Best Forex Brokers with ZAR Account

If you’re based in South Africa and looking to trade forex online – it’s worth sticking with a broker that is able to offer you a ZAR account. In doing so, you will avoid ongoing currency conversion charges when you deposit, trade, and withdraw in South African rands.

In this guide, we review the Best Forex Brokers with ZAR Account for 2021.

Best Forex Brokers with ZAR Account 2021

Before reading our in-depth reviews, check out which providers made our list of the Best Forex Brokers with ZAR Account.

- XM – Great Forex Broker with Multiple ZAR Accounts and Trading Platforms

- FXCM – Overall Best Forex Broker with ZAR Account

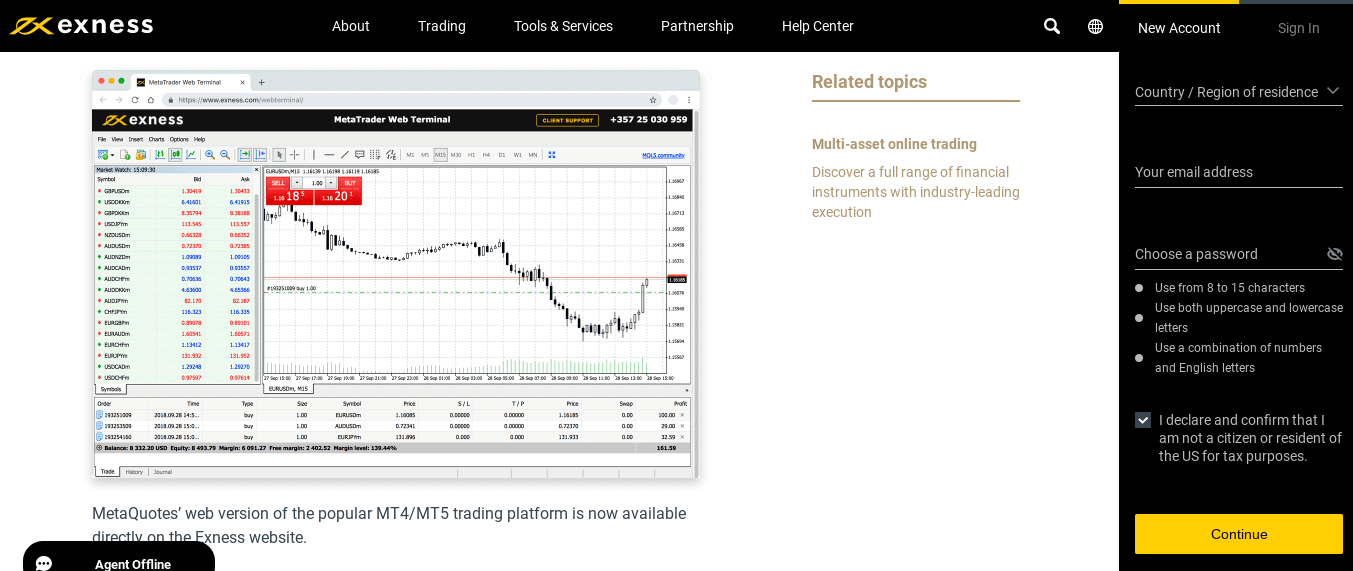

- Exness – No Minimum Deposit Forex Broker with ZAR Accounts

- HotForex – ZAR Forex Accounts with Spreads Starting at 0 Pips

- Khwezi Trade – Best Forex Broker with ZAR Account for EAs and Scalping

- Plus500 – One of Best Forex Brokers with ZAR Accounts for Low-Cost Leverage

Best Forex Brokers with ZAR Accounts Reviewed

On the one hand, selecting a forex broker that offers ZAR accounts will allow you to avoid ongoing currency conversion charges. However, there are many other factors that you need to consider when choosing a suitable forex trading site.

For example, you need to know what trading commissions and spreads are applicable, what currency markets are offered, and what payment methods are supported. You also need to consider the regulation and licensing.

Taking all of this into account – below we discuss the very best forex brokers with ZAR account.

1. XM – Great Forex Broker with Multiple ZAR Accounts and Trading Platforms

For example, both the Micro Account and Standard Account allow you to trade on a commission-free basis and the minimum deposit is just $5 (ZAR equivalent). If you are planning to trade large amounts, the XM Ultra Low Account might be more up your street. Although this account type attracts a small commission, you’ll get your forex spreads down to just 0.6 pips on major markets.

