Best ECN Brokers South Africa – Cheapest Brokers Revealed

ECN brokers allow you to trade directly with other market participants – so you’ll be getting the best spreads available. In choosing the best ECN broker for your needs – you need to consider core factors such as tradable markets, fees, payments, regulation, liquidity, and more.

In this guide, we review the Best ECN Brokers South Africa for 2021 and show you how to open an investment account today.

Best ECN Brokers South Africa 2021

After reviewing dozens of platforms, the best ECN brokers South Africa can be found below. We review each of the below ECN brokers further down.

- Pepperstone: Overall Best ECN Broker South Africa

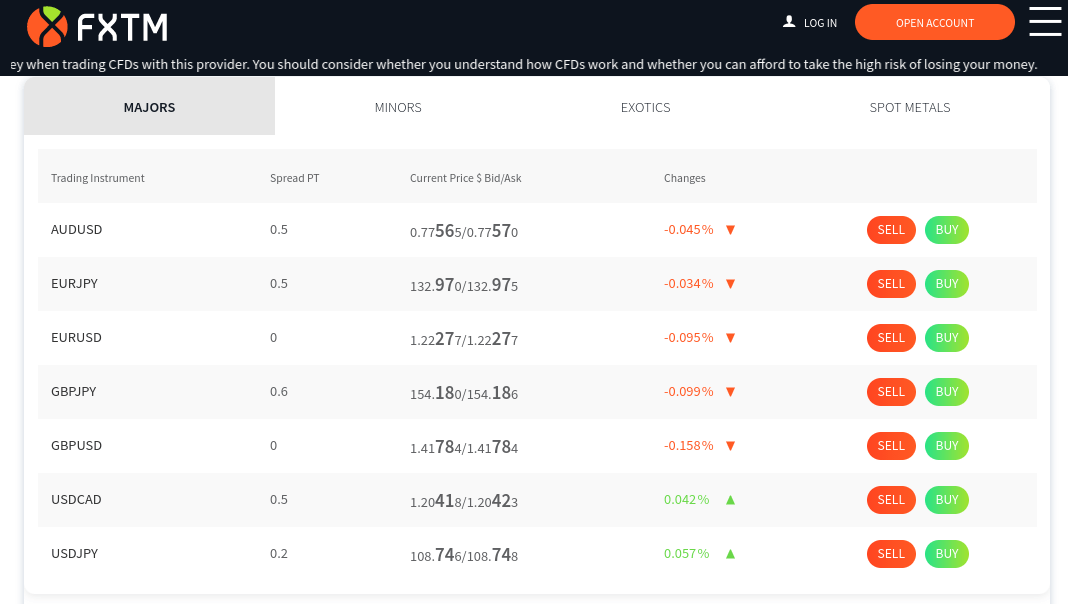

- FXTM: Low-Cost ECN Broker With Minimum Deposit of $500

- IC Markets: One of the Best ECN Brokers in South Africa for Advanced Trading Systems

- Blackstone Futures: Blackstone Futures – Best ECN Broker South Africa for ZAR Accounts

- Tickmill: Multi-Asset Broker With Spreads Starting From 0 Pips

- Hotforex: Best ECN Forex Broker South Africa for High Leverage

- FxPro: User-Friendly No Dealing Desk Broker (ECN-Like Fees)

- FP Markets: Forex ECN Broker With Micro Lots

- XM: Top-Rated ZAR Broker with 16 Trading Platforms

- Go Markets: Regulated Online Broker With Zero Spreads on Majors

Best ECN Brokers South Africa Reviewed

Ensuring that you choose the best ECN broker for your needs is crucial. After all, you need to look at metrics beyond just spreads and commissions. On the contrary, you also need to consider the safety of your funds, how much liquidity the broker attracts, and what markets you will be able to trade.

Taking all of this into account, below you will find the best ECN brokers South Africa in the market right now.

