How to Buy Tencent Shares in South Africa – With 0% Commission

Tencent is a company you may not have heard of – but the tech behemoth is growing and progressing at a rapid rate. The China-based firm continues to showcase impressive revenue growth, leading investors worldwide to add it to their portfolios.

In this guide, we discuss How to Buy Tencent Shares in South Africa – examining the company and its financials and showing you how to invest in Tencent without paying any commissions whatsoever.

How to Buy Tencent Shares in South Africa – Step by Step Guide 2021

If you’re looking to buy Tencent shares in South Africa right away? If so, by following the four steps below, you’ll be set up and ready to invest with Capital.com in under ten minutes – all without paying a single rand in commissions!

- Step 1: Open an account with Capital.com – Navigate to Capital.com’s website and click ‘Trade Now’. Provide a valid email address and choose a password to create your account.

- Step 2: Verify your Account – Upload proof of ID (a copy of your passport or driver’s license) and proof of address (a copy of a bank statement or utility bill) to verify your account.

- Step 3: Deposit – Fund your account by depositing via credit/debit card, bank transfer, or e-wallet.

- Step 4: Buy Tencent Shares – Search for Tencent in Capital.com’s trading platform and click ‘Buy’. Enter the number of shares you’d like to purchase in the order box and then click ‘Place Order’.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Step 1: Choose a Stock Broker

One of the most important things you must do when you decide to buy Tencent shares in South Africa is to research and sign up with an appropriate broker. Choosing one of the best share dealing platforms will mean you can trade both safely and cost-effectively. Due to the popularity of online trading in general, there is an abundance of broker options to choose from – so it can seem like a tricky task to decide which one is best.

To help you out with this, we’ve completed the research and found two of the best brokers for investing in South Africa. These two brokers will allow you to buy Tencent shares safely and in a low-cost manner – all from the comfort of your own home.

1. Avatrade – Best Broker to Buy Tencent Shares in South Africa with Low Fees

Another broker we’d highly recommend is Avatrade. Avatrade is well known throughout the world and have a solid presence in South Africa. Notably, this broker is regulated by the FSCA in South Africa – ensuring that traders are given the highest levels of security whilst trading.

Much like Capital.com, Avatrade does not charge any commissions when you place a trade. Fees are built into the spread, which tends to be very tight with Avatrade. Users can also use up to 5:1 leverage when trading stocks. So, if you invested 1000 ZAR in Tencent with 5x leverage, your position size would actually equate to 5000 ZAR! Furthermore, Avatrade offers a vast selection of currencies, indices, and ETFs if you wish to build a diversified portfolio.

Avatrade does not charge any deposit fees – although you may have to pay a currency conversion fee if you deposit in ZAR. The minimum deposit is only $100 (around 286 ZAR), which can be made via credit/debit card, bank transfer, and e-wallets such as Neteller and Skrill. Notably, Avatrade does not charge any withdrawal fees when using a credit/debit card – and withdrawals usually take around three business days to arrive in your bank account.

Pros:

- Suitable for experienced traders

- Zero commission trading

- User-friendly platform

- Trade Tencent shares with leverage

- Regulated and licensed to operate in SA

- Supports MetaTrader 4 and 5

- Offers numerous deposit options

Cons:

- Only offers CFDs

Your capital is at risk.

