How to Invest Money in South Africa – Top Investments Revealed

Based in South Africa and have a bit of spare money to invest? If so, there’s plenty of asset classes for you to consider. This includes the likes of shares, ETFs, bonds, mutual funds, gold, and even Bitcoin.

The good news is that all of the aforementioned assets – and more, can easily be bought and sold in South Africa from the comfort of your home.

In this guide, we explain How to Invest Money in South Africa in 2022. We also walk you through the process of choosing a low-cost broker and how to make your first investment today!

How to Invest Money in South Africa Quick Tutorial

If you’re looking for a quick-fire tutorial on how to invest money in South Africa online – check out below!

- Step 1: Open an Account With eToro: You’ll first need to open a brokerage account so you can invest online. eToro is a good option, as you will have access to thousands of investments and you won’t be charged any dealing fees or commissions!

- Step 2: Make a Deposit: You will now need to deposit some funds into your investment account. eToro supports several South African payment methods – such as a debit/credit card, bank wire, and e-wallet

- Step 3: Search for Investment: You now need to find the investments that you wish to make. eToro supports everything from stocks, ETFs, and indices, to commodities, forex, and cryptocurrencies.

- Step 4: Complete Investment: Once you have found an asset that interests you, complete the investment. For this, you simply need to enter your stake and confirm the order.

That’s it – you’ve just invested money on eToro without paying any commission.

67% of retail investor accounts lose money when trading CFDs with this provider.

Step 1: Choose a Top Investment Platform

If you’re wondering how to invest money in South Africa from the comfort of your home – you will first need to choose a trusted online broker. After all, the broker sits between you and your chosen investments.

There are many things that that you need to look out for when choosing a trusted investment platform – such as:

- Is the broker regulated by a tier-one body like the FCA, ASIC, or CySEC?

- What investments does the broker support – such as stocks, ETFs, index funds, and commodities?

- How much does the broker charge to buy and sell investments?

- How simple is the investment platform to use and is it suitable for newbies?

- What South African payment methods does the broker accept?

As you can see from the above – there is a lot to consider when choosing a South African investment platform.

To save you from countless hours of research, below we discuss a selection of the best stock brokers that allow you to invest money in South Africa.

1. eToro – Overall Best Investment Platform in South Africa

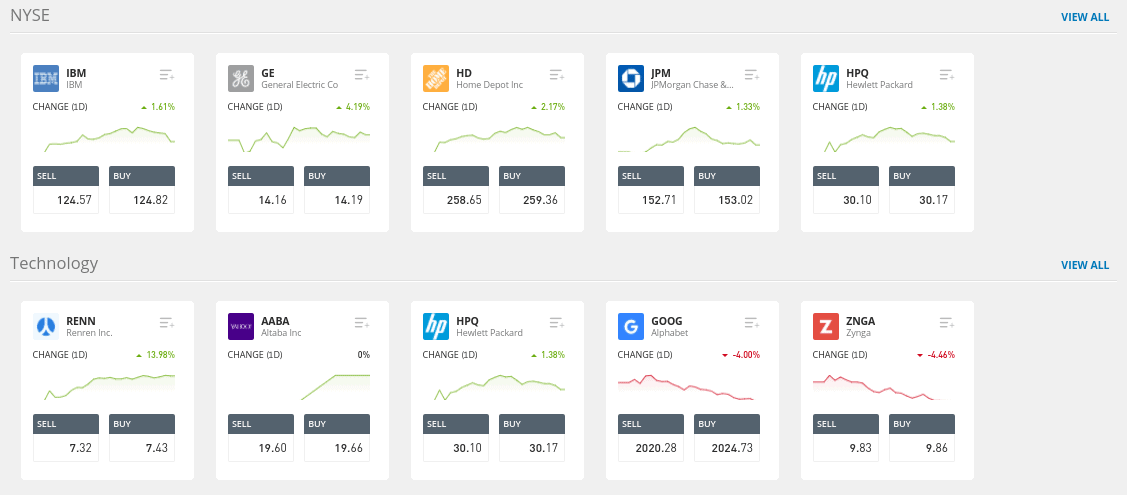

This includes 17 international stock exchanges – such as markets in New York (NASDAQ and NYSE), London, Amsterdam, Stockholm, Hong Kong, Frankfurt, and more. You can invest from just $50 into your chosen stock, as eToro supports fractional ownership.

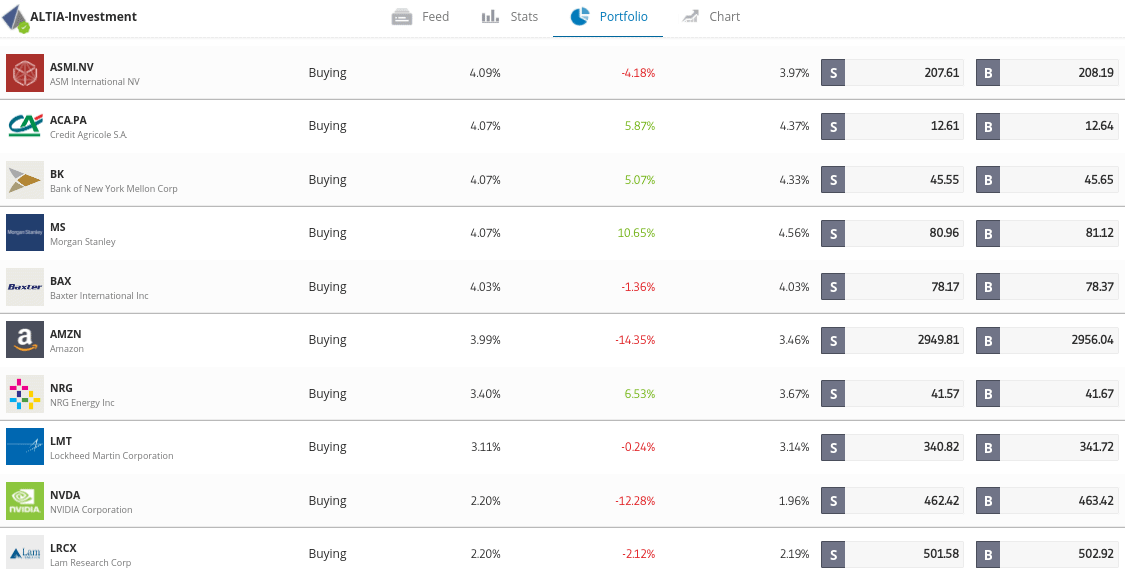

This is also the case with the 250+ ETFs that eToro supports. These track a magnitude of markets – such as gold, index funds, dividend stocks, and more. If you’re looking to buy cryptocurrency – eToro is also a great option. Not only does it allow you to invest in 18 different coins, but the minimum stake is just $25. There is also a CFD trading facility that supports indices, hard metals, energies, and forex. An additional investment product that you might consider is the Copy Trading tool.

