Best Forex Brokers in South Africa 2021 Revealed

Looking to buy and sell currencies in South Africa? You’ll need the right forex broker for the job if you want to be successful.

Your forex broker impacts everything from what currency pairs you can trade to how much forex trading will cost you. Plus, your broker is your best source of trading and research tools. There are a ton of brokers available in South Africa, but they vary in quality to a surprising degree.

In this guide, we’ll review the best forex brokers in South Africa for 2021 to make choosing the right one for you easier. In addition, we’ll cover everything you need to know about forex trading fees and what to look for when picking a currency broker.

The Best South African Forex Brokers

Residents of South Africa have a huge range of options when it comes to choosing a forex broker. But with so many options on the market – and not all of them good – it can be hard to pick the right one for you.

To make the choice easier, let’s take a look at the best forex brokers in South Africa for 2021. Whether you’re looking for the best forex brokers for beginners or the best advanced trading platforms, you’re sure to find it in our top forex brokers list.

Note: Since the forex market is global, most accounts are held in US dollars and most fees are priced in US dollars. For this reason, we have quoted US dollars below.

1. eToro – Overall Best South Africa Forex Broker

Better yet, eToro is fully commission-free. You only pay the spread when trading forex on this platform, and spreads for most currencies are quite low. The spread for the USD/ZAR pair is around 0.31%.

This broker does charge some deposit and withdrawal fees, including a currency conversion fee if you deposit rand into your account. But, on the whole, the fees are lower than many other forex brokers in South Africa. Note that the minimum deposit for eToro is $200.

eToro also stands out for its trading platform. The broker has a built-in social trading network through which you can interact with other traders and gauge sentiment around top currencies. You can also take advantage of eToro’s copy trading tools to mimic the positions of more experienced forex traders.

This broker is strictly regulated, so you can trade forex in confidence on eToro.it’s also great if you want to invest in other assets and diversify your portfolio, as this stock broker allows you to buy shares with no commission. All in all, eToro is certainly one of the very best forex brokers for beginners in South Africa.

Pros:

- Commission-free forex trading

- Low spreads

- Trade 47 different currency pairs

- Social trading network with copy trading

- Wide range of payment methods

- Strictly regulated

Cons:

- Currency conversion fee for depositing rand

68% of retail investor accounts lose money when trading CFDs with this provider.

2. FXCM – Best Forex Broker for Leverage

This broker has a relatively wide selection of currencies to trade, with 39 pairs on offer. If you prefer to trade the rand, you can buy and sell the USD/ZAR and JPY/ZAR pairs. Another nice thing about FXCM is that the broker has custom-made forex baskets, which essentially serve as funds of currencies. You can get exposure to the Australian dollar, British pound, Euro, and Japanese Yen at the same time when investing in one of these baskets.

Another big advantage to FXCM is that it offers access to very advanced trading platforms. With this broker, you can view technical charts through MetaTrader 4 in addition to FXCM’s own charting interface. MetaTrader 4 is suitable for more advanced traders since it enables you to build and test custom trading strategies. You can also use NinjaTrader for technical analysis if you prefer that platform.

The only significant downside to FXCM is that the minimum deposit requirement is rather high. You have to deposit $360 to open an account with this broker. But there are few account fees once you’re set up and all forex trades are commission free.

Pros:

- Leverage up to 1:400

- 39 currency pairs to trade

- Forex baskets for hedging

- Comes with MetaTrader 4 and NinjaTrader

- Commission-free trades with low spreads

Cons:

- Minimum deposit of $360

3. Plus500 – One of the best CFD providers

Plus500 does fall short of the mark when it comes to technical analysis. You don’t get access to a third-party platform like MetaTrader 4, but rather have to use the broker’s built-in charting interface. This has dozens of technical indicators, but you cannot develop your own custom trading strategy.

For more experienced traders, Plus500’s interface can feel a little bit limiting. One upside, though, is that you get access to price alerts so you can easily monitor your trades.

Pros:

- Commission-free CFD trading

- Very tight spreads

- More than 60 currency pairs for trading

- Leverage up to 30:1

- Price alerts

Cons:

- Limited technical analysis tools

4. IG – Good for Both Beginners and Advanced Forex Traders

That’s in part because the broker has a number of trading guides and educational tools that you can use to improve your trading skills. You can also take advantage of a built-in demo trading platform to practice forex trading without committing any money.

For more advanced traders, IG offers an expansive technical analysis platform called ProRealTime. You can also access MetaTrader 4 through this broker if you want to build and backtest your own strategies. Plus, IG has more than a dozen exotic currency pairs for trading that more experienced traders can turn to for niche opportunities.

All forex trades are commission-free and the broker’s spreads are very competitive for trading in South Africa, which is a big plus of using IG. It also has an excellent demo trading platform that you can use to try things out before putting your money on the line.

Pros:

- Educational resources for new traders

- Supports MetaTrader 4 integration

- Many exotic currency pairs for trading

- Commission free trades with low spreads

- Demo trading platform

Cons:

- Leverage limited to 50:1

Your capital is at risk.

What is a Forex Broker?

