Best Algorithmic Trading Platform in South Africa 2022

Algorithmic trading is the process of buying and selling assets in a fully automated manner. This allows you to actively trade your chosen financial instrument without needing to lift a finger. The most challenging part is finding a suitable algorithmic trading platform that meets your financial objectives.

In this guide, we review the Best Algorithmic Trading Platforms in South Africa for 2022 and walk you through the process of getting started today.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Algo Trading Platforms Fees Comparison

When considering which algo trading platform is best suited for your needs – you need to have a firm understanding of what fees and commissions are applicable. This is crucial, as your algorithmic trading strategy will be entering buy and sell positions on your behalf – so naturally, fees will apply.

Below you will find a fee comparison table that outlines the main fees you need to look for when using one of the algorhtmic trading platforms that we have reviewed today.

| Standard Commission | Spread | Minimum Deposit | Auto Trading Fee | |

| eToro | From 0% | Variable | $200 | No Fees for Copy Trading |

| Capital.com | 0% | Variable | $20 | Depends on the MT4 robot |

| Libertex | From 0% | ZERO on all markets | $100 | Depends on the MT5 robot |

| IG | 0% on all markets apart from stocks | Variable | $250 | No Fees for ProRealTime |

| FXCM | 0%% | Variable | $50 | Depends on Strategy |

Ultimately, if using MT4 or MT5 for your algorithmic trading endeavours, the fee that you pay for the software itself will depend on the provider in question.

Algorithmic Trading Guide

In many cases, algorithmic trading can be a complex battleground, so it’s important that you understand how this segment of the online investment scene works before parting with any money.

With this in mind, below we explain the basics of algo trading in South Africa.

What is Algorithmic Trading?

In its most basic form, algorithmic trading refers to the process of allowing a piece of software to trade on your behalf. Otherwise called an EA (expert advisor) or robot – algorithmic trading platforms allow you to actively day trading in a 100% passive manner.

This is because the robot will be programmed to scan the financial markets around the clock – constantly looking for opportunities to enter a position.

- In this sense, you are effectively performing in-depth research without needing to lift a finger.

- After all, the best algorhtmic trading systems will have the capacity to analyze pricing trends and deploy technical indicators in an autonomous manner.

- In the vast majority of cases, the algorithmic trading software will be built by a third-party provider that sells its system online.

- The underlying code installed into the software will be based on artificial intelligence, which is what allows the robot to operate independently.

It is important to note that, unlike experienced human traders, algorhtmic trading software only has the ability to look at the technicals. In other words, while it might be able to perform advanced technical analysis, the software will not be aware of what is happening in the real world.

