Best Volatility 75 Index Brokers South Africa

If you have a slightly higher appetite for risk – you might be considering the Volatility 75 Index. Often dubbed as the ‘Fear Index’, the Volatility 75 allows you to speculate on the market sentiment of the S&P 500.

In this guide, we review the Best Volatility 75 Index Brokers South Africa for 2022 and show you how to set up your first commission-free trade!

Your capital is at risk.

Best Volatility 75 Index Brokers List 2022

Below you will find the Best Volatility 75 Index Brokers South Africa in the market right now. You can read a full review of each trading platform by scrolling down!

- Capital.com – Overall Best Broker with Volatility 75 Index

- Avatrade – Best Broker for VIX Trading with MetaTrader 4

- IG – Best Volatility 75 Index Broker for Advanced Technical Traders

- Pepperstone – Best Broker with Volatility 75 Index for Raw Spread Accounts

- IC Markets – Best Volatility 75 Index Broker for High Leverage (1:500)

- Plus500 – Best Broker with Volatility 75 Index for Mobile Trading

Best Volatility 75 Index Brokers South Africa Reviewed

In searching for the best Volatility 75 Index brokers South Africa, your first port of call is to ensure the platform actually offers your desired market. After all, there are several variations of this index to suit risk appetites of all levels.

You then need to look at the fundamentals surrounding trading commissions, minimum account balances, payment methods, and regulation.

To save you hours of mundane research – below we discuss a selection of the best Volatility 75 Index brokers South Africa for 2022.