1. Pepperstone – Overall Best ECN Broker South Africa

In terms of its ECN services, this comes in the form of the Pepperstone Razor Account. In many cases, this will get you spreads of 0 pips when trading major currencies – and slightly more on other financial instruments. For this, you will pay a very competitive commission of just $3.50 per $100,000 traded. These super-tight spreads and lows commissions are especially condusive for algorithmic and scalper traders.

When it comes to trading platforms, Pepperstone gives you plenty of options. Most traders opt for MT4, but MT5 and cTrader are also supported. Opening an account is fast and seamless at Pepperstone and you can easily deposit funds with a debit/credit card or bank transfer. In terms of safety – this should be of no concern. After all, the ECN broker is authorized and regulated by the FCA (UK), ASIC (Australia), and DFSA (UAE).

Pros:

- Trade CFDs for stocks, forex, and commodities

- All fees built into the spread

- Includes paper trading with MetaTrader 4

- Copy and social trading features

- Great reputation

- Heavily regulated

Cons:

- Very high inactivity fee

Your capital is at risk.

2. FXTM – Low-Cost ECN Broker With Minimum Deposit of $500

You can also trade spot metals, stocks, energies, and index funds. When it comes to its ECN account, FXTM offers spreads from just 0.1 pips. As is industry standard, the best ECN spreads on this account type are usually found on major forex pairs like EUR/USD. To benefit from this super-tight spread, you will pay a commission of just $2 per lot. All orders benefit from market execution, so you’ll be trading directly with other participants.

What we also like about the FXTM ECN account is that the minimum deposit is just $500. This is very reasonable, as many ECN accounts require a much larger minimum. Once you have opened an ECN account – which supports USD, EUR, or GBP as its base currency, you can trade via MT4 or MT5. Leverage on the FXTM ECN account is capped to 1:30, albeit, you will get more if you are classed as a professional client.

Pros:

- Very tight spreads on ECN accounts

- Several asset classes to choose from

- Heaps of everyday deposit and withdrawal options

- Regulated in South Africa

- Easy registration process

- Supports MT4 and MT5

Cons:

- Limited number of stock CFDs

Your capital is at risk.

3. IC Markets – One of the Best ECN Brokers in South Africa for Advanced Trading Systems

First and foremost, you will have access to two ECN accounts – one that is compatible with MT4 and another that can be used via cTrader. Both ECN accounts allow you to trade from 0 pips. In terms of commissions, you will pay $3.50 per slide on MT4 and $3 on cTrader. The minimum deposit on both ECN accounts is just $200 – which is even lower than that of FXTM.

Secondly, IC Markets is a high leverage broker – with the platform offering up to 1:500. This means that you can multiply your stake by 500 times – which is huge. If you are looking to implement an advanced trading system, IC Markets supports forex EAs (expert advisors), scalping, hedging, and more. In terms of safety, IC Markets is regulated in several jurisdictions – including Australia, Cyprus, the Bahamas, and the Seychelles.

Pros:

- Heavily regulated

- Leverage of up to 1:500

- Spreads from 0 pips on ECN accounts

- Commissions from just $3 per slide

- MT4 and cTrader supported

Cons:

- Does not offer a native trading platform

Your capital is at risk.

4. Blackstone Futures – Best ECN Broker South Africa for ZAR Accounts

When it comes to fees, you will get ECN-like spreads at Blackstone Futures. This starts at 0.6 pips, albeit, you won’t be charged any trading commission. As such, Blackstone Futures is arguably a better option for those looking to trade smaller amounts. With that said, if you do have a relatively low account balance, this top-rated broker allows you to apply leverage of up to 1:400.

Pros:

- Located in South Africa – ZAR accounts

- 0% commission and spreads from 0.6 pips

- Multiple asset classes supported

- Accepts debit/credit cards, wallets, and local bank transfers

- Leverage of up to 1:400

Cons:

- Traditional ECN brokerage accounts not supported

Your capital is at risk.

