Best Brokers with NASDAQ South Africa

If you’re based in South Africa and wish to trade or invest in the NASDAQ 100 – there are dozens of online brokers to choose from. Your options include a traditional NASDAQ index fund via an ETF as well as leveraged CFDs.

In this guide, we review the Best Brokers with NASDAQ South Africa and walk you through the process of getting started with a low-cost investment account today.

Best Brokers with NASDAQ South Africa 2022

Below you will find an overview of the best brokers with NASDAQ South Africa for 2022. You can read our comprehensive review of each trading platform by scrolling down!

- Libertex – Overall Best NASDAQ Broker with Zero Spreads

- AvaTrade – Best FSCA Broker for Trading the NASDAQ

- VantageFX – Best Broker for Trading NASDAQ 100 CFDs

- IG – Best NASDAQ 100 Broker in South Africa for Day Trading

- Pepperstone – One of the Best NAS100 Brokers for Raw Spread Accounts

- FXCM – Reputable Best NASDAQ 100 Broker for Beginners

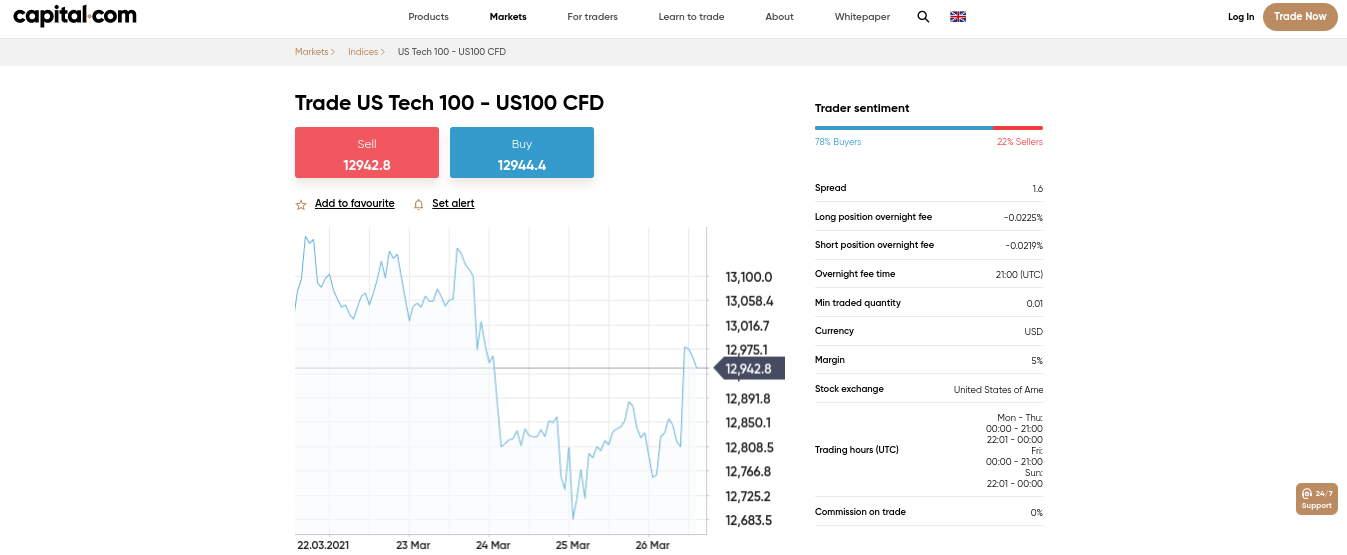

- Capital.com – Overall Best NASDAQ 100 Broker – 0% Commission

Best NAS100 Brokers in South Africa Reviewed

Alongside the S&P 500 and Dow Jones, the NASDAQ 100 is one of the most traded indices globally. After all, the index fund consists of tech-powerhouses like Apple, Tesla, Amazon, IBM, and Microsoft. With this in mind, there are heaps of South African brokers with NAS100 to consider.

To help clear the mist, below we discuss a selection of the best brokers with NASDAQ South Africa for 2022.

1. Libertex – Overall Best NASDAQ Broker with Zero Spreads

Aside from the index, Libertex allows users to trade cryptocurrencies, ETFs, stocks, bonds, commodities, and FX currency pairs within a clean and beginner-friendly platform.

