How to Buy Thungela Resources Shares In South Africa – With 0% Commission

Thungela is a mining company that produces and exports low-cost thermal coal in South Africa. The company’s shares are listed on the Johannesburg Stock Exchange (JSE) under the ticker symbol TGA. In this guide, we show you how to buy Thungela Resources shares in South Africa in %%currentyear%% Read on to learn all about Thungela and how to invest with 0% commission ✔ in South Africa with zero commissions.

How to Buy Thungela Resources Shares – Step by Step Guide 2021

If you intend to buy Thungela Resources shares in South Africa then look no further. We recommend that you use the popular regulated broker eToro due to their low fees and easy account opening process. Below are the steps to take:

- Step 1: Open an account using eToro– Visit eToro’s website and look out for the ‘TRADE NOW’ button to open a trading account. Click it and submit your email address and password.

- Step 2: Verify your Account – You would be required to upload a valid proof of ID (like a driver’s license or official passport). You would also need to upload proof of address (a recent copy of a bank statement or utility bill).

- Step 3: Deposit Funds – The broker allows a minimum deposit of $20 – which is about 330 rand, using any of eToro’s supported payment methods.

- Step 4: Buy Thungela Resources Shares – Search for the company in eToro’s trading platform and place a buying order.

Step 1: Choose a Stock Broker

One of the first steps you need to take if you want to buy Thungela Resources is to choose a broker. The broker should be one with specific qualities such as a suitable fee structure.

In this section, we will be reviewing eToro, the best stock broker in South Africa.

-

eToro – Best Broker To Buy Thungela Resources Shares

One of the reasons we have chosen eToro as our recommended broker to buy Thungela resources shares is its security.

The broker is heavily regulated by the UK’s Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). Therefore, it is safe to trade your funds with it. eToro is currently one of the best share trading platforms in the world.