This is suited for investors in South Africa that wish to take a hands-off approach. All you need to do is select an experienced trader that you like the look of, choose an amount to invest, and all future trades will be mirrored in your own eToro portfolio. There are also eToro CopyPortfolios, which are professionally-managed. When it comes to fees, no other brokers in South Africa get close to eToro. This is because all investments can be made commission-free.

This is the case when you buy an investment and again when you cash out. As there are no ongoing platform fees, you can keep hold of your investments for as long as you wish. Deposits do come with a very small FX fee of 0.5%, which covers South African debit/credit cards, e-wallets, and a bank wire. In terms of safety, eToro is regulated by three bodies – the FCA, ASIC, and CySEC. This ensures that you can invest in a safe and secure ecosystem.

You can read our full eToro review here!

Pros:

- All accounts denominated in US dollars

75% of retail investor accounts lose money when trading CFDs with this provider.

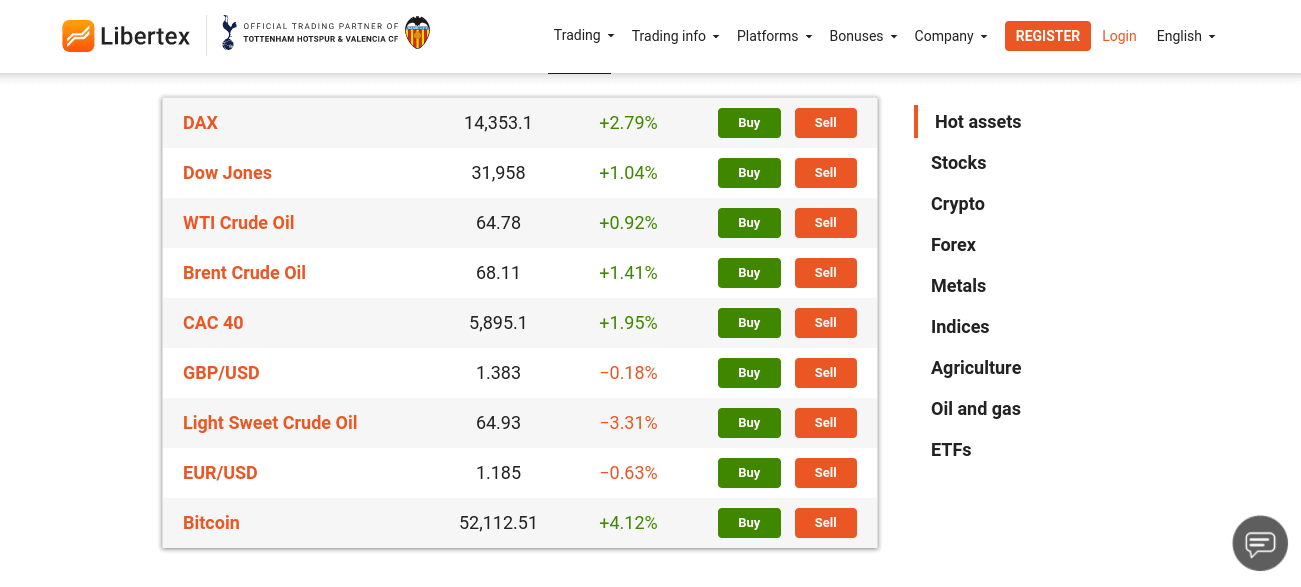

2. Libertex – Trade CFDs With Zero Spreads

For example, if gold is priced at $1,800 per ounce, you would need to speculate on whether you think this will rise or fall in the short-term. Trading CFDs at Libertex does come with a number of benefits that might be of interest. For example, you can trade your chosen asset with leverage – meaning you will have access to more capital than you have in your account.

At Libertex, this stands at over 1:500 when trading major indices like the S&P 500 and NASDAQ 100. In simple terms, this means that a 1,000 rand account balance would permit a maximum trade size of 500,000 rands. Other assets come with lower limits. For example, Libertex offers 1:300 on gold, 1:200 on forex trading, silver, and copper, 1:100 on several cryptocurrencies, and 1:20 on stocks. As you can see, the Libertex trading suite is super-diverse.

Where Libertex really stands out is in the fee department. At the forefront of this is the fact that you won’t be charged any spreads. In fact, the vast majority of markets offered by Libertex can also be traded at 0% commission. This once again makes the platform ideal for short-term investments. When it comes to getting started, Libertex offers a simple signup process that not only takes minutes – but can be completed online or via your phone.

The initial account minimum is just $100, but this goes down to $10 on all subsequent deposits. Supported payment methods include everything from Visa and MasterCard to e-wallets and a bank wire. Finally, your money is in safe hands when using Libertex, as the platform has been active in the online trading scene for over two decades. It is regulated not only by CySEC – but also the Financial Sector Conduct (FSP Number: 47381).

Pros:

- Only offers CFDs

- Not suitable for long-term investments

75.3% of retail investor accounts lose money when trading CFDs with this provider.

