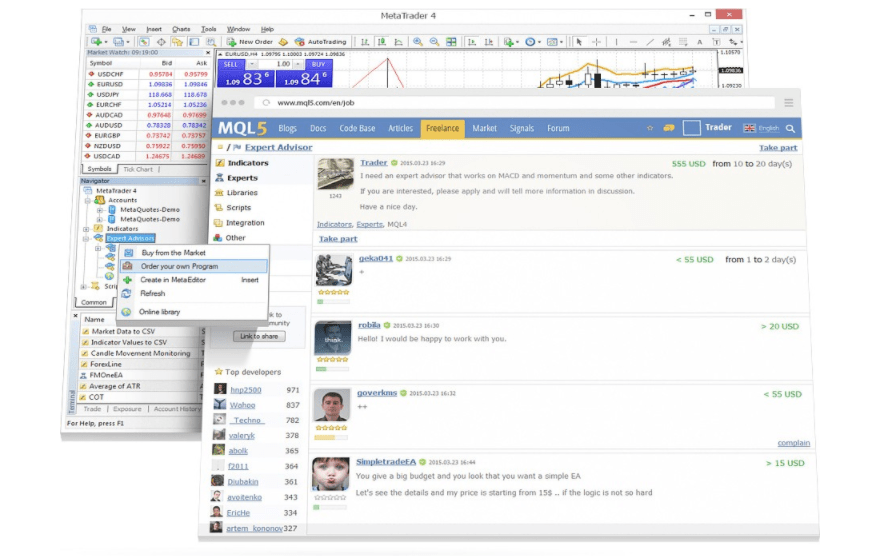

2. MT4 (via AvaTrade) – Best Auto Trading Software for Forex EAs

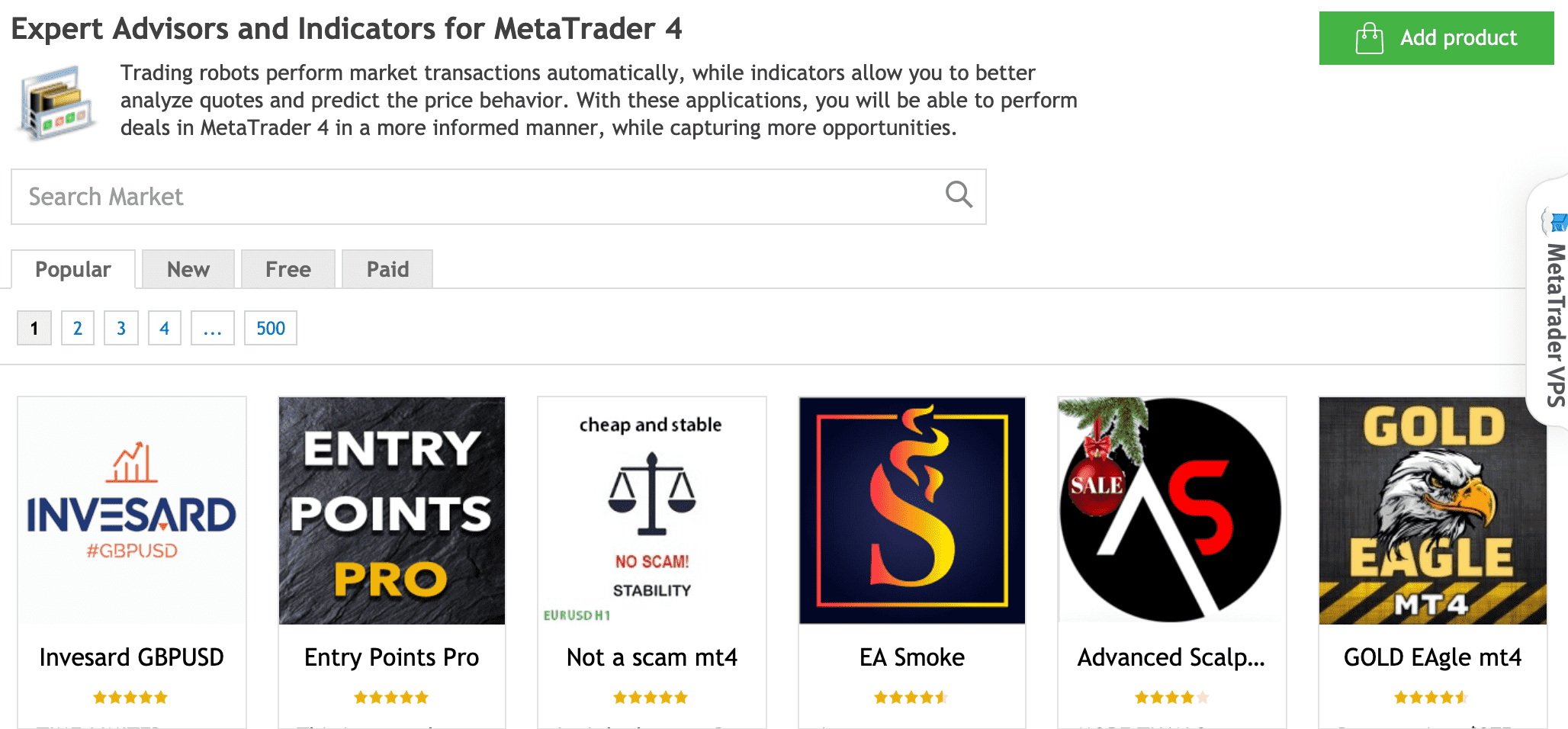

If you’ve done a bit of research on the best auto trading software providers – you’ve likely heard of forex Expert Advisors – or simply EAs. In a nutshell, forex EAs are automated software files that have built-in algorithms. They have the capacity to scans the forex market 24 hours per day, 7 days per week – meaning you do not need to do any technical analysis yourself.

