Best No Deposit Bonus Brokers South Africa – Cheapest Brokers Revealed

With hundreds of online trading platforms serving South Africans – competition between providers is extremely fierce. This is why more and more brokers are now offering no deposit bonuses as a means to entice you to their platform.In this guide, we review the Best No Deposit Bonus Brokers South Africa for 2021.

Your capital is at risk

Best No Deposit Bonus Brokers South Africa 2021

Below you will find a list of the best no deposit bonus brokers South Africa. You can find out what each share trading platform offers in more detail by scrolling down!

- eToro – Overall Best Broker South Africa for Bonuses – 0% Commission – Invest Now

- Libertex – Best Trading Bonus South Africa for Commission Rebate – Invest Now

- XM – Free VPS – Great for Automated Forex EAs

Best Brokers with Bonus South Africa Reviewed

Although are many stock brokers South Africa offering sign-up bonuses to traders – you shouldn’t join a platform solely for this purpose.

Instead – and assuming you are looking to trade online in the long-term, you’ll need to look at factors surrounding commissions, supported markets, leverage, payments, and regulation.

Taking all of this into account, below we review the best no deposit bonus brokers South Africa.

1. eToro – Overall Best Broker South Africa for Bonuses – 0% Commission

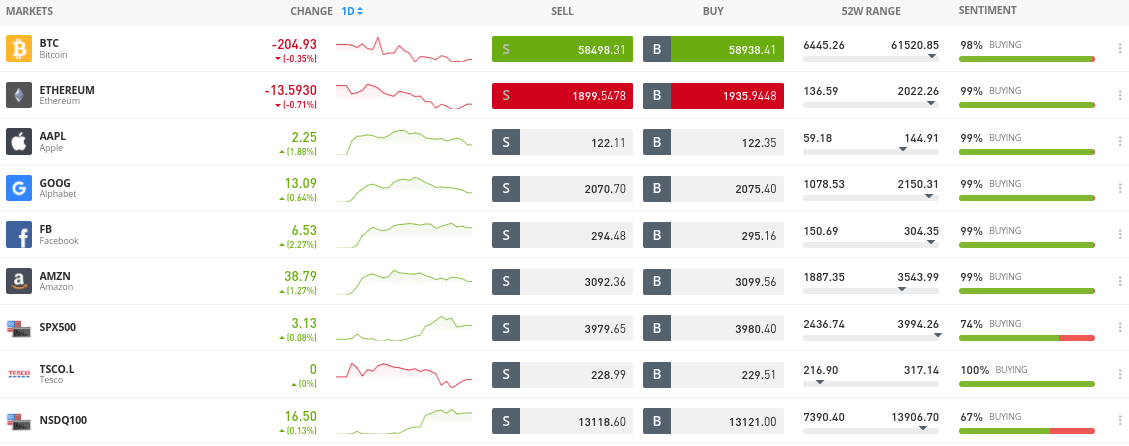

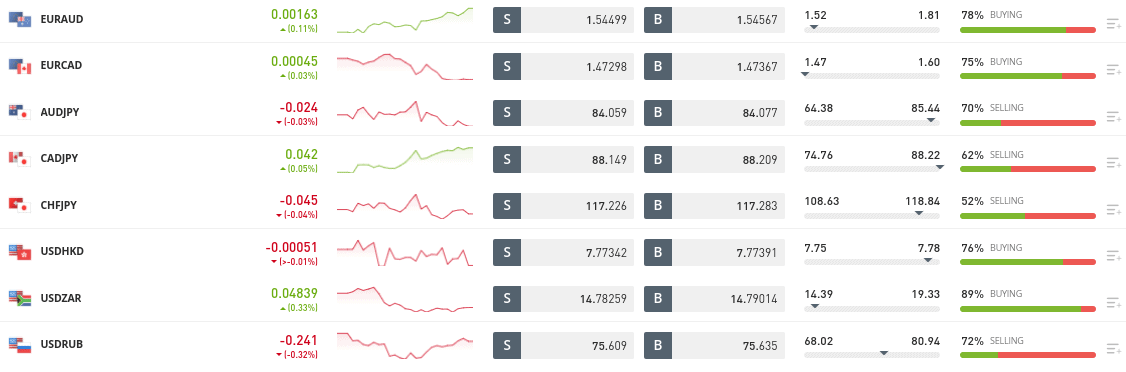

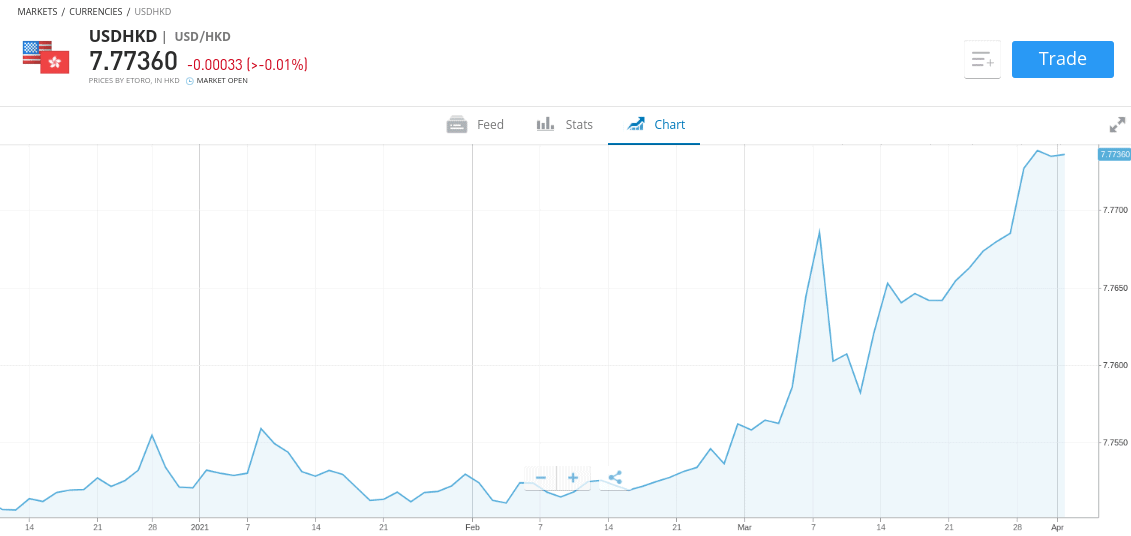

Overall, eToro is the best broker in South Africa – not only in terms of bonuses but fees, regulation, and user-friendliness. This top-rated platform allows you to trade a wide variety of financial instruments – including over 2,400 stocks and 250 ETFs.

This covers 17 international markets, such as the US, Hong Kong, Germany, France, and the UK. You can also trade commodities, indices, buy cryptocurrency, and forex. Each and every market at eToro can be traded commission-free and spreads are generally very competitive.