5. Tickmill – Multi-Asset Broker With Spreads Starting From 0 Pips

If you seek more complex financial instruments, Tickmill also offers futures markets. Tickmill offers three different account types, albeit, the one you will likely be interested in is the Pro Account. This is because you will get some of the best spreads available in the market – which starts from just 0 pips. If you are a retail client, you will be offered leverage of up to 1:30.

Although this is much lower than some of the other platforms on our ECN broker list – this is more than enough for the Average Joe trader. To access the tight-spreads offered by the Pro Account, you will pay a commission of $2 per $100,000 traded. There is also a VIP Account at Tickmill, which gets you spreads of 0 pips and the commission is reduced to $1 per $100,000 traded. However, this requires a minimum deposit of $50,000.

Pros:

- Minimum deposit just $100

- Spreads start from 0 pips

- Commission of $2 per $100,000 traded

- Heaps of supported markets

- Leverage offered on all financial instruments

Cons:

- No ZAR accounts

73% of retail investor accounts lose money when trading CFDs with Tickmill.

6. HotForex – Best ECN Forex Broker South Africa for High Leverage

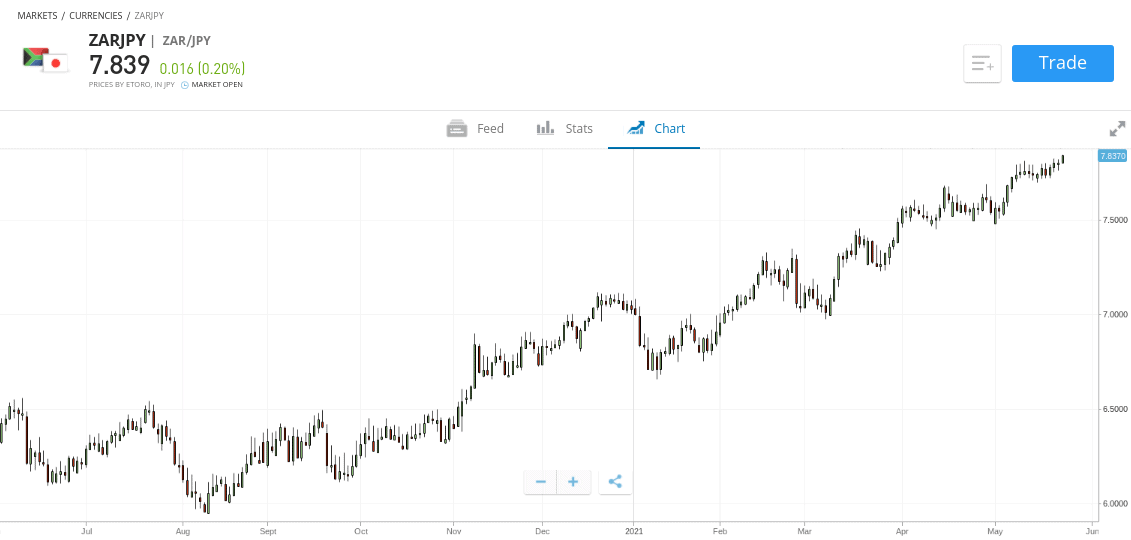

You will need to meet a minimum account balance of 2,800 ZAR to be eligible for this account type. In terms of supported markets, HotForex is home to dozens of pairs. If you want to trade the South African rand, you can do this against the Japanese yen, euro, US dollar, and British pound.

This top-rated broker also supports markets on indices, stocks, and commodities. We should also note that HotForex offers some of the highest levels of leverage in the market – which stands at a whopping 1:1000. You can trade via MT4 or MT5 and HotForex supports debit/credit cards and e-wallets. Finally, HotForex is also an FSCA regulated broker.

Pros:

- Leverage of up to 1:1000

- MT4 and MT5 supported

- Zero spread accounts available

- Minimum deposit just 70 rands

- Good educational materials

- Supports debit/credit cards, e-wallets, and bank account transfers

Cons:

- Support only available 24/5

- No native trading platform

72.03% of retail investor accounts lose money when trading CFDs with this provider

7. FxPro – User-Friendly No Dealing Desk Broker (ECN-Like Fees)

In turn, this means that you will get some of the best spreads available in the industry while paying 0% in commission. As the name suggests, FxPro offers an abundance of currency trading markets – with the platform covering majors, minors, and exotics.

