How To Buy Offshore Shares From South Africa 2026

Offshore markets offer South Africans a chance to secure their financial future. The South African economy represents less than 1% of the world’s economy, and by limiting your investments to the local market, you will miss out on lucrative opportunities overseas, which could help you grow your wealth in the long run.

Please keep reading our review if you are interested in learning how to buy offshore shares from ZA, and then you can draw your conclusions.

What are offshore investments?

Investments offshore refer to a wide range of investment strategies utilizing advantages outside the country where an investor resides. Several reputable offshore companies offer investment opportunities that are fiscally sound, time-tested, and, most importantly, legal.

Offshore investing can offer you a wide range of advantages depending on your current situation, such as tax benefits, asset protection, and privacy benefits. However, it is important to note that offshore accounts have some disadvantages, including increased regulatory scrutiny on a global scale and a high cost associated with them.

Why buy offshore shares 2026?

To build a balanced yet diversified portfolio for the future, you must include offshore strategies in your savings and investment plan. According to financial advisors, if you limit your investment portfolio to South Africa, you are basically putting all of your risk in one place. The same applies to people in other countries, which is why foreigners invest in the South African market; they diversify their portfolios by investing here.

Investing outside the country could be daunting, considering the sheer volume of international investments available, and the complexity of navigating this landscape might be one of the most challenging aspects. However, it is possible, and the benefits are well worth the effort.

Investing offshore has the following advantages:

- As a South African, offshore investment is a great way to capitalize on circumstances outside your country, providing a buffer against your market, inflation spikes, and fluctuations in the exchange rate. Nevertheless, offshore investments are not guaranteed to perform better than local ones due to numerous factors such as exchange rates and global economic conditions.

- In essence, investing offshore allows you to achieve higher investment diversification. The benefit of this type of investment method is that it allows you to access a wider variety of countries and regions and a broader selection of companies and emerging markets, thereby increasing your chances of earning a solid return.

How To Buy Offshore Shares From South Africa

The following step-by-step tutorial gets you through the process of how to buy offshore shares from South Africa. It is based on one recommended, regulated stockbroker Oanda; however, the steps remain the same for most brokers where you could make an offshore share purchase in under ten minutes.

In order to buy stocks, you need to follow the following steps:

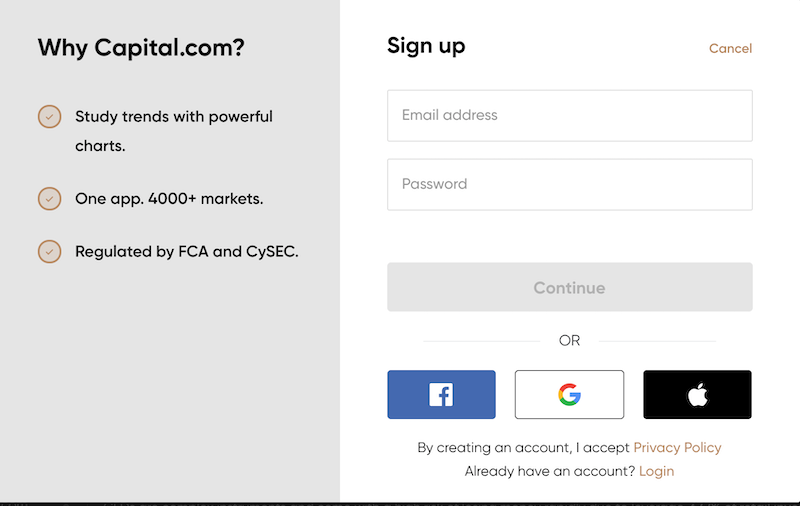

Step 1: Choose a broker that supports overseas markets

You must choose a broker who supports overseas markets, and Oanda is one of the best brokers on the market.

Visit Oanda’s official website and click on the “Open an account” button in the upper right corner of the webpage. Upon registering, you will be directed to the trading platform.

Click the ‘Register’ button on the Oanda website. That will require you to enter some personal information (full name, home address, date of birth, and contact information). A strong password and username are also required.

