How to Buy Shoprite Shares in South Africa – With 0% Commission

As the largest food retailer in Africa, Shoprite has outstanding brand appeal and are well-established in many different countries. With the company’s share price showing some solid bullish momentum over the past year, now might be a great time to consider adding Shoprite shares to your portfolio.

In this guide, we’ll discuss How to Buy Shoprite Shares in South Africa – analysing the company and its business model and showing you how to invest in Shoprite shares without paying any commissions whatsoever.

How to Buy Shoprite Shares in South Africa – Step by Step Guide 2021

If you’re looking to buy Shoprite shares in South Africa right away, then the four quick steps below will show you how to do so with Plus500 – all in under ten minutes.

- Step 1: Open an account with Plus500 – Head to Plus500’s homepage and click ‘Start Trading’. Next, enter a valid email address and choose a password for your account.

- Step 2: Upload ID – Verify your account by uploading proof of ID (copy of passport or driver’s license) and proof of address (copy of bank statement or utility bill).

- Step 3: Deposit – Fund your account via credit/debit card, bank transfer, or e-wallet.

- Step 4: Buy Shoprite Shares – Search for Shoprite in the Plus500 trading platform and click ‘Buy’. Enter the number of shares you’d like to purchase and click ‘Buy’ again.

Step 1: Choose a Stock Broker

The first thing you have to do when considering an investment in Shoprite is to find a broker that is both reliable and offers Shoprite as a tradeable asset. There are many great stock brokers available to retail traders these days, all of which provide various features and price structures. Due to this, it can seem tricky to research them all and figure out which one suits you best.

Not to worry – this section presents our recommendation for the best broker to buy Shoprite shares in South Africa, along with a mini-review covering everything you need to know.

