Best Trading App South Africa – Stock Trading Apps for Beginners

If you’re thinking about buying and selling shares in South Africa, then it’s crucial that you find a reliable stock app. After all, this will ensure that you are able to make last-minute investments at the click of a button. It will also ensure that you are able to exit a losing position – no matter where you are.

But, with so many stock trading apps available in the market, how do you know which one to choose?

In this guide, we explore the best stock apps in South Africa. On top of discussing the best providers of 2022, we also give you some handy tips on what you need to look out for when choosing a stock app yourself.

Key Takeaways on Trading Apps in South Africa

- Stocks apps have facilitated the process of operating in the financial markets for busy individuals who may need to execute transactions on the go.

- The best stock trading apps provide access a wide range of tools including multiple order types, advanced charting tools, breaking news, fundamental information from the companies, and account management features.

- Our research indicates that Libertex is the best stock app for South African residents due to the ample portfolio of stock CFDs they provide access to and many other positive features.

Best Trading App South Africa List

Before we take a detailed look at the top stock apps in South Africa, here’s a snapshot of the best trading app South Africa and the next best apps.

- Libertex – Popular stock CFD app with zero spreads

- AvaTrade – Best stock trading app with MT4 and MT5

- Vantage FX – Trade US, UK, and AU share CFDs

- Plus500 – CFD trading app with tight spreads and zero commission

- FXCM – Trade stock CFDs with low fees

- Capital.com – Overall best trading app South Africa with zero commission

- Tickmill – Top Meta Trader Stock App

Best Stock Trading App South Africa Revealed

In order to buy and sell stocks through a trading app, you will first need to locate a suitable broker. This is because trading apps are typically offered by traditional brokerage sites. As such, you need to consider a range of factors when choosing a stock app – such as fees, tradable stocks, payment methods, research, and regulation.

To help point you in the right direction, below you will find a selection of the best stock apps in South Africa.

Note: As the best stock trading apps in South Africa have an international presence, all of the fees and commissions outlined below are quoted in US dollars unless otherwise stated.

1. Libertex – Overall Best Stock Trading App with Zero Spreads

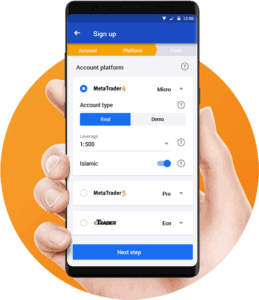

The Libertex Web Trader is also beginner-friendly, making it ideal for both new and advanced traders. In addition, Libertex supports MetaTrader 4 and 5, making it possible for users to easily log into the app with their account credentials and start trading. Did you know that Libertex is also considered the best ETF app in South Africa?