Step 2: Choose an Investment

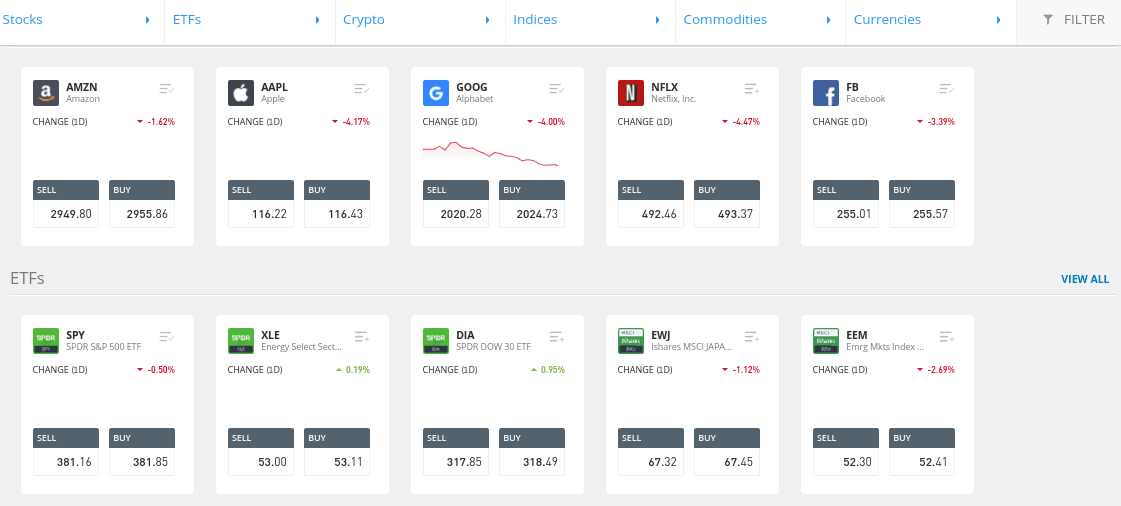

If you’re wondering how to invest money in South Africa – you should know that you have access to thousands of markets. As we covered in our mini-reviews of eToro and Libertex, this covers everything from stocks and cryptocurrencies to gold and indices.

If you are a complete newbie and you’re not sure which assets are right for you and your financial goals – the sections below discuss the best investments in South Africa right now.

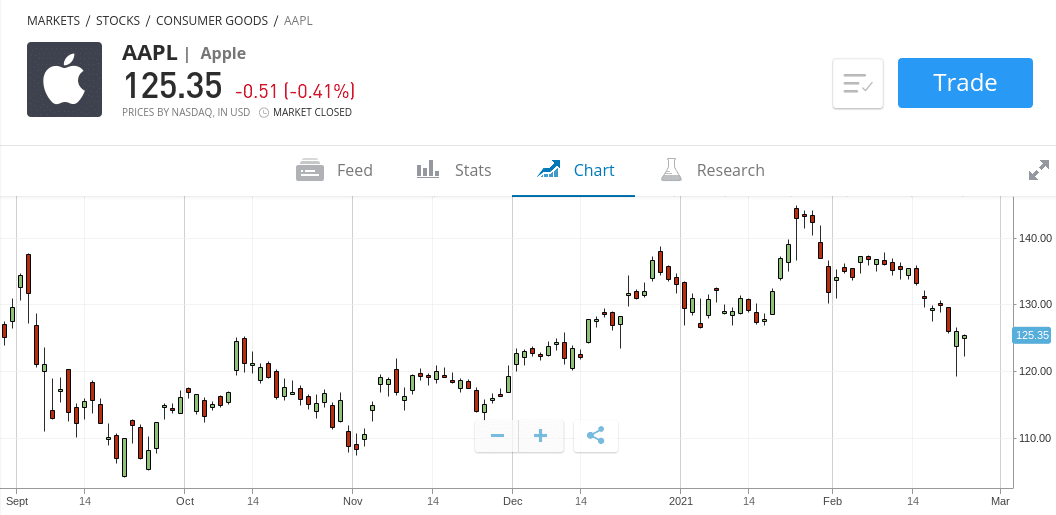

Stocks

Stocks and shares are often the go-to investment for South Africans. This is because they are easy to access and you can grow your investment in two forms – capital gains and dividends.

The former refers to the profit you will make if you sell your shares at a higher price than you originally paid. When it comes to dividends, not all stocks pay them. But, those that do will typically make a payment every three months. The more stocks you hold, the more you will be entitled to.

The best thing about investing in stocks in South Africa is that several platforms now support fractional shares. This means that you can purchase a small fraction of one stock – rather than having to buy a full share.

For example, if you were interested in Amazon – which trades at over $3,000 per stock (about 45,000 rands), this is out of reach for many first-time investors. However, by investing in Amazon at eToro – the minimum is just $50 (about 750 rands).

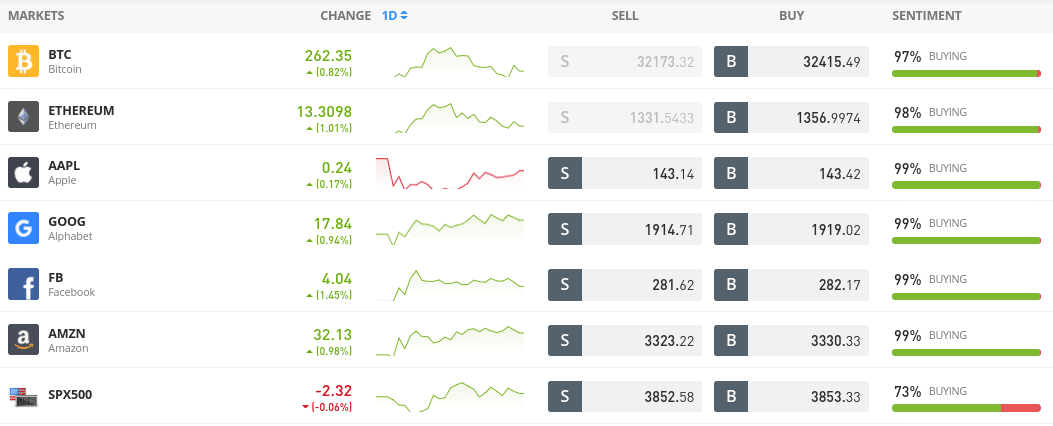

To give you an idea of some of the most popular stock investments with South Africans:

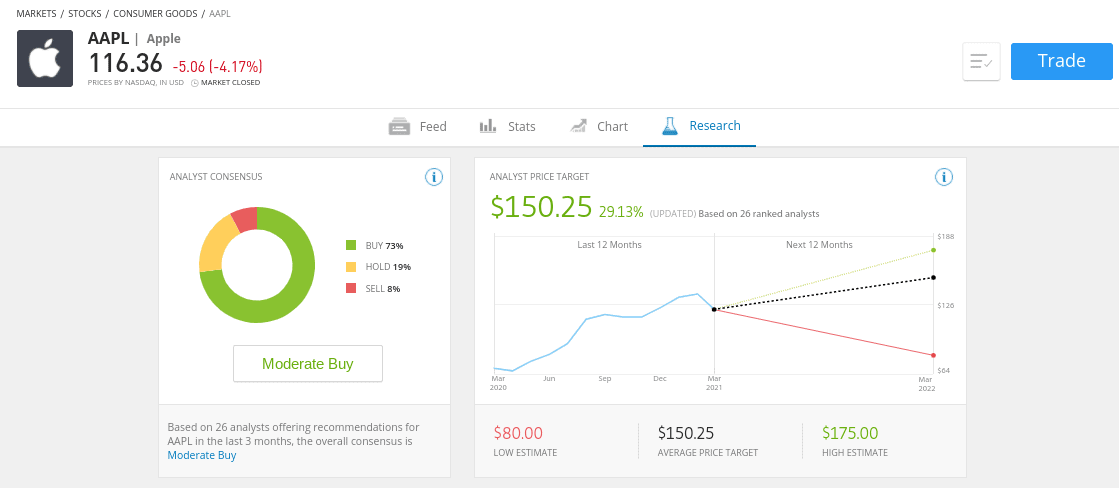

- US Stocks: Many South Africans buy shares listed on the NYSE or NASDAQ. These exchanges contain the largest companies in the world. Think along the lines of Tesla, Amazon, Apple, and Facebook.