1. Plus500 – Overall Best Broker to Buy Shoprite Shares in South Africa

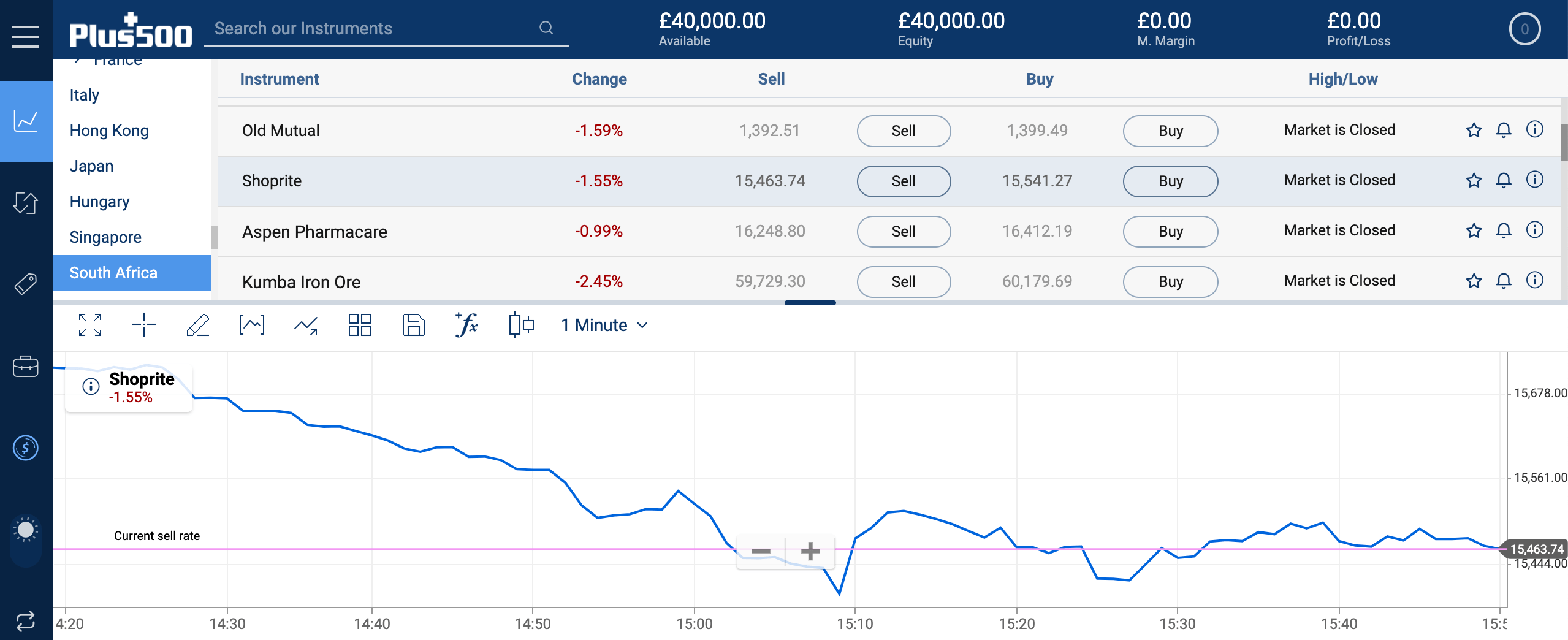

Through our research and experience, we’ve found that Plus500 is one of the best share trading platforms for investing in stocks in South Africa. Plus500 have a fantastic reputation throughout the world and boast over 430,000 active users. Furthermore, Plus500 is licensed and regulated by top entities such as the FCA and the ASIC – meaning that traders are afforded the highest levels of security for their accounts.

When you buy Shoprite shares (or any other type of shares for that matter), one of the critical things to look out for is a broker’s fee structure. In terms of Plus500, they offer 0% commission when you place a trade on their platform. This is a considerable benefit as it means you won’t have to pay any additional charges when you buy shares. Instead of a commission, Plus500’s fee is incorporated into the spread, which is the difference between an asset’s buy and sell prices. Usually, this spread is pretty consistent with Plus500’s peers – ensuring traders get fair prices when operating in the market.

Plus500 also offer a wide variety of assets for users to invest in. As they are primarily focused on CFD trading, Plus500 provide a vast array of stock CFDs that users can trade with leverage. Users can get up to 1:20 leverage on stock CFDs – which means that if you invested 1000 ZAR into Shoprite, you could essentially boost your position size to 20,000 ZAR, increasing potential profits.

Aside from stocks, Plus500 also offer a diverse range of currencies, indices, ETFs, and commodities to trade. Additionally, they also provide a selection of 14 different cryptos to trade. In terms of deposits, Plus500 allow users to fund their account via credit/debit card, bank transfer, PayPal, or Skrill. All deposits are free to make, and the minimum amount required is only $100 (1404 ZAR).

Finally, Plus500’s online trading platform is highly user-friendly and comes with advanced charting capabilities so that users can conduct their own technical analysis. The Plus500 mobile app is also great and features two-factor authentication for added security. Plus500 even offers a handy demo account, too – perfect for beginner traders looking to gain risk-free experience in the market.

Pros:

- Regulated by the FCA and ASIC

- Wide range of assets to trade

- No commissions when placing trades

- Zero deposit or withdrawal fees

- Advanced charting capabilities

- Sentiment tool for analysis

- Handy demo account feature

Cons:

- Inactivity fees charged

72% of retail CFD accounts lose money.

Research Shoprite Shares

As is the case with all of the best investments, it’s essential to thoroughly research the asset you intend to invest in beforehand to ensure it is a suitable addition to your portfolio. This is known as ‘due diligence’ and is a crucial part of the investment process. Areas such as the company’s historical share price and financials are important to examine to determine how appropriate an investment would be.

To help you out with this, the section below will cover some of the essential elements to consider before you buy Shoprite shares in South Africa.

What is Shoprite?

