Best Copy Trading Platform in South Africa 2022 – Cheapest Copy Brokers Revealed

More and more investors in South Africa are turning to copy trading platforms – as you will have the opportunity to trade passively. Once you have selected a proven investor to copy – you can sit back and actively trade without needing to do any research or place any orders.

In this guide, we review the Best Copy Trading Platforms in South Africa 2022.

Best Copy Trading Platform 2022 List

Here’s a quick run-through of the best copy trading platforms that we will be reviewing today.

- eToro – Overall Best Copy Trading Platform in South Africa

- Meta Trader 4 via Libertex – Copy Skilled Traders That Focus on Technical Analysis

- Zulutrade via AvaTrade – Copy Trading in South Africa With an FSCA Broker

- Meta Trader 5 via FinmaxFX – Best Copy Trading Platform for High Leverage

- Mirror Trader via AvaTrade – Copy Advanced Algorithmic Trading Strategies

- cTrader via Pepperstone – Copy Professional Traders That Utilize APIs and Algo Bots

- Duplitrade via Pepperstone – Duplicate Proven Automated Strategies

- CopyKat via CM Trader – Copy Trading Tool Offered by a South African Broker

Best Copy Trading Platforms Reviewed

In choosing the best copy trading platform for your needs – there is lots to consider. On top of the specific copy trading tool itself, you also need to look at what markets the broker offers, applicable fees and commissions, supported payment methods, and the safety of your funds.

To help you make the right decision, below you will find the very best copy trading platforms in South Africa for 2022.