- South African Stocks: Many South African investors prefer to stick with domestic stocks on the JSE. Some of the most traded JSE companies at the time of writing include Renergen, British American Tobacco, Naspers, Anglo American, and BHP Group

- UK Stocks: A lot of South Africans also have an interest in UK stocks listed on the FTSE 100. Largely, with the Brexit saga no longer creating market uncertainties, alongside a rising pound sterling and hugely successful vaccine rollout – the London Stock Exchange presents a great way to diversify into the UK economy.

- Emerging Market Stocks: If you have a higher appetite for risk and thus – seek higher-than-average returns, you might consider stocks listed in the emerging markets. This might include the likes of Thailand, Brazil, Russia, Indonesia, and China.

Crucially, irrespective of which stocks you decide to invest in, make sure you choose a broker that offers low commissions and account minimums.

ETFs

If you’re wondering how to invest money in South Africa in a more diversified way – ETFs (exchange-traded – funds) are likely to be of interest.

In a nutshell, ETFs track a certain marketplace – such as index funds, dividend stocks, emerging market bonds, or gold. In most cases, by investing in an ETF you will be purchasing dozens, hundreds, or even thousands of different financial instruments.

For example:

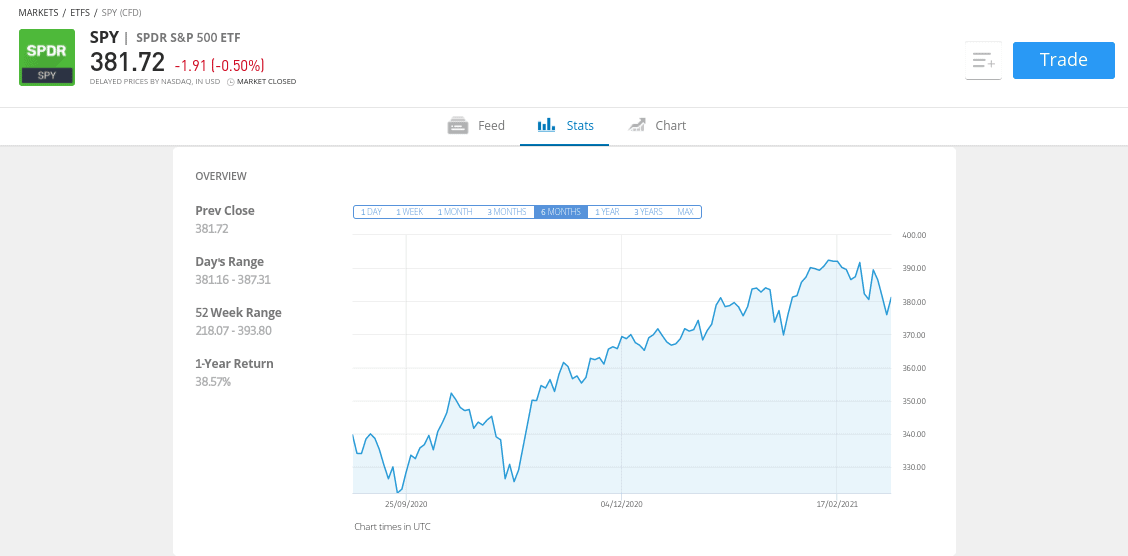

- Let’s suppose that you invest in the SPDR S&P 500 ETF at eToro

- This ETF tracks 500 large companies in the US – including the likes of Microsoft, Disney, Nike, IBM, Apple, Amazon, Tesla, Facebook, Visa, and Paypal

- As such, you now own a stake in all 500 stocks that represent the S&P 500

Most ETFs are weighted, meaning that your investment is spread out based on certain metrics. For example, if you were to invest $1,000 in the S&P 500 ETF and Microsoft has a weighting of 4% – $40 of your investment would be in Microsoft stocks. If 1% was weighted towards Paypal, you would own $10 worth of in Paypal stocks – and so on.

In terms of what ETFs you can invest in, this covers everything from:

- Index Funds: On top of the S&P 500, ETFs can track dozens of other index funds. This includes the likes of the FTSE 100, Dow Jones 30, NASDAQ 100, and the JSE Top 40.

- Dividend Stocks: There are heaps of top-performing ETFs that focus exclusively on high-yielding dividend stocks. This is suitable for those of you that seek regular income.

- Growth Stocks: If you’re wondering how to invest your money in South Africa via growth stocks, ETFs offer a great entry into this market. This is because rather than speculating on one or two companies, there are ETFs that give you access to dozens of growth stocks.

- Bonds: As bonds are often difficult to access for South African retail clients, ETFs allow you to invest with ease. There are some ETFs that contain thousands of bond instruments from a variety of marketplaces – which is great for diversification.

- Emerging Markets: There are many ETFs that focus on the emerging markets. For example, your portfolio might contain stocks and bonds from markets in South East Asia, South America, the Middle East, and Eastern Europe.

All in all, ETFs are a great way to invest money in South Africa if you want to create a highly diverse portfolio.