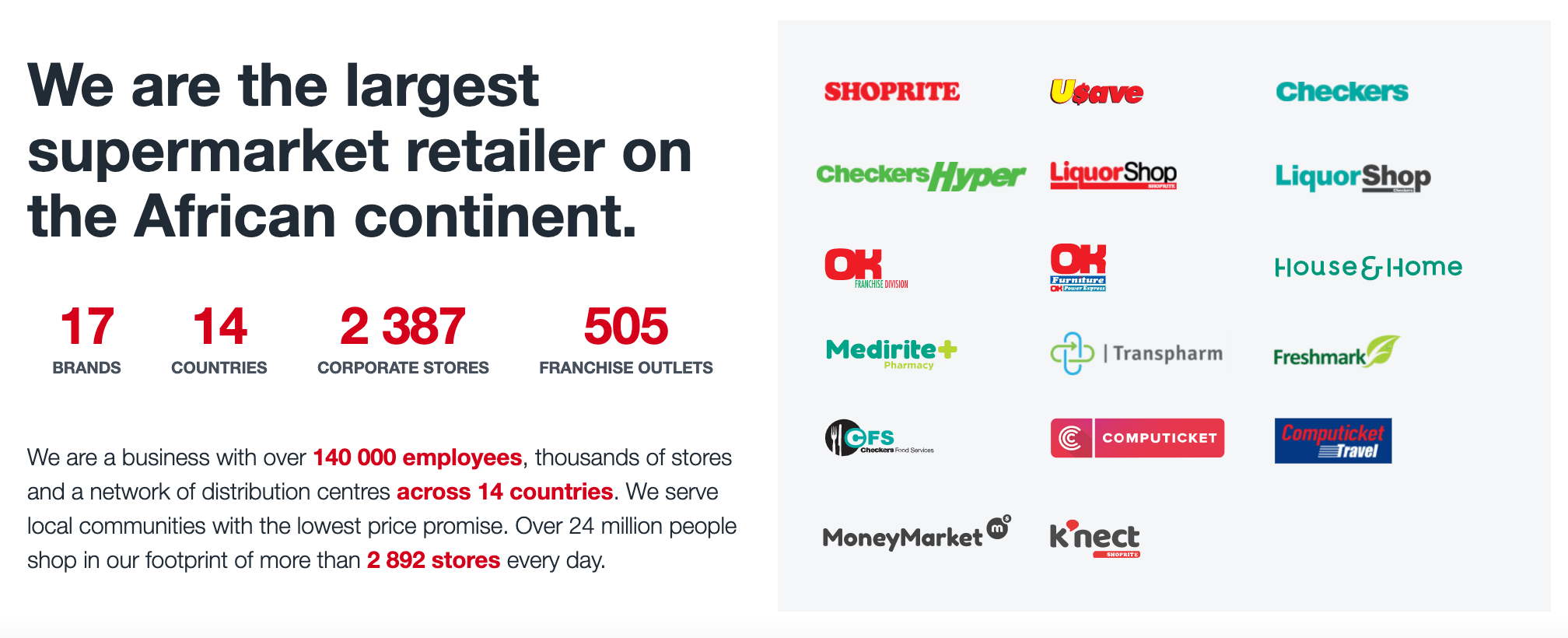

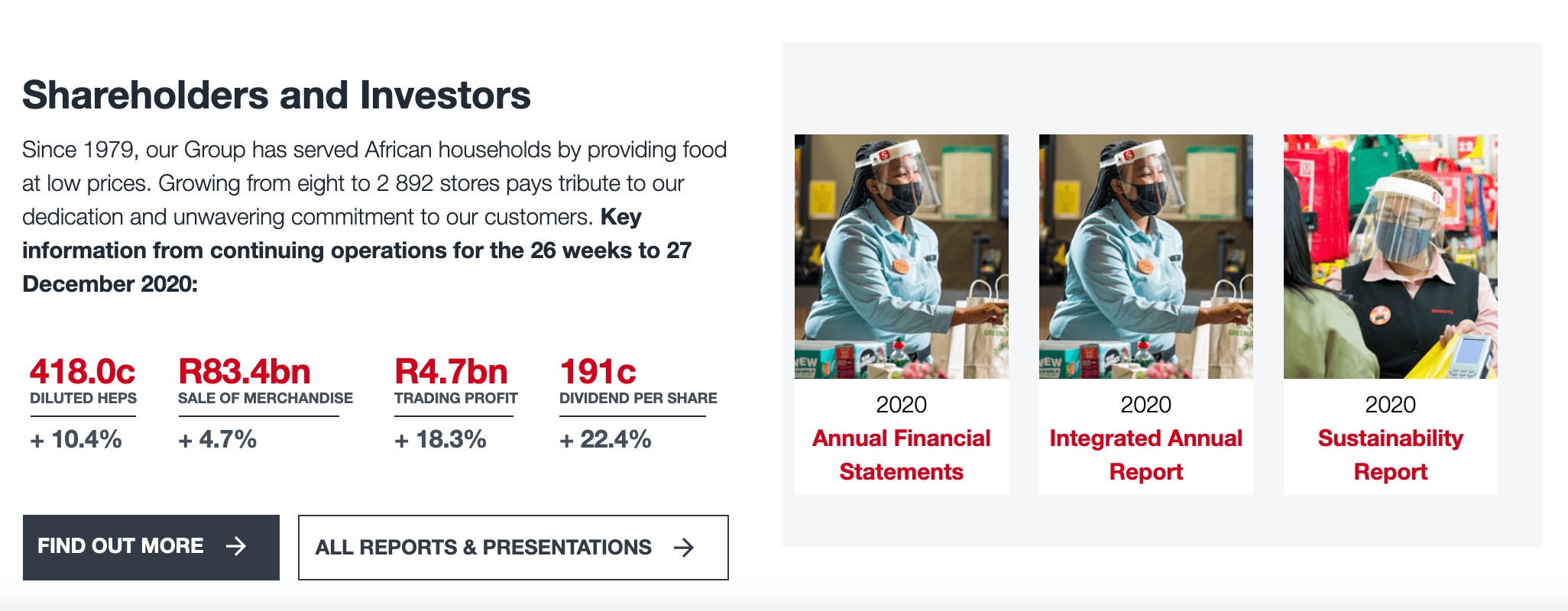

First of all – what is Shoprite, and what do they do? The Shoprite Group of Companies (commonly referred to as Shoprite) is the largest food retailer in Africa, operating 2892 locations in more than a dozen different countries. Shoprite’s company headquarters are located in Brackenfell, a town in the Western Cape Province. At the time of writing, Shoprite employs more than 140,000 people across all of the company’s locations in Africa.

Shoprite was initially launched in 1979 and gradually expanded into Namibia and Zambia. This expansion continued over the following decades as Shoprite acquired many smaller retailers and grew into other countries, including Zimbabwe and Madagascar. In the present day, Shoprite stores are located in 14 different countries in Africa.

Shoprite, as a company, own and operate various brands under its corporate umbrella. Included in these brands is the Shoprite chain of food retailers, which makes up the bulk of the company’s stores. Aside from Shoprite, the company also owns Checkers Supermarkets, Usave stores, MediRite pharmacies, LiquorShops, and various furniture outlets. Shoprite also operates its own franchise division, which allows them to distribute stock to different convenience stores in Africa.

Shoprite prides itself on offering low-cost goods to customers all across the country. This mindset has made them the largest fast-moving consumer goods retailer in Africa. Furthermore, this growth has not come at the expense of environmental responsibility – Shoprite ensure their operations are sustainable and actively support various causes which aim to protect the environment.

The Shoprite Group of Companies has a primary listing on the Johannesburg Stock Exchange under the ticker symbol SHP. In addition, the company also has secondary listings on the Namibian and Zambian Stock Exchanges. At the time of writing, Shoprite has a market cap of $92.05bn – making them one of the largest African countries today.