You can also trade shares, indices, energies, metals, and futures. FxPro is renowned for offering some of the fastest execution times in this space – averaging just 14ms. This translates into ultra-low latency and deep liquidity. When it comes to the trading platform itself – FxPro offers four options. On top of its own native browser-based platform, this also includes MT4, MT5, and cTrader.

Pros:

- Combines low spreads with 0% commission policy

- Supports forex, shares, indices, and commodities

- Average execution speed of 14ms

- Ultra-low latency and deep liquidty

- Multiple trading platforms supported

Cons:

- Not a true ECN broker – instead operates a no dealing desk platform

74.02% of retail investor accounts lose money when trading CFDs with this provider

8. FP Markets – Forex ECN Broker With MIcro Lots

This comes alongside a very competitive commission of $3 per slide. The minimum deposit on this account is just $100 and you can trade currencies from 0.01 lots. This will appeal to those seeking ECN-like pricing with smaller stakes.

If you are planning to trade with leverage, FP Markets offers up to 1:500 on major forex pairs and less on other markets. Automated trading software systems and forex EAs are supported – as are VPS networks. You can trade via MT4 or MT5 via software or through the FP Markets website.

Pros:

- Spreads start from 0.0 pips on Raw Account

- EAs and robots supported

- 1:500 leverage on major FX pairs

- Minimum deposit of just $100

- Commission of $3 per slide

Cons:

- Tight spreads only available during busy market conditions

Your capital is at risk when trading CFDs with this provider

9. XM – Top-Rated ZAR Broker with 16 Trading Platforms

Crucially, this means that you can trade currencies with spreads as low as 0 pips. The commission here is slightly higher than the other true ECN brokers on our list – which comes in at $3.50 per $100,000 traded. However, it should be noted that this is still competitive.

Interestingly, the XM Zero Acccount on XM is capped to leverage of 1:30. You can get higher limits by choosing a different account type, but equally, you won’t have access to 0 pip spreads. Nevertheless, XM supports over 16 trading platforms across mobile, web, and desktop devices. You can choose from MT4 or MT5 and XM permits algorithmic trading, hedging, and scalping.

Pros:

- Multiple ZAR accounts offered

- Some accounts offer commission-free trading

- Heaps of forex markets

- Trade CFDs via stocks and commodities

- High leverage

- 16 trading platforms supported

Cons:

- Does not offer markets on ETFs or cryptocurrencies

78.28% of retail investor accounts lose money when trading CFDs with this provider.

10. Go Markets – Regulated Online Broker With Zero Spreads on Majors

If you want access to industry-leading spreads, you’ll want to consider opening the Go Plus account. During standard market hours, this should get you spreads of 0 pips on pairs like AUD/USD and EUR/USD. This will cost you just $2 per slide. The minimum deposit to access the Go Plus account is a very reasonable $250.

Go Markets doesn’t offer its own native trading platform – so you will need to use MT4. We also like the fact that Go Markets offers a good number of user-friendly trading guides and financial blogs.

Pros:

- Spreads from 0 pips during standard forex trading hours

- Lots of guides and news blogs

- Trade at just $2 per slide

- Regulated by ASIC and CySEC

Cons:

- MT4 only – no native trading platform

50% of retail investor accounts lose money when trading CFDs with GO Markets Ltd

What is an ECN Broker?

An Electronic Communications Networks (ECN) broker refers to a provider that allows you to trade directly with market participants. This means that you will be able to access the same liquidity pool as major traders – namely banks, hedge funds, and financial institutions.

In other words, you will get some of the best asset prices available in the market, which translates into super-tight spreads. In many cases – and as we discussed in the above ECN broker reviews, you will be able to trade major currencies without paying any spreads at all. Instead, you just need to pay your chosen provider a small commission.

