How to Buy Orion Minerals Shares In South Africa – With 0% Commission

Orion Minerals Ltd, formerly Orion Minerals NL, is a minerals exploration firm that focuses on gold, copper, nickel, and platinum-group elements (PGE’s). The firm has a portfolio of projects across South Africa and Western Australia. Orion trades on both the Australian Securities Exchange (ASX) and Johannesburg Stock Exchange (JSE). This guide will discuss what you need to know about the company and how to buy Orion Minerals shares in South Africa with zero commission.

jordan 4 cheap

nike air jordan 4 oil green

nike air jordan 4

nike air jordan 4 black canvas

cheapest jordan 1

jordan 1 for sale

nike air jordan women

cheapest jordan 4

nike air jordan 6

cheap jordan shoes

cheap jordan 1s

nike air jordan 1 womens

mens jordan shoes on sale

nike air jordan womens high top

nike air jordan shoes

cheapest jordan 4

jordan 4 with nike air

air jordan sale

jordan shoes for sale

air jordan store

nike air jordan 4 red

nike air jordan 4 retro

jordan store

best jordan 1s

nike air jordan 1 high

nike air jordan mens low

best jordan 1 colorways

we the best jordan 5

cheap jordan 4

cheap jordan

best jordan shoes

jordan 1 university blue

nike air jordan mens shoes

jordan 4 military black

cheapest jordan 4s

best jordan 4s

nike air jordan women

jordan 4 cheap

nike air jordan 4

nike air jordan mens

jordan’s store

How to Buy Orion Minerals Shares – Step by Step Guide 2021

Ready to buy Orion Mineral shares today? Here’s a quick step-by-step process on how to buy Orion Mineral shares in South Africa on eToro.

- Step 1: Open an account with eToro – Go to eToro’s website and open a trading account by clicking on the ‘Trade Now’ button and submitting your email address and password.

- Step 2: Verify your Account – Upload proof of ID and proof of address to verify your identity.

- Step 3: Deposit Funds – Deposit a minimum of 20 GBP/USD/EUR with one of eToro’s supported payment methods.

- Step 4: Buy RBPlat Shares – Search for Orion Mineral shares in eToro’s trading platform and place a buying order.

Step 1: Choose a Stock Broker

Before we dive into how to invest in Orion Minerals shares in South Africa, you would need to choose a good broker. It is advisable to conduct due diligence and consider how safe and secure the platform is before you choose a stock broker. To make this decision easier for you, we recommend that you buy Orion Minerals shares from the top regulated broker eToro.

Step 1: Research Orion Minerals Shares

Investment decisions are taken only with factual data. This is where researching a company, and its financial track record comes into play. Carrying out your due diligence serves an important role, and that is to determine if a company’s share price will rise in the future. In essence, it breaks down the fundamentals and lets you know if the asset you are interested in is a good investment or not.

This section is geared towards this goal, and we cover Orion Minerals and its niche market, highlighting milestone events like acquisitions and share price performance over a period of time.

What is Orion Minerals?

Orion Minerals is an Australian-listed and South African-listed metal explorer and developer. It is on course to become a new generation of base metals producers via the development of its flagship Prieska Copper-Zinc Project and its Okiep Copper Project (OCP).

Both copper mining operations are based in South Africa’s Northern Cape. In its home country, Orion Minerals runs an exploratory joint venture with fellow ASX-listed company, IGO limited, in the Fraser Range Province. Prieska Copper-Zinc Project is the company’s flagship copper mine, and it has a long history, having been mined between the 1970s and 1990s. It is one of the world’s top 30 volcanogenic massive sulfides (VMS) base metal deposits, historically churning out 430,00 tonnes of Copper and 1 million tonnes (Mt) of zinc from 46.8Mt of sulfide ore milled.

Prieska has been shut up for decades following the apartheid years and Orion Minerals only recently completed an updated Bankable Feasibility Study (BFS) in May 2020, where a 12-year “Foundation Phase” 2.4Mt per annum underground mining operation was set up. The Prieska Project is expected to deliver metal production of 226,000 tonnes of Copper and 680,000 tonnes of zinc in multiple concentrates.

Its OCP is also another major metal production hub. Secured in an AUD53 million ($40.92 million) acquisition, OCP is projected to yield annual peak production of 9,000 tonnes of copper-in-concentrate, the company said following its findings from its foundation phase scoping study.

Commenting on the OCP findings, Managing Director and CEO Errol Smart said:

“The outcome of the Scoping Study supports the economic merit of developing a foundation phase mining operation while Orion conducts the required work and engineering studies to evaluate the potential to re-establish mining operations with outputs as were previously sustained for decades by previous owners.”

