Best ETF South Africa – Compare Top ETFs for 2022

ETFs (exchange-traded funds) offer a seamless way to invest in whole market sectors in a single trade. These funds typically contain dozens or hundreds of different stocks, so you can invest broadly across, say, the tech industry or the South African stock market.Finding the best ETF South Africa to add to your portfolio can be a challenge since there are so many options available.

That’s why we’ve put together a list of the 10 best ETFs to invest in for 2022 in South Africa.

Best Performing ETF in South Africa for 2022

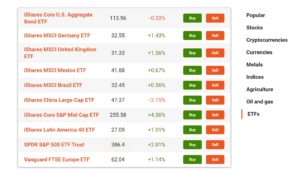

Looking for the best ETF South Africa? Check out these top 10 funds that span South Africa, the US, and beyond.

- iShares MSCI South Africa ETF – Best ETF to Invest in South Africa – Invest Now

- Vanguard S&P 500 ETF – Best for Investing in the US Stock Market – Invest Now

- SPDR S&P China ETF – Invest in China’s Growing Market – Invest Now

- Lyxor Pan Africa UCITS ETF – Best ETF to Invest in African Stocks

- iShares Russell 2000 ETF – Best ETF for Small-cap US Stocks

- Vanguard Real Estate ETF – Best REIT for South African Investors

- VanEck Vectors Africa ETF – Best ETF to Invest in the African Stock Exchange

- SPDR S&P Metals & Mining ETF – Invest in South Africa’s Mining Industry

- Renaissance IPO ETF – Best ETF for Investing in Hot IPOs

- ARK Innovation ETF – Top Performing ETF

Best ETFs South Africa Reviewed

Let’s take a closer look at each of the 10 best performing ETFs in South Africa. But before we do that, have you ever wondered what the best ETF app can offer? ETF apps let you buy and sell exchange-traded funds, manage your portfolio, and fund your account, all via your mobile device.

1. iShares MSCI South Africa ETF – Best ETF South Africa

Many South African investors simply want a simple way to invest in the South African stock market. The iShares MSCI South Africa ETF (EZA) helps you do exactly that. This fund contains 37 of the top stocks on the Johannesburg Stock Exchange, including Firstrand, Impala Platinum, MTN Group, and more.

The South Africa ETF has lagged the global market over the past year, in large part because South Africa has been relatively slow to recover from the COVID-19 pandemic. The fund lost 4.7% last year, and has only returned 8.5% since inception since South African shares have lost more than they’ve gained in recent years.

Don’t expect EZA to take off right away. It’s cheap right now, but that’s because the South African variant of the coronavirus has proven somewhat resistant to vaccines. That could keep the country’s economy hurting longer, and this ETF’s price will reflect the slower pace of growth.

75.26% of retail investor accounts lose money when trading CFDs with this provider.

2. Vanguard S&P 500 ETF – Best for Investing in the US Stock Market

The Vanguard S&P 500 ETF (VOO) is one of the most popular ETFs in the world, with a staggering 195 billion USD in assets under management. This fund tracks the US S&P 500 index and it contains 509 of the largest companies in the world.

The S&P 500 was one of the big success stories of last year, as the index – and VOO – gained over 31% despite the market crash in March. Analysts are generally very bullish on the US stock market in 2022, so the S&P 500 could notch another year of big gains.

Another thing working in this ETFs favor is that since it is so big, it has a gravity of its own. As new investors get into the market, VOO is often the first thing they invest in. That means that the S&P 500 itself can more easily weather a market storm – so this is a fund to consider buying and holding for a lifetime.

75.26% of retail investor accounts lose money when trading CFDs with this provider.

3. SPDR S&P China ETF – Invest in China’s Growing Market

China was another big winner of the COVID-19 pandemic. Although the country suffered badly in the earliest days of the pandemic, China’s manufacturing and technology sectors recovered quickly.