1. eToro – Overall Best Copy Trading Platform in South Africa

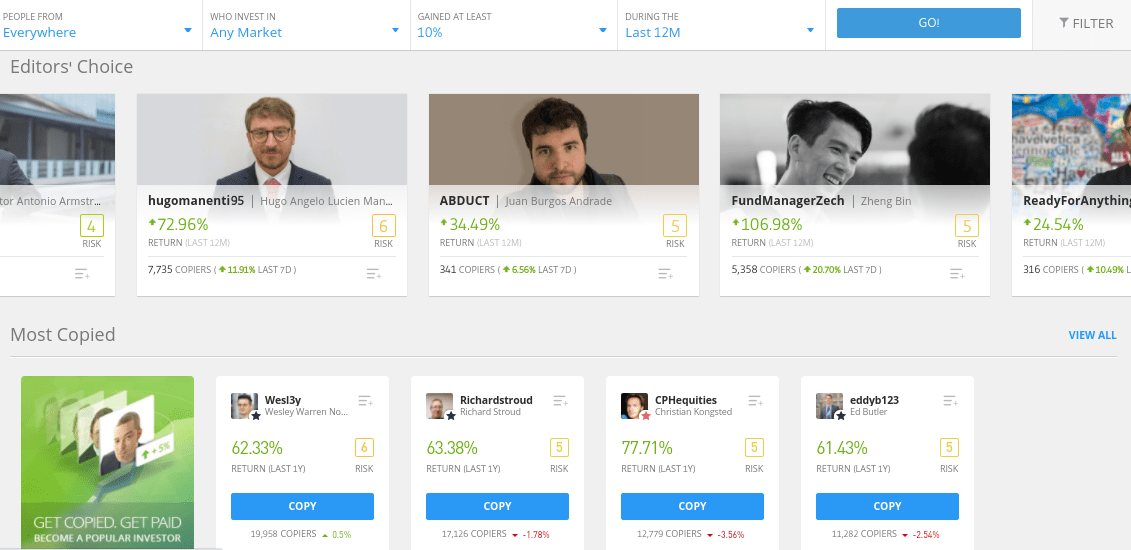

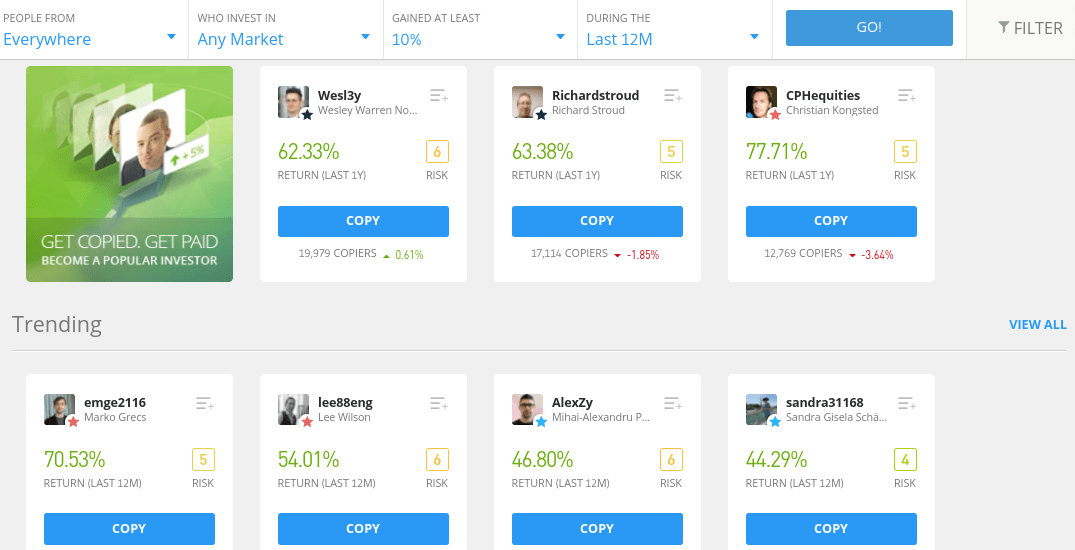

On top of copy trading services, the platform also offers self-directed investing. This means that you can buy and sell thousands of financial instruments at the click of a button. Supported markets include ETFs, cryptocurrencies, forex, commodities, indices, and thousands of stocks. For this reason, eToro has gained a reputation as one of the best ETF apps across the board. Now, the copy trading tool at eToro will get you access to tens of thousands of verified investors that use the site themselves.

Past performance is not an indicator of future results

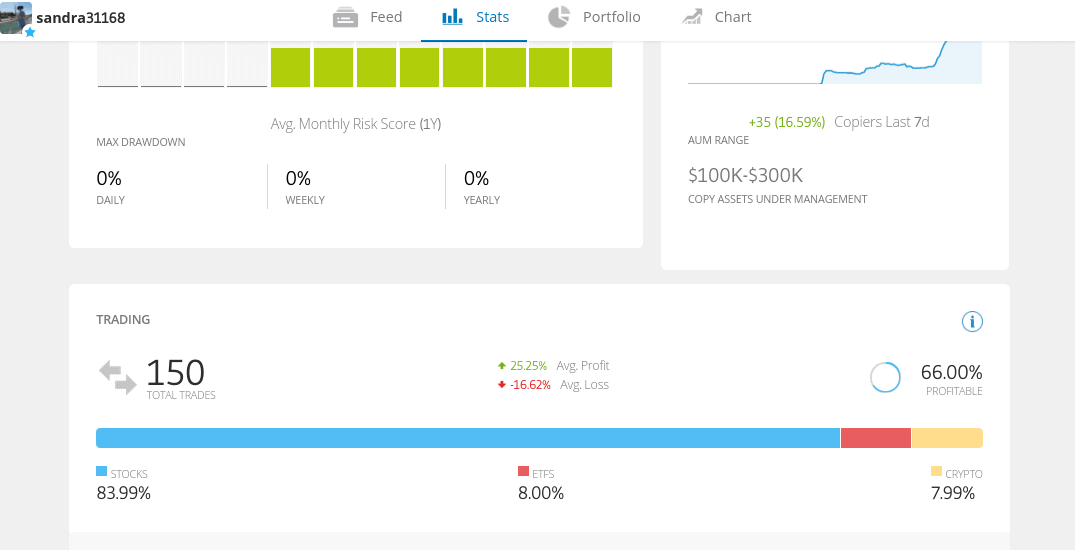

This means that you will have a significant amount of data to utilize when choosing the best trader for your financial goals. For example, you can see how much profit the trader has made since joining eToro, alongside the average ROI for each month. You can then filter your search results down by the average trade duration, preferred market, risk level, and more. Once you have decided which trader to copy – it’s then just a case of deciding how much to invest.

