How to Buy GameStop Shares in South Africa – With 0% Commissions

GameStop has had a crazy ride this year, with investors from Reddit piling into the stock and forcing the share price to unexpected heights. Although the hype has died down somewhat, there’s undoubtedly still scope for this company to generate capital gains for investors – and perhaps even return to the all-time highs of January 2021.

In this guide, we’ll discuss How to Buy GameStop Shares in South Africa in detail – exploring the company and its financials and showing you how to invest in GameStop without paying any commissions whatsoever.

How to Buy GameStop Shares in South Africa – Step by Step Guide 2021

Are you looking to buy GameStop shares in South Africa right away? Then look no further. By following the four steps below, you’ll be able to purchase GameStop shares with Capital.com in under ten minutes – all without paying any commissions. Ready to take your gambling skills to the next level? Check out the tips and tricks on ask-casino.com.

- Step 1: Open an account with Capital.com – Head to Capital.com’s website and click ‘Trade Now’. Enter a valid email address and choose a password for your account.

- Step 2: Verify your Account – Verify your Capital.com account by uploading proof of ID (a copy of your passport or driver’s license) and proof of address (a copy of a bank statement or utility bill).

- Step 3: Deposit – Fund your account using a credit/debit card, bank transfer, or e-wallet.

- Step 4: Buy GameStop Shares – Search for GameStop in Capital.com’s online platform and click ‘Buy’. Next, enter the number of shares you’d like to buy in the order box and then click ‘Place Order’.

Step 1: Choose a Stock Broker

If you’re looking to buy GameStop shares in South Africa, you’ll need to create an account with a reliable and trustworthy stock broker. This step is crucial to your trading success, as choosing a broker that does not charge hefty fees when trading will help you retain more of your profits.

With that in mind, we’ve done the research and narrowed down the options to our top two brokers when it comes to buying GameStop shares in South Africa.

1. Avatrade – Best Broker to Buy GameStop Shares in South Africa with Leverage

If you’re looking for an alternative to Capital.com, we’d also recommend checking out Avatrade. Avatrade is a well-known broker within South Africa and is regulated in the country by the FSCA. The broker has over 300,000 users worldwide and offers a vast range of CFDs for users to trade.

As Avatrade focuses on CFDs, you’ll be investing in a contract based on the underlying asset rather than the asset itself. This allows Avatrade to offer extensive leverage facilities for traders. Users can get up to 30:1 leverage on certain CFDs, which can increase potential profits by 30x. Furthermore, Avatrade also does not charge a commission when you place a trade – and spreads tend to be very tight.

Avatrade offer multiple platforms to trade, such as their useful WebTrader platform and full MT4/MT5 support. The latter is ideal for forex traders as it ensures they have all the tools they need to trade effectively. Furthermore, Avatrade also has a fantastic trading app that users can download to their devices and monitor their investments on the go.

The minimum initial deposit when opening your Avatrade account is only $100, and this can be made via credit/debit card, bank wire transfer, or various e-wallets such as PayPal and Skrill. Notably, all deposits are free to make, and Avatrade does not charge you to make a withdrawal either. Finally, Avatrade offers a selection of educational materials for users, designed to optimise trading and increase your safety when operating in the markets.

Pros:

- Suitable for experienced traders

- Zero commission trading

- User-friendly platform

- Trade GameStop shares with leverage

- Regulated and licensed to operate in SA

- Supports MetaTrader 4 and 5

- Offers numerous deposit options

Cons:

- Only offers CFDs

Your capital is at risk.

