How To Buy Coinbase Shares In South Africa – With No Commission

Coinbase is the most popular Bitcoin exchange based in the U.S and the second largest in the world, according to Coinmarketcap. With over $30 billion in monthly trading volumes, Coinbase is a powerhouse in the crypto trading scene. In this guide, we will show you How to Buy Coinbase shares with 0% commission and why Coinbase shares are a must-buy today.

lost and found jordan 1

nike air jordan mid

mens nike air jordan 1 low

cheap jordan 1

cheap jordans

jordan 4s cheap

nike air jordan 5

nike air jordan women’s shoes

jordan sale

cheap jordan 4s

nike air jordan 4 oil green

jordan 4s cheap

cheap jordan

nike air jordan 1 high

best jordan shoes

nike air jordan retro

nike air jordan red

jordan 3 dark iris

jordan 3 fire red

we the best jordan 5

best jordan 1s

nike air jordan shoes

cheap jordan 1

nike air jordan retro

jordan shoes sale

jordan 1 low

jordan 1 chicago

nike air jordan men’s sneakers

air jordan 4

jordan for sale

best jordan shoes

jordan store

jordan sale

best jordan 1

nike men’s air jordan 1 mid stores

cheapest jordan 4

best jordan

nike air jordan

nike air jordan 11 cool grey

nike sb x air jordan 4

cheapest jordan 1

How to Buy Coinbase Shares South Africa – Quick Guide 2021

Don’t have much time to spare? You can easily snag Coinbase shares by following this quick steps:

Step 1: Create an account on Capital.com – Visit the official website of Capital.com and click on ‘Trade Now’ to open a free account.

Step 2: Upload ID – You need to verify your identity before you can buy Coinbase shares on Capital.com. To do this, submit a copy of your official passport, driver’s license, and national ID.

Step 3: Fund your account – You will need to make a minimum deposit of $20 (about 283.38 ZAR). You can pay with a credit/debit card or make a bank transfer.

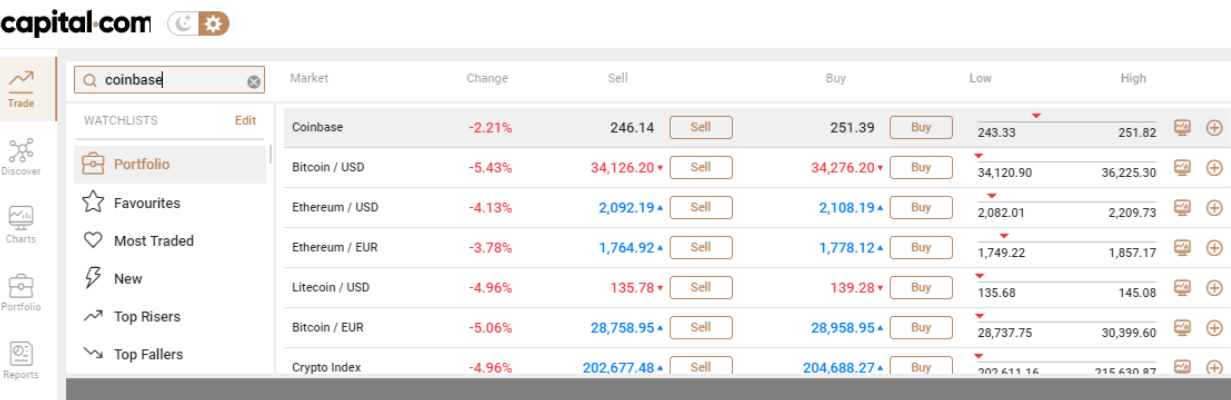

Step 4: Buy Coinbase Shares – Click on the search bar and type in ‘COIN.’ Select the first result that pops up and input the amount you want to invest. Click on ‘Open Trade’ to confirm your trade.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Step 1: Choose A Broker

To buy Coinbase shares, you will need to invest with a regulated broker who offers exposure to US stocks. You may have come across a number of them but you need to consider a few things before settling for one. One of them is the broker’s fee structure. This helps you to know how much you will be paying to trade on the broker’s platform. Another is the overall trading experience. Does the broker use the industry’s best trading tools to make its services worthwhile? To make the decision easy for you, we will explore two of the best stock brokers that allow you to trade Coinbase shares commission-free.