Once the forex EA has identified a trading opportunity, it will then place a buy or sell order on your behalf. As such, this is a 100% automated trading system that requires no input from you. One of the best ways to deploy a forex EA is through MetaTrader 4 (MT4). This third-party trading platform sits between you and your chosen broker and is super-popular with seasoned investors. This is because MT4 has some of the best technical indicators and chart analysis tools in the trading arena.

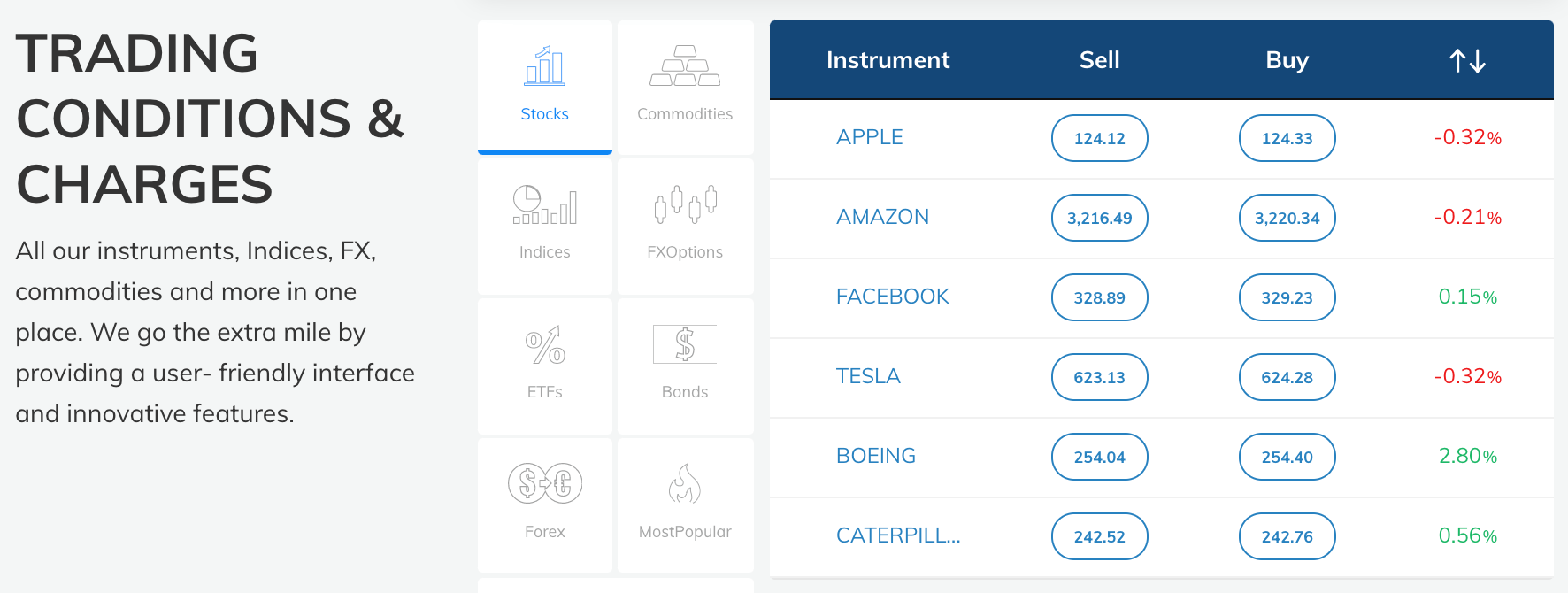

If you like the sound of MT4, you will first need to find a suitable broker that supports it. AvaTrade is generally perceived to be the best MT4 broker in South Africa, as the platform is heavily regulated and offers thousands of CFD markets. In fact, AvaTrade allows you to enter buy and sell positions without paying any commission – as all fees are built into the spread. AvaTrade also offers a great selection of educational resources – should you wish to improve your trading knowledge.

Once you are set up with AvaTrade – which requires a minimum deposit of $100, you can then link your account to MT4. Next, you will then need to scan the internet to find a forex EA that meets your needs. MT4 itself offers a marketplace of forex EAs that you can choose from, too. Either way, once you have found a suitable forex EA, you can then install the algorithmic trading software into MT4. In doing so, the software will begin trading for you on a 24/7 basis.