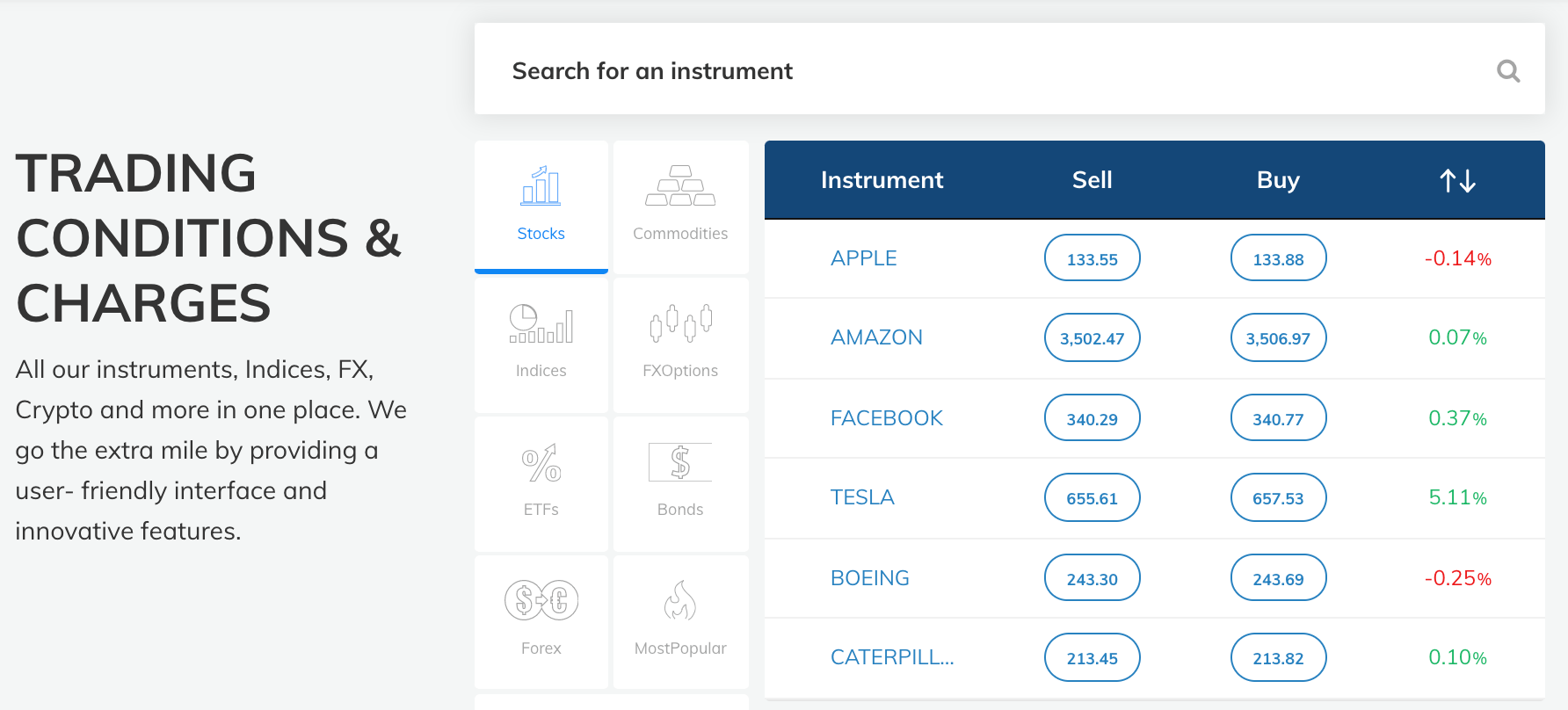

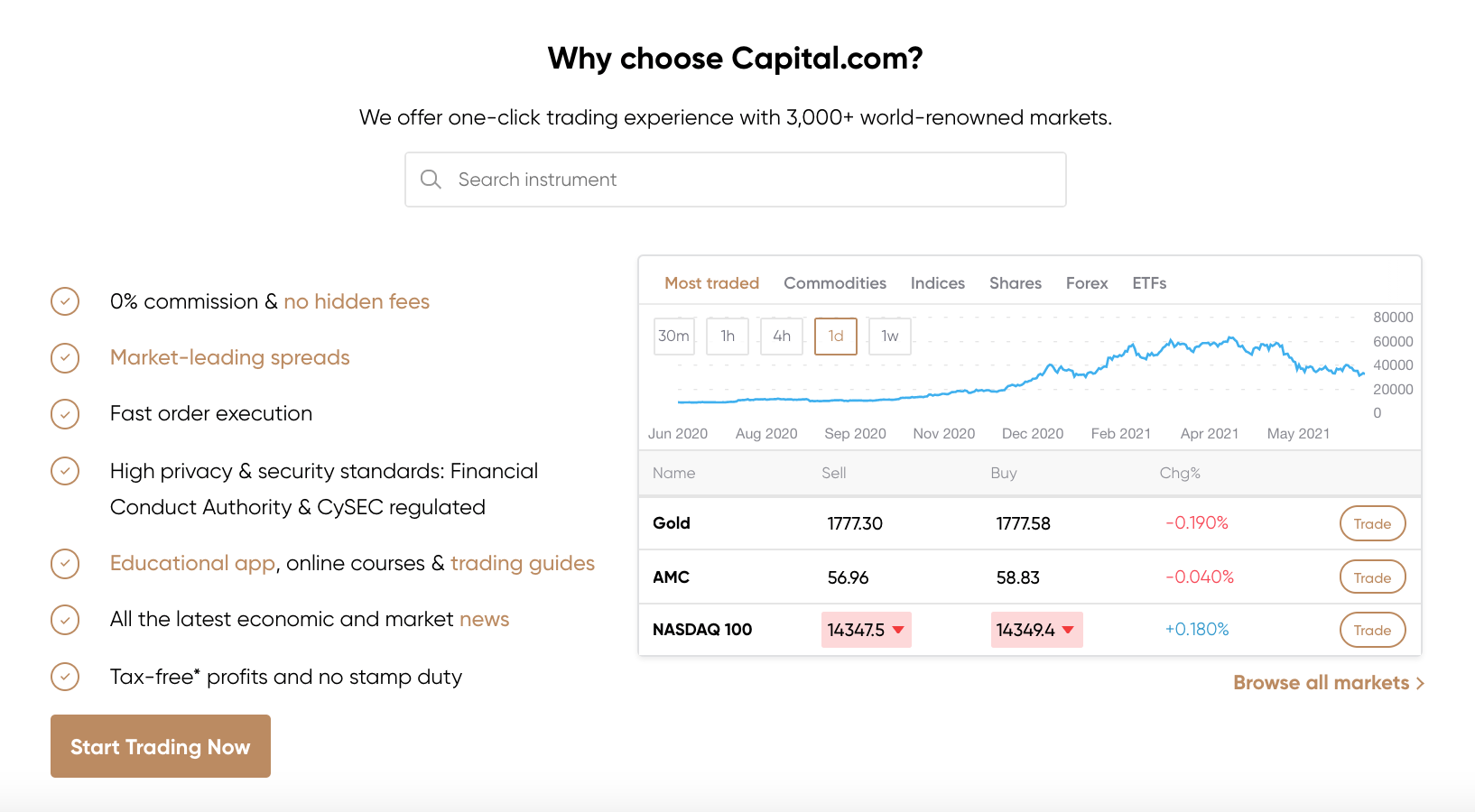

2. Capital.com – Overall Best Broker to Buy GameStop Shares in South Africa

Our top pick when it comes to brokers in South Africa is Capital.com. Capital.com has been in operation since 2016 and have a fantastic reputation with traders worldwide. This reputation is bolstered by regulation from top organisations such as the FCA, CySEC, and MiFID. Regulation from these entities ensures that Capital.com offer a safe and secure trading environment for all users.

One of the most appealing things about Capital.com is its fee structure. When you place a trade with Capital.com, you’ll avoid commissions and transaction fees altogether – this is in contrast with many other brokers who tend to charge a percentage of your position size as their fee. Capital.com’s costs are instead incorporated into the spread – this spread is usually minimal and is clearly quoted next to every asset.

