Bitcoin Investment South Africa – How to Invest in Bitcoin

If you’re based in South Africa and wish to invest in Bitcoin – the process can be completed from the comfort of your home with ease. All you need to do is open an account with a top-rated broker, deposit money via debit/credit card or an e-wallet, and choose how much you wish to invest in Bitcoin.

In this Bitcoin Investment South Africa guide, we walk you through the process of how to purchase this innovative digital currency in a safe and hassle-free manner.

-

-

Bitcoin Investment South Africa Quick Guide

Wondering how to invest in Bitcoin South Africa right now? If so, follow the quickfire steps outlined below.

- Step 1: Open a Brokerage Account: Choose a trusted cryptocurrency broker that allows you to invest in Bitcoin. eToro is a good option – as you can invest in Bitcoin using a debit/credit card or Paypal, without paying any commission and at a minimum trade size of just $25.

- Step 2: Deposit Funds: Choose a supported payment method and make a deposit.

- Step 3: Search for Bitcoin: Enter ‘Bitcoin’ into the eToro search box and click on ‘Trade’.

- Step 4: Invest in Bitcoin: Enter the amount of money (USD) you wish to invest in Bitcoin and confirm the order.

In most cases, the above process Bitcoin investment South Africa process should take you no more than 10 minutes to complete.

Bitcoin Investment – The Basics

There are generally two ways in which Bitcoin investment platforms allow you to gain exposure to the digital asset. The first is to ‘trade’ the digital currency, meaning that you are speculating on its future value in the short term. In some cases, this is performed at a cryptocurrency trading platform via leveraged CFDs.

This means that you can trade Bitcoin without actually owning it and thus – there is no requirement to worry about storage. However, if you are planning to ‘invest’ in Bitcoin, this means that you are looking to purchase digital coins and hold on to your investment in the long term.

This might see you sit tight for several months or even years. In doing so, you won’t need to worry about short-term price fluctuations, wider market conditions, and volatility levels. In order to invest in Bitcoin in the long term, you will need to think about how you wish to store your coins.

Some investors in South Africa will make a purchase and then withdraw the coins to a private Bitcoin wallet. However, the easiest and more secure option is to use a regulated Bitcoin trading platform like eToro – which allows you to store your coins online free of charge.

Is Bitcoin a Good Investment?

If this is your first time investing in Bitcoin, it is important to first do some research. After all, you will be investing and risking your hard-earned money, so it’s crucial to understand whether or not Bitcoin is a good investment by considering both the pros and cons.

To help clear the mist, below we discuss some of the reasons why you might decide to invest in Bitcoin.