The minimum deposit on the XM Ultra Low Account is a very reasonable $50 (ZAR equivalent). Another stand-out feature of XM is that it offers support for more than 16 different trading platforms. This includes MT4 and MT5 across Windows and Mac software, as well as browser-based access. You can also use MT4 and MT5 via a smartphone and tablet app – compatible with both Android and iOS.

We also like the fact that XM offers a huge library of educational tools. This includes video explainers, guides, platform tutorials, forex seminars, and live webinars. In the research department, you’ll find everything from financial news and trading ideas to economic calendars and market commentary. Leverage is offered on all markets at XM and in addition to forex – the platform also allows you to trade stock CFDs, energies, and precious metals.

Pros:

- Multiple ZAR accounts offered

- Some accounts offer commission-free trading

- Heaps of forex markets

- Trade CFDs via stocks and commodities

- High leverage

- 16 trading platforms supported

Cons:

- Does not offer markets on ETFs or cryptocurrencies

Your capital is at risk. Leveraged products may not be suitable for everyone

2. FXCM – One of Best Forex Brokers with ZAR Accounts for Low-Cost Leverage

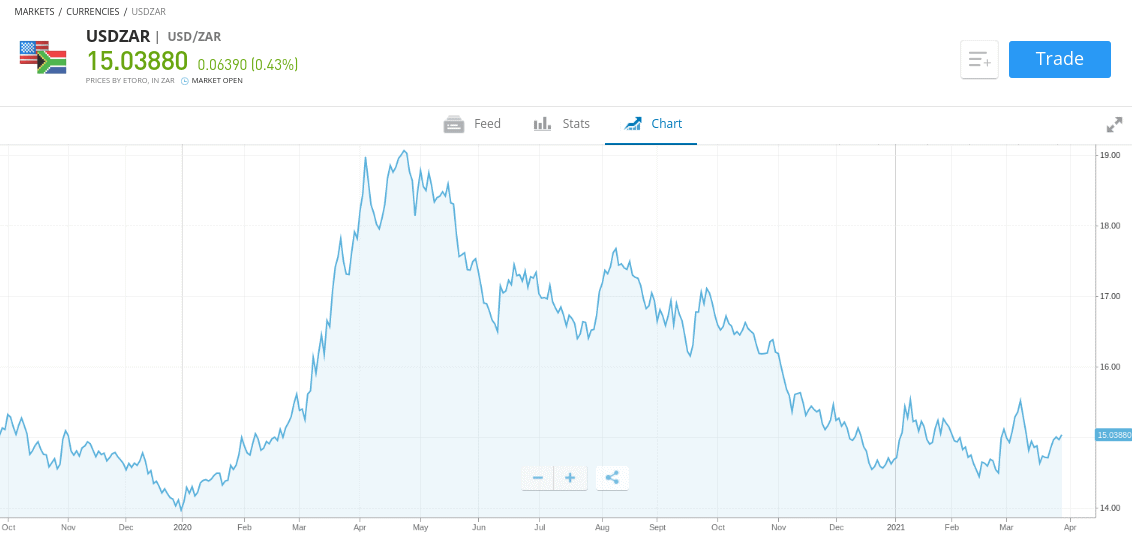

Best of all, the minimum deposit policy of this forex broker is just $50 – which translates into just under 750 ZAR. In terms of supported markets, FXCM offers a huge library of forex pairs – covering majors, minors, and exotics. In fact, the platform offers support for two ZAR-based trading pairs – USD/ZAR and JPY/ZAR.

When it comes to fees, FXCM is a 100% commission-free broker. As such, all trading costs are built into the spread. The most competitive spread on offer in the forex department is 1.3 pips on EUR/USD. If you want to trade USD/ZAR, this comes with a spread of 88.6 pips, JPY/ZAR comes in at a spread of 4 pips. There are no fees to deposit and withdraw funds when using a ZAR-based payment method, nor are there any ongoing platform fees.

Once you have opened an account with FXCM, you can trade directly within your web browser. Alternatively, FXCM is also compatible with MT4, NinjaTrader, ZuluTrade, and TradingView. FXCM also offers a mobile trading app for iOS and Android users. Outside of the forex trading department, FXCM also offers CFD instruments on stocks, indices, hard metals, energies, and digital currencies.