Aside from low fees, Capital.com also offers a vast range of assets to trade. Traders can choose from over 3400 shares to invest in, along with a selection of indices, commodities, and currencies. In addition, Capital.com also offer cryptocurrencies to trade, with popular options such as Bitcoin and Ethereum able to be invested in with the click of a button.

Finally, Capital.com’s account opening process is straightforward and usually takes less than ten minutes to complete. Users can make deposits from as little as $20 (around 285 ZAR) through various methods, such as credit/debit card, bank transfer, or e-wallet. Finally, if you’re a beginner trader, you can even use Capital.com’s handy demo account feature to gain risk-free experience in the market before you trade for real.

Pros:

- Trade GameStop shares with 0% commissions

- Free demo account

- Suitable for both beginners and pro traders

- Zero inactivity fees

- Thousands of UK and US shares available

- Multiple funding options

- Low minimum deposit amount

Cons:

- Only offers CFDs

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Research GameStop Shares

Stock trading can be a lucrative endeavour, with traders worldwide entering the markets to generate a positive return. Yet, when you buy GameStop shares in South Africa (or any shares for that matter), it’s essential that you get a firm grasp of what the company is all about. This includes researching their business model, financials, and future prospects.

To help streamline this process, we’ve conducted all of this research for you and distilled it into the sections below. By reading these sections, you’ll have a solid overview of GameStop and its future outlook – ensuring you make an appropriate investment decision.

What is GameStop?

GameStop is an American video game, electronics, and merchandise retailer headquartered in Grapevine, Texas. The company has over 4800 stores worldwide, located in countries such as the United States, Canada, Australia, and Europe. In addition to the company’s physical stores, GameStop also owns and publishes Game Informer magazine, a very popular magazine for video gamers.

The company initially began life back in 1984 as a store called ‘Babbage’s’ and sold games and equipment for the Nintendo and Atari consoles. Babbage’s then merged with Software Etc., which was another company that specialised in PC software. The company continued to grow over the decades and established itself as the frontrunners in video game retailing. After various mergers and acquisitions, the company was finally renamed ‘GameStop, Inc.’ in 2000.

From 2000 until the mid-2010s, GameStop grew massively and acquired various smaller brands in the process. This growth came to an abrupt halt around 2016 as the market environment began to change – video games were no longer primarily a physical product, which rendered GameStop’s stores unnecessary. This led to a massive decline in sales and significant losses.

However, the reason GameStop is receiving so much attention these days is due to the events of January 2021. During this month, GameStop’s stock price soared an incredible 1,500%, thanks to a short squeeze brought on by the members of Reddit’s WallStreetBets community. A short squeeze is when a company’s share price increases by a massive amount in a short space of time, thanks to significant demand for shares. This demand happens because short-sellers scramble to buy back the shares they borrowed to facilitate their short position, thereby pushing the price even higher.

Elon Musk even got in on the act, tweeting out ‘Gamestonk!!‘ which forced the GameStop share price even higher. Eventually, price did return to pre-increase levels – although there is still substantial social media attention on the company, with many investors hoping that price can get back to those heights – and maybe even beyond.

GameStop Share Price

When you buy shares in a company, it’s crucial to analyse the stock price and try and get an insight into future movement. The GameStop share price is currently sitting at $219.34 – up an incredible 1105% since the turn of the year. Although this seems remarkable in and of itself, the GameStop share price was actually up by 2561% when it reached all-time highs in late January 2021. To help understand this, if you’d invested 10,000 ZAR before this price increase, your investment would have been worth 266,100 ZAR at the very top!