When it comes to bonuses, there are two ways in which you can boost your trading capital. Firstly, eToro offers a signup promotion that allows you to earn $500 in bonus funds. For this, you will need to place $5,000 worth of cryptocurrency trades. As such, this bonus will either appeal to large-volume investors or day traders that place lots of positions throughout the week. The other bonus offering available at eToro is its referral program.

Put simply, for every person that signs up to eToro via your link – you will receive a trading bonus of $50. The main stipulation here is that the referred user needs to trade at least $100 for you to receive the funds. This is a much lower threshold than you will find at other trading platforms in South Africa. In addition to its signup promotions, eToro is also popular for its Copy Trading feature. This allows you to trade passively, as you will be copying the buy and sell positions of your chosen investor https://betshah.com/blog/most-wickets-in-a-single-season-of-ipl/.

When it comes to getting money into your eToro account, the broker supports South African debit/credit cards, bank account transfers, and even e-wallets like Paypal. It is also important to stress that your money is safe at eToro. The platform is regulated by three financial bodies – namely the FCA (UK), CySEC (Cyprus), and ASIC (Australia). Finally, you can join eToro online or via the provider’s mobile best trading app – which is compatible with iOS and Android phones.

Pros:

- Buy shares without paying any commission or share dealing charges

- 2,400+ shares listed on 17 international markets

- Trade forex, commodities, index funds, cryptocurrencies, and more

- Social and copy trading

- Mobile trading app

- Regulated by the FCA, CySEC, and ASIC

Cons:

- Not suitable for advanced traders that like to perform technical analysis

67% of retail investors lose money trading CFDs at this site

2. Libertex – Best Trading Bonus South Africa for Commission Rebate

Libertex is a popular CFD trading platform that offers heaps of markets. This includes everything from forex and commodities to cryptocurrencies and stocks. One of the main attractions of Libertex is that the platform offers ZERO spreads on all markets. This is particularly useful when it comes to trading less liquid markets.