Step 2: Verify your account

Upon accessing the trading interface, click on the icon with your initials located in the upper right corner. In addition, there is an option called “KYC.” The first time you click there, you will be directed to a page where you will be asked to upload a valid ID and proof of residence to verify your identity (the verification process typically takes 24 hours) then your account will be activated.

It is now crucial that you upload a couple of proofs of your identity (a recent copy of a bank account or utility bill, along with a copy of your South African passport or driver’s license).

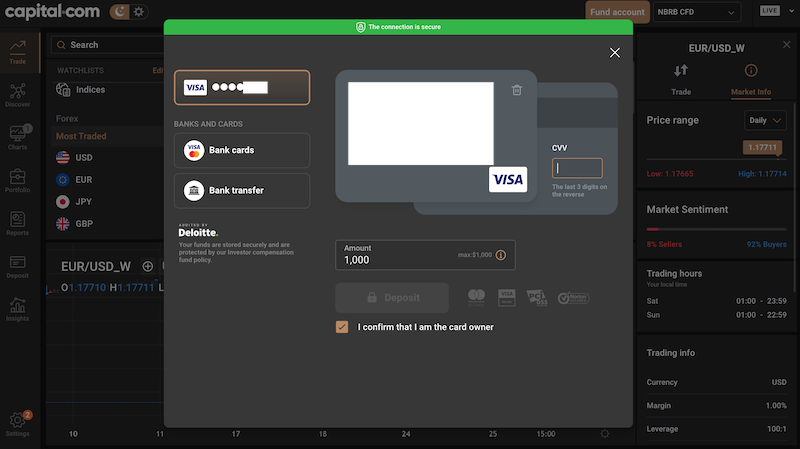

Step 3: Fund your account

When you have an active account, you can deposit some money to buy shares for the first time. It is possible to make deposits on Oanda using debit or credit cards, electronic wallets, or wire transfers. Your deposit will be cleared instantly with the first and second methods requiring only a minimum deposit of $20. This way, you can buy shares in over 3,000 companies worldwide from several international exchanges.

Step 4: Search for overseas stocks and start investing

The Trade button will be available as soon as the funds are cleared – the first one on the left panel of the trading interface – and you will be able to view all the stocks supported by the platform when you click on the “Stocks” label. In addition, you can filter stocks by country, sector, and market sentiment by clicking on the different hashtags available.

You can begin buying shares as soon as you have made a deposit, which is instant except for bank transfers. You can browse Oanda’s many different markets by clicking on the ‘MARKETS’ button followed by ‘SHARES.’ Alternatively, if you have a specific company in mind, enter it into the search box and select the result corresponding to your search term.

In either case, before signing up with any offshore stock broker, you should ensure that the broker you select will suit your needs. Fees and commissions, tradable shares, payment methods supported, and regulations should all be considered.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

6 Places To Buy Offshore Shares From South Africa- Reviewed

Researching the ins and outs of an online stockbroker can take quite a lot of time. Despite this, these are some of the best offshore share dealing accounts that can offer investment management services that meet certain minimum requirements. Financial Conduct Authority licenses allow debit and credit cards, bank accounts, and stock trading with domestic and foreign companies, among other things.

2. Oanda – Popular Platform To Buy Offshore Shares in South Africa

OANDA is a popular broker in South Africa with a comprehensive education suite, no minimum deposit requirement, low trading fees, and a great mobile trading app. OANDA’s global entity, however, has very little regulatory oversight and does not offer negative balance protection to South African traders.

There may also be disappointments for traders due to the lack of popular financial instruments and high withdrawal fees, but OANDA offers a great range of trading tools and detailed market analysis as well as support for both the MT4 and MT5 platforms.

Despite the poor regulatory oversight and the limited range of trading instruments OANDA offers, this is a good all-around broker. Moreover, with the introduction of MT5 support, we expect that the number of trading instruments will increase soon due to the low fees. If you want to learn more about Oanda, chech our review of this platform here.