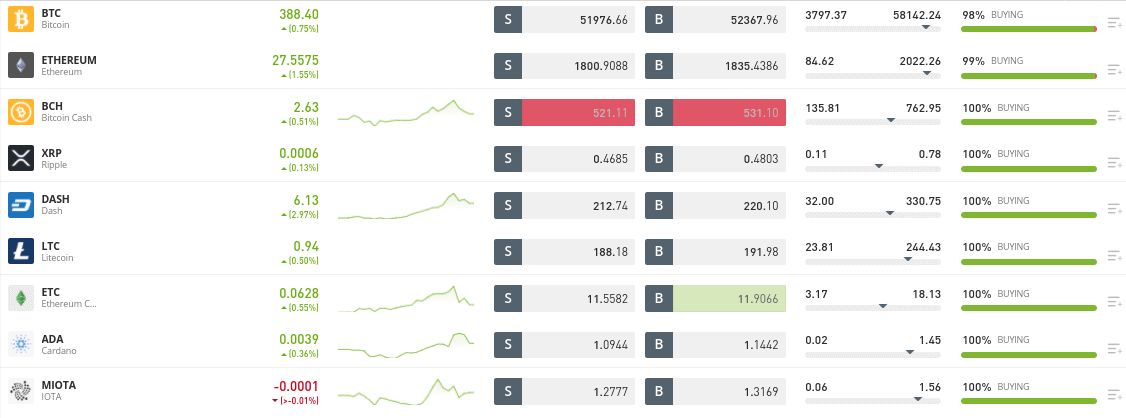

Cryptocurrencies

Cryptocurrencies like Bitcoin and Ethereum are growing at a rapid pace in South Africa – both in terms of market awareness and usage. As such, if you’re looking for an alternative investment to the likes of stocks, ETFs, and bonds – cryptocurrencies are worth considering. After all, Bitcoin has increased in value by a significant amount since it was launched in 2009.

Back then, you would have got dozens of coins for just $1. Fast forward 12 years and Bitcoin has since surpassed highs of $58,000. However, if you do decide to buy Bitcoin – or any crypto-asset for that matter – you should know that you are entering a volatile and speculative market.

Sure, cryptocurrencies are on a great run of form at the moment. But, history shows us that this can very quickly turn southwards – so you must have a firm grasp of the risks before taking the plunge. If you’re wondering how to invest money into cryptocurrencies in South Africa – you need to find a regulated platform that offers low fees and small account minimums.

At eToro, you can invest in 18 digital currencies commission-free and the minimum is just $25. The latter point is crucial, as this ensures that you can keep your crypto-asset stakes modest and thus – avoid overexposing your portfolio to this speculative marketplace.

Commodities

Another asset class to consider when learning how to invest money in South Africa is that of commodities. There are several popular brokers in this space that offer all three commodity categories – metals, energies, and agricultural products.

- Metals: Gold and silver and the most traded metals, albeit, you can also access platinum, copper, and palladium

- Energies: This market largely centers on crude oil and natural gas – both of which can be traded with ease in South Africa

- Agricultural Products: You then have agricultural commodities like wheat, corn, sugar, cocoa, soybeans, and coffee

If you are more of a long-term investor, then many South Africans like to allocate some of their portfolio funds to gold. This is because gold has held its own for thousands of years and offers a great way to hedge against the stock markets. This is especially the case during times of economic uncertainty.

In terms of how to invest money into a commodity like gold – the best option on the table is via an ETF. For example, the largest ETF in this space – the SPDR Gold, is physically-backed by gold. This means that by investing in the ETF, the value of your investment will rise and fall in correlation to the market price of the asset.

Best of all, by investing in commodities via an ETF – your money is never tied up. This is because ETFs are listed on public stock exchanges and thus – you can cash out your investment back to rands at any given time.

Step 3: Research the Market & Choose an Investment Strategy

Once you have decided which investments take your fancy – it’s then time to take a step back. After all, not only do you need to learn how to research the financial markets – but you also need to come up with an investment strategy.

To help you along the way, below we outline some helpful tips that will allow you to invest your hard-earned rands in a risk-averse and systematic manner.

Tip 1: Consider Your Financial Goals and Investment Budget

Perhaps the first step that all newbie investors should take is to consider what your financial goals are.

- For example, are you looking to create a long-term investment plan that spans several decades?

- Or, are you looking to take a more active role in the investment scene – by timing the market and trading assets on a short-term basis?

Understanding what your objections are is important, as this will dictate the type of investments that are suitable and how much time you will need to dedicate.

In addition to this, you also need to consider what your investment budget is. The good news is that you don’t need to have a 6-figure sum to be able to invest in South Africa.

Instead, user-friendly brokers like eToro require just $50 when buying stocks and $25 when investing in digital currencies. Either way, it’s important to assess how much money you have to invest in the financial markets before getting started.

Tip 2: Learn how to Research Investments

With thousands of investments available to South Africans, knowing which assets to consider can be challenging. With that said, you need to at least have a basic understanding of how the financial markets work before taking the plunge.

For example:

- You might be interested in buying Tesla shares because the stocks have performed so well in recent times. But, what does the future hold for the company in terms of upside?

- Similarly, you might be interested in an ETF that tracks gold, but is now the right time to invest when the stock markets continue to thrive?

Furthermore, it’s also a good idea to learn how to find value investments. These are assets that are perceived to be undervalued based on the current prices. As per the COVID-19 pandemic and wider lockdown measures – there are heaps of undervalued stocks on offer at present.

A good way to find these undervalued investments is to look at things like:

- The current market price in relation to pre-COVID levels

- Accounting metrics like the book-to-value and price-to-earnings ratio

- Growth levels in terms of revenue, operating income, and profit margins

- The strength of the company’s balance sheet – focusing on free cash flows and debt levels

On top of analyzing specific investments – like a stock or ETF, you also need to keep tabs on the wider markets. For example, when Central Banks like the Federal Reserve increase or decrease interest rates, this can have a positive or negative impact on the stock markets. Similarly, if there are rising tensions in the Middle East, this will have an effect on commodities like oil and natural gas.

Tip 3: Create a Diversification Plan

Irrespective of which assets take your fancy – when learning how to invest your money in South Africa it is crucial that you diversify. In the investment scene, this means creating a portfolio that covers many different asset classes, markets, risk levels, and economies.

For example, let’s suppose that you have 30,000 rands to invest in the financial markets. An inexperienced investor might consider investing the entire amount to a small selection of stocks, say – Tesla, IBM, Mircosoft, and Facebook.

There are many reasons why an investment plan like this is fraught with risk:

- You are investing in just four stocks – so you are exposed

- You are also over-exposed to the US tech industry – which often moves up and down in tandem

- You have only invested in stocks – and not diversified into other asset classes

Now, a seasoned investor in South Africa would instead allocate their 30,000 rands into a highly diversified basket of assets to mitigate their long-term risks.