2. Capital.com – Overall Best Broker to Buy Tencent Shares in South Africa

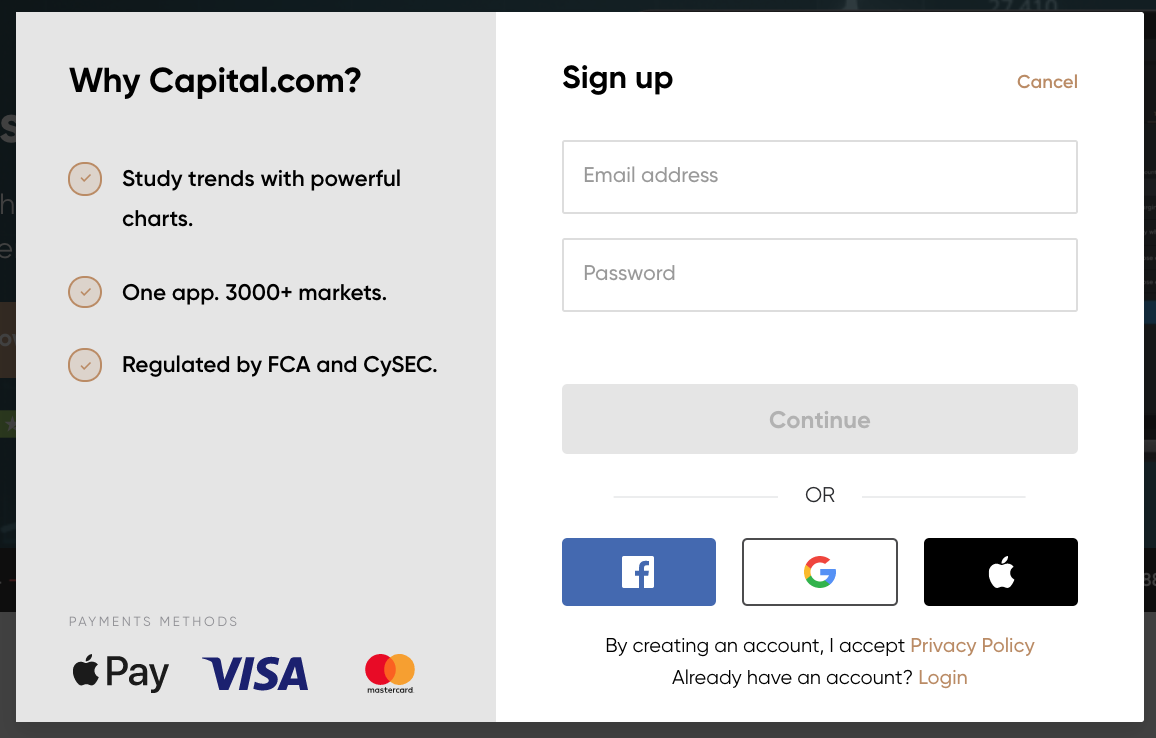

Our number one pick when it comes to brokers in South Africa is Capital.com. Launched in 2016, Capital.com has grown to become one of the leading CFD providers worldwide and has users in various countries. Capital.com is currently regulated by both the FCA and CySEC – two of the most reputable organisations in online trading. This ensures users are safe and adds credibility to the broker.

One of the most appealing things about Capital.com is its fee structure. As Capital.com focuses on CFDs, you’ll also be able to utilise leverage when trading. Users can receive up to 30:1 leverage on certain assets – meaning you can essentially boost your potential profits by up to 30x or lose your entire porfolio!

Capital.com’s sign up process is super simple and takes less than ten minutes to complete. Deposits can be made from as little as $20 (around 286 ZAR), ensuring traders with low amounts of capital can still get involved. Finally, Capital.com even offer an array of educational materials for traders to use. These include guides, glossaries, and even a handy ‘Capital.com TV’ feature that breaks down current market events.

Pros:

- Trade Tencent shares with 0% commissions

- Free demo account

- Suitable for both beginners and pro traders

- Zero inactivity fees

- Thousands of UK and US shares available

- Multiple funding options

- Low minimum deposit amount

Cons:

- Only offers CFDs

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Research Tencent Shares

Now that you have an idea of the best stock brokers in South Africa, let’s take a look at Tencent in detail. Researching the company beforehand is an essential part of the investment process. It allows you to gain insight into how the company is doing currently and where it could potentially go in the future.

With that in mind, the sections below break down some of the critical areas to focus on when investing in Tencent – helping you make an informed investment decision.

What is Tencent?