Pros:

- Trade CFDs on stocks, forex, and commodities

- All fees built into the spread

- Includes paper trading with MetaTrader 4

- Copy and social trading features

- Great reputation

- Heavily regulated

Cons:

- Very high inactivity fee

73.05% of retail investors lose money when trading CFDs at this site

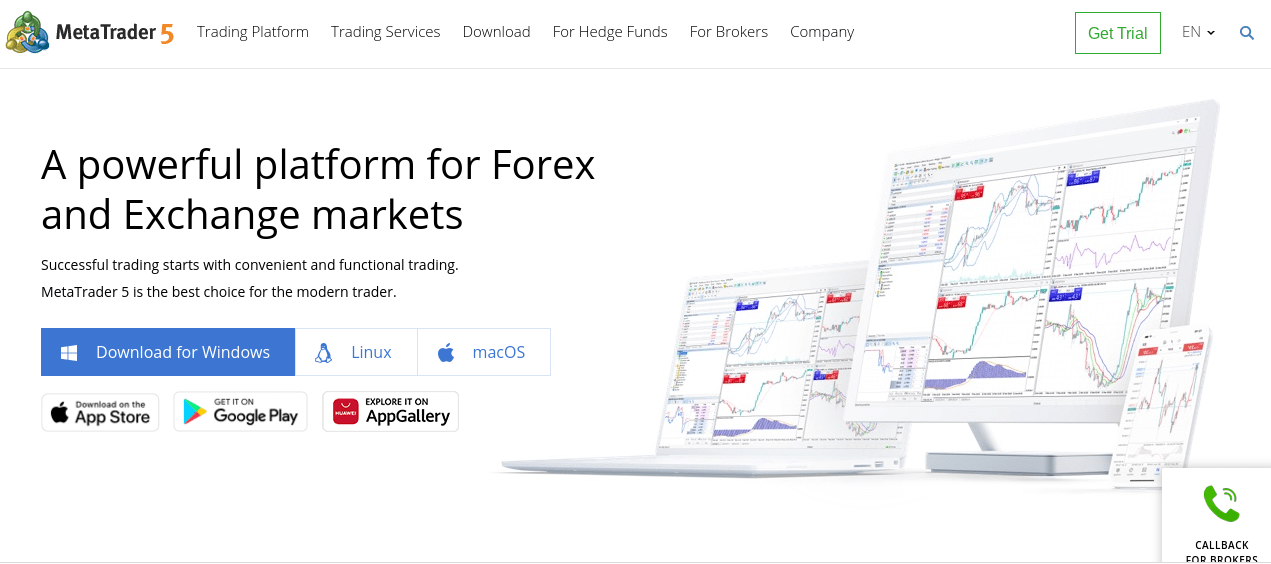

3. MT5 (via AvaTrade) – Access a Huge Pool of Successful Day Traders

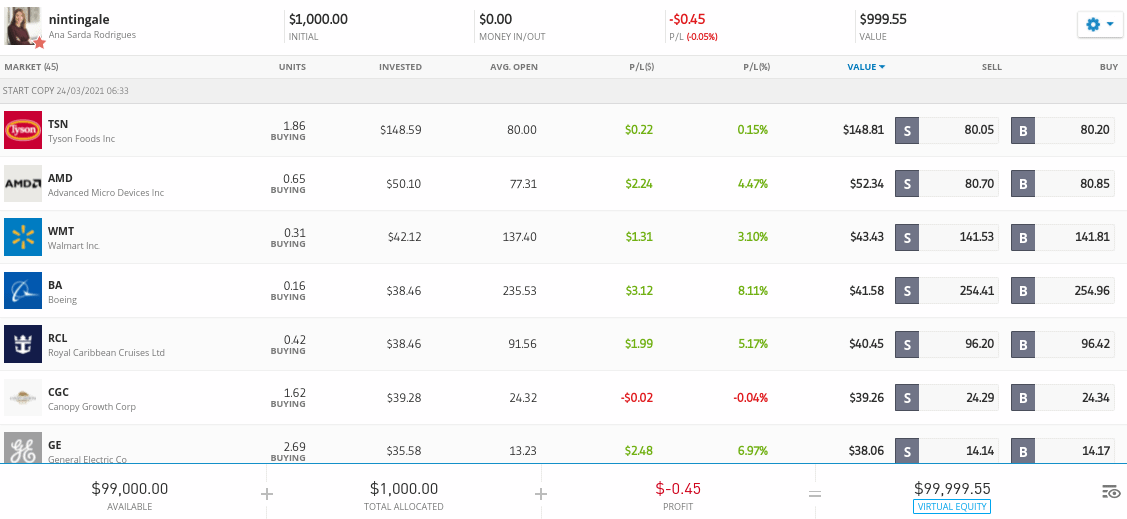

MT5 is provided by the same developer as MT4. This third-party platform is also popular with seasoned day trading pros that seek access to advanced chart analysis tools. With that said, MT5 offers its own native automated trading product that allows you to copy the buy and sell positions of a successful trader.

In fact, you will have access to thousands of traders – all of which you can copy irrespective of which broker they are using. The great thing is, MT5 gives you access to plenty of useful information that allows you to find a suitable trader. For example, you can look at what assets the trader likes to access, how much risk they generally take, and of course – how much money they have made since using MT5.