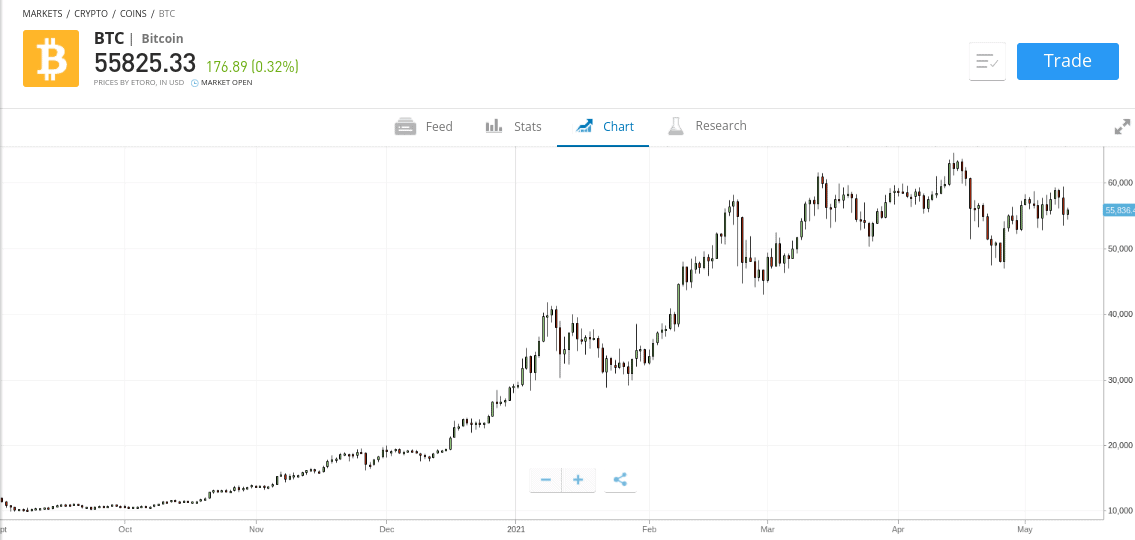

Top-Performing Asset Class

If you’re completely new to Bitcoin, you should know that this asset class is highly volatile. With that said, over the past 12 months, the digital currency has performed extremely well – going from lows of $5,000 in April 2020 to highs of over $60,000 just over a year later.

- This translates into gains of over 1,100%.

- As such, an investment of 15,000 rands just over 1-year ago would now be worth in excess of 165,000 rands.

- Had you entered the Bitcoin investment South Africa market even earlier – your gains would be considerably higher.

- For example, Bitcoin was worth just a fraction of a cent when it was first launched in 2009 – meaning that end-to-end growth stands at almost 600 million percent.

Of course, there is no guarantee that this parabolic upward momentum will continue. On the contrary, Bitcoin can and will go through extended bullish periods, where losses of more than 50% in a matter of weeks are still not uncommon.

Fractional Bitcoin Investment South Africa

Many South Africans are put off by Bitcoin because of how much a single coin now costs. However, thanks to brokers like eToro – which allow you to invest in Bitcoin via a fractional purchase, you can buy much smaller amounts.

In fact, eToro permits a minimum Bitcoin investment South Africa of just $25 – or about 350 rands. For example, let’s suppose that Bitcoin is currently priced at $60,000 and you decided to invest $600.

This means that you own 1% of a Bitcoin. If Bitcoin then increased by 30%, you would make gains of $180 (30% of $600 investment). Not only does this allow you to invest with small amounts, but it also paves the way of diversification into other crypto assets.

Big Institutions Have Since Entered the Bitcoin Market

In a time not so long ago, banks, financial institutions, and other large-scale organizations were quick to dub Bitcoin as a scam. Some argued that Bitcoin was nothing more than a ‘pump and dump’ bubble while others referred to the digital currency as a ‘Ponzi Scheme’. Either way, some of the largest institutions globally have since entered the Bitcoin marketplace themselves.

For example:

- Tesla: The world’s largest carmaker in terms of market capitalization recently invested $1.5 billion into Bitcoin. The digital currency now sits on the firm’s balance sheet.

- Paypal: The global e-wallet provider recently entered the cryptocurrency market by supported direct Bitcoin purchases through its website.

- Coinbase: Although a cryptocurrency broker by trade, the platform recently went public on the Nasdaq exchange. At the time of writing, its stocks now have a market capitalization of over $60 billion.

- Goldman Sachs: The large-scale investment bank recently set up a dedicated Bitcoin trading department.

- Microsoft: It is now possible to purchase goods and services from Microsoft using Bitcoin as a payment method.

The above examples are just a few of many. The key points here is that with so many large companies in one way, shape, or another gaining exposure to Bitcoin – this has cemented the digital currency as a legitimate asset class.

Store of Value

On the one hand, Bitcoin can be used to send and receive funds – so it operates much like a medium of exchange. This is especially true when you consider that the like of Microsoft (and many others) now allow you to pay for purchases with Bitcoin. However, many would argue that Bitcoin is more suited as a store of value.

- Much like gold, the total supply of Bitcoin will be limited.

- This will happen when a total of 21 million coins has been mined – which is expected to happen in just under 120 years.

- Crucially, as Bitcoin is finite, this means that in theory, its value should continue to appreciate over the course of time.

- Unlike gold, however, Bitcoin is a much more convenient store of value to invest in.

- Not only can you store it with ease via a digital wallet, but Bitcoin can be fractionated at the click of a button.

