How to Trade NASDAQ in South Africa 2022 – Best NAS100 Brokers

If you’re based in South Africa and wish to trade the NASDAQ – you’ll be speculating on the future value of one of the largest indices globally. After all, the index includes heavyweight US companies such as Apple, Amazon, Facebook, Microsoft, and Tesla.

In this guide, we discuss how to trade the NASDAQ in South Africa from the comfort of your home. On top of covering the basics, we also explore NASDAQ trading strategies and which brokers to consider using.

How to Trade NASDAQ in South Africa Quick Steps

Below you will find a quickfire guide on how to trade the NASDAQ in South Africa.

- Step 1: Open an Account With Capital.com: In order to trade the NASDAQ, you’ll need to open an account with a top-rated broker that offers a market on this stock index. Capital.com stands out for us, as the platform allows you to trade the NASDAQ via CFDs and with no commissions and tight spreads.

- Step 2: Deposit Funds: You’ll need to make a deposit into your newly created Capital.com account. You can do this with a debit or credit card, e-wallet, or bank account transfer.

- Step 3: Search for NASDAQ: To go straight to the relevant trading page, enter ‘NASDAQ’ into the search bar and click on ‘Trade’.

- Step 4: Place NASDAQ Order: You will now need to choose from a buy or sell order. The latter should be used if you think the index will fall in value and the former if you think it will rise. Finally, enter your stake and place the trade.

As you can see from the example above, trading the NASDAQ a Capital.com is simple and burden-free.

What is NASDAQ?

The National Association of Securities Dealers Automated Quotations – or simply the NASDAQ, is the world’s second-largest share trading market after the New York Stock Exchange (NYSE). The exchange is home to some of the largest technology stocks in the US – including the likes of Apple, Microsoft, Tesla, NVIDIA, Paypal, Amazon, and Facebook.

With that said, if you are wondering how to trade the NASDAQ, you will be speculating on a financial instrument that tracks the index. For example, the NASDAQ 100 is a stock market index that tracks the 100 largest companies listed on the exchange.

Like all stock indexes, this will be weighted to ensure that bigger companies have more of an influence on the value of the NASDAQ 100 in terms of market capitalization. Understanding this, alongside several other key metrics, is crucial when learning how to trade the NASDAQ.

Basic of NASDAQ Trading

To ensure you give yourself the best chance possible of making consistent gains when trading the NASDAQ, this section will outline some of the most important considerations to make.

Indices

Indices – otherwise referred to as an index, is a financial instrument tasked with tracking the wider stock markets. For example, the Dow Jones tracks 30 selected blue-chip stocks that are listed in the US. The S&P 500 tracks 500 large-cap stocks in the US, while the FTSE 100 tracks 100 companies from the London Stock Exchange.

You then have the NASDAQ 100, which is a tradable index that tracks 100 stocks from the exchange of the same name. The value of the NASDAQ instruments you are trading will rise and fall throughout the day depending on how the respective companies listed on the index are performing.