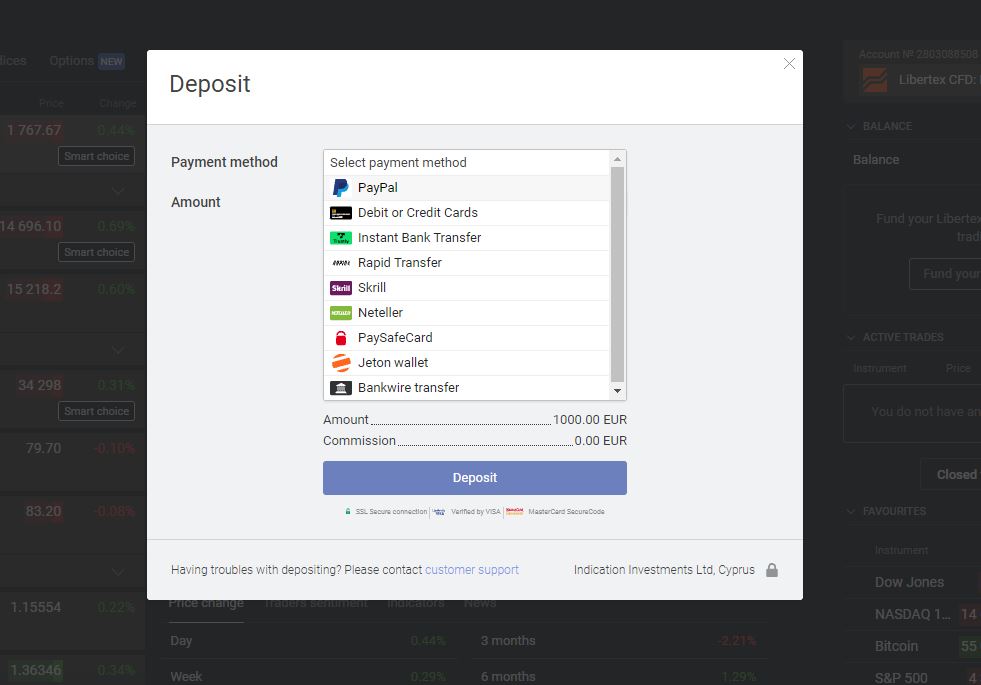

The cool benefit of using Libertex is that you can start trading with as little as €10. It also supports a large library of payment and withdrawal methods, and you can fund your account with PayPal, credit/debit card, international bank wire transfer, Skrill, and several others. No deposit fees are levied when using Libertex, which means you get to increase your purchasing power significantly. However, withdrawal fees are largely dependent on your preferred payment method as bank wire transfers attract €1 while Skrill payouts are free. To increase potential returns on investment, Libertex offers leverage up to 1:500 for users, further adding to its appeal. The operation of Libertex falls under the oversight of the Cyprus Securities and Exchange Commission (CySEC).

Pros:

Cons:

75.3% of retail investor accounts lose money when trading CFDs with this provider. As all of the platform’s financial instruments come in the form of CFDs. This means that you will have the option of applying leverage. At AvaTrade, this stands at a maximum of 1:400 for South African traders. You will also be able to choose from long and short positions, which is ideal for short-term trading. Its stock app – AvaTradeGO, is highly rated. This is because you will have access to all of the same features as found on the main desktop trading arena. For example, you can easily enter buy and sell positions, check the value of your portfolio, perform technical analysis, and more. An additional option at AvaTrade is to download the MT4 application and log in with your account credentials. This offers even more flexibility, such as being able to install automated trading software stock systems, and MT4 is also great for forex trading. When it comes to fees and commissions, AvaTrade is very competitive. Crucially, you can trade stock CFDs without paying any commissions. The broker also offers some fo the tightest spreads in the industry. You will also benefit from a strong regulatory standing, as Ava Capital Markets Pty is regulated by the South African Financial Sector Conduct Authority (FSCA No.45984). If you want to get started with the AvaTrade stock app right now, the process takes minutes. You can instantly deposit funds with a South African debit/credit card, and account minimums start at just $100. Pros: Cons:

71% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. Vantage requires a minimum deposit of $200, so it can be a little bit pricey to get stated with this broker. On top of that, the broker charges a $6 commission per trade. The good news is that there’s no added spread when trading stocks with Vantage FX. This broker has its own custom mobile app for iOS and Android devices. It’s impressively powerful and comes loaded with full-screen charts, 10 different timeframes, and a handful of popular technical indicators. We also love that the app has a built-in news feed so you can stay on top of the market from anywhere. If you want even more analysis power on your smartphone, Vantage FX integrates with the MetaTrader 4 and MetaTrader 5 mobile apps. You can also connect your account to Myfxbook, ZuluTrade, and Duplitrade to take advantage of copy trading. Vantage FX is regulated in the UK and Australia and offers negative balance protection to all clients. If you ever need help with your account, you’ll find 24/5 live chat support right inside the mobile app. Pros: Cons:

Trading Forex and CFDs involves significant risk and can result in the loss of your invested capital. Plus500 is another of the best stock exchange apps and is ideal if you are looking to trade contracts for differences. This is because the platform offers thousands of financial instruments – including more than 2,000+ stock CFDs, including many of the best shares. This covers heaps of markets – including companies listed on the Johannesburg Stock Exchange. This includes the likes of FirstRand, Shoprite, Bidvest Group, Aspen Pharmacare, Gold Fields, MTN and Sanlam. You will also be able to trade major stocks listed in the US, UK, Japan, Hong Kong, and Germany. Each and every stock CFD at Plus500 can be traded on a commission-free basis. In terms of the spread, this is often very competitive at Plus500 – especially on major stock CFDs. Outside of the stock CFD department, Plus500 also offers indices, forex, cryptocurrencies, interest rates, and more. In terms of its stock trading app, this is compatible with Android and iOS devices. There is no charge to download the app, but you will need to have an account to use it. This takes just minutes at Plus500. Once you have opened your account, you will be able to trade with leverage of up to 1:30. Tou will also have the option of placing both buy and sell orders on the app, which gives you heaps of flexibility. When it comes to funding your Plus500 account, you can do this with a debit/credit card, bank account, or e-wallet. The platform has a minimum deposit of £100, which is about 1,500 rands. There are no deposit or withdrawal fees in place. The platform’s regulatory standing is as follows: Plus500AU Pty Ltd (ACN 153301681), licensed by ASIC in Australia, AFSL #417727, FMA in New Zealand, FSP #486026; Authorised Financial Services Provider in South Africa, FSP #47546. Pros: Cons: At the forefront of this is its proprietary TradingStation platform – which is available online or via a mobile app. We like that FXCM also offers third-party trading apps too. This includes MT4, NinjaTrader, and ZuluTrade. All you need to do is download the respective app and log in with your FXCM credentials. Once you have installed your chosen app, you will have access to heaps of technical indicators and chart reading tools. Everything has been optimized for a smaller screen, which is crucial when trading on the move. In terms of its asset library, FXCM offers markets from the NASDAQ and NYSE. This includes major companies like Facebook, Apple, and Amazon. You can also trade indices, forex, cryptocurrencies, and commodities. All financial instruments – including stocks, can be traded on a commission-free basis. We find that FXCM is also very competitive with its spreads. Leverage facilities at the platform are also available, up to a maximum of 1:400. This means that a $200 account balance would allow you to enter positions worth $80,000. Account minimums start at just $50, which is ideal if you want to trade with low stakes. Pros: Cons:

73.42% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. Interestingly, Capital.com actually offers two mobile apps. Firstly, its proprietary stock tapp allows you to buy and sell stocks on the move. Available on both iOS and Android devices, you can also perform research, fund your account, and check the value of your investments. The other app that Capital.com offers is called Investmate. This is an educational application that strives to ease you into the world of online trading. It comes packed with mini-courses and quizzes, which is ideal if you are a trading newbie. When it comes to the stock trading arena itself, Capital.com offers lots of markets. This includes companies listed in the US, UK, Italy, Ireland, Norway, Hong Kong, and many others. In terms of licensing, Capital.com is regulated by the FCA and CySEC. This means that your money is safe at all times. What we also like about the platform is that it has a minimum deposit of just $20. This allows you to trade stocks with really small amounts. The only exception to this is if you transfer funds from a South African bank account – which carries an account minimum of $250. Pros: Cons:

78.79% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. Tickmill is a UK-based brokerage firm licensed by the Financial Conduct Authority (FCA) – a top-tier financial regulator – that offers access to a wide range of trading assets including forex, indexes, commodities, and cryptocurrencies in partnership with one of the world’s leading third-party trading platforms – MetaTrader. This provider supports both Meta Trader 4 and 5. These are two powerful trading interfaces used by beginners and professionals due to their advanced charting tools, user-friendly and intuitive design, customizable layouts, and mobile availability. Both Meta Trader versions are available for Android and iOS devices and they can be easily downloaded. MT5, for example, includes a selection of 38 different technical indicators, 6 pending order types, signal and copy trading features, and an economic calendar. Tickmill offers three different types of accounts to trade forex and CFDs. Trading fees vary depending on the instrument traded by the Classic Account charges no commissions per trade while spreads start at 1.6 pips for EUR/USD. Moreover, the minimum deposit to open an account is GBP 100. Deposits can be made via credit or debit card, bank transfer, or Skrill and this provider charges no deposit fee. Even though this provider does not currently offer stock CFDs, traders can operate with index CFDs covering multiple European markets along with the top three US index (S&P 500, Nasdaq, and Dow Jones). Pros: Cons:

Your capital is at risk. As such, when you download and install a stock market app, you are essentially using an online broker. This means that you will have one trading account that can be accessed across several mediums. In terms of what you can do on a stock market app, the overarching concept is that you can trade assets at the click of a button. For example: As you can see from the above, stock market apps allow you to access the share dealing arena via your mobile phone. All you need to do is choose which stocks you wish to trade, whether you think they will go up or down in value, and select the size of your stake. If you speculate correctly – you make money. If you don’t, the opposite happens. In a time not so long ago, the only way that you would be able to trade stocks online was via your desktop computer. While in most cases this will suffice, there might come a time when a stock market app is needed. Below we list some of the main reasons why you should consider obtaining a stock market app. There is nothing more frustrating than wanting to trade a stock, but not being able to because you are away from your desktop device. This is an issue that you will never face when in possession of a stock market app. For example, you might learn about a breaking news story that centres on Amazon. You think the news story will result in Amazon shares rapidly increasing in value. In order to turn your thought process into a live market order, all you need to do is open your trading app. Then, in a matter of seconds, your Amazon trade will be placed. Ultimately, stock market apps ensure that you will never miss a trading opportunity again! While having the ability to place a last-minute trade is important, stock market apps are also crucial when it comes to exiting a losing position. For example, let’s suppose that: Ordinarily, you would have been looking at losses of $1,200 ($10,000 x 12%) in a single day if you were unable to exit your position. However, by having a stock app installed on your phone, you were able to cut your losses by a significant amount by exiting the position instantly! This particular benefit leads on the from the section above. Put simply, the best South African stock apps will give you access to important news developments around the clock. In fact, you can have news stories pop-up on your phone in the form of a mobile notification. With that said, you won’t want your mobile phone going off every few minutes. On the contrary, you will only want to receive news developments that are relevant to your investments. As such, stock market apps allow you to choose which companies and/or sectors you want to be informed about. In doing so, you can enter and exit a trade as soon as the news story breaks! Having to log in to your stock portfolio on a desktop device can be cumbersome. However, by using a stock market app, you can do this at the click of a button. All you need to do is open the app and you will then be able to view the value of your portfolio in real-time. Stock market apps are also great for installing pricing alerts. This is because – much like receiving news developments, a notification will pop up on your mobile device. For example: This ensures that you do not miss the chance to turn your in-depth research into tradable profits. The vast majority of online stock brokers allow you to access their platform via your standard mobile web browser. But, this can often lead to a poor trading experience. This isn’t the case with stock market apps, as the application in question will have been built specifically for your operating system. This ensures that you are able to buy and sell stocks on the move in a seamless manner. With that said, you might be forced to use the mobile web browser version of the site if you do not possess an Android or iOS device. As noted above, in the vast majority of cases online brokers will design mobile apps for Android and iOS devices. This is because the aforementioned operating systems dominate the mobile application space. In other words, there is no point in spending countless hours building an app for the likes of Windows and Blackberry when such a small percentage of consumers use these providers. When it comes to getting your hands on the best stock market apps for Android, you can normally download them from the Google Play store. However, we would advise you to obtain the respective download link directly from the broker’s website. In doing so, you will ensure that you do not download an imitation. We think the best stock market apps for Android are Capital.com and Avatrade. If you are a user of Apple mobile and tablet products, you will be pleased to know that there heaps of iPhone stock apps. Much like in the case of Android, the application in question will have been built specifically for iOS devices. This ensures that you are accustomed to a cutting-edge mobile trading experience. Once again, make sure you obtain the download link from the broker’s platform, as opposed to searching for it in the Apple Store. Trading stocks and making consistent profits is most definitely possible. However, don’t make the mistake of thinking it’s easy. On the contrary, it can take many months or even years before you are making gains from your stock market investments. With this in mind, you have two main options at your disposal if you want to practice stock trading via your mobile phone – demo accounts and low-stake brokers. Crucially, the Capital.com demo account facility can be accessed via its native stock app. What we also like is that the Capital.com demo account mirrors that of the real-world financial markets. That is to say, whatever you see on the demo account – in terms of pricing, volume, and liquidity, will match that of the actual stock markets. This ensures that you are able to practice stock trading in live market conditions. Although some market commentators are proponents of demo accounts for newbies, others think the opposite. The overarching reason for this is that demo accounts do not prepare you for the emotional side of trading. After all, you won’t experience what it is like to encounter losses. This is something that all stock traders experience, so it’s crucial that you learn how to handle the emotions of losing trades. As such, you might be better suited to a low-stakes broker in your quest to practice stock trading. If you’re a beginner trade, it’s important to find a stock app that suits your level of experience. You’ll want a clear, easy-to-use platform that’s beginner friendly, as well as a demo account. You’ll