How to Buy Gold Fields Shares in South Africa – With 0% Commission

Gold Fields is one of the largest mining companies globally, generating over $3 billion in revenue every year. After a rocky couple of months in the market, the Gold Fields share price has begun to show some bullish momentum – prompting many investors to consider adding it to their portfolios.

In this guide, we’ll show you How to Buy Gold Fields Shares in South Africa – covering everything you need to know about the company and highlighting how you can invest in Gold Fields today, completely commission-free!

How to Buy Gold Fields Shares in South Africa – Step by Step Guide 2021

If you’re looking to buy Gold Fields shares in South Africa, look no further! By following the four steps below, you’ll be able to complete a commission-free investment in Gold Fields – in under ten minutes.

- Step 1: Open an account with Avatrade– Head to Avatrade’s website and click ‘Trade Now’. Enter a valid email address and choose a password to create your account

- Step 2: Verify your Account – Verify your account by uploading proof of ID (a copy of your passport or driver’s license) and proof of address (a copy of a bank statement or utility bill)

- Step 3: Fund your Account – Deposit via credit/debit card, bank transfer, or e-wallet.

- Step 4: Buy Gold Fields Shares – Search for ‘Gold Fields’ in Avatrade’s trading platform and click ‘Buy’. Enter the number of shares you’d like to purchase in the order box and then click ‘Place Order’.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Step 1: Choose a Stock Broker

First things first – you’ll need a safe and reliable stock broker so that you can buy Gold Fields shares in South Africa. To help narrow down the broker options available to you, this section presents the two best brokers in South Africa when it comes to buying Gold Fields shares.

1. AvaTrade – Best Broker to Buy Gold Fields Shares in South Africa with Low Fees

AvaTrade is a well-known broker in South Africa, boasting regulation from the FSCA. The platform offers a vast

AvaTrade’s fee is included in the spread. This spread is variable depending on market conditions but tends to be extremely tight. AvaTrade also offer leverage of up to 30:1 on certain assets – meaning that you can essentially boost your potential profits by 30x!

AvaTrade allows fee-free deposits, with the minimum threshold being only $100 (1456 ZAR). Users can make deposits via credit/debit card, bank transfer, and e-wallets such as Skrill and Neteller. If you are interested in forex trading, AvaTrade also offers full support for MT4 and MT5 – and even provide a free demo account feature for new traders too!

Pros:

- Suitable for experienced traders

- Zero commission trading

- User-friendly platform

- Trade Gold Fields shares with leverage

- Regulated and licensed to operate in SA

- Supports MetaTrader 4 and 5

- Offers numerous deposit options

Cons:

- Only offers CFDs

Your capital is at risk.

Step 2: Research Gold Fields Shares

Before you begin stock trading, it’s wise to get a solid understanding of the company you’ll be investing in. With that in mind, the sections below present the critical information you need to know before you buy Gold Fields shares in South Africa.

What is Gold Fields?