An online forex broker is a middleman that serves as the go-between for you and the $5 trillion international currency market. Your broker takes your orders to buy or sell a particular currency pair and routes them to a bank or another market maker who can fulfill your order. Then your broker holds your currency (or CFD contract) safely in your account until you want to exit your position.

In addition, South Africa forex brokers make sure that there’s enough liquidity in the system. When you want to buy or sell currency pairs, your trade is executed almost immediately. That’s thanks to brokers’ access to the global market – without a broker, you would have a hard time finding another currency holder to trade with.

The fact that forex brokers have moved online is also a big deal. Not that long ago, it was very difficult for South Africans to trade forex on the global stage. You needed access to a money manager at a brick-and-mortar brokerage, which could be prohibitively expensive for placing occasional trades. Thanks to online brokers, trading forex is cheaper and more accessible than ever before.

How Do South African Forex Brokers Work?

To illustrate how forex brokers work in South Africa, we’ll use eToro as an example. eToro works much like any other forex broker, but we prefer it because you get access to a robust trading platform, more than 40 currency pairs, and commission-free trading with low spreads.

To get started with a forex broker, all you have to do is open an account. This takes just a few minutes. Enter your personal details and contact information, create a new username and password, and verify your identity. This last step is required of all regulated forex brokers in South Africa to prevent fraud in forex trading.

You’ll also need to fund your account. eToro requires a $200 minimum deposit, but the platform makes it easy to add funds since you can use so many payment methods. For example, you can pay by credit or debit card, e-wallet, bank transfer, and more.

Now you’re ready to start trading. You may have access to dozens of forex pairs, but for the sake of example let’s say you want to buy USD/ZAR. You can search for this currency pair on eToro’s dashboard and then click ‘Trade’ when you find it. That opens an order form where you can tell the broker how much currency you want to buy. You can also specify a stop loss or take profit level and decide whether you want to apply leverage to your position.

When your order is ready, click ‘Trade’ to buy USD/ZAR.

Keep in mind that, for a real trade, you’ll want to do some research first. You can use your broker’s trading platform to view technical charts and explore common indicators to determine whether there is an opportunity for profit.

South Africa Forex Broker Fees: What You Need to Know

Online forex brokers may be cheaper than their traditional counterparts, but trading currencies still isn’t free. Figuring out how much forex trading costs can be difficult since every broker has a different fee structure. In general, fees are charged through a spread, a commission, or as an account fee.

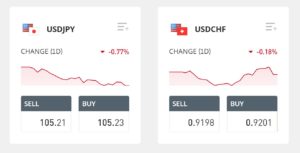

Spreads

Nearly every South Africa forex broker charges a spread. The spread is the difference between the price you can buy a currency pair at and the price you can sell it at. Your broker pockets this difference to make a profit on your trade.

Thanks to the spread, you open every trade at a slight loss. Just to break even, you’d need to cover the difference between what you bought the currency pair for and what you could sell it for.

Often, the spread is just a fraction of a percent. Most low-cost South African forex brokers, for example, charge less than 0.1% per trade for major currency pairs. Spreads can be higher – up to 0.5% – for minor and exotic currency pairs that trade with less liquidity.

Commissions

A commission is another fee that brokers can charge every time you place a trade. Forex trading commissions can be a flat charge per trade or a percentage of your total investment. For example, if you buy $5,000 worth of currency at a 0.1% commission, you would be charged $5 for that trade.

Commissions can add up quickly, so we recommend that you avoid them whenever possible. All of the top forex brokers in South Africa we reviewed offer commission-free forex trading.

Account Fees

Spreads and commissions are the biggest costs that most forex traders face. However, there are some other potential fees that you should be aware of:

- Deposit/Withdrawal Fees – Some South African forex brokers charge fees every time you deposit or withdraw money. The fee might depend on the payment method you use or it might be levied only if you withdraw less than some minimum amount.

- Currency Conversion Fee – Currency conversion fees are often charged if you deposit South African rand into your account. Most forex trading accounts are held in US dollars. You can save money by converting currency through another service and then depositing dollars into your brokerage account.

- Inactivity Fee – Some forex brokers require that you place a trade at least once every several months. If you go months at a time without trading, you could face an inactivity fee.

- Overnight Financing Fee – It’s important to keep in mind that forex trading is always short-term. If you hold forex positions overnight, you’ll be charged an overnight financing fee. This is especially true if you trade with leverage since you must pay interest on the loan you’ve effectively taken out from your broker.

How to Choose the Best South Africa Forex Broker?

We suggested a handful of top forex brokers that are suitable for different types of traders. But if you find yourself looking for another option, it’s important that you know what features to look for. So, let’s cover some of the most important things to consider when picking a forex broker in South Africa.

FSB Regulation

The best place to start when choosing a forex broker is to look at whether or not a platform is regulated. You should always use a broker that is under the authority of the Financial Services Board (FSB), South Africa’s regulatory authority.

This ensures that your broker is trustworthy and has its clients’ interests in mind. FSB-regulated forex brokers in South Africa are routinely audited for compliance with national and international financial laws. Plus, your funds will be in a segregated account that the broker can’t access for unintended purposes.