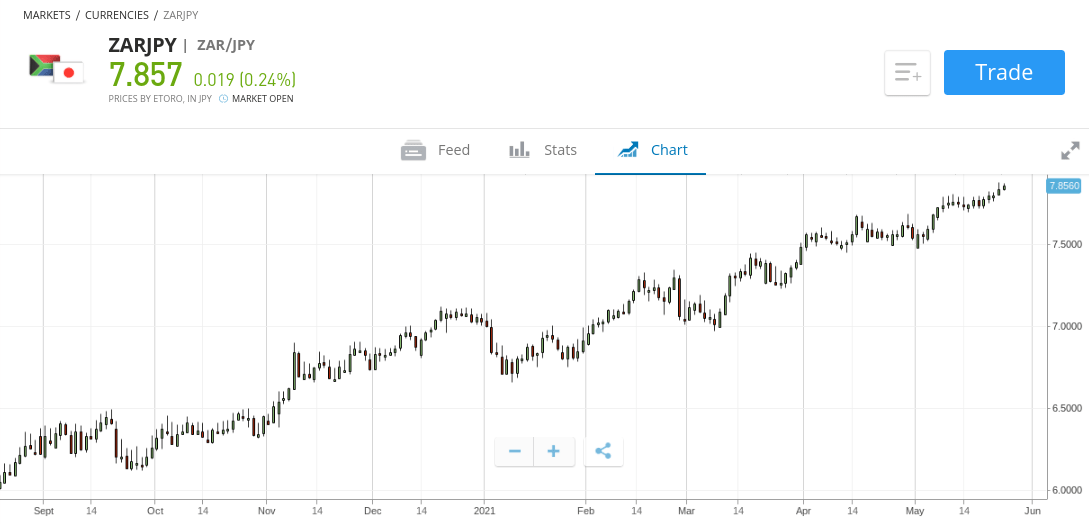

For example, if the Federal Reserve hiked interest rates, this would be big news in the financial space. However, the algorithmic trading software would not be aware of the news and thus – this is a major weakness. This is why we much prefer the Copy Trading tool offered by eToro – as you will be copying a successful investor that utilizes both technical and fundamental analysis.

Algorithmic Trading Strategies

There are essentially two leading algorhtmic trading strategies that are worth considering. The one you opt for will ultimately depend on how hands-off you wish to be and what your long-term financial goals are.

As such, we suggest reading through the following strategies to assess which one is best for you.

Algo Strategy 1: Copy Trading

The first and perhaps best algorithmic strategy to consider is that of Copy Trading. As we mentioned earlier in our reviews, the Copy Trading tool is offered by hugely popular online broker eToro – which is now used by over 20 million investors.

Put simply, you will be trading in a fully automated manner – as all of your buy and sell orders will mirror that of your chosen eToro investor. As eToro is home to thousands of verified traders, you can choose an investor that mirrors your financial goals.

For example:

- You might decide to search for a stock trading pro that has made at least 20% annually over the past two years.

- You might even narrow your search down further by specifying the average trade duration and risk rating.

- Once you have found a trader to copy, you can elect to mirror their currency portfolio and all ongoing positions.

- For instance, if the trader allocated 5% into a USD/ZAR buy order and you originally invested $500 – $25 of your own capital would be used to copy the trade.

- If the trader in question made 20% on this position, you would also make gains of 20%.

Ultimately, Copy Trading is a much better option than going with a fully automated algorhtmic software robot – as you have full control over your funds.

Plus, as eToro is heavily regulated, you don’t need to worry about the legitimacy of the historical trading results presented on the site. The same can’t be said with providers selling algorhtmic software robots – as they often make super-bold claims about the profits they have made but this is rarely variable.

