Best High Leverage Forex Brokers in South Africa

Want to trade forex with leverage? In this guide, we review the 10 best high leverage forex brokers in South Africa.

Best High Leverage Forex Brokers South Africa 2022

Here are the 10 best high leverage forex brokers in South Africa for 2022:

- AvaTrade – Best MetaTrader Broker with High Leverage

- VantageFX – Best High Leverage Forex Broker with Spread-free Accounts

- FinmaxFX – Best High Leverage Forex Broker with Autotrading

- Plus500 – High Leverage CFD Broker with Forex, Stocks, and More

- Skilling – Best Forex Broker for 500:1 Leverage

- Forex.com – Best High Leverage Point Broker for Research

- Blackstone Futures – Ultra Low-cost Forex Broker with High Leverage

- Alpari – Trade Forex with 3,000:1 Leverage in South Africa

- Capital.com – Overall Best High Leverage Forex Broker

Best High Leverage Forex Brokers South Africa Reviewed

Let’s dive into complete reviews of each of the best brokers with high leverage in South Africa.

1. AvaTrade – Best MetaTrader Broker with High Leverage

If you want to use MetaTrader 4 or 5 as your forex trading platform, AvaTrade is one of the best high leverage forex brokers available in South Africa. This broker lets you trade 55 currency pairs, and major pairs can be traded with 400:1 leverage. There are no trading commissions at AvaTrade and spreads start from just 0.9 pips.

Another major benefit to using AvaTrade is that it offers vanilla forex options. The broker has a specialized trading platform for options called AvaOptions. You can easily analyse dozens of popular options trading strategies and calculate your profit and loss. You can’t apply additional leverage when trading options, but this type of trading involves built-in leverage.

In addition to MetaTrader 4 and 5, AvaTrade offers several platforms for automated trading. You can copy more experienced forex traders using DupliTrade or ZuluTrade. Both platforms have thousands of forex traders available to copy as well as built-in analysis tools.

Advanced traders will also appreciate that AvaTrade offers MQL5, a forex signals service. MQL5 integrates with MetaTrader, so trading with forex signals is seamless. You can also build your own custom trading signals within AvaTrade’s MetaTrader integration.

AvaTrade is regulated by South Africa’s FSCA and regulators in Australia, Japan, and several other countries. The broker offers 24/5 customer support by phone, email, and live chat.

Pros:

- Trade with 400:1 leverage

- 55 currency pairs and forex options trading

- Integrates with MetaTrader 4 and 5

- Supports copy trading with ZuluTrade and DupliTrade

- Includes MQL5 forex signals service

- 24/5 customer support by phone, email, and chat

Cons:

- High inactivity fee after 3 months

Your capital is at risk.

2. VantageFX – Best High Leverage Forex Broker with Spread-free Accounts

There are a number of things to like about VantageFX beyond just the leverage this broker offers. You can open a commission-free trading account with just a $200 deposit, and spreads start from 1.4 pips. For more advanced traders, VantageFX offers ProECN and RawECN trading accounts. These send your orders directly to liquidity pools for execution, and they don’t carry any spreads. Instead, you pay a commission from $2 per trade for the ProECN account or $3 per trade for the RawECN account.

VantageFX integrates with MetaTrader 4 and MetaTrader 5, so you can take advantage of powerful trading tools like forex signals and strategy backtesting. Even better, this broker offers integrations for Myfxbook, ZuluTrade, and Duplitrade. All 3 platforms enable you to copy other forex traders, so you can easily automate your trading.

The broker also has its own custom trading platform for web and mobile. We were impressed by how comprehensive the mobile app in particular is. It includes dozens of technical studies and full-screen charting capabilities, plus price alerts, watchlists, and more. While it’s not as powerful as MetaTrader, the VantageFX app is very user-friendly and is a great addition for trading on the go.

VantageFX is regulated by the UK FCA and the Australian Securities and Investment Commission (ASIC). The broker doesn’t charge deposit, withdrawal, or inactivity fees, and you can fund your account using a debit card, credit card, or bank transfer.

Pros:

- Trade forex with 500:1 leverage

- Supports MetaTrader 4 and MetaTrader 5

- Automated copy trading through ZuluTrade, Myfxbook, and Duplitrade

- Spread-free ECN accounts available

- Regulated by FCA and ASIC

Cons:

- High minimum deposit for standard account

- No ZAR currency pairs to trade

Your capital is at risk.

3. FinmaxFX – Best High Leverage Forex Broker with Autotrading

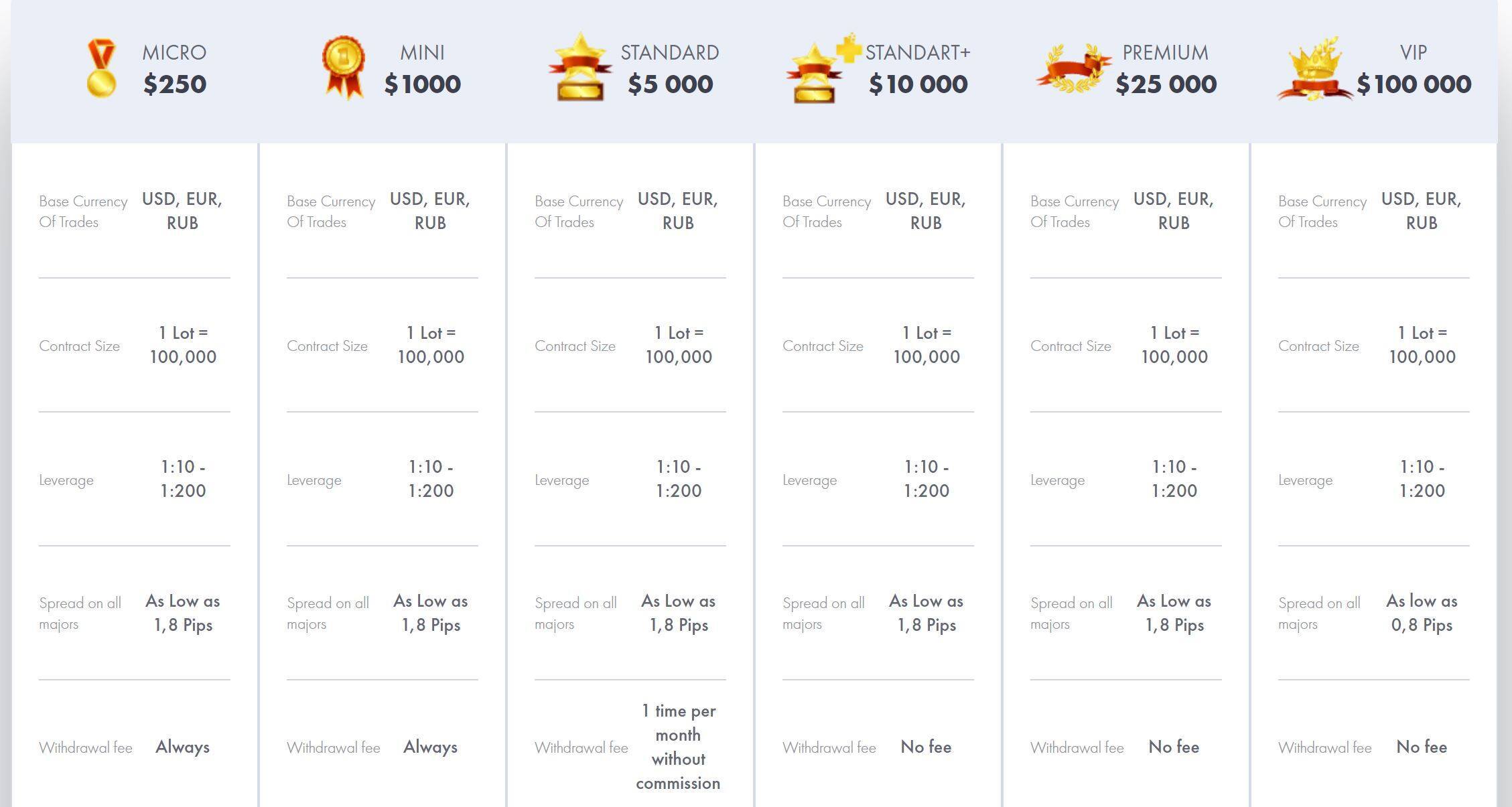

The broker offers 6 different account types, which won’t affect your leverage options but can impact your bonuses and access to forex signals. The Nano account is the entry-level account and requires a $250 deposit, but it is not eligible for bonuses or forex signals. The Mini account requires a $1,000 minimum deposit, but offers signals and trading bonuses up to 30%.