Once you find a trader that you like, you can copy them by paying a monthly subscription fee. The fee will vary from trader to trader, albeit, this generally averages about $30 per month. You are not locked into a subscription so you can stop copying a trader at any given time. Your positions will be proportionate to your own risk settings. For example, you can instruct MT5 to never risk more than 1% of your trading balance.

In a similar nature to MT4, if you want to use the MT5 automated trading service you will need to find a suitable broker. AvaTrade once against stands out from the crowd here, as the platform is compatible with both MT4 and MT5. As noted earlier, the broker allows you to trade commission-free alongside tight spreads. Additionally, AvaTrade supports free demo accounts, you can backtest your chosen copy trader without risking any money.

Pros:

- Trade CFDs on stocks, forex, and commodities

- All fees built into the spread

- Includes paper trading with MetaTrader 4

- Copy and social trading features

- Great reputation

- Heavily regulated

Cons:

- Very high inactivity fee

73.05% of retail investors lose money when trading CFDs at this site

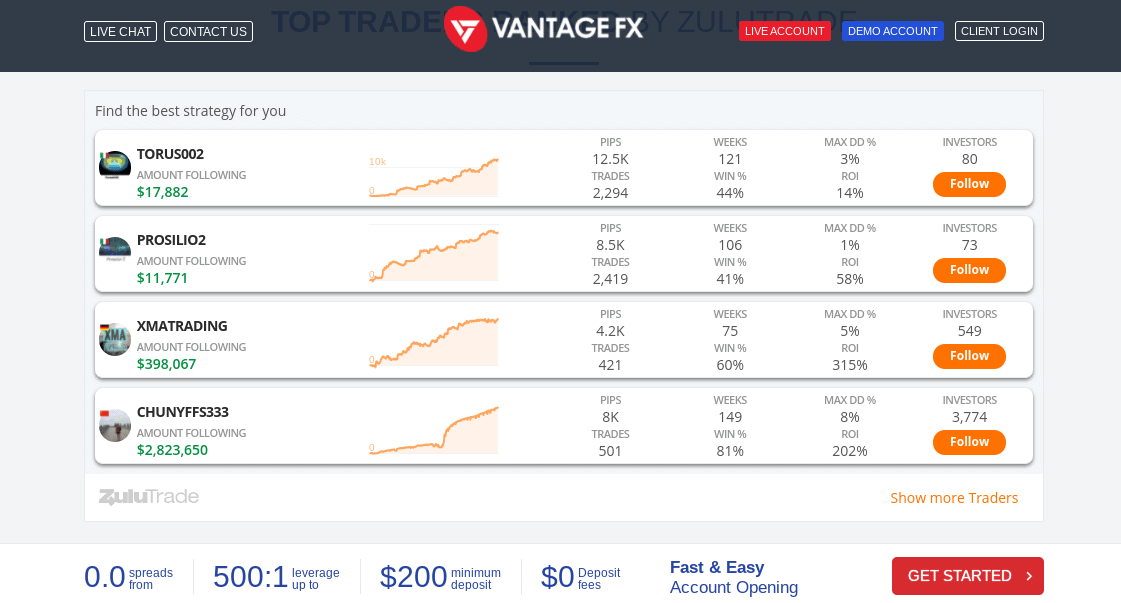

4. ZuluTrade via Vantage FX – Best Automated Trading Forex System for Beginners

ZuluTrade is another popular automated trading software platform that can be accessed directly through a supported broker. The platform is super easy to use, making it ideal for beginners.

You will have access to a wide pool of traders from a wide variety of asset classes. With that said, we found that the most successful ZuluTrade investors are involved in forex. You will have the opportunity to spend as much time as you need to choose a trader to copy.

You can view stats surrounding maximum drawdown, monthly ROI (return on investment), and average trade duration. Once you have selected a trader, you can then elect to replicate all future positions at a stake you feel comfortable with. Much like MT4 and MT5, you will need to choose a trusted brokerage that is compatible with ZuluTrade.

For this, we like the look of VantageFX. This popular online trading site is home to dozens of forex pairs, as well as markets on stocks, indices, energies, and more. VantageFX also offers ECN broker accounts – meaning that you can access spreads that start from 0.0 pips. Plus, the platform is also a high leverage broker – offering up to 1:500 on major forex markets.

Pros:- Huge selection of markets on forex and CFDs

- Leverage 1:500

- ECN accounts available

- Powerful mobile app for iOS and Android

- Scrollable news feeds

- Supports copy trading with ZuluTrade, Myfxbook, and Duplitrade

Cons:

- CFDs only

- $6 commission per share trade

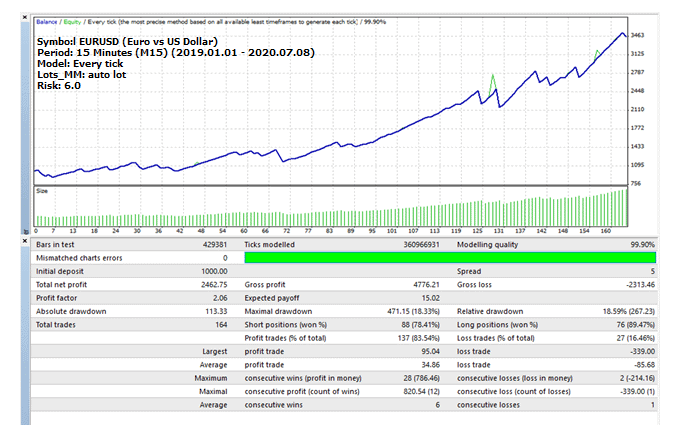

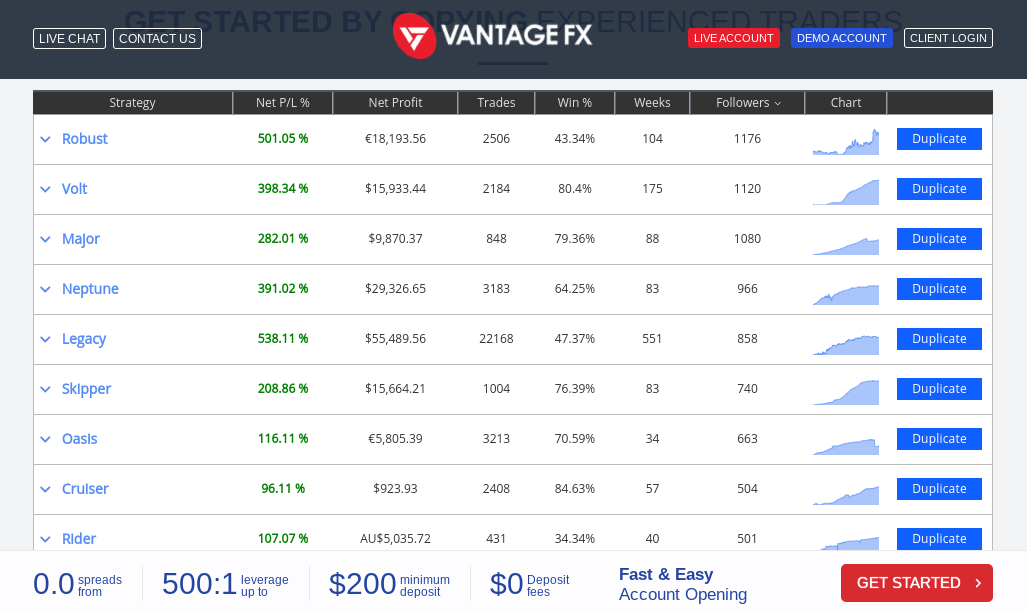

5. Duplitrade via Vantage FX – Best Automated Trading Software for Backtested Strategies

Duplitrade is a popular automated trading platform that allows you to sit back and invest without lifting a finger. With that said, Duplitrade does things a little bit different from the other providers discussed today – as you will be copying a strategy as opposed to an individual trader.

There is a good selection of strategies to choose from – each of which targets a different risk/reward system. For example, the Neptune strategy has the capacity to trade on the back of fundamental and technical analysis. The latter has a strong focus on the Elliot Wave indicator – which seeks to predict future trends by analyzing the 5-period and 35-period moving averages.

This Duplitrade strategy largely focuses on major forex pairs like EUR/USD and has returned a net profit of 391% since it was launched in late 2019. If you like the sound of Duplitrade for your automated trading software needs, you’ll need to go through a compatible broker. Once again, VantageFX is good for this. Take note, the minimum investment to use Duplitrade via VantageFX is $2,000. This is actually much lower than the requirement at other brokers – which typically averages $5,000.

Pros:- Huge selection of markets on forex and CFDs

- Leverage 1:500

- ECN accounts available

- Powerful mobile app for iOS and Android

- Scrollable news feeds

- Supports copy trading with ZuluTrade, Myfxbook, and Duplitrade

Cons:

- CFDs only

- $6 commission per share trade

6. NinjaTrader – Best Automated Software Platform for Experienced Traders

All of the best automated trading software providers that we have discussed thus far have one thing in common – they are perfect for beginners. With that said, if you are an experienced trader that is looking to deploy a highly advanced automated system – NinjaTrader might be the best option for you.

This online platform is home to thousands of tools that allow you to create a bespoke trading strategy. For example, you can purchase a third-party trading software system and then tweak it to the ‘T’. You can backtest your new strategy via a demo trading platform at NinjaTrader until you are ready to deploy it in live market conditions. This comes inclusive of a real-time market playback that allows you to break down your strategy second-by-second.

If you have experience in algorithmic coding, NinjaTrader also offers support for Custom C# Development. NinjaTrader also offers a marketplace that is home to hundreds of advanced technical indicators that you can install into your custom strategy. NinjaTrader also doubles up as a brokerage firm that specializes in the global futures market. The minimum amount required to trade futures at the platform is $400.

Pros:- Create highly advanced automated trading strategies

- Ideal for experienced traders with a knowledge of coding

- Marketplace with thousands of add-ons

- Access bespoke technical indicators

- Demo platform to backtest your custom strategies

Cons:

- Brokerage arm of the platform only offers futures

- Not suitable for beginners

What is Automated Trading Software?

In a nutshell, automated trading software allows you to trade in an autonomous manner. In other words, you won’t be required to perform any technical analysis or have any knowledge of how markets function. On the contrary, this role is reserved for your chosen automated trading software.

