How to Buy Altron Shares in South Africa – With 0% Commission

Altron, also known as Allied Electronics Corporation Ltd, is a technology company that provides a variety of Information Communication Technology (ICT) solutions including security solutions, cloud services, data, automation, ICT operations, and more.

Its shares are listed on the Johannesburg Stock Exchange (JSE) under the ticker symbol AEL. And, despite a crash of over 70% in its share price, some analysts believe that this stock is currently undervalued. In this guide, we show you how to buy Altron shares in South Africa with zero commissions and cover everything you need before you buy its shares.

How to Buy Altron Shares in South Africa – Step by Step Guide 2021

In order to buy shares of Altron, you first need to find an online platform like Capital.com that allows you to buy shares of South African companies. In this case, if you want to buy AEL without reading our guide, simply follow our quick steps section below:

- Step 1: Open an account with Capital.com – Visit Capital.com’s website and open an account by clicking on the ‘Trade Now’ button. Then, the broker requires you to submit your email address and choose a password to create your trading account.

- Step 2: Verify your Account – Upload the necessary documentation that verifies your identity. This includes proof of ID and proof of address.

- Step 3: Deposit Funds – Deposit a minimum of 20 GBP/USD/EUR with one of the supported payment methods – credit/debit card, bank transfer, or other e-wallet services.

- Step 4: Buy Altron (AEL) Shares – Search for Altron (AEL) shares in Capital.com’s trading platform and place a buying order.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Step 1: Choose a Stock Broker

In order to buy Altron shares in South Africa, you’ll need to find a reputable stock broker that offers you to trade South African shares. There are many options, so we’ve reviewed two of the best share dealing platforms that offer zero commission trading on shares, and other great trading tools that can greatly assist you in your trading experience.

1. AvaTrade – Top CFD Broker to Trade Altron shares

Another excellent brokerage firm that is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa and offers users to buy and sell shares is AvaTrade. This broker is more suited for professional traders who are looking for a variety of advanced trading platforms and tools as it offers the MetaTrader4, MetaTrader5, AvaTrade in-house platform, and the AvaOptions. Further, you’ll get access to a wide range of trading tools such as automated trading solutions and social trading tools.

Much like Capital.com, all stock trades at AvaTrade are commission-free, meaning you do not have to pay any fixed trading fees when you enter and exit a trade. Additionally, you can buy South African shares at AvaTrade with a leverage ratio of 5:1.

As mentioned above, one of the key points of AvaTrade is the range of platforms it offers. If you want to trade shares, you’ll be able to do that through the MT4 and MT5, or AvaTrade web trader platform. However, if you would like to trade on one of the best mobile trading apps in South Africa, AvaTrade offers the AvaTradeGo that is an award-winning mobile app with a sophisticated charting package and trading tools.

Finally, AvaTrade is one of the few commission-free share dealing platforms that is fully regulated and authorized by the South African Financial Sector Conduct Authority (FSCA No.45984).

Pros:

- AvaTrade offers a range of markets – shares, forex, commodities, indices, cryptocurrencies, and FX options.

- A variety of trading platforms and tools, including the MT4 and MT5

- Commission-free trading

- Great platform for experienced traders

- Features social and automated trading solutions – AvaSocial, DupliTrade, ZuluTrade, and ExpertAdvisors (MT4 and MT5)

- Regulated in South Africa by the Financial Sector Conduct Authority (FSCA)

- A leverage ratio of 5:1 on shares

Cons:

- A limited selection of shares when compared to brokers

Your capital is at risk.

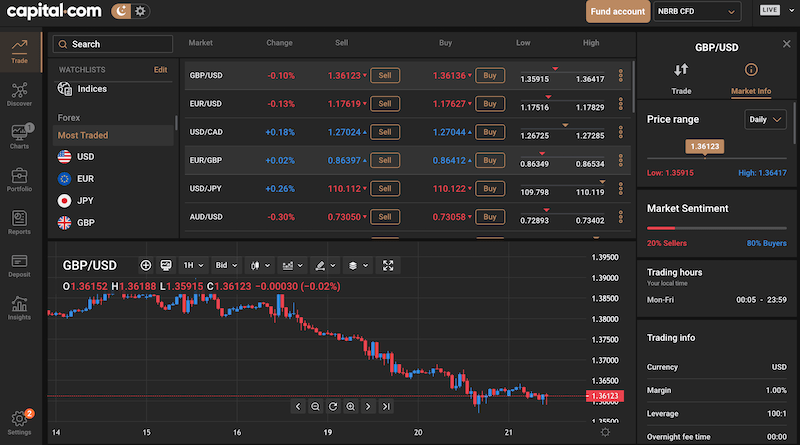

2. Capital.com – Overall Best Broker in South Africa to Buy Altron Shares

Best of all, Capital.com has developed a great in-house trading platform that is available on any web browser and as a mobile trading app. The platform has a beautiful design and comes packed with tools and features, including a revolutionary artificial intelligence tool that enables you to get useful trading insight. It also provides other useful trading tools and features like a market sentiment tool for each instrument, a news feed, WebTV, featured ideas, and more.