In fact, China was one of the only countries in the world to see strong GDP growth last year. The SPDR S&P China ETF (GXC) reflects that – the fund grew by 42% last year. This fund invests in nearly 2,000 of China’s biggest companies, so it’s a great way to invest in the world’s second-largest economy without navigating the complexities of the Shanghai Stock Exchange.

GXC has an average price-to-earnings (P/E) ratio of 17.7, so this fund is more expensive than most other passive index funds you’ll find. Still, given China’s potential growth, the fund could have plenty of room to outperform the rest of the global market. The expense ratio of 0.59% is also quite inexpensive.

75.26% of retail investor accounts lose money when trading CFDs with this provider.

4. Lyxor Pan Africa UCITS ETF – Best ETF to Invest in African Stocks

The best ETF in South Africa might be one that invests not just in South Africa, but also its neighbors to the north. The Lyxor Pan Africa UCITS ETF (PAF) invests in the 30 largest stocks in Africa, including shares from the JSE, Egypt, Nigeria, and more.

PAF suffered badly when the market crashed last March and global trade seized up, but it has since recovered strongly from the COVID-induced lows. The fund lost 2.65% last year, but is up nearly 8% over the past 5 years.

More important, this fund could take off in the years ahead. Foreign investments in Africa are ramping up as the continent modernizes, and a booming population is widely expected to bring countries like Nigeria onto the global economic stage.

PAF is passively managed and has an expense ratio of just 0.85%. Beware that the fund trades with low volume, so you could encounter high spreads when trying to open or close your position.

75.26% of retail investor accounts lose money when trading CFDs with this provider.

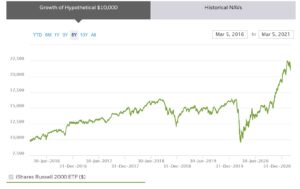

5. iShares Russell 2000 ETF – Best ETF for Small-cap US Stocks

While the biggest names in the US stock market grab a lot of investors’ attention, there’s much more to the US market than just Amazon, Facebook, and Apple. The iShares Russell 2000 ETF (IWM) attempts to mirror the growth of the Russell 2000 index, which tracks thousands of small- and mid-cap stocks that are all too often overlooked.

This ETF can be much more volatile than other US index funds. It fell more sharply during the coronavirus market crash – but it also rebounded more strongly. Last year alone, the fund returned a whopping 19.9%, and the gain from March onward was closer to 40%.

IWM has a very cheap expense ratio of just 0.19%. For the price, it’s one of the best performing ETFs for South Africa investors to explore.

75.26% of retail investor accounts lose money when trading CFDs with this provider.

6. Vanguard Real Estate ETF – Best REIT for South African Investors

The Vanguard Real Estate ETF (VNQ) is potentially one of the best ETFs South Africa for investors in search of a bargain. It invests in over 100 different REITs and real estate companies, spanning residential, commercial, healthcare, and industrial real estate.

This fund dropped precipitously when office buildings emptied out in March and businesses closed. While it has largely recovered, the fund is still feeling the effects of a new pandemic normal in which commercial buildings are no longer at the center of peoples’ lives. The fund is currently trading at a discount relative to the individual stocks and REITs it contains, too.

VNQ charges an expense ratio of just 0.12%, which is incredibly low even for a passively managed fund. The ETF pays out a quarterly distribution of around 1.6%, which you can reinvest in the fund or use as operating cash flow for your investment accounts.

75.26% of retail investor accounts lose money when trading CFDs with this provider.

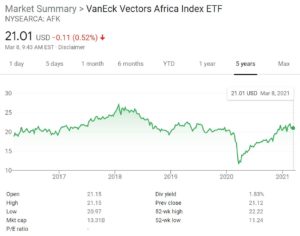

7. VanEck Vectors Africa ETF – Best ETF to Invest in the African Stock Exchange

The VanEck Vectors Africa ETF (AFK) is another pan-African fund with a slightly wider reach than the Lyxor Pan Africa UCITS ETF. AFK invests not only in companies based in Africa, but in a number of mining and financial companies that generate at least half their revenue in Africa. In total, AFK has a portfolio of 74 stocks.