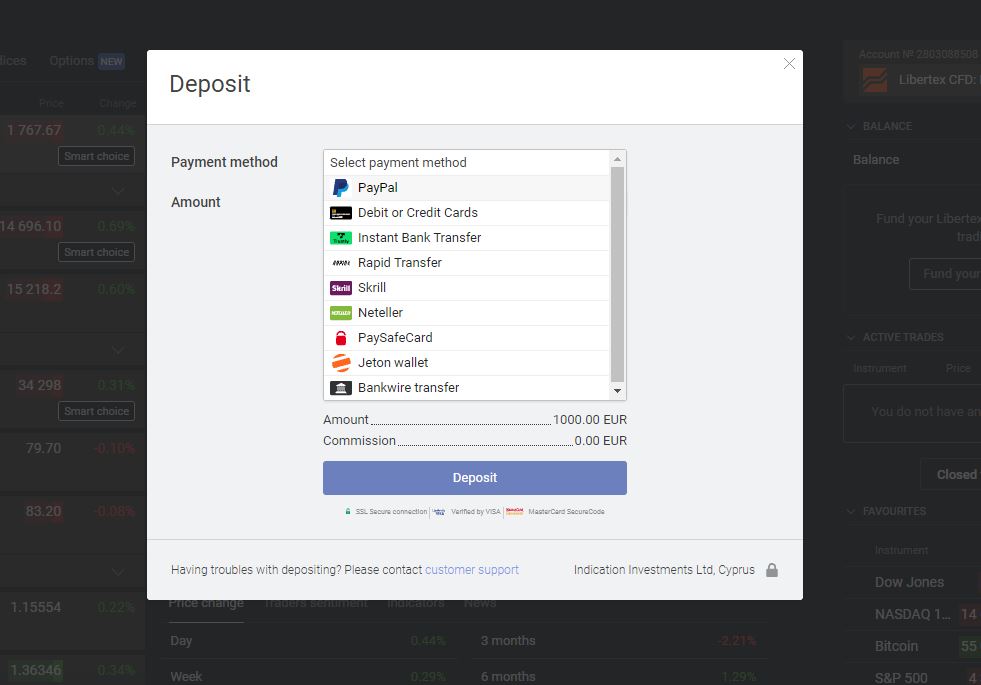

Users can also trade on the Web trading platform or use the popular MetaTrader 4 or 5 (MT4/5). Deposit fees are non-existent, and you can make a minimum deposit of €10 with an international bank wire transfer, credit/debit card, PayPal, GiroPay, Sofort, and several others. However, Libertex charges a withdrawal fee of €1 on bank wire transfers and 1% on select e-wallet providers.

Like other top online brokers, Libertex is regulated by a tier-1 body and subsidiary of the European regulatory commission CySEC. Libertex is equipped with a demo account to learn about the platform and how the financial market operates.

Pros:

- Multiple trading platforms

- Low minimum deposit of only €10

- Huge library of payment methods

- E-wallet transactions are processed instantly

- Demo account for new traders

- Offers customer support in 16 languages

Cons:

- Inactivity fee

75.3% of retail investor accounts lose money when trading CFDs with this provider.

