How to Buy Pfizer Shares in South Africa – With 0% Commission

Pfizer is one of the largest US pharmaceutical companies and developed the first COVID-19 vaccine to be used around the world. In this guide, we’ll show you how to buy Pfizer shares in South Africa with 0% commission and explain why Pfizer stock is a buy today.

How to Buy Pfizer Shares South Africa – Quick Guide 2021

- Step 1: Open an Account with Capital.com – Capital.com is our top-rated broker to buy Pfizer shares in South Africa. Head to the broker’s website and click ‘Trade Now’ to get started.

- Step 2: Upload ID – Capital.com requires you to verify your identity before you start trading. You just need a copy of your passport or driver’s license to complete this step.

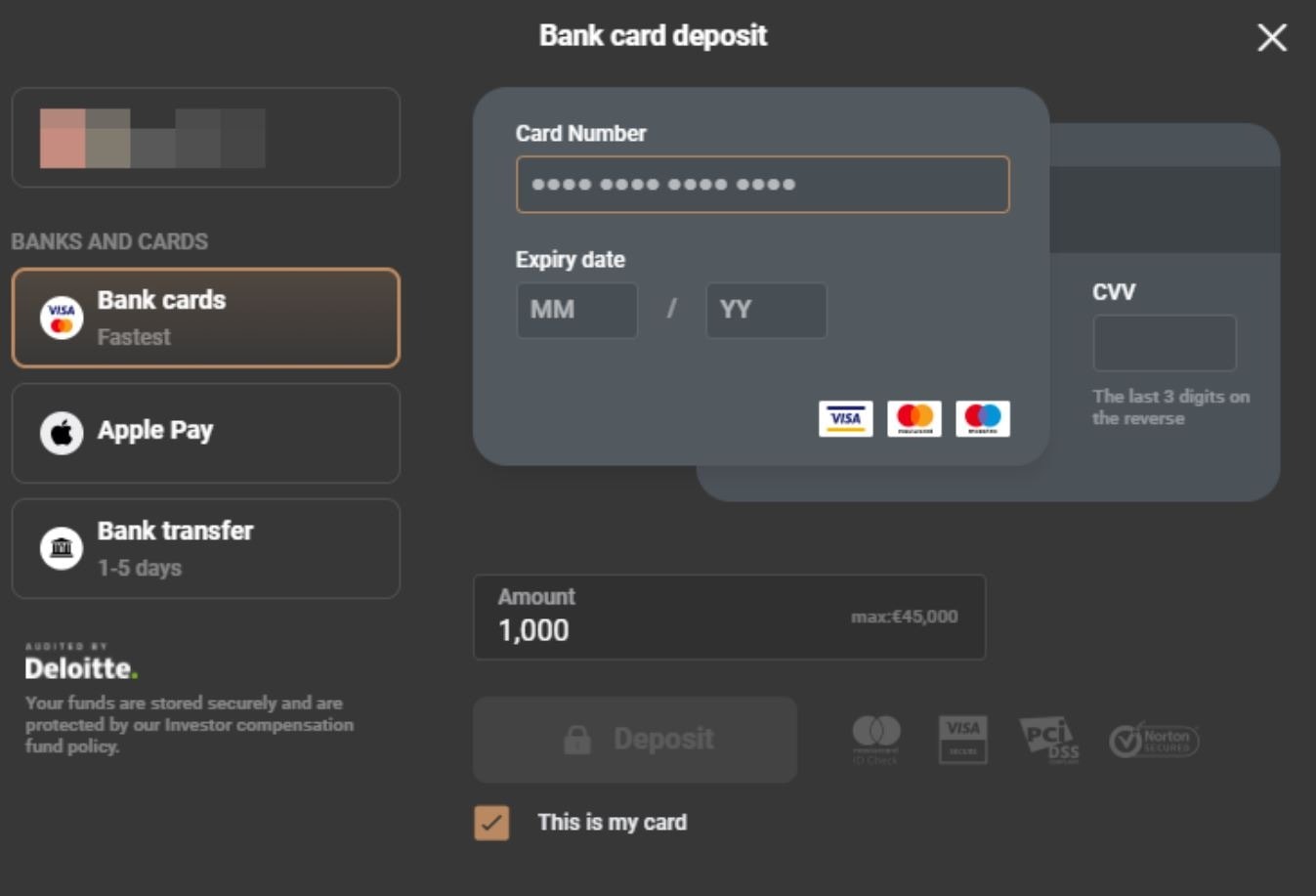

- Step 3: Deposit – You’ll need to make a minimum deposit of $20. You can pay by debit card, credit card, or bank transfer.