Pros:

Cons

3. Saxo – Leading Fintech Specialist in South Africa

Saxo Bank is widely recognized as a leading fintech and regtech specialist in South Africa. Saxo Bank offers traders, investors, and partners access to over 35,000 instruments across all asset classes from a single account, which can be accessed remotely.

As a regulated company, Saxo Bank has been licensed in six tier-1 jurisdictions, making it a good broker (low-risk) for trading forex and CFDs since it was founded in 1992.

In addition to providing clients of all sizes with professional-grade tools, industry-leading prices, and best-in-class service, As part of its differentiation strategy, the company builds digital platforms that facilitate access to multiple asset classes. It offers active traders a single, cross-collateralized account from which they can trade 35,000+ instruments across asset classes, including CFDs, stocks, forex, ETFs, and more.

The company provides multi-asset execution, prime brokerage services, and trading technology to more than 120 banks and more than 300 financial intermediaries.

Pros:

Cons

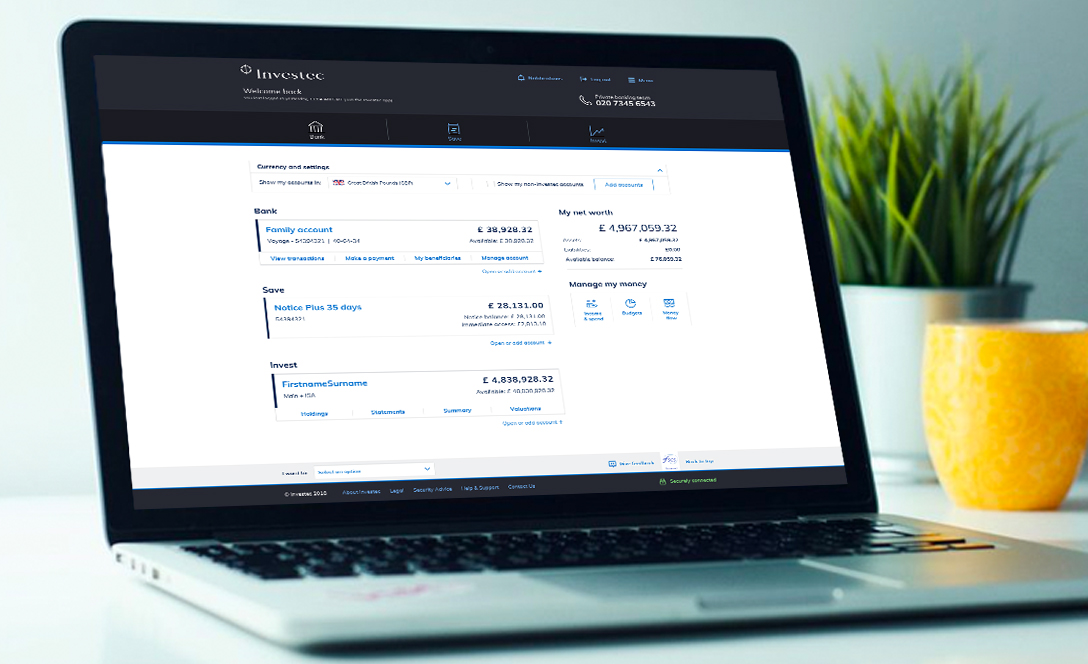

4. Investec – Platfrom with International Banking Investments in South Africa

Investec is a domestically relevant, internationally connected banking and wealth management group. Aside from the UK and South Africa, Investec offers international banking, investment, and wealth management services to private, institutional, and corporate clients.

Established in 1974, the group currently employs more than 8,200 people. Investec has a dual-listed company structure listed on the London Stock Exchange and the Johannesburg Stock Exchange. Various banking services are offered, including lending, transactional banking, advice, hedging, deposits and savings, and equity placement. In addition, private client investment management, investment advisory services, and financial planning services are offered by the wealth management business.