First and foremost – what is Tencent, and what do they do? Tencent is a Chinese tech conglomerate that has exposure to a wide variety of different sectors. The company was founded in 1998 and was initially funded by a selection of venture capitalists. Tencent has several subsidiaries that create and sell various products in the entertainment, artificial intelligence, and video game industries.

At the time of writing, Tencent is currently the world’s largest video game vendor – the company has part ownership of mega-popular games such as Fortnite and PlayerUnknown’s Battlegrounds (PUBG). These games are well-known worldwide and create vast revenue streams for Tencent through both advertising and in-game purchases. Aside from video games, Tencent also markets social media apps, music, payment systems, e-commerce systems, smartphones, and much more.

One of the things Tencent is most known for inside China is QQ and WeChat. These instant messaging apps, similar to Whatsapp, allow users to send text messages back and forth. On top of messaging, these apps also enable many other functions such as payments, shopping, video games, and more. According to Statista, WeChat had over 1.24 billion monthly active users in the first three months of 2021.

In 2018, Tencent moved past $500 billion in value – the first Asian tech company ever to do this. In the three years since, Tencent has become the most valuable publicly-traded company in China. This value has been driven by the revenue-generating business arms but also by the investment arm of the company. Tencent is currently invested in over 600 companies and is focusing on tech startups in Asia, emphasising cloud computing.

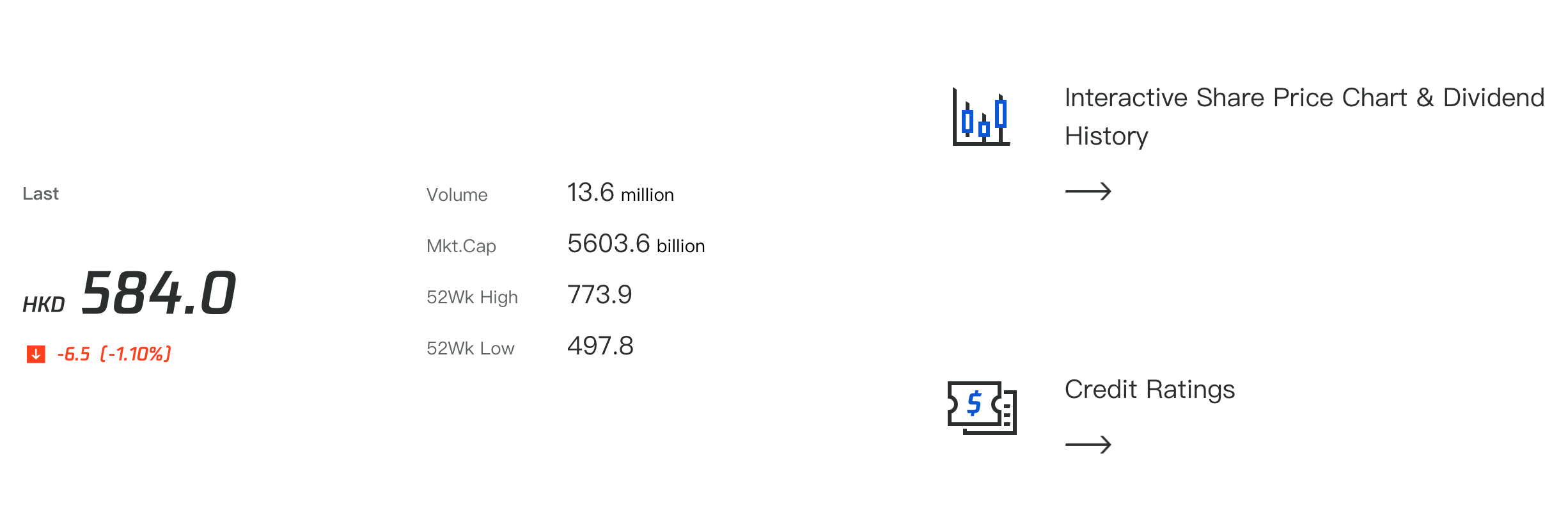

Tencent has a primary listing on the Hong Kong Stock Exchange and is also listed on the NASDAQ through American Depositary Receipts (ADR), which essentially mimic the movements of the actual Tencent stock. According to Yahoo Finance, Tencent currently has a market capitalisation of $734.89 billion – making it the 7th largest company globally at the time of writing.