1. AvaTrade – Trade CoinbaseShares With 0% Commission

Another is global CFD and Forex broker AvaTrade. Just like Capital.com, AvaTrade offers zero-commission trades for global shares. Unlike Capital.com, it only offers exposure to 600 stocks globally.

AvaTrade, which is a member of the Ava Group, is a regulated broker with the Financial Sector Conduct Authority (FSCA). It also has licenses from Abu Dhabi, UK, Ireland, and the British Virgin Islands. However, what makes AvaTrade stand out from the crowd is its social trading capability.

Through its iOS and Android offering, the social trading app lets users mimic the trading decisions of more experienced traders. It also enables users to learn about the latest news, moves, and announcements in the market. AvaTrade requires a minimum deposit of 1,433.17 ZAR to open a position. You can fund your account through multiple channels like credit cards, debit cards, or bank transfers. AvaTrade offers users three trading platform options, including its proprietary platform AvaTrade WebTrader and AvaOptions, and the popular MetaTrader 4 and 5 (MT 4 & 5). AvaTrade charges a $50 fee for inactivity after three months.

Pros

- Trade Coinbase shares commission-free

- 24/5 customer support

- Multiple payment channels

- Multiple trading platform

- Social trading

- Regulated by the FSCA and other bodies

Cons

- Limited exposure to global stocks

- High inactivity fee

- Few educational resources

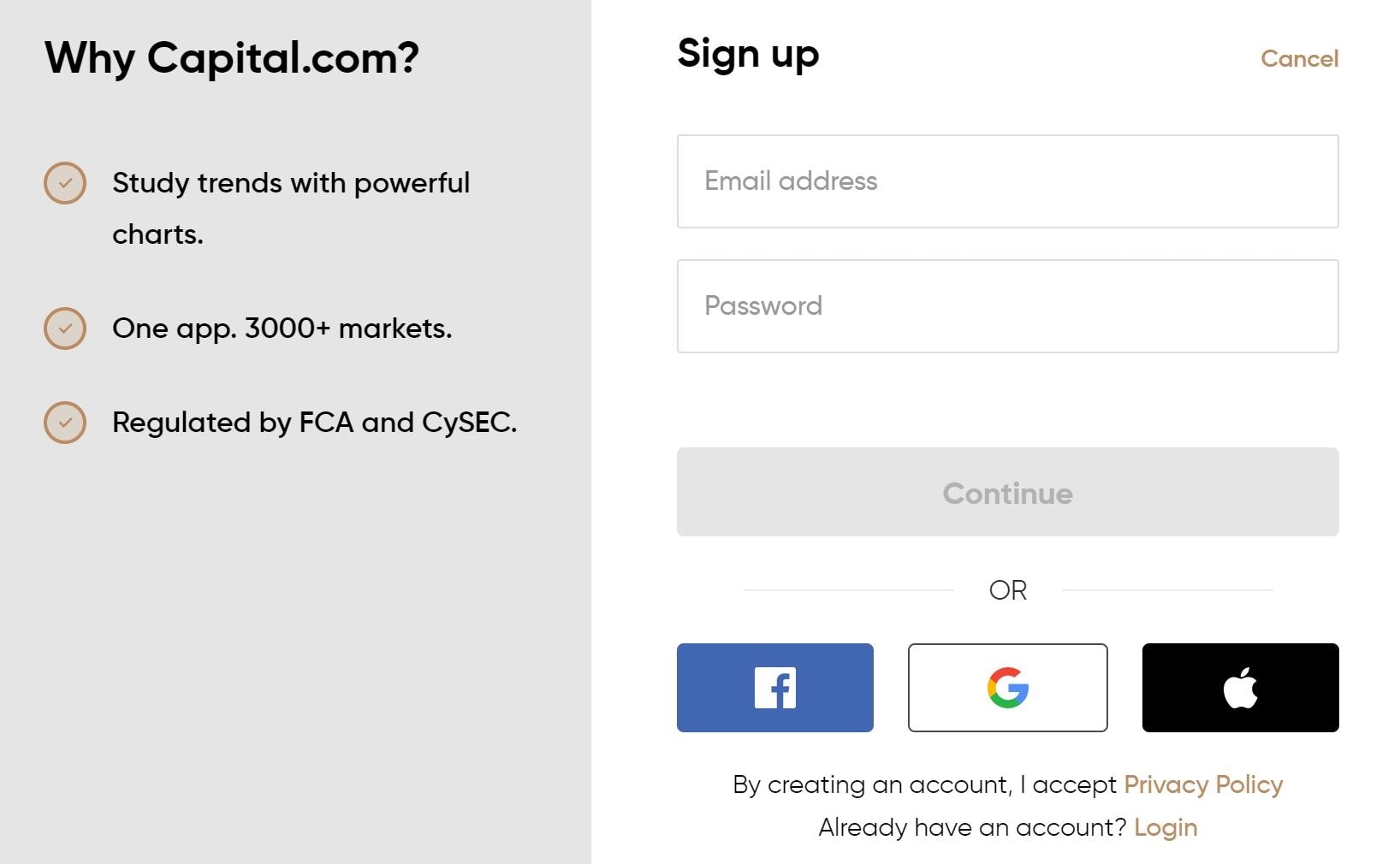

2. Capital.com – Overall Best Broker To Buy CoinbaseShares In South Africa

Our first pick for buying Coinbase shares in South Africa is the global CFD firm Capital.com. With operational bases in the UK, Cyprus, and Belarus, Capital.com offers exposure to over 3,000 global shares and other financial instruments. It’s a regulated stock broker and has licenses from reputable bodies in the regions it operates.

One thing that attracts users to Capital.com is its zero-commission trades for CFDs. The regulated broker also charges low spreads and requires a minimum deposit of just $20 (about 286.96 ZAR) for retail investors. Deposits are easily carried out through debit/credit cards or bank transfers.