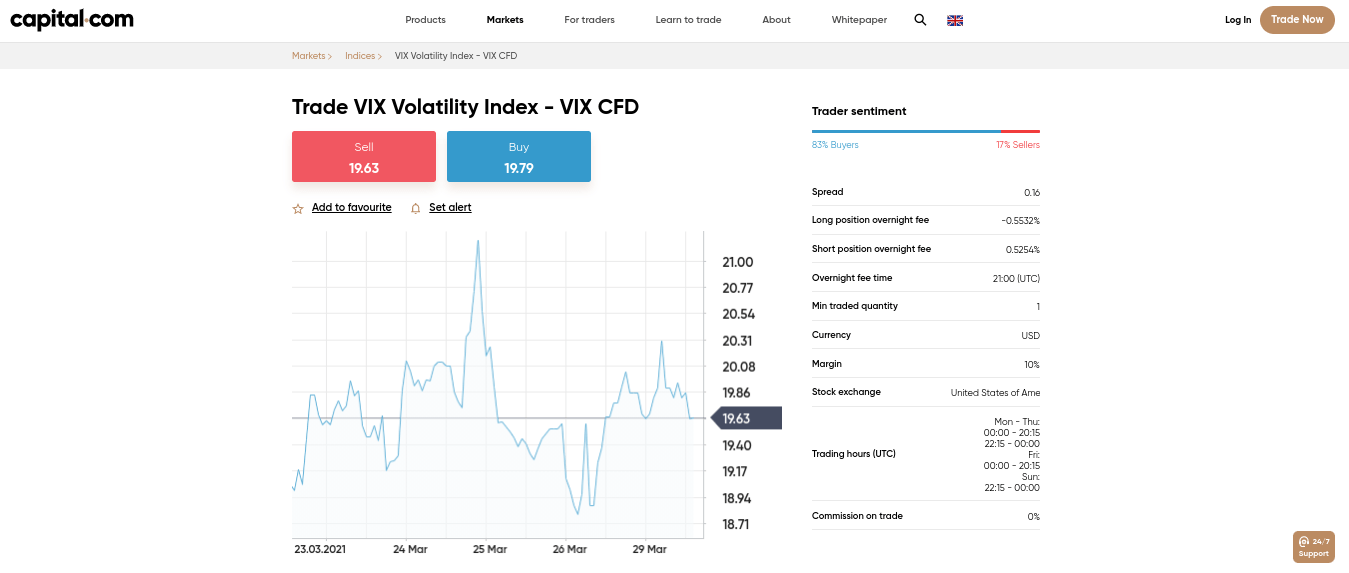

Capital.com – Overall Best Broker with Volatility 75 Index

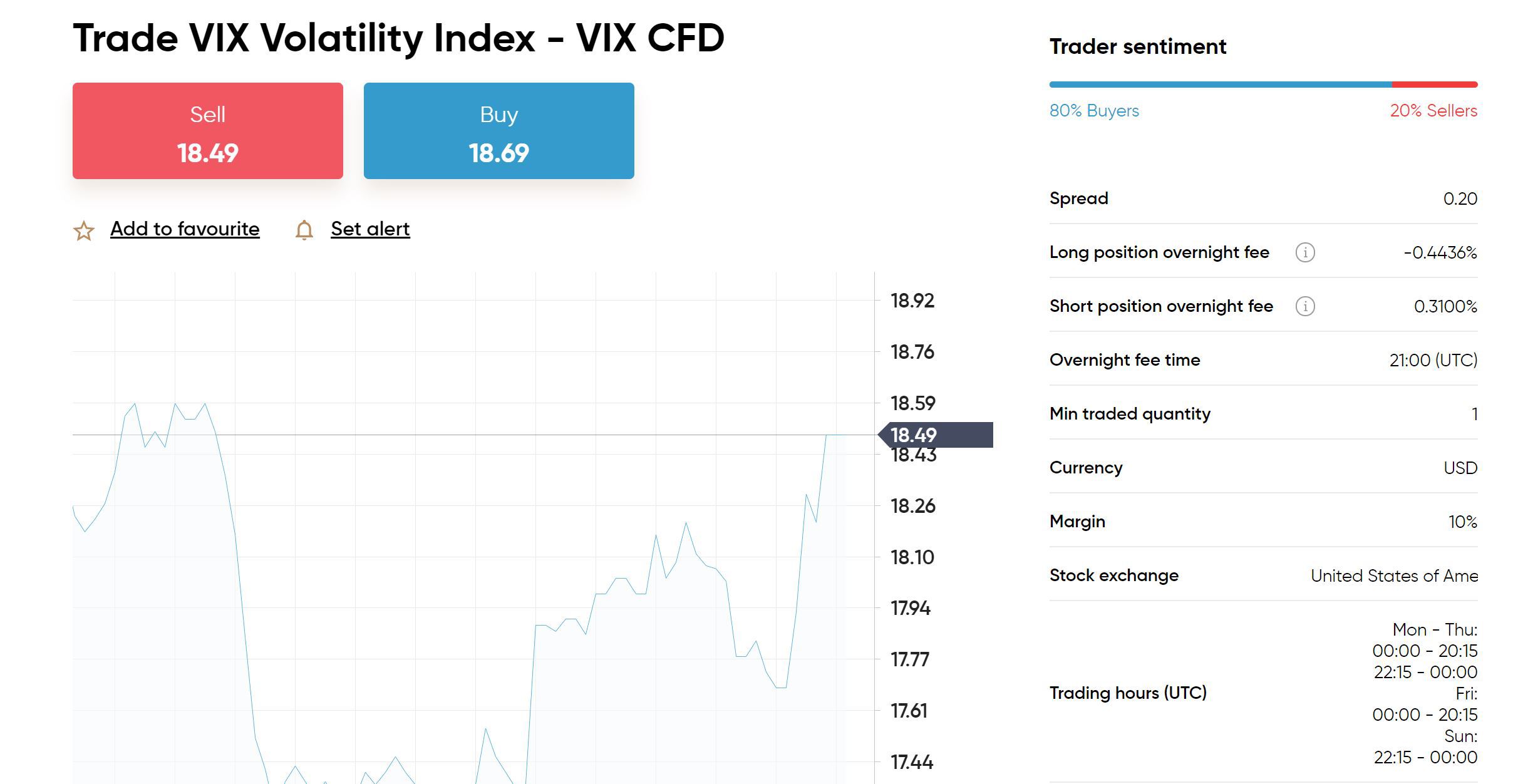

As you will be trading this marketplace via CFDs – you have the option of going long or short. You do, however, need to understand how the Volatility 75 Index works before speculating on whether you think its price will rise or fall – more on this later. Nevertheless, another benefit of using Capital.com to trade the Volatility 75 Index via CFDs is that you can apply leverage of up to 1:10.

This means that by allocating $100 from your account balance – you are effectively trading with $1,000. Capital.com is also a commission-free platform – so it’s only the spread that needs to be factored into your trading costs. At the time of writing, the CFD broker is quoting a spread of 0.8%. In terms of who Capital.com is suitable for – the platform is tailored towards beginners.

This is because it offers a full range of educational videos, trading courses, and guides. There is also a free demo account facility that you can use before risking any capital. When you are ready to start trading the Volatility 75 Index with real money, the minimum deposit at this CFD broker is just $20 (about 300 rands). You can deposit funds via a bank transfer, debit card, credit card, or e-wallet. Finally, Capital.com is regulated by several financial bodies – including the FCA and CySEC.