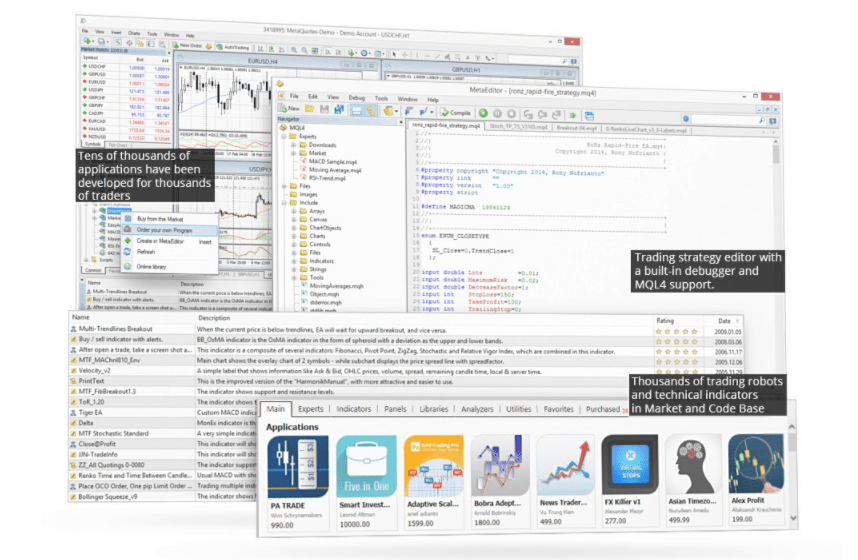

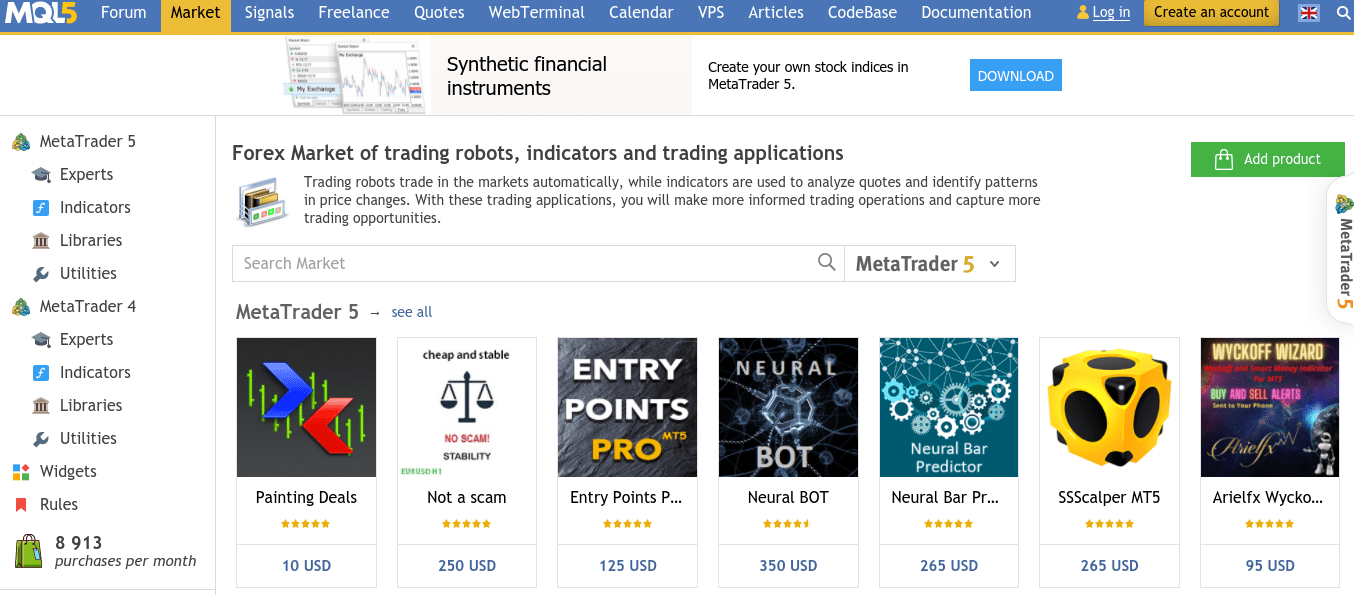

Algo Strategy 2: MT4/MT5 Robot

The next algo trading strategy to consider is that of a robot that you install into a third-party platform like MT4 or MT5. The former is the preferred option for algo developers, so you’ll likely have a much larger pool of strategies to choose from. Crucially, this option will allow you to sit back and actively trade without needing to lift a finger.

The MT4/MT5 robot will not only perform technical research on your behalf but place buy and sell positions, too. In fact, the robot will be operational 24 hours per day – a feat that not even the most seasoned of traders could match!

If this if the route you want to take, the most challenging part of the process is finding a suitable robot that is going to be able to make you consistent gains in a risk-averse manner. As noted earlier, this is difficult because robot providers are renowned for making hyperbole claims of unfounded profits that in most cases – are false.

The good news is that there is a way to mitigate the risks involved, by using a free demo account. This is offered by Capital.com (MT4) and Libertex (MT5) – so you can deploy your newly purchased robot without risking any trading funds. You will, however, need to pay for the robot itself.

Here’s what you need to do to start algo trading with an automated trading software or robot via MT4 or MT5:

- Open an account with a broker that supports MT4 or MT5

- Add funds to your newly created brokerage account

- Do lots of research to find an algorithmic trading robot that meets your financial goals

- Purchase your chosen robot and download the file to your desktop device

- Open MT4/MT5 and sign in with your brokerage login credentials

- Install the robot into MT4/5, set up your parameters, and authorize it to start trading

The most important thing to remember is that an algo robot will have access to your brokerage funds. As such, by ticking the authorization box on MT4/5, it will be able to use your funds to place real-world orders. If this makes you feel uncomfortable, you might be more suited for the eToro Copy Trading tool.