Crucially, ECN brokers are preferred by some traders in South Africa because they ensure that there is no conflict of interest. This is because the ECN broker will not have the capacity to trade against its own clients, which ensures that you are trading in a safe, transparent, and fair ecosystem.

Benefits of Choosing an ECN Broker

If you’re still not sure whether or not an ECN broker is right for you and your trading goals – below we discuss some of the main benefits associated with this account type.

Trade With Market Participants

Perhaps the most obvious benefit of using an ECN broker in South Africa is that you will be trading directly with other market participants. This means that your buy orders are matched directly with sellers, and your sell orders matched by buyers.

This is a huge benefit, not least because there is no conflict of interest. This is something that cannot be said for a number of other broker types. On the contrary, many market maker brokers will trade against their own clients.

Industry Leading Spreads

A direct benefit of being able to trade with other market participants is that you will typically get the best spreads available. In fact, many of the best ECN brokers South Africa that we reviewed earlier offer 0 pips on major currency pairs.

This ultimately means that there is no gap between the buy and sell price of the instrument. As such, this is highly conducive for scalping – which we discuss next. In contrast, commission-free market maker brokers will rarely be able to offer you a spread of less than 0.6 pips.

Ideal for Scalping

Scalping is one of the best trading strategies to learn – as it allows you to enter and exit positions in a relatively low-risk manner. This is because scalping involves targeting really small margins throughout the day – especially when volatility levels are low.

However, due to the micro-margins on offer, scalping traders rely heavily on ECN brokerage accounts. This is because they will only need to pay a small flat commission per slide as opposed to an unfavourable spread.

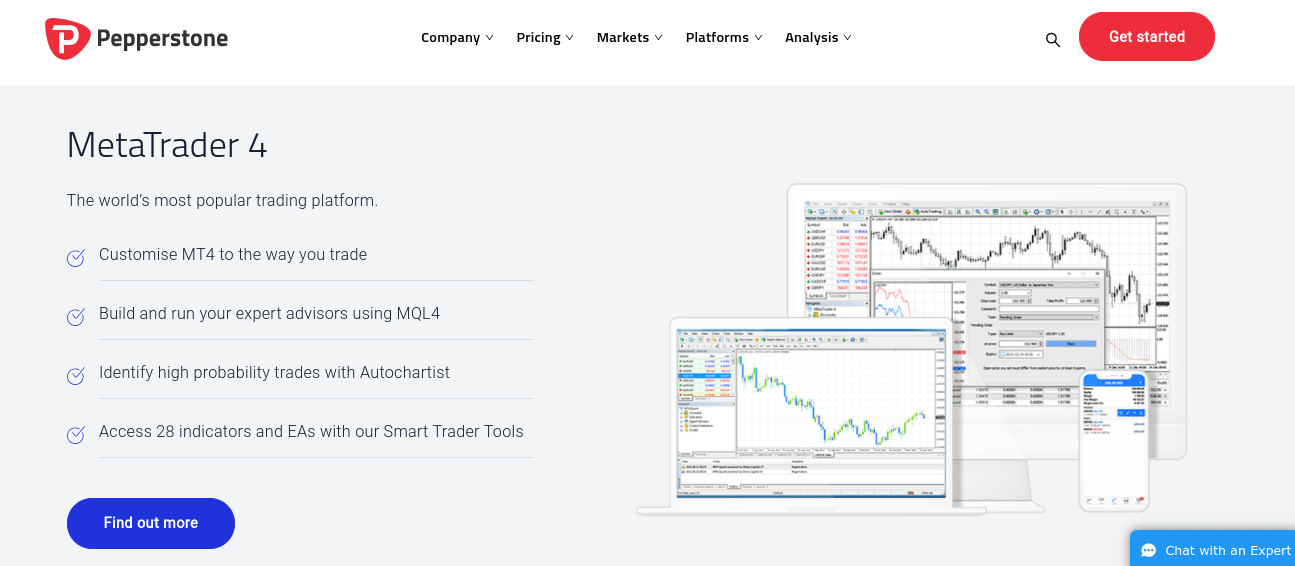

MT4 ECN Brokers

The vast majority of the best ECN brokers South Africa discussed today are compatible with MT4. This is because MT4 is typically the platform of choice with seasoned traders – especially those that are involved in the multi-trillion-dollar forex industry.