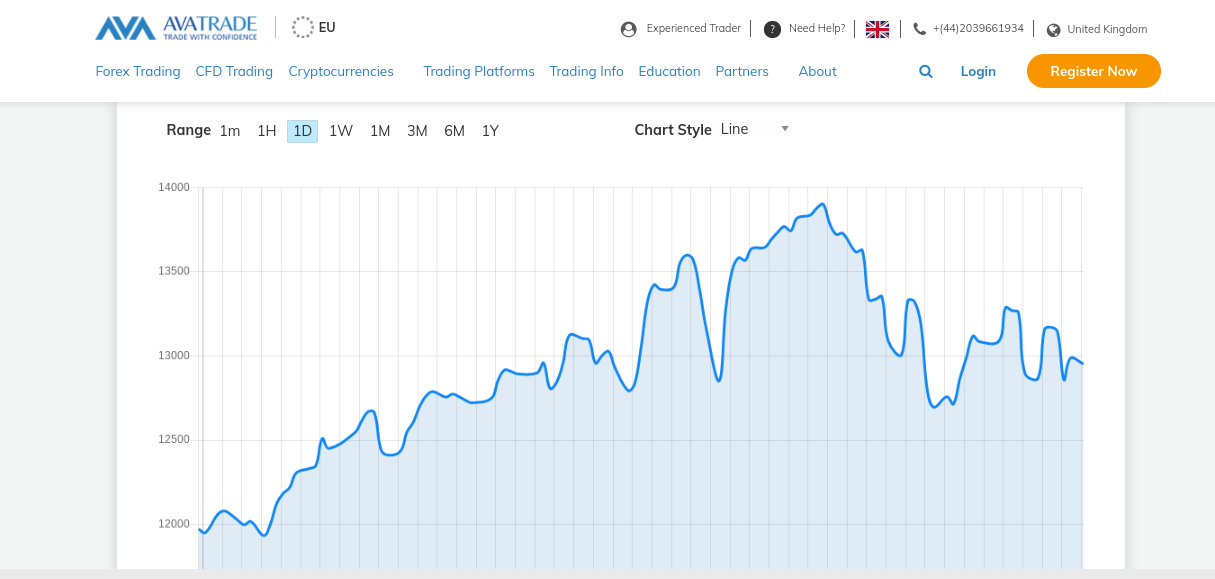

2. AvaTrade – Best FSCA Broker for Trading the NASDAQ

AvaTrade is a popular CFD trading site that is regulated by the South African Financial Sector Conduct Authority (FSCA number 45984). It is regulated in five other jurisdictions – so your capital is well protected at all times. Much like Libertex, Capital.com, and IG – AvaTrade allows you to trade the NASDAQ 100 via leveraged CFDs.

You won’t pay any commissions when trading at AvaTrade, as all fees are built into the spread. At the time of writing, this top-rated broker is charging a spread of just 1 point above the market rate. NASDAQ 100 CFDs at AvaTrade move in increments of 0.25 points – making it ideal for low-stake traders. Plus, if you decide to keep your position open overnight, you will pay a swap fee of just 0.0058%.

When it comes to trading platforms, AvaTrade gives you four options. This includes full support for both MT4 and MT5. You can also trade via the AvaTrade website or through the provider’s native mobile app. Getting started at AvaTrade requires a low minimum deposit o just $100. Supported payment types include e-wallets, bank transfers, and debit cards. You can also trade via the platform’s demo account without needing to make a deposit.

Pros:

- Trade CFDs for stocks, forex, and commodities

- All fees built into the spread

- Includes paper trading with MetaTrader 4

- Copy and social trading features

- Great reputation

- Heavily regulated

Cons:

- Very high inactivity fee

73.05% of retail investors lose money when trading CFDs at this site

3. VantageFX – Best Broker for Trading NASDAQ 100 CFDs

VantageFX is another flexible and powerful share trading platform available in South Africa. With this broker, you can trade over 50 US stocks, 50+ Australian stocks, and 70+ European stocks (including the UK). All shares trade as CFDs, so you can leverage your positions up to 20:1. That makes VantageFX ideal for staking out big positions in top companies.

In addition, Vantage has 15 stocks index CFDs, including a CFD for the NASDAQ 100. You can trade the NASDAQ 100 with leverage up to 333:1, making this broker a great option if you want to make a big bet on the US tech sector.

VantageFX offers several trading platforms, including MetaTrader 4 and MetaTrader 5. These platforms can be difficult to get started with, but they enable you to create fully custom technical studies and backtest your strategies against historical price data. In addition, VantageFX has its own web trading platform and mobile apps for iOS and Android devices. These are comprehensive enough for most share traders since they come packed with technical studies. The broker also integrates with Zulutrade, Duplitrade, and Myfxbook for social trading and copy trading.

One notable downside to VantageFX is that trading with this platform can be pricey. The platform charges fixed commissions of $6 per trade for US stocks and €10 per trade for UK and EU stocks. There’s no added spread to worry about and no inactivity fees, but these commissions are relatively expensive already.

VantageFX is regulated in Australia and the UK. To open an account, you’ll need to make a $200 minimum deposit.

