Forex Trading South Africa – Beginners Guide for Forex Trading

Forex trading involves buying and selling pairs of currencies. If you think the value of the South African rand is going to fall relative to the US dollar, for example, you can trade rand for dollars to take advantage of the price move.

Forex trading is a popular way for beginner and advanced traders alike to speculate on the global currency market. All told, more than $6.5 trillion in value is traded every single day.

For traders in South Africa, it’s easy to get access to the forex market through a regulated broker. In this guide, we’ll cover everything you need to know to start trading forex in South Africa. We’ll highlight top brokers you can use, explain how the market works, and offer some tips to help you trade currencies more successfully.

How Does Forex Trading Work in South Africa?

In order to trade forex successfully, you need to understand how this market works in South Africa. To get you started, we’ll explain everything you need to know about the basics of forex trading in South Africa.

What is Forex Trading?

Forex trading involves exchanging one currency for another. If you’ve ever travelled abroad and swapped rand for another currency, you engaged in a forex trade. Forex trading as a way to speculate, though, involves making a lot of these trades and timing them with moves in the market.

Currencies are typically traded in pairs, since the value of a currency is always defined in relationship to all the other currencies in the world. There are three general types of currency pairs:

- Major Pairs are between the US dollar and several of the world’s other widely used currencies. There are seven major currency pairs – EUR/USD, USD/JPY, GBP/USD, USD/CHF, USD/CAD, AUD/USD, and NZD/USD. Almost all South Africa forex brokers offer trading on these pairs.

- Minor Pairs involve crosses between the non-US currencies in the major pairs and between the US dollar and less widely traded currencies. For example, EUR/JPY and GBP/EUR are considered minor currency pairs. Most brokers offer all or the majority of minor currency pairs for trading.

- Exotic Pairs are currency crosses that are less frequently traded. USD/ZAR is an exotic pair, for example. Brokers vary widely in whether they offer trading on any exotic currencies and, if they do, which pairs.

How Does the Forex Market Work?

First, it’s global. The total value of currency traded every day is more than $6.5 trillion and trading takes place 24 hours a day, 5 days a week.

Second, the forex market has a huge amount of liquidity. That means that large orders can be fulfilled almost instantly, especially for major and minor currency pairs. Some exotic currency pairs can trade with low liquidity (and as a result, have higher spreads), but it’s unlikely that your broker will ever have trouble fulfilling your orders.

Keeping those differences in mind, the forex market is driven by supply and demand just like any other financial market. The value of a currency goes up when more traders want to buy it, and it drops when traders flock to alternative currencies. To profit from forex trading in South Africa, you must correctly predict when shifting demand for a currency will drive its value up or down relative to another currency.

What is Leverage and How Does It Work?

Leverage plays an important role in forex trading. Typically, a big day for currencies means that prices might move by 0.5% or less. To earn tangible profits from that, traders would need to invest enormous amounts of capital.

Leverage allows traders to multiply the effective sizes of their currency positions without putting more money in their trading account. Let’s say your broker offers 100:1 leverage. With $1,000 in your trading account, you can then buy or sell up to $100,000 in forex CFDs. That same 0.5% change in a currency’s value can generate a 50% change in the value of your position.

Leverage increases your risk as well as your potential profit, so beginner traders should be very cautious about using it. In addition, leverage involves borrowing money from your broker. You’ll be charged interest fees for holding leveraged positions overnight, which can dramatically eat into your returns if you’re not careful.

Forex Trading Tips Every Beginner Should Know

Of course, there’s more to trading forex successfully than just knowing how the market works. You need to go into trading with a defined strategy and use all the tools at your disposal to get ahead of the currency market. Let’s take a look at some of the things you should know in order to trade forex in South Africa.

Always Use a Regulated Broker

Think you found a broker with zero commissions and zero spreads? Think again. Unregulated brokers may offer great deals, but they’re not worth the risk – you could lose your whole account, and you’d have little or no legal recourse.

