How to Buy Palantir Shares in South Africa – With 0% Commissions

Palantir is a US software company that helps the US government and private companies tackle big data. In this guide, we show you how to buy Palantir shares in South Africa with 0% commissions and cover whether Palantir is a buy today.

How to Buy Palantir Shares in South Africa – Step by Step Guide 2021

Want to learn how to buy Palantir shares in South Africa right away? Just follow these 4 quick steps:

Step 1: Open an Account with eToro – Head to eToro and click ‘Trade Now’ to open a new account. Enter your email address and a password or sign up with Google or Facebook.

Step 2: Verify Your Account – Verify your trading account by uploading a copy of your passport or driver’s license and a copy of a bank statement or utility bill.

Step 3: Deposit – Fund your account using a credit/debit card, bank transfer, or e-wallet. eToro requires a minimum deposit of $20.

Step 4: Buy Palantir Shares – In your eToro dashboard, search for Palantir and then click ‘Buy’. Enter the number of shares you’d like to buy and then click ‘Place Order.’

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Step 1: Choose a Stock Broker

In order to buy Palantir shares in South Africa, you’ll need a stock broker that offers trading on US shares. There are lots of options, so to help you choose we’ve reviewed 2 of our favourites that offer 0% commission for stock trading.

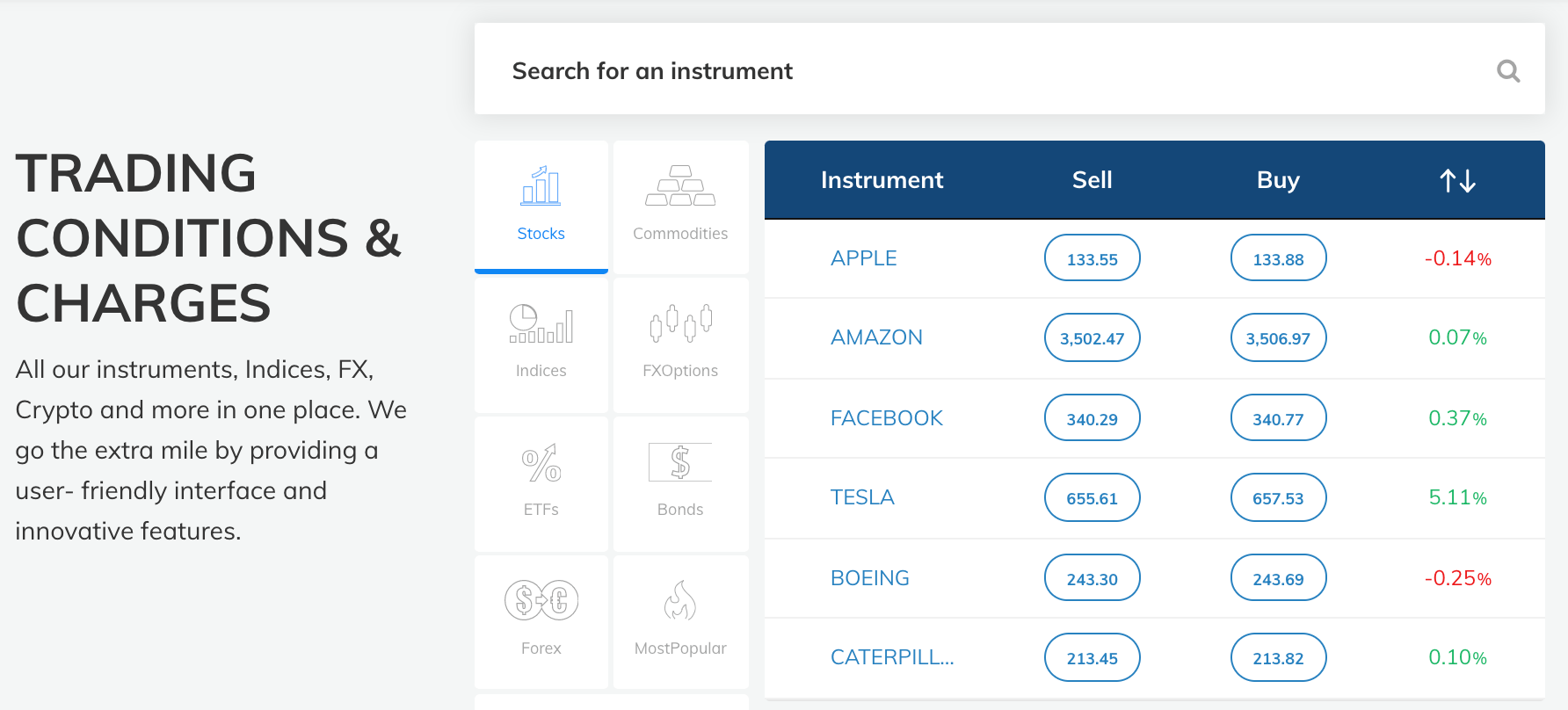

1. AvaTrade – Top CFD Broker for Share Trading in South Africa

AvaTrade is another top CFD broker that caters specifically to South African traders. This broker offers trading on hundreds of shares from the US, Europe, and around the globe. Plus, you can trade forex, commodities, stock indices, and more with AvaTrade.

All share trading is 100% commission-free. AvaTrade makes money instead by charging a spread on your share trades. You can also trade US shares with leverage up to 5:1, so this is a good option if you want to make the most of a small initial deposit.