VantageFX fees:

| Commission | None |

| Deposit Fee | Free |

| Withdrawal fee | Free |

| Inactivity fees | None |

Pros:

Cons:

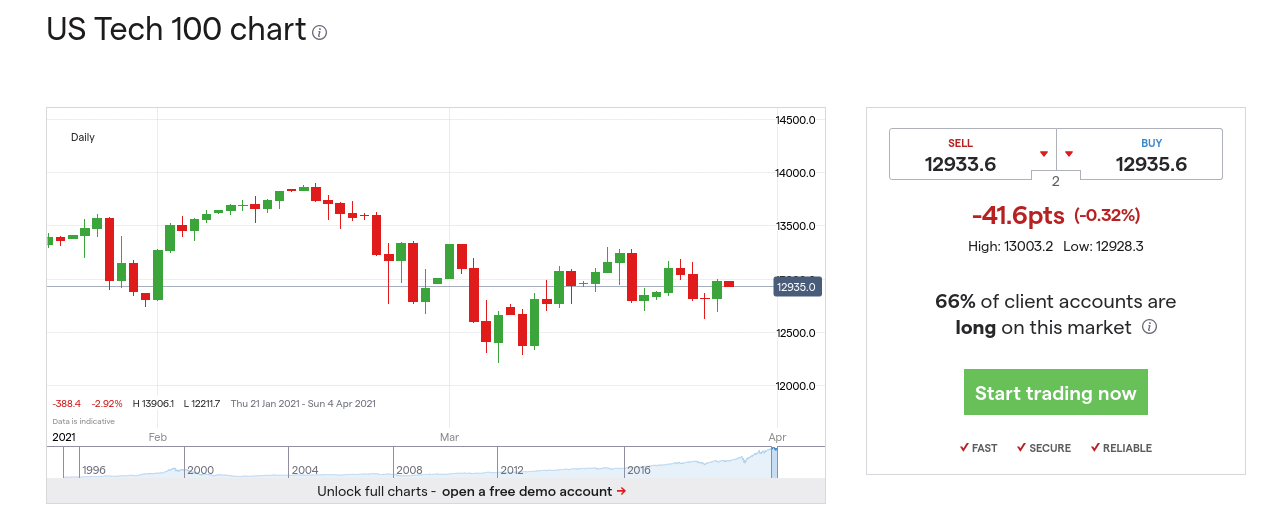

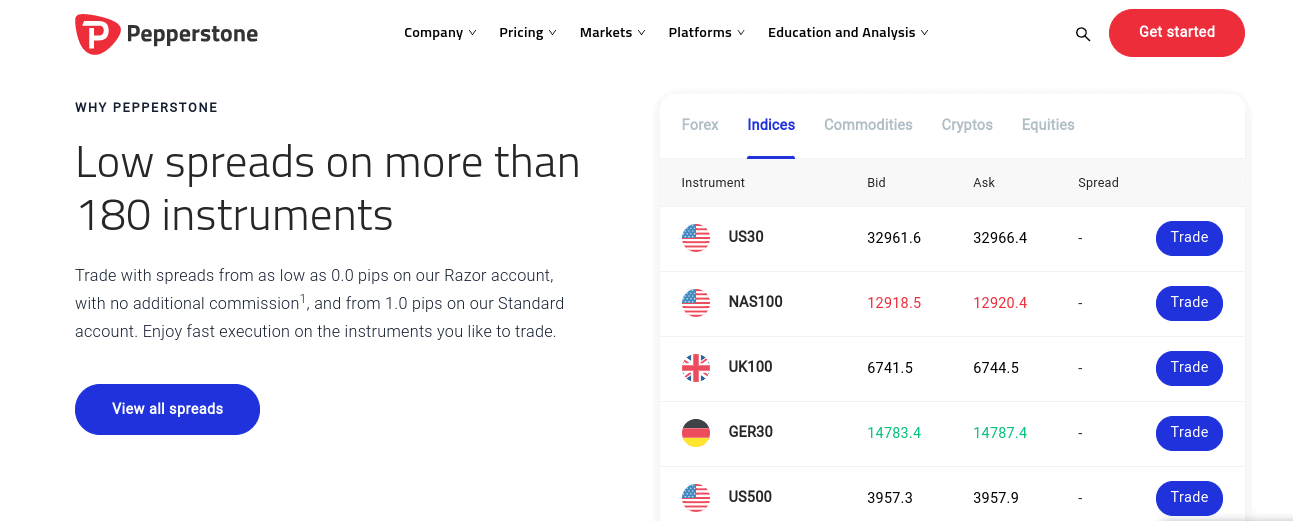

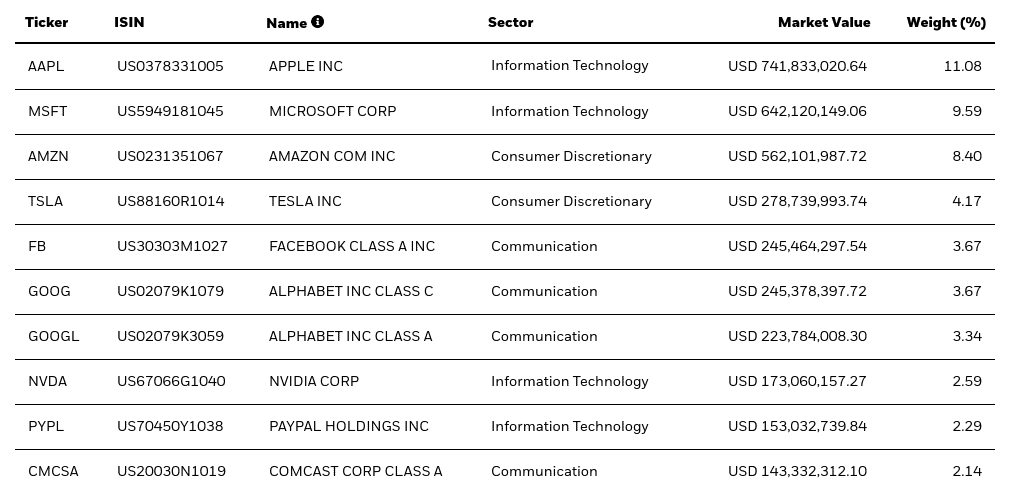

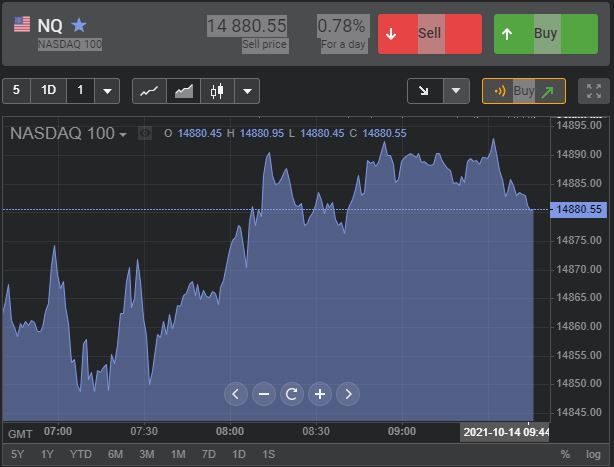

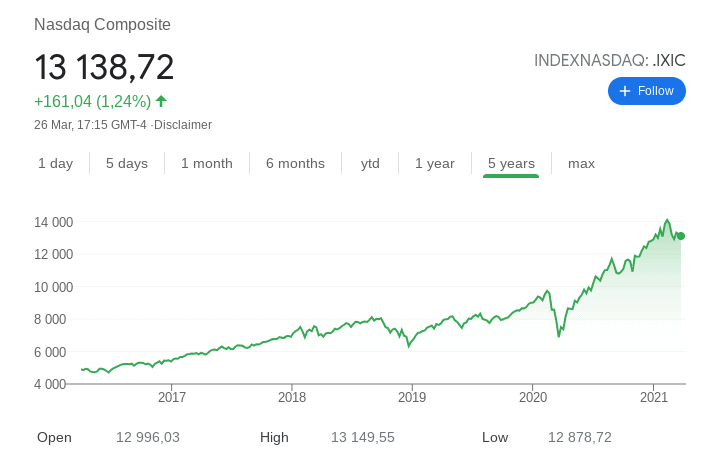

Your capital is at risk. IG is a trusted brokerage firm that launched over four decades ago. Although the platform also offers traditional investments, IG is particularly popular with day trading pros. This is because its platform comes packed with advanced tools and features. For example, IG’s proprietary platform offers multiple order types, pricing alerts, and chart drawing tools. You will also have access to a plethora of technical indicators, live pricing fees, and the ability to enter the market with your preferred currency. Alternatively, you can also trade via MT4 – as IG is fully compatible with this popular third-party platform. Either way, when trading the NASDAQ 100 at IG, you will get industry-leading spreads of just 1 point during busty market hours. If trading in the evening or across the weekend, do bear in mind that this can rise to a spread of 5 points. Commissions are built into the spread, so you always know exactly what you are paying. IG also allows you to trade with the NASDAQ 100 with leverage. Limits will depend on whether you are a retail or professional client. The minimum deposit to trade at IG is £250 – and the platform supports debit cards and bank transfers. Pros: Cons: 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. After all, you will be trading directly with market participants – as opposed to going through a third-party. In many cases, you won’t pay any spreads at all on this account type. Instead, you will pay a small commission of just $3.50 per slide. If, however, you want to trade the NASDAQ 100 with smaller stakes, Pepperstone is also worth considering. This is because the CFD broker also offers zero commission accounts that come alongside a small spread. Either way, you can trade with NASDAQ 100 at Pepperstone with leverage and even engage in short-selling via a CFD sell order. This platform offers a wide range of other asset classes – including stocks, hard metals, indices, energies, forex, and digital currencies. There is also support for 13 other major indices. Getting started at Pepperstone is straightforward and supported deposit methods include Paypal, Neteller, Skrill, Visa, MasterCard, and bank transfers. Pros: Cons: 73.05% of retail investors lose money when trading CFDs at this site Then, when you find that you are comfortable with how FXCM and the wider indices market works – you only need to meet a minimum deposit of $50. You can do this with a South African debit/credit card, Neteller, Skrill, or bank wire. FXCM offers high leverage limits on its CFD markets – which can go as high as 1:200 depending on the asset. We also like the fact that FXCM offers support for several third-party platforms. This includes MT4, NinjaTrader, ZuluTrade, and TradingView. The CFD broker also offers its own native platform – which can be accessed online or via the FXCM mobile app. Other supported markets at FXCM include stocks, commodities, cryptocurrencies, and forex. When it comes to fees, everything is built into the spread. At the time of writing, the NASDAQ 100 can be traded at a spread of just 0.06%. Pros: Cons: 73.05% of retail investors lose money when trading CFDs at this site As a non-EU retail trader, this means that South Africans can get up to 1:200 when trading major indices like the NASDAQ 100. In simple terms, this means that an account balance of $100 would permit a maximum trade of $20,000. Leverage on major forex pairs is even higher at 1:500 – should you