How to Buy IOTA in South Africa – Beginner’s Guide

Cryptocurrencies are once again experiencing a massive bull market. Bitcoin led the way in late 2020 and again earlier this year. More recently it has been so-called altcoins that have been in the spotlight and trading at new record highs. One of the most interesting altcoins is IOTA, which is also known as MIOTA. In this guide, we will tell you all about IOTA, both the cryptocurrency and the network behind it. We also explain how to buy IOTA South Africa.

How to Buy IOTA South Africa – Step by Step Guide 2021

If you are wondering how to buy IOTA South Africa, you’ll be happy to hear that it’s actually very easy. Just follow these four steps and you’ll be invested in IOTA in less than 10 minutes.

1. Open an Account with Capital.com – We recommend Capital.com for trading all asset classes including cryptocurrencies. Head to the website, and click ‘Join Now,’ to create a new account using your email address.

2. Verify Your Account – Before you can deposit funds in your account and begin trading, you will need to verify your account and your identity. Simply follow the prompts and you will soon be ready to fund your account.

3. Deposit Fund – You will need to deposit to fund your trading account. You can do this by debit card, credit card, bank transfer, PayPal, Neteller, or Skrill.

4. Invest in IOTA – Search for ‘IOTA’ in the search bar at the top of the page and then click ‘Trade. You can then either enter the number of units you want to buy or the USD amount you want to invest. Then simply click the ‘Open Trade’ button and your order will be executed at the market price. Congratulations, you now own IOTA.

Where to Buy IOTA South Africa

If you are wondering where to buy IOTA, we have reviewed all the options and recommend the following two best cryptocurrency trading platforms in South Africa.

1. eToro – Best Platform to Buy IOTA Cryptocurrency

eToro is our favorite broker for South Africans wanting to buy cryptocurrencies and other asset classes. This is because eToro has a very wide range of instruments available on its platform and does not charge commission on trades.

eToro is our favorite broker for South Africans wanting to buy cryptocurrencies and other asset classes. This is because eToro has a very wide range of instruments available on its platform and does not charge commission on trades.

The zero-commission structure has made eToro one of the most popular trading platforms. Since it was founded in 2007, the broker has built up a loyal client base of over 20 million investors around the world.

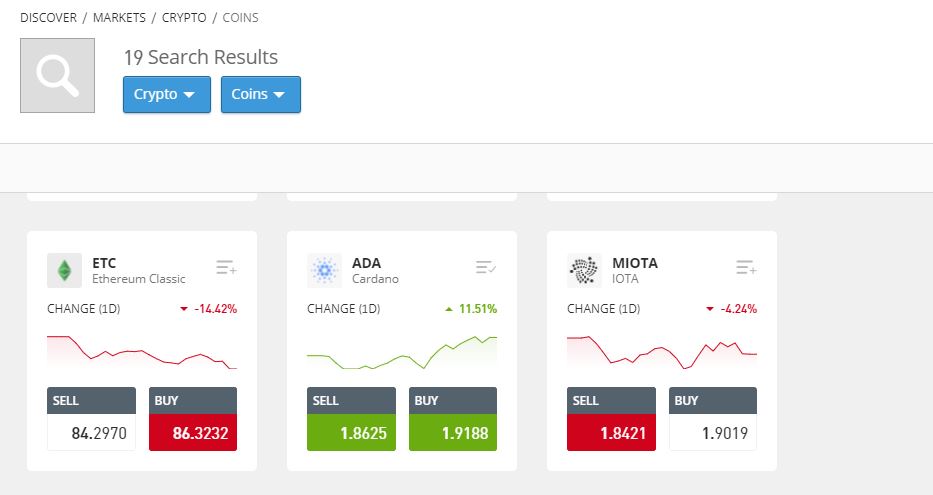

If you want to buy cryptocurrency, the platform currently lists 19 different coins. Besides IOTA, you’ll be able to buy Ethereum, Bitcoin, and all the other major altcoins. Besides cryptocurrencies, you can invest in around 2000 stocks, the major market indices, ETFs, currencies, and commodities.

eToro includes a built-in wallet for all your cryptocurrencies. One of the advantages of using a platform like eToro is that you can’t lose your private key as it’s easily recoverable from eToro.