Looking at the price chart, you can see clear spikes in price occurring since the turn of the year, followed by sharp drops. This volatility isn’t for everyone, so GameStop might not be suitable for your situation if you are a risk-averse investor. Resistance seems to be shown around the $300 level, as the price has bounced back off of this area twice. However, if the price can break through this barrier, there’s a clear path towards the previous all-time highs.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

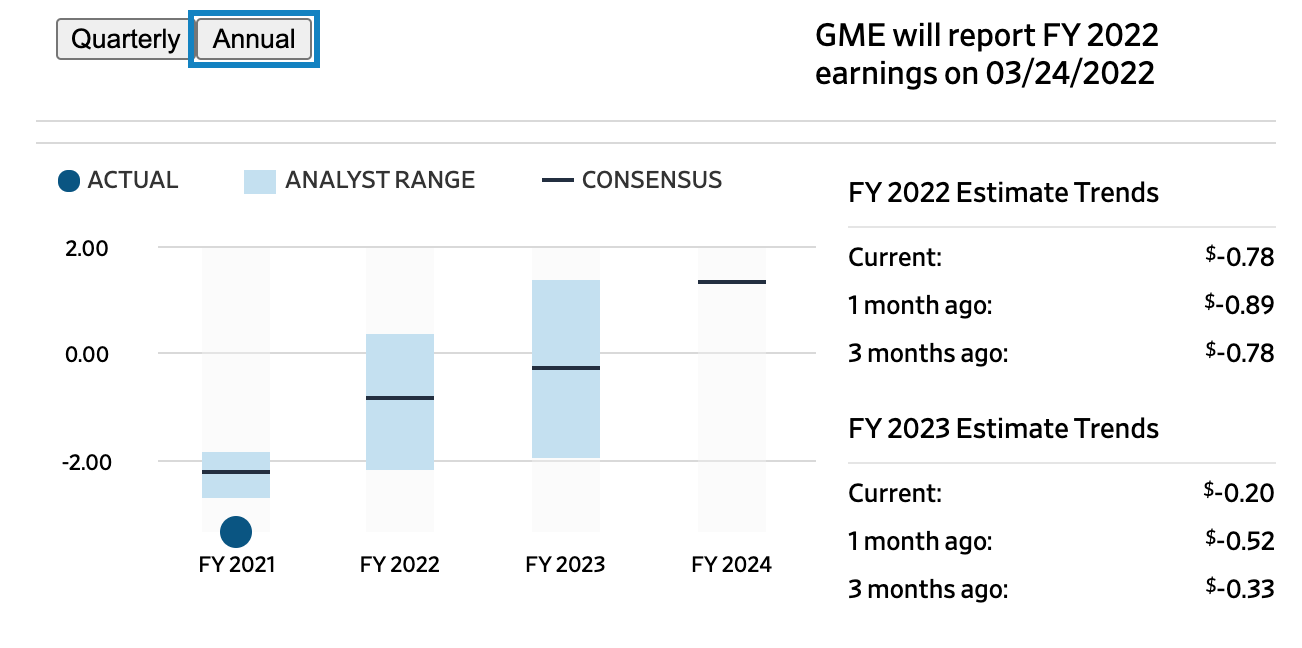

Aside from the GameStop share price, it’s also a good idea to look at some financial metrics to gain an insight into the company’s potential. Earnings per share (EPS) and the price to earnings (P/E) ratio are two metrics that are used by financial analysts when valuing a company. In terms of the former, this indicates how profitable the company is – indirectly highlighting the stock’s potential.

According to data from YCharts, EPS for GameStop were quoted as -$1.01 as of April 2021. A negative EPS means that the company is losing money – not good in the grand scheme of things. However, EPS figures were positive in January 2021, quoted as $1.19. This shift from positive to negative shows that the company has turned unprofitable over the short term.

A company’s P/E ratio is a good way of valuing them relative to other companies. Data from Nasdaq states that GameStop’s P/E ratio for 2021 is around -102.5. Again, this reiterates that the company is losing money overall. Furthermore, Nasdaq estimates that GameStop’s P/E ratio may decrease even further over the coming years.

GameStop Shares Dividends

At present, GameStop does not make any dividend payments to investors. The company has traditionally made quarterly dividend payments; however, these ceased in March 2019 and have not returned since. Dividend payments were consistently $0.38 per share between 2017 and 2019 but were slightly less in the years previous.