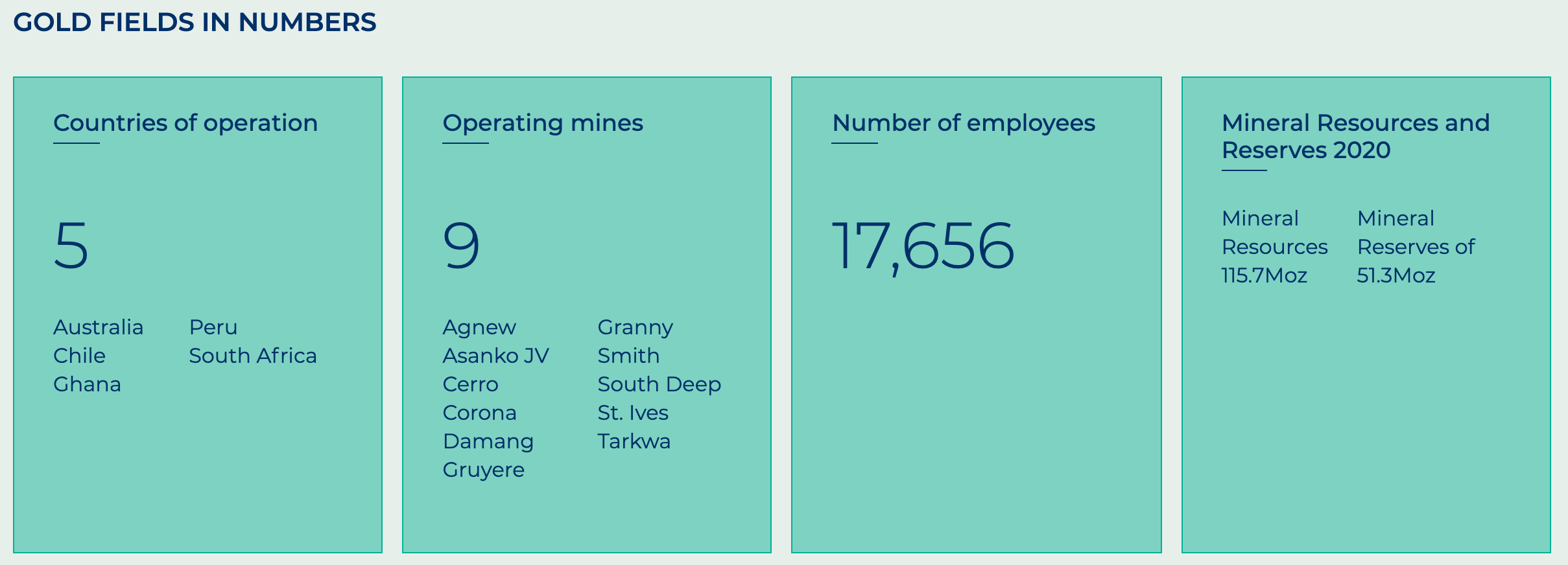

Gold Fields is a gold mining firm headquartered in Johannesburg, South Africa. According to Statista, Gold Fields were the sixth-largest gold mining company in the world based on production in 2020, with Newmont and Barrick Gold leading the way. Gold Fields has a primary listing on the Johannesburg Stock Exchange (JSE) but is also listed on the New York Stock Exchange (NYSE) through American Depositary Receipts.