Pros:

- Supports MetaTrader 4 and Ninja Trader

- A long-established and reputable broker

- Regulated by the FSCA

- ZAR deposits and withdrawals

- Mobile trading app

- No commission and tight spreads

Cons:

- CFDs only – no traditional investments

73.05% of retail investors lose money when trading CFDs at this site

3. Exness – No Minimum Deposit Forex Broker with ZAR Accounts

With that said, there are several ZAR account types to choose from at this forex broker. For example, if you want to trade via the MT5 platform, you will benefit from minimum spreads of 0.3 pips, zero commission, and leverage of up to 1:2000. If opting for MT4, you will also benefit from a 0% commission service and spreads as low as 0.3 pips on major pairs.

On top of forex pairs, Exness also allows you to trade stocks and indices. This comes in the form of CFDs – so short-selling is supported. If you like the sound of Exness, you can deposit funds with a variety of convenient payment methods. This includes debit/credit cards, Neteller, Skrill, Bitcoin, WebMoney, Perfect Money, or a local South African bank transfer. Apart from Bitcoin, all deposit methods are processed instantly at Exness.

Pros:

- Authorized by the FSCA

- No minimum deposit

- Supports ZAR accounts

- Compatible with MT4 and MT5

- Huge leverage limits

- Heaps of ZAR forex pairs

Cons:

- Website is a bit basic

- Limit number of stock CFDs

Your capital is at risk. Leveraged products may not be suitable for everyone

4. HotForex – ZAR Forex Accounts with Spreads Starting at 0 Pips

There are five different ZAR accounts to choose from at HotForex. If you are new to the forex world, you might be best off starting with the MIcro Account – which requires a minimum deposit of just 70 rands. This account offers spreads of 1 pip on major currencies and leverage of up to 1:1000 is offered.

This includes Visa, MasterCard, Maestro, bank wire, and Skrill. All supported payment methods are processed fee-free. HotForex doesn’t offer its own native trading platform. Instead, it is fully compatible with MT4 and MT5 – online, via desktop software, or through an Android/iOS app. Finally, HotForex is a good option if you want access to educational materials. This includes training courses, videos, webinars, and podcasts.

Pros:

- Leverage of up to 1:1000

- MT4 and MT5 supported

- Zero spread accounts available

- Minimum deposit just 70 rands

- Good educational materials

- Supports debit/credit cards, e-wallets, and bank account transfers

Cons:

- Support only available 24/5

- No native trading platform

Trading Leveraged Products such as Forex and Derivatives carry a high degree of risk to your capital

5. Khwezi Trade – Best Forex Broker with ZAR Account for EAs and Scalping

In total, there are four account types to choose from. All accounts come with leverage of 1:200 and a margin call rate of 100%. Depending on your chosen account, minimum deposits range from just 2,000 rands up to 50,000 rands. The higher the deposit minimum you meet, the better spreads on offer. All accounts are commission-free nonetheless.

Irrespective of which account you opt for, all trading must be done via MT4. You can do this through the Khwezi Trade website, or through MT4 software. Mobile trading is also possible via the MT4 app. We also like the fact that Khwezi Trade offers all new customers a free demo account facility. You don’t need to deposit any funds to gain access. When it comes to supported markets, you can trade dozens of forex pairs at this broker. This includes ZAR pairs containing GBP, EUR, and USD.

Pros:

- Happy to facilitate forex EAs and scalping strategies

- Various ZAR accounts – all 0% commission

- Trade forex, stocks, and indices

- High leverage limits

- Easy to open an account

- Regulated and based in South Africa

Cons:

- Only supports MT4

- No cryptocurrency markets

Your capital is at risk when trading CFDs at this provider

6. Plus500 – Overall Best Forex Broker with ZAR Account

Leverage can be a crucial component to have on your side when trading forex online. After all, most forex pros in South Africa look to enter and exit the market on a day trading basis – meaning that target margins are conversation. As such, leverage can make these small gains worthwhile.

In this respect, we found that Plus500 is one of the best forex brokers with ZAR accounts for accessing leverage. In fact, even if you are a retail investor client – Plus500 will offer you leverage of up to 1:30 when trading major forex pairs. This means that a 3,000 ZAR stake on EUR/USD would permit a maximum trade value of 90,000 ZAR.

When trading less liquid pairs, expect lower limits. If you’re looking to trade the South African rand – Plus500 has you covered. In fact, you can trade the rand against euros, British pounds, or US dollars. When it comes to fees, Plus500 doesn’t charge anything to deposit in ZAR when opening an account from South Africa. There are no commissions charged when you trade – so it’s only the spread that you need to factor in.