Price Movement in Points

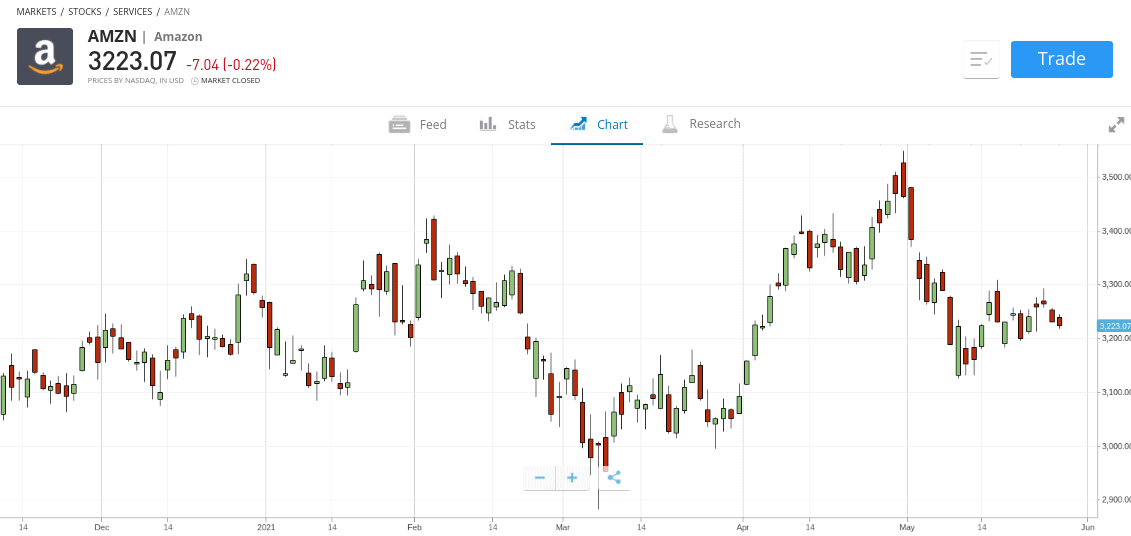

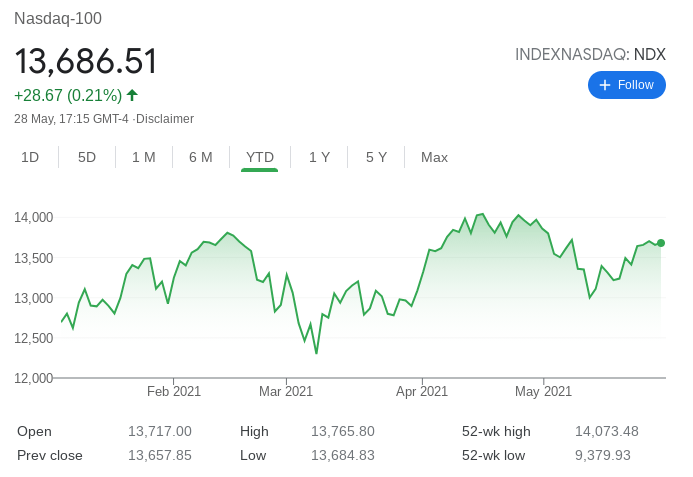

When you trade an individual stock like Apple or Amazon, each share is priced in US dollars. However, when trading an index like the NASDAQ, this is priced in points. For example, at the time of writing, the NASDAQ 100 is trading at 13,686 points. This means that when calculating your profits or losses, you should do so in percentage terms.

For instance:

- Let’s say that you think the NASDAQ 100 will rise, so you place a buy order

- You decide to stake $500 on this trade

- When you place the order, the NASDAQ 100 is priced at 13,686 points

- A few days later, the index is trading at 15,054 points

- This represents an increase of 10%

- As such, on a stake of $500, your profit amounts to $50

As we discuss later in this guide on how to trade the NASDAQ, you can also enter with a sell order. This means that you are speculating on the NASDAQ losing value via a short-selling position.