wish to diversify your trading strategy. Capital.com is also a low-cost option when it comes to trading the NASDAQ 100. This is because the CFD broker does not charge any trading commissions. Spreads are also very competitive, with Capital.com charging just 0.12% on the NASDAQ 100 at the time of writing. This CFD trading site is also popular with newbies. This is because the minimum deposit is just $20. You will also have access to a fully-fledged demo account – which mirrors live market conditions. The platform is also home to an abundance of trading guides, explainers, and courses. If you want to trade via your phone, Capital.com offers a mobile stock app that is compatible with iOS and Android devices. You can also trade via MT4 or through the main Capital.com website. Supported payment methods at this top-rated platform include debit/credit cards, bank transfers, and e-wallets. Finally, the platform is regulated by the FCA and CySEC. As such, you can trade the NASDAQ 100 in a safe and secure environment. Pros: Cons: 75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. When reviewing the best brokers with NAS100 in South Africa – we found that fees and commissions can vary wildly. As such, below you will find a fee comparison table applicable at each of the providers we have reviewed on this page. Don’t forget – spreads can and will vary throughout the day (unless using a fixed spread broker). In most cases, the spread will be at its most competitive when both the US and UK markets are open. After the NYSE – the NASDAQ is the largest stock exchange globally. the NASDAQ is often preferred by companies operating in the technology sectors. For example, you will find the likes of Amazon, Apple, Microsoft, Facebook, Paypal, and Tesla listed on the NASDAQ. With that said, there are also listings from other sectors, albeit, at a much lower weight than technology stocks. Nevertheless, one of the best ways to gain access to this stock exchange is via the NASDAQ 100 index. As the name suggests, this is a stock market index that tracks the value of the 100 largest companies listed on the exchange. Like most index funds, the NASDAQ 100 is weighted to take into account the market capitalization of each of its constituents. To give you an idea: As you can see from the above, the NASDAQ 100 is heavily weighted towards Apple, Microsoft, and Amazon – with a collective weight of 28%. As such, the stock prices of these three firms have a major impact on the value of the NASDAQ 100 index. With that said, although we cover NASDAQ 100 trading strategies shortly – it is important to note that this index does allow you to invest in a diversified manner. That is to say – rather than putting all of your eggs into a few individual stocks, the index allows you to mitigate your risk across 100 different firms. There are generally two different ways in which you can trade the NASDAQ from the comfort of your home – ETF index funds or CFDs. The financial instrument that you opt for will ultimately depend on whether you are looking to invest in the index in the long or short term. Before we get to that – it is important that you first have a firm grasp of how the value of the NASDAQ 100 is determined. In doing so, you will be able to make informed investment decisions as to whether the index is likely to rise or fall in value. As we briefly covered earlier, the NASDAQ 100 index utilizes a ‘weighting’ system based on market capitalization. In simple terms, this means that companies with a higher valuation will have a bigger impact on the value of the NASDAQ 100. So, in the case of Apple, the tech stock has a market capitalization of more than $2 trillion, and thus – its NASDAQ 100 weight stands over 11%. Facebook, on the other hand, has a market capitalization of $800 billion. Naturally, the