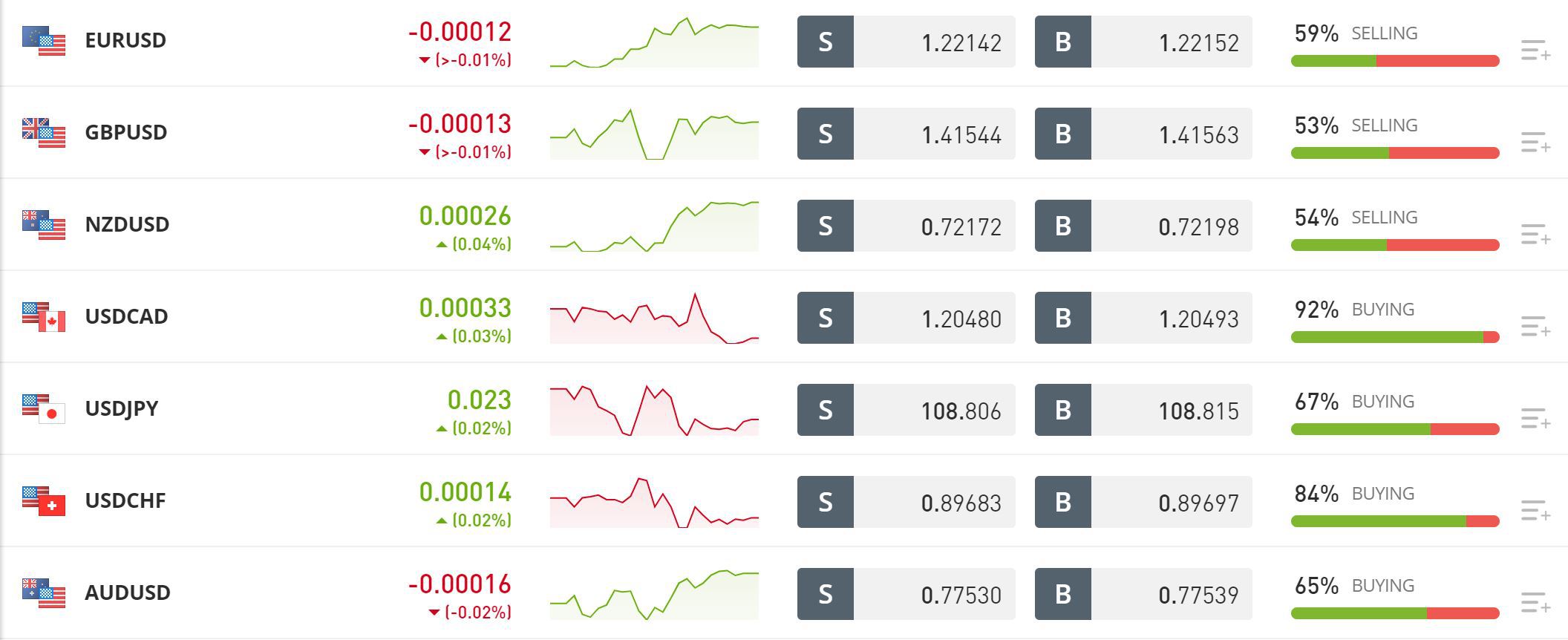

eToro offers stock trading options mainly that allow users to engage with the stock market. However, users can also trade crypto assets and forex via the platform.

With eToro, you get access to over 6000 assets from multiple stock exchanges in the world. Another reason why we recommend eToro is the fact that its minimum deposit amount is only $20. This means you can get started trading these assets at a low cost.

eToro is also beginner-friendly; the broker offers traders a wide selection of educational materials on their website. This includes articles, a glossary, and various courses to help them get up to speed in the markets. They also offer a demo account you can use before real trading. This provides a risk-free way of gaining exposure to the trading platform.

Pros:

- Educational tools for beginners and professional traders

- No deposit and withdrawal fees

- Huge range of assets like stocks, indices, cryptocurrencies, and so on

- Minimum deposit requirement of only $20

- Free demo account available

Cons:

- Limited crypto assets

- Doesn’t offer CFD trading

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Step 2: Research Thungela Resources Shares

Thungela Resources’ impressive start to life as an independent coal mining business has many investors excited about the project. However, before investing in the company, we recommend spending some time running a background check of the company to determine if it is a good investment or not. To this end, this section covers the company’s business structure and tracks its financial performance in the last six months. So let’s dive right into it.

What is Thungela Resources?

Thungela Resources is a leading pure-play producer and exporter of high-quality, low-cost thermal coal in South Africa. To sum it up, it is focused on the coal mining business. Even though it recently became a public company, Thungela has its history stretched back as far as 1945 and was part of a group of companies under the umbrella of Anglo American thermal business.

Following a May 5 Anglo American General Meeting, Thungela Resources was formed, and the shareholders approved the demerger of Thungela Resources from its parent company. This new standalone, independent coal mining company is focused on the coal mining industry in South Africa and is currently headed by CEO July Ndlovu. A set of objectives were highlighted following the demerger, with the company stating that it would produce a low cash-cost and high margin assets following its attributable 16.5 million tonnes of saleable export in the previous year.

Other focus areas include a strong balance sheet with capital support when needed alongside a robust environmental, social, and governance (ESG) framework. Following its formation and subsequent demerging, Thungela Resources launched on the Johannesburg and London Stock Exchanges on June 7, 2021. So far, Thungela Resources has lived up to shareholders’ expectations.

In a recent earnings call, the company noted in its interim results that it generated R3 billion in net cash that ended June 2021. It attracted R2.5 billion in cash injection supported by strong operational cash flows, and its earnings per share (EPS) stood at 313c per share with a calculated average number of shares standing at 74,408,794. Thungela Resources’ remarkable first few months of operating are more evident in its share price performance. Making its entry on June 7 at 2,190 ZAC, it has surged 133.84% in the last three months and currently trades at 5,121 ZAC.