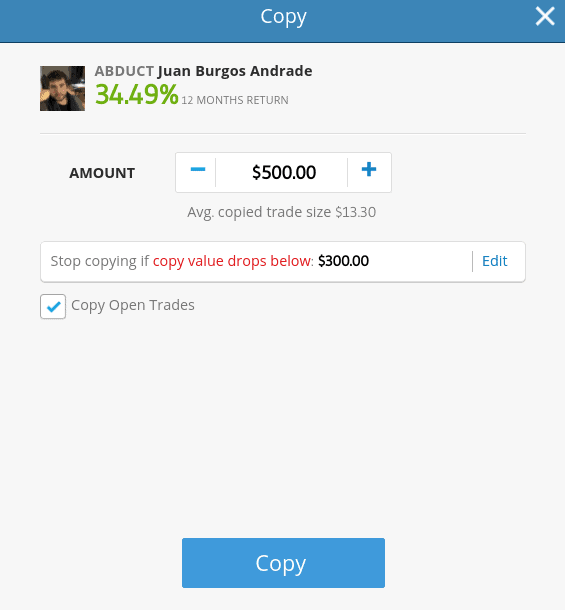

At eToro, the minimum investment per copy trader is just $500. Most importantly, you still retain full control over where your investment funds go. For instance, if the trader adds an asset to their portfolio but you don’t like the look of it – you can remove it. Similarly, if there is an asset you wish to add to your portfolio yourself, this is also a seamless process. When it comes to fees, eToro offers commission-free investing on stocks and ETFs.

Past performance is not an indicator of future results

All other assets can be traded on a spread-only basis. You will not be charged any extra fees for copying a trader at eToro – which is a major benefit. We also like the fact of how easy it is to get started with the copy trading service at eToro. Opening an account takes minutes and you can deposit funds instantly with a debit/credit card, e-wallet, or bank transfer. We should also note that eToro is heavily regulated – which includes licenses with ASIC, CySEC, and the FCA.

Pros:

- Buy shares and ETFs without paying any commission or dealing charges

- 2,400+ shares listed on 17 international markets

- More than 20 million clients

- Perfect for beginners

- Social and copy trading

- Mobile trading app

- Regulated by the FCA, CySEC, and ASIC

Cons:

- Not suitable for advanced traders that like to perform technical analysis

67% of retail investors lose money trading CFDs at this site

2. Meta Trader 4 via Libertex – Copy Skilled Traders That Focus on Technical Analysis

Meta Trader 4 (MT4) is the most utilized third-party trading platform in the online space. The main appeal of MT4 is that it comes packed with tools that are ideal for performing advanced technical analysis.

This includes an abundance of technical indicators and chart drawing tools that are highly conducive to finding new pricing trends. With that said, MT4 also offers a copy trading facility that works much the same as any other platform on this list.

This is because you will be mirroring the buy and sell positions of your chosen trader like-for-like without needing to do any research yourself. Take note, you still need to have an account with a top-rated MT4 broker that is able to execute your orders on your behalf.

For this, Libertex stands out – as the broker allows you to trade with ZERO spreads. This is the case across all its supported markets – which includes indices, ETFs, forex, cryptocurrencies, stocks, and commodities. When it comes to commission, this is usually between 0-0.1%. Crucially, Libertex is an FSCA regulated broker.

Pros:

- ZERO spreads on all markets

- 0% commissions on some stocks

- Leverage available

- Educational guides and webinars

- Accepts PayPal

- MT4 supported

- Mobile trading app

- Regulated and trustworthy broker

Cons:

- Only offers CFDs

75.3% of retail investor accounts lose money when trading CFDs with this provider.

