How to Buy RBPlat Shares In South Africa – With 0% Commission

Royal Bafokeng Platinum, also known as RBPlat, is one of South Africa’s leading mining operators. The firm mines and produces platinum group metals like platinum, palladium, rhodium, and iridium. Founded in 2008, the company has since built a largely unrivaled reputation and prominence within the sector. This guide discusses how to buy RBPlat shares in South Africa with zero commission.

How to Buy RBPlat Shares – Step by Step Guide 2021

Ready to buy RBPlat shares today? Here’s a quick step-by-step process on how to buy RBPlat shares in South Africa on eToro.

- Step 1: Open an account with eToro – Go to eToro’s website and open a trading account by clicking on the ‘Trade Now’ button and submitting your email address and password.

- Step 2: Verify your Account – Upload proof of ID and proof of address to verify your identity.

- Step 3: Deposit Funds – Deposit a minimum of 20 GBP/USD/EUR with one of eToro’s supported payment methods.

- Step 4: Buy RBPlat Shares – Search for Royal Bafokeng Platinum or RBPlat shares in eToro’s trading platform and place a buying order.

Step 1: Choose a Stock Broker

When choosing a stockbroker, it’s always wise to research to understand how it operates. To help you choose wisely, we have decided to bring you the best broker to buy RBPlat shares in South Africa. In this section, we will be reviewing eToro, the best stockbroker in South Africa.

This brokerage offers maximum security on its platform. Also, its operations are smooth and transparent in every approach, offering customers cost-effective transactions.

1. eToro – Best Low-Cost Broker To Buy RBPlat Shares

eToro is one of the best brokers with a strong reputation in South Africa and other countries worldwide. eToro boasts of over 5,000 assets available for its customers. It also offers access to stock indices, forex trading, and cryptocurrencies like Bitcoin and Ethereum.

This platform differs in many ways. eToro is social trading platform where users can copy other investor’s portfolios and share investment decisions with the eToro community. Additionally, there’s no charge for depositing funds into your account. The broker accepts deposits in South African Rands, which it converts to US dollars for your transactions.

In terms of fee structure, eToro uses the commission model. The platform is known to have one of the lowest fees making it one of the best cost-effective platforms to buy shares. The platform is advantageous to newbie traders, as the broker’s minimum deposit limit is set at $20 (about R300). However, this option is only opened to users who use credit or debit cards as payment methods. The minimum deposit made through bank wire transfer is $250 (about R3,700). The platform also accepts payment other methods for fund deposits such as Webmoney, Sofort, and others.

eToro broker is heavily regulated by the UK’s Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC).

For pro traders,eToro offers features for advanced performance such as analysis and charting tools. The broker also features an educational app that informs beginners on the tenets in the stock markets. It also organizes exclusive webinars and courses that encourage greater performances for beginners.

Pros:

- Very low spreads

- Strong regulatory background

- Has over 5,000 assets

- Unique educational tools for beginners

- No deposit and withdrawal fees

- Minimum deposit requirement of only $20

- Free demo account available

Cons:

- Fees are applicable

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Step 2: Research Rbplat Shares

Making investment decisions is not something one rushes into. Given the importance of understanding the niche market that a company operates in, conducting research is an important step towards hedging your losses in this volatile financial market. We have taken the step to give you a breakdown of the ins and outs of the Rbplat business and the company's share performance.

What is Rbplat?

Rbplat or Royal Bafokeng Platinum is a black-owned and mid-tier mining company that started as a joint venture between Anglo American Platinum (Amplat) and Royal Bafokeng Holdings (RBH). It is a South African company focused on the mining and exploration of precious metals. This collaborative mining activity birthed the Bafokeng Rasimone Platinum Mine Joint Venture (BRPM JV). Through the years, Rbplat worked together with its American mining partner. Rbplat later acquired a 67% majority interest in BRPM JV in 2010 and assumed operational control of the joint venture with Amplat holding onto the remaining 33% majority share.

Rbplat later acquired AMPlat’s 33% stake in the venture in July 2018 in a two-phased transaction. The first phase, which saw RBPlat settling AMPlat for its 33% interest, was completed in December 2018. The second phase saw Rbplat acquire the full title for Amplat’s stake in the mining venture. The deal was completed for around R2.2 billion (about $154.63 million).

Rbplat has made BRPM a huge success. The company owns one of the largest platinum reserves in South Africa, having an estimated value of 47.9 million oz of platinum under custody.

By way of earnings, the Rbplat has also shown remarkable growth. In its interim results ended June 30, 2021, Rbplat posted high earnings prompted by the increased demand for PGM products.

ts earnings before taxes, interests, depreciation and amortization touched R5.5 billion compared to R2.1 billion for the same period last year. Its headline earnings surged by 465% to R4.87 billion.

In a statement, Rbplat noted that its interim dividend earnings shot up to R1.5 billion in addition to R482.3 million buy-back and redemption of a portion of its convertible bonds.

