How To Buy Tesla Shares South Africa – With No Commission

Are you based in South Africa and wish to buy Tesla shares? If yes, this guide would show you how to buy Tesla shares in South Africa in a simple and low-cost way. Let’s jump right in.

How to Buy Tesla Shares South Africa – Quick Guide 2021

The easiest and fastest way to buy Tesla shares in South Africa is via Capital.com. If you’re pressed for time, here’s a quickfire guide on how the process works in South Africa right now.

- Step 1: Open an account with Capital.com – You will first need to open an account with Capital.com – which will simply require some personal details.

- Step 2: Upload ID – As a regulated broker that does things by the book – Capital.com will ask you to upload a copy of your ID.

- Step 3: Deposit – You can instantly deposit funds with a debit/credit card or e-wallet. The minimum is just $20 at Capital.com.

- Step 4: Buy Tesla Shares – Now, you can search for Tesla and click on the ‘Buy’ button. Enter your stake and confirm the trade.

And that’s it – you’ve just bought Tesla share CFDs at Capital.com, paying zero commission!

Step 1: Find a South Africa Stock Broker That Offers Tesla Shares

Deciding on the best stock broker to buy Tesla shares in South Africa is a big step. There are many options to choose from. They differ in features, fee structure, and investment options available.

One key thing to keep in mind is that since Tesla trades on the NASDAQ stock exchange, you will need a broker with NASDAQ shares. This section presents two vetted trading options to buy Tesla shares to make this decision-making process easier for South African investors.

1. AvaTrade – Advanced Trading Platform to Buy Tesla Shares

![]() AvaTrade is an international forex broker famous for its CopyTrading features, which allow new users to monitor the trade movements of more experienced investors. The platform offers MT4 and MT5 trading support. Still unsure on how to buy Tesla shares in South Africa? This is the platform for you. AvaTrade is regulated and licensed by the Financial Sector Conduct Authority (FSCA) in South Africa.

AvaTrade is an international forex broker famous for its CopyTrading features, which allow new users to monitor the trade movements of more experienced investors. The platform offers MT4 and MT5 trading support. Still unsure on how to buy Tesla shares in South Africa? This is the platform for you. AvaTrade is regulated and licensed by the Financial Sector Conduct Authority (FSCA) in South Africa.

At a fundamental level, AvaTrade is a bit similar to Capital.com. It specializes in CFD instruments and allows for easy speculation on the future value of Tesla shares without necessarily owning the stock.

AvaTrade also offers leveraged trading, which means you can long or short Tesla stock with more funds than you deposited in your account. The online broker also uses the spread model rather than bother South African investors with multiple trading fees. This means you won’t get charged any commissions or fees when trading Tesla shares. Instead, the online stock broker builds the fees into the spread.

However, to get started, AvaTrade requires a minimum deposit of $100. You can fund your trading account with this broker using bank wire, instant deposits, debit, and credit cards.

Pros:

- Suitable for pro traders

- Zero commission trading

- User-friendly platform

- Leverage trading for Tesla shares

- Regulated and licensed to operate in SA

- Supports MetaTrader 4 and 5

- Offers numerous funding options

Cons:

- Not suitable for beginners

- Minimum deposit of $100

Your capital is at risk.