Thanks to that international exposure, this fund has drastically outperformed the Johannesburg Stock Exchange along with most South African companies. It returned 25.4% in 2020 and jumped up more than 4% in 2021. The fund has an expense ratio of 0.86% before dividend distributions.

Another reason we think this is one of the best ETFs to invest in in South Africa is that it’s much easier than other Africa-related funds to move into and out of. AFK trades on the NYSE ARCA exchange and has a daily volume of over 500,000 USD. So, spreads are typically tight and you aren’t likely to run into issues trying to quickly trade this ETF.

75.26% of retail investor accounts lose money when trading CFDs with this provider.

8. SPDR S&P Metals & Mining ETF – Invest in South Africa’s Mining Industry

While not explicitly an ETF focused on South African companies, the SPDR S&P Metals & Mining ETF (XME) has a fair amount of exposure to South Africa’s mining industry. The fund invests in stocks related to steel manufacturing in the US, gold mining in Africa, and mining for rare earth elements like lithium in China.

As demand for semiconductors and other precious metals skyrocketed last year, so too did XME’s price. The fund shot up 64%, despite losing 5% over the prior 10 years.

While the fund’s long-term performance is disappointing, it could be hard to put the genie back in the bottle when it comes to demand for metals. Electric cars, cryptocurrency mining, and renewable energy technology all demand huge volumes of metals, which should continue pushing up the prices of the companies that mine them. So, look for XME to be one of the best ETFs South Africa for long-term growth.

75.26% of retail investor accounts lose money when trading CFDs with this provider.

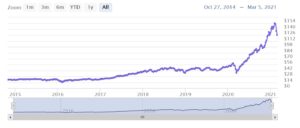

9. Renaissance IPO ETF – Best ETF for Investing in Hot IPOs

The Renaissance IPO ETF (IPO) is an exciting and unique fund for South African investors who have a strong tolerance for risk. The fund invests in new IPOs in the US stock market and holds them for up to 2 years after they go public. The idea is to capture the initial upside that many companies have experienced shortly after launching on the NYSE or NASDAQ stock exchanges.

The fund has performed extremely well over the past year, which isn’t surprising to any investors who have watched the red hot IPO market. It gained 112% in 2020, and could be on track for another big year with companies like Instacart, Rivian, Robinhood, and Coinbase expected to go public this year.

IPO has an expense ratio of just 0.60%, which is surprisingly low given that the fund managers have to research each IPO and decide what to invest in. The fund is updated once per quarter, so it can occasionally lag behind changes in the market for a few months.

75.26% of retail investor accounts lose money when trading CFDs with this provider.

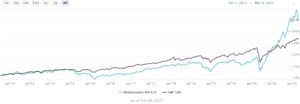

10. ARK Innovation ETF – Top Performing ETF of 2022

The ARK Innovation ETF (ARKK) was one of the best performing ETFs in South Africa last year. This fund, launched by guru investor Cathie Wood, returned over 146% for investors in 2020. It’s been hit hard by the recent pullback in the US market, so now could be the perfect time to get in at a discount.

The fund is actively managed and seeks out young public companies with innovative business models and aggressive plans for growth. Names currently in the portfolio include Tesla, Square, Teladoc, Zillow, and Shopify. The portfolio also includes some lesser-known companies operating in the fields of genetics, AI, and renewable energy.

ARKK typically has between 35 and 55 holdings, although the number and relative weights can vary from week to week. The fund has an expense ratio of 0.75%, which is moderately pricey but very reasonable given its exceptional performance.

75.26% of retail investor accounts lose money when trading CFDs with this provider.

How to Choose the Best ETFs to Invest In

With thousands of ETFs to choose from, how do you decide which one is the best performing ETF South Africa for your portfolio? There are several factors to consider when choosing the best ETF to invest in 2022 in South Africa.