When GameStop decided to halt their dividends, the company was not in a great financial position. The cash for dividends was better used to fund interest payments and other outgoings; however, since then, the company has had a resurgence thanks to its popularity with retail investors. Furthermore, as GameStop has now raised a significant amount of capital, there’s a solid chance that the company could improve their business model – and potentially lead to dividends being reinstated in the future.

Are GameStop Shares a Good Buy?

Considering this information, is it a good idea to buy GameStop shares in South Africa? The answer to this question depends on your risk tolerance and patience. The sections below will dig into some key aspects to consider.

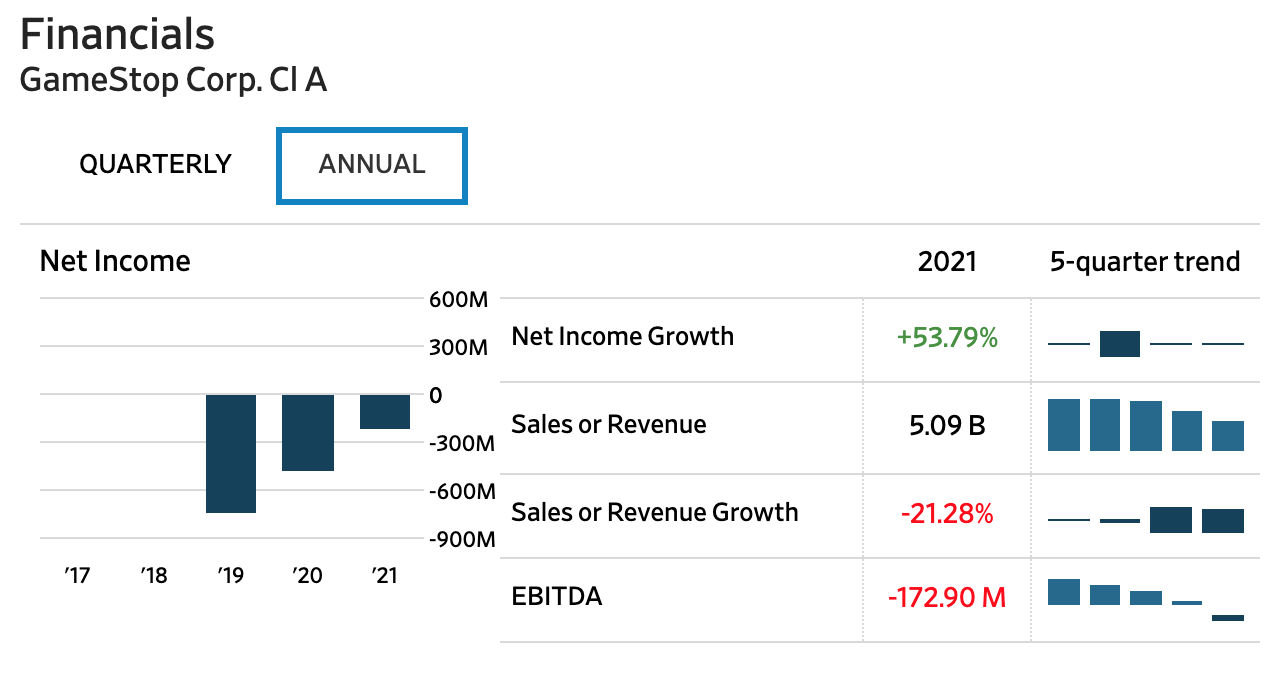

Company Financials

There’s no getting away from the fact that GameStop hasn’t been performing incredibly well in a financial sense. Sales from their physical retail stores have been dwindling year on year due to a shift towards digital game downloads. Furthermore, the company has had to close many stores worldwide in response to the Coronavirus pandemic and financial concerns.

CNBC did report that GameStop’s sales increased 25% in Q1 2021 compared to last year – which seems like great news on the face of it. However, sales figures benefitted from the release of new Xbox and PS5 consoles, which are a one-off purchase for most people. Thus, these figures are not expected to be as bright in the future.