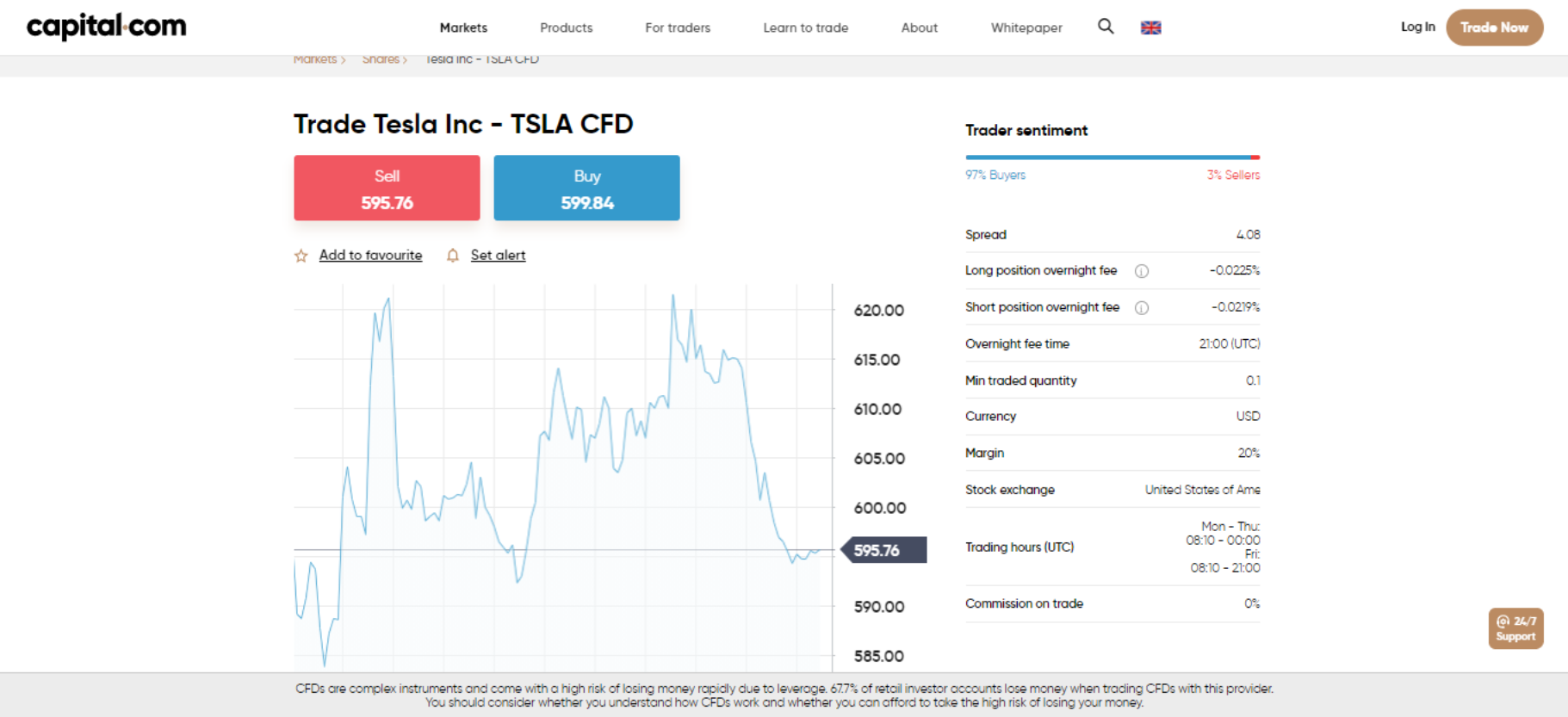

2. Capital.com – Buy Tesla Shares in South Africa at 0% Commission

If you are looking to trade contracts for difference (CFDs), Capital.com is the broker.

Capital.com is the best share trading platform to buy Tesla stocks. Using Capital.com, you can trade Tesla CFDs, allowing you to speculate on Tesla’s share price without necessarily becoming a stockholder.

Founded in 2016, Capital.com is a global CFD and forex broker and is regulated by reputable bodies like the UK’s Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the National Bank of Belarus (NBRB).

In addition, Capital.com is also quite cost-effective to trade on. It’s a 0% commission broker, which means you can focus on trading Tesla shares without having to pay unnecessary broker fees. The platform uses a spread model, which is quite competitive.

Capital.com is also very user-friendly and intuitive, making it easy for beginners in the capital markets to find their way around the platform easily. It also supports more sophisticated investors and uses industry-leading trading tools, charts, figures, and analysis to enable traders to make trading decisions.

The platform is suitable for both newbie and pro traders. There are two options for both classes. Beginners can use the main Capital.com web-trading platform to get started. It’s a simple interface free of the complex charts and graphs jargon. You also get a free demo account to test the waters using paper funds. Seasoned traders can use the basic platform in conjunction with MT4.