For example, low-cap stocks or indices typically come with wider spreads. But, at Libertex, both the bid and ask price remain constant at all times. When it comes to the bonus offering at Libertex, this is based on a commission rebate model. That is to say, by signing up for the promotion, will receive 10% of all trading commissions back as bonus funds.

There are a few terms and conditions that you need to be aware of before approaching this bonus. Firstly, the minimum deposit to be eligible is $100 and the maximum rebate on offer is $10,000. Secondly, the bonus funds will be credited in 2% increments – based on the amount you deposited. For example, if you funded your account with $500 – your first rebate would be credited when you reach $10 in payable commission.

The commission rebate bouns offered by Libertex are likely suited more to those of you that like to trade with leverage. This is because your trading stakes will be much larger and thus – you’ll be able to target a much higher rebate. If you are a retail client, Libertex will offer leverage of up to 1:30 on major forex pairs and less on other financial instruments. In terms of trading platforms, Libertex is compatible with both MT4 and MT5.

The CFD broker also offers its own native web trading platform – which you can access via your standard browser. In terms of getting started, Libertex accounts take minutes to open and you can meet the minimum deposit requirement by making a bank transfer, or using a debit/credit card or e-wallet. Finally, Libertex is a heavily regulated trading platform that has been active in this space for over two decades.

Pros:

- ZERO spreads on all markets

- 0% commissions on some stocks

- Leverage available

- Educational guides and webinars

- Accepts PayPal

- MT4 and MT5 supported

- Mobile trading app

- Regulated and trustworthy broker

Cons:

- Only offers CFDs

75.3% of retail investor accounts lose money when trading CFDs with this provider.

3. XM – Free VPS – Great for Automated Forex EAs

But, when joining top-rated broker XM – the platform will offer you a free VPS! In order to be eligible, you need to have a minimum account balance of $5,000 and place at least five trades per month. If you don’t meet this criterion, the XM VPS will cost you $28 per month.

The VPS itself can be installed directly into MT4 or MT5 – which are the go-to platforms for automated trading. XM is particularly popular with South African traders as the platform offers ZAR accounts. This means that you can deposit, trade, and withdraw funds in South African rands and thus – not be exposed to FX currency conversion fees.

In terms of supported markets, XM offers heaps of forex pairs, commodities, and stocks. There are several account types to choose from and the minimum deposit is just $5. If you are planning to trade large volumes, the XM Ultra Low Account offers spreads of just 0.6 pips. When it comes to fees, this depends on the account type you opt for.

The Standard Account, for example, allows you to trade commission-free. There are no fees to deposit and withdraw funds, and supported payment types include debit/credit cards, e-wallets, and bank transfers. Finally, XM is regulated by several bodies and is authorized to offer trading services in South Africa – hence its support for ZAR accounts.

Pros:

- Multiple ZAR accounts offered

- Some accounts offer commission-free trading

- Heaps of forex markets

- Trade CFDs via stocks and commodities

- High leverage

- 16 trading platforms supported

Cons:

- Does not offer markets on ETFs or cryptocurrencies

Your capital is at risk. Leveraged products may not be suitable for everyone

Brokers with Bonus Comparison

Although it can be tempting to sign up with a broker to claim a welcome bonus – you must have a firm grasp of the underlying terms and conditions. Below we list the key stipulations associated with the best no deposit bonus brokers South Africa.

| Broker | Bonus Type | Bonus Amount | Key Terms |

| eToro | Trading rebate | $500 | Trade $5,000 worth of crypto to get a $500 bonus |

| Libertex | Commission rebate | Up to $10,000 | 10% commission rebate, paid in 2% increments |

| XM | Free VPS | Free VPS | Minimum $5,000 balance and 5 trades per month |

Bonus terms and conditions will change regularly, so be sure to check this yourself before claiming the promotion.

How to Choose the Right Broker Bonus for You

There are heaps of bonuses available to South African traders. The main concept here is that by opening an account with the respective broker and meeting a series of conditions surrounding deposits and/or trading volume – you will receive bonus funds. However, it is crucial to note that you need to have a full understanding of the terms and conditions installed by the best no deposit bonus brokers South Africa before proceeding.