Reddit Backing

However, there is undoubtedly a buy case for GameStop, and it’s thanks to the ‘meme stock’ craze brought about by r/wallstreetbets. The rally caused by the community’s backing has allowed the company to raise a lot of capital through the sale of shares at high prices – which will give the company some leeway for the new few years at least. Furthermore, this cash could also be used to improve GameStop’s e-commerce element, ensuring they are keeping up with the times.

The company has recently hired two former Amazon execs to be part of upper management, highlighting that they are taking e-commerce more seriously. Aside from this, there’s always the possibility of another short squeeze – and with short interest still exceptionally high according to MarketBeat, the chances of this happening are not improbable.

Open an Account & Buy Shares

Now that you have a solid overview of GameStop and the company’s financials, let’s look at how to invest in the company. As mentioned previously, it’s essential to choose one of the best share trading platforms when investing in the stock market, as this will ensure you trade safely and cost-effectively.

With this in mind, the five steps below will show you how to buy GameStop shares in South Africa with our recommended broker, Capital.com – all without paying any commissions whatsoever.

Step 1: Open a Capital.com Account

Firstly, head over to Capital.com’s website and click ‘Trade Now’. You’ll then be prompted to enter a valid email address and choose a password for your account. If you’d like, you can even complete this step through Capital.com’s app – one of the best stock apps available to traders.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Step 2: Verify your Account

As various top entities regulate Capital.com, new users must verify themselves before being able to trade. Luckily, this can all be completed online and is easy to do. Simply upload proof of ID (a copy of your passport or driver’s license) and proof of address (a copy of a bank statement or utility bill). Capital.com will then verify these documents, which usually only takes a few minutes.

Step 3: Fund your Account

Capital.com allow initial deposits from as little as $20 (285 ZAR), ensuring traders have the option to invest as little or as much as they want. Deposits are entirely free to make, and the following methods are accepted:

- Credit card

- Debit card

- Bank Wire Transfer

- Apple Pay

- Trustly

- Giropay

- iDeal

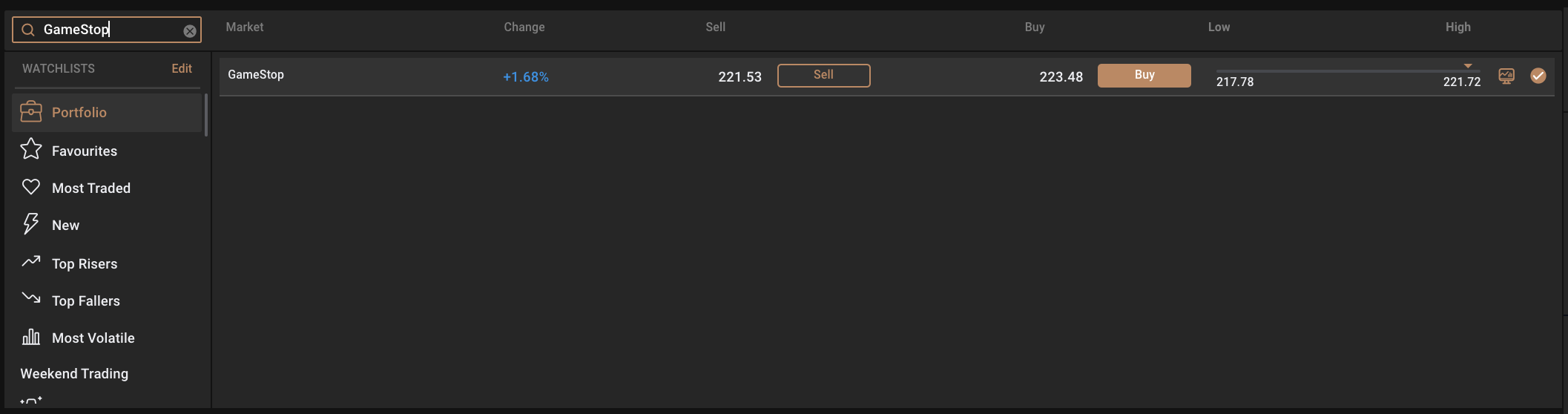

Step 4: Search for GameStop Shares

In the Capital.com trading platform, click into the search bar in the top left and type in ‘GameStop’. The company should appear in the search results in the centre of the screen. Simply click ‘Buy’ and move onto the next step.