Another great thing about Capital.com is that it is a multi-asset brokerage platform. As such, in addition to shares, users can also trade cryptocurrencies, FX currency pairs, indices, commodities, and ETFs. In terms of the security and the safety of your funds, Capital.com is regulated by the UK Financial Conduct Authority and is one of the most trusted CFD brokerage firms in South Africa. It also maintains an extremely low minimum deposit requirement of just $20 (about 285 ZAR).

Pros:

- Capital.com offers commission free trading

- Suitable for beginners and professional traders

- Zero management fees

- Competitive spreads

- Over 3600 shares are available from various stock exchanges around the world

- Supports the MetaTrader4

- Excellent in house trading platform that uses artificial intelligence technology

- Low minimum deposit amount of just $20

- Offers a free demo account

Cons:

- Only offers CFDs

- Not regulated by the Financial Sector Conduct Authority (FSCA)

75.26% of retail investor accounts lose money when trading CFDs with this provider.

Step 2: Research Altron Shares

Before you buy shares of Altron, it’s important to get more details about the company and its share price performance over the last years. So in this section of our guide, we’ll break down some of the most important things you need to know before you invest in Altron.

What is Altron?

The company was founded in 1965 and operates in several areas including Africa, Europe, the Middle East, and Australia, though most of Altron’s sales and revenue are derived from its operations in South Africa. Allied Electronics Corporation Ltd employs more than 8500 employees around the world.

Since 2017, Mteto Nyati is the company’s chief executive officer (CEO), and so far, Nyati’s appointment has been a huge success as Altron has more than doubled its market cap in the last four years. At the time of writing, Altron has a market capitalization of 4.10 billion ZAR.

Altron Share Price

Altron shares are listed on the Johannesburg Stock Exchange (JSE) under the ticker symbol AEL. From 2015 to December 2020, ALE’s share price was trading on a long and steady upward trend, rising from around 500 ZAC in Dec 2015 to 3460 ZAC on Dec 4, 2020. However, at that point, Altron shares crashed more than 70% following the announcement of a spin-off and a new listing of its UK business known as Bytes on the London Stock Exchange (LSE).

From the start of this year, Altron’s share price is trading at a fairly narrow range between 846 ZAC to 1330 ZAC. Also, it has a negative YTD return of around -4%. In terms of the fundamentals, Altron’s share price to the company’s earnings per share (P/E ratio) currently stands at 32.90 – which is relatively high but indicates the high expectations that investors have for Altron’s growth in the future.

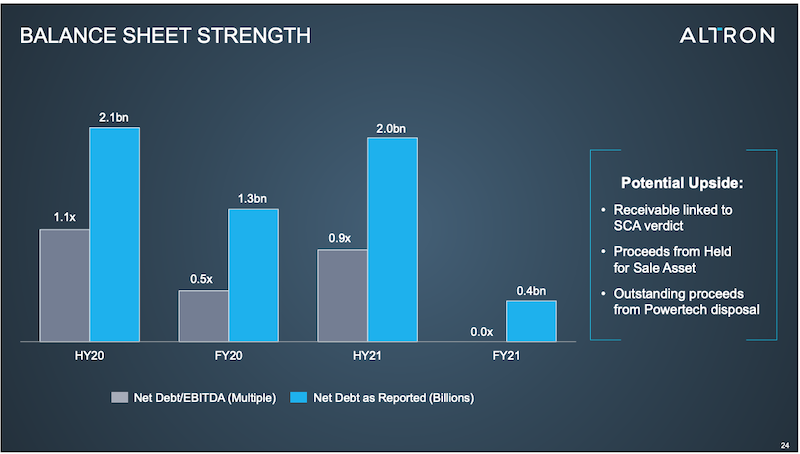

Altron is also in a great position financially, especially following the demerger of its UK business Bytes Technology Group. The company expects that net debt will decrease from 1.3 billion in 2020 to 400 million in 2021. Even more importantly, operating free cash flow grew by over 600% to R612 million.

Altron Shares Dividends

Since 2016, Allied Electronics Corporation Pty Ltd did not pay dividends to shareholders for over three years due to the Company’s restructuring process. However, in 2018, the SA company announced that it would resume paying dividends to shareholders as restructuring paid off. In May 2021, Altron declared that a final cash dividend of 15 cents per share for the financial year ended 28 February 2021 will be paid to shareholders. This represents a dividend yield of 4.65%, which is fairly in the current zero interest rate policy that most central banks around the world maintain.