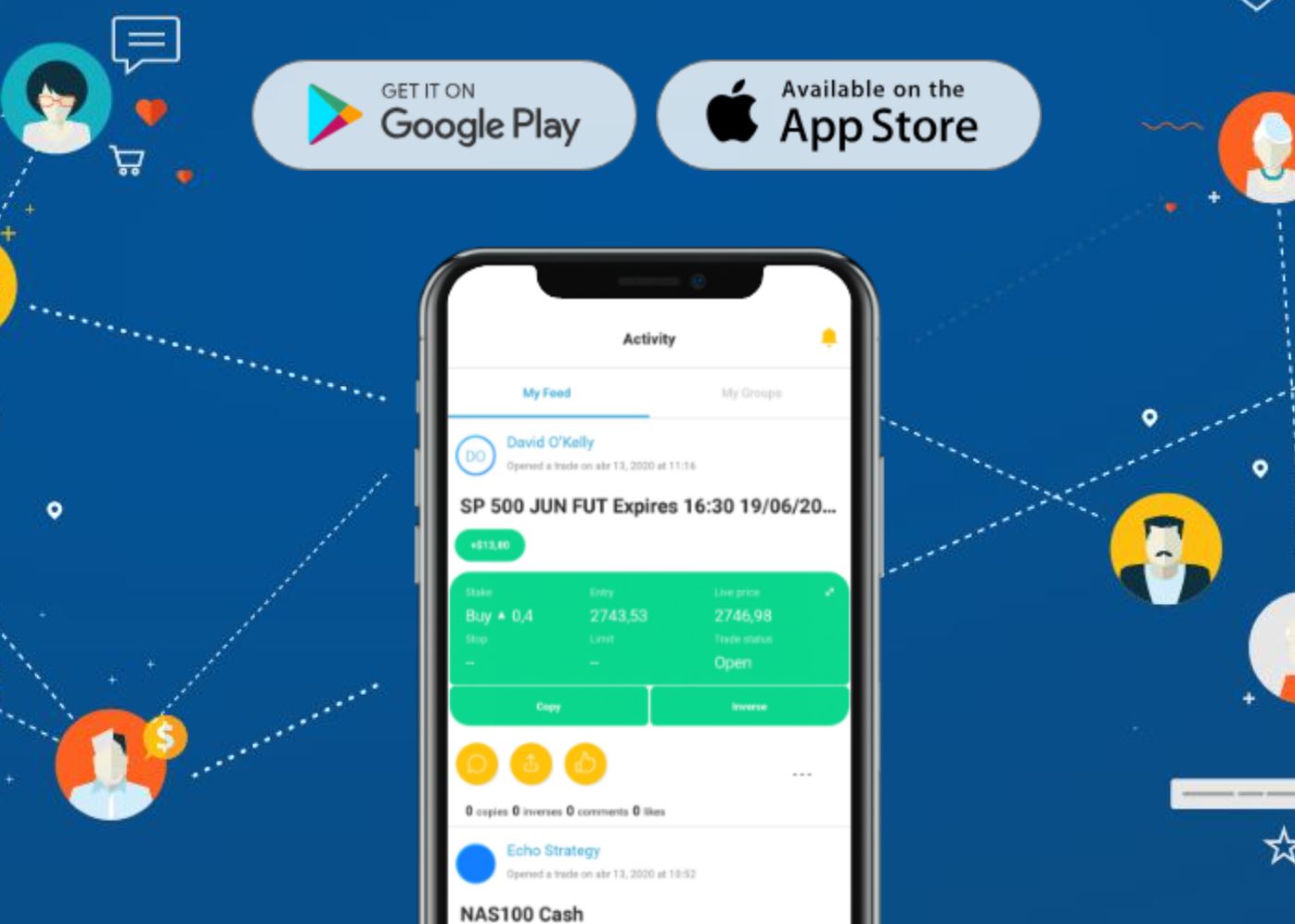

AvaTrade stands out in part because it offers social trading. With the AvaSocial mobile app for iOS and Android devices, you can connect with tens of thousands of fellow traders from South Africa and beyond. It’s easy to start discussions or even copy the positions of more experienced traders. AvaTrade copy trading essentially lets you put your portfolio on autopilot.

AvaTrade’s trading platform is also quite simple to use. It’s available for the web and mobile devices, and you can easily monitor price charts, set up watchlists, and check market news. The platform doesn’t have the most comprehensive tools available for technical analysis, but AvaTrade integrates with MetaTrader 4 and 5 for traders who want more advanced trading tools.

AvaTrade is regulated by the UK FCA and the Australian Securities and Investment Commission (ASIC). The broker offers 24/5 customer support and requires just a $100 (1,400 ZAR) minimum deposit to open a new account.

Pros:

- 100% commission-free share trading

- Includes a market news feed and watchlists

- Support social trading and copy trading

- Integrates with MetaTrader 4 and 5

- Regulated in the UK and Australia

Cons:

- Limited selection of global shares

Your capital is at risk.