Following the results of the Scoping Study, the foundational scale mining operations could operate for the next twelve years. Also, Orion’s processing plant is expected to have a throughput of 760,000 tonnes per year, leaving aside 9,000 tonnes that can be sold in marketable concentrates.

Orion Minerals Share Price

Orion Minerals is listed on two major exchanges; one in-home country Australia and the other on the main board of South Africa’s JSE floor. According to the company, the idea is to provide an additional funding source for its operations in the country and enable investor participation in the mining business.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Its ORN share price performance has been hard-hit by bouts of high volatility. Opening trade at 24 ZAC on September 2017, Orion Minerals surged to a mouth-watering value of 140 ZAC two months before falling sharply to 45 ZAC on November 24, 2017. This decline was checked by a 3.5% surge on December 15, 2017, to 59 ZAC, where ORN stock lost its steam. Its share price has continued to be in a constant influx averaging 40 ZAC in the last three years. So far, ORN has hit a price valuation of 60 ZAC on February 26 before tailing off. At press time, ORN is trading at 33 ZAC with an all-time percentage surge of 37.50%. Its 52-week high stands at 99 ZAC and has a market cap of R1.18 billion.

Orion Minerals Share Dividends

Investors also rely on a company’s dividends payout to generate passive income. However, Orion Minerals does not currently pay investors dividends. We have not been able to clarify if the company intends to do this in the near future.

Are Orion Minerals Shares A Good Buy?

Orion Minerals have been making some calculated steps as the copper market heats up. But will it be a good investment for your money? We list some reasons why we think you should consider adding Orion Minerals to your portfolio.

Orion Minerals’ Direct Approach To Exploration

The one singular thing that has kept Orion Minerals going against all odds has been the management’s direct approach towards exploration. The metal producer is known for its swiftness in exploring potential mineral deposits in key regions. An instance is its March discovery of an open-pit diamond drill hole at Jacomynspan located 80km North-West of the Prieska Copper-Zinc Project.

The company’s release intersected a massive sulfide zone at 31.53m with 0.72% of Nickel, 0.34% of Copper, 0.05% of Cobalt, and 0.45g/t 2PGE+Au from a 100.63m down-hole. Also, the potential high-grade nickel-copper-cobalt-PGE has 1.55% of Nickel, 0.345% of Copper, 0.10% of Cobalt, and 0.43g/t 2PGE+Au from 106m down-hole.

A company with a keen eye for the industry-breaking trend is one you should look out for.

Copper Prices Are Up

The global economy was on a downtrend throughout 2020, and one of the affected sectors was the mineral exploration and mining space. However, things are already looking up since the roll-out of Covid-19 vaccines and the subsequent reopening of businesses. This was reflected when the Copper price rose 130% from its March 2020 levels to $10,512 per metric ton on May 9. At the same period in the previous year, Copper traded at half the price, with demand drying up due to the lockdown restrictions in several regions.

This exponential growth is due to growing market confidence about the vaccines returning a sense of normalcy to the world’s economic engine. Also, prices picked up due to high demand from China, the world’s largest consumer of Copper, and with few metal producers in operation, Copper value shot up. According to the World Bank, estimates for Copper are positive, and the electricity-conducting metal is projected to hit an average of $8,500 per metric ton by the end of the year. The IMF is more conservative and puts its figure a little below $8,313, while the Department of Industry, Science, Energy, and Resources of Australia says Copper’s spot price will average $8,257 in 2021.

Financial Discipline

In its June quarterly cash flow report, Orion Minerals show many positives. According to the Australian metal company, the interests received from exploration and evaluation surged AUD1,916,000 year-to-date (YTD). Net cash flow from investing activities stood at AUD1,094,000 for the current quarter. Its bank balances stood at AUD20,553,000 with no overdrafts whatsoever.

Loan arrangements stood at AUD1,321,000, while its cash and cash equivalents stand at AUD17,391,000.

Step 3: Open an Account and Buy Shares

Once you have conducted your research and are confident in your investment, then it’s then time to buy Orion Minerals shares. This section would give you a deeper look into the process it takes to invest in Orion Minerals using our recommended South African broker, eToro. From our discovery, eToro is a top-regulated online broker that offers 0% commission trades and is the best place to buy shares in South Africa.

75.26% of retail investor accounts lose money when trading CFDs with this provider.