Shoprite Share Price

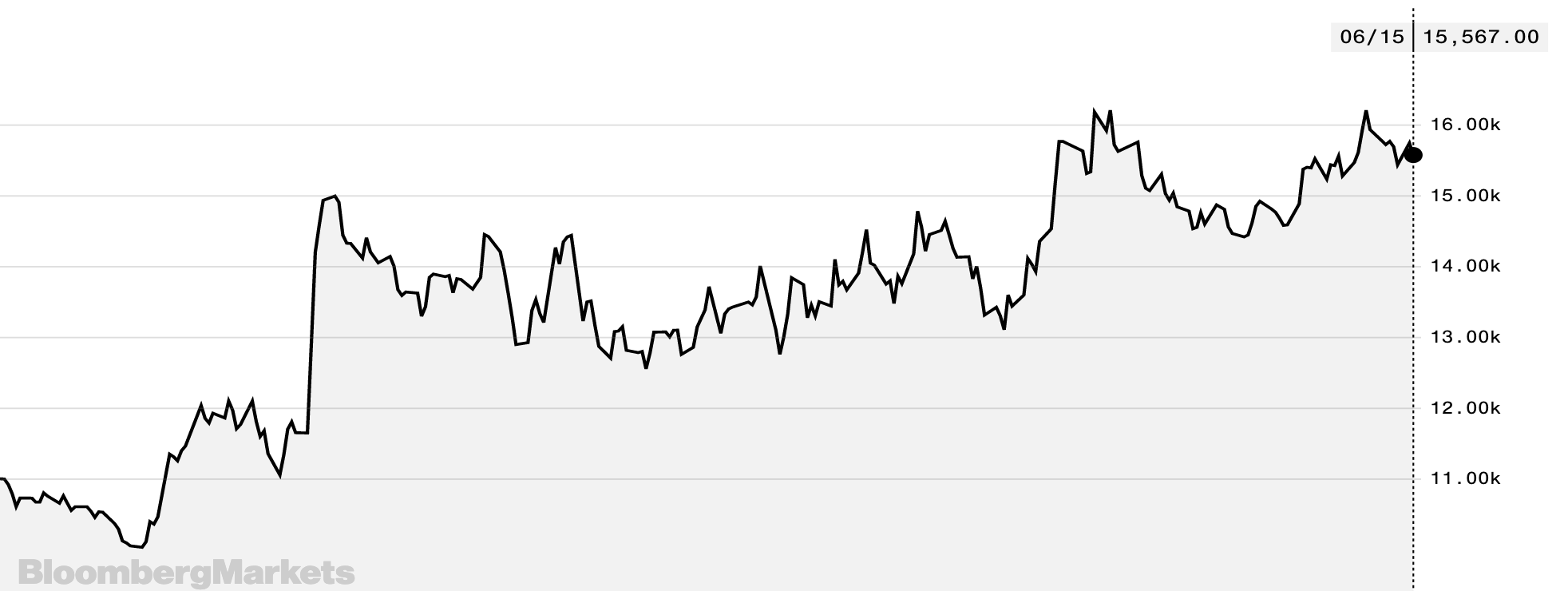

Before you buy shares in a company, it’s a good idea to examine areas such as the company’s historical share price and financials to see whether it’d be a good investment. At the time of writing, the Shoprite share price is quoted at 15,383 ZAC per share. This equates to a 20% rise since the start of the year – although the stock is down 7.3% since this date last year.

The Shoprite share price reached all-time highs in March 2018 when shares were valued at 28,195 ZAC. From then until July 2020, Shoprite’s shares suffered a significant price decline, losing over 64% of their value. However, since July 2020, the company has turned its fortunes around, and the Shoprite share price is now heading in an upwards trajectory, forming clear higher-highs and higher-lows on the daily and weekly timeframes.

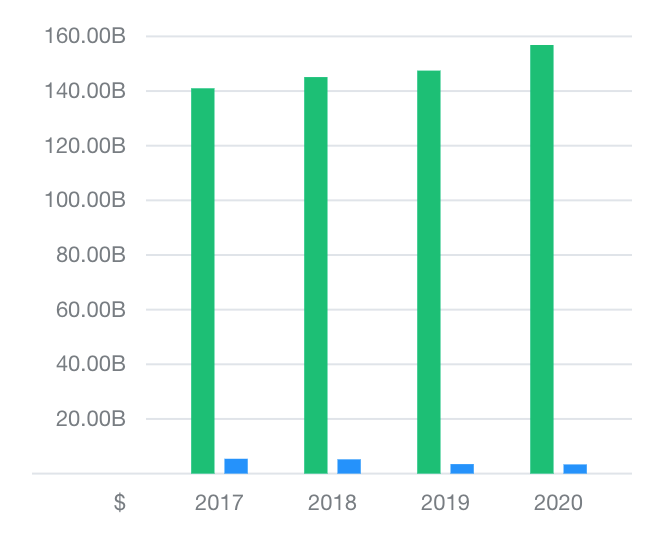

According to data from the Financial Times, the company has made 159.14bn ZAR in revenue over the past twelve months. This has translated into a net income of 3.55bn ZAR, meaning the company is comfortably profitable. These figures are even more impressive considering the impact of the Coronavirus pandemic – the number of shoppers would have decreased drastically due to social distancing measures and curfews in certain areas.

72% of retail CFD accounts lose money.

It’s also a good idea to look at the company’s earnings per share (EPS) and price-to-earnings (P/E) ratio to get an idea of where the company is at in terms of value. Looking at the latter, this metric indicates how valuable a company’s shares are – the higher the P/E ratio, the more valuable they are considered to be. In Shoprite’s case, the company’s P/E ratio is 27.51 at the time of writing.

This means that Shoprite is trading at just over 27x their earnings and indicates that investors expect a solid level of growth from this company going forward. This is the highest level that the company’s P/E ratio has been at since 2018. In terms of EPS, this metric is an excellent way to determine how profitable a company is. Shoprite’s EPS for the previous twelve months is stated as 6.35 ZAC, according to data from Yahoo Finance.

This EPS figure shows that the company is profitable and makes a healthy amount of earnings for each outstanding share. Revenues are increasing year on year, and the company has a solid level of free cash flow. These factors combine to show that Shoprite is in a good position financially – and with lockdowns easing across the world, there’s now a great opportunity to boost these figures even more.