Pros:

- 0% commission trading

- Leveraged Tesla trading

- Comes with a demo account

- Suitable for both beginners and pro traders

- Zero inactivity fees

- Thousands of UK and US shares available

- Multilple funding options

Cons:

- Minimum deposits

- Verification process takes 24 hours

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Step 2: Open a Share Dealing Account and Make a Deposit

To get started trading Tesla shares in South Africa from home, you need to open a trading account. We recommend Capital.com as the most suitable platform to get the job done from the options provided above. The platform is regulated to operate in South Africa. It offers zero commission, tight spreads, and a minimum deposit of $20 to get started.

To get started, visit Capital.com and elect to open an account. You’ll need to provide some personal information so that the broker knows who you are.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

From there, you’ll be asked to complete the KYC (Know Your Customer) process. To complete KYC, you will need to upload a copy of your passport, driver’s license, or national ID card. In most cases, Capital.com will automatically verify the document – so you don’t need to wait around. Instead, you can proceed to make a deposit.

You can deposit funds using a debit or credit card. Other options available on Capital.com include Apple Pay and bank transfers.

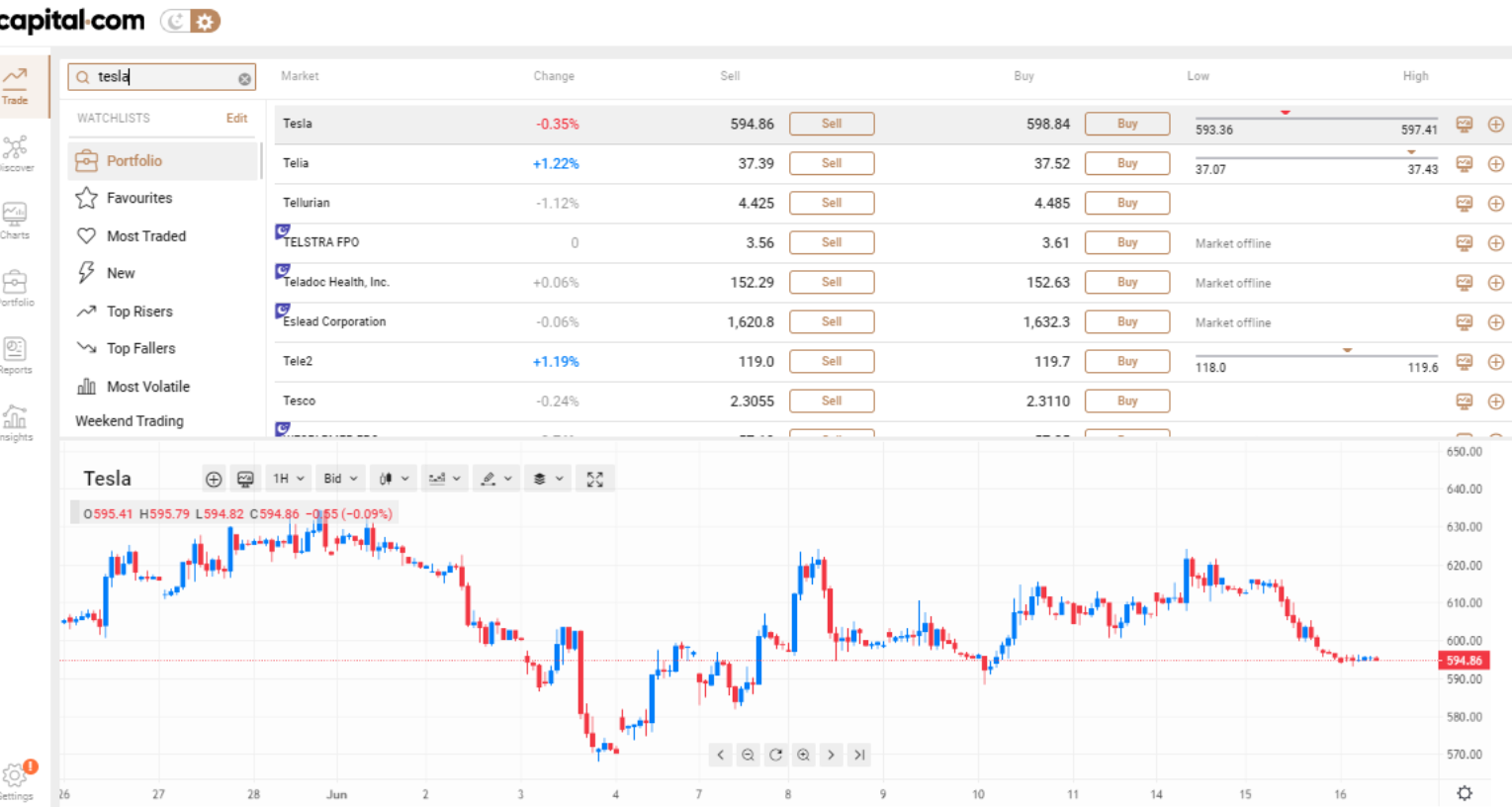

Step 3: Buy Tesla Shares

Now that you have made a deposit into your Capital.com brokerage account – you can proceed to buy Tesla shares. At the top of the screen, you should see a search box. Type in ‘Tesla’ and click on ‘Buy’ to purchase the stock when the market loads.

Finally, enter the amount of money you want to risk on the trade and confirm the order. You can cash out your position at any time – as long as the NASDAQ exchange is open.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Research Tesla Shares

Tesla Inc. may be the EV company of the future, but it needs to pass the litmus test just like every other investment. Buying any company’s shares without understanding the company’s historical data and performance in the last few years can impair your investment decision.

Savvy investors spend much time combing through a company’s records before making a buying decision. To make this process easy, we have taken the time to comb through the details to see how the US EV manufacturer has performed in the last quarter.

What is Tesla?

Founded originally by Martin Eberhard and Marc Tarpenning in 2003 as Tesla Motors, the company has succeeded in the last one and a half-decade. Current Tesla boss Elon Musk, Ian Wright, and JB Straubel joined a year later, and all five became the company’s co-founders.