To give you a ball-park figure, you’ll currently pay a spread of 0.11% when trading USD/ZAR. This is very competitive when you consider that this market falls within the scope of an exotic pair. In terms of safety, Plus500AU Pty Ltd is an Authorised Financial Services Provider #47546 in South Africa. You can get started by depositing funds with a debit/credit card, Paypal, or bank transfer. The minimum deposit at Plus500 is the ZAR equivalent of $100 (about 1,500 rands).

Pros:

- Commission-free CFD platform – only pay the spread

- Thousands of financial instruments across heaps of markets

- Leverage of up to 1:30

- Ability to enter buy and sell positions

- Takes just minutes to open an account and deposit funds

Cons:

- CFDs only

- Only suitable for experienced traders

Best Forex Brokers with ZAR Accounts Fees Comparison

If you read through the above reviews – then you will know that fees can vary wildly at the best forex brokers with ZAR account. To help clear the mist, below you will find a dedicated fee comparison table that outlines the main account charges you should expect at each provider.

| ZAR Forex Broker | Commission | Spread (Minimum) |

| FXCM | 0% | 1.3 pips |

| Plus500 | 0% | 0.11% on USD/ZAR |

| XM | 0% | 0.6 pips |

| Exness | 0% | 0.3 pips |

| HotForex | 0% | 0 pips |

| Khwezi Trade | 0% | 1 pip |

Commissions can change at any given time and spreads are often charged on a variable basis. As such, be sure to check applicable fees before opening an account with your chosen forex broker.

Benefits of Using Forex Brokers with ZAR Accounts?

There are hundreds of online forex brokers that allow South African retail investors to open an account with ease. But, most of these platforms will charge you a premium when using a domestic payment method. This means that you are at a financial disadvantage before you’ve even had a chance to place your first trade.

- The best forex brokers with ZAR accounts on the other hand ensure that you can deposit and withdraw funds on a fee-free basis.

- This means that by making a 200 rand deposit – the entire amount will be credited to your account.

- At non-ZAR forex brokers, you should expect to pay up to 1% in conversion fees.

- This means a 200 rand deposit would leave you with 198 rands in capital.

Another core benefit of using the best forex brokers with ZAR accounts is that everything is denominated in South African rands. For example, when using an international broker that utilizes US dollars – all stakes, profits, and losses will be displayed in USD. This can make it confusing to know exactly how much you are making or losing.

Plus, when you eventually get around to cashing out your balance – this needs to be converted back to ZAR. You might end up getting back less than you had hoped for – as ongoing currency exchange fluctuations need to be taken into account.

ZAR Forex Brokers Payment Methods

When using the best forex brokers with ZAR account – you will usually be given a wide range of local payment types to choose from.

This might consist of the following:

- Debit/Credit Cards (Visa, MasterCard, Maestro)

- Paypal

- Neteller

- Skrill

- Local Bank Transfer

- Bitcoin

Even if you are opting for a local bank transfer – the best forex brokers with ZAR account will often process this instantly.

When it comes to deposit charges, you won’t pay a currency conversion fee when opening a ZAR forex account. The broker might, however, charge a transaction fee of its own – so do bear this in mind.

ZAR Forex Trading Accounts Regulation

This can be a relatively simple procedure at many online brokers – as you simply need to upload a copy of your government-issued ID alongside a proof of address. In some cases, the broker might be able to validate the documents instantly.

In addition to KYC, all forex brokers supporting ZAR accounts must be authorized by the South African Financial Sector Conduct Authority (FSCA). If the broker is regulated by the FSCA, this comes with additional safeguards. For example, all FSCA-regulated forex brokers must keep client money in segregated bank accounts.

How to Get Started with the Best Broker with a ZAR Account

In this part of our guide, we are going to walk you through the process of getting started with a ZAR account and placing your first commission-free forex trade!