social media giant has a lower NASDAQ 100 weight of just over 3%. Once you get past the so-called ‘tech big boys’, the weighting ratio quickly drops below 1%. For example, the likes of Dexcom, Paccar, Cintas, Paychex, and Alexion Pharmaceuticals each have a NASDAQ 100 weighting of less than 0.30%. In a nutshell, when individual stocks listed on the NASDAQ 100 go up and down in value, this will have an impact on the price of the NASDAQ 100. Of course, the likes of Amazon, Apple, and Microsoft will have a much bigger influence than those with a small weight. In other words, if the three aforementioned tech giants have a good day on the NASDAQ, it is all but certain that the index will increase in value. Here’s a simple example to help clear the mist: It is important to remember that the NASDAQ 100 is not only reweighted on a regular basis – but often rebalanced. The former means that the weighting of each company on the index will change in line with the firm’s market capitalization. In terms of rebalancing, this means that a new company can replace a NASDAQ 100 constituent if its market value warrants it. So now that we have covered how the NASDAQ 100 works in trading terms – we now need to explain how you actually gain exposure to the index. In the sections below we explore the two main NASDAQ trading strategies – long-term ETFs and short-term CFDs. If you are looking to invest in the NASDAQ 100 in the long-term, then the best way of doing this is to purchase an ETF. There are many ETFs that are tasked with tracking the NASDAQ. One of the best, however, is the iShares NASDAQ UCITS ETF. This ETF will buy shares in all 100 constituents of the NASDAQ 100 at the correct weight. In essence, this means that you are indirectly buying all 100 shares yourself – but via a single trade. Every time that the index is reweighted by the NASDAQ Composite, iShares will mirror this with its own portfolio. For example, if it holds 11% in Apple shares but the NASDAQ reduced the weighting to 9% – iShares will do the same. Here’s a quick example of how a long-term NASDAQ investment would look when investing in an ETF. In terms of making money from this long-term NASDAQ 100 investment – this can come via an increased NAV and dividends. We explain how this works in the sections below. The NAV (Net Asset Value) of your chosen NASDAQ ETF reflects the value of all 100 shares held by the provider. In other words, at the end of each day, the NAV is the total number of NASDAQ shares held multiplied by each individual stock price. As and when the NAV increases, so will the value of your NASDAQ investment. For example: As NASDAQ ETFs are traded on public stock exchanges – you can cash out your investment at any given time to realize your NAV gains. In addition to the NAV, the best brokers with NASDAQ South Africa also allow you to earn dividends. This is because some companies listed on the NASDAQ are dividend-paying stocks. As such, you will be entitled to your share. For example, if the NASDAQ ETF yields dividends of 2% and you invested $10,000 – you will receive a payment of $200.With that said, some of the largest stocks listed on the NASDAQ – namely Amazon, Facebook, and Tesla – do not pay dividends. As such, the dividend yield on NASDAQ 100 ETFs will also be much lower than the likes of the Dow Jones or S&P 500. Nevertheless, the best brokers with NAS100 in South Africa will add your dividend payments to your balance as soon as the cash is received. If you see yourself as more of a short-term trader (swing trading, day trading, etc.) – then you might be more suited for leverage CFDs. As we covered earlier, this means that you will be tasked with speculating on the rise or fall of the NASDAQ 100 without actually taking ownership of any of the shares. When doing this