Passively vs. Actively Managed ETFs

First, it’s important to understand the difference between passively managed and actively managed ETFs.

Passively managed ETFs are designed to track a market index, such as the S&P 500 or the Johannesburg Stock Exchange All Share Index. These funds typically contain the same stocks as the index and the holdings don’t change very frequently. Passively managed funds tend to have low expense ratios since they require relatively little oversight from fund managers.

Actively managed ETFs, on the other hand, are portfolios in which the fund manager makes investing decisions on a daily, weekly, monthly, or quarterly basis. The fund manager conducts research to determine what stocks to add and remove from the fund, and sets price targets for each holding. Actively managed funds typically follow an investment theme and have higher expense ratios.

Investment Exposure

One of the most important decisions you’ll need to make when choosing an ETF is what types of assets you want exposure to. For example, you can choose between investing in an ETF with exposure to the South African stock market or one with exposure to the US stock market. You can also choose between a fund that invests in stocks and one that invests in real estate or bonds.

When considering your exposure, think about what’s already in your portfolio and how diversified the fund itself is. A fund that invests in a niche market sector may offer better returns than a total-market ETF, but it also leaves you at higher risk if that sector experiences a downturn.

You can potentially balance exposure and risk by investing in multiple ETFs. Look for funds that have very few holdings in common and that invest in not just different market sectors, but also different countries or even different asset classes.

Performance

Performance is, of course, a major consideration when choosing an ETF. For passively managed ETFs, fund performance is typically tied to the performance of the underlying index. For actively managed ETFs, fund performance is much more dependent on the investing theme and fund manager’s decisions.

Look at how an ETF has performed not just over the past year, but also over the last 5 or 10 years. If the performance is highly variable, think about why that is the case and consider whether market conditions over the coming year are likely to be hospitable for the fund’s current holdings.

You can also look at a fund’s P/E ratio, which is a weighted average of the P/E ratios of all holdings. This offers a sense of whether a fund is relatively expensive from a fundamental perspective – and pricing in aggressive growth – or whether it is cheap and potentially undervalued.

Expense Ratio

The expense ratio of an ETF is its annual management fee. The expense ratio is typically given as a percentage, and is less than 1% for many of the best ETFs in South Africa. If an ETF you’re interested in has an expense ratio higher than 1%, see if you can find a similar fund that charges less money.

Types of ETFs

Here is a list of the most popular ETFs to invest in right now in South Africa:

Best South Africa ETF Investment Platforms 2022

In order to buy shares of an ETF in South Africa, you’ll need a high-quality investment platform or ETF app. There are many to choose from, but not all offer a wide range of ETFs and some charge expensive trading fees.

To help you invest in ETFs, let’s review two of the best South Africa ETF investment platforms for 2022.

1. Capital.com – Overall Best ETF Investment Platform in South Africa

Capital.com is our #1-rated broker to invest in ETFs in South Africa. This CFD broker offers trading on more than 3,000 shares and over 85 ETFs, and you can trade individual shares and funds with leverage up to 5:1. There’s no commission to buy or sell ETFs with Capital.com and the broker has no deposit, withdrawal, or inactivity fees.

Another thing we love about Capital.com is that it’s extremely beginner-friendly. The trading platform includes dozens of educational videos and guides to help you learn the basics of ETF trading and investing. In addition, Capital.com has a dedicated mobile app to help you test your knowledge about the market. You can even try out a demo account to try out trading ETFs risk-free.

Capital.com’s custom trading platform is available for the web and as a mobile app for iOS and Android devices. It’s not the most in-depth platform we’ve found for technical analysis, but it’s perfect for ETF trading because it’s so easy to use. You get access to a variety of order types, plus a news feed and economic calendar to help guide your investments.

The platform also uses AI to help you trade better. The software automatically recognizes patterns in your trading and suggests improvements that can boost your win rate.

Capital.com is regulated by the UK Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). This ETF broker offers 24/7 customer support by phone, email, and live chat. Best of all, you can open a new account with just $20!