To help clear the mist, below we explain the many metrics that need to be considered in your search for the best forex brokers with no deposit bonus.

Type of Welcome Bonus

First and foremost, you need to have a grasp of the type of bonus being offered – as there are many variations to brokerage welcome packages.

The main bonus types are elaborated on below:

No Deposit Bonus

No deposit bonuses are arguably the most sought-after promotion in the online forex trading scene. As the name implies, this will entitle you to a bonus without needing to make a deposit. Instead, you typically only need to open an account and verify your identity. Then, the broker will credit your account with the respective bonus funds.

There are several points to note about promotions offered by the best forex brokers with no deposit bonus. Firstly, you should expect the size of the bonus to be insignificant. In fact, rarely will brokers offer a no deposit bonus in excess of $10-$20. After all, you are being given free trading funds by the broker – so the amount being offered will, of course, be modest.

Additionally, you should also expect the wagering requirements on no deposit bonuses to be much higher than other promotion types. Although we cover how wagering requirements work shortly – this refers to the amount of trading volume that needs to be met before the bonus can be withdrawn.

Matched Deposit Bonus

A lot of top-rated trading platforms will opt for a traditional matched deposit bonus. This means that the broker will match your first deposit by a certain amount.

- For example, the broker might offer a 100% matched deposit bonus of up to $500.

- This means that by depositing the maximum of $500 – the broker will match this with $500 in bonus funds.

- In turn, you will start with a balance of $1,000.

With this type of promotion, the entire balance will likely be converted to bonus capital straight away. This means that although you deposited $500 with your own money, you won’t be able to withdraw the funds until the respective bonus terms have been met. Once again, this typically comes in the form of wagering requirements that are focused on minimum trading volume.

Commission Rebate

Many trading platforms in South Africa will offer a bonus in the shape of a commission rebate. This means that you will get a percentage of any commissions paid back in the form of bonus funds. For example, Libertex offers a generous rebate of 10% on all commissions paid. This means that by paying $100 in commission, Libertex will credit your account with $10.

In many cases, a commission rebate promotion of this type will be paid in withdrawal cash. In other words, when you receive your rebate you can withdraw the funds back to your bank account or use the money as trading capital. As such, there is no requirement to meet any further wagering requirements.

Minimum Deposit

Once you have a firm understanding of the terms installed by the platform, you need need to assess what the minimum deposit is to be eligible for the bonus. Of course, this won’t be an issue when using or claiming a conventional no deposit bonus – as there is no requirement to fund your account.

However, this type of promotion is somewhat of a rarity these days, so it’s more likely that you will be given a matched deposit bonus or rebate. As such, make sure that the minimum deposit amount isn’t more than you would normally feel comfortable with.

Wagering Requirements

As we briefly noted earlier, wagering requirements refer to the terms and conditions regarding your ability to turn bonus funds into withdrawal cash. This is the most important condition to be aware of – as you will often find that wagering requirements make it almost impossible to benefit from the bonus in monetary terms.

67% of retail investor accounts lose money when trading CFDs with this provider.

In the vast majority of cases, the best no deposit bonus brokers South Africa will stipulate a minimum amount of trading volume that needs to be met before a withdrawal can be made.

For example:

- You are given a no deposit bonus of $200 by your chosen broker

- The terms state that you need to trade $20,000 at the platform before you can withdraw the $200 bonus funds

- At the end of week one, you open and close $1,000 worth of trading positions

- This means that you still have $19,000 left to trade before you can withdraw your bonus funds

Take note, you also need to understand how the broker calculates trading volume. For example, if you enter a $200 position and cash it out when it is worth $300 – the best forex brokers with bonus will class this as $500 in total volume. However, other brokers might only count the initial stake of $200 – so do bear this in mind.

Time Limit

On top of wagering requirements, another key hindrance when claiming a no deposit bonus is that most brokers stipulate a time limit. That is to say, you will usually have a specific number of days to use the bonus funds before they are revoked.

The best no deposit bonus brokers South Africa typically give you at least 30 days to meet the wagering requirements. With that said, we have also come across bonuses that give you just 7 days.

Deposit Methods

Unless you are claiming a no deposit promotion specifically, you will need to fund your account before you are given access to your bonus funds. As such, be sure to check whether or not your preferred payment method is supported. Top-rated broker eToro supports a full suite of South African payment methods – including debit/credit cards, e-wallets, and a bank account transfer.