Pros:

- Trading on hundreds of US and UK shares

- Educational app for new traders

- AI assistant identifies your weak points

- Trade ideas generated daily

- Excellent charting and analysis interface

- No inactivity fees

- Thousands of UK and US shares

- 100% commission free trading

Cons:

- Cannot build custom trading strategies

78.79% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

AvaTrade – Best Broker for VIX Trading with MetaTrader 4

AvaTrade also has its own custom trading platform that’s very easy to use. We especially like that it comes with a built-in news feed, so you can easily stay on top of the events that will move the volatility index. The platform also has an economic calendar and includes analysis from a team of in-house market experts to help you navigate trading.

Trading with AvaTrade is 100% commission-free. The broker charges spreads for trading the Volatility 75 index, and these are generally in line with the industry average. You can get started with AvaTrade with just a $100 minimum deposit, and the broker accepts payment by credit card and debit card as well as bank transfer.

AvaTrade is regulated in South Africa by the FSCA and in Ireland, Australia, and Japan. The broker offers 24/5 customer support, which is a huge plus if you ever need help with your account. In addition, all AvaTrade accounts come with negative balance protection to ensure you can never lose more money than you deposit into your account.

Pros:

- 100% commission-free index trading

- Integrates with MetaTrader 4 and 5

- Custom platform with in-house analysis

- News feed and economic calendar

- Regulated in South Africa

Cons:

- Minimum deposit of $100

Your capital is at risk.

IG – Best Volatility 75 Index Broker for Advanced Technical Traders

If you are an experienced online trader – which you should be if opting to speculate on the Volatility 75 Index, then IG is a great option to consider. This brokerage firm has been operational since 1974 and is now used by hundreds of thousands of traders. And of course – IG is heavily regulated and authorized to offer trading accounts to South Africans.

When trading the Volatility 75 Index at IG, you will be doing so via a CFD instrument. Once again, this gives you the option of applying leverage and choosing from a long or short position. Upon registering an account at IG, you will then have various options when it comes to choosing a trading platform. If using the native platform built by IG – this can be accessed directly from within your web browser.

If you want to use MT4 – this is also supported. IG also offers ProRealTime – which is an advanced charting package that includes over 100 technical indicators and volatility signals. IG also supports third-party trading and forex robots – which you can deploy via MT4. When it comes to trading fees, IG builds all commissions into the spread. The platform utilizes a variable spread system that will fluctuate based on market volume and volatility levels. At the time of writing, this stands at 0.91% on the Volatility 75 Index.

An additional benefit of using IG to trade the Volatility 75 Index is that it offers this marketplace 7 days per week – closing only between the hours of 23:00 – 09:15 (UK – London Local Time). Leverage is also offered on this market, but is capped at just 1:5. You can open an account at IG by meeting a slightly higher minimum of £250 (about 5,000 rands). The broker supports fee-free deposits via debit cards and South African bank transfers. If using a credit card – this will cost you between 0.5% and 1%.

Pros:

- Trusted broker with a long-standing reputation

- Good value share dealing services

- Leverage and short-selling also available

- Spread betting and CFD products

- Access to South African and international markets

- Great research department

Cons:

- Minimum deposit of £250

- US stocks have a $15 minimum commission

Your capital is at risk when trading CFDs with this provider

Pepperstone – Best Broker with Volatility 75 Index for Raw Spread Accounts

This popular online trading site offers one of the best raw spread accounts in the market. Offered as a ‘Razor Account’, this will allow you to place buy and sell positions that are matched by direct market participants. By not going through a market maker model, this means that you will get the best spreads possible when trading at Pepperstone. In turn, you will pay a very small flat commission which varies depending on the market currency.

If, for example, you were to trade the Volatility 75 Index, this is priced in USD – so your commission on the Razor Account would amount to $3.50 per slide. When it comes to supported markets, Pepperstone offers the Volatility 75 Index through rolling front-month VIX futures. This gives you access to the same levels of pricing and liquidity as any other Volatility 75 Index market – albeit, in a cost-effective manner.

Other tradable markets offered by Pepperstone – which typically come via CFDs, include stocks, indices, commodities, and cryptocurrencies. This top-rated broker gives you access to three different third-party platforms – with Pepperstone covering MT4, MT5, and cTrader. All of these platforms can be accessed via the Pepperstone website, or through the respective desktop software or mobile app.