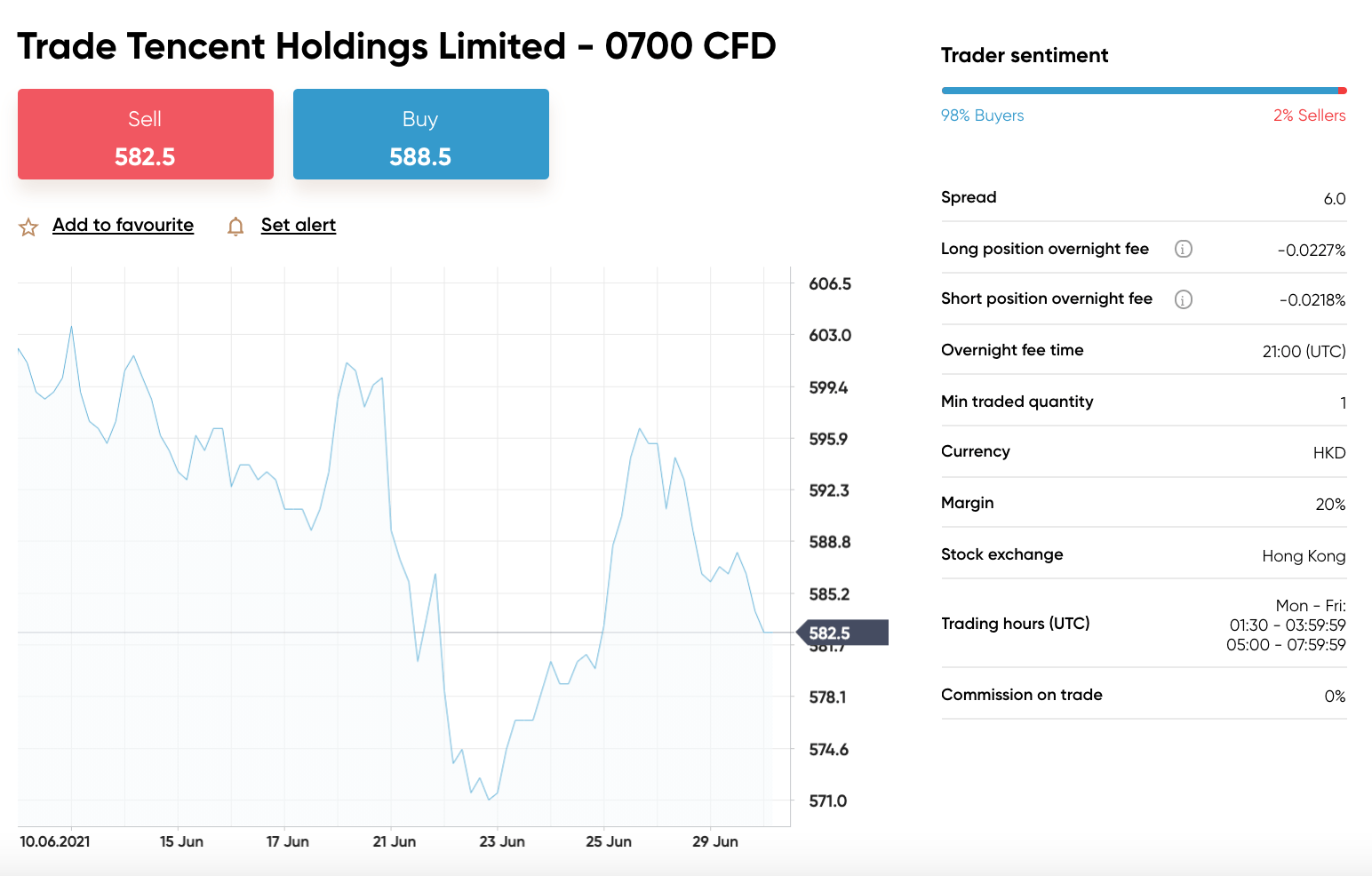

Tencent Share Price

To conduct stock trading effectively, you need to have a solid understanding of a company’s price history. This context allows investors to predict future movements and inform investment decisions. In the case of Tencent, the stock is currently trading at $76.60 – up 3.80% since the turn of the year. Notably, the Tencent share price did reach an all-time high of $99.42 in mid-February; however, it has declined since then.