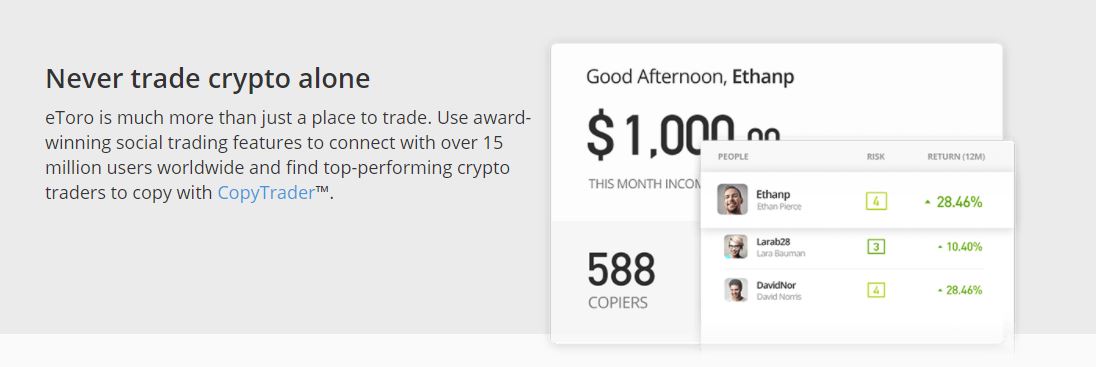

One of the reasons for eToro’s popularity is its copy trading feature. You can review the performance of experienced traders and then allocate any amount to copy the trades of traders you choose. There’s also a very active community of traders sharing ideas and research on the platform.

The minimum amount South African clients can deposit on the platform is $200, which is roughly ZAR R3000. You can easily fund your wallet eToro is regulated by the FCA in the UK and CySec in Cyprus.

Pros

- 19 different digital currencies on the platform.

- Zero commission and competitive spreads.

- Easy to recover your private key.

- Accepts debit/credit cards, e-wallets, and bank transfers.

- Copy-trading and social trading features.

- 24/5 customer phone support.

Cons

- Limited technical analysis functionality.

67% of retail investor accounts lose money when trading CFDs with this provider.

Cryptoassets are highly volatile unregulated investment products. No investor protection.