Weighting

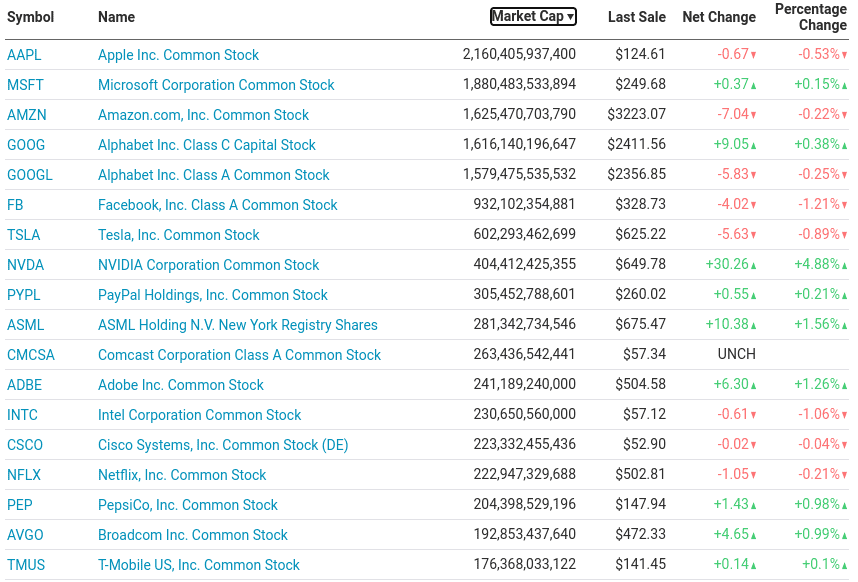

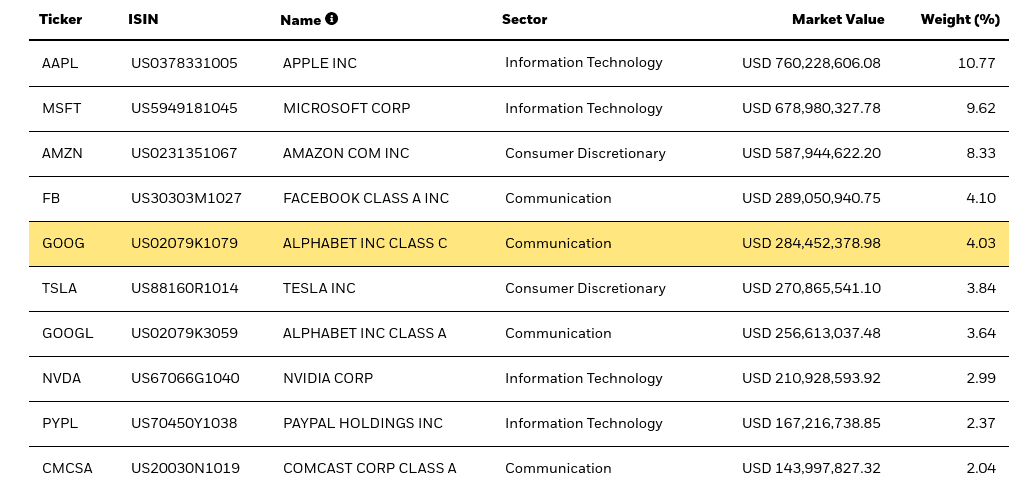

It is also important to understand the weighting system that the NASDAQ takes. This is because the top-three companies on the index in terms of market capitalization currently make up more than 28% of the entire market. This consists of Apple (10.77%) Microsoft (9.62%) and Amazon (8.33%).

Naturally, this means that these three stocks will have a much more significant influence on the value of the NASDAQ in comparison to other constituents.

For instance, the likes of Paychex, Cintas, and Dexcom each have a NASDAQ weighting of 0.30%. As a result, when attempting to speculate on the NASDAQ, you’ll need to have a specific focus on how the Big Three are performing. Other top-weighted stocks on the index include Facebook (4.10%), Alphabet Class C (4.03%), and Tesla (3.84%).

Note: Google’s parent company – Alphabet, actually has two stock market listings. This covers Class A and Class C shares. As such, this is another company that you need to focus on when speculating on the future value of the NASDAQ.

The Best Time to Trade NASDAQ in South Africa

Like most stock markets, the NASDAQ exchange is open Monday to Friday. The exchange is based in New York and standard NASDAQ trading hours are 9:30 AM to 4 PM – Eastern Time. So, what is the best time to trade the NASDAQ from South Africa?

South Africa is 6 hours ahead of New York. As such, this means NASDAQ trading hours in South Africa are 3.30 PM to 10 PM. With that said, some online trading platforms will allow you to trade outside of NASDAQ trading hours.

The only issue here is that outside of standard hours, the amount of liquidity available will be much lower. In turn, this means that the spreads offered by your chosen broker will be less favourable. This is why you are best advised to only trade during standard NASDAQ trading hours.

Ways of Trading NASDAQ

As noted above, the main way to trade the NASDAQ in South Africa is through an index that tracks the exchange. There are two main ways of doing this. Firstly, if you are a short-term trader, you will be best suited for leveraged CFDs. Alternatively, if you are a long-term investor, you might consider an ETF.

Let’s explore both options so that you choose a suitable instrument for your financial goals.

NASDAQ CFDs

CFDs (contracts-for-differences) are popular financial instruments that are tasked with tracking an asset in real-time. For example, if the NASDAQ 100 is priced at 13,500 points, so will the CFD instrument at your chosen broker. If the NASDAQ 100 drops by 4%, as will the CFD.

Crucially, when you trade CFDs, you do not own the underlying asset(s). Instead, you are merely looking to predict whether the value of the respective asset rises or falls.

For example:

- You are trading the NASDAQ 100 via a CFD instrument at a regulated broker

- The CFD is priced at 13,500 points – which is like-for-like with the actual value of the NASDAQ

- You think the NASDAQ CFD will rise in value, so you place a $300 buy order

- A few hours later, the NASDAQ CFD has risen by 5%

- Happy with your gains, you place a sell order to close the position

- On a stake of $300, your 5% profit amounts to $15

There are many benefits of trading the NASDAQ via CFDs – such as:

Long or Short

When trading CFDs, you always have the option of going on long (buy order) or short (sell order). This is a major benefit, as you have the opportunity to profit from both rising and falling markets. After all, the NASDAQ 100 will always go through bullish and bearish trends, so CFDs allow you to follow the wider markets in whichever direction it takes.