via CFDs, there are several benefits that the best brokers with NASDAQ South Africa offer. This includes: When you invest in the NASDAQ 100 via an ETF, you are doing so because you think the index will rise. Plus, you’ll also receive a conservation amount of quarterly dividends. However, when trading the NASDAQ 100 via CFDs – you can profit from both rising and falling markets. For example, if you think the index will rise, you will place a CFD buy order. If you think the index is likely to fall in value, you will place a CFD sell order. All of the South African brokers with NAS100 discussed on this page allow you to choose from a long or short order via CFDs – which offers ultimate flexibility. On top of being able to go long and short, the best brokers with NASDAQ South Africa also offer leverage when you trade this index via CFDs. This means that you can boost the value of your stake – allowing you to trade with much larger amounts. For example, some of the best brokers with NASDAQ South Africa discussed today allow you to trade with leverage of up to 1:200 – even if you are a retail trader. This is because there are no limits imposed on South Africans, so you can often trade with the same amount of leverage as is given to professional clients. Here’s what a leveraged NASDAQ 100 trade of 1:200 would look like in practice: As great as leverage can be when your NASDAQ 100 trade goes in your favor – it can also result in huge losses. This is because leverage will amplify both your gains and losses – depending on how the trade pans out. If you have read our guide on the best brokers with NASDAQ South Africa up to this point – you should know have the required knowledge to proceed with a trade. You should also know whether you wish to invest in this index in the long or short run. To conclude, we are now going to show you how to get started with the best broker for NASDAQ markets – Libertex. To get the ball rolling you will need to head over to the Libertex website and open an account. This shouldn’t take you more than a few minutes. Enter the following personal information to get your Libertex account opened: You will also need to verify your mobile number. Libertex is regulated by several reputable financial bodies – so it also needs to verify the information you provided when you registered. Once again, this shouldn’t take you more than a few minutes – as you simply need to upload a copy of your passport or driver’s license – in addition to a recently issued bank statement or utility bill. You will now need to make a deposit so that you can start trading the NASDAQ 100. Another reason why Libertex is one of the best NASDAQ brokers in South Africa is that it offers heaps of everyday payment methods. This includes: Now that you have funded your Libertex account, you can proceed to trade the NASDAQ 100. If you wish to trade this index via leveraged CFDs, search for ‘NASDAQ 100’ and click on it when it appears. Upon clicking on the ‘Buy’ button, an order box will appear. All you need to do here is enter the amount of money that you wish to invest in the NASDAQ 100. Finally, click on the ‘Place Order’ button to complete your commission-free NASDAQ 100 investment! In summary, the NASDAQ 100 is one of the best performing index funds of the past decade. After all, some of its largest-weighted stocks – Apple, Amazon, Facebook, and Tesla – continue to outperform the wide market year-on-year. If you wish to get started with an investment today – we found that Libertex is one of the best brokers with NASDAQ South Africa for this purpose. The regulated broker allows you to invest in the index via ETFs or through leveraged CFDs. Either way, you won’t pay a single rand in commission! 75.3% of retail investor accounts lose money when trading CFDs with this provider.