Pros:

- Trade CFDs for stocks, forex, and commodities

- All fees built into the spread

- Includes paper trading with MetaTrader 4

- Copy and social trading features

- Great reputation

- Heavily regulated

Cons:

- Very high inactivity fee

Your capital is at risk.

IC Markets – Best Volatility 75 Index Broker for High Leverage (1:500)

There are several account types to choose from on this platform, so fees will depend on the one you opt for. For example, the Standard Account allows you to trade on a commission-free basis, with spreads starting at 1 pip. The Raw Spread Account permits ZERO spread trading alongside a commission of $3.50 per slide – much like the Razor Account at Pepperstone. If trading via cTrader, the IC Markets Raw Spread Account reduces the commission to $3 per slide.

When it comes to deposits and withdrawals, IC Markets supports Visa, MasterCard, Paypal, Neteller, Skrill, and several other e-wallets. You can also transfer funds from your South African bank account, but this isn’t processed instantly like the aforementioned payment types (2-5 business days). In terms of withdrawals, there are no fees applicable unless opting for a bank wire. Best of all, IC Markers will process your withdrawals on a same-day basis – as long as it is made before 12:00 AEST ( Australian Eastern Standard Time ).

Pros:

- Leverage of up to 1:500

- Several account types supported

- Choose from a commission-free account or raw spreads

- Heaps of financial markets on offer

- MT4, MT5, and cTrader

- Good reputation

Cons:

- Doesn’t offer a native trading platform

- No traditional investments or spread betting

Your capital is at risk when trading CFDs with this provider

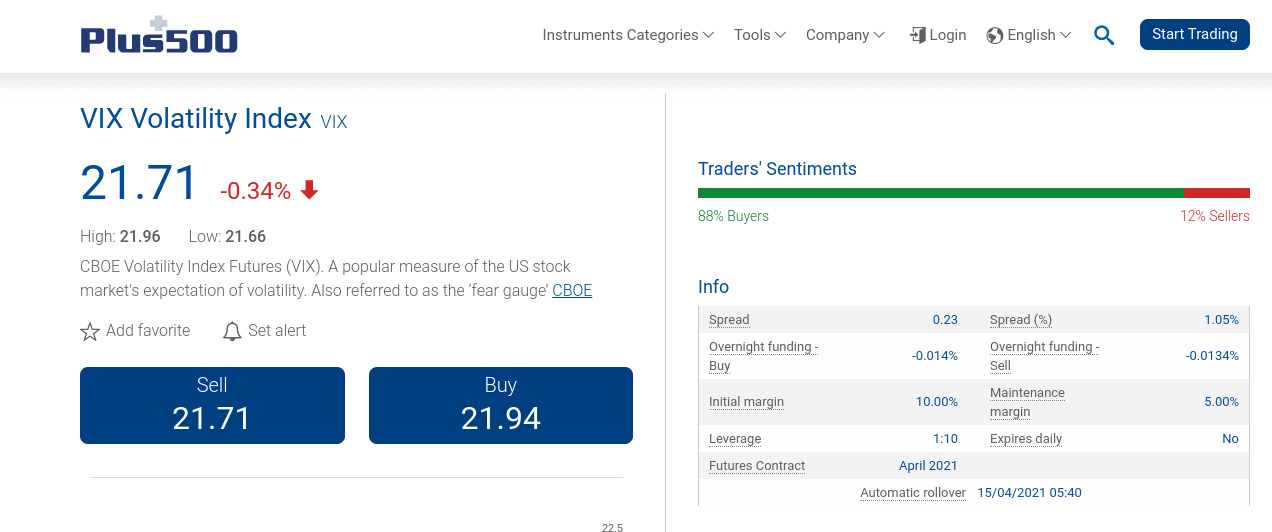

Plus500 – Best Broker with Volatility 75 Index for Mobile Trading

Plus500 is an established and regulated trading platform that specializes in CFDs. The platform is authorized to operate in South Africa and its parent company is listed on the London Stock Exchange. This top-rated platform allows you to trade the VIX Volatility Index with ease. All you need to do is quickly open an account and you can start trading via your web-browser.

With that said, Plus500 really stands out when it comes to its mobile trading app. Available on both iOS and Android – this free application gives you access to all of the same account features that you will find on the main Plus500 website. This means that you can deposit/withdraw funds, check the value of your portfolio, perform research, and of course – trade the VIX Volatility Index at the click of a button.