The process of getting set up on MT4 via your ECN brokerage account is actually very simple. Once you have registered with an ECN broker, you can access MT4 online, through desktop software, or an iOS/Android app.

Then, it’s just a case of logging into MT4 with your ECN account details provided by your broker. As soon as you are logged in, you can then start trading on MT4 with your brokerage funds.

ECN Brokers with No Commission

As we have covered throughout this guide, ECN brokers are able to offer some of the best spreads available in the market – which often stand at 0 pips. It goes without saying that ECN trading platforms are in the business of making money – so in return for offering tight spreads they will charge a flat commission.

This is typically in the region of $2-$4 for every $100,000 traded. Taking this into account, ECN brokers without commission do not exist. If they did, there would be no mechanism in place for the broker to generate revenue.

On the flip side, there are hundreds of commission-free trading platforms in the online space. This means that the only fee you will pay is the spread. Of course, the spread in this instance will be much higher than you can get with a conventional ECN broker account.

How to Get Started with an ECN Broker

If you are ready to start trading via a top-rated ECN brokerage account – we are now going to walk you through the process with Pepperstone.

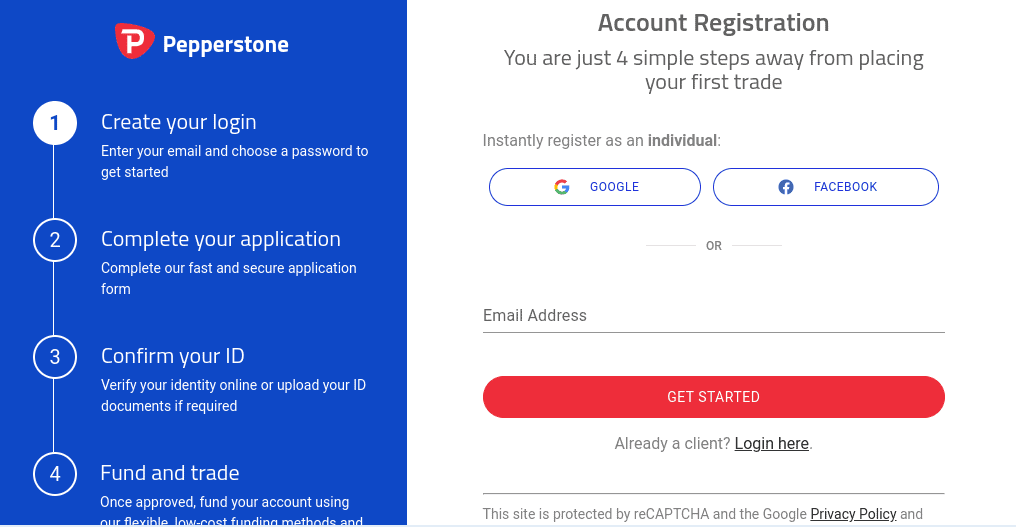

Step 1: Join Pepperstone

The first step is to visit Pepperstone and open an investment account. The platform offers two different plans – but you will want to opt for the Razor Spread Account. This is the account type that will get you access to ECN-like spreads that start from 0 pips.

Follow the on-screen instructions by entering your personal information and contact details. You will need to verify your email address by proceeding to the next step.

Step 2: Complete KYC Process

Like all regulated brokers, Pepperstone is required to verify your identity before giving you unfettered access to trading facilities.

The KYC process requires a copy of your government-issued ID – which can be a passport, driver’s license, or national ID card.