Its six-month revenue grew 108.1% to R9 584.3 million, prompted by company-wide growth and PGM basket prices increase.

Breaking the details down further, Rbplat noted that platinum contributed 22.2% to the revenue while palladium and rhodium contributed 65.9% collectively to the general revenue. The company mines Platinum Group Metals (PGMs) in the Merensky and UG2 reefs in Rustenberg, North West. It operates the Bafokeng Rasimone Platinum Mine (comprising a North and South shaft), Styldrift, the BRPM Concentrator complex, and the Maseve concentrator plant.

The company is also working on a pre-feasibility study on its Styldrift II exploration project to the east of the current Styldrift mine. Rbplat is listed on the Johannesburg Stock Exchange (JSE) as RBP.

Rbplat Share Price

Rbplat became a public limited company on November 8, 2010, after increasing its stake in the BRPM JV mining partnership to 67%. It became the first community-owned business to list on the JSE and opened trading at 6,406.92 ZAC. It continued trading within the 5,000 and 6,000 ZAC range, momentarily dipping in August 2012 to 4,556.24 ZAC and 4,499.87 ZAC in July 2013.

The company's stock price rallied in the first eight months of the following year, trading north of 7,000 ZAC for much of the highlighted period. However, a severe market downturn prompted by low platinum demand and price saw its share price nosedive in December 2015 to 2,177.60 ZAC.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

These volatile price movements continued for most of the last five years, with RBP stock value truly making a comeback in mid-2020, rallying to 7,199 ZAC in 2020. Since its ascent, Rbplat has not looked back despite the global economic meltdown that characterized much of the economic activities of the period. It surged to a 52-week high of 12,083 ZAC in March this year and tried retesting this price level in late July when it rallied to 11,589 ZAC. RBP stock is trading at 8,706 ZAC at press time after dipping 8.36% in the last 24 hours. It has a market cap of R25.26 billion and a price-to-earnings (P/E) ratio of 3.21.

Rbplat Share Dividends

Investors are as much interested in a company’s dividend payout as well as its share performance. In this regard, Rbplat’s shareholders set for a bumper year. In its interim earnings result, Rbplat announced that its dividend earnings stood at R1.5 billion in addition to its already extant R482.3 million buy-back cash in stocks. Given this, the company announced an interim gross cash dividend of 535 cents per share, which came up to R1.5 billion.

This is a little below the mining company’s 575 cents per share for the previous quarter. According to CFO Hanre Roussouw, Rbplat has toned down on its dividend payment in a bid to maintain financial discipline. Roussouw believes the markets could turn negative within a short period. Rbplat defends its position by saying this reduced payout would keep them in a place of strength and continued growth.

Are Rbplat Shares A Good Buy?

So, should you buy Rbplat shares? Well, considering the mining company's strong performance in the opening half of the year, it is one of the best mining stocks to buy in South Africa right now. However, a few other reasons also play in Rbplat’s favor.

Strong Earnings For The Year

In earnings, the only mining company that has performed better than Rbplat is former joint partner Anglo American Platinum (Amplat). In its interim results, Amplat announced a net cash position of R57.6 billion. Its interim dividend for the six months stood at a whopping R175 per share, or R46.4 billion, while it posted a record EBITDA value of R63.3 billion, a 385% increase from the previous year.

Compared to Amplat, Rbplat pales in comparison. However, its production capacity and size greatly differ from the more established and older mining business. The company's R5.5 billion EBITDA earnings and R1.5 billion dividend earnings show that Rbplat is on the right track.

PGM Products Are In High Demand

Platinum Group Metal (PGM) products had been on an all-year low following the global pandemic, seeing demand from the petroleum sector for gasoline and jet fuel nosedive. Other sectors where platinum, palladium, and rhodium played a role in everyday life also suffered a major hit. In a PGM Market report for 2020, the PGM output for South Africa was projected to fall by at least 20%.

However, things are gradually looking up with physical distancing measures and ease in lockdown restrictions becoming a norm as businesses resume.

This has seen PGM demand surge, with the total primary supply up 20% from its 2020 levels of 4,944,000 oz to 6,096,000 oz in May. Demand is gradually picking up, although the 5,481,000 is short from the 2019 and 2020 levels of 6,388,000 and 5,613,000. Rbplat has benefited from this renewed wave of market forces, reflecting in its revenue stream for the first six months of the year. As the world puts a lid on the Covid pandemic, mining and exploration companies are gradually making a profit.

Styldrift II Project Is A Gem

Rbplat has expanded its production capacity as market demand increases. Its open mine Styldrift II project's completion has boosted its production volume, with the East-bound shaft operation making up 40% of its overall mineral resources. Styldrift II boasts of 59Mt Merensky reef at an average 4E grade of 7.77g/t of Mineral Resource width of 106cm. It also has a 71Mt UG2 reef at a middle stage of 5.01 g/t over a Mineral Resource width of 124 cm. The project began as a pre-feasibility study back in 2015, has completed 98 primary exploration drill holes, equivalent to 125,000 cm of diamond core drilling with 350 Merensky reef intersections and 307 UG2 reef intersections.