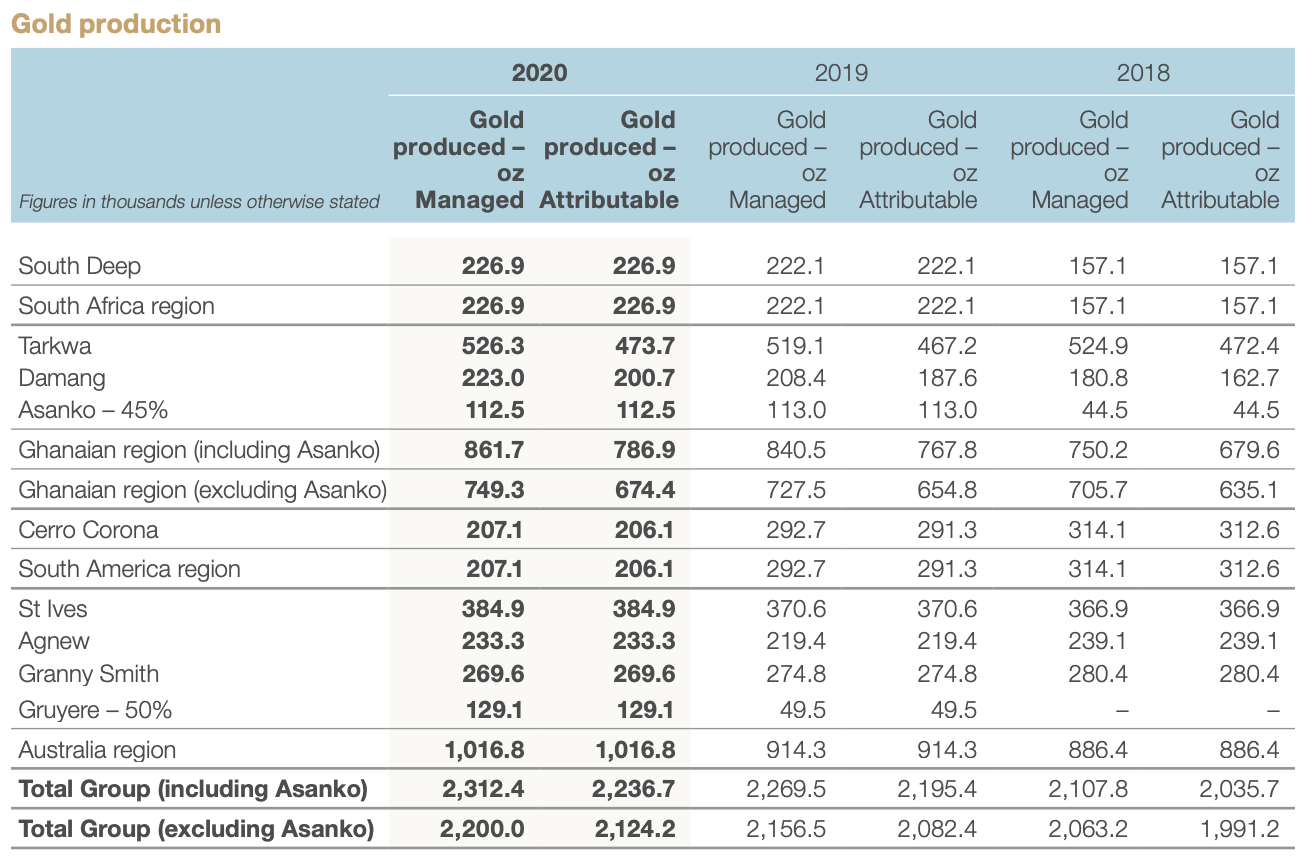

Gold Fields owns and operates mines in four countries – South Africa, Australia, Ghana, and Peru. The company is involved in underground and surface gold mining, scouring for the metal in the land they own. Gold Fields will then extract, process, and smelt the gold to remove impurities. This gold is then sold to other parties, which is how the company generates most of its revenue.