Shoprite Shares Dividends

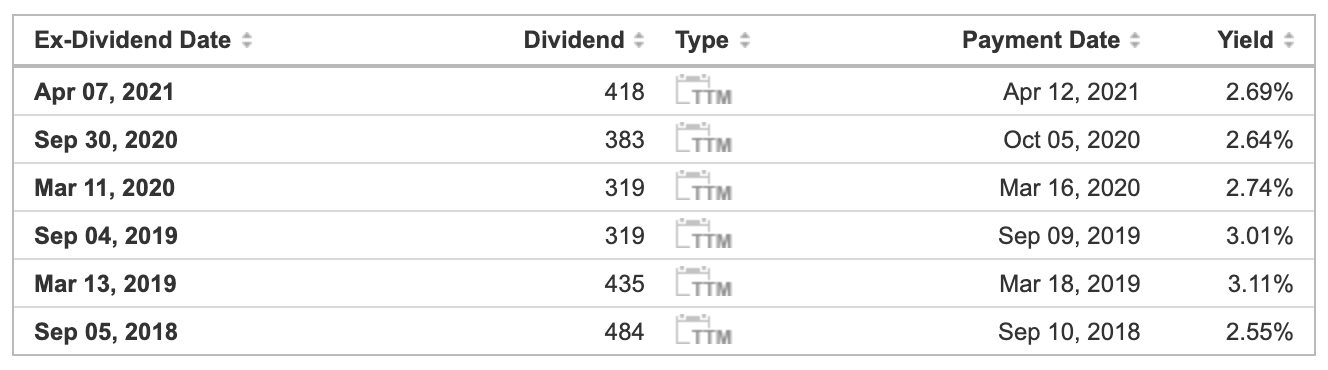

Many of the best shares to buy will pay a dividend to shareholders – and Shoprite is no different. When you buy Shoprite shares in South Africa, you will be entitled to a dividend payment from the company. These payments typically happen twice per year – once in March/April and once in September/October.

Dividends usually arrive a week or so after the ex-dividend date – if you own Shoprite shares before this date, then you will be entitled to a dividend payment. Historically, Shoprite’s ex-dividend date for the second payment of the year occurs in September. So, if you are interested in buying Shoprite shares, make sure you get them before this date to be eligible for the dividend payment.

In terms of yields, Shoprite’s dividend is stable and impressive. Data from Investing.com highlights that dividend yields have not dropped below 2.5% over the last three years – which is an excellent return for shareholders. Yields have even risen as high as 3.11%, which is much higher than the average for companies operating in the same industry. Overall, these impressive yields are a great benefit to shareholders and hint at the cash-rich nature of Shoprite as a company.

Are Shoprite Shares a Good Buy?

So, putting all of the information mentioned above together, can Shoprite shares be considered a possible buying opportunity? We believe so – and the sections below will present our reasoning for this mindset.

Well-Established Company

Firstly, Shoprite is very well-established in Africa, which means that the company has a solid foundation for growth. Having a stable supply chain and sound infrastructure means that the volatility of a growing firm is not a worry for Shoprite shareholders. By looking at the price chart, you can see that large spikes in the Shoprite share price are few and far between – which is ideal for more risk-averse investors.

Furthermore, as Shoprite is so well-established, it puts them in a great position to benefit from increased footfall brought about by lockdowns easing. A report by the Africa Business Venture stated that consumer spending in Africa is expected to grow to an incredible $2.1trillion by 2025 – and Shoprite is well placed to benefit from this growth. If the company can continue to expand into other countries and territories, it’ll allow them the chance to increase overall revenues.

Solid Financials

Another critical point to note about Shoprite is the company’s financials. If you decide to buy Shoprite shares in South Africa, you’ll be investing in a company showcasing year-on-year revenue growth and consistent net income. Furthermore, EBIT figures are increasing each year which is another positive sign for the company.

Although Shoprite’s financials look great, their expenses are still remaining the same, if not higher, each year. The fact that revenues and EBIT figures are growing whilst costs are not decreasing is a testament to how attractive Shoprite’s products and brand appeal are. If the company can make headway in reducing expenses, it’ll mean more net income – and a greater chance of share price increases.

Attractive Dividend Yield

Finally, and as noted earlier, the company pays a consistent and attractive dividend to shareholders. This bi-annual dividend is a great way to add a passive income stream to your portfolio – and with the yields that Shoprite offer, these dividend payments could be a great way to boost your overall return.