Supported Markets

It goes without saying that you also need to explore what financial markets you will have access to upon claiming the bonus. We found that the best no deposit bonus brokers South Africa allow you to use your promotional capital on all supported markets. This means that you will likely be able to trade stocks, commodities, forex, and cryptocurrencies with your bonus funds.

Spreads and Commissions

Don’t forget – just because you will be trading with bonus funds this doesn’t mean that you will avoid spreads and commissions. On the contrary, this will have a major impact on your ability to turn a profit and thus – make money from your free bonus funds. The only broker that we have come across that doesn’t charge any spreads is Libertex.

On all other platforms, you will find a gap between the buy and sell price of your chosen market. This can and will vary quite considerably depending on the broker you have signed up with and the account type you are on.

Additionally, many trading platforms in South Africa will charge a commission on each position that you enter. Once again, this will be deducted from your bonus account balance. With that said, the best no deposit bonus brokers South Africa – such as eToro and XM – offer 0% commission accounts.

How to Get Started with a Bonus Broker

If you’re ready to claim a welcome bonus right now – we are now going to walk you through the general process. For the guidelines below, we explain how to claim a bonus from top-rated brokerage site eToro.

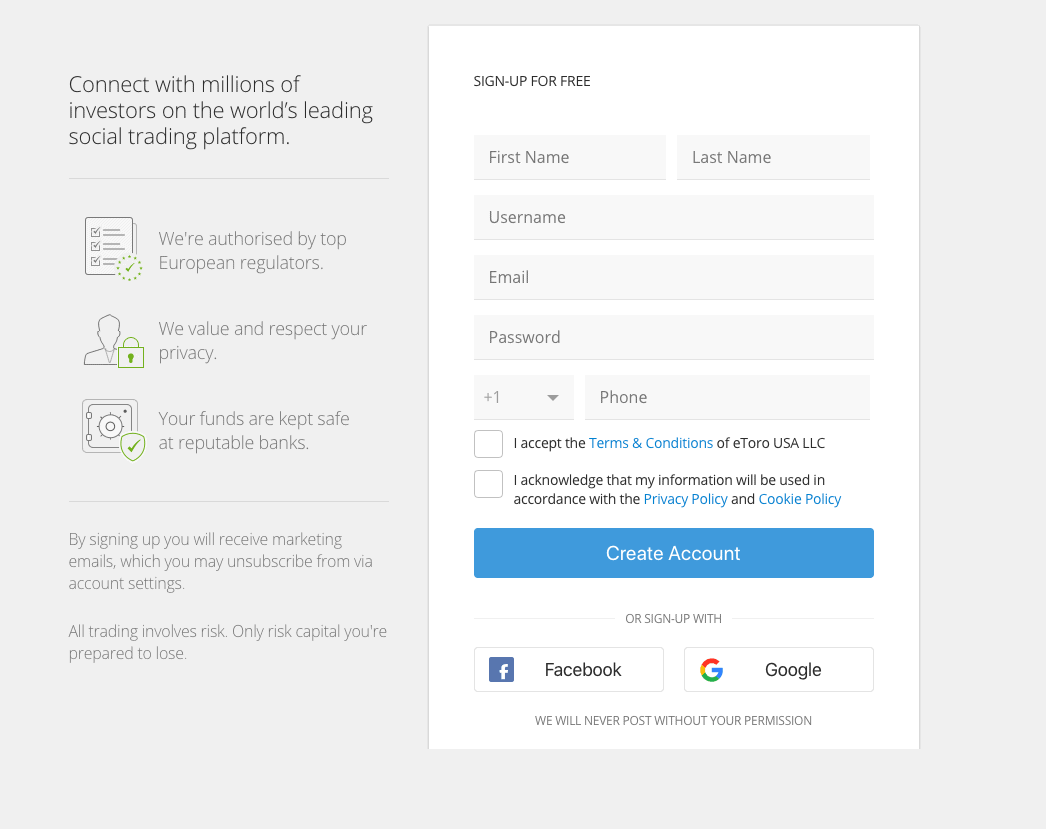

Step 1. Open an Investment Account

Before you can get your hands on a bonus at eToro – you will first need to open an account. From start to finish, this should take you no more than 10 minutes.