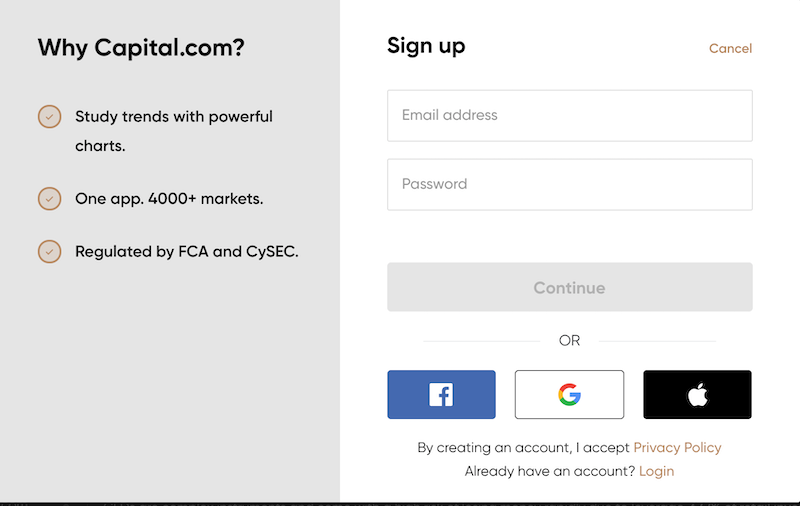

Step 1: Open an Account With eToro

To open an account on eToro. Go to the official website and click on the ‘Trade Now‘ icon. This would take you to the online form page, where you would be required to fill in your personal information such as name, date of birth, email address, phone number, and others. You will also be asked to choose a username and password.

Step 2: Upload ID

eToro requires new users to upload a valid means of identification and other documents to verify their identity. This is part of the brokers’ mandatory know-your-customer (KYC) process in line with its regulatory duties. Therefore, you will upload any of your government-issued ID and a recent utility bill or bank statement for account verification.

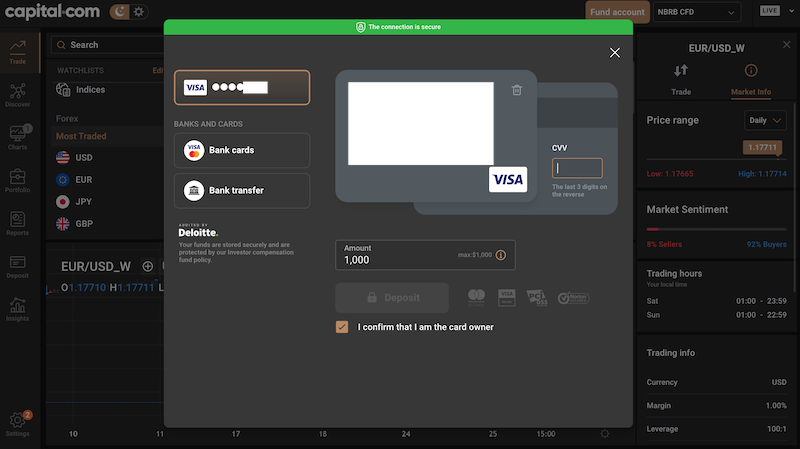

Step 3: Make a Deposit

eToro offers different payment methods for deposits. Some of which include bank wire transfer, credit and debit cards, Sofort, and others. But before you can start trading, you need to deposit funds into your account. eToro has a low minimum deposit entry of only $20 when using the different payment methods except for bank wire transfers. For wire transfer, eToro’s minimum deposit is $250.

Step 4: Buy Orion Minerals Shares

The final step is to buy Orion Minerals shares. All you need to do is type in the ticker symbol ‘ORN’ into the search bar on the top left-hand corner. This would take you to the order box, where you input the number of shares you want to buy, set your stop loss (SL), and take profit (TP) levels if you use leverage. Finally, click on ‘Buy’ to complete the purchase.

Should You Buy Orion Minerals Shares?

Orion’s pivotal role in the fast-paced metal production sector is a good reason why you should buy Orion Mineral shares. Another reason is the general positives surrounding base metals like Copper. High demand and shortage of supply have seen copper prices shoot up to $10,512 per metric ton. Estimates by top financial bodies denote that it will drop anytime soon. Orion Minerals’ continued exploration and acquisition of historical mines could elevate the company’s status into one of the top global metal producers in the next couple of years. If you want to buy Orion Minerals shares, we recommend using eToro’s user-friendly platform. It also offers commission-free trades, which increases your purchasing power over time.

eToro– Buy Orion Minerals Shares With Low Commission

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.