FinmaxFX stands out for its trading platforms, which include MetaTrader 5 and ZuluTrade. Both of these platforms will be familiar to experienced forex traders, and their popularity means that there’s no shortage of tutorials for how to get started. Notably, MetaTrader 5 also supports trading on stocks, commodities, indices, and cryptocurrencies with FinmaxFX.

The ZuluTrade integration brings copy trading to FinmaxFX. You can look at how forex traders have performed in the past and what types of currencies they focus on. Once you select a trader to copy, ZuluTrade will automatically mimic their positions in your account without any additional work on your part.

FinmaxFX is regulated by the Vanuatu Securities and Exchange Commission. The broker offers customer support by phone, email, and live chat 5 days a week.

Pros:

- Trade forex with 200:1 leverage

- Supports forex signals trading with MetaTrader 5

- Trading bonuses starting at 30%

- Automated copy trading through ZuluTrade

- Regulated by Vanuatu SEC

Cons:

- High minimum deposit for Mini account

- Social trading network isn’t the most robust

Your capital is at risk.

4. Plus500 – High Leverage CFD Broker with Forex, Stocks, and More

Plus500 is limited in how much leverage it can offer by ESMA regulations. So, the broker offers 30:1 leverage for major forex pairs, 5:1 leverage for stock CFDs, and 2:1 leverage for cryptocurrency CFDs. While this isn’t an extreme amount of leverage, it’s more than enough to help you grow your account quickly.

One thing we especially like about Plus500 is that it keeps fees low and makes it easy to get started. You can open an account with a $100 minimum deposit and pay using a credit card or debit card. In addition, there are no deposit or withdrawal fees and the broker’s forex trading spreads start at a very competitive 1.0 pips. Just watch out for the inactivity fee, which kicks in after 3 months without trading.

Plus500’s trading platform is good for beginner traders, but it’s not the software we’d recommend for in-depth technical analysis. You get access to around 80 technical studies and drawing tools, plus customizable price charts. However, there’s very little information about the depth of orders for a currency pair and you cannot use forex signals with the platform.

Plus500 is regulated in numerous countries around the world. It’s overseen by the UK FCA and CySEC, as well as by South Africa’s Financial Sector Conduct Authority (FSCA). The broker offers 24/7 customer support by live chat and email, so you can get in touch anytime you need help.

Pros:

- Multi-asset CFD broker with forex, stocks, crypto, and more

- Spreads start from 1.0 pips with no deposit/withdrawal fees

- Trading platform is very easy to use

- Regulated in South Africa and Europe

- 24/7 customer support by live chat and email

Cons:

- Inactivity fee after 3 months

- Limited technical analysis tools in trading platform

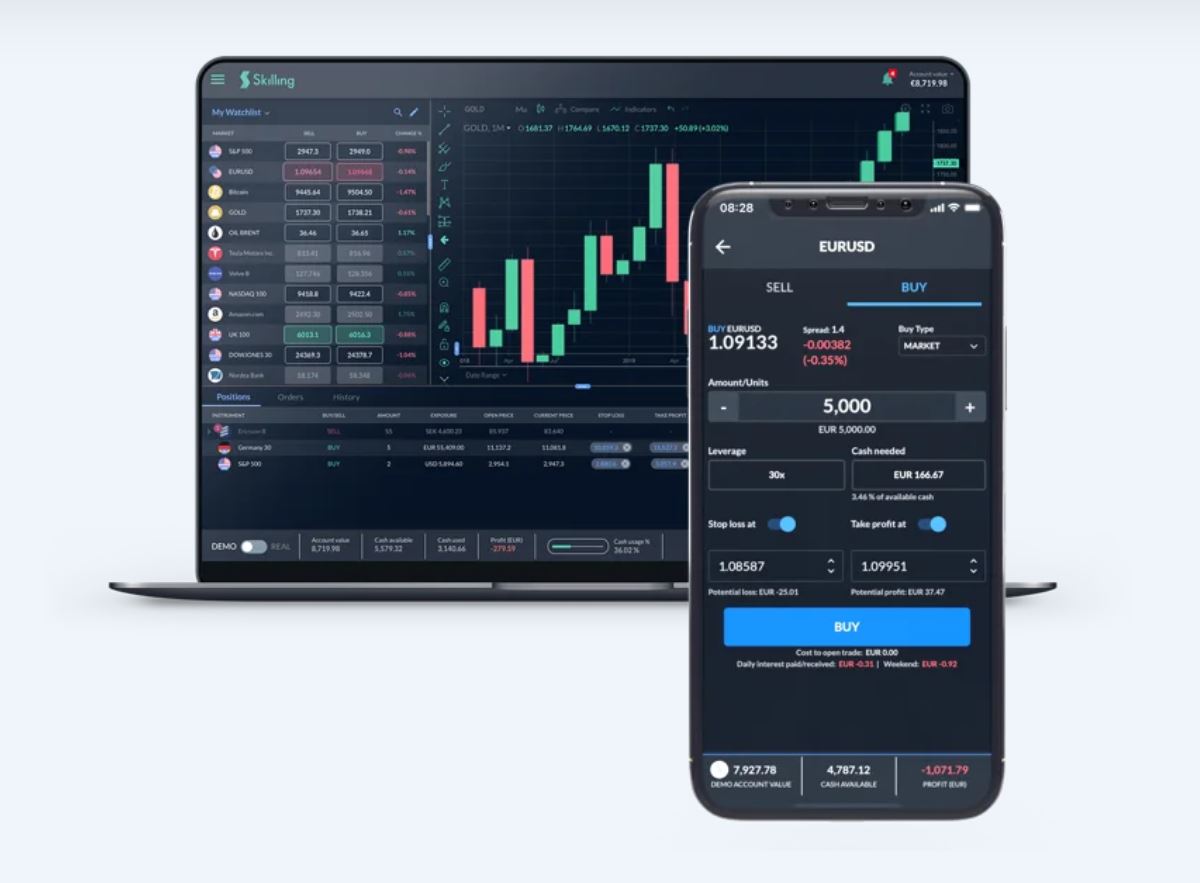

5. Skilling – Best Forex Broker for 500:1 Leverage

This broker is also inexpensive. Spreads for forex trading start at 0.7 pips, and you won’t find deposit, withdrawal, or inactivity fees at Skilling. In fact, for occasional forex traders, this is one of the cheapest forex trading platforms in South Africa.

Skilling also stands out for its selection of trading platforms. The custom Skilling Trader platform, available for web and mobile, is simultaneously easy to use and highly advanced. It doesn’t support forex signals, but you’ll find dozens of technical studies and drawing tools. The platform also includes a trade assistant module, which helps first-time traders navigate the order execution process.

In addition to Skilling Trader, you have access to Skilling cTrader and MetaTrader 4. cTrader is designed for algorithmic trading using the C# programming language. If you want to automate your trades, this allows you to do that with full control. MetaTrader 4 enables you to trade with forex signals and can help you backtest strategies for automation with cTrader.

Skilling Seychelles is regulated by Seychelles and offers customer support by phone, email, and live chat from Monday-Friday.

Pros:

- Trade forex with 500:1 leverage

- Spreads from 0.7 pips

- No inactivity fees

- Skilling Trader includes a trade assistant module

- Supports algorithmic trading with cTrader and MetaTrader 4

- Skilling Seychelles is regulated by Seychelles

Cons:

- Dynamic leverage model means that available leverage can change

Your capital is at risk.