Bitcoin is also a lot more liquid than gold, as you can sell your digital currency back to cash 24/7 via an online cryptocurrency exchange.

Ways of Investing in Bitcoin

If you’re wondering how the Bitcoin investment South Africa works in practice – there are actually several ways to gain exposure to this exciting asset class.

This includes the following:

Buying Bitcoin

Perhaps the most obvious way to invest in Bitcoin is to purchase coins directly. The easiest way of doing this is to use a regulated online broker that supports a convenient payment method. Although we review the best Bitcoin exchange providers later in this guide, we found that eToro is the best broker for the job.

This is because it takes just minutes to complete the Bitcoin investment process from the comfort of your home. You can use a South African debit/credit card, bank account, or even an e-wallet like Paypal. Then, when it comes to storage, you can simply leave your coins in the eToro Bitcoin wallet until you are ready to cash out.

Some investors in South Africa will instead elect to use a third-party cryptocurrency exchange. In many cases, this will require you to buy Bitcoin in exchange for another digital currency – like Ethereum or Ripple. Not only is this process cumbersome, but the vast majority of cryptocurrency exchanges are unregulated. Once again, this is why we prefer eToro.

Buy Bitcoin Stocks

Another option that will allow you to gain exposure to this cryptocurrency is to buy Bitcoin stocks. In a nutshell, these are publicly-listed stocks that are directly involved in the digital currency industry.

At the forefront of this is Coinbase – the world’s largest cryptocurrency broker which is home to more than 35 million clients. The platform was listed on the Nasdaq in April 2021 and in many ways – the value of the shares will be very closely correlated with that of Bitcoin and the wider digital currency marketplace.

Other Bitcoin-related stocks include:

- Square

- Riot Blockchain

- Marathon Digital Holdings

There is every potential that in the coming years – we will see more and more crypto-related companies listed on a public stock exchange. This will give newbie investors an even easier path to make a Bitcoin investment South Africa.

Trade Bitcoin CFDs

The other option that you have is to trade Bitcoin CFDs. In South Africa, this is often the preferred option for experienced investors. This is because CFDs – or contracts-for-differences, allow you to speculate on the future value of Bitcoin without taking ownership.

Instead, the CFDs simply track the real-world price of Bitcoin. This allows you to speculate on Bitcoin with leverage – meaning you can trade with more money than you have in your brokerage accounts. Bitcoin CFDs also allow you to short-sell, which is great if you think that the digital currency is likely to go down in value.

Best Bitcoin Investment Sites

if you’re ready to complete the Bitcoin investment South Africa process right now – you’ll first need to choose a suited broker. Below, you will find three of the best Bitcoin brokers currently being used by South African traders.