There is a free demo trading account that you can take advantage of at Plus500 before making a deposit. This mirrors live market conditions – so it’s a great way to get a feel for the platform without risking any capital. If you want top start trading with real money straight away, Plus500 requires a minimum deposit of $100 (about 1,500 rands). Supported payment methods include a South African debit/credit card, e-wallet, and bank account wire.

Plus500 also offers a ZAR forex account, which is a big plus for South African currencies traders.

Pros:

- Commission-free CFD platform – only pay the spread

- Thousands of financial instruments across heaps of markets

- Leverage of up to 1:30

- Ability to enter buy and sell positions

- Takes just minutes to open an account and deposit funds

Cons:

- CFDs only

- Only suitable for experienced traders

Best Volatility 75 Index Brokers Fees Comparison

Below you will find a Volatility 75 Index brokers list in terms of commissions and spreads.

| Broker | Commission (Standard Account) | Spread (Average) |

| Capital.com | 0% | 0.80% |

| Plus500 | 0% | 1.05% |

| AvaTrade | 0% | 1.00% |

| IG | 0% | 0.91% |

| Pepperstone | 0% | From 1 point |

| IC Markets | 0% | Variable |

As we noted in our Volatility 75 Index brokers list reviews, some providers offer several types. For example, one account might offer commission-free trading with a small spread, while another might charge a small commission but offer zero-spread trading. As such, always check fees and account types before joining your chosen broker.

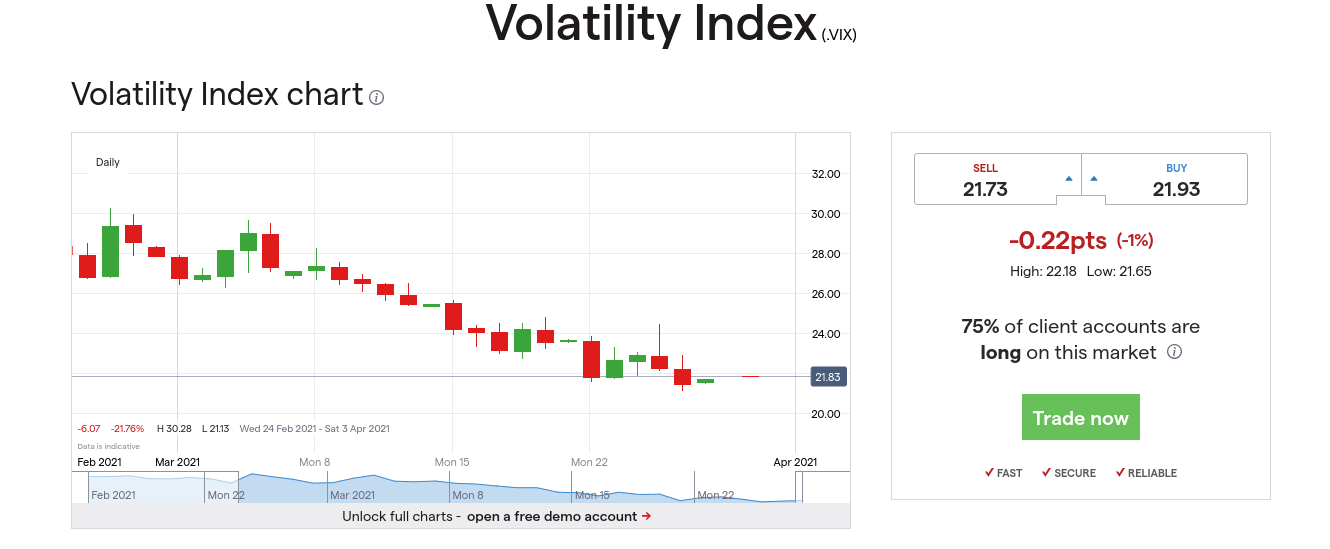

What is the Volatility 75 Index?

In its most basic form, the Volatility Index – or VIX for short, is a financial instrument that seeks to track market sentiment. In other words, it’s a ‘fear or greed’ index that gives us an indication as to whether the wider markets are feeling bullish or bearish.

The index itself is operated by the Chicago Board Options Exchange (CBOE), albeit, there are several variations offered by online brokers. For example, you can trade the Volatility Index via an ETF provider like iShares and Vanguard, or opt for conventional CFD instruments.

Either way, the market sentiment of the Volatility Index is based on the S&P 500. This is because the S&P 500 – which tracks the value of 500 large-scale US-listed stocks, is often the best way to gauge the strength or weakness of the American financial markets.