Forex brokers regulated by South Africa’s Financial Services Board keep your money in segregated accounts and abide by international rules that help safeguard your account. Whether you use one of our recommended brokers or another trading platform, make sure the broker is trustworthy and regulated.

Use Technical Analysis

Technical analysis is the key to successful forex trading in South Africa. With technical analysis, you use price charts to identify trends, momentum, and other factors that help predict the future price of a currency.

Technical analysis isn’t bulletproof, and it takes a lot of work. But without mastering this kind of analysis, you’re essentially guessing as to where a currency’s value might be headed next.

Always Have an Exit Strategy

Before you place any forex trade, it’s important to know how you’re going to get out of that trade if it goes against you. Risk mitigation techniques like stop losses come in very handy for this purpose. You can set a stop loss so that if a currency’s value drops unexpectedly, your broker will automatically sell your position before things get too bad.

We also recommend setting take profit levels for your forex trades. It’s better to consolidate profits after a successful trade than to get greedy and lose sight of your original plan.

Use Forex Trading Signals

Trading signals are automated triggers to buy or sell a currency. Typically, they’re based on a set of technical indicators that you can customize and combine.

Using signals when trading forex is essential since the market moves so fast. If you’re relying on watching price charts all day every day, you’ll quickly get burned out on trading – not to mention you’re still liable to miss trading opportunities.

Forex trading signals enable you to stay on top of the market without being glued to your screen. Just make sure that every buy signal is paired with a stop loss so that you’re automatically protected if your signals don’t work as well as planned.

Practice with a Forex Trading Demo Account

Before you jump into live trading, it’s a good idea to practice using a forex trading demo account. Most top forex brokers in South Africa offer demo trading.

With a practice account, you can work out a trading strategy and test out forex trading signals in a risk-free environment. This is also a good setting for learning how to apply technical analysis more generally. Even expert traders use forex trading demo accounts since they are such a valuable tool for trying out new things.

Basic Forex Trading Strategies

There are tons of different strategies you can use when it comes to trading forex. No matter which one you decide to use, having a strategy is essential so that you aren’t trading on a whim. Let’s take a look at several basic forex trading strategies you can try:

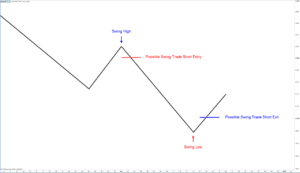

- Swing Trading involves buying at moments when a currency’s momentum changes. That means, for example, buying right after a bottom is reached. Then, rather than wait for the absolute price peak, you should sell your position as soon as the upward momentum starts to fade.

- Scalping is a high-frequency trading strategy that makes small profits from tiny changes in the value of a currency. Scalping involves a lot of losing – you just need your win rate to be greater than 50% to make money with this strategy.

- Fundamental Trading requires you to look at the economic factors driving demand for a currency. This is a complex technique that involves studying government debt, inflation rates, political events, and much more. It’s important to get the timing of changes right when using fundamental analysis.

What is a Forex Trading App?

A forex trading app is simply a mobile application that allows you to trade forex on your smartphone or tablet. These days, virtually all of the top forex brokers offer forex trading apps for iOS and Android devices. These apps offer the full functionality of web and desktop platforms, and they make it much easier to trade on your mobile.

More advanced forex trading platforms, such as MetaTrader 4, are also available in mobile form. This means you can choose between a user-friendly proprietary platform and professional platforms. If you do want to trade forex on your mobile and benefit from features like price alerts, then check out the forex brokers below, all of which offer impressive forex trading apps.

Let’s take a look at how our recommended forex trading brokers compare in terms of their mobile app

| Forex Trading App | Features | Our Rating (out of 5) | Learn more |

| eToro | Social trading, copy trading | 5 | Open account |

| Plus500 | Basic charting, high leverage | 4.8 | Open account |

| AvaTrade | MT4/5, options trading | 4.6 | Open account |

| Capital.com | Educational app, AI trading | 4.5 | Open account |

| Libertex | MT4, news | 4.3 | Open account |

Choosing the Best South Africa Forex Broker

To get started trading forex in South Africa, you need a reliable forex broker. The good news is that there are dozens of brokers you can use that offer trading on all of the major currency pairs along with many minor and exotic pairs. The bad news is that not all of these brokers offer the trading tools you need, and some are more expensive than others.