Pros:

- Can only trade ETFs as CFDs

- Limited technical analysis tools

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider

2. Libertex – Best ETF Trading Platform with Zero Spreads

Users get to trade against the popular iShares ETF offering alongside SDPR S&P 500 and Vanguard. Offering ETFs as CFDs, Libertex leverages up to 1:30 for retail investors and 1:600 for professional investors. This means you get to trade the price differences of an ETF without worrying about the value of the underlying asset.

In terms of fees, Libertex is one of the best in this department. There are no deposit fees, and withdrawal fees largely depend on the user’s chosen payout method. The minimum deposit is also low as you can start with as little as €10 or $10, depending on your location. Libertex also operates on multiple devices spanning web, Android, iOS, and Windows. Aside from this, Libertex is regulated by tier-1 body the Cyprus Securities and Exchange Commission (CySEC).

Pros:

- Inactivity fee of €5 after 90 days

75.3% of retail investor accounts lose money when trading CFDs with this provider.

3. AvaTrade – Best ETF Trading Platform in South Africa

If you’re more interested in actively trading ETFs for a profit than in long-term investing, AvaTrade is one of the best platforms available in South Africa. This CFD broker has a relatively narrow selection of just 41 funds, but it includes ETFs for the US, China, Europe, and emerging markets in South America.

AvaTrade only offers ETFs as CFDs, with leverage available up to 20:1. You cannot invest in ETFs outright, and it’s important to keep in mind that CFDs carry additional fees when you buy on margin.

This broker has a very attractive fee structure. You can trade ETFs 100% commission-free, and spreads start at just 0.13% of your trade value. In addition, AvaTrade has a minimum deposit of only $100. You can fund your account using a credit card, debit card, bank transfer, or e-wallet like Neteller or Skrill.

AvaTrade has a couple different trading platforms to choose from, including its own proprietary software as well as MetaTrader 4 and 5. We found AvaTrade’s platform to be easy to use and quite in-depth for technical analysis. However, more advanced traders may prefer the MetaTrader platforms because they offer strategy backtesting, trading signals, and fully custom indicators.

AvaTrade is regulated in a number of countries, including South Africa, Ireland, Japan, and Australia. If you need help with your account at any point, support is available 24/5 by phone, email, and live chat.

Pros:

- Only 41 ETFs to choose from

Your capital is at risk.

How to Buy the Best ETFs South Africa

Ready to start investing in the best performing ETFs in South Africa? We’ll show you how to buy ETFs using Libertex, which offers over 85 funds and 0% commission trading.

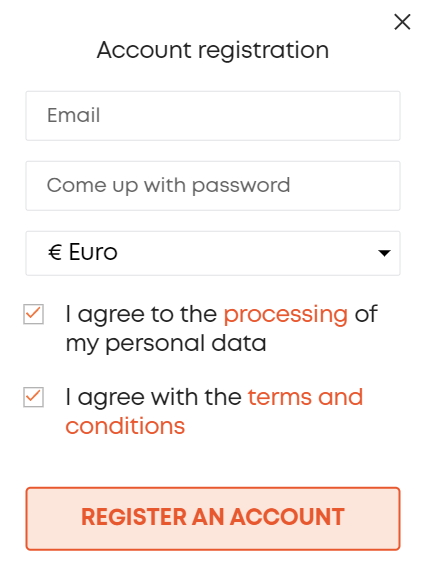

Step 1: Create a Libertex Account

Head to the Libertex website to create a new account. Click ‘Trade Now’ and register with your email.

Libertex is regulated by the UK’s Financial Conduct Authority, which enforces Know Your Customer (KYC) rules. So, you must verify your identity before you can buy and sell ETFs. Simply upload a copy of your driver’s license or passport and a copy of a recent utility bill or financial statement.