- Step 4: Buy Pfizer Shares – Search for ‘Pfizer’ and click ‘Buy’ when it appears. Enter the amount you want to invest and confirm your trade.

Step 1: Find a South Africa Stock Broker That Offers Pfizer Shares

In order to buy Pfizer stock, you’ll need a South African stock broker that offers trading on US shares. The good news is that Pfizer is a massive company listed on the New York Stock Exchange (NYSE), so the shares are carried by most South African brokers.

When it comes to choosing the best broker, though, there’s a bit more to think about. Your broker will impact how much it costs to trade, what tools you have access to, and more.

To make your choice easier, let’s review two of the best 0% commission South African stock brokers to buy Pfizer shares:

1. AvaTrade – Trade Pfizer Share CFDs with 0% Commission

AvaTrade

AvaTrade offers a few different trading platforms to choose from based on your level of experience. For newer traders, the custom AvaTrade platform is easy to use and offers plenty of technical firepower. It comes with dozens of technical studies as well as a news feed and price alerts.

For more experienced traders, AvaTrade offers integration with MetaTrader 4 and 5. These platforms are somewhat complex to get started with, but they enable you to create custom indicators from scratch and backtest your strategy against historical data. MetaTrader also makes it possible to create fully customisable alerts so you never miss an opportunity to trade.

This broker also has a social trading app for iOS and Android called AvaSocial. The AvaSocial app enables you to connect with thousands of other share traders to discuss the latest market moves, news, and more. You can also follow more experienced traders and automatically mimic their trades. This copy trading makes it easy to put your portfolio on auto-pilot.

AvaTrade is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa and the FCA in the UK, as well as in several other countries. The platform requires a minimum deposit of $100 to open a new account and accepts credit cards and debit cards. If you ever need help with your account, AvaTrade’s support team is available 24/5.

Pros:

- 100% commission-free CFD trading

- Multiple trading platforms including MetaTrader 4/5

- Social trading with AvaSocial mobile app

- Supports copy trading

- Regulated in South Africa

- 24/5 customer support

Cons:

- Limited selection of global shares

- Relatively few educational resources for new traders

Your capital is at risk.