It is really important to note that the Volatility 75 Index is best left to experienced traders. This is because the index is somewhat complex to understand, insofar that it operates in an ‘inverse’ manner. Additionally, understanding what influences the rise or fall of the Volatility 75 Index is something that newbies might find difficult.

How to Trade Volatility 75 Index

Before you can trade the Volatility 75 Index effectively, you need to understand how this financial instrument operates. First and foremost, and like most index markets – the Volatility 75 is priced in points as opposed to dollars. The price of the index itself is determined by activity in the options trading market.

That is to say:

- Market sentiment is gauged by looking at what options positions have been executed by institutional players.

- This is because options are bought and sold as a way to speculate on the value of an asset in the future.

- So, if more people are buying call options on the S&P 500, this means that market sentiment is strong.

- Conversely, if put options are being favored, the markets are feeling bearish.

As we briefly noted earlier, the Volatility 75 Index is an inverse market.

This means that:

- If market sentiment on the S&P 500 is strong, then the Volatility 75 Index will drop in value

- If, however, market sentiment is weak, then the Volatility 75 Index will rise in value

As you can see, this is why the best Volatility 75 Index brokers South Africa allow you to choose from a long or short position. This is crucial, as it allows you to profit from both rising and falling markets.

Why Trade the Volatility 75 Index?

Make no mistake about it – the Volatility 75 Index is a complex financial instrument that should not be traded unless you know what you are doing.

If you’re still wondering whether or not this marketplace is right for you – below we discuss some of the main reasons why you might decide to trade the Volatility 75 Index from the comfort of your home.

Bet Against the US Stock Markets

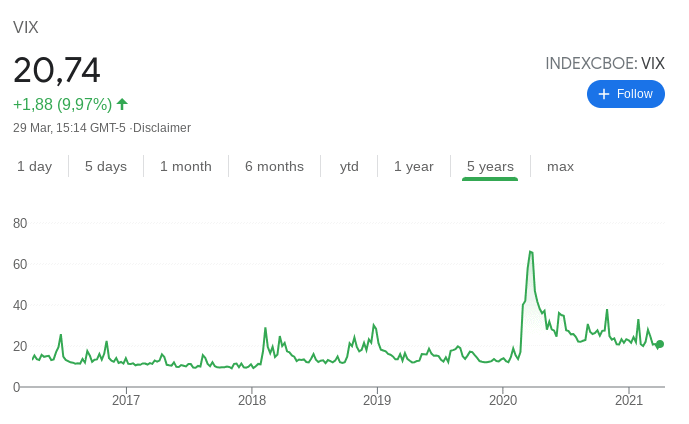

Perhaps the main advantage of trading the Volatility 75 Index is that it allows you to bet against the wider US stock markets. This could be particularly useful during uncertain times. For example, in early 2020 – fears of the coronavirus pandemic resulted in the S&P 500 losing more than 30% in the space of a few weeks.

As an inverse financial instrument, the S&P 500 dropping in value resulted in the Volatility 75 Index increasing in value.

For instance:

- The Volatility 75 Index was priced at 13.68 points on February 14th, 2020.

- On March 20th, 2020 – the index was priced at 66 points.

- This means that had you entered the market on February 14th – you would have been looking at gains of over 382% In just over a month

There are a couple of important points to note about the above example. First, you will notice that the value of the index rose by 382%. If you had instead looked to profit from the fall of the S&P 500 via a traditional short-selling trade – you wouldn’t have made anywhere near as much. After all, if the S&P 500 falls by 30% and you short-sell it – you will only make 30%.

Secondly, the Volatility 75 Index spiked in value on the very same day as the S&P 500 begun its short-term capitulation (February 14th, 2020). The index also peaked on the same day that the S&P 500 began its recovery. This illustrates that there is a very strong correlation between the two financial instruments.

Great for Hedging

Another reason why you might consider trading the Volatility 75 Index is that it allows you to hedge against open stock market positions. For example, let’s suppose that you are invested in an S&P 500 ETF – or you hold a number of stocks that have a major influence on this marketplace (such as Amazon, Apple, and Microsoft).

If there are market murmurs that a temporary downward pricing swing is imminent, an inexperienced investor might be tempted to cash out their stock trading position. However, a seasoned trader might instead look to go long on the Volatility 75 Index to cover via a hedging strategy.