2. Capital.com – Low-Cost Ethereum CFD Broker in South Africa

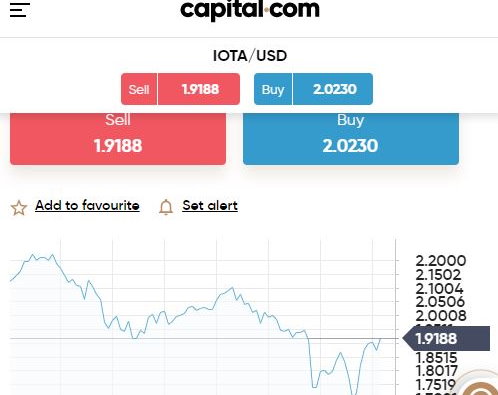

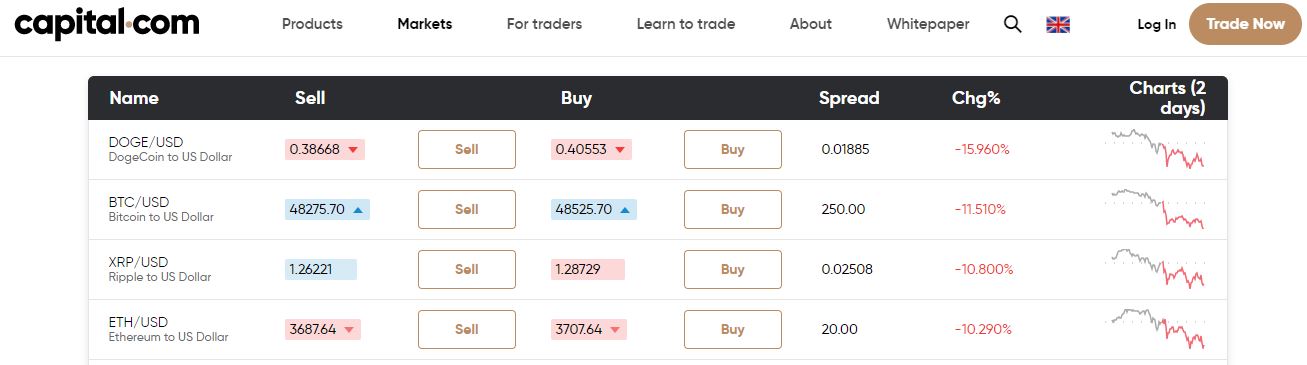

As far as digital currencies go, the platform offers as many as 2,000 different cryptocurrency pairs. You can also trade a lot of cryptocurrencies against different currencies and digital currencies including Euros, Rubles, and Bitcoin. This means you can select the currency you are effectively selling when you buy a crypto asset. You can also trade against Bitcoin if you think an altcoin is set to outperform it.

As mentioned, Capital.com is a CFD broker so all positions are held as contracts for difference. This means you can easily use leverage and short sell any asset without the hassle of borrowing it first. Another advantage of CFDs is that they eliminate the need for a crypto wallet and private keys.

Apart from cryptocurrencies, you can trade a very wide range of stocks, ETFs, currencies, commodities, and indices on the platform. Once again, you will own a CFD rather than the underlying instrument. The spreads and leverage available vary from market to market depending on volatility and liquidity.

The minimum deposit amount on the platform is just $20, or about R300 if you buy IOTA South Africa. So, you really don’t need a lot of capital to get started. Like eToro, Capital.com is regulated by both the FCA in the UK.

Pros

- Tight spreads on all products.

- Leverage of 1:2 available on crypto assets.

- Get started with just $20.

- Regulated by the FCA.

- MetaTrader 4 compatible.

- Great educational resources.

Cons

- Can’t buy underlying instruments.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

How to Buy IOTA South Africa - eToro Tutorial

If you are ready to buy IOTA South Africa this section will guide you through the process step by step. We will use eToro as an example as it is our favorite broker for anyone wanting to know where to buy IOTA. You should then have a very good idea of how to buy IOTA in South Africa. It will only take a few minutes to make your first investment in IOTA.

Step 1: Open an eToro Account

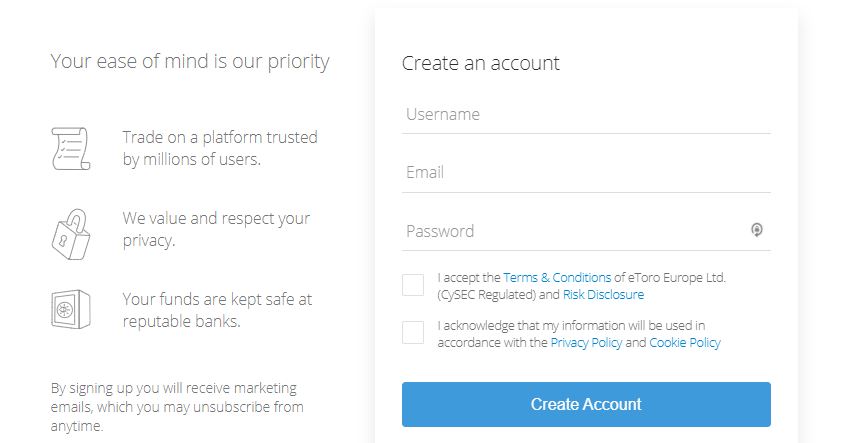

To get started, navigate to the eToro homepage and click on the ‘Sign Up’ button which you will find at the top right of the page.Enter your email address and choose a username and password. Once you have done this you will have a basic account, though there are a few more steps before you can begin trading.