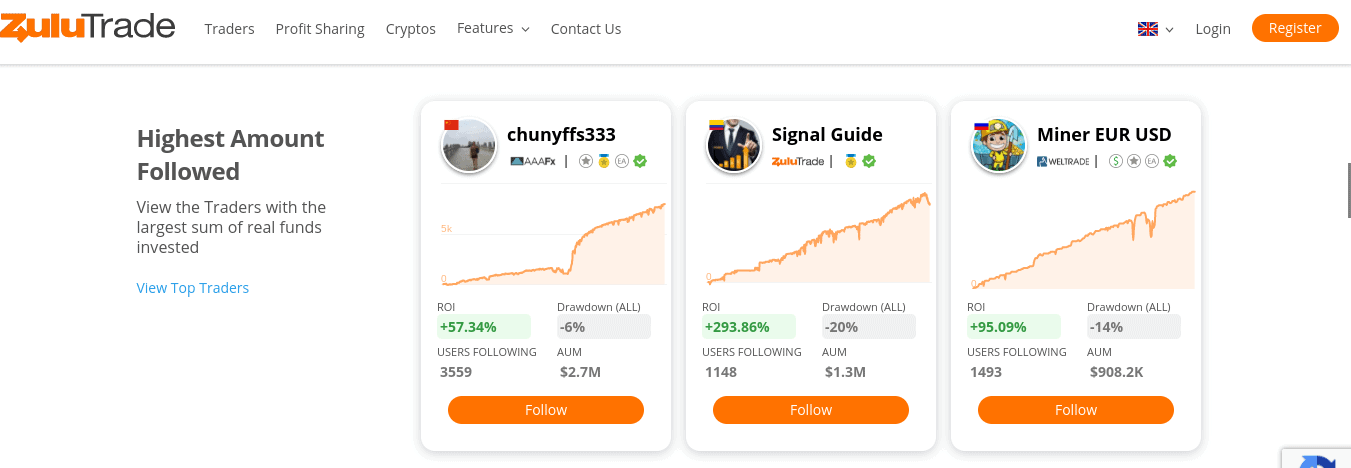

3. Zulutrade via AvaTrade – Copy Trading in South Africa With an FSCA Broker

Next up on our list of platforms offering copy trading in South Africa is that of Zulutrade. This platform allows you to choose a trader that you like the look of and mirror them like-for-like. You’ll have access to a number of data points that allow you to make an informed decision.

The set-up process is a lot more complex than that of eToro, as Zulutrade must be connected to either MT4 or MT5. Naturally, this means that you first need to open an account with an MT4/MT5 broker. For this, we like AvaTrade – as the broker gives you access to MT4, MT5, and Zulutrade.

Plus, the platform is authorized and regulated by the FSCA – alongside five other bodies. Once you are set up, Avatrade gives you access to thousands of markets – all of which can be traded at 0% commission. When trading major assets like forex and indices – you’ll get some of the best spreads in the industry.

In terms of the fundamentals, Avatrade requires a minimum deposit of $100 to get started. You can usually open an account in just a few minutes and deposit funds instantly with a debit or credit card. Bank wires are also available to those in South Africa but this will delay the process.

Pros:

- Trade CFDs on stocks, forex, and commodities

- All fees built into the spread

- Includes paper trading with MetaTrader 4

- Copy and social trading features

- Great reputation

- Heavily regulated

Cons:

- Very high inactivity fee

73.05% of retail investors lose money when trading CFDs at this site

4. Meta Trader 5 via FinmaxFX – Best Copy Trading Platform for High Leverage

If this sounds like you – might want to consider using a copy trading platform that offers high leverage. For this, we like FinmaxFX – as the broker offers leverage of up to 1:200 on major forex trading pairs – even if you are a retail client. This means that you can turn a $50 account balance into trading capital of $10,000.

In order do copy trade at Finmaxfx, you will be going through Meta Trader 5 (MT5). Much like MT4, this is a hugely popular third-party trading platform that is used by seasoned technical traders. The process will require you to open an account with MQL5, and then browse the many signal providers available.

Each provider charges a monthly subscription fee that will vary depending on the trader. Then, you will need to connect your MQL5 account with MT5, and in turn, with FinmaxFX. Once you are set up, you will have access to a plethora of financial markets. This is inclusive of forex, stocks, bonds, cryptocurrencies, and commodities- all in the form of CFD instruments.

Pros:

- Trade forex with 200:1 leverage

- Supports forex signals trading with MetaTrader 5

- Trading bonuses starting at 30%

- Automated copy trading through ZuluTrade

- Regulated by Vanuatu SEC

Cons:

- High minimum deposit for the Mini Account

- Social trading network isn’t the most robust

Your capital is at risk.

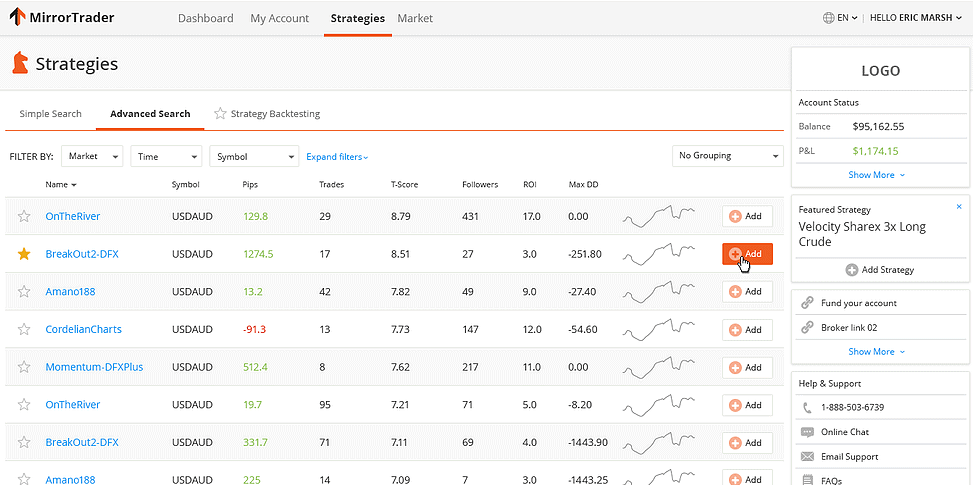

5. Mirror Trader via AvaTrade – Copy Advanced Algorithmic Trading Strategies

Mirror Trader is an automated trading software offered by Tradency. This particular copy trading system will see you mirror a proven system – many of which are based on algorhtmic strategies.