Are Altron Shares a Good Buy?

Generally, Altron has been a riddle for investors for some time, largely due to the lack of news and updates. Still, Altron is one of the strongest mid-cap stocks on the Johannesburg Stock Exchange, and one of the most diversified companies in the market.

With that in mind, is now the right time to buy Alron shares? Let’s take a closer look at the main reasons why this stock is worth considering.

Altron is a Diversified Company

Altron operations are carried on in a multi-industry environment as it has a variety of unrelated products and services. Notably, Allied Electronics Corp. Ltd is not a typical company and is considered a conglomerate (a multi-industry company) business. Overall, it provides technology solutions in fintech, safety and cybersecurity, health technology, and digital transformation.

Consequently, the company makes its revenues from a variety of sources, which certainly makes it a less risky business.

Earnings Growth from Bytes Demerger

In April 2021, Altron said it expects earnings to double in the full year to end in February and earnings per share (EPS) are expected to increase by more than 100% in the first quarter of 2021. The reason for that is largely due to the demerger of Bytes Technology Group in December 2020, which has been a huge deal for Atron shareholders and has resulted in a profit of R13 billion.

Moreover, for the year ended 28 February, 2021 Altron reported an increase of 4% in gross invoiced income to R7.7 billion, a huge increase of 31% in cash generated from operations to R2.2 billion, an increase of 152% of unlocked shareholder value, and EPS increase of 44% YoY. All in all, the company’s financials look good despite the negative impact of the Covid-19 pandemic.

A New Acquisition of Security Firm Lawtrust

On April 19, Altron has announced the acquisition of Lawtrust, a digital trust services and cyber information security solutions company, for a total amount of R245 million. The Lawtrust acquisition deal strengthens Allied Electronics Corp. Ltd’s dominance in the South African market as one of the largest and most influential cybersecurity companies.

Step 3: Open an Account & Buy Shares

If you are ready to buy Allied Electronics Corp. Ltd (Altron) shares, we are now going to show you the full account creation and buying process with Capital.com.

Step 1: Open a Trading Account at Capital.com

First, head over to Capital.com’s website and sign up for an online trading account. To do that, click on the ‘Trade‘ button on the broker’s homepage and submit your email address and create a password. Alternatively, you can also sign up using your Facebook, Google, or Apple account.

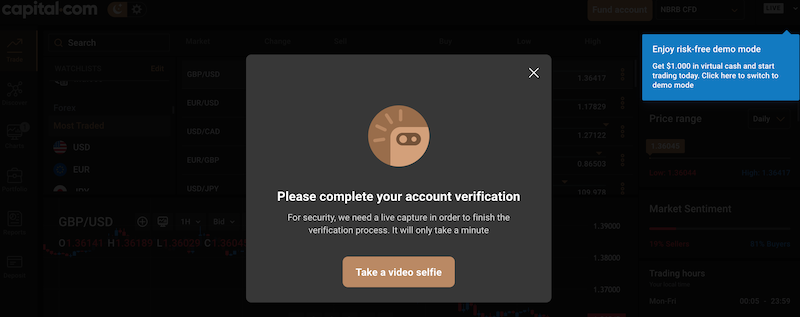

Step 2: Verify Your Identity

Capital.com is a regulated CFD broker, and thus, it must verify the identity of all of its clients. This means you need to upload a copy of your passport or driver’s license as well as a copy of a bank statement or utility bill. Then, the broker also requires you to take a selfie video as a verification method.

Step 3: Deposit Funds

Next, you need to make a deposit of at least 20 EUR/GBP/USD, which is around 285 South African Rands. You can add funds to your account by using one of the following payment options – credit card and debit card, bank wire transfer, ApplePay, QIWI, Sofort, iDeal, Giropay, Multibanko, Przelewy24, and Webmoney,.

Step 4: Buy Altron Shares

Now in the final step, you need to find Altron shares and place a buying order on the Capital.com trading platform. From the Capital.com trading platform, type in Altron or AEL in the search bar, enter the number of shares you want to buy, and click on the Buy button to send the order.

Altron Shares Buy or Sell?

After analyzing Altron’s share price, it seems that this stock is a clear case of ‘buying the deeps’. After all, the AEL share price dropped more than 70% since late 2020 and is currently trading at a fair price. Also, given the fact that the company’s business is diversified and it currently has a strong balance sheet, there’s no reason to see Altron’s share price fall further. And, it is notable that in the current conditions in the market, Allied Electronics Corp. Ltd. is one of the best passive income stocks in South Africa with a dividend yield of 4.65%.

If you’re interested in buying AEL shares, we suggest you use Capital.com. This broker has an extremely low minimum deposit requirement, an excellent trading platform, a zero-commission policy, and a leverage ratio of 5:1 on shares.

Capital.com – Buy Altron Shares With Zero Commission

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.