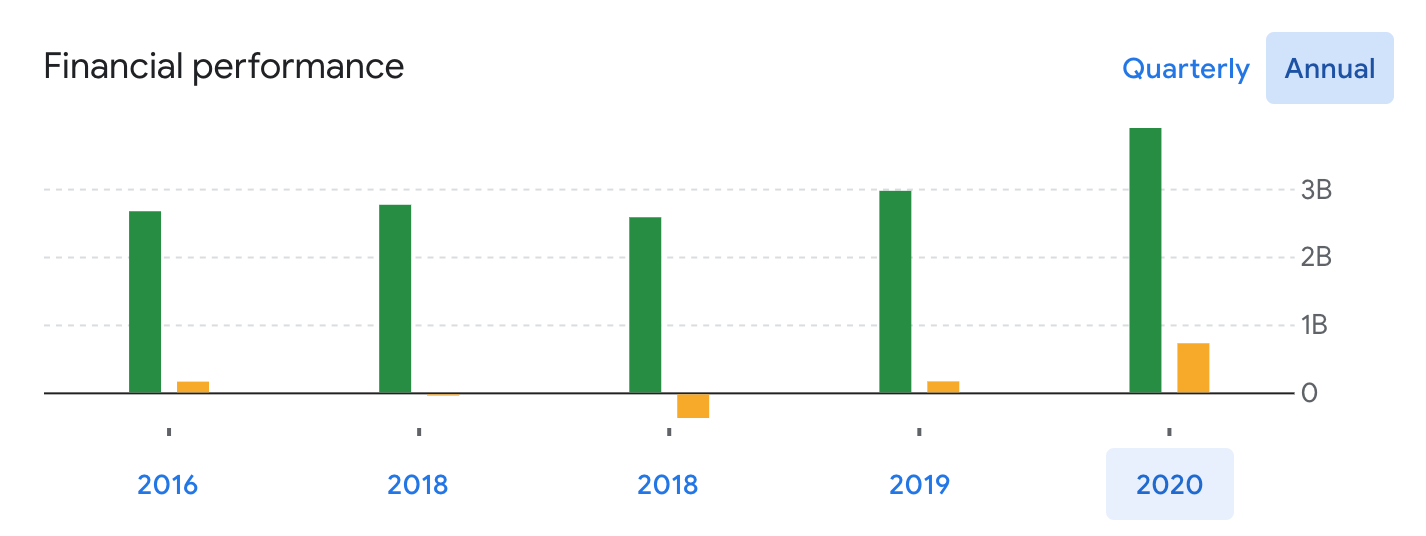

According to data gathered from Yahoo Finance, Gold Fields has a market cap of $8.32 billion. The company generated over $3.8 billion in revenue in 2020, a $900 million increase from the year previous. This resulted in net profits that were over $600 million more than in 2019, highlighting impressive growth for the company. This financial position is expected to strengthen as Gold Fields continues to ramp up its production levels.

Gold Fields Share Price

In terms of the Gold Fields share price, shares are currently valued at 13,666 ZAC. This represents a slight decrease of 2.81% from the start of the year and a 31% decrease from this date last year. Looking at these stats, you might be wondering whether Gold Fields can be considered one of the best shares to buy given the poor stock performance – yet it’s wise to consider the bigger picture.

Aside from the Gold Fields share price, it’s essential to look at metrics such as its P/E ratio and EPS. In terms of the former, YCharts puts this at 11.33. This number won’t mean much out of context, but when compared to rival firms such as Harmony Gold Mining and DRDGold (who don’t even have a P/E ratio), it’s clear to see how well Gold Fields are performing.

71.2% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

EPS for Gold Fields is currently $0.81, based on data from the most recent financial period. This is a significant increase from the EPS estimate of $0.19 that was showcased in 2019; furthermore, EPS figures were negative before this, so it highlights the impressive profit growth that Gold Fields has generated.

Overall, the Gold Fields share price doesn’t tell the whole story. Diving into the finances a bit, you can see that revenues and profits are increasing year on year. This adds further confidence when you decide to buy Gold Fields shares in South Africa.

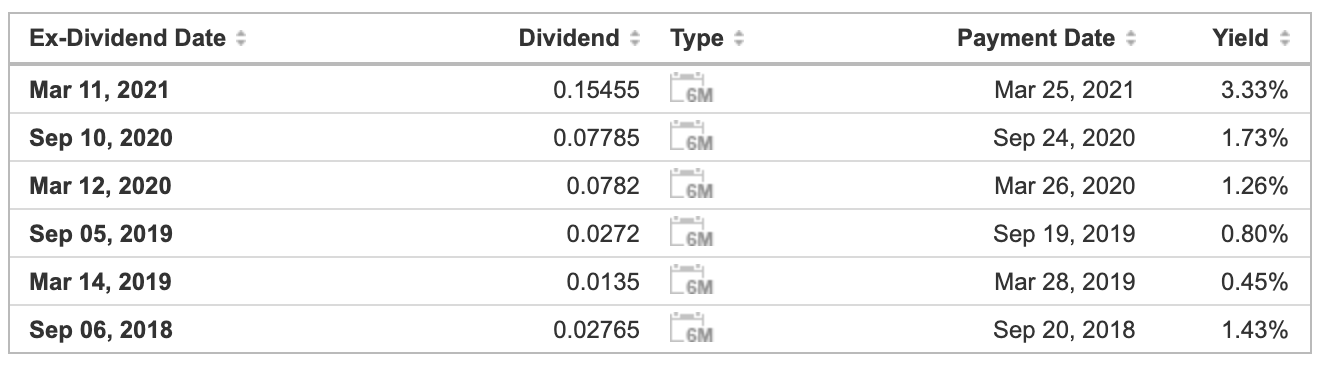

Gold Fields Shares Dividends

If you are wondering how to invest money to generate a passive income stream, purchasing dividend-paying stocks is a good idea. Gold Fields is one of those stocks, providing an impressive dividend yield of 3.43% at the time of writing. Yields have increased steadily since 2019 as the company’s profits have grown – which hints at further yield increases in the future.

Gold Fields make their dividend payments twice per year – once in March and once in September. The ex-dividend date tends to be around two weeks before the payment is made. The next ex-dividend date is scheduled to be in early September, judging by historical data. So, if you were to buy Gold Fields shares in South Africa before then, you’d be entitled to receive dividend payments.

Are Gold Fields Shares a Good Buy?