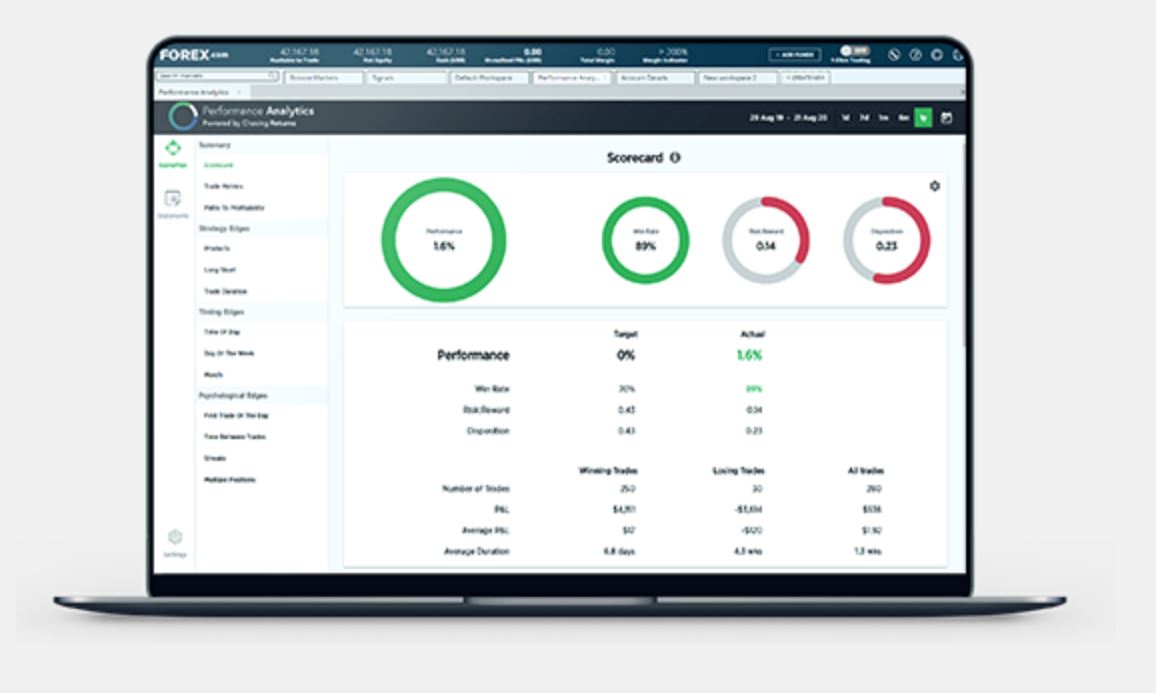

6. Forex.com – Best High Leverage Point Broker for Research

On top of that, Forex.com offers a Performance Analytics module with every trading account at no extra charge. This enables you to closely monitor your profit and loss and correlate it with factors like trade timing, currency pair, and common psychological traps. The Performance Analytics module is a key tool for improving the profitability of your trades.

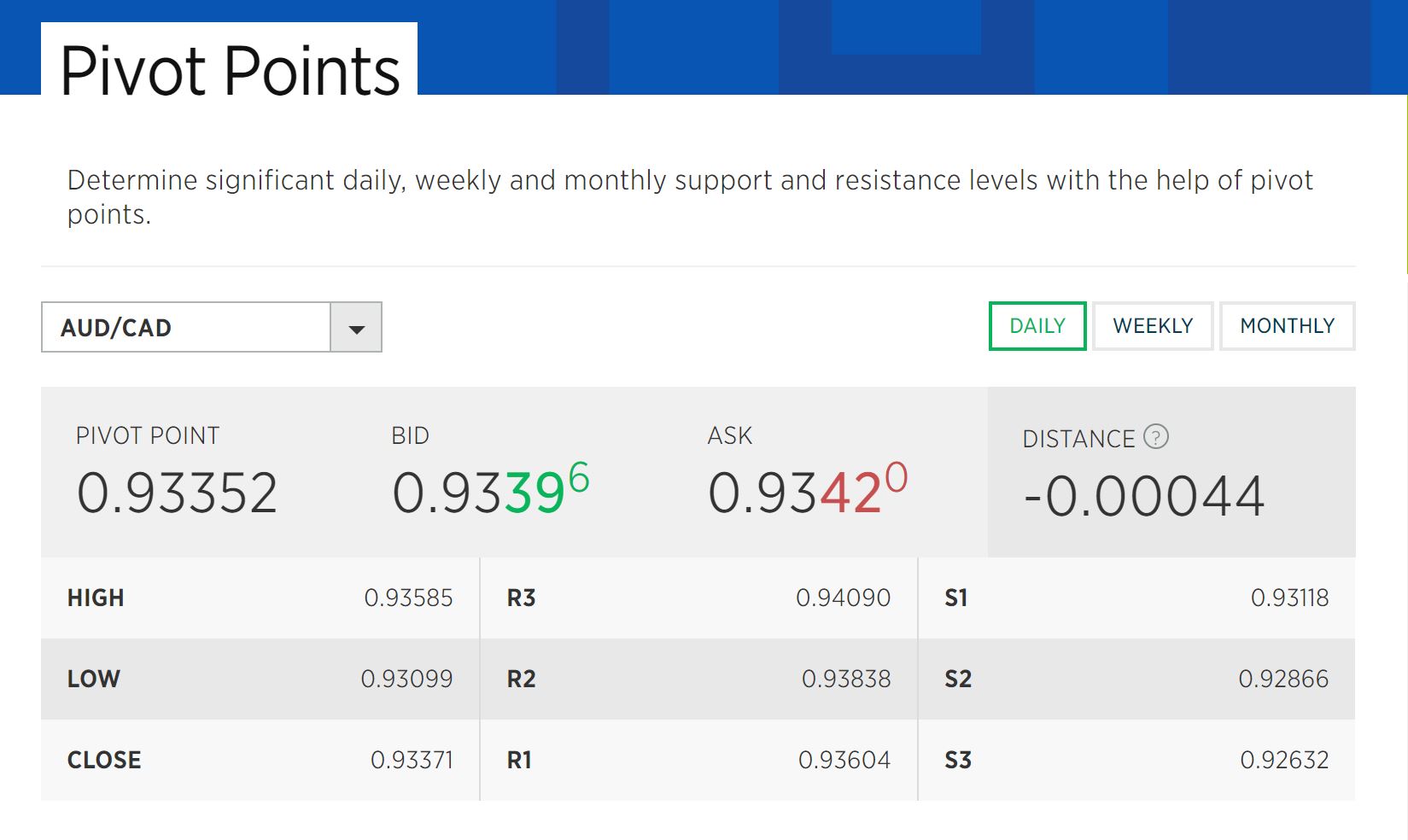

Forex.com also gives traders access to two comprehensive forex trading platforms: MetaTrader 4 and NinjaTrader. Both platforms enable you to use forex signals for technical forex trading and you can backtest strategies easily. You’ll also find pivot points analysis, professional research reports, and an economic calendar on Forex.com’s platform.

Forex.com offers trading on over 80 currency pairs and gives you access to 50:1 leverage. Spreads start at just 1.0 pips and the broker doesn’t charge deposit or withdrawal fees. Forex.com does charge an inactivity fee, but it’s just $15 after 12 months without trading.

The platform is regulated by the UK FCA and the Commodity Futures Trading Commission in the US. You can get in touch with Forex.com’s customer support team 24/5, but support is only available by email.

Pros:

- Trade 80+ forex pairs with 50:1 leverage

- Performance Analytics module helps you improve your win rate

- Integrates with MetaTrader 4 and NinjaTrader

- Includes pivot points analysis and research reports

- Regulated in the UK and US

Cons:

- Platform can be complex for beginner forex traders

Your capital is at risk.