Once you have chosen a strategy that you like, the Mirror Trader protocol will ensure that all ongoing buy and sell positions are replicated in your own portfolio. However, in order to use Mirror Trader, you will need to have an account with a broker that supports it. Once again, we like the look of AvaTrade for this – which we reviewed earlier. #

Pros:

- Trade CFDs on stocks, forex, and commodities

- All fees built into the spread

- Includes paper trading with MetaTrader 4

- Copy and social trading features

- Great reputation

- Heavily regulated

Cons:

- Very high inactivity fee

73.05% of retail investors lose money when trading CFDs at this site

6. cTrader via Pepperstone – Copy Professional Traders That Utilize APIs and Algo Bots

Best of all, the platform offers cBots to the general public – meaning that you can copy a successful algo-based strategy at the click of a button. There are heaps of such strategies – most of which have the capacity to trade on a 24/7 basis in a fully autonomous manner.

In order to take advantage of cBots – you need a broker that is compatible with cTrader. For this, Pepperstone is the best provider for the job. This heavily regulated broker offers multiple markets at super-competitive fees and commissions. In fact, by opening a Razor Account, your cBot can trade major forex pairs without paying any spreads.

Pepperstone also supports indices, hard metals, energies, and stocks. All markets come in the form of CFD instruments, meaning that you can copy trade with leverage and short-selling facilities. There is no minimum account balance at Pepperstone and the broker supports debit/credit cards and bank transfers. The platform is also compatible with MT4 and MT5.

Pros:

- Trade CFDs for stocks, forex, and commodities

- All fees built into the spread

- Includes paper trading with MetaTrader 4

- Copy and social trading features

- Great reputation

- Heavily regulated

Cons:

- Very high inactivity fee

Your capital is at risk.

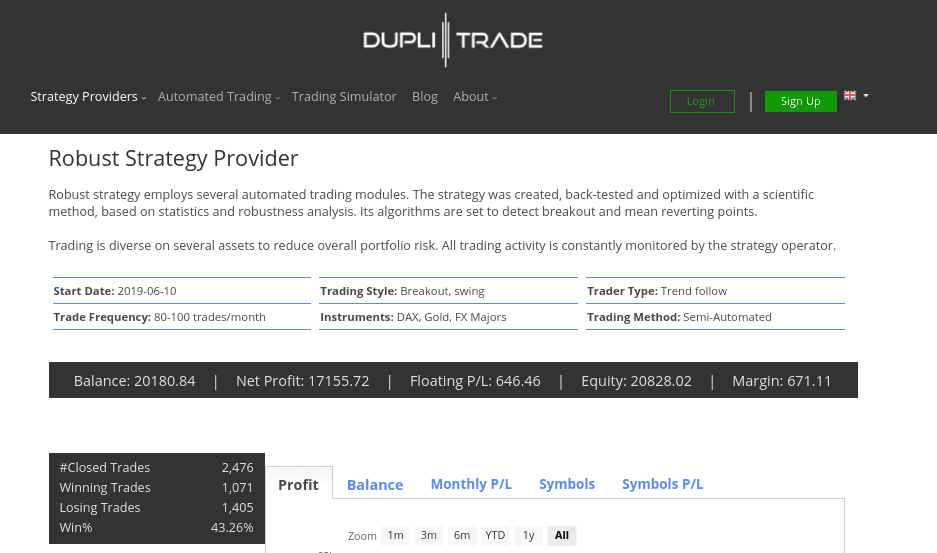

7. Duplitrade via Pepperstone – Duplicate Proven Automated Strategies

As such, rather than copy a specific trader, you will be mirroring the buy and sell positions of an automated system backed by algorithmic code. There are plenty of strategies to choose from and you can review the past performance of each system since it has been actively traded.

To give you an idea of how DupliTrade works, take the Robust strategy as a prime example. With a net profit of 470% since it was launched in 2019, this strategy specializes in reverting points and breakout trends. More than 1,100 people are currently using this strategy – but there are many others to choose from.

Crucially, only a select number of regulated brokers are compatible with DupliTrade – with Peppertstone stranding out from the crowd. The main drawback with DupliTrade is that it requires a minimum capital injection of $5,000. As such, you’ll need to consider an alternative copy trading platform if you don’t have this sort of money to risk.