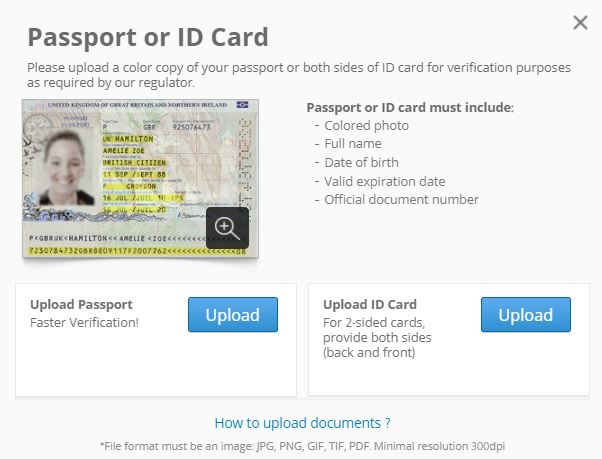

Step 2: Verify Your Account and your Identity

The next step requires you to enter some more information. You will then receive an email and an SMS to verify your email address and phone number. At this point, you can make a limited deposit and begin trading. However, you will need to verify your identity at a later stage or to deposit a higher amount.

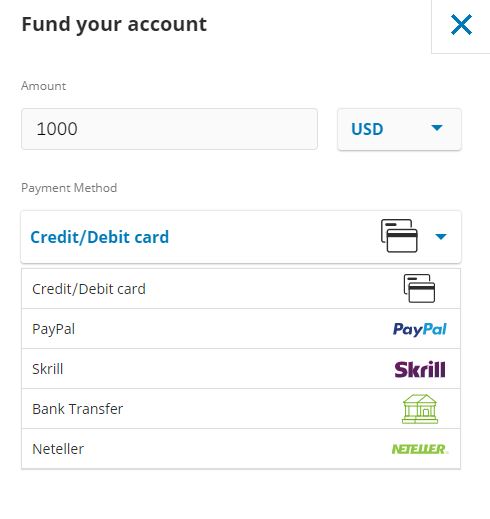

Step 3: Fund Your Account

The final step before you start trading is to fund your account. This is easy as eToro offers the following alternatives.

- Credit/Debit Card

- Bank Transfer

- Klarna/Sofort

- E-Wallets: PayPal, Skrill, Neteller

Funding your account with a credit card is usually the fastest. South African investors need to deposit $200 (around ZAR 3000) to trade on the eToro platform.

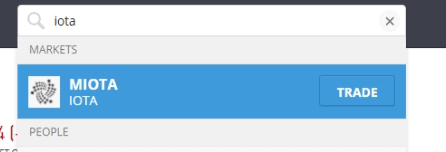

Step 4: Find IOTA on the Platform

There are two ways to find the digital currency you want to invest in. You can navigate to IOTA by clicking on the ‘Trade Markets’ tab on the left, then on ‘Crypto’ at the top of the page, and then scrolling through the various cryptocurrencies. Or you can simply type IOTA into the search bar at the top.

If you click on 'Trade', you will be taken to a page with the current price, a chart, and research.

Step 5: Buy IOTA

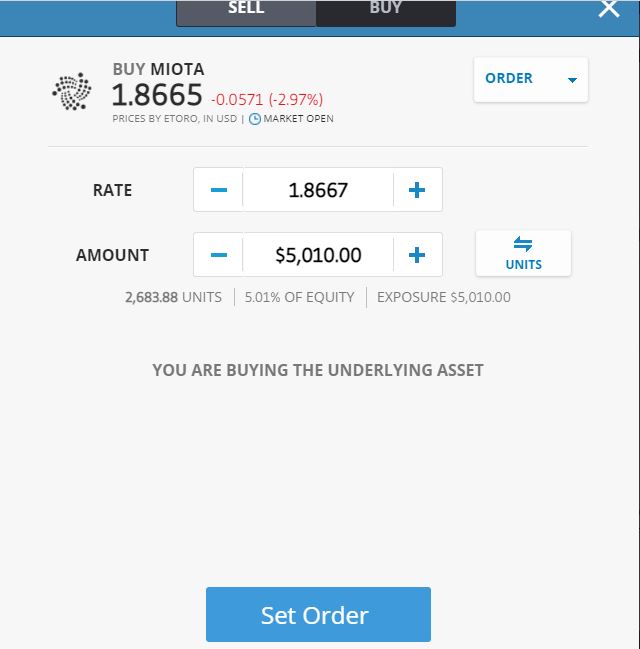

Once you are on the IOTA page, click ‘Trade’ to open an order entry ticket. You can trade immediately at the current price by selecting ‘Trade’, or you can enter an order with a limit by selecting ‘Order.’

