How To Buy Johnson & Johnson Shares in South Africa – With 0% Commission

Johnson & Johnson (J&J) is one of the oldest pharmaceutical companies in the United States and its one dose covid-19 vaccine has been dubbed a “game-changer” by health experts. In this guide, we’ll show you How to Buy Johnson & Johnson shares in South Africa with 0% commission and show you why the company’s shares are a must-buy today.

air jordan 1 low

nike air jordan 4 oil green

best jordan 4

nike air jordan 4 black canvas

nike air jordan 1

jordan for sale

jordan shoes online

best jordan shoes

nike air jordan women

nike air jordan 1 retro high og

nike air jordan mid 1

jordan shoes online

jordan 4 red thunder

air jordan 1

off white jordan 1

nike air jordan red and black

best jordan 4

jordan 1 sale

jordan 1 for sale

nike air jordan 11 midnight navy

nike air jordan 1 retro high

nike air jordan high tops

jordan shoes for men

jordan 4 black cat

nike air jordan shoes

nike air jordan low

nike air jordan 4 retro trainers

mens nike air jordan

jordan outlet

nike air jordan 4

jordan for sale

nike air jordan mid

best jordan 1

air jordan sale

sales of air jordan

nike air jordan 11

nike air jordan 4 black

nike air jordan mid

cheapest jordan 4

nike air jordan mens basketball shoes

nike air max 90 mens on sale

How to Buy Johnson & Johnson Shares in South Africa – Quick Guide 2021

Step 1: Open an account with Capital.com – Go to the official website of Capital.com and click on ‘Trade Now’ to open a free account.

Step 2: Upload ID – You need to verify your identity before you can trade on the Capital.com platform. Submit a copy of your official passport, driver’s license, and national ID to get started.

Step 3: Fund your account – You will need to make a minimum deposit of $20 (about 283.38 ZAR). You can pay with a credit/debit card or make a bank transfer.

Step 4 – Buy Johnson & Johnson Shares – Search for ‘JNJ’ and click on ‘Buy’ on the first result that pops up. Input the amount you want to invest and confirm your trade.

Step 1: Choose a Stock Broker

To buy Johnson & Johnson shares in South Africa, you will need to invest through a trusted broker that offers exposure to US stocks. In your search, you will come across many stock brokers who offer these services and it may be difficult to choose the best one for you.

What should guide your decision is the broker’s fee structure and overall trading experience. To make this decision easier, we will show you two of the best stock brokers that will let you invest in Johnson & Johnson shares commission-free.

1. AvaTrade – Trade Johnson & Johnson Shares With 0% Commission

AvaTrade is another zero-commission broker that offers trades for Johnson & Johnson shares in South Africa.

Just like Capital.com, it offers zero-commission trades to over 600 stocks globally. It is also a regulated broker and has licenses from regulators across the world, including South Africa’s Financial Sector Conduct Authority (FSCA). AvaTrade offers a great trading platform specific to the user’s unique trading strength. New traders can stick to the proprietary trading platform which is user-friendly and offers a rich set of trading features, and price alerts.

More experienced traders can switch to the platform’s MetaTrader 4 and 5 (MT4 and MT5) to create custom technical indicators. Unlike Capital.com, AvaTrade offers a social trading platform for iOS and Android devices. This allows new traders to mimic the trading moves of more experienced traders. It also enables users to connect with other traders to learn about the latest moves, news, and more. AvaTrade requires a minimum deposit of $100 (about 1,415.38 ZAR). You can fund your account through multiple channels like credit cards, debit cards, or through your local bank transfer. AvaTrade’s support team is available 24/5.

Pros

- Regulated by the FSCA

- 0% commission on CFD trades

- Supports copy trading

- Multiple trading platforms for different users

- Over 600 stocks for trading

- Rich set of trading features

Cons

- High inactivity fee

- Few educational resources

- Limited global shares on offer

Your capital is at risk.

2. Capital.com – Overall Best Broker To Buy Johnson & Johnson Shares in South Africa

Our number one pick for buying Johnson & Johnson shares in South Africa is global CFD and FX firm Capital.com. Operating out of offices in the UK, Cyprus, and Belarus, Capital.com gives access to over 3,000 global shares from the US, UK, and much of Europe.

Trading CFDs with Capital.com is commission-free and you are charged low spreads for your trade. In terms of minimum deposit, you can fund your account with 283.08 ZAR or $20 making it a great platform for retail investors. You can make deposits through your debit/credit card, and bank transfers. Capital.com is not only trying to capture retail traders as it operates a separate trading platform for institutional investors called Prime Capital Division. With its AI-centered trading engine, traders can make better trading decisions.