Furthermore, and perhaps most importantly, some automated trading software providers will place orders on your behalf. This essentially allows you to day trade financial instruments without needing to be at your device. Instead, you can sit back and allow the software to trade 24 hours per day – 7 days per week.

With that said – and as we cover in the next section, there are many types of automated trading software platforms. Some operate on a 100% automated basis while others give you more control over your funds.

How do Automated Trading Systems Work?

As we have covered in our reviews of the best automatic trading software providers – there are many types to consider. This generally consists of Copy Trading, semi-automated signals, and trading robots or EAs.

To ensure you choose the best automated trading software for your financial goals – we explain how each system works below.

Automated Copy Trading

The most popular automated system utilized by beginners in South Africa is that of a Copy Trading tool. As the name suggests, this will entail choosing an expert trader with a proven track record of making consistent gains and then copying their positions like-for-like.

The best way to do this is through an online broker like Avatrade – as all you need to do is download MetaTrader 4 to get started. Furthermore, you simply need to register an account and you can start browsing through the many verified copy traders that use the platform.

Here’s an example of how copy trading at Avatrade works:

- Sign up for an Avatrade account

- Make a deposit

- Download and install MT4

- Link MT4 to your Avatrade account

- Install an EA to trade on your behalf

Now, although copy trading with Avatrade is simple to do, it can be difficult to decide which EA to choose. Fortunately, each one comes accompanied with useful information which will help you decide.

For example, some of the information provided on the EA’s include:

- User reviews

- Comments

- The ability to test the EA before purchasing

- Screenshots of the EA in action

- Detailed breakdown by the publisher

- Telegram groups

We should also note that you can stop copying a trader at any given time when using MT4 and Avatrade. Plus, you can add assets to your portfolio on a DIY basis, so you get the best of both worlds.

Semi-Automated Signals

If you don’t feel comfortable trading in a fully automated way, you might be better suited for signals. As we covered earlier in our Learn2Trade review, this is a semi-automated way of trading. This is because the team at Learn2Trade will monitor the markets on your behalf – performing technical and fundamental analysis around the clock.

Then, when they find a trading opportunity, they will send out a signal via Telegram. This will tell you what orders to place at your chosen trading platform.

Here’s an example of what a Learn2Trade trading signal might look like:

- Market: USD/JPY

- Order: Buy

- Limit Price: 109.65

- Stop-Loss Price: 108.50

- Take-Profit Price: 110.06

The reason that this is a semi-automated way of trading is that the research and analysis has been undertaking for you. But, you still need to go and place the suggested orders yourself. Of course, you are under no obligation to do this. In fact, Learn2Trade actively promotes independent research, so you can verify the signal with your own findings.

Trading Robot and Forex EAs via MT4/MT5

Another option that you have at your disposal is to use an automated trading robot or forex EA. As we covered earlier, both operate in the same way – as the underlying software will be backed by artificial intelligence. Each robot/EA will have its own pre-set conditions that it must follow based on a specific strategy.

- For example, the robot might be tasked with short-selling a forex pair when the RSI surpasses 80.

- Or, it might be programmed to go long on gold when the asset experienced a price increase of more than 3% in a 24 hour period.

- Either way, MT4 automated trading robots come with their pros and cons.

Regarding the benefits, the MT4 automated trading robot will be able to scan the markets around the clock – 24 hours per day. This is a feat that a human trader is unable to rival. Additionally, as the robot is programmed to follow the underlying software code, this avoids the risk of it making emotional decisions. There is no fear of fatigue, either.

However, the overarching drawback with an MT4 automated trading robot is that you need to give it permission to trade with your funds. This means that it can place as many orders as it likes around the clock. In turn, you might wake up one morning to find that your trading balance has been wiped clean.

A further drawback is that MT4 robot software is based on pre-defined code that focuses exclusively on technical indicators and pricing action. As a result, it has no concept of real-world events that can influence the value of an asset.

How to Choose the Best Auto Trading Software for You

As you will be risking your hard-earned capital, you need to make sure that you choose the best auto trading software for your financial goals and tolerance for risk.

As such, be sure to make the following considerations before taking the plunge:

What Types of Auto Trading it Offers

We can leave this consideration fairly brief, as we discussed automated trading software types in the sections above. Nevertheless, you’ll want to choose from one of the following:

- Copy Trading via a regulated broker

- Automated software file via MT4/MT5

- Semi-Automated system via trading signals

Once again, the option you elect to take will depend on how much control you want over your trading capital.

Can you Verify the Results?

This consideration is arguably the most important. After all, the end-game is that you hope to make consistent profits from your chosen automatic trading software without taking too much risk.

- The key problem is that it is not always possible to verify the claims made by software providers. Well, in the case of forex EAs and robots, anyways.

- This is because automated robots are not offered by regulated brokerage firms.

- On the contrary, anyone can build a trading robot and then sell it on their website.

- In turn, this has created an industry that is now dominated by scam artists.

For example, you’ll often come across robot providers that claim to generate double-digit returns each and every month. But, there is rarely any way to verify this information. Crucially, this is why we much prefer using an expert advisor through a regulated broker such as Avatrade.