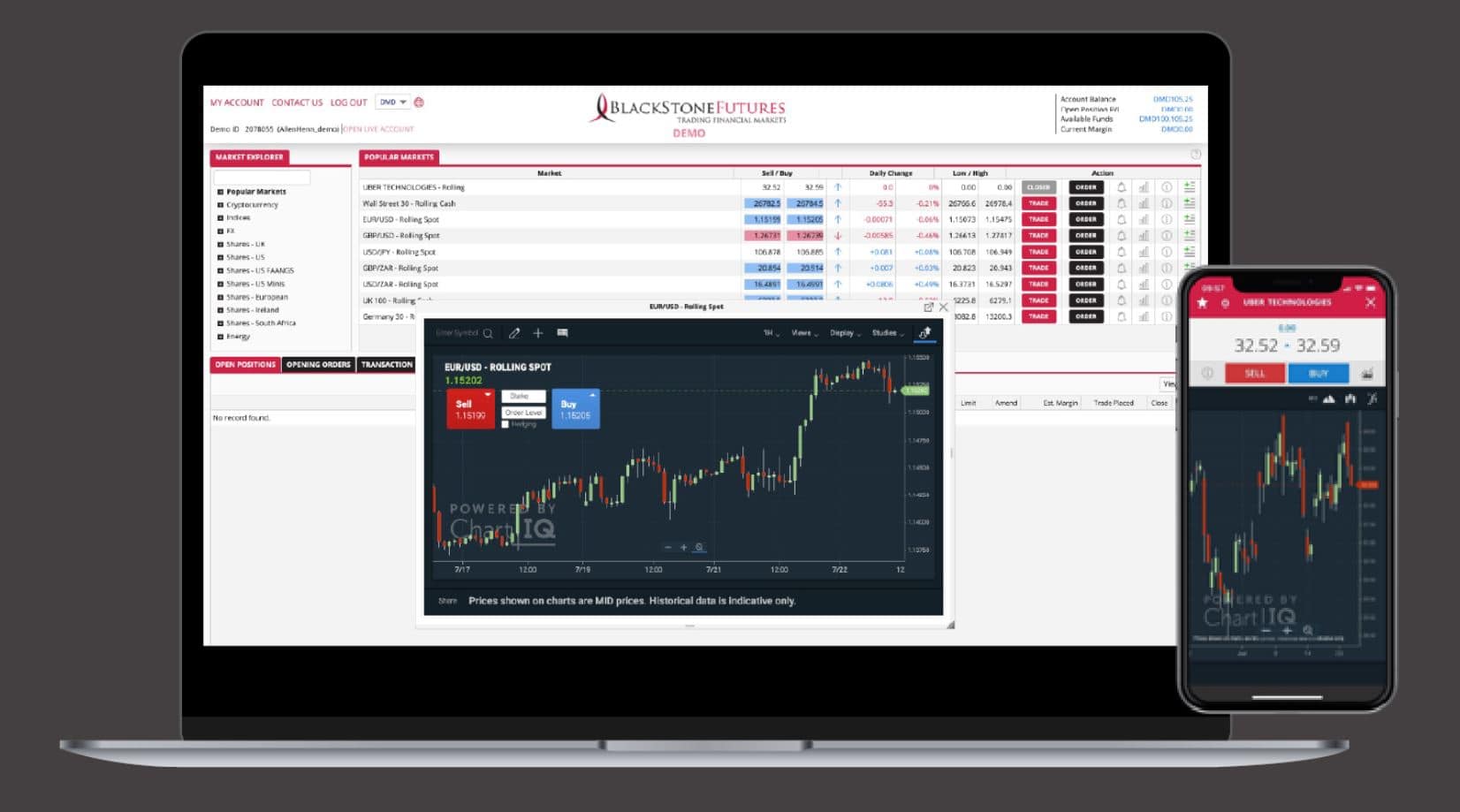

7. Blackstone Futures – Ultra Low-cost Forex Broker with High Leverage

Despite how inexpensive it is, Blackstone Futures allows traders to apply leverage up to 400:1 to major forex pairs. Importantly, all brokerage accounts include negative balance protection. So even when you’re trading with leverage, you can never lose more money than you have in your account if a trade goes against you.

The broker offers two trading platforms, MetaTrader 4 and CloudTrade. CloudTrade is Blackstone Futures’ proprietary trading platform and we’ve been very impressed by how powerful it is. The platform is highly customisable and offers advanced order options so you can tailor your trades to match market conditions. On top of that, CloudTrade is available as a mobile app.

Blackstone Futures also stands out for its exceptional customer support. You can get one-on-one client support by phone or email 24/5. Blackstone Futures also offers free same-day withdrawals, so it’s easy to access your money when you need it.

Blackstone Futures is based in South Africa and is one of the best FSCA regulated brokers,The broker has been operating since 2009 and has gained a large following in its home country.

Pros:

- Spreads as low as 0.6 pips

- Trade with 400:1 leverage

- All accounts include negative balance protection

- Integrates with MetaTrader 4

- 24/5 customer support by phone and email

- Regulated in South Africa

Cons:

- Limited selection of forex pairs

Your capital is at risk.

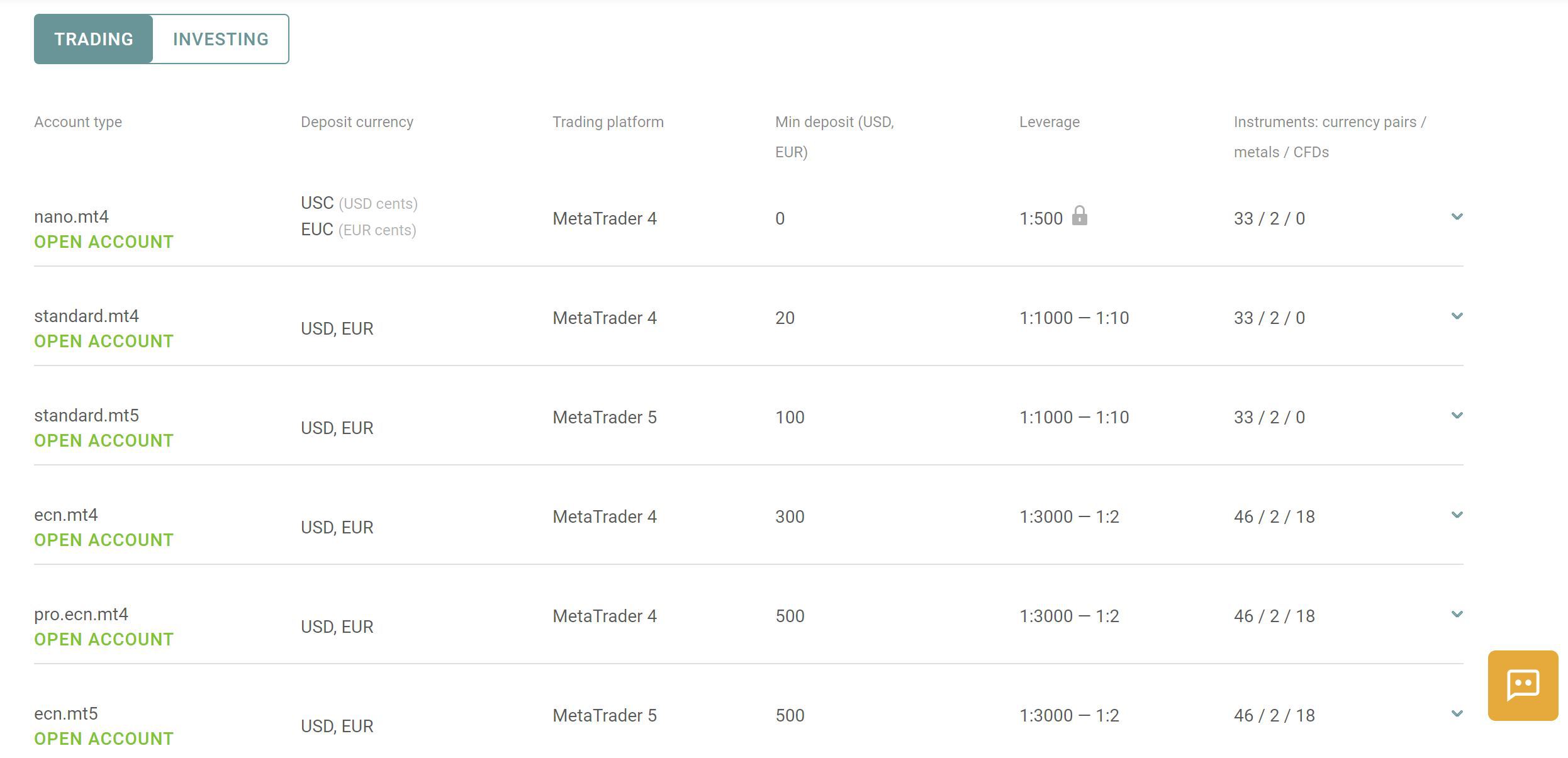

8. Alpari – Trade Forex with 3,000:1 Leverage in South Africa

What makes Alpari unique is that it offers more leverage than almost any other regulated brokers with high leverage. You can trade major forex pairs on 1,000:1 margin with a standard account, which only requires a $20 minimum deposit. If you open a nano account, which doesn’t require any minimum deposit, you can trade with 500:1 leverage.