This might look like the following:

- 10% in growth stocks

- 20% in blue-chip stocks

- 20% in gold

- 20% in ETFs

- 5% in cryptocurrencies

- 25% in low-risk bonds

As you can see from the above, a diversified portfolio will contain several asset classes as different weights. For example, there is 25% in low-risk bonds and 20% in blue-chip stocks. But, the investor also has exposure to some higher-yielding assets – like growth stocks and cryptocurrencies.

Not only should your diversification plan cover many different asset classes, but also marketplaces. For example, you might consider investing in assets listed in South Africa, the US, the UK, and the emerging markets.

Tip 4: Dollar-Cost Average Your Investments

If you’re looking to invest in the most risk-averse way possible, another tip to consider is that of dollar-cost averaging. In simple terms, this means that instead of investing one lump sum – you will create a consistent investment plan at set intervals. For example, in the section above, we discussed what a seasoned trader in South Africa would do with a 30,000 rand investment.

Although diversification is the right strategy to take, it wouldn’t make sense to invest to entire 30,000 rands in one go. In doing so, you are over-reliant on timing the market correctly. In other words, if you invested the 30,000 rands at a time when the wide markets were about to peak – you would have overpaid for the respective assets.

To counter this risk, it would be much wider to invest small amounts on a regular basis – otherwise known as dollar-cost averaging.

This might look like the following:

- You have 30,000 rands to invest

- You invest 1,000 rands into the S&P 500, 1000 rands into gold, and 1,000 rands into a bond ETF

- You repeat the above process at the end of each month

- This means by month 10 – you would have made 10 individual investments into each of the above assets

- In doing so, you will have invested at a different cost price each time

The main benefit of investing at regular intervals is that you are not overly reliant on the current health of the markets. On the one hand, the markets are moving southwards, each investment will result in a cheaper cost price. If, however, the markets are moving northwards, you’ll pay a higher cost price – but you will be making money along the way.

Now, in order to [A] benefit from dollar-cost- averaging and [B] be able to diversify at the same time – you need to choose a broker that permits small minimum investments. As we noted earlier, the minimum stake on eToro is just $25 on digital currencies and $50 on stocks and ETFs. As such, this allows you to create a super risk-averse diversification plan via dollar-cost averaging!

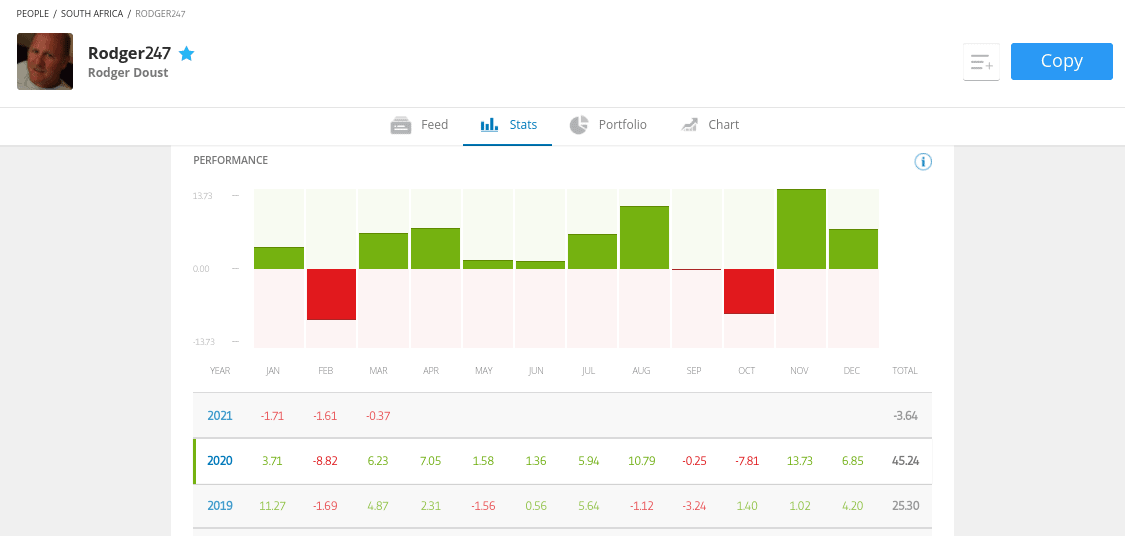

Tip 5: Consider Passive Investing via Copy Trading

If the thought of research the markets, diversifying, dollar-cost averaging, and creating financial goals seem overwhelming – there is another option. That is to say, rather than taking an active role to investing in South Africa – while not leave it to the experts? In doing so, your chosen provider will determine which assets to buy and sell – and when.

One of the best tools in the market in this respect is the eToro Copy Trading feature. The platform is now home to over 17 million traders – many of which are part of this program.

- What you can do is browse the best-performing eToro investors – looking at metrics like average monthly returns, risk rating, preferred asset, and average trade duration.

- Then, once you find a pro-investor that aligns with your financial goals – you can copy their portfolio like-for-like.

- You can also elect to copy all ongoing trades.

- So, if the investor offloads their shares in British American Tobacco and then adds Apple stocks – you will mirror the exact same trade.

The best thing about this feature is that you only need to meet a minimum investment of $500 (about 7,500 rands) – and all trades are executed at a proportionate amount. For example, if you invest $500 and the pro-investor allocates 10% of their portfolio into gold – you will invest $50 into gold.

Step 4: Learn How to Invest Money on eToro

This guide has explained the ins and outs of how to invest money in South Africa. Not only in terms of choosing assets – but how to choose a reliable broker and what investment plans and strategies to consider.

To conclude, we are now going to walk you through the process of how to invest your money at commission-free platform eToro.