2. Capital.com – Overall Best Broker to Buy Pfizer Shares in South Africa

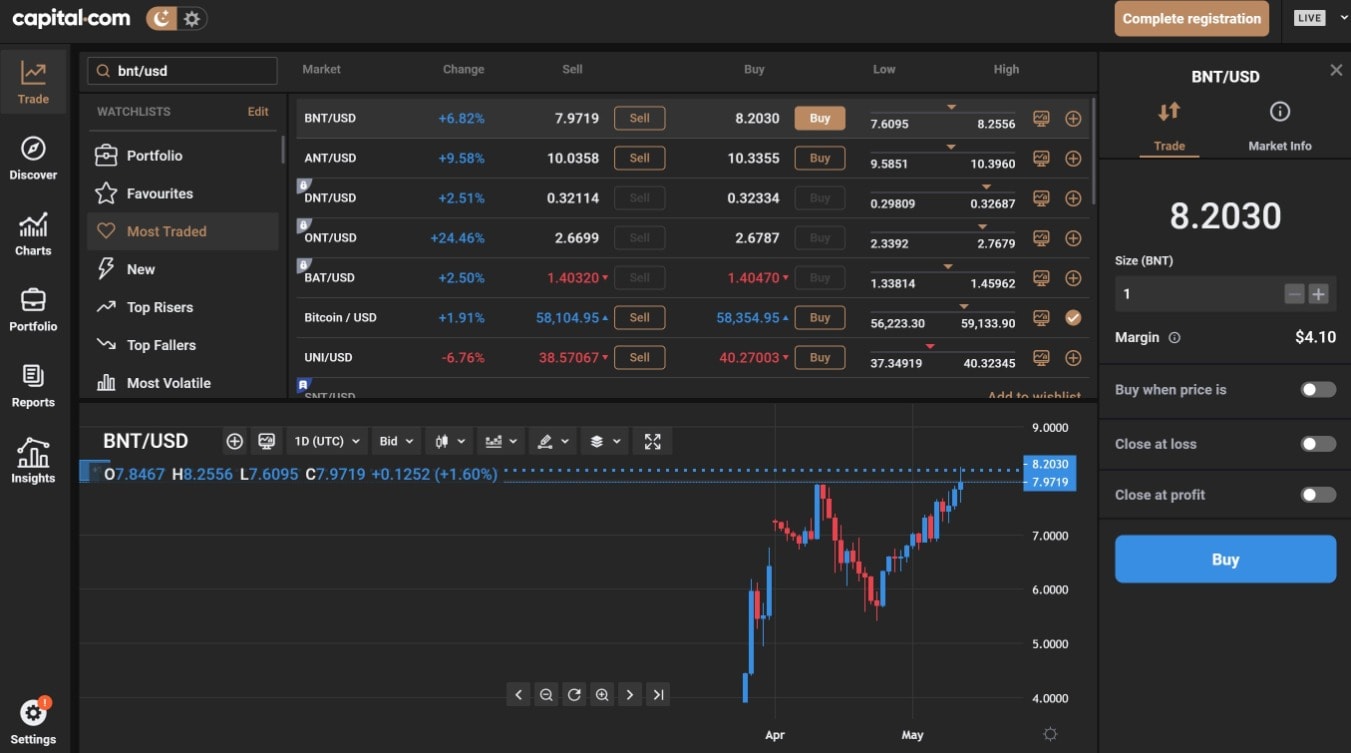

Capital.com offers its own custom trading platform for the web and mobile devices. It’s very user-friendly and comes packed with features, including technical charts, watchlists, a news feed, and price alerts. We also like that the platform integrates with TradingView, which makes it easy to create custom technical studies and backtest your trading strategy against historical price data.

Another nice thing about Capital.com’s share trading platform is that it actively helps improve your trading. The platform uses AI software to analyze your trades and spot patterns that contribute to your wins and losses. The results are summarized for you, making it simple to alter your trading behaviour to increase your win rate and minimize your losses.

This broker also stands out for its educational resources. Capital.com has dozens of educational videos, articles, and interactive courses that cover everything from CFD trading to popular technical trading strategies. The broker even has a mobile app dedicated to education. It includes quizzes so you can test your knowledge before starting to trade.

Capital.com requires a minimum deposit of $20, which is equal to around 300 ZAR. The broker accepts credit cards, debit cards, and bank transfers. Capital.com is regulated by the UK’s Financial Conduct Authority (FCA) and offers 24/7 customer support, so it’s considered very trustworthy.

Pros:

- Trade over 3,000 share CFDs

- 100% commission-free trading with low spreads

- Charting platform integrates with TradingView

- AI software helps you improve your trading

- Tons of educational resources

- $20 minimum deposit

- 24/7 customer support

Cons:

- Price alerts are only available through the mobile app

- Limited analyst research on stocks

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Step 2: Research Pfizer Shares

Before you jump into buying Pfizer shares, it’s important to do your research into the company. We’ll cover everything you need to know about Pfizer and help you decide whether you should buy or sell Pfizer shares today.