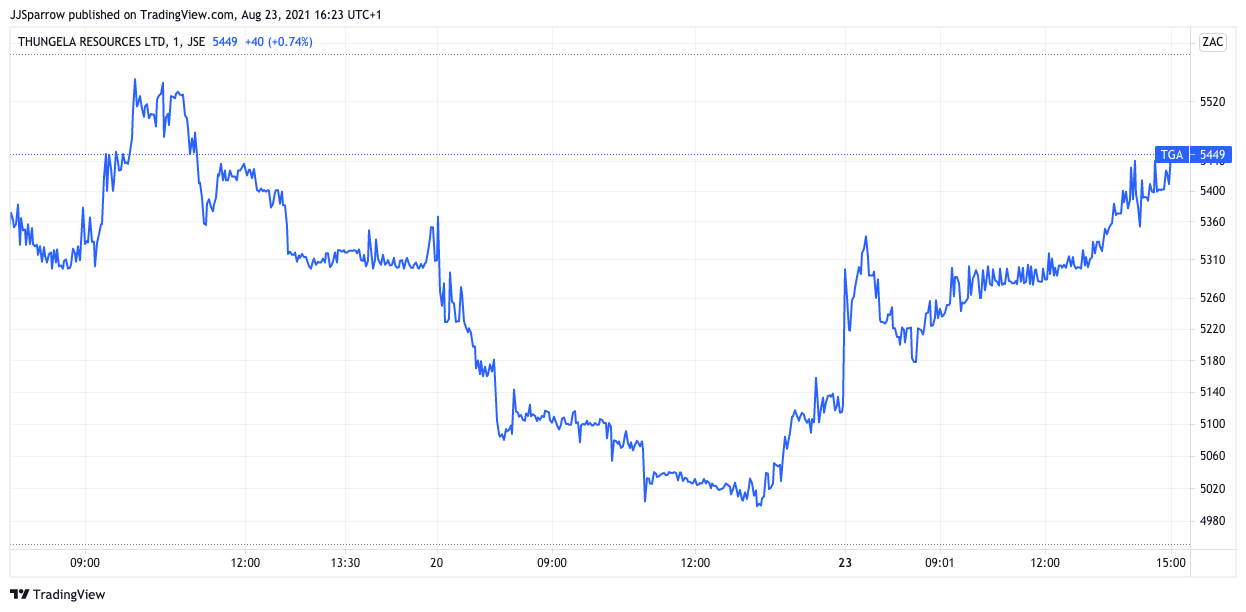

Thungela Resources Share Price

As we stated earlier, this coal mining company has been setting the pace ever since it came into the public eye. It began its remarkable journey at 2,190 ZAC and quickly catapulted to 2,895 ZAC over the next 24 hours. However, this was not its best price action as it continued rallying before hitting a near post-high of 5,166 ZAC on August 17.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

With the company increasing its South Asian ties, its share price surged, topping a record value of 5,418 on August 18. Its 52-week high stands at 5,681 ZAC with a market cap of R6.98 billion. Opening Friday’s trade at 5,309 ZAC, Thungela Resources had an intra-day high before dipping to a mid-term low of 4,952 ZAR. However, it recovered and closed the day at 5,121 ZAC, increasing 15% in the 24-hour window.

Regarding its shareholder volume, Anglo American shareholders get to exchange ten shares for one TGA share while still retaining ownership of the Anglo American enterprise.

Thungela Resources Share Dividends

Dividend payouts are another passive revenue source investors and shareholders can make more money from holding a company’s stock. We do not have enough information to determine if Thungela Resources intends to pay dividends to investors regarding its share dividends. It is still a relatively new public company and has not yet completed a full financial year. However, its dividend payment on the London Stock Exchange (LSE) is noted as zero, which could mean that the company may roll out dividend payments to compensate its shareholders.

Are Thungela Resources Shares A Good Buy?

In a largely competitive South African coal mining landscape, Thungela Resources have swept investors off their feet with its remarkable success in such a short period. This makes it one of the most attractive thermal-focused energy stocks in the South African market. Aside from this, there are a few other reasons why we think you should buy Thungela Resources shares.

Strong Interim Results

Thungela Resources hit the ground running. Its interim results have been largely impressive and show a strong business structure and great revenue source. According to the earnings report, the coal mining business was able to generate R3 billion by the end of its initial public opening (IPO) launch in June and so far has R6.98 billion in market value.

Aside from this, since becoming an independent coal mining South African operation, it has received R2.5 billion in cash injection showing that more investors believe in the team and business potential.