The platform in question is authorized and regulated by three reputable financial bodies – so you know you are using a credible provider. Plus, when you perform your research on which trader to copy, all information is 100% verifiable. This is because every time the trader enters or exits a position, this information is publicly viewable.

Assets

Next up in your search for the best automated trading system is to consider the asset class you want to gain exposure to. For example, if you are searching for an automated trading forex system – make sure the software specializes in currencies.

If you opt to use Avatrade as your broker of choice, the platform allows you to filter your search down by the market – such as stocks, forex, cryptocurrencies, or commodities.

Fees

When it comes to choosing an automated trading system based solely on fees – you do need to tread with caution. Sure, you don’t want to overpay for a strategy before knowing whether or not it works. But, in the world of automated trading, you often get what you pay for.

For example, would you rather pay $150 per month for an automated trading system that makes gains of 10% per week, or $10 per month for software that just about breaks even?

In terms of how you will be charged, signal providers like Learn2Trade charge a monthly subscription, which is also the case with copy traders on MT5. In the case of MT4 robot providers, you often need to pay a one-off fee to gain access to the robot software.

Free Trial or Refund Policy

Make no mistake about it – rogue automated trading providers will never offer a free trial or moneyback guarantee of any sort – simply because they know that their system does not generate consistent financial returns. On the contrary, they know that there is every chance you will lose money.

This consideration in itself allows you to make a judgement on whether or not the provider is credible. For example, Learn2Trade offers two crucial safeguards – as it has done since it was launched 8 years ago.

Firstly, you will have access to free trading signals that require no deposit or subscription. If you decide to start with the Premium plan for 3-5 signals per day, this comes with a 30-day moneyback guarantee for all new customers. To the best of our knowledge, Learn2Trade executes its refund policy on a no-questions-asked basis.

Customer Service

Once again, by electing to use an auto trading strategy, you are putting your hard-earned capital at risk. As such, you’ll want to choose a provider that offers top-notch customer support. The best providers will offer a live chat facility that allows you to speak with a support agent in real-time.

This is something offered by Avatrade, Learn2Trade, and many of the other providers discussed today. If your chosen automated trading provider only offers email – this can be problematic.

How to Start Automated Trading

Ready to access the financial trading scene with an automated system? If so, we are now going to walk you through the automated Copy Trading process with regulated broker Avatrade.

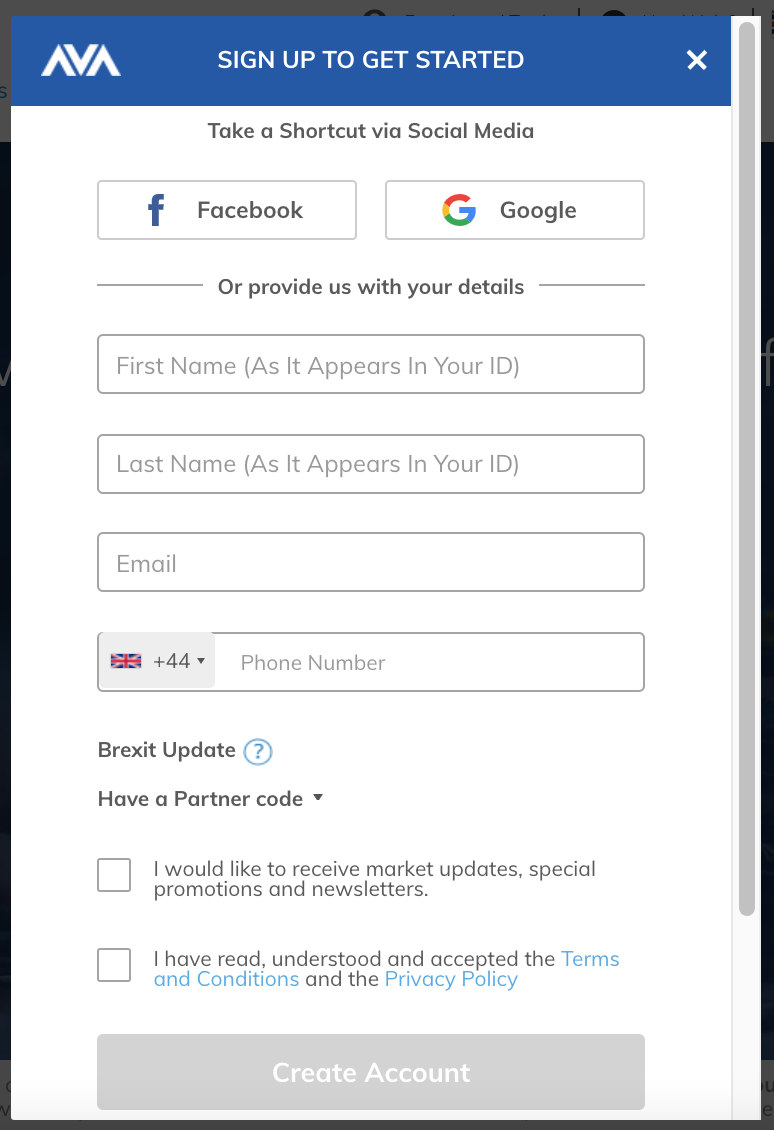

Step 1: Join Avatrade

Opening an account at Avatrade is fast and seamless. Simply visit the Avatrade website and click ‘Register Now‘. You will now be prompted to enter your personal information and contact details – much like you would at any other regulated brokerage site.