Capital.com is also a regulated broker meaning your funds are safe with them. Unlike most traditional brokers, Capital.com uses a segregated account system that separates users’ funds from the company’s finances. This way, accountability is ensured. Capital.com offers a web and mobile trading platform and users can easily gain access to rich trading features like technical charts, watchlists, a news feed, trading tools, and price alerts.

Capital.com also integrates with TradingView making it easy for users to create custom indicators before making a trading decision. To help new investors familiarize themselves with the financial markets, Capital.com offers educational resources, including videos, articles, and interactive courses that teach users everything there is to know about trading and how to create custom trading strategies. It even has a dedicated app for this purpose.

Pros

- 100% commission-free trading with low spreads

- Trade over 3,000 shares from the global markets

- Great educational resources for learning

- $20 minimum deposit

- Charting platform works with TradingView

- 24/7 customer support

- No deposit or withdrawal fees

Cons

- Price alerts are not available on the web platform

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Step 2: Research Johnson & Johnson Shares

Johnson & Johnson is an American multinational corporation founded in 1886. The company is situated in New Jersey, United States, and is the largest pharmaceutical company in the world. Before we move into buying Johnson & Johnson shares, we would lay bare the company's financial track record. We’ll cover everything you need to know about the Big Pharma company and the best broker to gain exposure through.

What is Johnson and Johnson?

Robert served as the first president of the company after its inception in 1886. This saw the early medical startup create a line of ready-to-use sterile surgical dressings. They later added household products, and medical guides as the company expanded. From 1887, the company sold medicated plasters such as Johnson & Johnson’s Black Perfect Taffeta Court Plaster.

J&J also manufactured the world’s first surgical products, including sutures, absorbent cotton, and gauze. The American pharmaceutical company is hugely popular for its Baby Powder and its vast array of baby-care products and maternity kits.

Following on these and other successes, Johnson & Johnson went public in 1944 through an initial public offering (IPO) to global acclaim. Johnson & Johnson may be a household name but its share price has had a tumultuous ride in the general stock market. It traded below $1 in 1970 and only began to pick up momentum as the company began penetrating new markets.

Johnson and Johnson Share Price

At the beginning of the 21st century, JNJ stock rose to $28.53. It has maintained an upward trajectory ever since surging almost two-fold a decade later to $47.05 in 2010.

JNJ's stock price has continued its uptrend ever since surging to $151.21 in 2020. Its all-time high was $173.65 per stock. The price later fell to $164.23 following market correction. It has grown 3.96% from 2020 to 2021 in the year-over-year growth metric.

Currently, most of Johnson & Johnson’s share price movement is influenced by its coronavirus vaccines. Its inoculation against the SARS-Cov-2 (the official name for coronavirus) was seen as a “game-changer when it received a Food and Drug Administration (FDA) approval in late February.

This was because the J&J vaccine solution requires only one dose as against two doses that close competitors like Moderna and Pfizer use. Using a viral vector method, the J&J vaccine introduces a different virus as a bit of coronavirus’ genetic material into the cells. The patient’s immune system then learns to identify and overcome the virus.

Another major plus with the J&J vaccine is that it can be stored in normal refrigerators while the Pfizer and Moderna vaccines need to be stored below freezing temperatures to retain their efficacy. However, the Johnson & Johnson vaccine has not performed up to expectation with only 4% of its total dose administered in the US so far. This is because patients who took the vaccine suffered serious blood-clotting disorder.

The FDA asked that vaccinations with the J&J vaccine should stop for ten days in April. Johnson & Johnson was dealt a further blow after regulators demanded it pulls out tens of millions of doses from its Baltimore plant on the premise that they are contaminated. This has further impacted the JNJ stock performance making the company count its losses. However, Johnson & Johnson’s position as a global pharmaceutical brand is paying international dividends. The Kenyan government is looking to vaccinate its citizens with Johnson & Johnson’s covid-19 vaccine, according to Principal Secretary Susan Mochache. This will see the African country receive over 10 million doses of the vaccine through the African Union Mechanism.

International patronage for its one-dose vaccine could help the American company recover some of its losses in the long term. At press time, the company has a market cap of $435.09 billion and has a price-to-earnings ratio (P/E ratio) of 19.69.

Johnson & Johnson Share Dividends

Johnson & Johnson, much like most public companies, has been paying shareholder dividends yearly. The percentage may vary from year to year but it has paid an average median of 4% yearly. Its Q1 dividend payment was $1.01 per share of the company’s ordinary stock.

Should I Buy Johnson & Johnson Shares?

Should you buy Johnson & Johnson shares? We think you should. Here are a few reasons:

Johnson & Johnson Is A Win For The Long Term

Looking at today’s news stories may make you feel that the largest pharmaceutical company has missed out on a major opportunity through its covid vaccine. We are not denying that fact but there are other hidden gems in the narrative.