In order to help you find a forex trading platform in South Africa that’s right for you, we’ll review five of our top picks for 2022.

1. eToro – Overall Best Forex Trading Platform

Better yet, eToro offers forex CFD trading with 0% commissions. When you place a trade through this broker, the only fee you pay is the spread. eToro’s spreads aren’t the lowest in the industry, but they’re close – you’ll pay just 0.31% when trading USD/ZAR, for example.

eToro does have some account fees to take note of, including an inactivity fee if you go more than a year without trading. There are also deposit, withdrawal, and currency conversion fees, but you can minimize these charges with careful account management. eToro requires a minimum deposit of $200 to start trading.

Another thing we like about eToro is that it has a built-in social trading network. You can follow fellow forex traders to see what currencies they’re speculating on and gauge trader sentiment around different currencies. You can also take advantage of copy trading to put a portion of your portfolio on autopilot.

In addition to forex, eToro offers a wide range of other assets. You can buy shares, including many of the best shares, and you can also trade indices, commodities, and even cryptocurrencies! If you want to trade on your mobile, eToro also has an excellent forex trading app.

Pros:

- Some account fees, including withdrawal fees

75% of retail investor accounts lose money when trading CFDs with this provider.

2. Libertex – Excellent Forex Trading App

What’s really unique about Libertex, though, is that this brokerage doesn’t charge floating spreads. Instead, it charges percentage-based commissions for every trade. These commissions are as low as 0.08% for forex trades, so you may be able to save money with Libertex’s pricing model compared to a traditional forex spread model. Keep in mind that the broker does charge withdrawal fees, though, so you’re not entirely off the hook when it comes to fees.

Libertex offers both its own capable trading platform as well as MetaTrader 4 for its clients. Both forex trading platforms are available on the web, mobile, and desktop, so you can monitor the market and place trades from anywhere.

Libertex’s trading platform is a little bit more intuitive and easier for beginner traders, while MetaTrader 4 enables you to build and backtest custom trading strategies. This broker also has one of the best forex trading apps we’ve seen.

Cons:

- Withdrawal fees

- Leverage is limited to just 30:1

75.3% of retail investor accounts lose money when trading CFDs with this provider.

3. Plus500 – Low-cost CFD Trading Accounts

Plus500 also stands out for offering a massive amount of leverage. With this broker, you can trade major currency pairs on margin at a ratio of up to 300:1. There are more than 60 currency pairs in all, so you’ll never find yourself wishing for more trading options.

The only area where Plus500 falls short is in technical analysis. This trading platform comes with a charting interface, but the technical studies are somewhat limited and you’re not able to build your own indicators. Beginner and intermediate traders probably won’t notice the limitations, but the broker can feel constraining for more advanced forex traders.

Cons:

- Limited technical analysis for advanced traders

- No social trading network

4. AvaTrade – Advanced Charting with MetaTrader 4

AvaTrade offers CFD trading for more than 50 currency pairs. Better yet, forex traders can take advantage of vanilla options trading. That means you can speculate not only on whether a currency’s value will change but also the magnitude and the timing of that value change. Options provide traders with more flexible strategies, including the possibility of hedging.

We also like AvaTrade because it offers quite a bit of leverage for more advanced traders. You can trade major pairs on margin at up to 400:1, and even exotics come with potential leverage of 50:1. If you want to place big bets with a relatively small account, this broker is worth a look.

Trading with AvaTrade is commission-free, but unfortunately, this broker isn’t the cheapest option for South African traders. The spreads can be quite high – USD/ZAR, for example, trades with a fee of 0.85%. AvaTrade makes up for that in part, though, by eliminating most account fees that would otherwise eat into your trading profits.