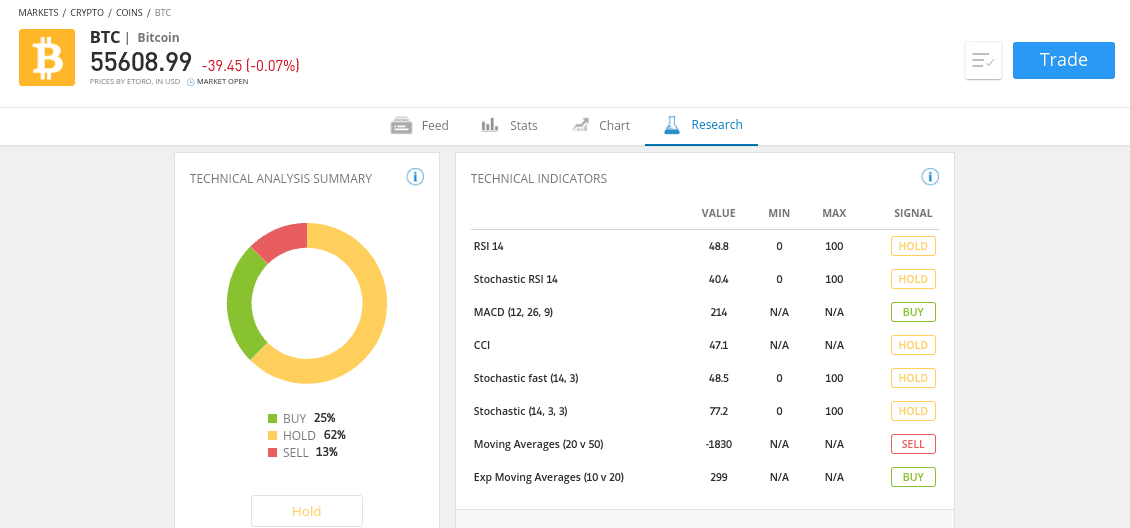

1. eToro – Best Bitcoin Investment South Africa Platform

eToro is a popular online broker that now facilitates over 20 million investor accounts. The platform is easy to use and thus – makes a great Bitcoin investment platform for newbies where you can buy cryptocurrency. This top-rated provider allows you to invest in Bitcoin without paying any commissions or dealing fees.

You can also invest at a minimum stake of just $25, which is great for first-timers. On top of Bitcoin, eToro also allows you to invest in 18 other digital currencies – including the likes of Ethereum, Ripple, Bitcoin Cash, and more. If you wish to invest in a passive nature, eToro offers a Copy Trading tool. This allows you to copy an experienced eToro investor, meaning all positions will be mirrored in your own account.

There is also a professionally managed cryptocurrency portfolio offered by the eToro team. This consists of a diversified basket of cryptocurrencies that is rebalanced on a regular basis. When it comes to payments, eToro supports several convenient deposit methods – including debit/credit cards, Paypal, Neteller, and bank transfers. You’ll have no issues when it comes to security, as eToro is regulated by ASIC, CySEC, and the FCA. As such, eToro will store your Bitcoin investment until you’re ready to cash out.

Pros:

- Invest in Bitcoin and 18 other digital currencies

- 2,400+ shares listed on 17 international markets

- More than 20 million clients

- Perfect for beginners

- Social and copy trading

- Mobile trading app

- Regulated by the FCA, CySEC, and ASIC

Cons:

- Not suitable for advanced traders that like to perform technical analysis

67% of retail investor accounts lose money when trading CFDs with this provider.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