Unlike most traditional brokers, Capital.com uses a segregated account system that helps to ensure accountability. User funds are kept in a separate account from the company’s funds.

Capital.com does not charge deposit or withdrawal fees making it one of the best trading platforms to buy Coinbase shares

Pros

- Trade Coinbase shares with 0% commission

- Low entry barrier for retail users

- No deposit or withdrawal fees

- Offers institutional services

- Offers exposure to 3,000+ global shares

- Low spreads

Cons

- No price alert on the web platform

- CFD trades only

- Overnight charges apply

- Leverage up to 1:30 for retail investors only

- Limited research analysis on stocks

Step 2: Research Coinbase Shares

On the global crypto exchange trading chart, Coinbase is third with popular Bitcoin brokers Binance and Huobi Global, occupying the first and second positions respectively. Even though it was originally birthed in San Francisco, Coinbase does not have a physical location as its center of operations. Before we dig into how you can buy Coinbase shares with no commission, we will look into Coinbase’s early years and potential growth in the nearest future. We will also explore its financials since it went public in April 2021 and show you the best broker to buy Coinbase shares from.

What is Coinbase?

Coinbase Global does not have a lot of history behind it. In fact, it is just nine years old and a few months in the capital markets after going public through Nasdaq on April 14, 2021. It has no physical location and has been expanding rapidly in the last few years.

Founded in 2012 by Brian Armstrong, Coinbase is a top US crypto exchange offering exposure to large-cap cryptocurrencies like Bitcoin and Ethereum. With a daily trading volume of over $1 billion, Coinbase is a top-tiered Bitcoin exchange and is the first destination for most US crypto enthusiasts.

Relative to Binance and Huobi, Coinbase operates two different platforms tailored to specific customer niches.

The first is Coinbase which is ideal for crypto beginners. The platform is user-friendly and highly intuitive. New crypto investors in supported US states except for Hawaii generally revert to the platform due to its customer-centric approach. Coinbase offers exposure to over 50 crypto assets.