For example:

- We noted in our example above that the S&P 500 lost over 30% in the space of a few weeks in early 2020

- During the exact same period, the Volatility 75 Index increase in value by over 382%

- As such, had you kept hold of your S&P 500 stocks while at the same entered a long position on the Volatility 75 Index – you would have not only hedged your capital – but walked away with a very tidy profit

This is why it’s a great idea to learn the ins and outs of hedging when investing in the financial markets. Oftentimes, newbies will simply sell their investments at the first hint of a market correction. But, in many cases, it’s wise to sit tight and instead deploy a hedging strategy.

Trade With Leverage

In the vast majority of cases, the best Volatility 75 Index brokers South Africa will offer this marketplace via CFD. As we covered in our reviews, this allows you to trade with leverage.

The amount of leverage that you can get your hands on will usually be determined by the broker that you sign up with. In the case of Capital.com, for example, you can trade index markets with leverage of up to 1:20. This means that you can access $20,000 worth of trading capital by depositing just $1,000.

Volatility 75 Index Trading Strategies and Tips

Trading the Volatility 75 Index is no easy feat – especially if you are a complete newbie. With this in mind, below we discuss a selection of highly-rated strategies that you might consider learning.

Keep Abreast of Financial News

Financial news is a crucial driver in pricing the Volatility 75 Index. After all, important new developments will determine whether the markets are bullish or bearish.

For example:

- When news of the first COVID-19 vaccine being approved in the US was announced – this resulted in the S&P 500 increasing in value. In turn, this resulted in the value of the Volatility 75 Index going down.

- In another example, when there are rumors that the Federal Reserve is considering an interest rate hike, this will often result in the S&P 500 losing value. This is because it becomes less attractive for financial institutions and hedge funds to borrow money and thus – inject capital into the stock markets. In turn, this would likely result in the Volatility 75 Index increasing in value.

These are just two scenarios of many. The key point is that in order to trade the Volatility 75 Index effectively, you need to have a firm grasp of key financial news stories as soon as they break. Some of the Volatility 75 Index brokers South Africa discussed today allow you to receive real-time notifications when an important new development is announced.

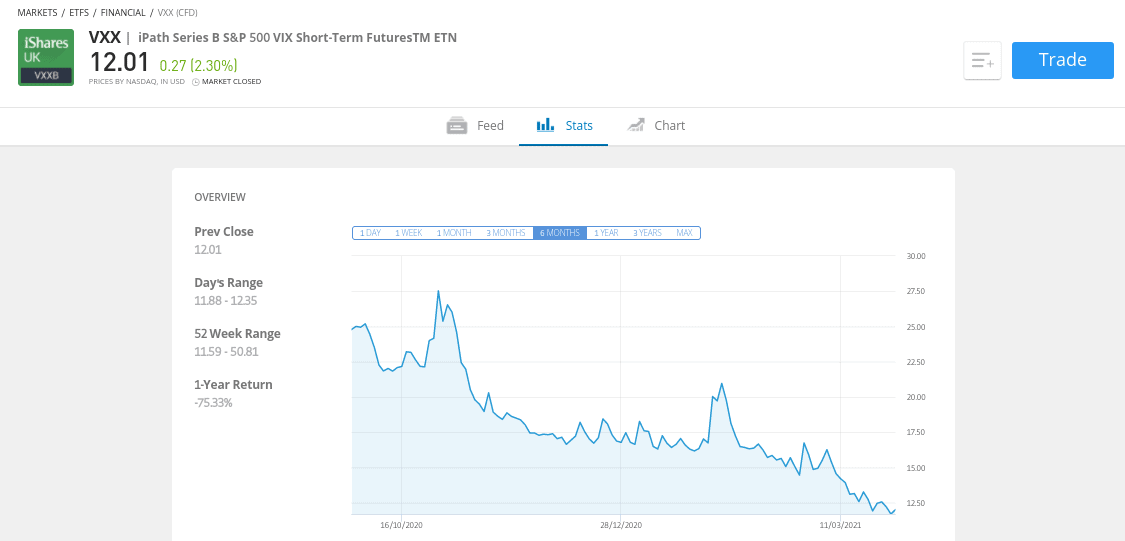

Consider an ETN for Prolonged Market Slumps

One of the best ways to trade the Volatility 75 Index is via a CFD. This is because you will have access to long and short positions, leverage, and low-cost spreads. However, if you believe that a prolonged market correction is in the making – it might be better to opt for an ETN (Exchange-Traded Note) that tracks the Volatility 75 Index.