2. eToro – Overall Best Stock Broker in South Africa

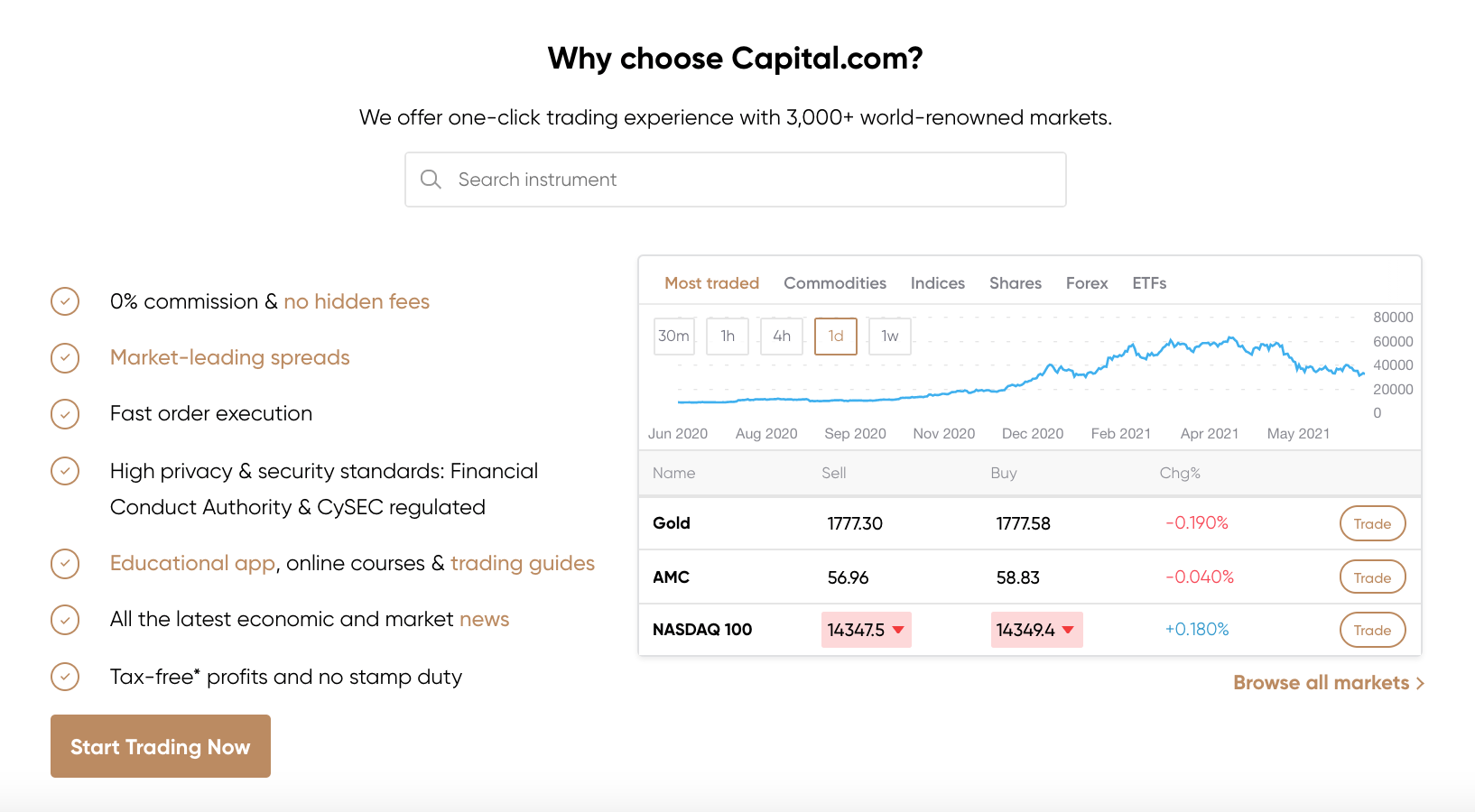

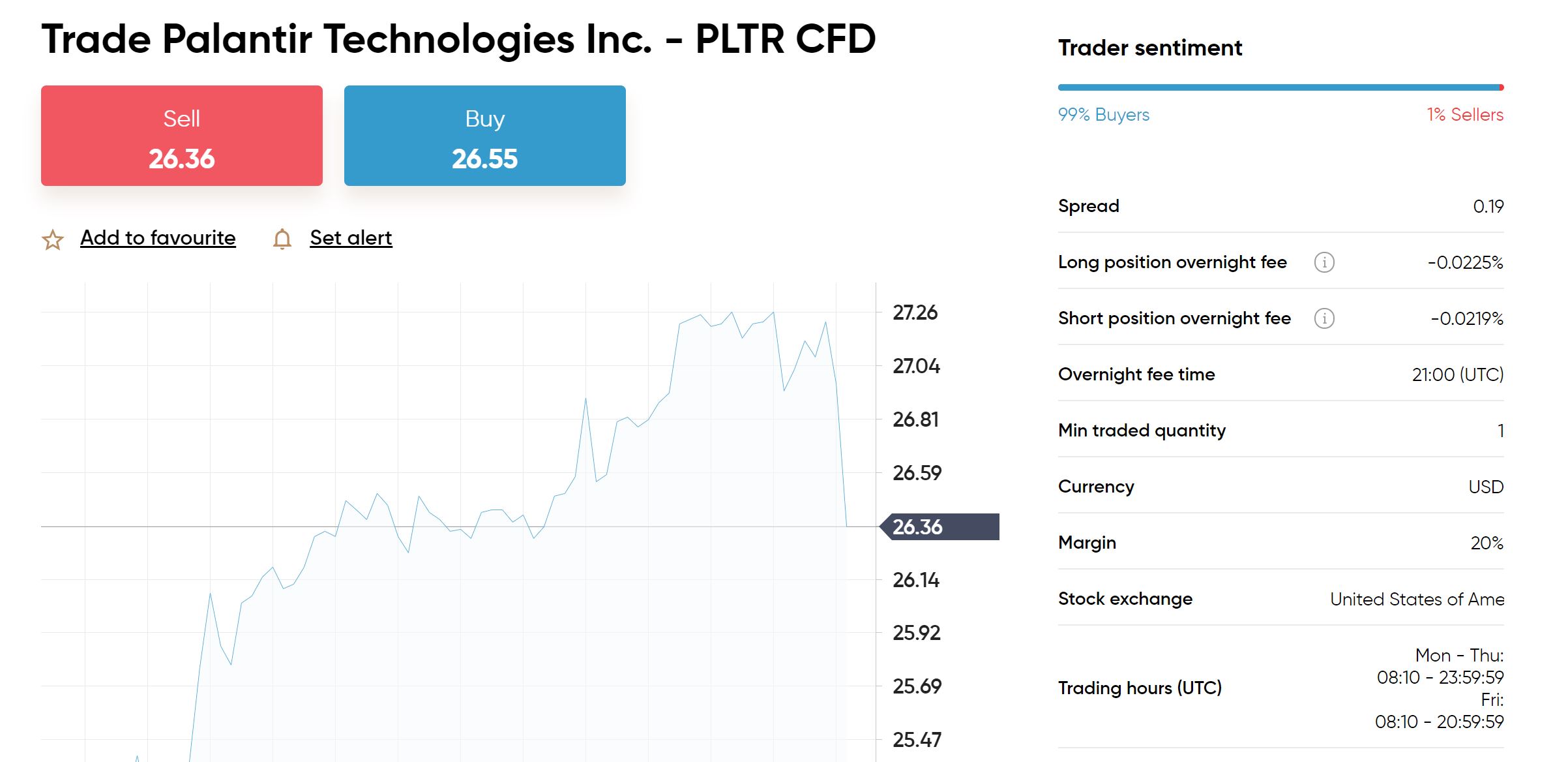

eToro is our #1-rated stock broker in South Africa and our recommended choice for buying Palantir shares. This CFD trading platform offers more than 3,000 shares from the US, UK, and Europe, including Palantir.

All stock trades at eToro are 100% commission-free. You just pay a spread, which is typically around 0.85% of your trade value for Palantir shares. Even better, you can trade Palantir shares with leverage up to 5:1.

eToro has its own custom share trading platform that’s available for the web and mobile devices. The platform is very easy to use and comes packed with technical analyses to help you find the best time to trade. eToro also offers a market news feed and economic calendar to help you time the market.