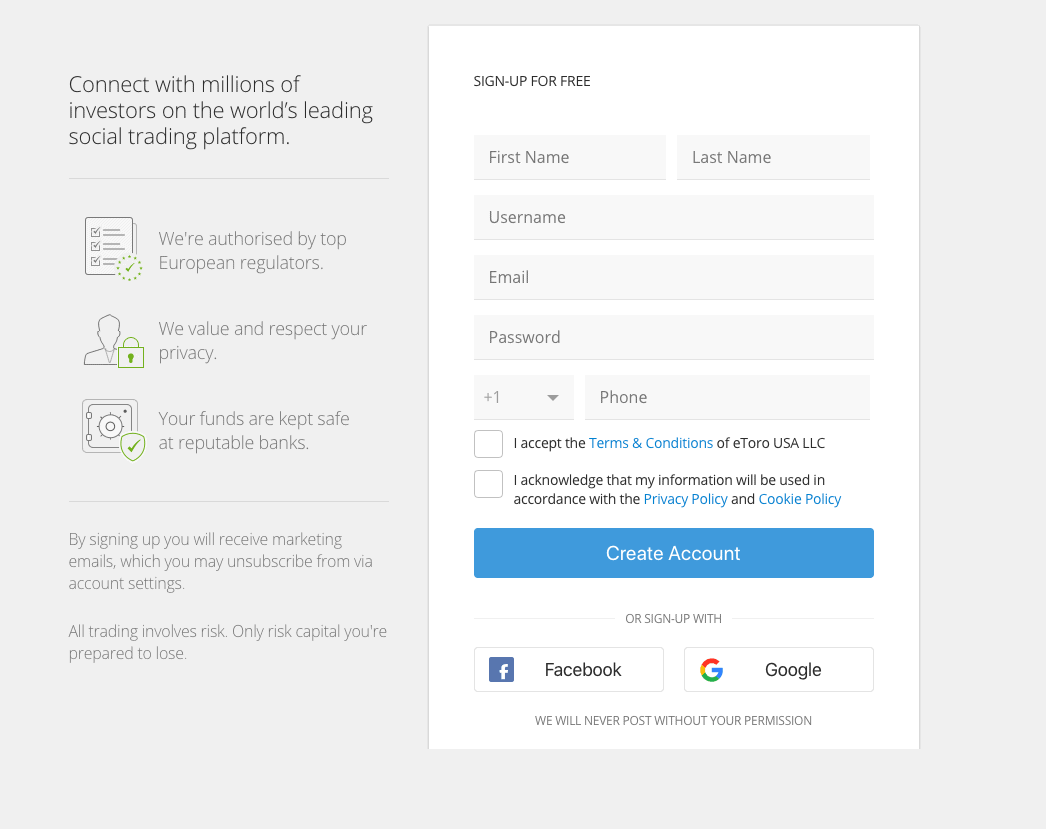

Open an Investment Account

The first part of the process is to open an investment account at eToro. This shouldn’t take you more than a few minutes. You will first need to visit the eToro website and click ‘Join Now’.

Then, you will be asked to provide a range of information, such as:

- First and Last Name

- Nationality

- Residential Address

- Date of Birth

- Telephone Number

- Email Address

- Username and Passsport

To complete the registration process on eToro, you’ll need to confirm your email address and mobile number.

Upload ID

Regulated brokers like eToro take KYC (Know Your Customer) laws seriously. This means that you will need to upload a couple of documents to verify your identity.

This includes:

- Valid passport or driver’s license

- Utility bill or bank account statement

eToro should be able to automatically verify your documents via its FinTech system.

Deposit Investment Funds

The final step of the setup process at eToro is to make a deposit. After all, you’ll need access to trading funds if you want to make investments from the comfort of your home.

Now, eToro supports a full selection of South Africa payment methods – most of which are processed instantly.

This includes:

- Visa

- MasterCard

- Maestro

- Paypal

- Neteller

- Skrill

- Bank Wire

Although eToro allows you to use a payment method that is denominated in South African rands, the US dollar is a primary currency used on the platform. As such, your deposit will incur a small fee of 0.5%. On the flip side, you’ll then have access to thousands of financial markets on a commission-free basis.

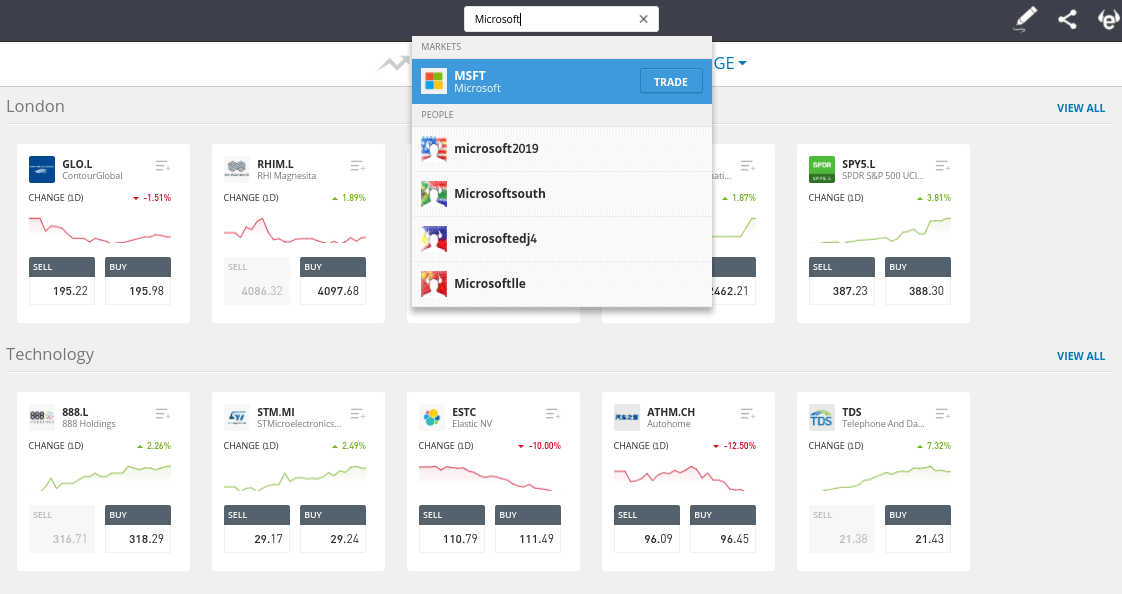

Search for Investments

Now you have made a deposit – you are ready to start making some investments! If you already know the specific asset that you wish to buy – for example, Tesla stocks or the SPDR S&P 500 ETF, you can search for it. However, it’s probably best to spend a bit of time seeing what markets you will have at your disposal.

Simply click on the ‘Trade Markets’ button on the left side of the page and you will see the many asset classes supported (e.g. stocks, indices, crypto, forex, etc.).

n clicking on an asset class, you can then narrow the results down further. For example, when clicking on the ‘Stocks’ button, you can filter down by the exchange (e.g. NASDAQ, NYSE, London) and the sector (e.g. consumer goods, tech, healthcare).