This is because you won’t be liable for overnight financing fees that are part and parcel of leveraged CFDs. Instead, you’ll only need to pay a very small maintenance charge that typically sits below 1% per year. Additionally, when using low-cost share dealing platform – you can invest in a volatility ETN without paying commission.

Analyze the S&P 500 Options Market

As we noted earlier, the value of the Volatility 75 Index is largely driven by the S&P 500 options market. This is typically based on options that mature in 30 days’ time.

- For example, if there are more investors purchasing 30-day put options on the S&P 500, then there is every chance that the Volatility 75 Index will rise in value.

- And of course – if more investors are purchasing call options, then this means the markets are bullish and thus – you should expect the Volatility 75 Index to drop.

- If you want to become a prolific trader in this market – it is, therefore, crucial to keep tabs on the options arena.

There are many online websites that give you key information regarding S&P 500 options – such as transparent order books, prices and implied volatility levels.

How to Get Started with the Best Volatility 75 Index Broker

If you feel confident that you have the required knowledge and experience to trade the Volatility 75 Index – we are now going to show you how to get started. The guidelines below will walk you through the process of placing a commission-free trade on a popular Volatility 75 Index market – the Barclays iPath Series B S&P 500 VIX Short-Term Futures ETN.

Step 1. Open an Investment Account

Visit the Capital.com website and open an account. You will be asked to enter some personal information and contact details – which is standard practice in the online brokerage scene.

Capital.com will also ask you to upload some documentation – as per the regulations installed by its license issuers. This should only take you a minute – as you simply need to upload a copy of your passport/driver’s license and a proof of address.

Step 2. Deposit Funds

You will now need to add some money to your Capital.com account. The broker supports various South African payment methods – such as Visa and MasterCard. This covers both debit and credit cards. Bank transfers are also supported but this will delay the funding process by a couple of days.

Although you can deposit funds with a payment method backed by South African rands, Capital.com doesn’t offer ZAR accounts. Instead, your deposit will be instantly converted into US dollars at a very favorable exchange rate. Then, you’ll be able to invest or trade any market of your choice without paying any commission.

Step 3. Search for Volatility Market

Now that you have a funded Capital.com account, you can proceed to trade your chosen volatility market. As noted above, we think that the best way to do this is via the Barclays iPath Series B S&P 500 VIX Short-Term Futures ETN. After all, this ETN tracks the price of the VIX as per the Chicago Board Options Exchange that it is listed on.

So, to go straight to the respective marketplace – enter ‘VIX’ into the search box and click on the result that loads up.

Step 4. Set up a VIX Trading Order

Now you need to set up a trading order.

This is very straightforward at Capital.com, as you simply need to enter the amount that you want to stake on the position. When you are ready to place your commission-free VXX position – click on the ‘Place Order’ button.

Conclusion

This guide has explained everything there is to know about the Volatility 75 Index. As you should now have a firm grasp of – this volatility market is not for the faint-hearted.

With that said – whether you are looking to speculate on the decline of the S&P 500 or you simply want to enter a hedging position – the best Volatility 75 Index broker in South Africa is Capital.com.

At this heavily regulated platform you can trade volatility instruments without paying any commission. The minimum stake is just $50 and you get started with an account in less than 10 minutes!

Capital.com – Best Volatility 75 Index Broker South Africa with 0% Commission

78.79% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

FAQs

Does XM have Volatility 75 Index?

No - although XM offers 20 equity indices, it does not offer a market on the Volatility 75 Index. This page has reviewed a selection of the best Volatility 75 Index brokers South Africa - with commission-free broker Capital.com coming out on top.

What moves Volatility 75 Index?

The Volatility 75 Index is influenced by market sentiment. More specifically, the index attempts to determine whether institutional investors are bullish or bearish on the S&P 500. In terms of price action, the index looks at trading activity on S&P 500 options contracts that are due to mature in 30 days.

What is the best time to trade Volatility 75 Index??

The Volatility 75 Index is an inverse financial instrument. This means that when the S&P 500 is up, the Volatility 75 Index is down (and visa-versa). As such, you'll want to trade the Volatility 75 Index when you believe that the S&P 500 is likely to experience a downward market correction.

Which broker has Volatility 75?

There are many top-rated brokers that offer a market on the Volatility 75 Index. This includes the likes of Capital.com, Plus500, AvaTrade, IG, and Pepperstone. All of the aforementioned brokers offer a commission-free trading account.

What exchange is the Volatility Index 75 listed on?

The Volatility 75 Index (VIX) is listed on the Chicago Board Options Exchange (CBOE).