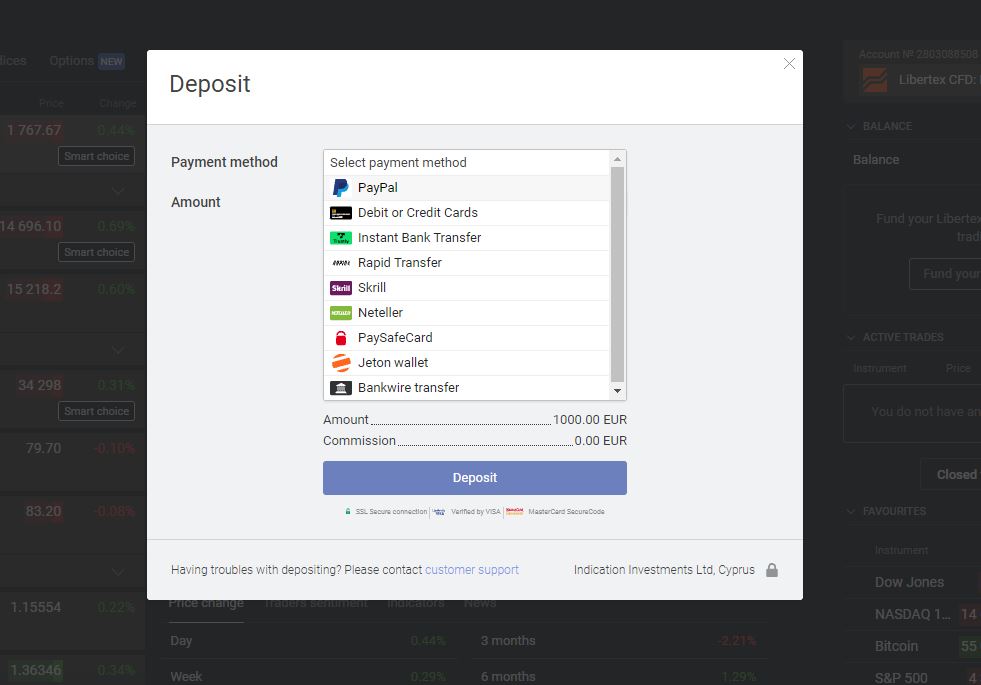

Step 2: Fund Your Account

Next, you can fund your new trading account. Libertex requires a minimum deposit of just 10 EUR. You can pay by bank transfer, credit card, or debit card.

Step 3: Buy Your First ETF

Now you’re ready to buy ETFs using Libertex. Head to your account dashboard and search for the name or ticker symbol of the ETF you want to invest in. When it appears in the drop-down menu, click on it and then click ‘Buy’ to open a new order form.

Choose how much money you want to invest in the ETF. When you’re ready, click ‘Buy’ to buy your first ETF in South Africa.

Libertex – Best ETF Investment Platform in South Africa with 0% Commission

ETFs enable you to create a diversified portfolio with just a few investments. While it can be a challenge to find the best performing ETF South Africa when there are so many choices, our list of the top 10 best ETFs for 2022 can help you start investing today.

Ready to buy ETFs in South Africa? Click the link below to get started with Libertex!

75.3% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

What is an ETF’s expense ratio?

Are there ETFs that track the Johannesburg Stock Exchange?

What if my brokerage doesn’t carry a specific ETF?

How much money do I need to invest in ETFs?

Latest News

Hvordan spille poker og Norgescsino

For tiden er det mange mennesker som ønsker å lære å spille poker og norgescsino. Dette er fordi spillene er veldig morsomme og folk kan få mye penger fra dem. Det er imidlertid et par ting du bør huske på når du skal lære å spille poker og norgescsino. Disse tingene inkluderer RNG, Cashback og...

Lär dig grunderna för kasinobordsspel

Om du har funderat på att prova på kasinot kanske du undrar vilka spel du ska spela. Bordsspel inkluderar Blackjack, Poker och Craps. Om du vill lära dig mer om dessa spel, läs vidare. Här är några grunder om dessa spel. Du kommer att kunna välja det bästa spelet att spela baserat på dina personliga...