Another neat thing that eToro offers is AI software that analyses your trades. The software automatically identifies patterns that correlate with your wins and losses and brings them to your attention. So, it’s easy to improve your win rate over time.

eToro is regulated by the UK’s Financial Conduct Authority and is considered very trustworthy. The broker also offers 24/7 customer support by phone, email, and live chat, so you can get in touch at any time if you have questions about your account. You can open a new account with as little as $20 (about 285 ZAR).

Pros:

- 100% commission-free share trading

- Trade Palantir shares with 5:1 leverage

- Over 3,000 US, UK, and European shares

- 24/7 customer support

- Regulated by the UK FCA

Cons:

- Cannot create your own custom technical studies

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Step 2: Research Palantir Shares

Before you buy Palantir shares, it’s important to have a full picture of this company. In this section, we’ll explain everything you need to know about what Palantir is, how it makes money, and what its future may look like.

What is Palantir?

Palantir provides highly complex, highly customized data-crunching algorithms to help government agencies and companies leverage all of the data they now have. The company is relatively secretive about how its algorithms work, but past customers have provided glowing reviews of Palantir’s technologies.

Palantir’s name comes from the J.R.R. Tolein’s Lord of the Rings trilogy. In those books, “palantiri” are seeing-stones that enable the holder to see events in other parts of the world. The name reflects Palantir’s mission: to use big data to enable insights that are akin to peeking behind the curtain of what we can normally see.