Once you have selected the amount you want to invest and a limit price, if applicable’ you can click ‘Set Order’ or ‘Open Trade’ to send the order to the market.

What is IOTA?

IOTA is both a distributed ledger, or blockchain and a cryptocurrency and is specifically designed to facilitate payments between devices.

The internet of things, or IoT, refers to devices that communicate with one another over the internet. These ‘devices’ range from smartphones to autonomous vehicles and machines, medical devices, and household appliances. As these machines gather data, they can exchange that data with other machines. Facilitating payments between these devices and machines incentivizes cooperation and data sharing.

The network is not just a means of facilitating machine to machine payments, but a means of facilitating the development of technology for the internet of things. The network is open source so that developers can use it to build solutions within the industry.

The History of IOTA

The IOTA project began in 2015 with four developers joining forces to build a protocol to power the internet of things. At that stage, the concept of a machine-to-machine economy was very new, but it was not unheard of.

The project was funded with a crowd sale in 2015, which raised $500,000 worth of various cryptocurrencies. At the time there was no allocation to the founders or for a development fund. The participants in the crowd sale ended up donating IOTA back to the project to ensure there was a budget for development. Numerous projects in several industries are now in development on the IOTA network.

IOTA cryptocurrency

The IOTA cryptocurrency is a utility token that facilitates the flow of information on the IOTA network. IOTA is actually the smallest available unit, and the total supply of IOTA is 2,779,530,283,277,761. In practice, when you trade IOTA, you are trading MIOTA which is equal to 1,000,000 IOTA. This sometimes creates confusion, but if you trade on an exchange or with a broker you will only be trading MIOTA. When a price is quoted for IOTA it is actually the price for MIOTA.

IOTA’s Ledger – The Tangle

Before we describe IOTA’s ledger, it’s worth describing the blockchains typically used to record cryptocurrency transactions. A blockchain is a type of distributed ledger on which transactions are securely recorded. Transactions are added to the blockchain in blocks by miners. The blockchain also acts as a record of how many digital coins are held by each wallet. Miners are rewarded for updating the ledger with newly minted coins.

Most, but not all cryptocurrencies are recorded on blockchains. If for example, you buy Bitcoin, the transaction will be recorded on a blockchain.

Transactions on the IOTA network are recorded on a slightly different type of ledger which is called ‘The Tangle’. This ledger has no blocks, chains, or miners. Instead, the Tangle is based on a concept known as a directed acyclic graph or DAG. This sounds very complicated, but really it is just a collection of nodes that can only be connected in one direction and the connections can never form a loop.

In the case of the Tangle, the nodes are transactions between network participants. Every time a node adds a new transaction to the network, it must first approve two other transactions.

IOTA Mining

When the project was initially launched, the entire token supply was issued to crowd sale participants. This means no new coins are created and there is no mining of IOTA.

Because transactions are essentially approved by network participants, there is no need for miners to add new transactions. This concept means there are also no transaction fees, and the network is free to use. This aspect of the system is essential to facilitating micropayments which are often smaller than the fees charged on other networks.

Why Buy IOTA? IOTA Analysis

IOTA is a currency for a new machine-to-machine economy that is now in its infancy. There are two reasons to buy IOTA. The first is if you see increased demand for IOTA or for cryptocurrencies in general. This would apply to the short to medium term.

The reason a long-term investor would buy IOTA is based on the fact that IOTA is the leading network being developed for the internet of things. Every year, millions of new devices are being connected to the internet. These devices gather data and user data. There is a very strong argument to be made for creating an economy where devices communicate with one another and buy and sell data.

Without a monetary economy, there is little incentive to allow devices to share data. When micropayments are introduced, the cost associated with sharing data can be covered, or used to pay for the running costs of such a device.

IOTA Use Cases

IOTA is the only project setting out to create a single network that can be used by all devices and across all industries. To understand the potential, we can look at a few of IOTA’s use cases.

The network can be used to manage supply chains and improve their efficiency. Scanners that are connected to the network can collect data on the location of any product and transmit the data to the rest of the network.

The IOTA network can be used to manage an electric vehicle charging network. The network can be used to buy and sell electricity by any device, building, or machine that generates, uses, or stores electricity.