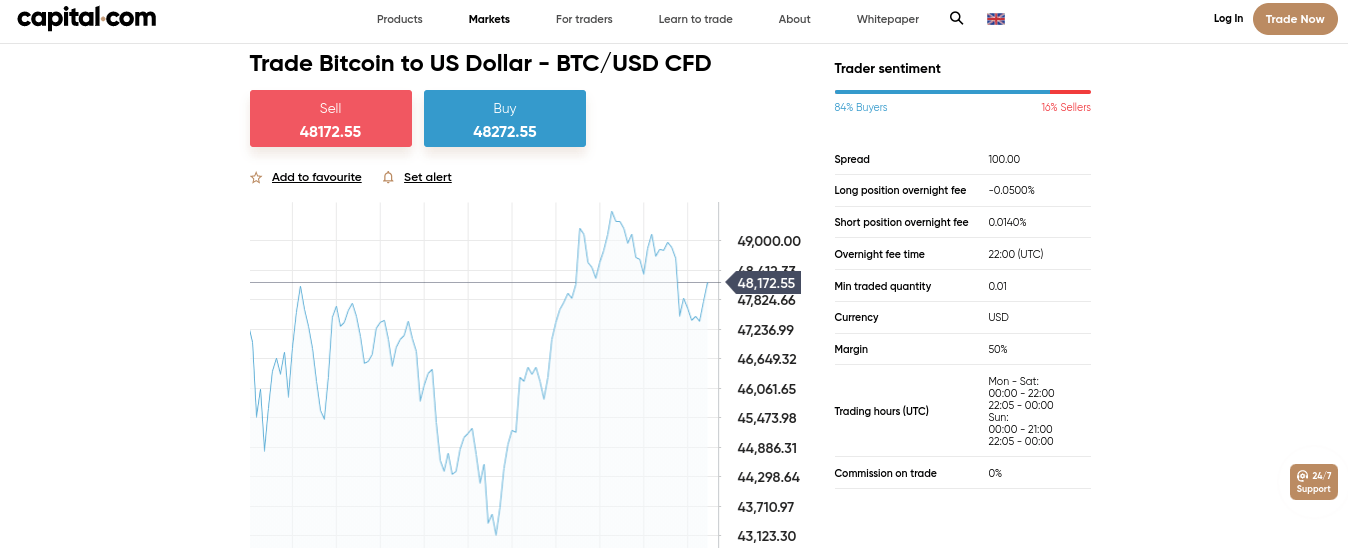

2. Capital.com – Trade Bitcoin CFDs With Leverage ($20 Minimum Deposit)

This Bitcoin Investment South Africa Guide noted earlier that you can also gain exposure to this industry via leveraged CFDs. This means that you will be trading the future price of Bitcoin without actually owning then coins. As such, you don’t need to concern yourself with private wallets or security threats.

With this in mind, the best online broker to trade Bitcoin CFDs is Capital.com. The platform is heavily regulated – with licenses issued by the FCA and CySEC. You can trade hundreds of cryptocurrency pairs – many of which contain Bitcoin. In fact, Capital.com even offers a pair on BTC/ZAR – meaning that you can trade the exchange rate between Bitcoin and the South African rand.

All markets on the Capital.com platform can be traded commission-free alongside tight spreads. The broker offers leverage too – so you can trade with more than you have in your account. If at some point in time you think that Bitcoin will decline in value, Capital.com permits short-selling. The minimum deposit at this top-rated trading site is just $20 – which you can facilitate with a debit/credit card or e-wallet. Capital.com also offers a demo account that allows you to trade Bitcoin risk-free.

Pros:

- Trade shares, index funds, ETFs, crypto, forex, commodities, and more

- Educational app for new traders

- AI assistant identifies your weak points

- Minimum deposit just $20

- Excellent charting and analysis interface

- No inactivity fees

- Thousands of UK and US shares

- 100% commission free trading

Cons:

- Cannot build custom trading strategies

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

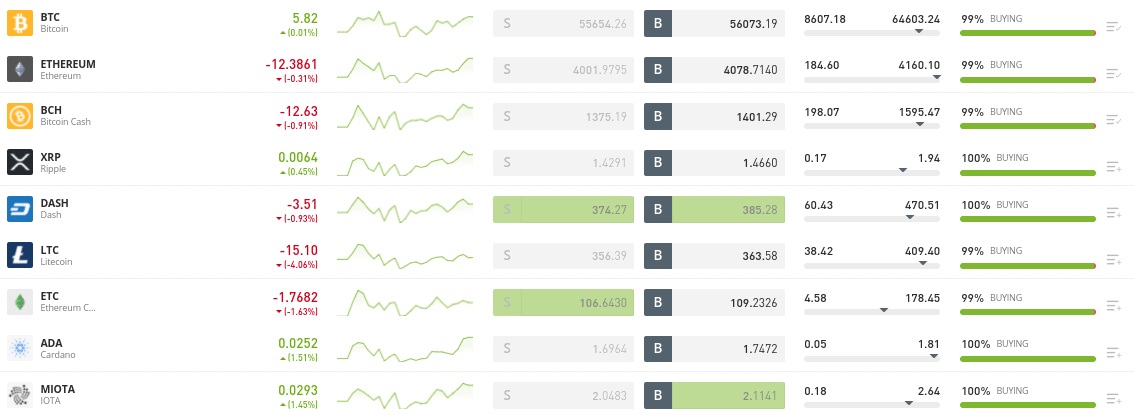

3. Binance – Largest Bitcoin Exchange for Trading Volume and Liquidity

If you’re looking for a traditional cryptocurrency exchange to invest in Bitcoin – Binance is another option to consider. The platform is home to billions of dollars worth of trading volume every day – so you will never struggle to purchase Bitcoin at competitive spreads alongside high levels of liquidity.

Binance charges a standard trading commission of just 0.1% per slide. This can be reduced further when you hit certain trading milestones throughout the month or by holding an allocation of BNB Coins. Many traders in South Africa will use Binance to buy Bitcoin by exchanging it with another digital coin. This prevents the need to provide any personal information upon opening an account.