To get the ball rolling, head over to the eToro website and click on the ‘Join Now’ button. Then, you will be asked to enter your personal information and contact details.

Step 2. Upload ID

eToro is a regulated broker – so in order to keep you and your fellow traders safe, it is required to collect some identity documents from you.

All you need to do is upload a copy of you:

- Passport or driver’s license

- Utility bill or bank account statement

In most cases, the eToro system will verify the documents in less than a couple of minutes.

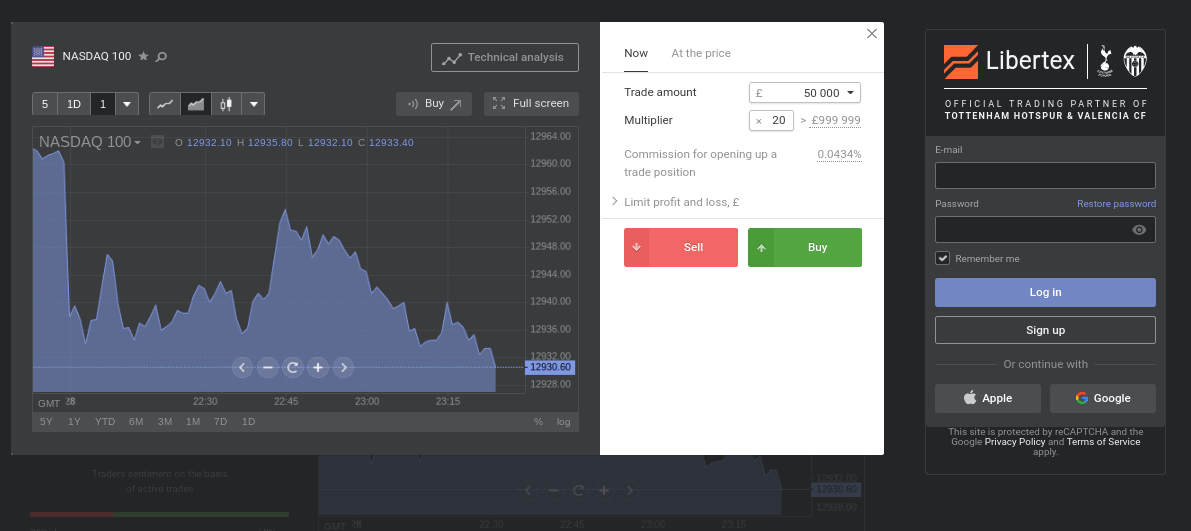

Step 3. Claim $500 Bonus

There is no requirement to enter a promo code of any sort to claim the $500 welcome bonus at eToro. Instead, you simply need to place $5,000 worth of cryptocurrency trades. As such, you’ll need to first deposit some funds so that you can start working towards the trading volume threshold.

Step 4. Deposit Funds

You can deposit funds instantly at eToro when using a South African debit/credit card, Paypal, Skrill, or Neteller. You can also transfer funds from your bank account but this might delay the process by a couple of days.