Pros:

Cons

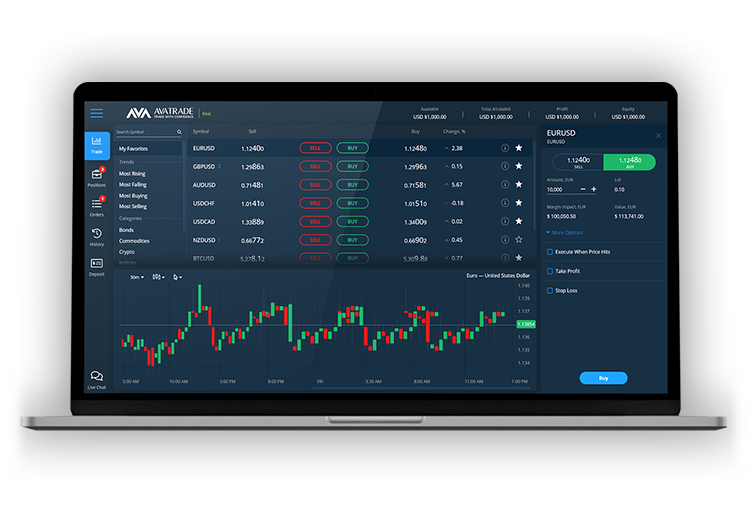

5. AvaTrade – Advanced Trading Platforms to Buy and Sell Shares

This more in-depth trading platform allows you to trade shares in South Africa. In addition, you can build custom strategies with this software, backtest them against historical price data, and much more.

With this broker’s trading platform for web and mobile devices, a built-in news feed and analysis tools can help you figure out what stocks are worth buying.

As a CFD broker, AvaTrade does not allow you to buy shares outright. However, over 600 CFDs on stocks are available through the broker.

It is regulated by the Financial Services Commission of South Africa and by regulators in Australia, Japan, and Ireland. In addition to positive balance protection, all clients receive leverage protection. You can open an account for just $100; support is available 24/5. If you want to know more abour AvaTrade, check our review here.

Pros:

Cons

6. CM Trading – One of the Most Innovative Companies on the Market

In South Africa, CM Trading is a brand name operated by BLACKSTONE Marketing SA (PTY) LTD. It is South Africa’s largest broker and one of the most innovative companies in the world.

As a one-stop destination for online trading, CM Trading was founded by traders for traders. CMTrading is an online Forex broker specializing in Forex, Index, and Commodity trading.

In addition to the ability to use Forex, Index, and Commodities, including Cryptocurrencies, through seamless, technology-driven processes, traders can also invest confidently in a highly safe and regulated environment.

Pros:

Cons

Pros of Offshore Investing

People invest offshore for a variety of reasons, including the following:

Benefits of taxation

Many countries (known as tax havens) offer tax incentives to foreign investors to attract them. An offshore country’s tax rate is designed to attract outside wealth by promoting a healthy investment environment. Small countries with few resources and a small population can dramatically increase economic activity by attracting investors.

Offshore investment is when offshore investors form a corporation in a foreign country. Investors’ accounts are held in a corporation that serves as a shell, shielding them from higher taxes in their home countries. As a result, the corporation does not engage in local operations and pays little or no tax. There are also a lot of foreign companies that enjoy tax-exempt status when they invest in U.S. markets. Thus, investing through foreign corporations has distinct advantages over investing as an individual.

Asset Protection

Offshore centers are becoming increasingly popular as a means of restructuring ownership of assets. For example, individual wealth ownership can be transferred through trusts, foundations, or corporations. In addition, people worried about lawsuits, foreclosing lenders, or creditors collecting outstanding debts often transfer assets from their personal estates to an entity abroad.

Individuals are no longer vulnerable to seizure or other domestic issues by transferring ownership on paper. As a result, U.S. residents can contribute tax-free to their offshore trusts if they are trustors. Although the trustor of an offshore asset-protection fund will not receive any distributions from the trust, the trust’s income (the capital gains) will still be taxed.