Deposit Methods

Before you can start trading forex, you need to fund your trading account. That’s a lot easier to do if your broker supports a wide variety of payment methods. Most of the best forex brokers accept bank and wire transfers. For convenience, you should look for the ability to pay by credit or debit card or to transfer funds from an e-wallet like Neteller, Skrill, or PayPal.

Currency Pairs for Trading

The range of currency pairs that a broker offers is a major factor in deciding between platforms. Most brokers offer trading on the seven major currency pairs, all of which involve the US dollar. Most brokers also offer several dozen minor pairs, although not all brokers offer trading on every minor currency.

If you want to trade exotic currencies, though, you need to look specifically for a broker that offers these pairs. Generally, the best forex brokers in South Africa offer more than 40 currency pairs to choose among.

Fees and Charges

We’ve talked in detail about how brokers’ fee structures work, but how much should you actually be paying? The answer to this question depends on your trading style and how frequently you trade, but here are some guidelines for choosing a broker based on cost:

- Always choose a commission-free broker when possible.

- Look for low spreads. Major currency pairs should have spreads of less than 0.1%.

- Avoid deposit and withdrawal fees.

- Keep account fees and overnight funding fees as low as possible.

Trading and Analysis Tools

Your forex broker is your best source of technical analysis tools. Forex traders rely heavily on technical analysis and price charts to spot trading opportunities, so it’s important that your broker’s platform has everything you need.

Nearly every forex broker offers technical price charts, but how capable they vary a lot between platforms. Some of the best forex brokers in South Africa offer their own proprietary charting interfaces, which can be very easy to use while also providing a lot of options. But if you want to build your own custom indicators and test out strategies, look for an established third-party charting software like MetaTrader 4 or NinjaTrader.

Educational resources are also important, especially for newer traders. Look for guides, video tutorials, and demo trading platforms that you can use to improve your trading without risking real money.

Other potential tools to look for include social trading networks, price alerts, and economic calendars. All of these features give you different ways of looking at the forex market and help you develop a competitive edge.

High Leverage Forex Brokers

For many traders, leverage is a key consideration when choosing a South Africa forex broker. Put simply, leverage allows you to make larger trades by borrowing capital from a broker. For example, a 1000 rands trade with 1:5 leverage applied is worth 5000 rands.

Leverage limits vary a lot between brokers. European-regulated brokers generally limit retail clients to 1:30 forex leverage, but brokers licensed outside of Europe can offer much higher limits, such as 1:200. Just remember that the higher the leverage, the higher the risk.

Forex Brokers with Bonus Offers

Some forex brokers offer bonus deals to entice new customers. These bonuses can reward you with trading funds that you can use on forex and other markets. For example, forex brokers with free bonus offers may reward you 1500 rands when you make a 100 rands deposit.

Some of the best brokers for forex even offer no deposit bonus forex bonuses, which reward you with bonus funds simply for signing up. Just remember that the best no deposit bonus brokers offer usually require you to trade a certain amount before you can withdraw any money earned from using the bonus funds.

Trade Forex Today

South African forex traders have access to a wide range of top forex brokers. These brokers vary widely in what type of currency trader they’re catering to by offering different tools, pricing structures, currency pairs, and more. In order to find the best South Africa forex broker for you, it’s important to know what features to look for.

With this guide, you can easily compare the best forex brokers in South Africa for 2021 to help pick the forex broker that’s right for you. If you want to start trading right away at a low cost, we recommend eToro. eToro offers commission-free forex trading, a wide variety of currency pairs, and an advanced trading platform with technical charts and social trading.

eToro – Best South Africa Forex Broker with 0% Commission

75% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

Is there an advantage to trading forex with CFDs?

CFDs (contracts for difference) allow you to speculate on a currency without actually owning it. This is very helpful for forex trading because owning foreign currencies comes with some regulatory headaches. Plus, when you trade CFDs, you are able to apply leverage to your forex trades.

Do I need to create a custom trading strategy?

Creating your own custom forex trading strategy requires a lot of skill and patience. This is something that experienced forex traders take on, but it’s not necessary when you’re just starting out. Many popular technical studies are popular for a reason – they work relatively well and provide actionable insights on the market.

How much leverage do I need to trade forex?

You aren’t required to use leverage when trading forex, but it can be very helpful. Currencies typically move in very small amounts relative to one another, so you would need to commit a lot of money to see a return of several percent in a day. With leverage, you can increase your potential returns without pouring more money into your trading account.

Are online forex brokers in South Africa trustworthy?

Generally, online South Africa forex brokers are trustworthy. But it’s important to ensure that they are fully regulated. Brokers operating in South Africa should be regulated by the Financial Services Board. Even better, many brokers that operate internationally are also regulated buy the UK’s Financial Conduct Authority and the Australian Securities and Investment Commission.

How can I avoid currency conversion fees?

Converting currencies generally isn’t free, unfortunately, but you can avoid brokerage conversion fees. Rather than deposit rand into your account, convert your money to US dollars using a low-cost third-party service. Then deposit the dollars into your trading account and you can avoid additional fees.