Step 3: Open an Account and Buy Shares

After conducting your research, you should be confident in buying RBPlat shares. To get started, you will need to open an account with a broker that provides support for South African companies and shares. From our discovery, eToro is a top-regulated online broker that offers 0% commission trades and is the best place to buy shares in South Africa. This section will show you how to open an account on eToro and buy RBPlat shares.

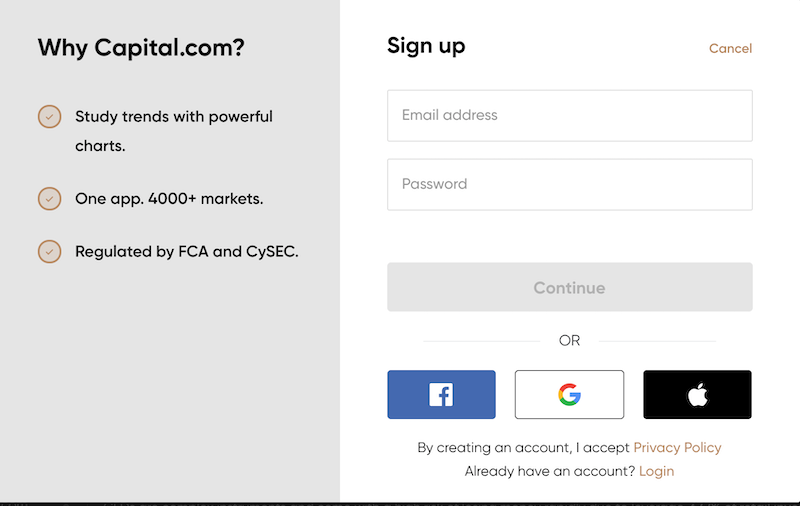

Step 1: Open a Trading Account at eToro

Opening an account on eToro is easy. Visit the official website and click on the 'Trade Now' icon. This would take you to the online form page, where you would be required to fill in your personal information such as name, date of birth, email address, phone number, and others. You will also be asked to choose a username and password. It is advisable to create a password with a combination of special characters, numbers, upper and lower cases to make your password strong. You can also fast-track the registration process by connecting your Google, Facebook, or Apple account.

75.26% of retail investor accounts lose money when trading CFDs with this provider.

Step 2: Upload ID

eToro requires all new users to complete a mandatory know-your-customer (KYC) process as part of its regulatory duties. This means you will be required to upload a copy of your passport or driver's license, national ID, and proof of address which can be a recent copy of your bank statement or utility bill.

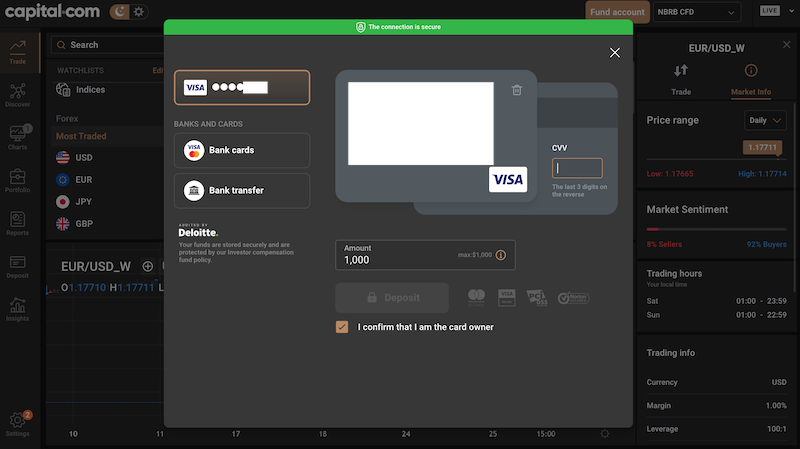

Step 3: Make a Deposit

eToro offers different payment methods for deposits. This includes bank wire transfer, credit and debit cards, Sofort, iDeal, Giropay, Multibanko, and others. The broker has a low minimum deposit entry bar, and you can get started with just $20 for both credit and debit cards. However, the minimum deposit for the bank wire transfer is $250.

Step 4: Buy RBPlat Shares

Now you can buy RBPlat shares. To do this, type ‘RBPlat’ into the search bar on the top left corner of your page and input the number of shares you want to buy. Once you are satisfied with your order form, you can click on 'Buy' to gain exposure to RBPlat shares.

Should You Buy/Sell Rbplat Shares?

Rbplat’s strong six months performance shows that the mining company will likely make a good investment in the long run. Also, the strong demand for PGM products in the past year signals a global market recovery following the global pandemic. If you want to buy Rbplat shares, you should be on the lookout for a regulated broker who offers exposure to South African shares. From our extensive research, we recommend using eToro. Ready to start trading RBPlat shares with zero commissions? Click the link below to get started.

eToro– Buy RBPlat Shares With Low Fees

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.