Confidentiality

Secrecy legislation is a complementary benefit that is offered by many offshore jurisdictions. Corporate and banking confidentiality is strictly enforced in these countries. As a result, if this confidentiality is breached, there are serious consequences that the offending party will suffer. The disclosure of customer identities is an example of a breach of banking confidentiality. In addition, some jurisdictions consider disclosing shareholders a breach of corporate confidentiality.

Secrecy does not imply that offshore investors are criminals with something to hide. Additionally, it is important to note that offshore laws will allow identity disclosure if there are clear instances of money laundering, drug trafficking, or any other illegal activity. However, from the perspective of a high-profile investor, keeping information, such as the investor’s identity, a secret while accumulating shares of a public company can provide a significant financial (and legal) advantage to the investor. Most high-profile investors don’t want the public to know what stocks they own. The majority of multimillionaire investors do not want a bunch of little fish buying the same stocks that they have targeted in the past for large-volume stock purchases. Prices rise because of the small fry

The laws of offshore jurisdictions are, in most cases, immune to the laws that may apply where an investor resides because nations are not required to accept foreign laws. The U.S. courts have the authority to assert jurisdiction over any assets located within the borders of the United States. As a result, investors should ensure that their assets are not held physically in the United States. However, assets held in foreign bank accounts are still subject to US law.

Diversification of Investments

Some countries restrict citizens’ ability to invest internationally. As a result of these restrictions, investors cannot build a truly diversified portfolio of investments. On the other hand, the flexibility of offshore accounts gives investors access to all major exchanges and international markets.

Additionally, developing nations offer many opportunities, especially those beginning to privatize government-controlled sectors. For example, the world’s largest consumer market is enticing investors with China’s willingness to privatize some industries.

Cons of Offshore Investing

There are benefits to locating investments and assets offshore but also drawbacks.

Tax Risky

Investing offshore directly is perceived to be complex, so many investors prefer to invest through rand-denominated feeder funds.

Investec sales manager Paul Hutchinson says the tax consequences favor direct offshore investment over investing through rand-denominated feeder funds for discretionary investors (rather than retirement funds or living annuities).

When investors divest offshore structures (direct investments), they must calculate their capital gain in foreign currencies (dollars, euros or pounds) and multiply it by the rand exchange rate on the divesting date.

As a result, the rand or foreign currency plays no role in determining capital gains. They are, however, entitled to gain capital gains when they disinvest from a rand-denominated feeder fund. Any rand appreciation that impacts the value of the offshore assets in which the fund invests is included in the capital gain.

As a result, Hutchinson explains that both capital gains and rand depreciation charged to the fund are subject to capital gains tax.

Due to rand depreciation over the investment period, an investor who invested R1 million in a rand-denominated feeder fund received a return of approximately R90,000.

Cost

It is not cheap to set up an offshore account. For example, a corporation may need to be registered offshore depending on an individual’s investment goals and the jurisdiction they choose. That could mean hefty legal fees and the cost of registering a corporation or account. In addition, investors sometimes must own a residence in the country where their offshore account or holding company is located.

The minimum investment for many offshore accounts is between $100,000 and $1 million. The companies that make money by facilitating offshore investments know they are in high demand by the very wealthy, and therefore they charge a high price for their services.

How To Buy Offshore Shares From South Africa- Conclusion

Over the past decade, there has been a considerable change in the process of buying offshore shares in South Africa. You are no longer required to speak with a traditional stockbroker over the phone when placing your buy and sell orders. Alternatively, you may choose a regulated online share trading platform. With your debit/credit card, you can deposit some funds and choose which stocks you want to buy. For example, consider Oanda, which offers a wide variety of global shares and low commissions.

Oanda – The Best Place To Buy Offshore Shares in South Africa

75.26% of retail investor accounts lose money when trading CFDs with this provider.

Frequently Asked Questions on Buying Offshore Shares From ZA

How to trade overseas stocks from South Africa?

What are the main benefits of offshore trading?

Is offshore trading safe?

What is the best offshore trading platform?