If, however, you want to use Binance to buy Bitcoin with a credit card, then you will need to provide your personal information and upload a copy of your ID. You will be charged a flat fee of $10 to buy Bitcoin in this manner – which is about 150 rands. This is the case regardless of the size of your Bitcoin investment. Binance is also a good option if you wish to actively trade digital currencies – as the exchange is home to hundreds of fiat-to-crypto and crypto-to-crypto pairs.

Pros

- Largest cryptocurrency exchange in terms of trading volume

- Hundreds of cryptocurrency pairs supported

- Trading commission of just 0.1%

- Supports debit/credit cards and bank transfers

- Great reputation in the cryptocurrency scene

- Ideal for advanced traders that seek sophisticated tools and features

Cons

- Not great for newbie investors

- Bank deposits are slow

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

How to Invest in Bitcoin on eToro

This Bitcoin Investment South Africa Guide has covered everything there is to know about buying this popular digital currency. To conclude, we are going to walk you through the process of how to invest in Bitcoin South Africa at eToro.

In choosing this top-rated broker, you’ll be able to invest in BTC without paying a rand in commission. Plus, opening an account takes minutes and you can easily deposit funds with your debit/credit card and even Paypal.

Step 1. Open an Account with eToro – Pay 0% Commission on Bitcoin Investments

Visit the eToro website to open an account. You will need to provide your personal information and contact details – such as your name, home address, and telephone number.

You will also need to choose a username and a strong password. Once you have confirmed your email address and telephone number your eToro account is open.

Step 2. Upload ID

All regulated cryptocurrency brokers require you to upload a government-issued ID as part of a KYC process. At eToro, you can upload a copy of your passport, driver’s license, or national ID card. You will also need to upload a document issued within the past three months that verifies your address. This can be a utility bill or a bank account statement.

Step 3. Make a Deposit

You will now need to make a deposit into your eToro account.

You can choose from the following payment types:

- Debit Card

- Credit Card

- Paypal

- Neteller

- Skrill

- Bank Transfer

eToro accepts South Africa-issued payment cards and bank accounts, albeit, your deposit will be converted to US dollars. Although this comes with a small FX fee of 0.5% – you will be able to invest in Bitcoin without paying any commission.

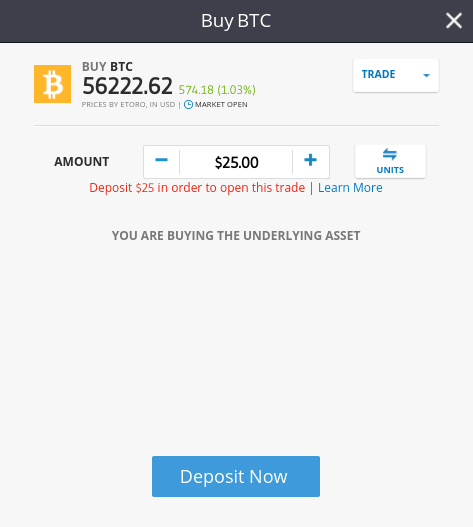

Step 4. Make a Bitcoin Investment South Africa

Now that you have added funds to your account, it’s time to complete your Bitcoin investment. Search for ‘BTC’ and then click on the ‘Trade’ button. An order box will then appear.

You now need to enter the amount that you wish to invest in Bitcoin (in USD). The minimum stake is just $25 at eToro. Finally, click on the ‘Open Trade’ button to complete your commission-free Bitcoin investment South Africa!

Conclusion – eToro – Best Broker to Invest in Bitcoin South Africa

This comprehensive guide has covered the ins and outs of how to invest in Bitcoin South Africa. We have also explored the many reasons why so many people in South Africa are investing in this digital currency and the many ways in which you can enter the market as a newbie.

If you’re wondering how to invest in Bitcoin in South Africa in the fastest and most cost-effective way – consider eToro. This heavily regulated platform allows you to invest in cryptocurrencies without paying any commission and at a minimum stake of just $25. You can open an account and complete the investment process in minutes by clicking on the link below!