also want low fees, educational resources and trading tools to help make the process easier. Capital.com comes up trumps in each of these categories. Firstly, it’s got a fantastically intuitive platform which is geared towards new traders, and it has a $100,000 demo account. Throw in zero commission and incredible learning materials, and it’s easy to see why Capital.com is our pick for the best stock app for beginners. So now that you know the ins and outs of how stock apps in South Africa work, and why you should consider obtaining one – we are now going to give you some tips on how to find a provider. This will ensure that you are able to pick a South African stock broker that meets your needs. The most important thing that you need to look out for when choosing the best stock app for your needs is whether or not the underlying broker is safe. After all, you will be depositing your hand-earned rands into the app. This is why you should only opt for a stock app if it is regulated by a reputable licensing body. In South Africa, that would be the FSCA. If using an international brokerage firm, then look out for providers that are regulated by the FCA, ASIC, or CySEC. Doing so will ensure that you are able to buy and sell stocks in a safe environment. It will also ensure that your money is ringfenced from the broker’s own bank account. You do, of course, need to explore what stocks you will be able to trade. For example, if you’re looking to trade companies that are listed on the Johannesburg Stock Exchange, then you will be best suited for Plus500. This is because its trading app gives you access to heaps of South African stocks. If you are more interested in large-cap companies from the US – such as Amazon, Tesla, and Google – then Capital.com is likely to be your best option. You also need to explore whether the trading app allows you to ‘buy’ shares or ‘trade’ them via stock CFDs. When stock apps first became a thing, the end-to-end trading experience was somewhat cumbersome. However, technology has come a long way in recent years, meaning that it is now possible to buy and sell stocks without being hindered by a smaller screen. That isn’t to say that you should expect all stock market apps to offer a seamless experience. On the contrary, some providers still fall short in this department. In order to buy and sell shares from your mobile phone, you will need to pay a fee of some sort. If using a CFD broker like Plus500 or Capital.com, you will be able to trade without paying any commissions. You will, however, need to take the spread into account. If you are looking to buy shares in the traditional sense, you typically need to pay a share dealing charge. This is usually a flat fee that is charged at both ends of the trade. You then need to consider what the mobile stock platform is like. Crucially, just because you are trading on your mobile phone, this isn’t to say that you won’t need access to chart reading tools. As such, make sure the app is packed with technical indicators and other chart-reading features. If you are just starting out in the world of mobile stock trading, then you should choose an app that offers educational material. Capital.com is good in this department, as it offers several resources that can help you build your trading knowledge. This includes guides and explainers on key trading strategies, as well as regular webinars. Of course, this can all be accessed from the provider’s stock app. You are going to be depositing real-world rands into your chosen stock app. As such, you need to choose a provider that supports your preferred payment method. Most South Africans opt for a local debit or credit card, as the payment will be processed instantly. This is also the case with e-wallets like Paypal and Skrill. If you want to deposit and withdraw funds with your local bank account, this is supported by most stock apps, too. However, it can take a few days for the funds to arrive. Finally, you should also ensure that your chosen stock trading app offers top-notch support. In an ideal world, you will be able to contact the customer service team via the app. You can normally do this through a live chat facility. So now that you know how to choose a stock app that meets your investing goals, we are now going to guide you through the process of getting started today. We are going to show you the process with our top-rated stock app provider Libertex. Your first port of call will be to download the Libertex mobile app. As we noted earlier in our guide, the safest way to do this is to visit the official Libertex website and obtain the download link. This will ensure you do not mistakenly download an imitation of the app via your respective store. Once the app has been downloaded, install it. When you open up the app for the first time, Libertex will ask you to open an account. This is standard practice in the stock app space, as the brokerage firm needs to know who you are before it can offer you trading facilities. As such, you’ll need to provide the following information: You will also need to choose a username and password, which is what you will use to log into Libertex on future visits to the app. Once the account is open, you will be asked to deposit some funds. You can choose from a: The minimum deposit is 10 EUR. As soon as your Libertex account is funded, you can start trading stocks straight away. To get the ball rolling, enter the name of the company that you wish to trade. In this example, we are using Netflix. Once you click on the ‘Buy’ button, you will see an order box. This is where you need to enter the amount that you wish to stake on the trade. Finally, click on the ‘Open Trade’ button to complete your stock trade! All in all, stock apps are becoming super-popular with South Africans that are looking to take their investment strategies to the next level. This is because they allow you to enter or exit a position at the click of a button – no matter where you are. You will also have access to real-time notifications – including news developments and pricing alerts. With that said, the most difficult part is finding a stock trading app that meets your needs. As per our extensive research of the best stock apps in South Africa, we found that Libertex ticks most boxes. You will be able to buy or trade over 3,000+ stocks from 17 international; markets – all on a commission-free basis. You will also benefit from a strong regulatory standing and heaps of supported payment methods. You can get started right now by clicking on the link below! Your capital is at risk