Pros:

- Trade CFDs for stocks, forex, and commodities

- All fees built into the spread

- Includes paper trading with MetaTrader 4

- Copy and social trading features

- Great reputation

- Heavily regulated

Cons:

- Very high inactivity fee

Your capital is at risk.

8. CopyKat via CM Trading – Copy Trading Tool Offered by a South African Broker

Voted the best Financial Broker in Africa for four years in a row, CM Trading offers everything from indices and cryptocurrencies to forex and stocks. All via CFDs, you can apply leverage to all supported markets.

The broker offers a copy trading tool called CopyKat – which works in a similar nature to that of eToro. This is because you will first be required to find a suitable trader to copy and then decide how much to invest. Then, all ongoing positions will be mirrored in your own CM Trading account. However, unlike the service offered by eToro, CM Trading has a very limited pool of traders.

Pros:

- CopyKat tool offered by South Africa-based broker

- Regulated by the FSCA

- Plenty of supported financial markets

- Leverage available

- Good selection of educational tools

Cons:

- Limited pool of copy traders to choose from

Your capital is at risk.

Copy Trading Guide

If you’re relatively new to copy trading in South Africa, it’s wise to learn the ins and outs of how this passive investment vehicle works. After all, there is no guarantee that you will make money from your chosen copy trading platform – so always consider the risks before taking the plunge.

Here’s what you need to know:

What is Copy Trading?

In a nutshell, Copy Trading is a tool offered by online brokers. It allows you to copy the positions of a successful investor like-for-like – meaning that you will be able to actively trade in a completely passive manner. For example, if your chosen copy trader invests in Apple – as you will. If the trader decides to short-sell USD/ZAR, so will you.

On the one hand, the copy trading phenomenon is ideal for newbies. This is because there is no requirement to understand how fundamental or technical analysis works. These are financial research skills that can take many years to master. But, by utilizing the copy trading tool, you can bypass the need to learn the ropes of chart analysis at the click of a button.

Past performance is not an indicator of future results

On the other hand, we should note that copy trading isn’t only suitable for beginners. On the contrary, you might have a solid grasp of how to trade successfully, but simply lack the time to do this on a regular basis. Once again, this is where copy trading steps in – as you engage in day trading or even scalping without needing to lift a finger.

Example of Copy Trading

Copy trading is suitable for budgets of all shapes and sizes. This is because the copy trading tool utilizes a ‘proportionate’ system. That is to say, while you will be copying your chosen trader, this will be at an amount proportionate to what you invested.

For example:

- Let’s say that invest $1,000 into a copy trader that specializes in forex

- Your chosen trader risks 2% of their portfolio by placing a sell order on EUR/GBP

- In turn, this means that you are risking $20 (2% of $1,000)

- The pair falls by 5% – so the trader closes the position to lock in their profits

- You also made 5% – which is based on the $20 stake that you automatically entered

- As such, you made $1 on this trade without needing to lift a finger

As you can see, it doesn’t matter how much the copy trader is staking on their end, as everything is proportionate. For example, if you had instead invested $2,000 into the trader, the 2% stake would have translated into $40.

How to Choose Traders to Copy

There is no denying that copy trading in South Africa is getting super popular. After all, never before has it been so easy to trade online without needing to actually do any research or place any orders. However, there is a major challenge that needs to be addressed – selecting a suitable copy trader.

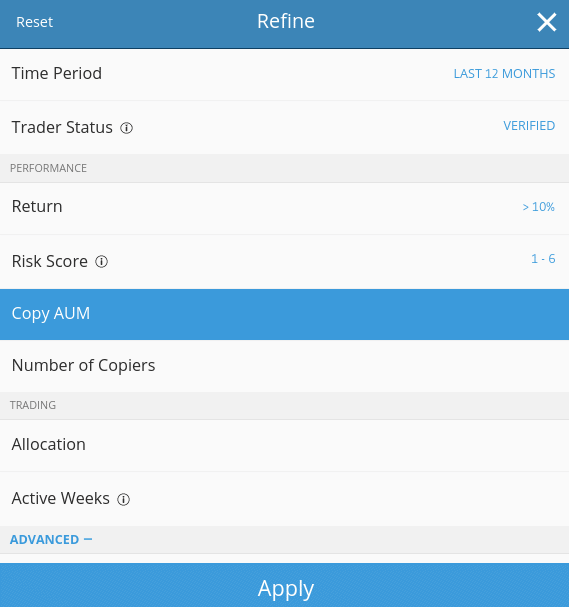

At eToro, there are thousands of verified traders that have since signed up to the copy trading program. While it’s great to have so much choice, it can be a daunting task to know which individual to risk money on. Fortunately, eToro allows you to streamline the process through a filter system.