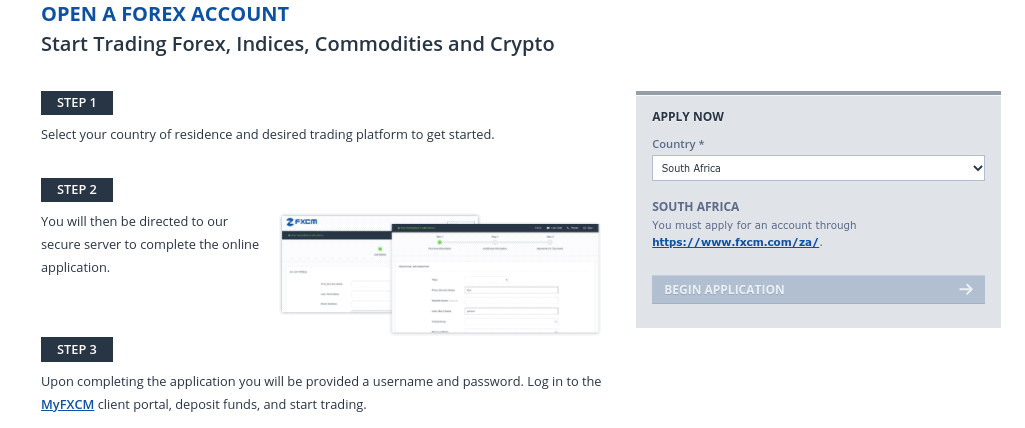

Step 1: Open a ZAR Account

Before you can start trading you will need to open a forex brokerage account. We like FXCM as the platform is regulated by the FSCA, requires a minimum deposit of just 750 ZAR, and charges no trading commission.

To complete the process with this top-rated ZAR broker, visit the FXCM website and click on the ‘Open Account’ button. Then, you will be asked to enter your personal information. Think along the lines of your name, address, date of birth, and contact details.

Step 2: Upload Documents

As noted earlier, all of the best forex brokers with ZAR account discussed on this page are authorized and/or regulated by the FSCA. As such, a core requirement is for FXCM to verify your identity.

You complete the process online by uploading a copy of your passport or driver’s license.

Step 3: Deposit Funds

Once you have uploaded the required documents, you can then proceed to make a deposit. The minimum deposit is $50 – or about 750 rands. You can choose from a debit/credit card, bank account transfer, or e-wallet.

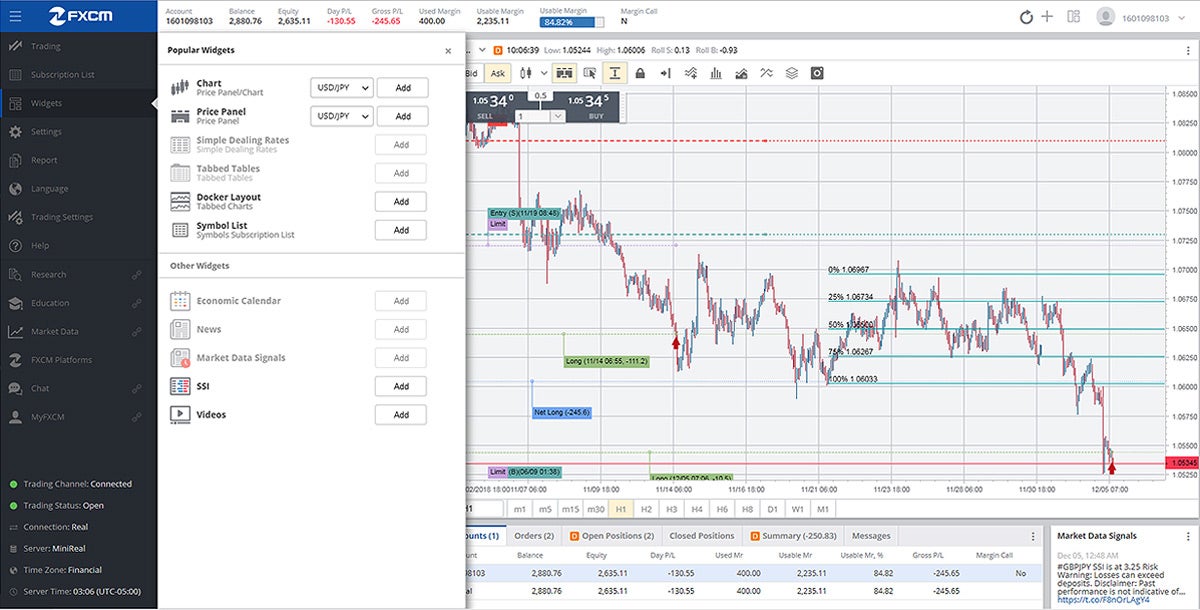

Step 4: Choose Trading Platform

Now that you have a fully-funded FXCM account – you need to decide which trading platform that you want to use. FXCM supports MT4, NinjaTrader, ZuluTrade, and TradingView. Or, you might decide to use Trading Station – which is a web-based platform designed by FXCM.