2. AvaTrade – Best Stock Trading App South Africa for MT4

3. Vantage FX – Trade US, UK, and AU Share CFDs

4. Plus500 – Trading App South Africa With Low-Cost CFDs

5. FXCM – Best Trading App for High Leverage

6. Capital.com – Best Stock Trading App South Africa for Education

7. Tickmill – Top Meta Trader Stock Trading App

Best Stock Apps in South Africa Compared

Broker

# of Stocks

Pricing Structure

Cost of Trading AMZN Stock

Minimum Deposit

Libertex

50+ global stocks

Commission/Overnight Fees

0.0003%

€ 10

AvaTrade

100+ global stocks

Spread/Overnight Fees

0.13%

$100

Vantage FX

170+ UK/US/AU stocks

Fixed Fee per Trade

$6 per order

$200

Plus500

500+ global stocks

Spread/Overnight Fees

0.75%

$100

FXCM

20+ US stocks primarily

Spread/Overnight Fees

0%

$50

Capital.com

4,000+ global stocks

Spread/Overnight Fees

$0.46

$20

Tickmill

Only Stock Indexes

Spread/Overnight Fees

–

GBP 100

What is a Stock Trading App?

Why Use Stock Apps in South Africa?

Never Miss a Trade

Exit a Losing Position

Access to Stock Market News 24/7

Keep Tabs on Your Portfolio

Pricing Alerts in Real-Time

Optimized for Your Phone

Stock Market Apps for Android

iPhone Stock Apps

Best Apps to Practice Stock Trading

Demo Accounts

Low-Stake Brokers

Best Stock App for Beginners

How to Choose a Stock Trading App

Regulation

Available Stocks

Mobile Trading Experience

Fees

Trading Platform & Tools

Education

Payment Methods

Customer Service

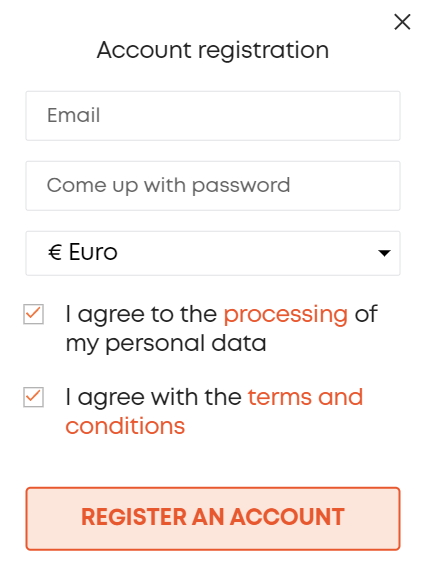

How to Use the Best Stock Trading App for Beginners in South Africa

Step 1: Download and Install the Libertex App

Step 2: Open Account and Upload ID

Step 3: Deposit Funds

Step 4: Place a Trade or Invest

The Verdict

Libertex – Best Stock Trading App South Africa

FAQs

How do stock apps work?

Are stock apps available for iPhone and Android?

Are stock apps available on tablets?

Do all stockbrokers have mobile trading apps?

Are stock apps free to download?

Can you trade with real mobile on a stock market app?

Can you practice stock trading on an app?

What is the best stock app in South Africa?