To complete the Avatrade account opening process, upload a copy of your government-issued ID and proof of address. Avatrade will automatically verify your documents via its FinTech protocol.

Step 2: Deposit Funds

You can now add some funds to your Avatrade investment account. The platform requires a minimum deposit of $100, which equates to around 1375 ZAR

The platform supports the following payment methods:

- Visa

- MasterCard

- Visa Electron

- Maestro

- WebMoney

- Skrill

- Neteller

- Bank Transfer

Other than a bank transfer, all of the other payment types listed above will be processed instantly.

Step 3: Download and Install MT4

Once you have created an Avatrade account and made a deposit, it’s now time to download MT4 so that you can begin copy trading. The great thing is that Avatrade allow you to download MT4 from their website, and even offer a handy video guide showing you all the necessary steps to take. Once you have downloaded and installed the software, simply link your Avatrade account to the MT4 software using your login details.

Step 4: Set up Expert Advisor and Begin Copy Trading

Now that you have a broker account and MT4 downloaded, it’s time to choose your expert advisor to make your trades MetaTrader’s creators offer a handy marketplace with a huge number of EA’s to choose from, so make sure to thoroughly research your options before making a decision.

Once you’ve chosen an EA, download and install it following the instructions provided. Once installed, the EA can begin automatically trading on your behalf – allowing you to sit back and let the algorithm do all the work!

AvaTrade – Best Broker for Automated Trading 2022

This guide has explained everything there is to know about automated trading software platforms. We have covered robots and forex EAs that you can install into MT4 and MT5, as well as semi-automated trading signals. We’ve also run you through the many considerations that you need to make in finding an auto trading system for your financial goals.

Ultimately, we can conclude that the best way to begin automating your trading is through using AvaTrade. By downloading MT4 and installing an expert advisor, you are able to allow trades to be completed for you automatically, using your AvaTrade account to facilitate them. Notably, AvaTrade do not charge any commissions when placing trades, and are heavily regulated by top organisations around the world.

73.05% of retail investors lose money when trading CFDs at this site

FAQs

What is the best automated trading software platform?

If you are looking to trade in an automated manner in a safe and secure environment, it's crucial that you stick with a regulated broker. At Avatrade, you can download MT4 and use one of the expert advisors to automatically trade on your behalf. Notably, these trades will not come with any commissions attached as Avatrade use a 0% commission structure.

Where can you buy automated trading forex software?

Automated forex trading systems are typically utilized on MT4. These are software files that are created by third parties, which you then install into the MT4 platform. However, there is rarely any way to verify the prior success of MT4 forex robots. As such, proceed at your own risk.

Do automated trading systems work?

There is no one-size-fits-all answer to this question. Sure, hedge funds have been using automated systems for several decades and with great success. However, if you buy an automated system from a third-party, it's very unlikely that the robot will be able to outperform the market consistently.

How do you backtest automated trading software?

If you are looking to backtest automated trading software, you will need to do this via a brokerage demo account. For example, if the robot is compatible with MT4, you might consider registering with AvaTrade and then testing the automated software via a free paper trading account.

Is automated trading legal?

Yes, automated trading is perfectly legal. The vast majority of trading platforms not only accept automated trading systems - but they actively promote it.

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane PepiLatest News

Hvordan spille poker og Norgescsino

For tiden er det mange mennesker som ønsker å lære å spille poker og norgescsino. Dette er fordi spillene er veldig morsomme og folk kan få mye penger fra dem. Det er imidlertid et par ting du bør huske på når du skal lære å spille poker og norgescsino. Disse tingene inkluderer RNG, Cashback og...

Lär dig grunderna för kasinobordsspel

Om du har funderat på att prova på kasinot kanske du undrar vilka spel du ska spela. Bordsspel inkluderar Blackjack, Poker och Craps. Om du vill lära dig mer om dessa spel, läs vidare. Här är några grunder om dessa spel. Du kommer att kunna välja det bästa spelet att spela baserat på dina personliga...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

BuyShares.co.uk © 2025.

All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up

Some investors in South Africa seek automated trading systems that allow them to trade without lifting a finger. However, if you’re the type of investor that wants a little more control over where your capital is utilized, you might want to consider a semi-automated trading system that focuses on signals.

Some investors in South Africa seek automated trading systems that allow them to trade without lifting a finger. However, if you’re the type of investor that wants a little more control over where your capital is utilized, you might want to consider a semi-automated trading system that focuses on signals.

All of the best automated trading software providers that we have discussed thus far have one thing in common – they are perfect for beginners. With that said, if you are an experienced trader that is looking to deploy a highly advanced automated system – NinjaTrader might be the best option for you.

All of the best automated trading software providers that we have discussed thus far have one thing in common – they are perfect for beginners. With that said, if you are an experienced trader that is looking to deploy a highly advanced automated system – NinjaTrader might be the best option for you.