Can Algo Trading Beat the Market?

If you’re wondering whether or not algorithmic trading strategies can beat the market – the simple answer is yes. The reason we say this is that some of the largest and most successful trading floors in the world have been utilizing algorithmic trading software since the 1980s.

In comparison to a human trader, the algorhtmic software can:

- Trade 24 hours per day, 7 days per week – all without experiencing fatigue

- Avoid trading emotions in their entirety

- Scans thousands of markets simultaneously

- Create millions of potential scenarios and outcomes every second

- Find and take advantage of arbitrage trading opportunities in a matter of milliseconds

However, as great as the above features might look on paper – there is a really important point to make. That is – large hedge funds, banks, and financial institutions have access to a significant amount of resources – meaning that they possess algorhtmic trading software that is far more advanced than any retail client can get their hands on.

This means that the vast majority of algo trading robots that you come across in the online space will be of sub-par quality to consistently outperform the market. After all, if somebody was able to build an advanced strategy that consistently makes money – why would they sell it for a few hundred dollars and ultimately – give away their secret source?

Once again, this is why in the grand scheme of things, the eToro Copy Trading option is the best way to go if you seek automated investment services.

How to Get Started with the Best Algorithmic Trading Broker

If like us you think that Copy Trading is a much safer alternative to algorhtmic robots, we are now going to walk you through the process of getting started. In fact, by following the simple steps outlined below, you could be copying your first eToro trader in less than 10 minutes!

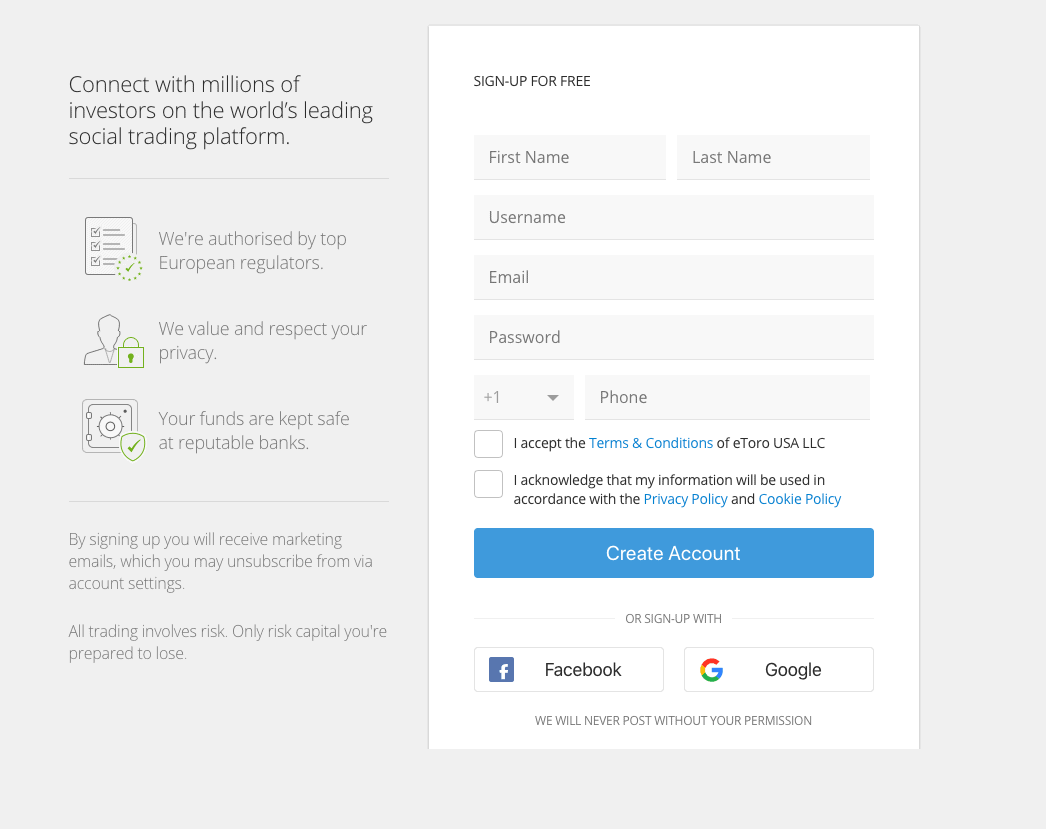

Step 1: Open an eToro Account

The first step is to go through the burden-free process of opening an eToro account. You can do this online or via your mobile phone. Simply head over to the eToro website and click on the ‘Join Now’ button.