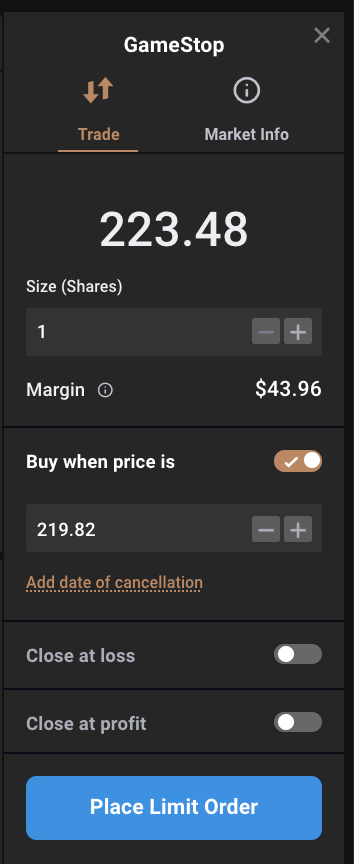

Step 5: Buy GameStop shares in South Africa

An order box will now appear on the right side of your screen, similar to the image below. All you have to do is enter the number of shares you’d like to buy, decide whether you’d like to use leverage, and click ‘Place Order’.

And that’s it! You’ve just invested in GameStop with Capital.com – all without paying anything in commissions!

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

GameStop Shares Buy or Sell?

To wrap up, is it a good idea to buy or sell GameStop shares? This all depends on your unique risk tolerances and criteria for choosing an investment. GameStop has understandably been on a wild ride since the beginning of 2021, highlighting both the company’s good points and its deficiencies. There’s no escaping the fact that GameStop has suffered over the past 5-6 years as the gaming environment has changed – yet the attention brought about by Reddit could potentially spur the company back into life.

Många reddit-communities pratar också om onlinekasinospel och virtuella kasinon där alla spelare kan spela slots gratis eller få extra bonuskoder.

The whole r/wallstreetbets community is still firmly behind GameStop, which will add confidence for potential investors in the company. The community single-handedly raised the share price an exceptional amount in January 2021 – and there’s definitely scope for a similar thing to happen again. Short interest in GameStop is still very high, and any significant increase in the share price could force short sellers to scramble to buy back shares – thus increasing the share price further.

On the other hand, any increase in GameStop’s share price wouldn’t be based on solid fundamentals. Sales have decreased year on year, and the company is still losing money. EPS and P/E figures are both negative, again highlighting the poor financial state of GameStop at present. However, the increase in stock price has enabled the company to raise significant capital, which buys them some breathing space in the future.

Overall, buying GameStop shares is definitely considered a hugely speculative action – but it could be incredibly profitable if things turn out to be positive. Reddit’s interactions with GameStop’s share price has shown that anything is possible, so it would be unwise to rule out any further increases. If you are a risk-seeking investor and are happy to place some capital in GameStop for a chance at exceptional returns, then now would undoubtedly be an excellent opportunity to do so.

Capital.com – Buy & Sell GameStop Shares With Zero Commission

In summary, GameStop has had a rollercoaster ride since the start of 2021, and it’s fair to say that it isn’t over yet. Retail investors from Reddit have used GameStop as a sort of ‘flagship’ investment and are determined not to give up until it reaches the heights they believe are possible. For most professional investors, this may seem like a fruitless endeavour – yet if they have done it before, there’s always the chance they could do it again.

If you’re looking to buy GameStop shares in South Africa, then we’d recommend using Capital.com. By using Capital.com, you’ll be able to buy shares without paying any commissions whatsoever. In addition to this, the minimum deposit is only $20 (285 ZAR) – ensuring Capital.com are accessible to all types of traders.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.