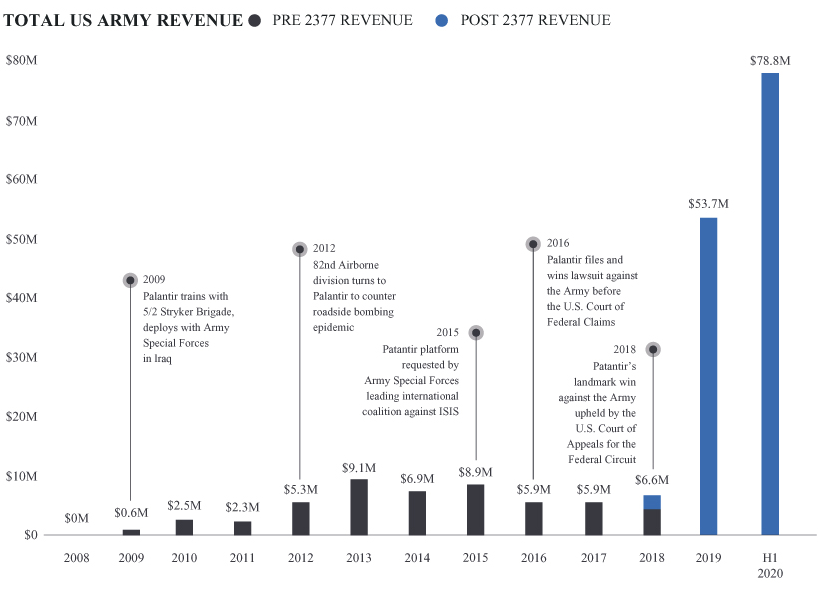

This company originally began as a contractor for US government intelligence agencies. It continues to work with US intelligence and has greatly expanded its US government footprint – Palantir now contracts with the Department of Defense, Immigration and Customs Enforcement, and numerous city police departments.

Palantir also has a commercial branch that works with companies like Morgan Stanley, Fiat Chrysler, and Airbus. The company also works with a number of hedge funds.

Palantir Share Price

Palantir went public on the New York Stock Exchange (NYSE) on September 30, 2020. The company used a direct listing instead of a traditional IPO, so employees and existing shareholders were able to sell their shares, but no new shares were issued.

At opening, Palantir shares traded at $10 apiece. However, they fell to $9.50 – a 5% loss – by the end of the first day of trading.

The stock rallied in the months ahead, though, and ended 2020 at $23.55 per share – more than doubling the money of investors who got in during the IPO. There was relatively little news about the company during this time to drive the stock price higher, which made some Wall Street analysts nervous. At the same time, Citron Research, a short-selling firm, called Palantir stock a “online casinos” because of how risky the firm thought the stock was.

Despite the criticism, Palantir shares have continued to rise. The stock hit $45 apiece in January 2021 and now trades at $26.85 per share. At the current price, Palantir has a market cap of over $50 billion.

Palantir Shares Dividend

Palantir is not profitable and does not issue a dividend to shareholders. The company is likely many years away from issuing a dividend and, like many companies, may choose to not do so at any point in the future.

Are Palantir Shares a Good Buy?

Palantir shares have been something of a black box for investors. The share price is up 168% from the IPO, and yet there’s been almost no news since the company went public.

So, are Palantir shares worth buying today? Let’s take a closer look at some of the reasons why this stock is worth your attention.

A Growing Client Base

One of the most important reasons to be bullish about Palantir is that the company has been consistently and aggressively growing its client base. In the past month alone, the company has received new contracts from the US Federal Aviation Administration and the US Special Operations Command. Palantir has also brought on 50 new salespeople since going public, which will help it continue the fast pace of client acquisition.

The catch is that Palantir’s clientele are still largely agencies of the US government. More than half of Palantir’s revenue comes from government agencies, in fact. While this is a stable source of revenue, it does mean that Palanitr is more exposed to public scrutiny – and criticism from lawmakers – than it would be otherwise.

Palantir recognizes this, and the company has been working actively to bring on more companies. Still, investors – and Palantir’s leadership – expect that to take years, not months. So think of Palantir as a long-term investing opportunity, not a short-term trade.

Niche Opportunity

Another reason to like Palantir is simply that it’s occupying a niche that almost no other company can match. The US government and most major companies are sitting on mountains of data that they don’t know how to make use of. Companies like Microsoft, Amazon, and Google can give them the computational power to process that data, but not the expertise to analyse it.