The second is Coinbase Pro which is designed for more sophisticated investors. It offers a much larger and robust charting and trading experience. Operating like a traditional exchange, Coinbase Pro enables traders to buy cryptocurrencies using market orders. This allows them to place orders, limits, and stop orders easily. Coinbase Pro also supports margin trading and uses more sophisticated trading tools.

Also unlike the user-friendly Coinbase, the Pro platform is more globally-focused as it offers 100 trading pairs worldwide and more than 40 crypto to crypto trading pairs in 42 regions.

The key difference between both platforms is the fee structure. User-focused Coinbase may be appealing to the end-user however, it is more expensive than the Pro version. This fee structure is highly dependent on where the user is trading from.

Coinbase charges a whopping 2% for crypto conversion on its platform while deposit methods like bank transfer and Coinbase USD wallet attract a levy of 1.49%. Depositing through a debit/credit card will see you billed 3.99% for the transaction while wire transfer attracts a $10 levy and $25 when you want to transfer through this method. It also charges for variable spreads depending on the user’s purchases and trades. Purchases below $10,000 attract a variable spread of 0.50%.

The Pro platform charges less with the maker-taker fees set at 0.50% for $10k below. It also diminishes the more the user invests to 0.000%.

Aside from crypto onboarding for retail investors, Coinbase also offers custodial services for cryptocurrency storage for institutions, a cryptocurrency platform for businesses, and owns a stablecoin USDC.

Coinbase is the only publicly traded crypto exchange company in the world. It went public through a direct listing on Nasdaq on April 14, 2021.

Coinbase’s direct listing was hailed as an industry win for the emerging crypto industry and its COIN stock opened trade on Thursday at $429.54 with $100 billion in market cap before the price slumped. It subsequently lost more than 40% on the first week of its debut and has found it hard to regain its opening day high.

This is because Coinbase is intrinsically tied to the price action of the world’s first cryptocurrency Bitcoin. The positive price action of the premier digital asset means more money for the company which makes money from trading fees. Despite what many have since called a less-than-expected performance, Coinbase has grown in just three months since going public. Its verified user base grew 13 million from 43 million unique users. Its trading volume piqued at $335 billion which saw it generate over $1.8 billion in total revenue.

However, compared to popular centralized Bitcoin exchange Bitcoin, Coinbase has not been able to penetrate the broader crypto market due to its slow process in adding support for popular crypto-assets.

Meanwhile, the US exchange is already picking up and has added support for many alternative currencies (called altcoins for short). According to CEO Brian Armstrong, the crypto exchange will list as many cryptocurrencies as possible. He also added in the tweet that users will be able to give ratings and reviews on the assets that are currently trading

Coinbase is not resting on its laurels and is actively looking into taking the good news of cryptocurrencies to other regions. In a filing with Japan’s financial watchdog, the US exchange registered with the Financial Services Agency (FSA). This will see them offer Japanese customers exposure to large-cap crypto assets like Bitcoin and Ethereum, as well as Stellar, Bitcoin Cash, and Litecoin.

It is also expanding its operations in Europe. According to a June 28 blog post, the crypto exchange has received a crypto custody services license from the German Federal Financial Supervisory Authority (BaFin). This will see the company operate as Coinbase Germany GmbH in the European territory.

Coinbase Share Price

Coinbase operates in a keenly contested crypto market with the likes of Binance and Huobi leading the pack. However, the fact that it is a public company has built investors’ confidence as to its long-term growth. Meanwhile, its COIN share price has performed much like the crypto assets it offers exposure to. Launching with over $400 per share and a $100 billion market valuation, Coinbase’s COIN ended the first day of trade with $328.33 shedding off over 30% of its value.

Reflecting on the crypto market, COIN has not been able to regain its 52-week high of April and has traded at a lowly $212.98 since going public. However, COIN is rallying with the emerging industry as Bitcoin price action has been mostly positive in the last few days. It currently trades at $256.81.

Coinbase Share Dividends

Coinbase is just six months in the public eye and has never rewarded its shareholders. However, the company has stated that it does not intend to pay any cash dividend for its stocks.