Once the company gets a handle on the side effects of the dose, its vaccine could become a best-seller in the world of medicine. This is because the ease of storage and the fact that a patient has to use it just once instead of taking two jabs is a great selling point for the company. This is more appealing to communities who do not have adequate access to healthcare facilities as they can just take it once and be immune to the deadly disease. Also added to this is the fact that the vaccine is reported to be effective against hospitalization and death.

A Clear Winner In The Biotech Marathon

Johnson & Johnson did not become #1 in the game by luck. The 130-year-old has continually innovated and expanded into niche markets like baby-care products having more than 30% of the market share to itself. Even though it trails rivals like Pfizer and Moderna in the vaccine arms race, the company has multiple revenue streams to fall back on, making it one of the most diversified biotechnology companies in the world. Market analysts have given the JNJ stock a ‘Buy’ verdict with a 12-months median forecast of $187, and a high estimate of $204 (about 2887.37 South African Rand.)

Open an Account & Buy Shares

Are you ready now to buy Johnson & Johnson shares? We’ll show you how to easily open a free account with Capital.com – one of the best stock apps available to traders and trade Johnson & Johnson shares commission-free.

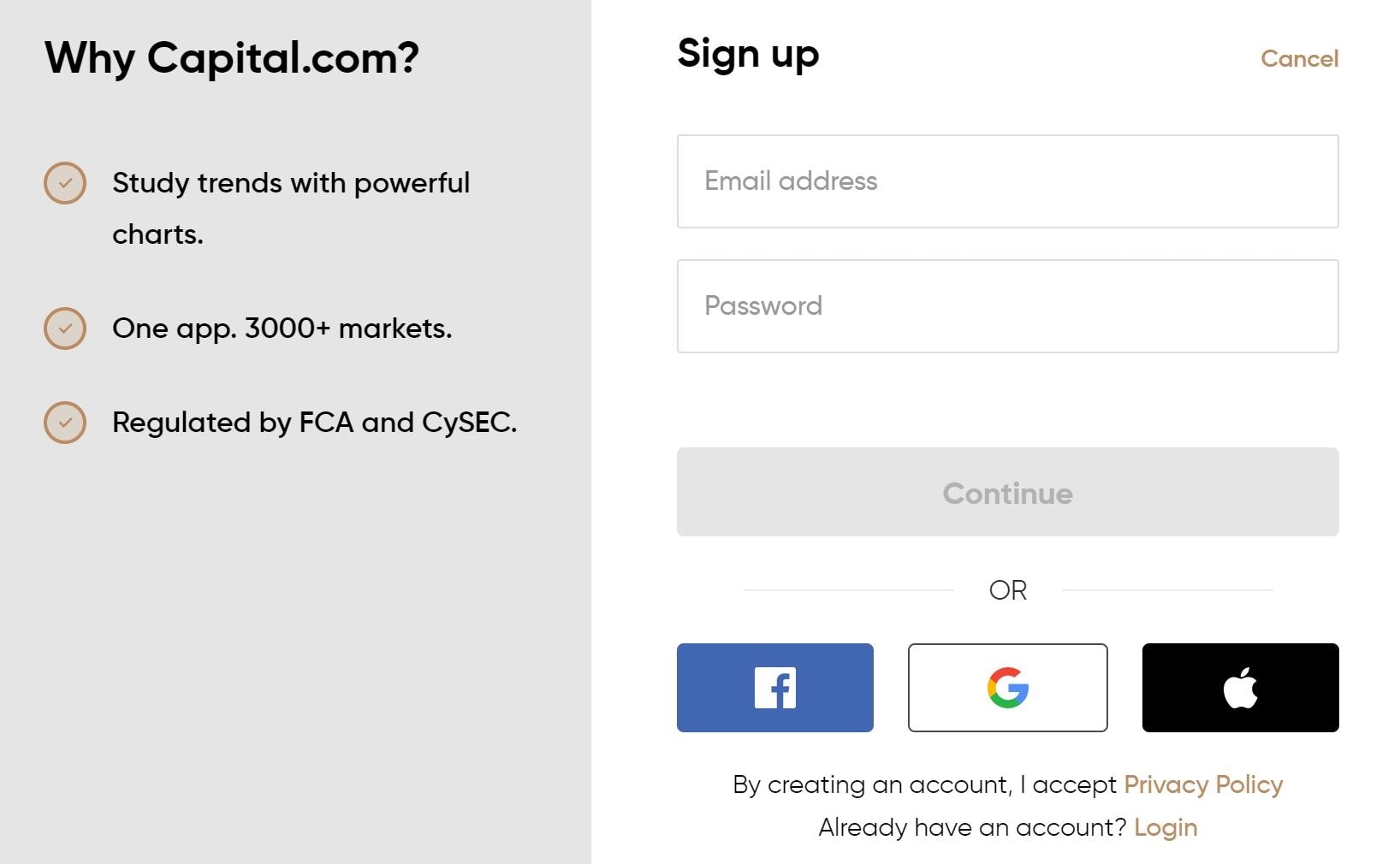

Step 1: Open a Capital.com Account

To get started, visit the official website of Capital.com and click on the ‘Trade Now’ button. You can find that in the top right-hand corner. Enter your email address and choose a unique, strong password. If you do not want to do this, Capital.com allows you to sign up with your Google, Facebook, and Apple account with just a click.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Step 2: Verify your Account