Finally, even though dividend yields are already relatively high, there’s always scope for these to increase further. Shoprite’s net income and free cash flow are both solid, which means that financially they are in a position to pay a solid dividend. In the past, Shoprite has paid larger yields to shareholders – and if the company’s financials continue to improve, there’s a good chance yields may follow suit.

Open an Account & Buy Shares

Now that you have a solid understanding of what Shoprite is and how they function as a business, it’s time to discuss how actually to invest in the company. To facilitate your investment, you will need to create an account with a trusted and reliable broker – ideally regulated by one or more top institutions.

In our opinion, Plus500 offers the best and safest trading platform for South African traders. So, by following the steps below, we’ll show you how to buy Shoprite shares in South Africa with Plus500 – all without paying any commissions.

Step 1: Create a Plus500 Account

Head over to Plus500’s website and click ‘Start Trading’. On the following page, opt for a real account and then enter a valid email address and password to create your account. Alternatively, you begin this process on the Plus500 app, one of the best stock apps available to traders.

72% of retail CFD accounts lose money.

Step 2: Verify your Account

Before you can begin trading, you will have to verify your account with Plus500. Fortunately, this is very simple to do and usually takes minutes. Go to your account information page and upload proof of ID (a copy of your passport or driver’s license) and proof of address (a copy of a bank statement or utility bill). Plus500 will then verify these documents – once completed, move on to the next step.

Step 3: Make a Deposit

Now that your account is verified, you can make a deposit. Plus500 does not charge any fees when you make deposits and allow users to fund their account from as little as $100 (1404 ZAR). In terms of deposit options, Plus500 accept the following methods:

- Credit card

- Debit Card

- Bank Transfer

- PayPal

- Skrill

Step 4: Search for Shoprite

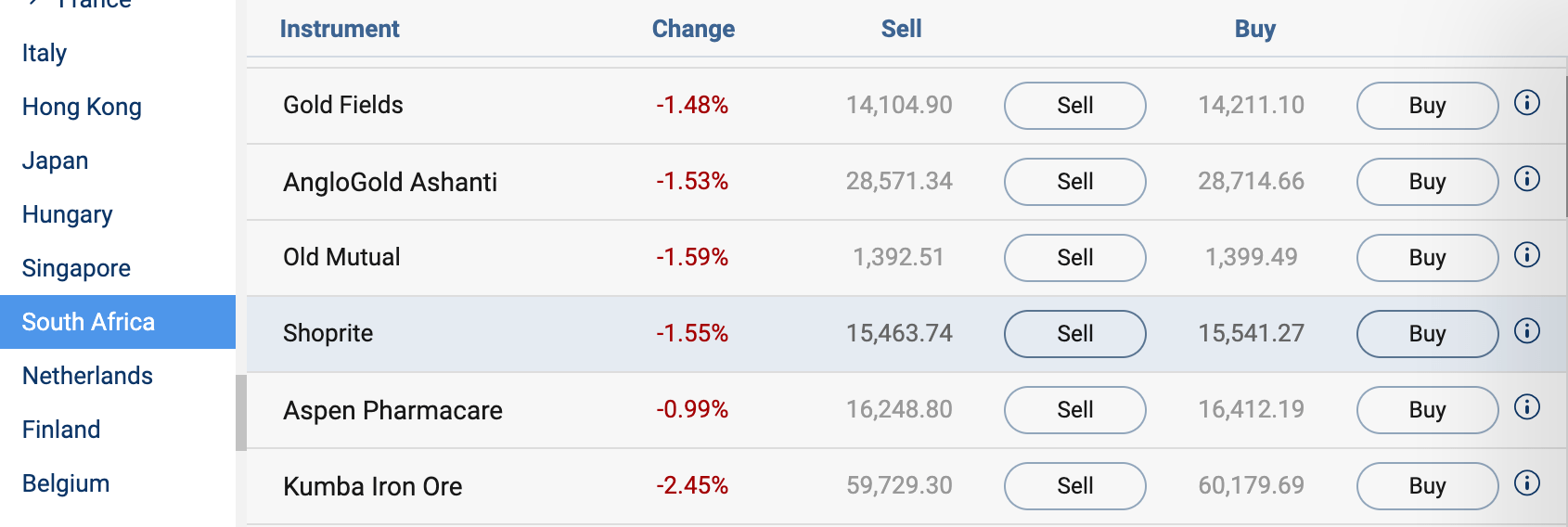

Go to Plus500’s trading platform and type ‘Shoprite’ into the search bar in the top left corner of the screen. Shoprite’s shares should now appear in the list in the middle of the screen – when you see them, click ‘Buy’.