Pfizer Share Price History

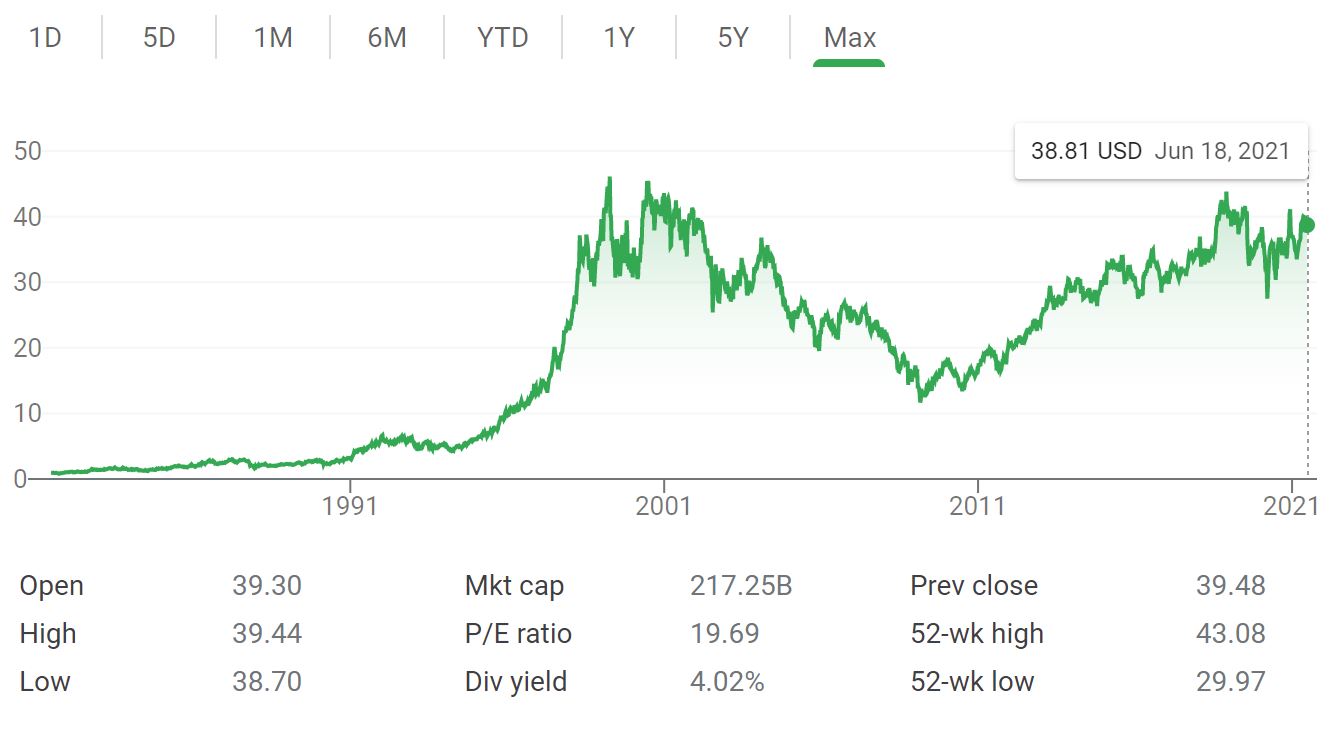

Pfizer went public on the New York Stock Exchange in 1942, almost 100 years after the company was founded. At the time, the $5.9 million IPO was one of the biggest in US history.

Fast forward to the 1990s, and Pfizer stock had appreciated by over one million-fold. Pfizer released Viagra in 1998, which even today brings in around half a billion dollars per year.

The run-up to the Viagra release was a huge event for the Pfizer stock price. The shares shot up from $11 apiece in 1996 to over $35 apiece by 1998. The shares hit an all-time high of over $45 per share in 2000 and have yet to top that.

Pfizer’s stock entered a prolonged decline in the early 2000s, as the company fell behind on new drug development and debate about health care reform in the US brewed. In 2009, the stock hit a low of around $12 per share.

Since that point, Pfizer shares have been gaining value rapidly once again. The shares topped $42 in 2018 and were trading above $37 per share before the COVID-19 pandemic hit in March 2020. Pfizer stock did dip briefly when the market crashed at the start of the pandemic, but they quickly recovered after Pfizer announced it would be working on a COVID-19 vaccine with BioNTech.

The Pfizer-BioNTech was the first COVID-19 vaccine to be approved in the US in December 2020. The news lifted the stock to over $41 per share. Pfizer shares soon fell to $33, however, after the company announced poor trial results for its rheumatoid arthritis drug Xeljanz.