4, IG – Best NASDAQ 100 Broker in South Africa for Day Trading

5. Pepperstone – One of the Best NAS100 Brokers for Raw Spread Accounts

6. FXCM – Reputable Best NASDAQ 100 Broker for Beginners

7. Capital.com – Overall Best NASDAQ 100 Broker – 0% Commission

Best Brokers with NASDAQ Fees Comparison

NASDAQ Broker

NASDAQ Commission

NASDAQ Spread (Average)

Capital.com

0%

0.12%

AvaTrade

0%

1 point

VantageFX

0%

0.8 points

IG

0%

1 point

Pepperstone

0% (Standard) $3.50 (Raw)

Depends on account

FXCM

0%

0.06%

What is NASDAQ?

How to Trade NASDAQ

Market Capitalization Weighting Methodology

Points not Dollars

NASDAQ Trading Strategies

Long-Term Trading Strategy via Index Fund ETFs

NAV

Dividends

Short-Term Trading Strategy via Leveraged CFDs

Long or Short Positions

Leveraged Positions

How to Get Started with the Best Broker for NASDAQ

Step 1: Open a Trading Account

Step 2: Identity Verification

Step 3: Deposit Funds

Step 4: Trade or Invest in the NASDAQ 100

Libertex – Best Best Broker for NASDAQ 100 in South Africa (Zero Commission)

FAQs

What is NASDAQ 100?

Which broker has NAS100?

Which brokers with NASDAQ in South Africa have the lowest fees?

What time does NASDAQ open in South Africa?

What does the NASDAQ stand for?

Is the NASDAQ 100 a good investment?