Tesla has stunned the world with its EV sedans like the Tesla Roadster, Model S, Model 3, and its sport utility vehicle (SUV), Model Y, and its Model X. Riding on this success, Tesla has seen its market cap rise to $587.53 billion making it the world’s most valuable company.

Relying on the world’s need to transition from the traditional internal combustion engine to eco-friendly battery-powered sedans, Tesla is one of the fastest-growing companies globally, even temporarily surpassing Facebook at the beginning of the year.

Moving on to the figures, Tesla said it made over $1 billion in non-GAAP net income – the highest ever in the company’s history. Its GAAP operating income stood at $594 million, while its GAAP net income came up to $438 million. Turning to its automotive revenue, Tesla said it made over $9 billion with a 75% year-over-year return. Its total income was put at $10.3 billion, increasing 74% in the last year.

Touting the growing preference for its cars, Tesla said that its low-cost Model 3 was the best-selling premium sedan globally. Tesla is not placing all its bets on its electric sedans, given the growing competition from long-established automobile companies Ford Motors and EV startup Lucid Motor. As such, it has 59 subsidiaries spread across 23 countries. Tesla is listed on the tech-focused Nasdaq stock exchange under the ticker TSLA.

Tesla Share Price

An important metric that you need in making an investment decision is the company’s share price and previous performance. This should help you decide if there is a potential upside for the company and investors to buy into the project.

Regarding its share price, Tesla has performed phenomenally. Coming into the year, Tesla’s share price surged to $905.23, following a growing interest in its Model 3 sedans. Although this figure has since tapered off due to global chip shortages and delivery delays due to supply chain instability, Tesla’s share price has not fallen to $400 in the last months.

It currently trades at $595.39, showing a 0.03% drop from the day before. When we look into other metrics like its price-to-earnings ratio (P/E ratio), Tesla stands at a mouth-watering 610.44. Although this is generally not a good sign as the lower a P/E ratio is, the more viable the company may likely be, technology companies like Tesla have a higher P/E ratio. And with the fact that Tesla is a first mover in the nascent field of battery-powered mass vehicles, the company’s P/E ratio is a reflection of its growth trajectory.