You will be asked for your:

- Name

- Nationality

- Date of Birth

- Home Address

- Contact Details

Once you have verified your email address and mobile number, you will then be asked to upload a copy of your government-issued ID. This is to ensure that eToro remains compliant with its three license issuers – the FCA, ASIC, and CySEC.

Step 2: Make a Deposit

Now that you have an eToro investment account, you can make a deposit. The minimum deposit is $200 – but if you want to use the Copy Trading tool, this will require an investment of at least $500 per trader.

You can choose from one of the payment types listed below:

- Visa

- MasterCard

- Maestro

- Paypal

- Skrill

- Neteller

- Bank Transfer

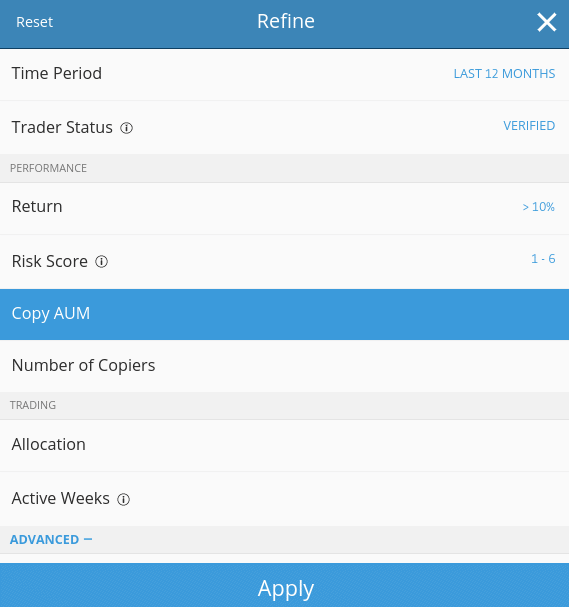

Step 3: Find a Successful Copy Trader

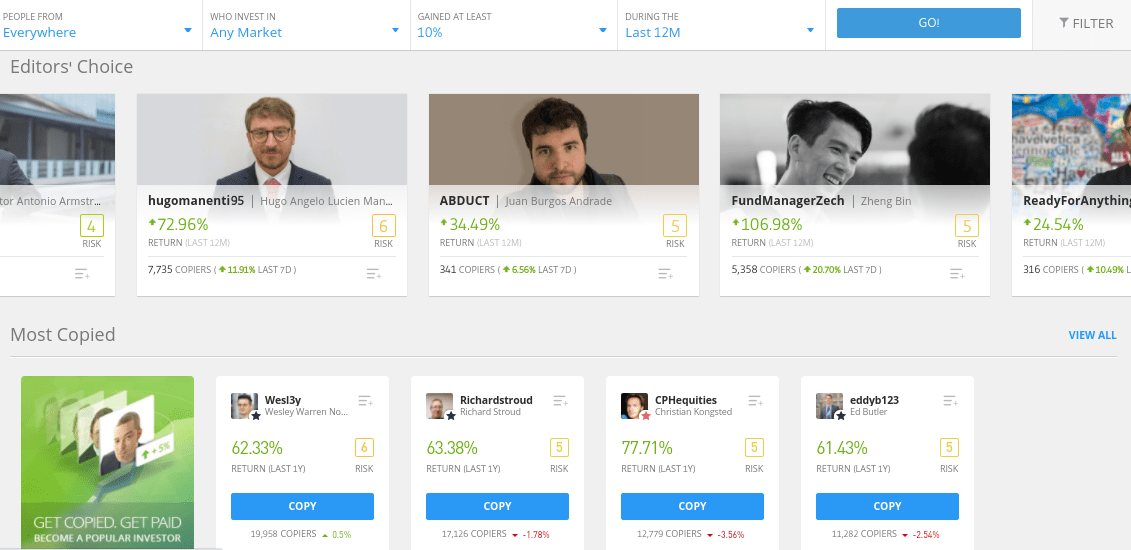

You can now begin researching the many verified traders on eToro to find one that alligns with your financial goals, preferred asset class, and tolerance for risk. First, click on the ‘Copy People’ button from the dashboard on the left-hand side of the screen.