Even more impressive, Alpari offers up to 3,000:1 leverage for high-volume traders. To access this amount of leverage – as well as a handful of exotic forex pairs that aren’t available to other accounts – you’ll need a $300 minimum deposit. You can trade with either the MetaTrader 4 or MetaTrader 5 platforms.

Another nice thing about Alpari is that the broker offers generous promotions and bonuses. The Alpari loyalty program, for instance, offers up to a 20% refund on your trading spreads. If you refer a friend to Alpari, the broker will give you a $35 referral bonus.

Alpari requires you to deposit funds into your account via a wire transfer since the broker isn’t part of most major financial networks. You cannot pay by credit or debit card, although you can use the cryptocurrency Tether to fund your account.

Pros:

- Trade with up to 3,000:1 leverage

- No minimum deposit to open a nano account

- Supports MetaTrader 4 and 5

- 20% refund on spreads through the loyalty program

Cons:

- Loosely regulated in St. Vincent and the Grenadines

- Doesn’t accept credit or debit cards

Your capital is at risk.

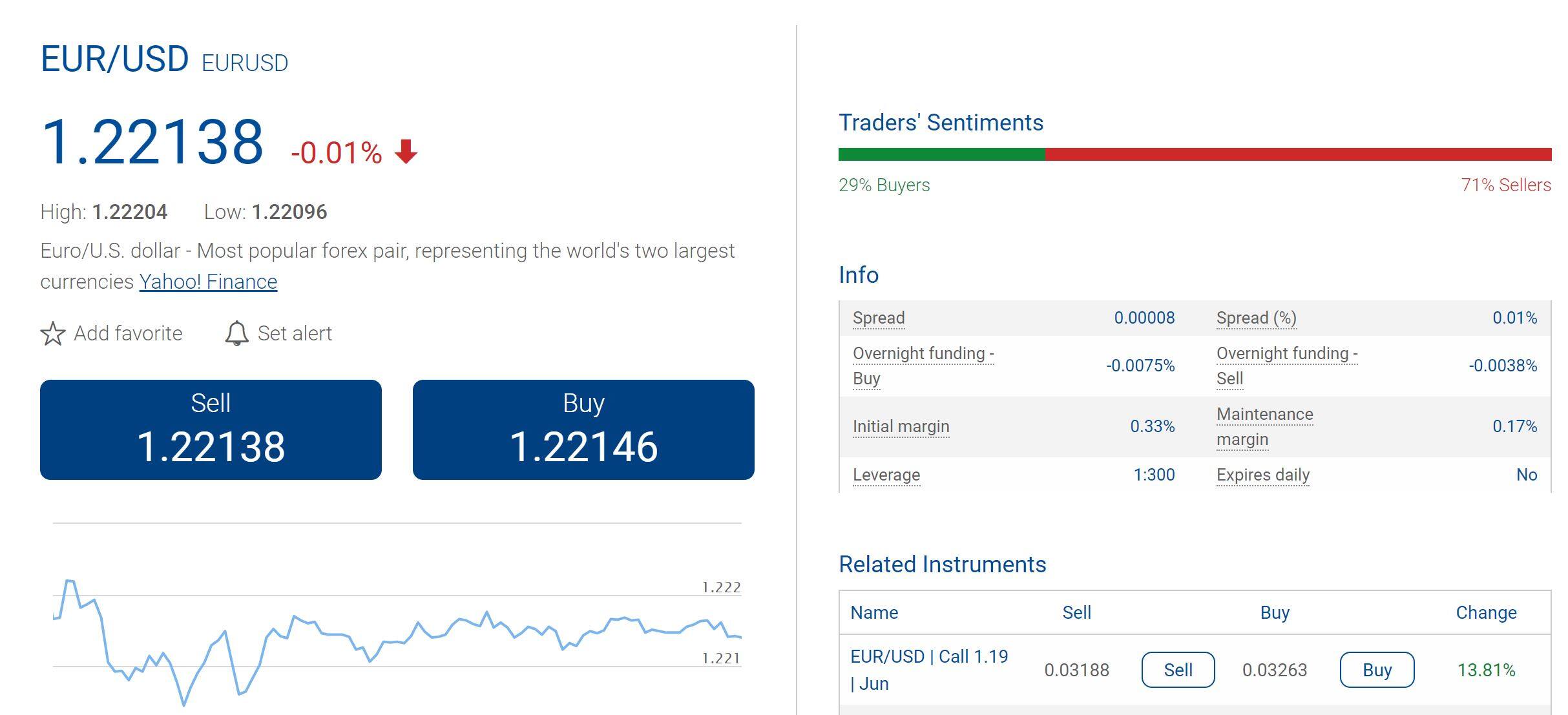

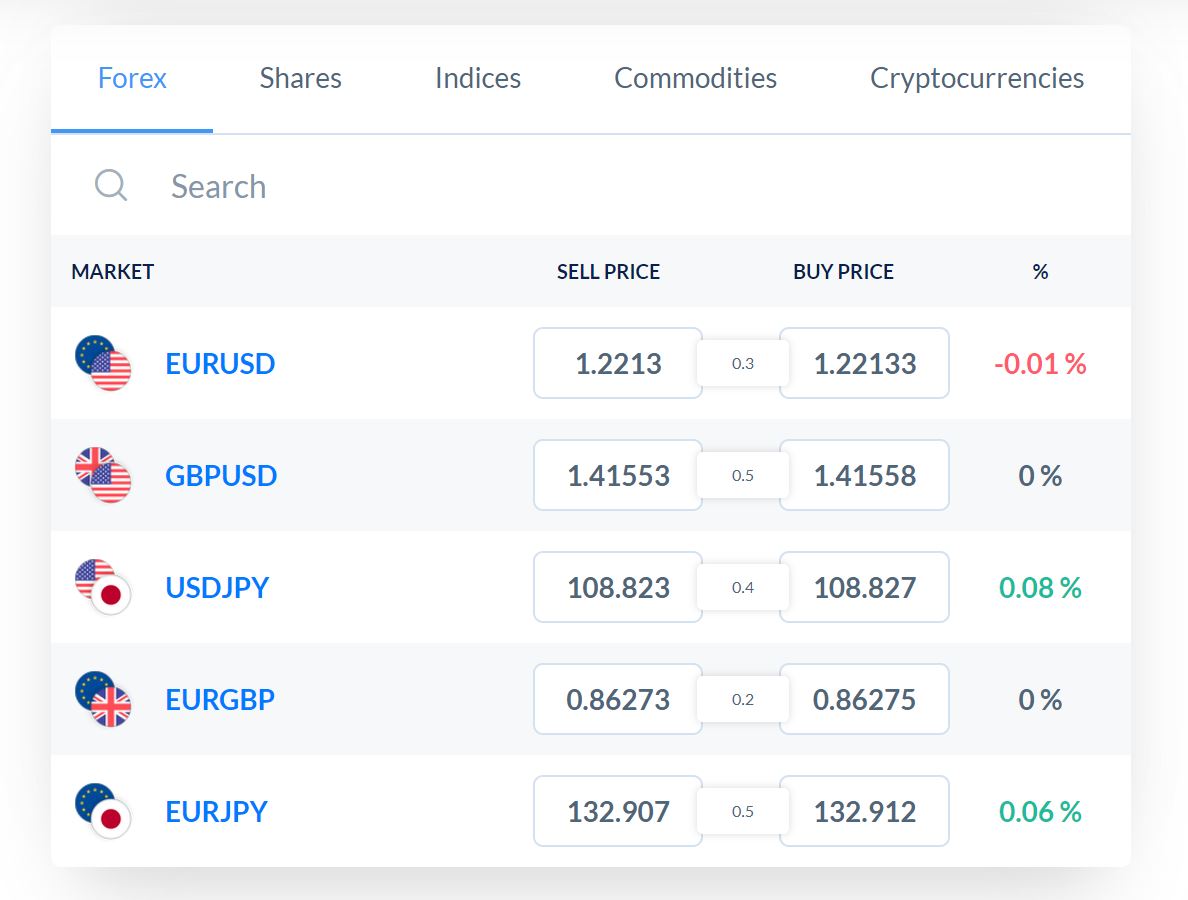

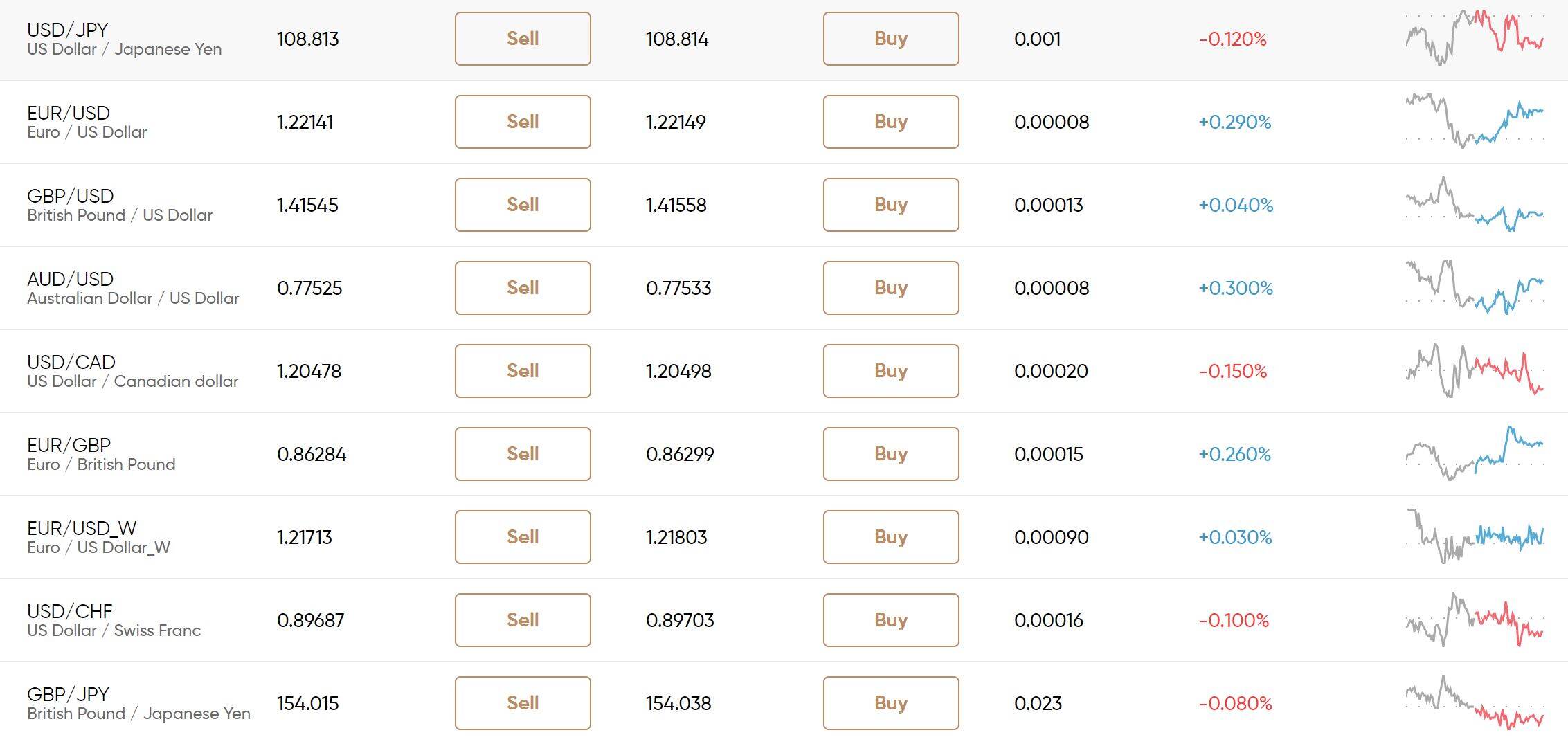

9. Capital.com – Overall Best High Leverage Forex Broker

To start, Capital.com offers trading on over 140 currency pairs with leverage up to 1:30. That means that you’re not only limited to trading major and minor currency pairs – you can also specialize in volatile exotics that see lower than average trading volume. The broker doesn’t charge commissions and spreads start from just 0.8 pips.

Capital.com’s trading platform includes artificial intelligence software to help you analyze your trading behavior. If all your best trades are coming before 10 am, for example, the software will let you know. This is extremely helpful for new forex traders because it lets you know what you’re doing well and what you could change to be more profitable.

We also love Capital.com’s library of educational tutorials and videos. You’ll find explainers about the forex market specifically and introductions to popular technical trading strategies. Capital.com even has a dedicated mobile app for education, which includes quizzes so you can test your knowledge before trading.

Capital.com requires a minimum deposit of just $20 to open an account. There are no deposit, withdrawal, or inactivity fees. The broker’s customer service team is available 24/7 by phone, email, and live chat if you need help. Capital.com is regulated by the Cyprus Securities and Exchange Commission (CySEC).

Pros:

- Trade over 140 forex pairs

- Spreads from 0.8 pips and no inactivity fee

- AI software helps you improve your trading profits

- Tons of educational resources, including a mobile app

- Open an account with a $20 minimum deposit

- Regulated by CySEC

Cons:

- Leverage limited to 1:£0 for major forex pairs

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