Cons:

- Very high spreads

- Somewhat complex for first-time forex traders

5. Capital.com – AI Algorithms to Improve Your Trading

While AI integration might make Capital.com sound like an expert-only platform, this broker does quite a bit to cater to first-time traders. There are numerous guides and tutorials available through Capital.com that explain the ins and outs of forex trading. Plus, this broker even offers a dedicated forex trading education app that helps you learn and practice basic forex trading strategies. You can also take advantage of the demo account to try out what you’ve learned.

Capital.com offers trading on dozens of popular forex pairs, including all of the major and minor pairs. You just need a $100 minimum deposit to get started, and this broker lets you apply leverage up to 100:1. All trading through Capital.com is commission-free and the spreads on forex trades are impressively competitive given the quality of tools this broker offers.

Cons:

- No social trading network

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Place Your First Forex Trade

At this point, you’re ready to start trading forex. To help you place your first trade, we’ll demonstrate the process using eToro.

We prefer to use eToro because the trading platform is very user-friendly, the broker accepts a wide range of deposit methods, and you can trade forex CFDs for more than 45 currency pairs. If you choose another broker, though, the process for signing up and placing a trade will look very similar.

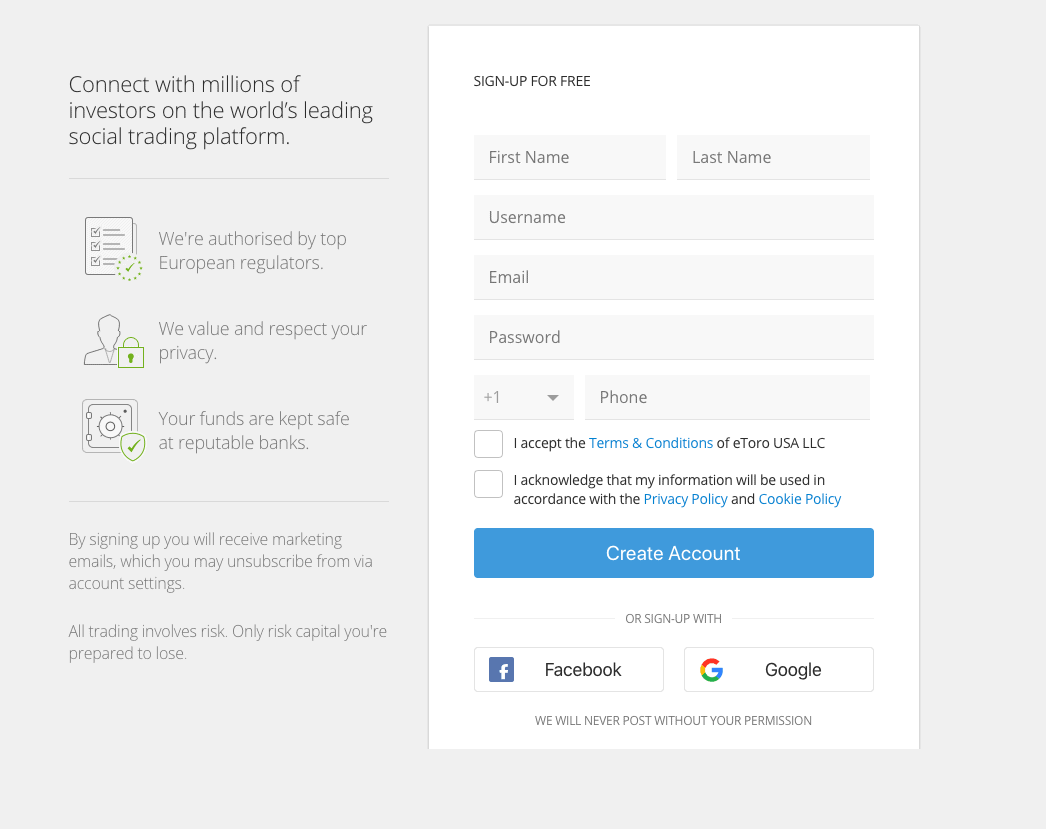

Step 1: Open a Forex Trading Account

To open a forex trading account, navigate to eToro’s homepage and click ‘Join Now.’ That will take you to a sign-up form where you can create a new username and password as well as enter your personal details.

eToro and all other regulated forex brokers also require you to verify your identity at this step. You must upload a copy of your driver’s license or passport, along with a utility bill or account statement that shows your current address. Verification happens instantly and you’re able to access your account immediately afterward.