Then, you are advised to use the filter buttons that you have access to. For example, you can find a suitable trader by specifying the minimum amount of profit made over a certain period – for example, 10% annually for at least 3 years.

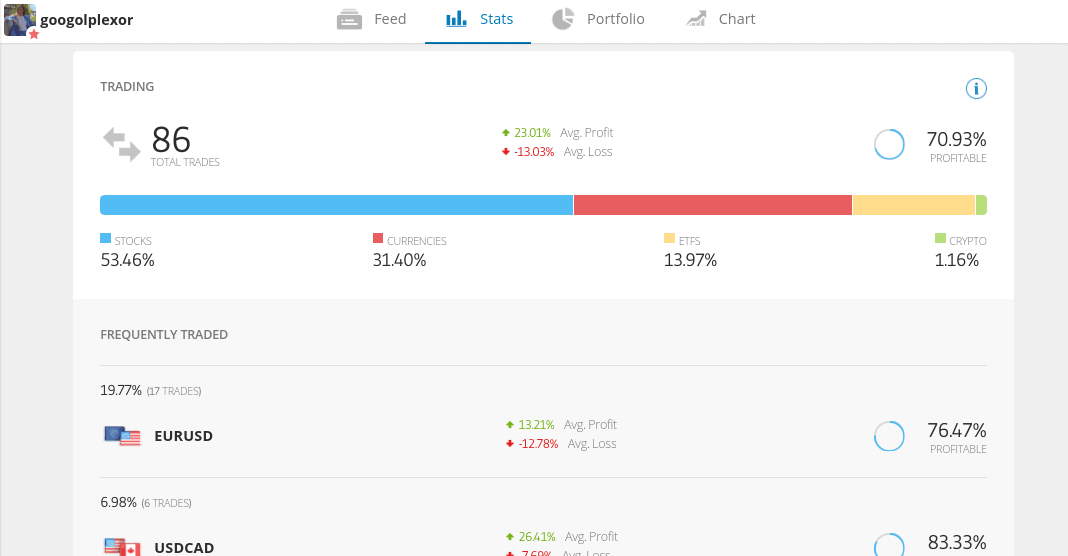

When you are presented with the results, you can click on a trader to view their profile.