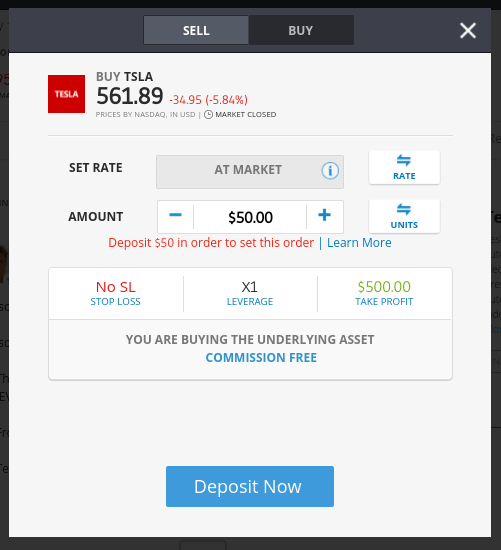

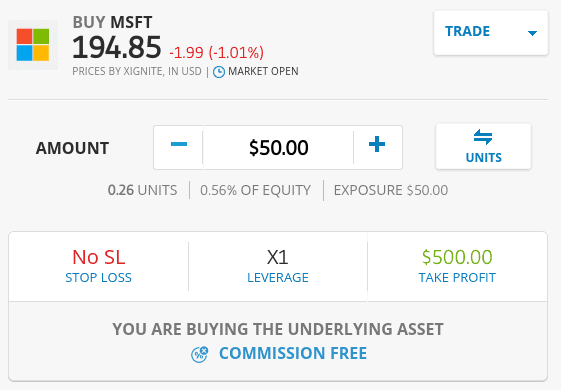

Once you have found an investment that you wish to trade – click on it. On the next page, you’ll need to click on the ‘Trade’ button. In doing so, an ‘order box’ will appear.

Place Investment Order

Assuming you are ready to make an investment into your chosen financial instrument – all you need to do now is place an order. In the example below, we are placing an investment order on Microsoft stocks. As you can see, in the ‘Amount’ box, this is set to $50 – which is the minimum. You can invest any amount of your choosing – as long as it is at least $50.

You will also see buttons related to ‘stop-loss’ and ‘take-profit’ orders, as well as leverage. You don’t really need to worry about these orders unless you are planning to trade on a short-term basis.

Nevertheless, to complete your commission-free investment on eToro – click on the ‘Open Trade’ button.

Note: If you instead see a button that says ‘Set Order’, this means that the respective market is closed. By clicking it, eToro will execute your investment order once the market reopens.

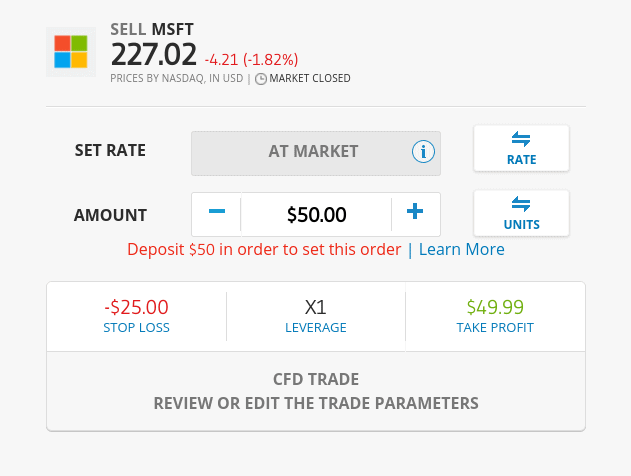

Cash Your Investment Out

There will likely come a time when you decide to cash your investment out. This might be because you want to lock in your profits or because you need access to cash. Either way, the process at eToro takes seconds.

Firstly, click on the ‘Portfolio’ button on the left side of the page. You will then see a list of your investments as well as the current market value. Click on the ‘Sell’ button next to the investment that you wish to sell. If the respective market is closed, this will be greyed out.

eToro will then ask you how much of your investment you wish to sell. You can offload your investment in full or just a partial amount to reduce your exposure. Either way, once you complete the sell order, the funds will be reflected in your eToro cash balance.

Then, you can use this money to invest in other assets on eToro and request a withdrawal. If its the latter, the funds will be sent back to your original payment method – such as your bank account, debit/credit card, or e-wallet. Take note, the minimum withdrawal on eToro is just $30 and you will be charged a fee of $5.

Conclusion

This comprehensive guide on how to invest money in South Africa has covered everything there is to know. Irrespective of your experience in the online investment scene – getting started could not be easier.

With that said, don’t forget about the importance of diversification, creating an investment plan, and dollar-cost averaging. You will, of course, also need to choose a suitable broker that is able to execute your investments on your behalf.

We found that eToro offers the best route to invest in the financial markets for South Africans. This is because the regulated broker offers everything from stocks and ETFs to commodities and cryptocurrencies – all on a commission-free basis.

The minimum stake size starts from just $25 too. Plus, if you’re looking to invest passively – eToro offers an innovative Copy Trading tool!

eToro – Invest Money in South Africa – 0% Commission

67% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

How to invest and make money daily?

If you're wondering how to invest and make money daily, this means that you are looking to take a short-term approach to the financial markets. After all, investments should be viewed as a long-term strategy. Nevertheless, if you're looking at how to invest and make money daily, you might be suited for Copy Trading. This is a feature offered by eToro that allows you to copy a seasoned day trading pro. Everything time the pro buys and sells a financial instrument - the same trade will be mirrored in your own account.

What is the best investment option in South Africa?

With thousands of financial markets across dozens of asset classes - the best investment option will vary from person to person. For example, if you are looking to solid, predictable growth - then blue-chip stocks and bonds might be of interest. If, however, you're looking to make above-average returns - the likes of growth stocks, commodities, and cryptocurrencies might be more up your street.

What can I invest in to make money in South Africa?

All investment classes give you the opportunity to make money. The amount you make is largely dependent on how much risk you feel comfortable taking. For example, while Bitcoin generated returns of over 10x in 2020 - the risks are much higher than the likes of dividend stocks or government bonds.

How to invest money in South Africa online?

If you are based in South Africa and wish to invest money online - you will first need to choose a trusted broker. eToro is a good option, as the broker offers thousands of markets on a commission-free basis. Plus, account minimums are really low.

How do you invest in the JSE?

If you are looking to invest in the JSE - you have two options. Firstly, you can pick and choose individual JSE-listed stocks - such as Naspers or BHP Group. Secondly - and perhaps the more attractive option is to invest in an ETF that tracks the JSE Top 40. In doing so, you will be investing in 40 of the largest JSE-listed stocks through a single trade.