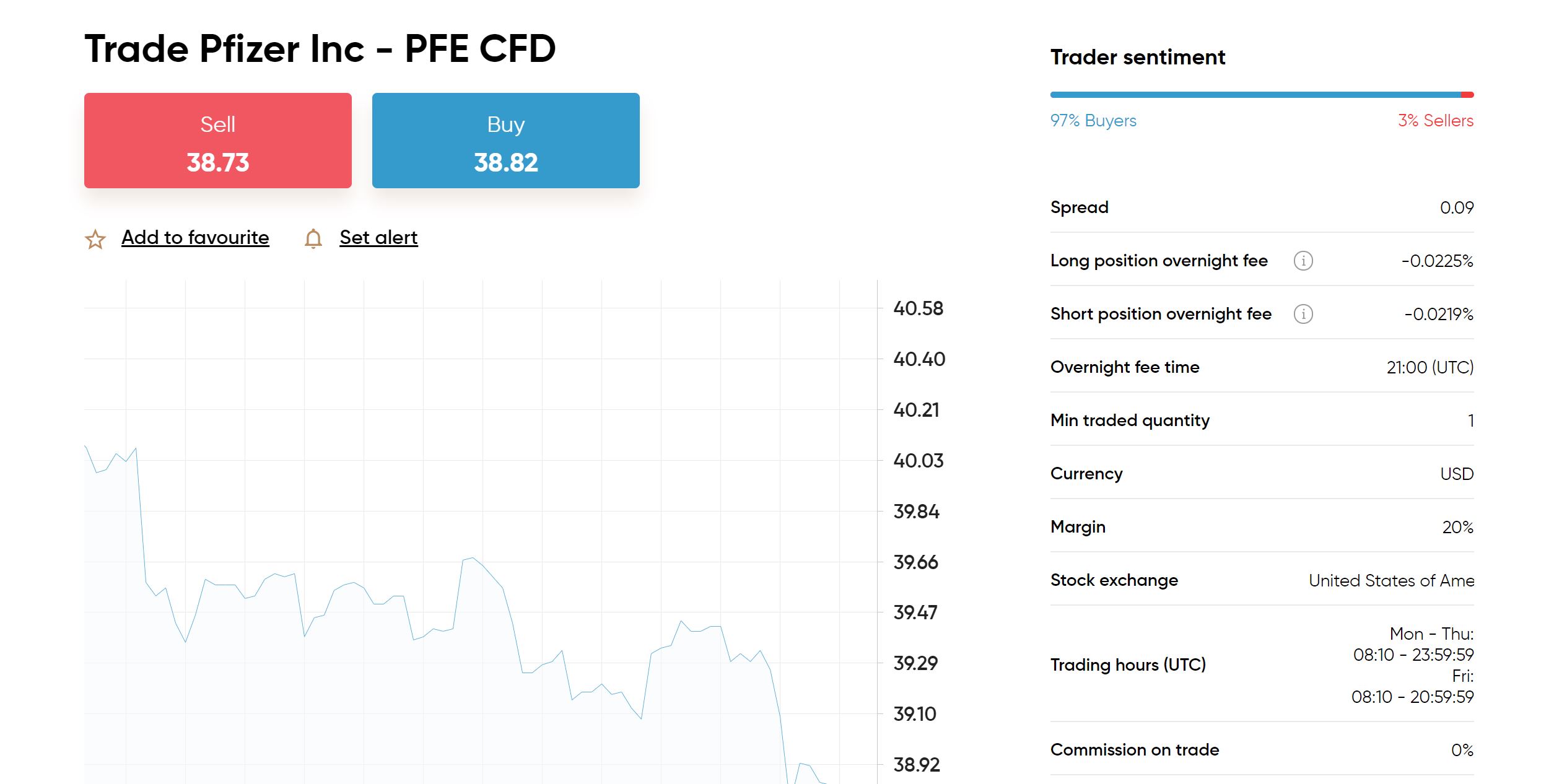

Today, Pfizer shares are trading around $38.81. The company has a market capitalisation of $217 billion and a price-to-earnings ratio (P/E ratio) of 19.7.