High Leverage Forex Brokers Fees & Leverage Comparison

Now that you know more about the best high leverage forex brokers in South Africa, let’s take a look at how their fees and leverage offerings stack up.

| Maximum Forex Leverage | Trade Commission | EUR/USD Spread | Deposit/Withdrawal Fees | Inactivity Fees | |

| Capital.com | 1:30 | None | 0.8 pips | None | None |

| AvaTrade | 400:1 | None | 0.9 pips | None | $50 per quarter after 3 months |

| VantageFX | 500:1 | None | 1.4 pips | None | None |

| FinmaxFX | 200:1 | None | 3.0 pips | None | $80 per month after 2 months |

| Plus500 | 30:1 | None | 1.0 pip | None | $10 per month after 3 months |

| Skilling | 500:1 | None | 0.7 pips | None | None |

| Forex.com | 50:1 | None | 1.0 pip | None | $15 per month after 12 months |

| Blackstone Futures | 400:1 | None | 0.6 pips | None | None |

| Alpari | 3000:1 | None | 0.9 pips | None | $5 per month after 6 months |

High Leverage Explained – What You Need to Know

Wondering what it means for a forex broker to have a high leverage point? In this section, we’ll cover everything you need to know about trading with leverage.

What is Leverage?

Leverage enables you to trade with more money than you have on hand. When you trade with leverage, you’re essentially borrowing money from your broker to fund your trade. You only need to put up a fraction of your total trade size, and your broker takes care of the rest.

The amount of leverage you can apply to a trade refers to the ratio between how much money you have to put in versus how much you can borrow from your broker. For example, if you want to open a $1,000 position and your broker offers 100:1 leverage, you would only need to put in $10. Your broker will cover the remaining $990 to open your trade.

What’s Considered High Leverage?

There’s no standard definition for what’s considered high leverage. However, most traders would say any leverage above 30:1 is high. That’s because the European Securities and Markets Authority (ESMA) has a rule limiting brokers regulated in Europe to offering 30:1 leverage for retail forex trading accounts.

In South Africa, where forex brokers aren’t constrained by ESMA rules, you’ll find forex brokers with high leverage up to 500:1 or even 1,000:1. That means that if you want to open a $1,000 forex trade, you would only need to commit as little as $1 to the trade.

Still, 30:1 leverage is a lot, especially for newer traders. That’s why we’ve included several European brokers like Capital.com and Plus500 in our roundup of the best high leverage forex brokers.

What are the Benefits of High Leverage?

There are several reasons why forex traders might want to trade with high leverage.

The first is that leverage amplifies your profits. If you trade with 100:1 leverage, a 0.1% movement in the price of a forex pair translates to a 10% change in the value of your position. This is incredibly important in the world of forex, where currency pairs typically only move relative to one another by small amounts.