That’s where Palantir comes in. The company embeds experienced data analysts with every company they work with, so they have a real focus on problem-solving for clients. At the same time, Palantir’s algorithms are widely praised by current and former clients as breakthrough technologies. For companies that want to make use of all their data to be more profitable and more efficient, there aren’t many alternatives to Palantir.

This is critical because the amount of data that companies have – and the number of companies that want to make use of their data – is only growing over time. That means more potential opportunity for Palantir even as the company’s footprint expands.

Long-term Growth

Palantir turned its first quarterly profit this spring, and that’s likely just the beginning of a bright future for this company. Palantir has been able to grow its revenue by nearly 50% in the first quarter of 2021 compared to the same time period last year, and it expects revenue growth to continue apace.

Even better, Palantir has been growing its revenue per customer consistently. That’s a strong sign that the company can not only retain customers, but strongly monetize them after putting in a huge initial investment during the onboarding process.

Palantir is currently forecasting a compound annual growth rate of over 30% through 2025, which is on its own spectacular news for investors. However, that doesn’t account for the recent additions to the sales team, which could positively impact revenue as well. Palantir also has billions in cash on its balance sheet and relatively little debt, so it’s in good financial shape to continue to grow aggressively.

Step 3: Open an Account & Buy Shares

Ready to buy Palantir shares? We’ll show you how to get started with eToro and pay nothing in commissions.

Step 1: Open an Account with eToro

To open a new eToro trading account, head to the broker’s website and click ‘Trade Now.’ Enter your email address and a password, or sign up with Google or Facebook.

Step 2: Verify Your Account

eToro requires all news traders to verify their identity to comply with Know Your Customer (KYC) regulations. You can complete this step online by uploading a copy of your passport or driver’s license and a copy of a bank statement or utility bill.

Step 3: Deposit Funds

Next, it’s time to fund your account. eToro requires a minimum deposit of $20, which is around 285 ZAR. You can pay by credit card, debit card, bank transfer, or e-wallet.

Step 4: Buy Palantir Shares

Now you’re ready to buy Palantir shares. From your account dashboard, search for ‘Palantir’ and click on it when it appears. Then click ‘Buy’ to open an order form. Enter the number of shares you’d like to buy and click ‘Place Order’ to complete your trade.

Palantir Shares Buy or Sell?

Palantir stock has been alternatively praised and criticized by investors and analysts. On the one hand, the company is valued highly and only recently turned its first quarterly profit after 18 years in business. On the other hand, Palantir is rapidly expanding its revenue, beating Wall Street expectations, and occupying a niche that’s projected to grow rapidly in coming years.

Given that, we think that Palantir shares are a buy today. Keep in mind that this stock represents a long term investment since it’s likely to take several years or longer for Palantir to realize returns from the clients it onboards today. CEO Alex Karp commented recently that Palantir is “in this for the long haul” – a clear sign that the company is focused on providing returns to investors for the next 50 years rather than sacrificing to deliver profits immediately.

Ready to buy Palantir shares in South Africa? Click the link below to get started with eToro and pay zero commissions when you buy and sell shares!

eToro – Buy & Sell Palantir Shares With Zero Commission

Crypto assets are highly volatile and unregulated in EU countries. No consumer protection. Tax on profits may apply.

FAQs

What is Palantir’s stock ticker symbol?

Palantir trades on the New York Stock Exchange under the ticker symbol PLTR.

Who is the CEO of Palantir?

The CEO of Palantir is Alex Karp, one of the company’s original founders.

Is Palantir a good investment?

Palantir is a long-term growth stock with a lot of potential upside. The company is not yet profitable, so it is considered risky. For investors who are willing to stick with Palantir, though, the company is forecasting a 30% annual growth rate for the next 5 years.

What does Palantir do?

Palantir is a big data analytics company. It helps government agencies and companies analyse their data to detect patterns and make decisions. Palantir embeds data analysts with every client the company works with.

Does Palantir operate outside the US?

Palantir does operate in Europe and Asia. However, the majority of the company’s revenue comes from the US. Palantir’s reliance on the US government may also make it harder for the company to expand internationally in the future.