Another metric we would like to use is Tesla’s earnings per share (EPS). EPS is a figure describing a company’s profit per outstanding share of stock, and according to official records, Tesla’s EPS share price stands at $0.93 while the EPS estimate stands at $0.79. Looking at the EPS trend, Tesla is at a healthy 4.11 on the 90-day chart while the current EPS estimate is at 4.54. Looking at the growth estimates for the current quarter, Tesla is at a whopping 118.20%, with the next quarter 55.30%. For the fiscal year, Tesla is projected to grow by 102.70%.

Even though Tesla is 35% below its all-time high of $905 at the beginning of the year, Tesla is a good investment given the surge in interests in eco-friendly vehicles.

Tesla Share Dividends

One of the things investors generally lookout for is the dividend payment of a company, and this is something you should keep in mind when choosing to buy a company’s stock.

However, Tesla Inc has not been recorded paying any shareholder dividends. According to the company, it is retaining future earnings to finance its future growth and is not considering paying dividends in the foreseeable future.

Are Tesla Shares A Good Buy?

We’ve said a lot about what Tesla Inc is all about and plans to do. Looking at its past performance and historical record, we have seen that the EV and battery maker has been highly successful in the last decade and a half.

Critics of the SpaceX twin have reportedly said that the stock price is overvalued, but the Tesla brand is expanding daily into more renewable energy sources. Its Solar City subsidiary is highly popular among residential, commercial, and industrial customers. With Tesla going all out in its Gigafactories worldwide, the company has not hit the limit of its potential yet.

Running an inter-planetary business on the side with SpaceX, Elon Musk has navigated the once disregarded EV startup into a global automobile company since taking the reins in 2008.

With the collective drive and focus of the company, Tesla should post some good returns in the nearest future. However, as we always advise our readers – do your own research (DYOR) to make sure you must have covered all the basics and are convinced about the potential of the company you have an interest in.

Elon Musk has repeatedly been asked if the growing competition from auto stalwarts could take away the company’s market share. He replied that competition is needed to enable a greener environment for all humans. Alongside this, he points to the positive effect it would have on the company. We consider Tesla shares a great buy for the following reasons:

-

Tesla Has A First Mover Advantage

Tesla was formed in 2003 and has become a major force to reckon with in the EV space. With climate concerns growing by the day, Tesla’s battery-powered sedans have become more accepted.

The general automobile industry is slowly catching on with Ford Motors rolling out an EV version of its best-selling pickup truck, F-150.

But for now, Tesla Inc has control of more than 80% of the burgeoning EV space. As more and more auto companies adapt their cars to batteries, customers will naturally gravitate towards a long-established brand in the space. This is where Tesla will like to shine as long as it can keep its delivery numbers high. Tesla is also working on producing its own in-house batteries for its cars, reducing its expense and making its sedans go for a bargain in the long term. An affordable EV is every car owner’s dream, and investors with Tesla stock in their portfolio may enjoy greater returns soon.

-

EV Engines Are Competing With Internal Combustion Engines

Car owners were generally worried about the range EV cars can cover before needing a recharge, making them stick to the more trustworthy internal combustion engines. Another dilemma EVs faced was the recharge time. Fuel-powered cars take the top of two minutes for a full refill, and EVs took hours in the early years.

However, tech is catching up with the EV space.

EVs are posting better range estimates by the day, and the recharge time is gradually becoming faster. With EVs like Ford’s F-150e now partially powering homes in the event of a power blackout, car owners are warming to the idea of owning one. Added to the fact that you can plug them at night and have a fully charged sedan waiting for you in the morning, the EV space is set for phenomenal growth in the next decade.

Capital.com – Buy Tesla Shares in South Africa With 0% Commission

Discovering how to buy Tesla shares in South Africa has never been easier – especially when you have regulated brokers like Capital.com providing you with a regulated platform that’s easy to navigate and at a commission rate of 0%. You can buy Tesla shares with this broker in a matter of minutes by quickly opening an account, making an instant deposit, and confirm your buy order.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.