67% of retail investor accounts lose money when trading CFDs with this provider.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

FAQs

Is Bitcoin a good investment?

Wondering is Bitcoin a good investment? If so, you'll likely know that this digital currency has increased in value by millions of percentage points since the project was launched in 2009. In the last year alone, Bitcoin has increased by over 1,100%. With that said, there is no guarantee that your Bitcoin investment will make you money - so do bear this in mind.

What are the Bitcoin investment sites?

If you're looking for the best Bitcoin investment sites, Capital.com and Binance are worth considering. However, we found that the overall best Bitcoin investment platform is eToro. You'll be able to invest in Bitcoin commission-free, the broker supports heaps of payment methods, and you will have the protection of three regulatory bodies.

How to invest in Bitcoin in South Africa?

If you're wondering how to invest in Bitcoin in South Africa, the process will take you no more than 10 minutes at eToro. Simply register an account, deposit some funds with a debit/credit card or Paypal, and enter the amount of Bitcoin that you wish to purchase.

How to invest in Bitcoin South Africa with Paypal?

Looking at how to invest in Bitcoin South Africa with Paypal? If so, eToro supports several e-wallets - including Paypal, Skrill, and Neteller.

How risky is Bitcoin investing?

Bitcoin investing - and all cryptocurrencies for that matter, is highly speculative. Crucially, both the potential rewards and risks are much higher than traditional assets like stocks and bonds. As such, ensure that you limit your Bitcoin investing stakes to modest amounts.

How do you sell Bitcoin in South Africa?

If you bought your Bitcoin from eToro, the coins will remain in your portfolio until you are ready to cash out. When you are, you can instantly sell your Bitcoin investment back to cash. Then, you can withdraw the funds back to your preferred payment method.

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane Pepi

More How to Buy Cryptocurrency South Africa – Beginner’s Guide GuidesView all

Latest News

Hvordan spille poker og Norgescsino

For tiden er det mange mennesker som ønsker å lære å spille poker og norgescsino. Dette er fordi spillene er veldig morsomme og folk kan få mye penger fra dem. Det er imidlertid et par ting du bør huske på når du skal lære å spille poker og norgescsino. Disse tingene inkluderer RNG, Cashback og...

Lär dig grunderna för kasinobordsspel

Om du har funderat på att prova på kasinot kanske du undrar vilka spel du ska spela. Bordsspel inkluderar Blackjack, Poker och Craps. Om du vill lära dig mer om dessa spel, läs vidare. Här är några grunder om dessa spel. Du kommer att kunna välja det bästa spelet att spela baserat på dina personliga...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

BuyShares.co.uk © 2025.

All Rights Reserved. UK Company No. 11705811.

eToro is a popular online broker that now facilitates over 20 million investor accounts. The platform is easy to use and thus – makes a great Bitcoin investment platform for newbies where you can

eToro is a popular online broker that now facilitates over 20 million investor accounts. The platform is easy to use and thus – makes a great Bitcoin investment platform for newbies where you can

This Bitcoin Investment South Africa Guide noted earlier that you can also gain exposure to this industry via leveraged CFDs. This means that you will be trading the future price of Bitcoin without actually owning then coins. As such, you don’t need to concern yourself with private wallets or security threats.

This Bitcoin Investment South Africa Guide noted earlier that you can also gain exposure to this industry via leveraged CFDs. This means that you will be trading the future price of Bitcoin without actually owning then coins. As such, you don’t need to concern yourself with private wallets or security threats.

If you’re looking for a traditional cryptocurrency exchange to invest in Bitcoin – Binance is another option to consider. The platform is home to billions of dollars worth of trading volume every day – so you will never struggle to purchase Bitcoin at competitive spreads alongside high levels of liquidity.

If you’re looking for a traditional cryptocurrency exchange to invest in Bitcoin – Binance is another option to consider. The platform is home to billions of dollars worth of trading volume every day – so you will never struggle to purchase Bitcoin at competitive spreads alongside high levels of liquidity.