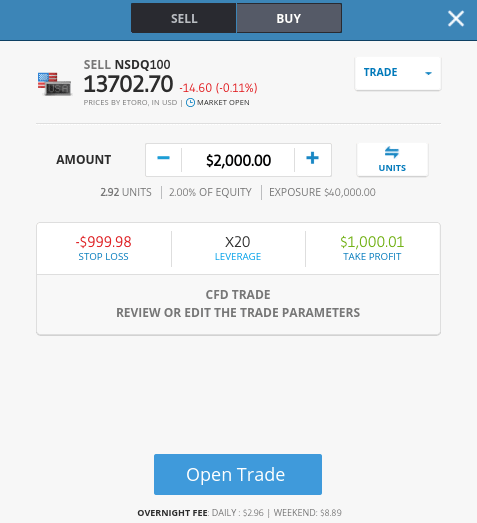

Leverage

Another major benefit of trading the NASDAQ in South Africa via CFD instruments is that you will have access to leverage. This will get you access to more trading funds than you have in your account. This is because your chosen broker will boost the value of your stake – based on how much leverage you decide to apply.

As a major index, the best NASDAQ brokers in South Africa will offer you very high levels of leverage. In some cases, you might get as much as 1:200. This means that your stake is multiplied by a factor of 200x – so a $100 position becomes $20,000.

Here’s an example of how a leveraged NASDAQ trade works in practice:

- You want to go long on the NASDAQ and stake $200

- You apply leverage of 1:20 to this position

- Your trade is successful – as the NASDAQ is now worth 15% more

- On a stake of $200 – a 15% increase would amount to a profit of $30

- However, you applied leverage of 1:20 – so your profit is boosted to $600

Don’t forget – leverage will also boost your losses. In fact, if your trade goes against you by a certain amount, your trade can be liquidated by the broker. This will happen when the value of the position drops by the amount of margin you put up.

For example, on leverage of 1:20 – your margin amounts to 5% (as for every $100 traded, you only need to put up $5). As such, if your position went down by 5%, it would be liquidated.

Very Low Fees

We should also mention that when trading the NASDAQ via CFD instruments, you will benefit from super-low trading fees. In fact, the best CFD platforms allow you to trade without paying any commission – so it’s only the spread that you need to take into account. The spread will typically be very competitive too – as the NASDAQ is one of the most traded indices in the financial arena.

NASDAQ Shares

If you want to directly trade NASDAQ companies rather than CFDs, you could consider buying and selling the following top NASDAQ shares:

NASDAQ ETFs

While CFDs are aimed at short-term traders, ETFs are more suited for long-term investors. As such, if you want to invest in the long-term value of the companies that are listed on the NASDAQ, an ETF is by far the best way to go. There are plenty of NASDAQ ETFs to choose from, albeit, most operate in a similar nature.

We explain the fundamentals in the sections below.

The Basics

Let’s take the iShares NASDAQ 100 UCITS ETF as a prime example. The financial institution behind the ETF – iShares, will personally buy all 100 stocks that form the NASDAQ 100. They will do this at the correct weighting to ensure that the ETF is as closely aligned to the NASDAQ as possible.

For example, 10.77% of its portfolio will be held in Apple shares and 2.99% in NVIDIA. If you were to invest in the iShares NASDAQ 100 UCITS ETF, you would own a share of all of the stocks held by the provider.

- For instance, let’s assume that you invest $1,000 into the ETF.

- At a weighting of 10.77%, this means that $107.70 of your investment is held in Apple shares.

- At a weighting of 2.99%, $29.90 of your investment is held in NVIDIA shares

This ownership structure remains the case for all 100 shares purchased by the NASDAQ ETF provider

Dividends

Many companies on the NASDAQ 100 pay dividends. When investing in an ETF that tracks the index, you will be entitled to your share of any distributions. Most ETF providers will make a payment every three months. After all, it would be inefficient for the provider to distribute a dividend every time it received a payment from one of the 100 NASDAQ constituents.

For example, let’s say that over the course of three months, the ETF receives dividends at an annualized yield of 3%. This means that for the quarter, you will receive 0.75% on the amount you have invested. As such, on an investment of $1,000, you will receive a dividend of $7.50.

Note: If you are looking to focus on dividend income, the NASDAQ isn’t the best option in the market. This is because many of the largest companies listed on the NASDAQ do not pay dividends. This includes the likes of Amazon, Facebook, and Tesla.

NAV

The other way that you can make money by investing in a NASDAQ 100 ETF is through capital gains. This is achieved when the NAV (Net Asset Value) of the ETF increases. The NAV is simply the total value of the ETF based on current market prices. In theory, if the value of the NASDAQ increases by 10% in year one, then the NAV should follow suit.

However, there will always be a slight discrepancy between the NAV and the actual NASDAQ, as you need to factor in ETF operating costs. For example, between March 31st 2020 and 2021, the iShares NASDAQ 100 UCITS ETF increased by 68.09%. The actual NASDAQ benchmark increased by 68.47%, which is only a slight difference.