Step 3: Deposit Funds

You will now be asked to deposit some funds into your Razor Spread Account. Pepperstone permits local bank transfers and debit/credit card deposits. The latter is the best option as this will be processed instantly.

Step 4: Choose Platform

Now that you have a fully funded account at Pepperstone, you will need to decide which trading platform you want to use. Most traders will elect to use MT4, but you also have MT5 and cTrader. These platforms can be accessed online via the Pepperstone website for ease.

However, it might be best to download the respective software to your desktop device. In doing so, you will have access to more technical indicators and chart drawing tools – and have the ability to install and deploy an automated forex robot.

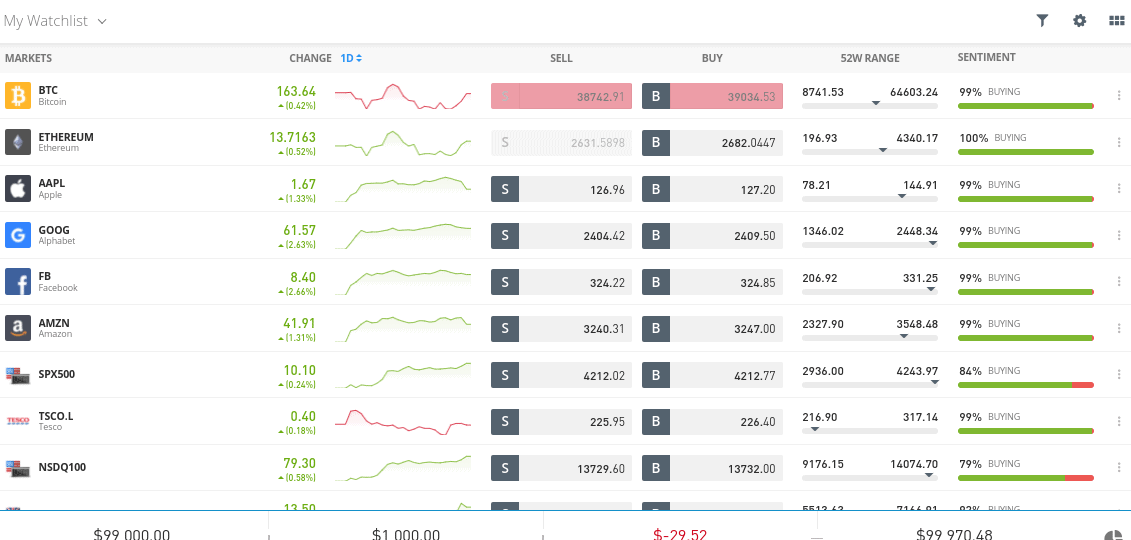

Step 5: Start Trading

The final part of the process is to start trading via your Razor Spread Account. You will need to find a market to trade – which you can do by using the search bar on your chosen trading platform. Then it’s just a case of setting up an order and Pepperstone will do the rest!

eToro – An Alternative to ECN Brokers

Many traders are attracted to ECN broker accounts because they typically offer the tightest spreads available in the market. However, all things considered, these account types are only worth opening if you are a seasoned investor that plans to trade with large volumes.