However, keep in mind that leverage is a double-edged sword. When you trade with 100:1 leverage, a 0.1% drop in the value of the currency you own translates to a 10% loss in your trading account value. So, high leverage is generally best for aggressive traders with a high risk tolerance.

Another benefit to choosing market execution brokers with high leverage is that they enable you to open more positions than you would otherwise be able to. For example, if you have $1,000 to trade, you could open a single forex position worth $1,000. But with 100:1 leverage, you could open 100 different positions each worth $1,000. That’s because when you apply 100:1 leverage, you only need to commit $10 to each trade.

What Other Assets Can You Trade with High Leverage

Many of the best high leverage forex brokers don’t limit you to trading forex. In fact, they offer a wide range of assets to trade with high leverage.

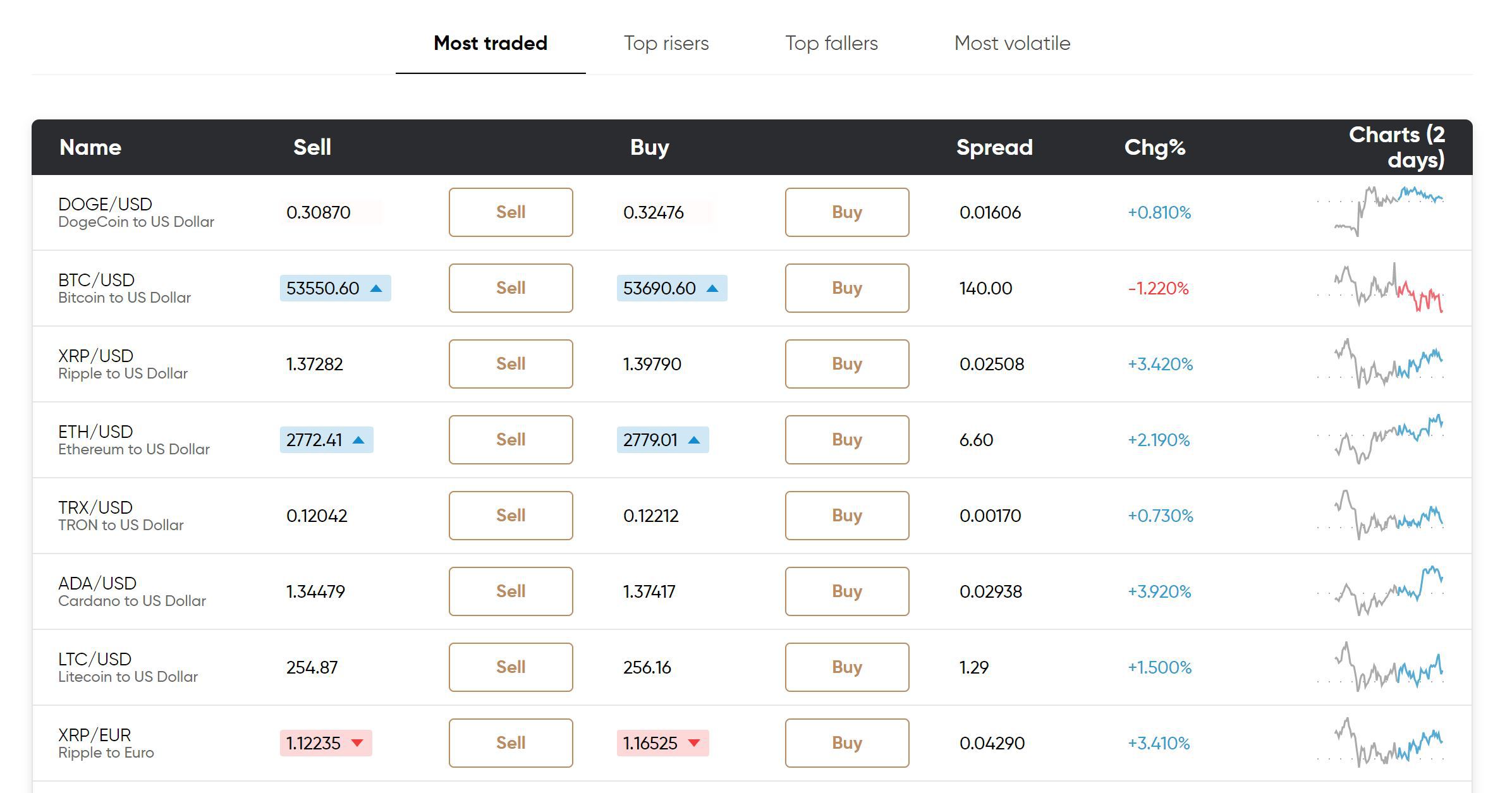

Cryptocurrencies

Cryptocurrency trading has become increasingly popular and it has a lot in common with forex trading. With cryptocurrency trading, you can buy Bitcoin or trade the Bitcoin/USD currency pair. Alternatively, you can choose from dozens of popular cryptocurrencies and even trade instruments that pit them against one another.

Since cryptocurrencies often experience large price movements, brokers typically limit how much leverage you can apply. For brokers that follow ESMA rules, the leverage limit for cryptocurrencies is just 2:1.

Stocks and ETFs

Stocks and ETFs can be traded at most major brokers. Some brokers have a limited selection of just the most popular US stocks, while others like Capital.com allow you to buy shares from around the globe.

Leverage limits for stock and ETF trading vary widely, and they can even change depending on how popular the stock you want to trade is. European stock trading platforms can offer a maximum of 5:1 leverage for equities.

Stock Indices

Stock indices are instruments that track a whole country’s stock market. For example, the S&P 500 and FTSE 100 are stock indices that track the US and UK stock markets, respectively.

Indices can be traded with more leverage than individual stocks. Depending on the index trading platform you use and the index you want to trade, you can typically apply leverage up to 20:1.

Commodities

Commodities include assets like gold, silver, crude oil, and wheat. When trading commodities, you only have to buy and sell CFD contracts, so you never have to take possession of the underlying product itself.

How much leverage you can use for commodity trading varies widely between CFD trading platforms and products. You might be able to trade gold with 20:1 leverage, for example, but only use 10:1 leverage for oil trading.

How to Get Started with a High Leverage Forex Broker

Ready to start trading forex? We’ll show you how to get started with one of our top-rated brokers with high leverage: Capital.com.