Step 5. Start Trading

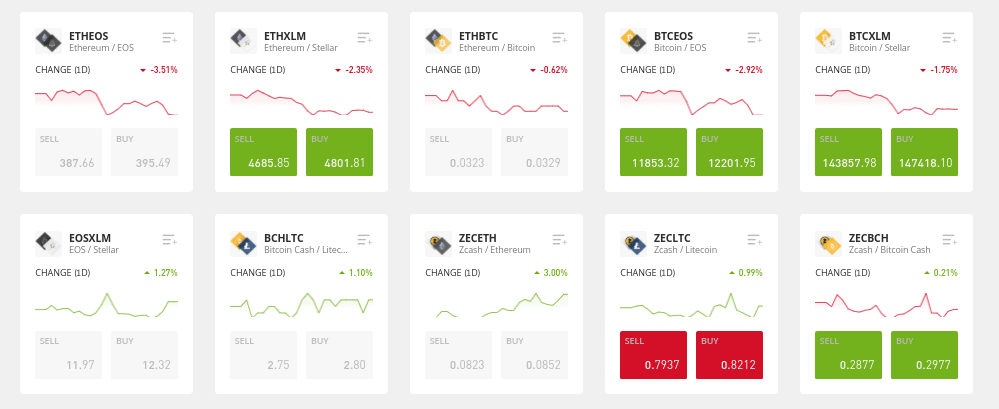

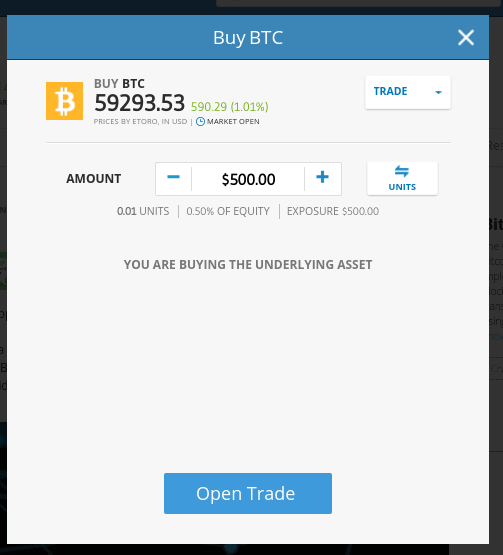

Assuming that you are targeting the $500 welcome bonus – you will now need to start trading cryptocurrencies. Click on the ‘Trade Markets’ button followed by ‘Crypto’ to see what markets you have available to you.

eToro offers an abundance of digital currency markets – covering fiat-to-crypto pairs like BTC/USD and crypto-cross pairs like BTC/ETH.

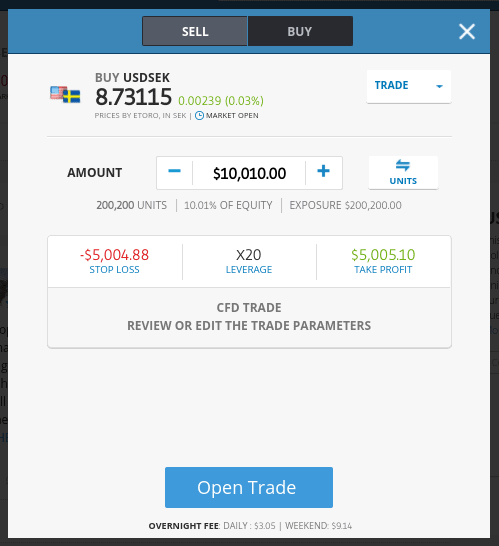

Once you find a pair that you wish to trade, you’ll need to set up an order. As you can see from the example below, you are required to choose from a buy (long) or sell (short) order, enter your stake, and choose your leverage amount – if applicable.

To place your trade, click on the ‘Set Order’ button. Once you close the position, the amount will be taken off of your $5,000 target!

Best No Bonus Brokers South Africa – Conclusion

This guide explained how trading bonuses work and reviewed the best promotions currently available to South Africans. As you now know, bonuses are often unattractive once you take the time to read through the terms and conditions. This is largely because you need to meet a really high wagering requirement before you can withdraw the bonus funds.

Nevertheless, we found that eToro is one of the best forex brokers with bonus. You’ll have access to a $500 bonus when trading a minimum of $5,000 in cryptocurrency positions. Plus, the broker is a good long-term option – as you can trade thousands of financial markets without paying any commission.

eToro – Best Broker South Africa with 0% Commission

68% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

Which broker gives no deposit bonus?

The days of broker no deposit bonuses is slowly but surely coming to an end - with platforms now opting for matched deposit bonuses or commission rebates.

What is forex no deposit bonus?

A forex no deposit bonus allows you to claim free trading funds simply for signing up to a broker for the first time. You will, however, need to meet a variety of terms and conditions before you are able to turn the bonus funds into withdrawal cash.

Can you withdraw a no deposit bonus?

In order to withdraw a no deposit bonus, you first need to meet some terms and conditions. This is largely focused on wagering requirements - meaning that you need to trade a certain amount before the bonus is withdrawable. Take note, the minimum threshold is often really high - which often makes the no deposit bonus worthless.

Are no deposit bonuses worth it?

On the one hand, no deposit bonuses are often near-impossible to withdraw - as the wagering requirements are so high. With that said, no deposit bonuses allow you to trade at the respective platform without needing to fund your account. As such, this allows you to get a feel for the platform before making a financial commitment.

What is the best broker bonus 2021?

We found that the best broker bonus in the market right now is offered by eToro. Put simply, the broker is offering a $500 bonusw when you meet a minimum trade volume of $5,000. This does, however, need to be traded on cryptocurrency markets.