NASDAQ Trading Strategies

If you are learning how to trade the NASDAQ for the very first time, it is important that you have a strategy in place. Although there are hundreds of potential strategies that can be implemented, in the sections below we focus on a small selection that is ideal for beginners.

Focus on the Largest Weighted Constituents

If you are planning to trade the NASDAQ 100 on a short-term basis, then it is crucial that you play an active role. At the forefront of this is placing a strong focus on NASDAQ constituents that have the largest weight. Once again, this will include the likes of Amazon, Apple, and Microsoft. As we noted earlier, these three companies alone make up over 28% of the entire index.

If we were to add in the two Alphabet listings, this figure would increase to almost 36%. The best way to approach this strategy is to look out for quarterly earnings reports. This is where the respect NASDAQ stock will update shareholders on its progress over the prior three months. Key reporting to look out for includes revenue, operating profit, and operating margin.

Ultimately, if one of the big NASDAQ players has a great quarter, then there is every chance that the index will see a rise in value. Of course, if the opposite happens, then the price of the NASDAQ might see a decrease.

Dollar-Cost Averaging

If you are learning how to trade the NASDAQ for the first time, then short-term speculation via CFDs might be a challenge. Instead, you are likely better suited for a long-term investment strategy. The best way to approach this in a risk-averse manner is to take a dollar-cost averaging strategy. This means that you will be investing a small amount of money into the NASDAQ at pre-defined intervals.

- For example, you might decide to invest $100 into a NASDAQ 100 ETF at the end of each month.

- Naturally, this means that every time you invest, you will get a different cost price.

- This cost price will be averaged out on each subsequent investment – meaning that you don’t need to worry about short-term volatility.

- In fact, even if the NASDAQ is dropping, this allows you to invest at a lower price.

It is important to note that the dollar-cost averaging strategy will only work if you are using a broker that permits small investments. This is why we like Capital.com, as the broker allows you to invest in a NASDAQ 100 ETF at a minimum stake of $50 per trade.

NASDAQ 100 Forecast

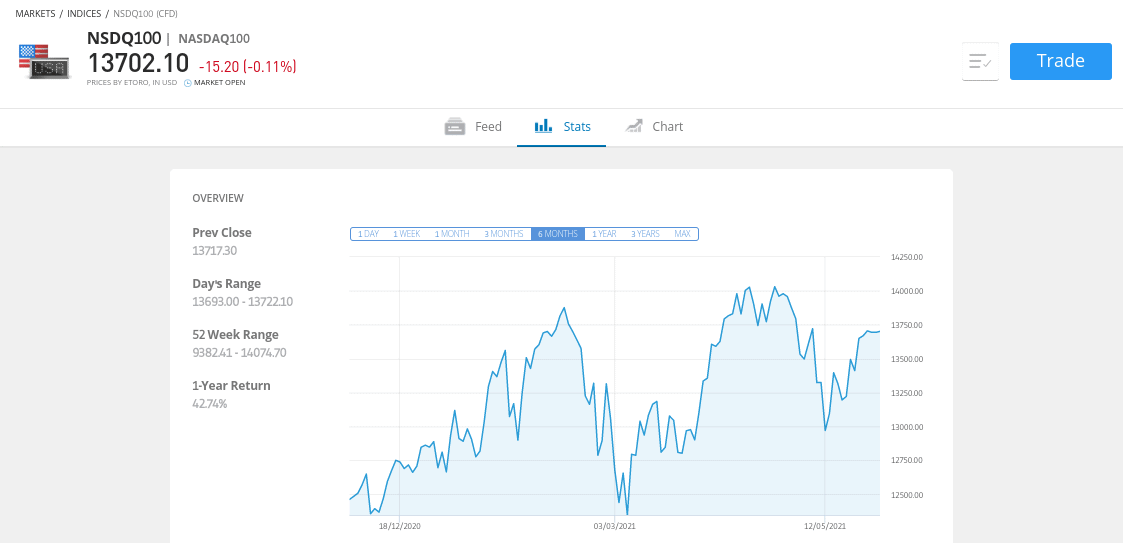

Analyzing the future value of the NASDAQ 100 is a lot more challenging in comparison to individual stocks. This is because the index consists of 100 different companies. Even more pertinently – the value of the NASDAQ 100 is based exclusively on the performance of the 100 stocks in the index. This is then broken down by the weight of each equity.

With that said, technical analysis is still worth persuing when trading the NASDAQ, especially when it comes to levels of supports and resistance. For example, on two separate occasions in 2021, the NASDAQ 100 has failed to break past 14,000 points. This in itself appears to be a physiological zone for investors.