Its total non-controlling interest (NCI) stands at a remarkable R118 million while its earnings per share (EPS) went for 313c a pop. Earnings stood at R1.88 billion, and the company’s revenue has increased by 500%, thanks to the recovery in thermal coal prices.

Coals’ Demand Is Outpacing Supply

Coal may be hazardous to the environment, but recent environmental hazards have seen coal demand outpace its supply. This is apparent as coal futures prices surged to $170 a tonne given the growing demand from China’s biggest industrial provinces and a rebound in industrial output.

The Chinese government restarted its coal production in areas like Shanxi and Xinjiang due to electricity shortages prompted by severe floods and typhoons. Also, a trade spat with Australia has exacerbated the severity of the coal shortage, while flooding in countries like Indonesia and Colombia has continued to see the price of coal hit a record high. Thungela’s position as a global producer and exporter of thermal coal could see it leverage on the present demand gap and end the year on a strong note.

Step 3: Open an Account & Buy Shares

Thungela Resources’ strong start to life in the stock market can be exciting for you as an investor. But if you want to buy Thungela Resources shares, you need to open an account with a regulated and fee-saving broker.

From our extensive research, eToro fits the bill, and its low minimum deposit entry bar make it a top destination to buy shares in South Africa. This section will highlight the steps to get started in a few minutes.

Step 1: Create an Account with eToro

Navigate to the official website of eToro and click on the ‘Trade Now‘ button to get started. You will be redirected to a signup page where all you have to do is input your email address and choose a unique, strong password. You also get the convenience of registering with your Google, Facebook, or Apple account on Capita.com.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Step 2: Upload ID

We mentioned earlier that eToro is a regulated broker, which means you need to verify your identity on the platform. To do this, you will need to submit a copy of your official passport or driver’s license for processing. Also, you will need to upload proof of residence by submitting a recent copy of your bank statement or utility bill.

Once these documents have been uploaded, your identity will be verified within minutes.

Step 3: Fund your Account

After your identity must have been verified, you can now proceed to fund your trading account. To get started, you will need to make a minimum deposit of $20 which costs around 285 ZAC for South African users. To pay, eToro offers various payment methods, and you can use any of the following options, including bank wire transfer, Sofort, Trustly, Giropay, Multibanko, and several others.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Step 4: Buy Thungela Resources Shares

The final step is to buy Thungela Resources shares, and this step is breezy. All you need to do is type in the ticker symbol ‘TGA’ into the search bar on the top left-hand corner. Once the page loads up, input the number of shares you want to buy, set your stop loss (SL), and take profit (TP) levels if you use leverage.

Once you are done, click on ‘Buy’ to complete the purchase.

Thungela Resources Buy or Sell?

So, is Thungela Resources a buy or sell opportunity? Well, to be candid, this decision solely lies in your hands. Aside from the few bits of information we have been able to piece together in this article, we recommend you conduct personal research if you intend to buy Thungela Resources shares.

Also, note that all company shares are privy to volatility which means they may rise or fall. So, essentially you are making an informed bet that the company’s share value will increase in the future. However, Thungela’s 90% holding of Anglo American’s South African market shows its intent to expand its reach globally.

Given its pseudo-experience (it has been running since 1945 under Anglo American), we believe Thungela Resources will deliver on its potential. Several regions are currently battling several natural disasters, and coals still have a crucial role to play as the world gradually transitions to renewable energy sources. Thungela Resources will remain in business for the next decade or so, and its projected growth could be a great investment for you.

If you have decided to buy Thungela Resources shares today, we recommend using eToro as your official broker. Operating out of offices in London, Cyprus, and Belarus, the regulated broker offers commission-free trades and has low forex and stock fees. Also, you get maximum leverage of 1:30 for retail transactions and a maximum of 1:500 for professionals.

Another crucial thing you should consider is customer support. eToro is reputed to have one of the best customer support services in the industry as they provide quick and in-depth answers anytime you are in a fix. The account opening process is also easy, and the trading platform is generally user-friendly, which means you should not have any issues entering and exiting a position.

eToro – Buy Thungela Resources Shares In South Africa

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.