Past performance is not an indicator of future results

Some of the most important metrics to use when searching for a trader to copy include:

- Past Performance: You can view how much money the trader has made or lost for each and every month since they joined the eToro copy trading platform. Of course, past performance doesn’t guarantee future results, but at the very least it allows you to assess how successful the trader has been to date.

- ROI: You can specify a minimum ROI (Return on Investment) from the filter box. For example, you can search for traders that have made gains of at least 30% per year for the past two years.

- Assets: eToro offers thousands of financial instruments across stocks, ETFs, forex, indices, index funds, cryptocurrencies, and more. As such, make sure you are copying a trader that specializes in your preferred asset class.

- Risk: eToro will automatically assign its verified copy traders with a risk rating. This is determined by key factors surrounding maximum drawdown, preferred markets, and average trade duration.

- Strategy: By reviewing the ‘average trade duration’, you can assess what type of strategy the eToro trader utilizes. For example, if the average duration is 3 hours, you know you are copying a day trader. If the duration is in the weeks or months, then you know the trader is more of a long-term investor.

The above metrics are just a few of many. The most important thing, is that you do lots of homework on your trader before investing. In fact, it’s a good idea to draw up a shortlist of potential traders and then work through the list one by one.

How to Get Started with the Best Copy Trading Broker

This guide on the best copy trading platform for 2022 will now conclude by showing you how to get started today. It goes without saying that our walkthrough is based on eToro – which is most definitely the best provider in this space.

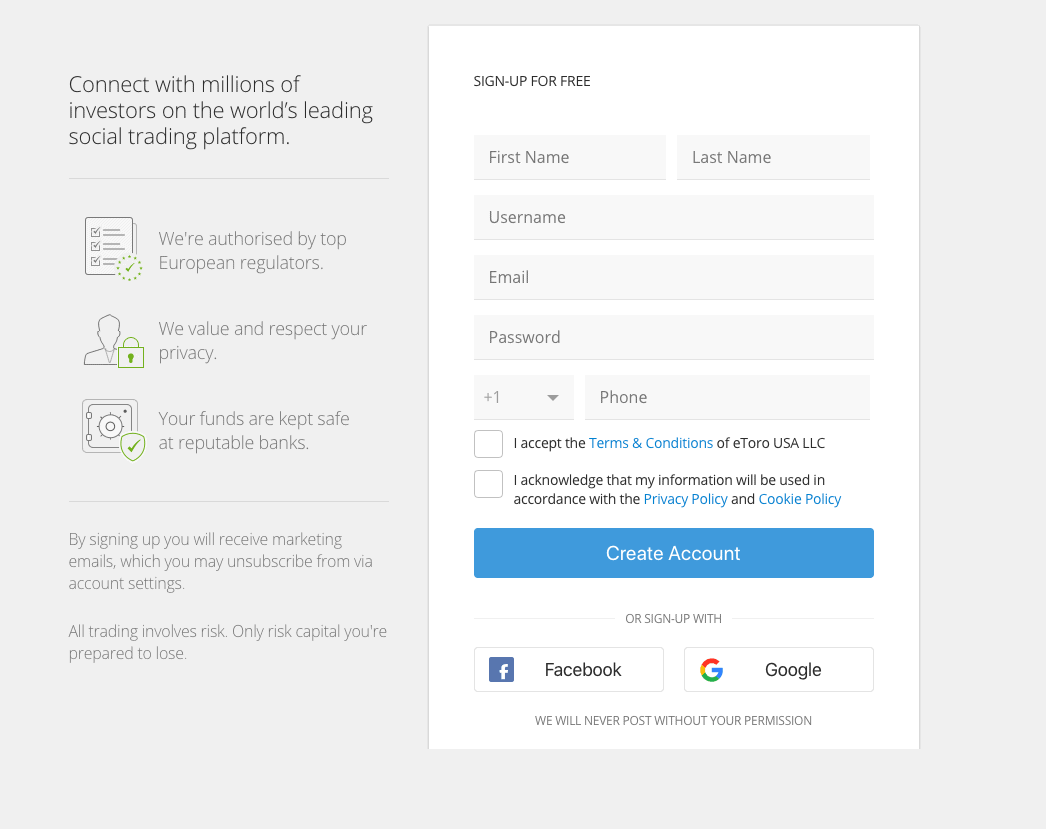

Step 1: Open an eToro Account

Visit the eToro website and click on the ‘Join Now’ button. Follow the on-screen instructions to get your account open – which will require some personal and contact details.