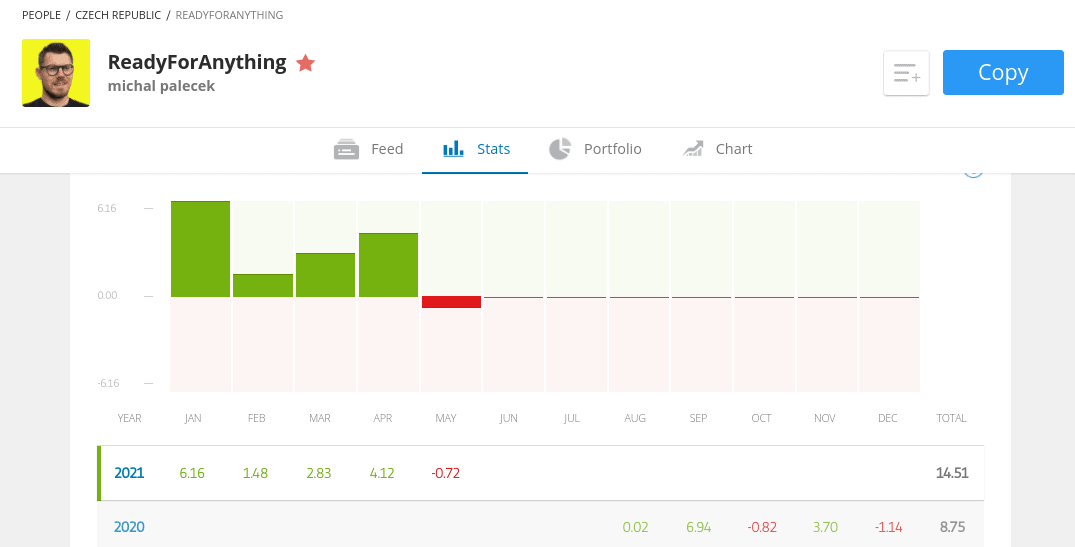

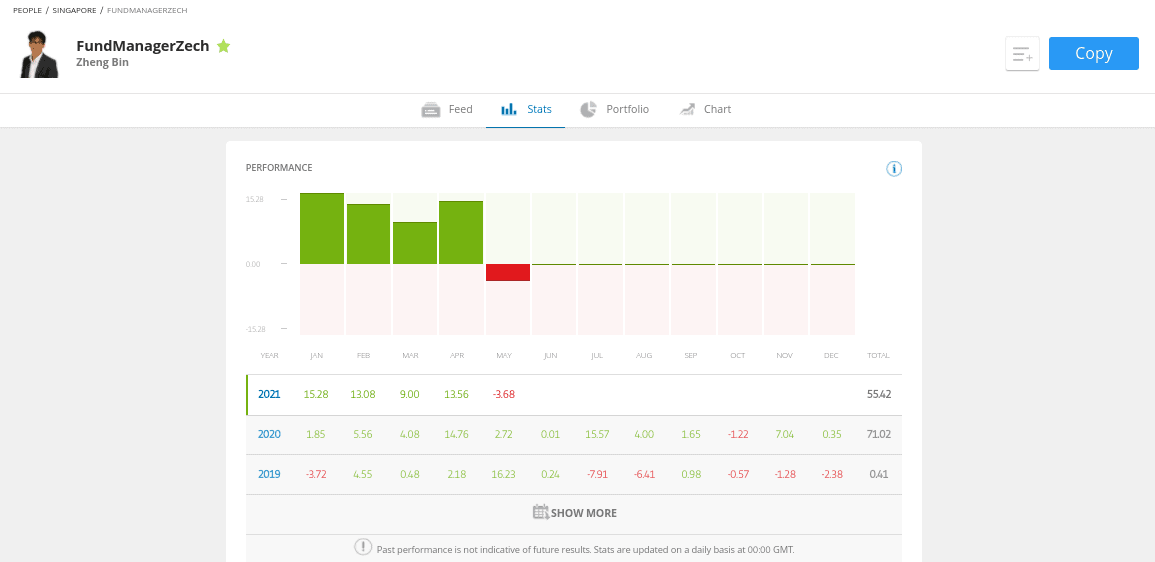

Step 4: Review Trader Stats

Once you click on a trader, you will be presented with a significant amount of data. For example, you can view the individual’s historical performance since joining eToro. This is broken down nicely by a profit or loss figure for each month.

You can also see what assets the trader likes to buy and sell and how long they typically keep a position open for. Ultimately, you should spend as much time as you need to find a suitable eToro investor – as they will be trading on your behalf.

Step 5: Complete Investment

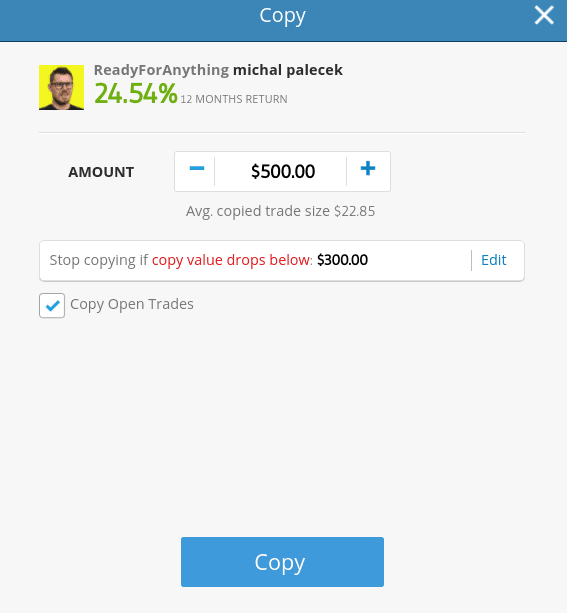

Once you have found a suitable trader to copy, you will need to complete a simple investment order. First, click on the ‘Copy’ button. In doing so, you will see an order box like in the image below.