So, tying everything together, is it a good idea to buy Gold Fields shares in South Africa? We believe so. Presented below are two of the critical reasons why Gold Fields represents a good buying opportunity this year.

Strong Financial Position

As you can see from the chart below, both revenue and net income figures are trending upwards for Gold Fields. Net profit margin is up 240% from the previous year, while cash on hand is 72%. Obviously, this is fantastic news for the company and its shareholders, which will inevitably influence the stock price.

The latter is essential to note, as having more cash available means that dividend increases are more likely. Furthermore, gold demand is expected to increase from a wide range of sources, most notably Central Banks and jewellers. Also, more and more gold is being used in technology these days, which is great news for Gold Fields.

Market Conditions

As a gold producer, Gold Fields are inevitably affected by the price of gold. Price has been steadily declining since August 2020, which hasn’t made ideal conditions for the company. However, over the past month, the price of gold has begun to rise again – which could mean great things for the company’s bottom line.

If gold’s price were to increase, it would mean that Gold Fields will generate more money for every ounce of gold produced. Ultimately, this would mean great things for revenues. Furthermore, if Gold Fields can continue increasing production levels, it would add a further boost to its finances.

Step 3: Open an Account & Buy Shares

Now it’s time to take a look at the process of buying shares in Gold Fields. The five steps below will show you how to buy shares in Gold Fields with Avatrade – all without paying any commissions whatsoever.

Step 1: Open an Avatrade Account

Head to Avatrade’s homepage and click ‘Trade Now’. Enter a valid email address and choose a password to create your account.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Step 2: Verify your Account

Avatrade abides by the strictest regulatory policies, meaning that new users must verify themselves before trading. To do so, simply upload proof of ID (a copy of your driver’s license or passport) and proof of address (a copy of a bank statement or utility bill).

Step 3: Make a Deposit

New Avatrade users can deposit as little as $100 to fund their accounts. In terms of deposit methods, the following options are available:

- Credit card

- Debit card

- Bank wire transfer

- Apple Pay

- iDeal

- Giropay

- Trustly

Step 4: Search for Gold Fields

Type ‘Gold Fields’ into the search bar on Avatrade’s trading platform – the company should then appear in the search results. Click ‘Buy’ and move on to the next step.

Step 5: Buy Gold Fields Shares in South Africa

In the order box on the right side of the screen, simply enter the number of shares you’d like to purchase. Once you are happy with everything, click ‘Place Order’.

And that’s it! You’ve just completed a commission-free investment in Gold Fields!

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Gold Fields Shares Buy or Sell?

So, overall, is Gold Fields a buy or a sell opportunity? Given the present circumstances, we feel it’s a good buying opportunity. As noted earlier, Gold Fields’ share price doesn’t tell the whole story. At first, you might glance at the price chart and see some bearish momentum, which may prompt you to believe the company is on a downward trajectory – but this isn’t the case.

Gold Fields’ revenue has increased drastically over the past year, which is impressive given the scale of the Coronavirus pandemic. What’s more, physical gold is now in demand from an incredibly diverse range of buyers, such as jewellers, central banks, technology companies, and more. As more uses for gold keep popping up, this will mean further demand for Gold Fields’ produce.

Gold Fields is also a good buy opportunity due to the high dividend that the company pays. Yields have increased over the past two years as Gold Fields have generated more profits – and there’s every chance these increases could continue. As noted earlier, cash on hand is at an all-time high for the company, so definitely keep an eye out for the dividend announcement due to happen in early September.

Avatrade – Buy & Sell Gold Fields Shares with Low Commissions

As shown throughout this article, Gold Fields are in a fantastic position to capitalise on the current market environment and showcase some bullish momentum in the coming months. Although the recent downwards trajectory may seem concerning at first, if you consider the company’s strong fundamentals, it’s a fantastic opportunity to get in at a lower price.

So, if you’re looking to buy Gold Fields shares right away, we’d recommend opening an account with Avatrade. As one of the most user-friendly brokers in South Africa, Avatrad ensure their platform is accessible thanks to low commissions and a tremendous range of assets. What’s more, the minimum deposit amount is only $100, meaning you can start small and build as you go!

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.