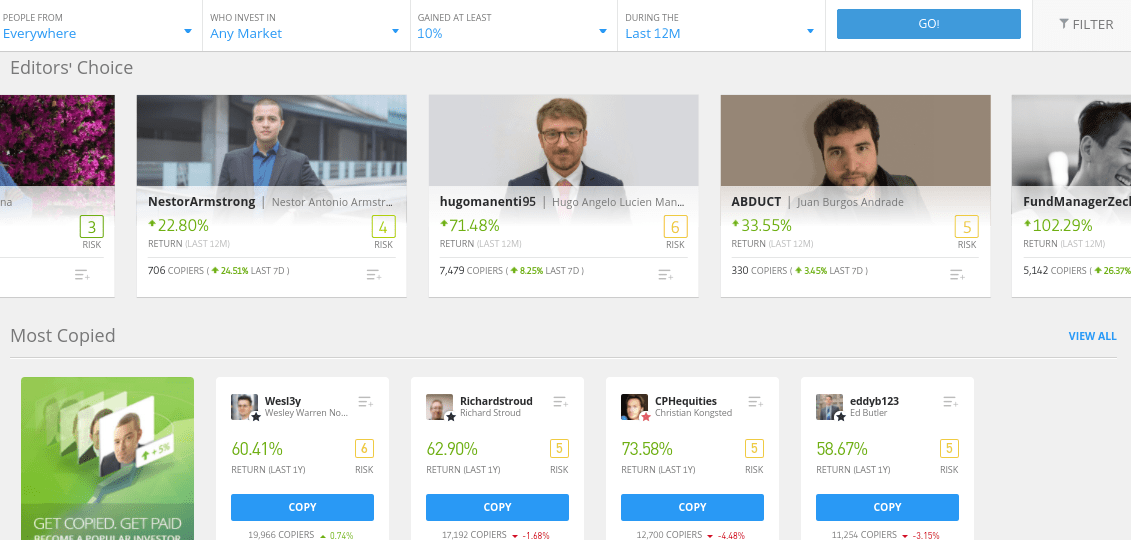

If you sit within the remit of a retail client – then we would suggest an alternative in the form of eToro. This popular online broker – which is now used by over 20 million traders, allows you to buy and sell stocks and ETFs without paying any commission. You can also trade the likes of forex, cryptocurrencies, indices, and commodities on a spread-only basis.

In terms of usability, eToro offers a simple and seamless trading platform that is especially suitable for newbies. You can also access social and copy trading features – with the latter allowing you to ‘copy’ other eToro traders. This allows you to engage in passive trading without needing to rely on automated robots.

Past performance is not an indicator of future results

We should also note eToro is heavily regulated and supports a wide variety of payment types. This includes Paypal, Neteller, Visa, MasterCard, Maestro, and bank transfers. If you’re looking to trade on the move – eToro offers a top-rated trading app.

67% of retail investor accounts lose money when trading CFDs with this provider.

Pepperstone – Overall Best ECN Broker South Africa 2021

In summary, the best ECN brokers South Africa allow you to trade financial instruments with super-tight spreads. In fact, when trading major currency pairs like EUR/USD, you’ll often get a spread of 0 pips. This allows you to target modest gains throughout the day without getting hammered by unfavourable spreads and commissions.

If you’re ready to start trading via a top-rated ECN broker – Pepperstone is the best platform for the job. Getting started takes minutes and once you have made an instant deposit – you can start trading via MT4, MT5, or cTrader alongside some of the best spreads available in the market.

Your capital is at risk.

FAQs

What is a true ECN broker?

A true ECN broker is one that has direct access to the electronic communications network. This means that you will be able to trade directly with other market participants - which includes the likes of hedge funds and banks. If you're looking for a true ECN forex brokers list - scroll up to our reviews.

How do you identify an ECN broker?

Not only do you need to ensure the broker is a true ECN provider, but you need to explore metrics surrounding commission, markets, payments, regulation, trading tools, customer support, and more. We took all of these factors into account when compiling our ECN broker list reviews.

How do ECN forex brokers make money?

ECN forex brokers make money by charging a flat commission per lot. In most cases, you will pay between $2-$4 for every $100,000 traded.

Are ECN forex brokers good?

It is important to note that ECN forex brokers are best suited for experienced traders that have access to a large amount of capital. If you are a retail client, you might be better suited for a market maker broker. This is because you will likely be able to trade with 0% commission - which is more favourable for casual traders.

How much leverage do ECN brokers in South Africa offer?

Leverage limits will vary wildly depending on your chosen platform. With that said, many of the ECN brokers discussed today offer leverage of up to 1:500.

What assets can you trade at true ECN brokers?

True ECN brokers will normally specialize in forex markets. However, some true ECN brokers also offer alternative asset classes in the shape of CFDs. Some of the true ECN brokers that we reviewed today offer everything from stocks and indices to metals and energies.