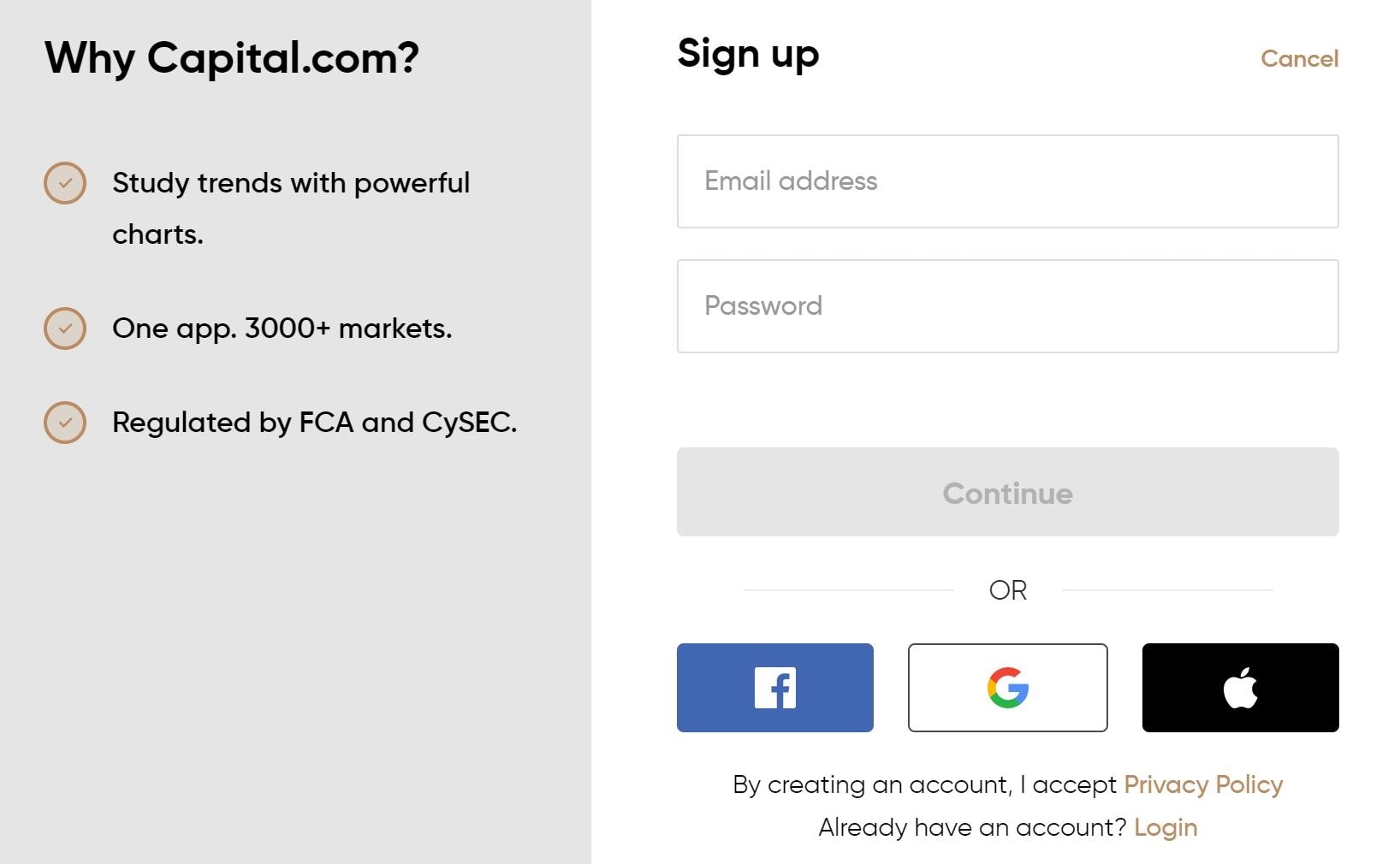

Step 1: Open a Trading Account

To get started with Capital.com, head to the broker’s website and click ‘Trade Now’ to register a new trading account. Enter your email and a password to begin.

Step 2: Verify Your Identity

Capital.com is regulated by the UK Financial Conduct Authority, which requires the broker to verify customers’ identities. You can complete this step online in just a few minutes. Simply upload a copy of your driver’s license or passport and a copy of a recent utility bill or bank statement that shows your address.

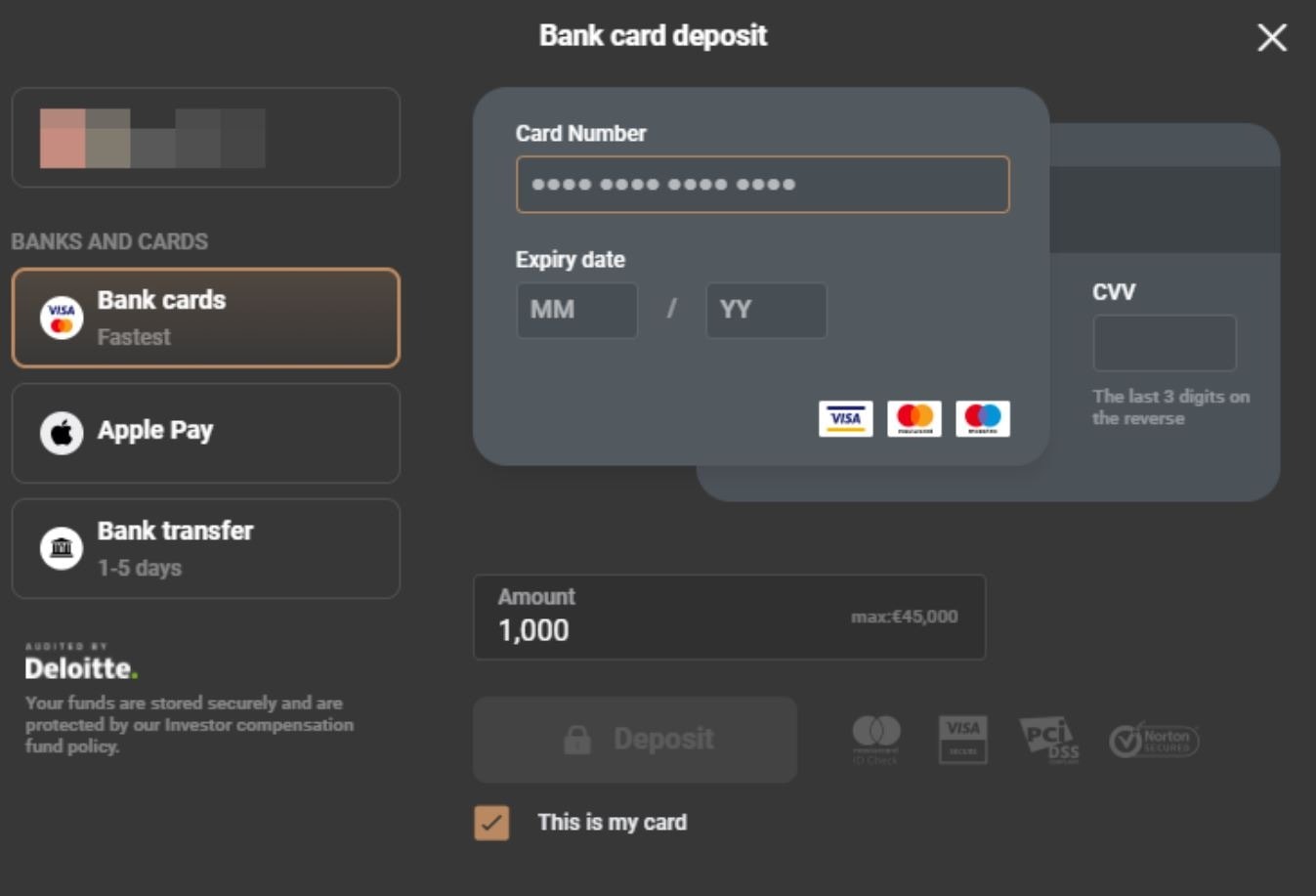

Step 3: Deposit Funds

The next step is to fund your new trading account. Capital.com requires a minimum deposit of just $20 (280 ZAR), which you can pay by credit card, debit card, or bank transfer.

Step 4: Trade Forex

Now you’re ready to trade forex with Capital.com. Search for the currency pair you want to trade in the Capital.com dashboard. When it appears, click on it and then click ‘Buy’ to open a new order form.

In the order form, enter the amount of the currency pair you want to purchase. Then choose how much leverage to use, up to 1:30 for major forex pairs or 20:1 for minor forex pairs. You can also set a stop-loss level or take-profit level for your trade.

Once you’re ready, click ‘Open Trade’ to trade forex with leverage.

Capital.com – Best High Leverage Forex Broker South Africa

The best high leverage forex brokers in South Africa enable you to trade currency pairs with leverage up to 1:30 and few fees. By trading with high leverage, you can make bigger bets on the forex market and open more positions to hedge your bets.

If you’re ready to start trading forex with the best high leverage forex broker, click the link below to open an Capital.com account today!

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

FAQs

Are there costs to using leverage?

Most high leverage brokers charge rollover fees, also known as swap fees, when you hold a leveraged position overnight. For this reason, leverage is best used when day trading forex.

Can I choose how much leverage to use?

Some forex brokers allow you to specify exactly how much leverage you want to use. Others automatically apply the maximum leverage to every trade or give you a few leverage levels to choose from.

How much money do I need to trade forex with high leverage?

You can start trading forex with high leverage with just a small initial deposit. Brokers like Capital.com require a deposit of $20 (280 ZAR) to open an account.

Which forex broker has the highest leverage?

Alpari has the highest leverage of any South African forex broker we reviewed. You can trade major currency pairs with leverage up to 4,000:1.

Should I trade forex with high leverage?

Trading forex with high leverage brokers increases your potential profits, but also your potential risk. Leverage is best for forex traders who have a high risk tolerance and who are focused on day trading.