IOTA can also be used to safely and securely transmit medical devices. Devices that collect medical data, hospitals, care providers, laboratories, and patients can all use the network to transmit data and control who can and can’t access it.

Taiwan’s capital city Taipei is working on a project to use the IOTA network to create a smart city. One way in which the network may be used involves distributing information on air pollution from sensors. Traffic data can also be shared between traffic lights, vehicles, and authorities to better manage the flow of traffic around a city.

IOTA Price

Although IOTA’s tokens were released in 2016, the IOTA cryptocurrency only began trading on exchanges in the middle of 2017. The first trades were at about $0.38 and there was a fair amount of volatility. The really big move began in November 2017 shortly after Bitcoin crossed the $5,000 level. IOTA, or MIOTA to be precise, rose to an all-time high of $5.36 on 19th December 2017.

After that, the price fell all the way back to $1.03 in April 2018. This was in line with the rest of the cryptocurrency market as most digital currencies followed Bitcoin lower. There was a brief rally to $ 2.50 in the middle of 2018, after which IOTA drifted lower for two years.

It reached its lowest level of $0.13 in March 2020 when global markets crashed. A new rally began in February this year, a few months after Bitcoin began to trade at new all-time highs. The peak of this really was $2.53 in the middle of April. Since the IOTA has traded in a wide range between $1.60 and $2.26.

IOTA Price Prediction

Most people who have been able to make money with Bitcoin and altcoins have done so by simply holding for the long term. However, you can also trade cryptocurrencies actively.

The crypto market is driven by sentiment and so it’s difficult to make predictions. IOTA is currently rangebound, but a breakout above $2.26 would initially target the recent high at $2.53. If it can break that level, the only obvious target would be the all-time high at $5.36.

Whether or not IOTA gets back to $5.36, or higher, depends on two things. If the crypto market as a whole manages to attract new investors, most of the major altcoins will probably trade higher. Typically, the altcoins follow Bitcoin, so if Bitcoin makes a new high, there’s a good chance coins like IOTA will too. Alternatively, if the IOTA network itself shows signs of progress, investors are likely to see more value in IOTA.

eToro - Best Broker to Buy IOTA South Africa

In this post we have given you an overview of the IOTA network and the cryptocurrency that powers it. We have also given you an idea of where to buy IOTA and how to buy IOTA South Africa.

If you are ready to invest in IOTA, eToro is our recommended choice of broker. You’ll be able to invest without paying commissions and eToro’s social trading features are a great way to learn more about the cryptocurrency market.

67% of retail investor accounts lose money when trading CFDs with this provider.

Cryptoassets are highly volatile unregulated investment products. No investor protection.

FAQ

What is IOTA Cryptocurrency?

IOTA is the cryptocurrency that powers the IOTA network. IOTA is the smallest unit of the network’s currency and there are 2.7 quadrillion IOTA in circulation. When you trade the currency, you are actually trading MIOTA, with each MIOTA being one million IOTA. IOTA are used make micropayments on the IOTA network. Because the network enables the machine-to-machine economy, payments in IOTA or MIOTA are made between devices.

Where Can I Buy IOTA Cryptocurrency?

If you want to buy cryptocurrency South Africa, we recommend eToro as the platform doesn’t charge commission and offers one of the largest ranges of instruments around.

What Does IOTA Stand for?

IOTA is not actually an abbreviation but simple a name. However, it is probably a play on words, combining IoT which means Internet of Things, and one meaning of the word IOTA, which is ‘an infinitesimal amount’. MIOTA stands for one million IOTA.

How to Sell IOTA?

You can sell IOTA on the eToro platform by navigating to your position on the portfolio page and clicking the red X. You will then be taken to a page where you can click on ‘Close Trade.’

How to Mine IOTA?

IOTA is not actually mined like Bitcoin and Ethereum are. When The IOTA project was launched, the entire token supply was immediately issued to participants in the crowd sale. There is no need to mine IOTA because transactions are verified by network participants when new transactions are added to the network. Before a node adds a new transaction to the network, it verifies another two transactions. This means there are no fees and no need to pay miners by issuing new tokens.