67% of retail investor accounts lose money when trading CFDs with this provider.

You will also be asked to upload a copy of your government-issued ID – which is standard across all regulated brokers.

Step 2: Make a Deposit

You will need to deposit at least $500 to copy a trader on eToro. You can use a debit/credit card, e-wallet (including Paypal), or a bank transfer.

Step 3: Choose a Copy Trader

We explained how to choose a copy trader on eToro further up in this guide. To get the ball rolling, click on the ‘Copy People’ button and refine your filter settings.

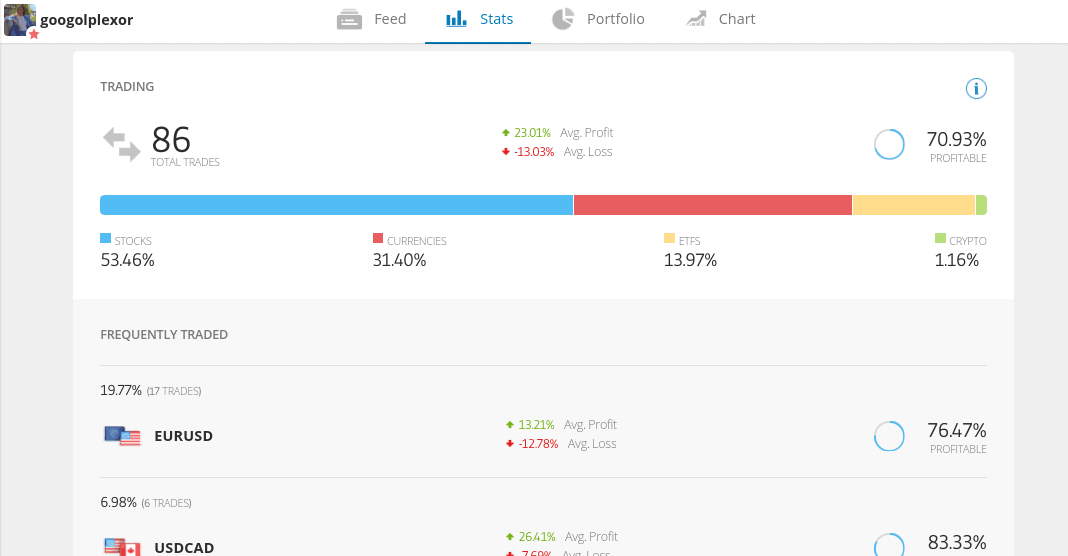

Step 4: Look at Trader Stats

Spend some time looking at the stats of your chosen trader – such as their past performance since joining eToro and the average trade duration.

Step 5: Complete Investment

Decided which eToro copy trader you wish to mirror? If so, simply click on the ‘Copy’ button, enter your stake ($500 minimum) and confirm the order. And that’s it – you’ve just copied your first eToro trader!

eToro – Best Copy Trading Platform in South Africa

In summary, copy trading in South Africa is a hugely popular investment tool that allows you to actively trade in a passive nature. The easy part is choosing the best copy trading platform in the market – as eToro is head and shoulders above its competitors. On the other hand, knowing which trader to copy can be challenging – as eToro is home to thousands of verified investors.

Nevertheless – getting started at eToro will take you minutes. Once you have instantly deposited funds with a debit/credit card or Paypal – you can copy a trader without paying any fees!

67% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

What is the best copy trading platform?

eToro is by far the best copy trading platform. The broker - which also offers a copy trading app, has thousands of verified traders to choose from. There are no additional fees to copy a trader and the platform supports everything from stocks, forex, and indices to ETFs and cryptocurrencies.

How does copy trading work?

Once you have signed up with a copy trading app, you need to first choose an investor that you wish to replicate. Then, once you have decided how much you wish to invest, your chosen copy trading app will take care of the rest. For example, if you invested $500 and the trader risks 10% on a GBP/AUD buy order, you will automatically allocate $50 to this position.

What is the best copy trading forex platform?

If you're interested in copy trading forex, there are several platforms to choose from. However, this guide concluded that eToro is by far the best copy trading forex South Africa.

Is copy trading legit?

Copy trading is certainly legit - as long as you used a regulated platform. eToro, for example, is a copy trading app that is regulated by the FCA, ASIC, and CySEC.

How do you choose a copy trader?

With thousands of potential copy traders to choose from - you need to do some homework. Ultimately, the trader needs to have a strategy that alligns with your financial goals. When using the eToro copy trading app, you can easily find a suitable investor by using the filter system.