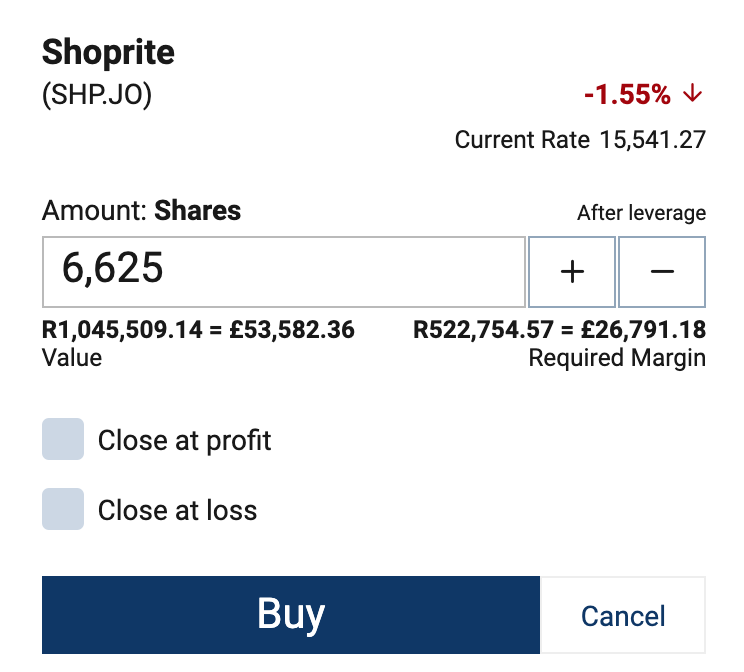

Step 5: Buy Shoprite Shares in South Africa

An order box should now appear on the right side of the screen. In this box, you can enter the number of shares you’d like to buy, opt to place a stop loss, and choose whether you’d like to use leverage. Once you are happy with everything, click ‘Buy’.

And that’s it! You’ve officially invested in Shoprite shares – without paying a rand in commissions!

72% of retail CFD accounts lose money.

Shoprite Shares Buy or Sell?

So, to wrap everything up, are Shoprite shares a buy or a sell opportunity? We feel they are the former as the company has an excellent track record in Africa and has the resources and supply chain to make the most of rising consumer demand. Shoprite owns numerous popular brands, and even though they are best known for food retailing, the company’s operations are diverse enough to appeal to a wide range of demographics and customer needs.

Shoprite’s shares are also beginning to showcase some bullish momentum, which is an excellent sign after the prolonged decrease showcased over the past year or so. The fact that shares are rising shows that market sentiment is shifting to positive – so now might be a good time to get in whilst there’s still immense upside potential.

Shoprite’s financial situation is solid, so there’s tangible backing to the share price increasing. Furthermore, as lockdowns across Africa ease, Shoprite will be one of the companies that could benefit from increased footfall. This will ultimately mean more significant revenues – and if the company can lower expenses, higher net income too.

Overall, Shoprite is undoubtedly a good addition to your portfolio if you’d looking for a stock with good potential for long-term growth. Shoprite has been in the game for a long time now, so rapid price increases are pretty unlikely. However, this also means that volatility is also unlikely – and combining this with Shoprite’s attractive dividend yields and solid financials, it’s clear to see why the company might be worth an investment in the near future.

Plus500 – Buy & Sell Shoprite Shares With Zero Commission

In summary, Shoprite is one of the most well-established companies in South Africa – and with incredible levels of brand appeal and an efficient supply chain, the company firmly holds its position as Africa’s largest food retailer. Although the Shoprite share price has taken a hit in recent years, the upside momentum over the past twelve months could be the beginning of a much longer bull run – meaning now is a great time to consider an investment.

If you have already decided to invest in Shoprite, we’d recommend using Plus500 to make your investment. Plus500 offer a safe and licensed trading environment for users, boating regulation from both the FCA and the ASIC. In addition to this, Plus500’s minimum deposit is only $100 (1404 ZAR), and they do not charge any commissions whatsoever when you place a trade.

72% of retail CFD accounts lose money.