At the time of writing, the NASDAQ 100 is trading at 13,686 points. This means that the index is once again approaching the identified resistance line. If the NASDAQ breaches past 14,000 points convincingly, this could see the index go on a prolonged bullish period.

If, however, the index once again fails to breach 14,000 points, this could be a good time to enter a short-selling order – at least in the short term.

Best NASDAQ Brokers

Another important metric to consider when learning how to trade the NASDAQ is that of your chosen brokerage site. After all, the only way to trade the NASDAQ safely is through a regulated provider. On top of core metrics like fees, commissions, and payments – you also need to consider whether your chosen broker offers NASDAQ CFDs, ETFs, or potentially both.

We have done the hard work for you by reviewing the best NASDAQ brokers in South Africa for 2022.

1. Capital.com – Great NASDAQ 100 Broker for Beginners

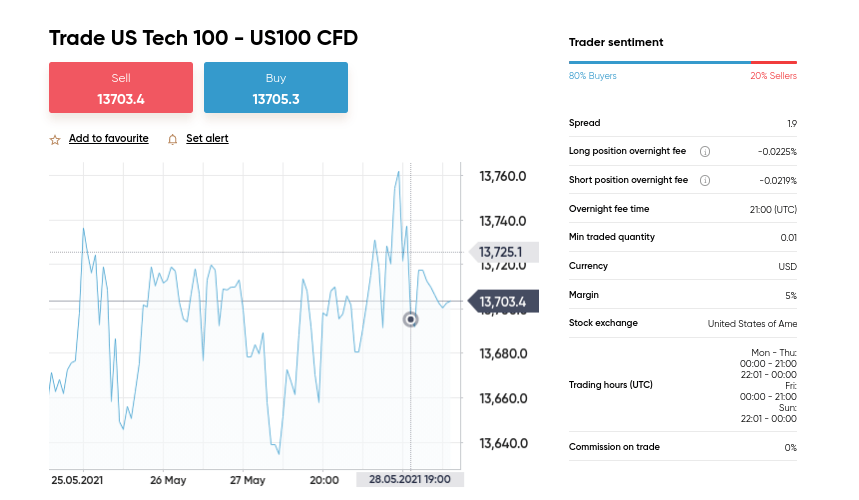

This top-rated trading platform does not charge any commissions and spreads are super-tight. In fact, at the time of writing, the NASDAQ 100 CFD market on Capital.com is trading at a spread of just 1.9 points. The other option that you have at Capital.com is to trade a NASDAQ 100 ETF. You won’t be investing in the ETF itself, rather, you will be trading CFDs.

When reviewing Capital.com, we found that the platform is a great option for beginners. For example, once you have registered, you can start trading the NASDAQ 100 via the Capital.com demo account. This comes pre-loaded with $10,000 in paper trading funds, which more than enough to get to grips with the index in a risk-free manner. Minimum deposits are also very low on Capital.com, as you only need to fund your account with $20.

When it comes to payments, you can easily deposit funds with a debit/credit card or e-wallet. If you choose to deposit via a bank transfer, this is also possible, but the minimum increases to $250. You can open an account and make a deposit online or via the Capital.com stock app. This top-rated CFD broker is regulated by the FCA and CySEC – so you can be sure you are trading the NASDAQ in fair and transparent conditions.

Pros:

- Educational app for new traders

- AI assistant identifies your weak points

- Trade ideas generated daily

- Excellent charting and analysis interface

- No inactivity fees

- Thousands of UK and US shares

- 100% commission free trading

Cons:

- Cannot build custom trading strategies

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

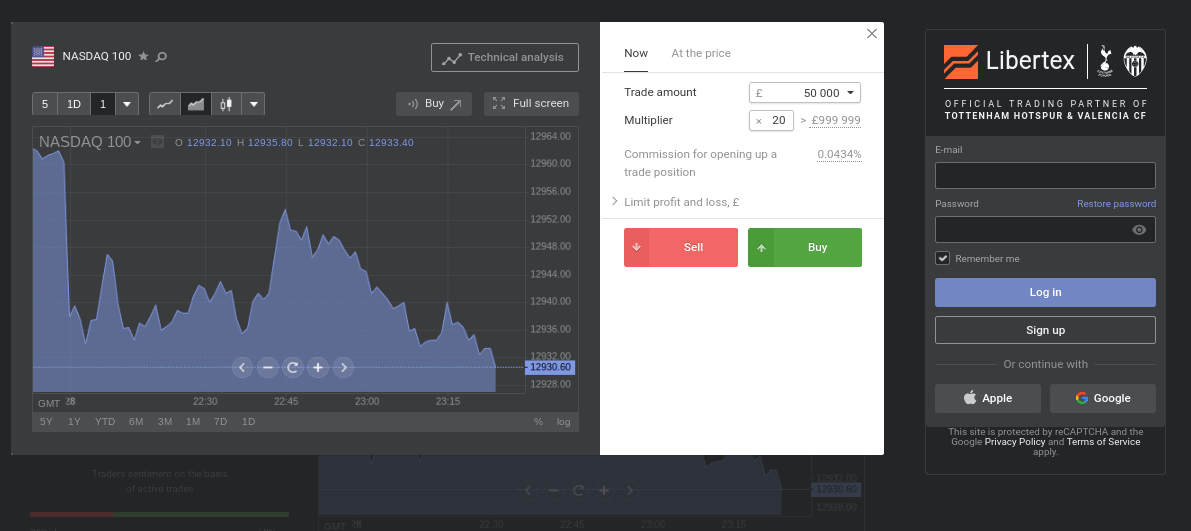

2. Libertex – Trade NASDAQ 100 CFDs at Zero Spreads

Libertex is another CFD trading platform that is popular in South Africa. In fact, the broker is authorized and regulated by the Financial Sector Conduct Authority (FSCA), as well as CySEC. This top-rated broker stands out for us as it allows you to trade the NASDAQ 100 without paying any spreads.

This means that there is no disparity between the bid and ask price of the index, which is ideal for those electing for a day trading strategy. Although you will need to pay a small commission to benefit from Libertex’s zero spread policy, this stands at just 0.036% per slide when trading the NASDAQ 100. As such, a $1,000 position would attract a commission of just $0.36.

Much like Capital.com, Libertex allows you to trade the NASDAQ 100 with leverage. When it comes to supported trading platforms, Libertex gives you three options. If you’re a newbie, the Libertex web-trading platform is simple and easy to use. If you want access to more advanced features and technical indicators, you can access Libertex via the MetaTrader series – which is inclusive of both MT4 and MT5.

Irrespective of which platform you choose, the minimum deposit at this CFD broker is just $100. Once you fund your account for the first time, the minimum deposit drops to just $10 per transaction. Supported deposit types include debit/credit cards, e-wallets, and bank transfers. If you want to practice trading the NASDAQ before risking any money, Libertex offers a free demo account. This allows you to formulate a NASDAQ trading strategy in live market conditions in a risk-free manner.

Pros:

- ZERO spreads on all markets

- 0% commissions on some stocks

- Leverage available

- Educational guides and webinars

- Accepts PayPal

- MT4 supported

- Mobile trading app

- Regulated and trustworthy broker

Cons:

- Only offers CFDs

75.3% of retail investor accounts lose money when trading CFDs with this provider.

How to Trade NASDAQ on Capital.com

If you’re looking to start trading the NASDAQ right now – this section of our guide will walk you through the process step-by-step. For our tutorial, we are using Capital.com – which is one of the best brokers with NASDAQ for 2022.