Before you can buy Johnson & Johnson shares, you need to verify your identity. You can do this easily by uploading a copy of your official passport, driver’s license, or national ID. Once you complete this, Capital.com will verify your identity within minutes.

Step 3: Fund your Account

The next step is to fund your account and you can do this through several payment channels. You can make a minimum deposit of $20 (about 283.08 ZAR). Deposits are entirely free to make, and the following methods are accepted:

- Credit card

- Debit card

- Bank Wire Transfer

- Apple Pay

- Trustly

- Giropay

- iDeal

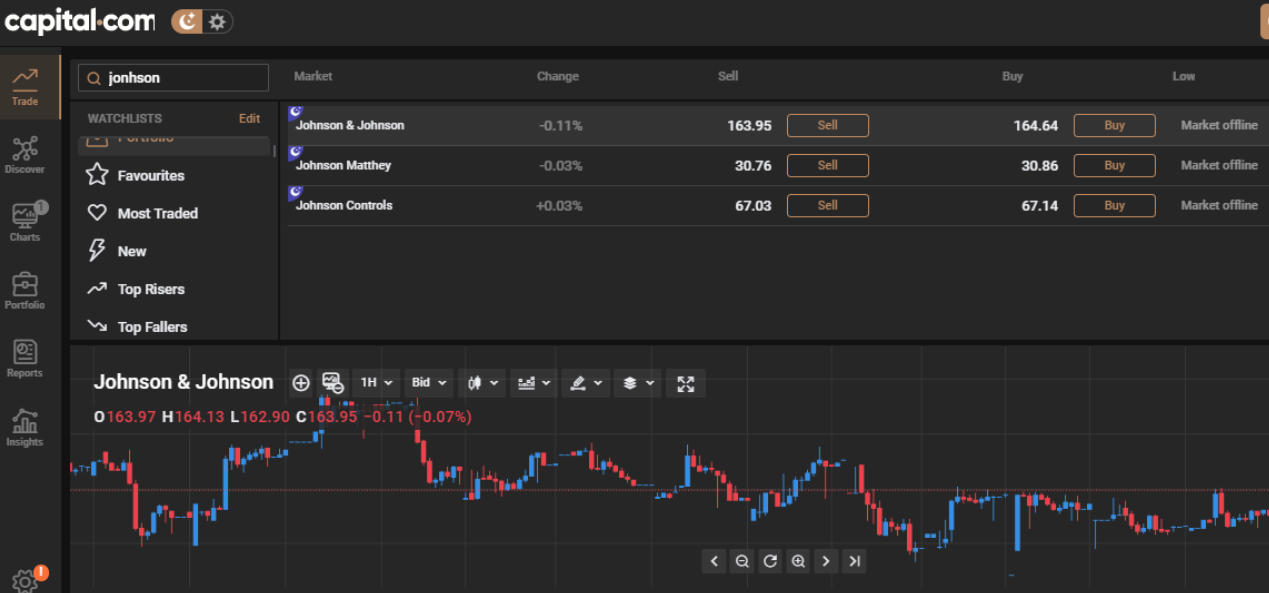

Step 4: Buy Johnson & Johnson Shares

Once your deposit is confirmed, click on the search bar at the top of the Capital.com dashboard and type in ‘JNJ.’ You will be shown ‘JNJ CFD,’ click on ‘Buy’ to get started. On the order page that follows, fill in the amount you want to invest in Johnson & Johnson in US dollars. It's advisable that you also put a stop-loss order and take profit level to protect your investment. When you’re comfortable with the order form, click on ‘Open Trade’ to buy Johnson & Johnson shares with Capital.com.

Capital.com – Buy & Sell Johnson & Johnson Shares in South Africa With 0% Commission

Johnson & Johnson has been one of the major players in the global pandemic scene. Making over 3.9 million doses with tens of millions more in the works, the company is set to make $10 billion before the end of the year. Its share price has been a small reflection of this success rising 3.96% on the year-over-year period. The fact that it is currently trading under $200 makes Johnson & Johnson shares a bargain for any investor. Johnson & Johnson’s recurrent expansion into niche consumer markets could push its price much higher in the next year or so. If you are thinking of buying Johnson & Johnson shares, click the link below and get started on Capital.com for commission-free trades.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.