Next, enter the amount that you want to invest in ther trader – ensuring that you meet a $500 minimum. You will notice that by default, the ‘Copy Open Trades’ button is ticked. This means that you will be copying the trader’s current portfolio, as well as all ongoing positions.

Finally, to confirm your investment – click on the ‘Copy’ button at the bottom of the order box.

And that’s it – you have just taken your first step into the world of passive trading! Your copy trading position will remain open until you decide to cash out – which you can do any time.

eToro – Best Broker for Automated Copy Trading

This guide has discussed the best algorithmic trading platforms in South Africa for 2022. As we have explained, there are many types of algorithmic trading strategies available in the market. You might be tempted to use a conventional algorithmic trading robot that buys and sells assets on your behalf 24 hours per day.

However, we found that the challenging part is finding a robot that is able to make consistent gains. After all, most end up blowing through account balances in one fell swoop. Instead, we much prefer the automated Copy Trading tool available at regulated brokerage site eToro.

You will have access to a plethora of successful investors that you can copy at the click of a button without paying any additional fees. Whether you want to actively day trade forex or invest in long-term stocks – eToro has a trader that is sure to align with your financial goals and tolerance for risk.

67% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

What is the best algorithmic trading platform?

If you want to use an algorithmic trading robot - then the best platforms to do this with are MT4 and MT5. If, however, you take the automated Copy Trading route, then eToro is the best platform for the job.

How does Algorithmic trading work?

Algorhtmic trading relies on a software file that is pre-programmed to trade autonomously. The underlying technology code ensures that the robot follows a set of conditions - which is usually backed by artificial intelligence. For example, the robot might be instructed to sell GBP/USD when the pair breaches an RSI level of 85.

Do algorithmic trading systems work?

On the one hand, hedge funds and financial institutions have been successfully using algorithmic trading systems for several decades. As they have access to vast resources, their robots are able to consistently beat the market. However, as a retail client, you will only have access to algorithmic trading strategies that are available to buy from a third party. In all likelihood, the robot won't be advanced enough to outperform the market and thus - make you consistent gains.

How do you set up algorithmic trading software?

Most algo trading software files are compatible with either MT4 or MT5. As such, the first step is open an account with a top-rated broker that is compatible with your preferred MT4/5platform. Then, you will need to upload the robot software into MT4/5 and authorize it to start trading on your behalf.

How do you try algorithmic trading for free?

You can test out your algorithmic trading system by using a free brokerage demo account. These are offered by the likes of Capital.com (MT4) and Libertex (MT5). For as long as the algo trading robot is trading in demo mode, you won't be risking any money.

Latest News

Hvordan spille poker og Norgescsino

For tiden er det mange mennesker som ønsker å lære å spille poker og norgescsino. Dette er fordi spillene er veldig morsomme og folk kan få mye penger fra dem. Det er imidlertid et par ting du bør huske på når du skal lære å spille poker og norgescsino. Disse tingene inkluderer RNG, Cashback og...

Lär dig grunderna för kasinobordsspel

Om du har funderat på att prova på kasinot kanske du undrar vilka spel du ska spela. Bordsspel inkluderar Blackjack, Poker och Craps. Om du vill lära dig mer om dessa spel, läs vidare. Här är några grunder om dessa spel. Du kommer att kunna välja det bästa spelet att spela baserat på dina personliga...

Past performance is not an indicator of future results

Past performance is not an indicator of future results

If you’re an experienced algorithmic trader that wishes to take things to the very next level – it’s well worth considering FXCM. This popular CFD and

If you’re an experienced algorithmic trader that wishes to take things to the very next level – it’s well worth considering FXCM. This popular CFD and