Pfizer Share Dividends

Pfizer has paid a dividend to investors since it went public. The yield has varied slightly from year to year, but is typically around 3-4%. Today, Pfizer’s quarterly dividend delivers a 4.02% yield for investors.

Should I Buy Pfizer Shares?

Should you buy Pfizer shares today? We think the answer is a resounding yes. Here’s why:

The COVID-19 Vaccine is a Huge WIn for Pfizer

It’s hard to overstate how big of a win the COVID-19 vaccine that Pfizer developed in partnership with BioNTech is for the company. Last month, Pfizer announced that it expects to sell around $26 billion worth of the vaccine in 2021. That number alone is more than half the drugmaker’s total revenue for 2020!

The even better news for Pfizer is that most of this revenue is coming from deals with developed countries like the US, EU, and Canada. Much of the developing world will still need doses, so there’s an opportunity for Pfizer to continue its huge sales of the vaccine for several years to come. If it turns out that a booster shot will be needed – as most experts anticipate – then demand for Pfizer’s COVID-19 vaccine will go on indefinitely.

Excellent Growth Ahead

Despite the success of Pfizer’s vaccine, the shares have hardly budged since last year. Pfizer has gained ground, but not as much as the overall market.

This seems especially strange given that Pfizer is forecasting a compound annual growth rate (CAGR) of 6% for the next 5 years. This number was calculated without accounting for all of the drugs in Pfizer’s development pipeline, so you can read it as a minimum expected growth rate. That should not only keep Pfizer’s dividend strong, but also ensure the share price holds its ground even in the face of disappointing drug news.

Looking Down the Pipeline

The major thing that’s held Pfizer shares back over the past year is a lack of promising drugs in its development pipeline. Unfortunately, the company has had a string of drugs that didn’t live up to expectations, and it’s likely to be a number of years before it lands on another blockbuster.

That said, we don’t think this should be a huge issue for the company. Even while Pfizer searches for its next big hit, the company is growing, not shrinking. The COVID-19 vaccine is itself a blockbuster drug that will deliver steady revenue for years to come. Plus, this is a company that has over 150 years of success behind it. We’re fairly confident that Pfizer will have another breadwinner like Viagra, even if it takes a few years of holding onto the stock first.

Step 3: Open an Account and Deposit Funds

Ready to buy Pfizer shares? We’ll show you how to open an account with Capital.com, which offers commission-free trading on Pfizer and more than 3,000 shares from around the globe.

To get started, head to the Capital.com website and click ‘Trade Now.’ Enter your email and a password or sign up using your Google or Facebook account details.

Before you can start trading, Capital.com requires you to verify your identity to comply with Know Your Customer (KYC) rules. You can complete this step online in a few minutes by uploading a copy of your driver’s license or passport. You’ll also need a proof of address, which can be a financial statement or utility bill.

Next, it’s time to fund your account. Capital.com requires a minimum deposit of $20 (about 300 ZAR), which you can pay by credit card, debit card, or bank transfer. Credit and debit payments are available for trading instantly, while bank transfers can take a few days to reach your account.

Step 4: Buy Pfizer Shares

Once your account is all set, find the search bar at the top of the Capital.com dashboard and enter ‘Pfizer.’ When the shares appear, click on them and then click ‘Buy.’

In the order form, enter the amount you want to invest in Pfizer in US dollars. You can enter additional order details like a stop loss or take profit level if it makes sense for your trading strategy. When you’re ready, click ‘Open Trade’ to buy Pfizer shares with Capital.com.

Capital.com – Buy Pfizer Shares in South Africa With 0% Commission

Pfizer has been one of the most important global companies over the past year. In partnership with BioNTech, the company developed the first COVID-19 vaccine and is on track to sell over $26 billion worth of that vaccine this year.

Despite that massive success, Pfizer’s share price hasn’t budged much in the last 12 months. To us, that makes Pfizer look significantly undervalued. That’s especially true when you account for the fact that this is a company with 150 years of success behind it. So, we think Pfizer shares are a strong buy today.

If you’re ready to buy Pfizer shares, click the link below to get started with Capital.com and pay nothing in commissions.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.