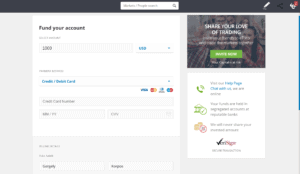

Step 2: Fund Your Account

Before you can start trading currencies, you need to fund your new account. eToro requires a minimum deposit of $200 US, and you can save money on currency conversion fees by changing rand to US dollars through another exchange platform before making a deposit.

To make a payment, you can choose from a variety of different methods:

- Visa or Mastercard (debit or credit)

- Bank transfer

- Wire transfer (extra fee applies)

- Neteller

- Skrill

- PayPal

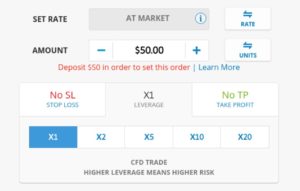

Step 3: Place Your Forex Trade

With a funded account, you’re ready to place your first trade. Search for the currency pair you want to trade in the search box at the top of the eToro dashboard – for example, to trade USD/ZAR, enter ‘USD/ZAR.’ When the currency pair appears in the drop-down menu, click on it.

You’ll be taken to the page for that currency pair. Click ‘Trade’ to open a new order form.

The order form is what you’ll use to tell eToro how much currency you want to trade. You can trade any amount greater than $40. Set a stop loss and take profit level for your trade and decide whether to apply leverage. When you’re ready, click ‘Buy’ to buy US dollars or click ‘Sell’ to buy rand.

Conclusion

Forex trading is a way to take part in the $6.5 trillion global currency market. Through the forex market, South African forex traders can speculate on currencies from around the world.

Mastering forex trading and making a steady profit is hard work. We’ve presented a number of trading strategies and tips to help you get started, but we recommend that you continue learning and practicing your skills to increase your chances of success.

Now you’ve read our guide to forex trading for beginners, you can get started with any of our recommended South Africa forex brokers. We highly recommend eToro, which offers commission-free trading, low spreads, and access to more than 45 currency pairs through a user-friendly trading platform.

eToro – Best South Africa Forex Broker with 0% Commission

75% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

Why should I trade forex using CFDs?

When you trade CFDs (contracts for difference), you don’t own the underlying currency outright. That’s often a good thing because there are some regulatory headaches that come with owning foreign currencies. In addition, CFDs make it easier to trade currencies with leverage.

Do I have to use leverage when trading forex?

No, you do not have to use leverage when trading forex. You get to decide how much leverage to apply, if any, when you place a trade. Many forex traders use forex to increase their potential profits, but keep in mind that it also increases your risk.

Why do different forex pairs have different spreads?

Some forex pairs are more liquid than others, meaning it is easier for your broker to fill orders. Currency pairs with high liquidity typically have lower spreads, while pairs with low liquidity have higher spreads. This is why trading major currency pairs is often cheaper than trading exotics.

How do stop losses work when trading forex?

A stop loss is a standing order that tells your broker to exit your forex position if the price drops below a certain threshold. Typically, that means that you will sell your currency position at the stop loss price, even if the price of the currency continues to fall. This is an important tool for limiting risk when trading forex.

Who regulates forex brokers in South Africa?

Trustworthy forex brokers in South Africa are regulated by the Financial Services Board, the country’s financial watchdog. Many brokers that operate internationally are also regulated by the UK Financial Conduct Authority and the Australian Securities and Investment Commission. We recommend that you always use a regulated broker for trading forex or any other assets.