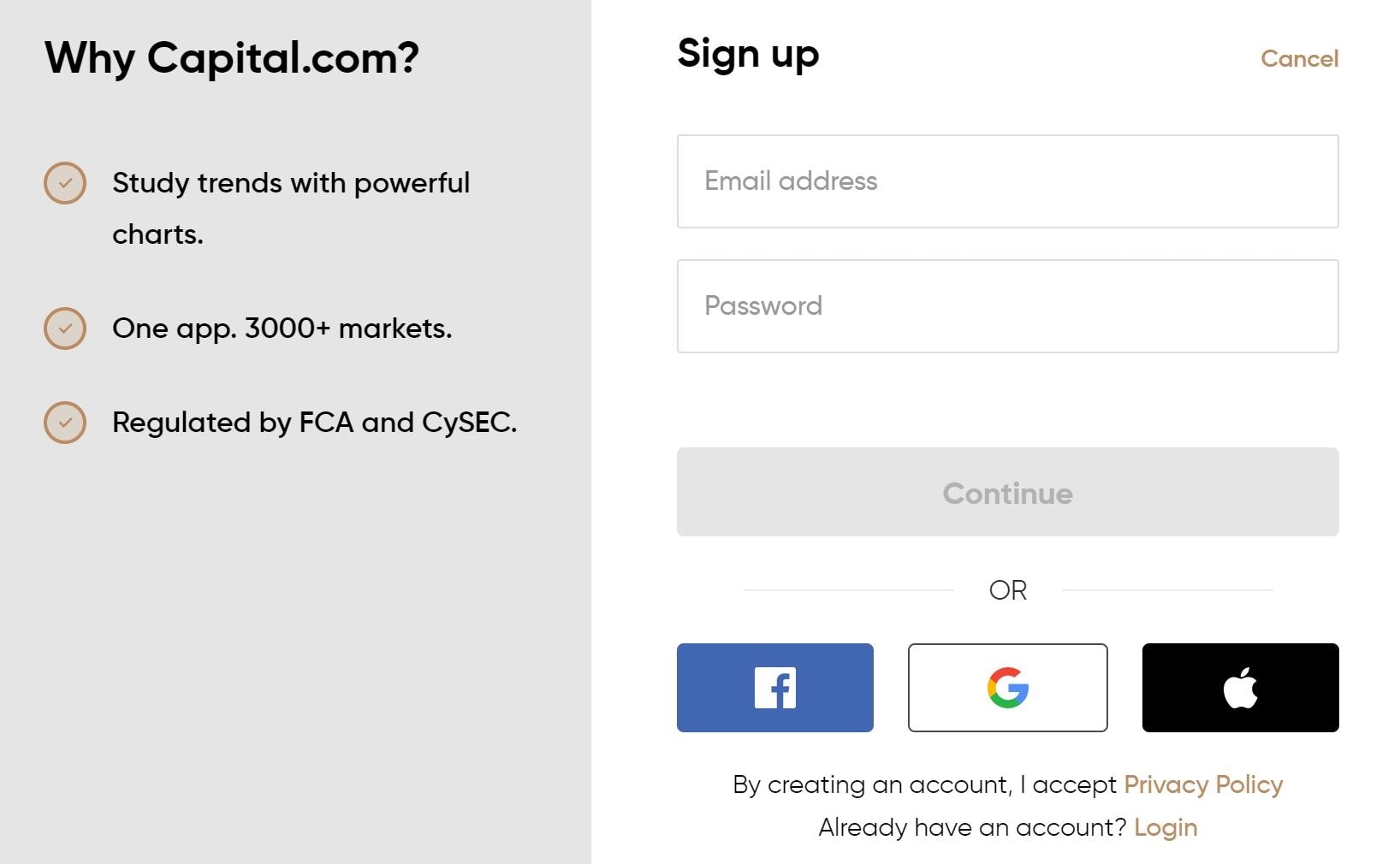

Step 1: Open a Trading Account

Head over to the Capital.com website and open an account. You will be asked to enter your personal information and contact details – so simply follow the on-screen instructions when prompted.

75.26% of retail investor accounts lose money when trading CFDs with this provider.

You also need to choose a username and a strong password and verify both your email address and mobile number.

Step 2: Upload ID

Capital.com is regulated by three tier-one licensing bodies, so it needs to collect some ID from you. For this, you will need to upload a copy of your government-issued ID and a proof of address. The latter requires a recently issued (within the past 3 months) utility bill or a bank account statement.

Step 3: Deposit Funds

To deposit funds into your Capital.com trading account, you can do this instantly with a debit/credit card, Paypal, Skrill, or Neteller. You can also fund your account via a bank transfer.

Step 4: Choose NASDAQ Market

Capital.com allows you to trade the NASDAQ via CFDs or invest through an ETF. You can find your preferred instrument by clicking on the ‘Trade Markets’ button, followed by the respective asset class.

For example, if you want to trade the NASDAQ 100 via CFDs, click on the ‘Indices’ button. Or, if you want to invest in a NASDAQ ETF, simply click on the ‘ETF’ button to find your preferred provider (e.g. iShares).

Step 5: Place NASDAQ Trade

You will now be asked to set up an order. In our example, we are looking to go long on a NASDAQ 100 CFD – meaning we are speculating on the value of the index rising. If you want to go short, click on the ‘Sell’ button. Otherwise, leave this set as a ‘buy order’.

75.26% of retail investor accounts lose money when trading CFDs with this provider.

Next, you will need to enter your stake into the ‘Amount’ box. As you can see from the example above, we are staking $200. With that said, the minimum stake is just $20 on Capital.com.

Finally, click on the ‘Open Trade’ button to complete your NASDAQ trade.

How to Trade the NASDAQ – Conclusion

This comprehensive guide has walked you through the process of how to trade the NASDAQ in South Africa. Not only have we discussed the many ways in which you can trade this popular index, but we’ve also outlined some of the best strategies to consider.

All that is left for you to do is choose an online broker and place your first NASDAQ trade. For this, we think that Capital.com is the best NASDAQ broker – as you can choose between leveraged CFDs or a traditional ETF. Both options require a minimum stake of just $50 per position and trading fees at the platform are industry-leading.

Capital.com – Best NASDAQ Broker in South Africa

75.26% of retail investors lose money trading CFDs at this site