Step 5: Start Trading Forex

Now that you are logged into your chosen platform – it’s time to start trading forex! All supported platforms come with a search facility – so simply enter the name of the forex pair that you wish to trade.

Then, it’s just a case of placing your entry and exit orders – all of which will be executed by FXCM commission-free!

Conclusion

This guide has reviewed the very best forex brokers with ZAR account. All of the providers discussed today allow you to deposit funds in South African rands without paying any fees or conversion charges. Plus, each broker offers at least one account that permits commission-free forex trading.

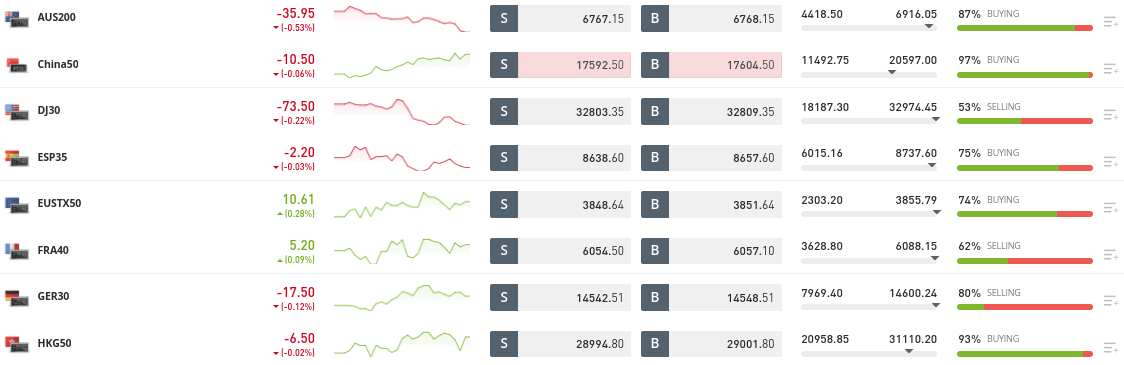

An Alternative to ZAR Brokers – eToro

Before concluding this guide in its entirety – it is worth noting that in some cases, you might be better off using a non-ZAR broker. More specifically, when reviewing eToro – we found that although the broker operates in US dollars – overall it offers a more cost-effective and user-friendly experience.

For example, you can easily deposit funds with a South African debit/credit card, bank account, or e-wallet. Although you will pay an FX fee of 0.5% – there are no other charges to take into account. Whether you want to trade forex or investment in stocks and ETFs – eToro is commission-free.

Plus, spreads on major markets are some of the best we have seen. The minimum deposit at this broker is just $50 and unlike most ZAR accounts – you can utilize a feature called Copy Trading. Without paying any additional fees, this allows you to copy an experienced forex trader like-for-like. This means that you can actively trade forex in a 100% passive nature.

In addition to forex, eToro – which now boasts over 20 million users, allows you to invest in more than 2,400 stocks, 250 ETFs, and 16 digital currencies. As there are no ongoing platform fees – you can keep hold of your long-term investments for as long as you want.

eToro – Overall Best Forex Broker South Africa 2021

68% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

What is the best broker with a ZAR account in South Africa?

We found that the best broker with a ZAR account in South Africa is FXCM. This FSCA-regulated broker offers heaps of forex pairs - many of which contain the South African rand. There are no commissions charged on the platform and spreads are very competitive..

What is a ZAR forex account?

A ZAR forex account allows you to deposit and withdraw funds in South African rands - without needing to pay any FX conversion fees.

What ZAR forex pairs can you trade?

This depends on the ZAR forex broker that you open an account with. At a minimum, you can often trade ZAR against the US dollar. With that said, some brokers also offer ZAR markets against the euro, British pound, Japanese yen, Australian dollar, and more.

What is the minimum ZAR forex account deposit?

Minimum deposits are stipulated by the broker in question - so can and will vary. Some brokers have no minimum deposit at all - while others require more than 10,000 rands. As such, always check this before opening an account.

How much forex leverage can you get in South Africa?

As there are no limits imposed on South African traders, some forex platforms offer as much as 1:1000.

Do all brokers have ZAR trading accounts?

No. Although the most popular forex brokers are located outside of South Africa, they rarely offer ZAR accounts. Instead, your deposit will be converted into a major currency like US dollars - which in most cases, attracts an FX fee.