Should I Buy Coinbase Shares?

Should you buy Coinbase shares? We think you should. Here are a few reasons why we think Coinbase shares will appreciate with time:

COIN Is Tied To Bitcoin Performance

Coinbase’s COIN stock is the first-ever publicly traded stock that is tied to a virtual currency. If Bitcoin rallies, then COIN is most likely to reflect this positive momentum. However, the downside is it may affect its performance in the event of a downtrend. Notwithstanding this, popular digital investment founder and CEO of Ark Investments Cathie Wood believes in the long-term value of COIN and has invested over $200 million in the company. Bitcoin’s continued adoption means that it is likely going to be around for a long time and as more countries are finding more utility for the digital asset, it means its value is set for an uptrend in the long term.

Coinbase Going Global

Coinbase is also taking steps to diversify its business and global reach. Moving from a physical location to a remote-first company, the crypto exchange is penetrating as much of the burgeoning industry’s customer base as possible. As we mentioned earlier, it has recently gotten regulatory clearance from Japanese regulators to offer its crypto services to Japanese investors. It has also received a license to operate in a major European country, Germany. Coinbase is also reportedly eyeing Asian giants India and is looking to establish a presence there.

Open an Account & Buy Shares

Are you ready now to buy Coinbase shares? We’ll show you how to easily open a free account with Capital.com – one of the best stock apps available to traders and trade Coinbase shares commission-free.

Step 1: Open a Capital.com Account

To get started, visit the official website of Capital.com and click on the ‘Trade Now’ button. You can find that in the top right-hand corner. Enter your email address and choose a unique, strong password. If you do not want to do this, Capital.com allows you to sign up with your Google, Facebook, and Apple account with just a click.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Step 2: Verify your Account

Before you can buy Coinbase shares, you need to verify your identity. You can do this easily by uploading a copy of your official passport, driver’s license, or national ID. Once you complete this, Capital.com will verify your identity within minutes.

Step 3: Fund your Account

The next step is to fund your account and you can do this through several payment channels. You can make a minimum deposit of $20 (about 283.08 ZAR). Deposits are entirely free to make, and the following methods are accepted:

- Credit card

- Debit card

- Bank Wire Transfer

- Apple Pay

- Trustly

- Giropay

- iDeal

Step 4: Buy Coinbase Shares

Once your deposit has been confirmed, click on the search bar and type in ‘COIN.’ You can find this on the top of the Capital.com dashboard. You will be shown ‘COIN CFD,’ click on ‘Buy’ to get started. On the following order page, input how much you want to invest in Coinbase shares in US dollars. Also, remember to put a stop-loss order and take-profit level to minimize your exposure to the underlying asset. When you are satisfied, click on ‘Open Trade’ to buy Coinbase shares with Capital.com.

Coinbase Shares Buy Or Sell?

Coinbase has profited from the Bitcoin rally so far this year and even saw its user base climb by 13 million in its first quarter as a public company.

Coinbase’s business model means the exchange relies on the price action of cryptocurrencies and the latest downtrend has impacted its COIN stock negatively. However, the company is already taking steps to expand its market outside the US. The cryptocurrency exchange has received an operational license from regulators in Germany.

It is also extending its operations to regions like India and the company is already fast-tracking its listing process for new cryptocurrencies. The future is bright, the company has shown an increase in its earnings. Coinbase stock is a buy for us. There’s plenty of upside with this stock.

Capital.com – Buy Coinbase Shares In South Africa With 0% Commission

Even though Coinbase is not up to a year in the capital markets, it has gotten a lot of investors’ attention. This has primarily been because of the crypto exchange’s user-friendly platform. Aside from this, the Bitcoin exchange’s foray into institutionalized services has set it for more growth. A global expansion is definitely a marker for a stellar second half of the year. Even though COIN may not be close to its high, the continued innovation of the Bitcoin exchange could see it prove its critics wrong. If you are ready to buy Coinbase shares, you can get started by clicking the link below to trade on Capital.com commission-free.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.