Overall though, the Tencent share price does showcase some strong bullish momentum on the higher timeframes. The weekly and daily timeframes still show higher highs and higher lows – and although the price has decreased in recent weeks, this could perhaps be seen as a pullback rather than the start of a downtrend.

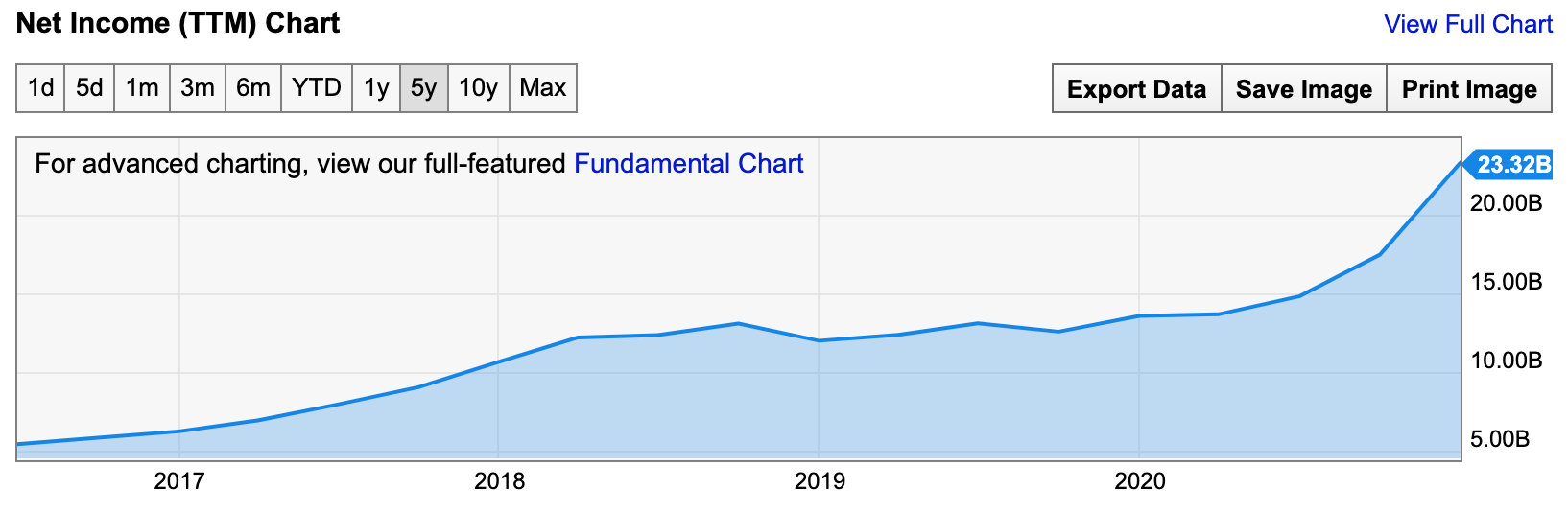

Taking a quick look at Tencent’s revenues, data from Statista notes that Tencent generated an income of 482 billion Yuan in 2020 – this equates to around $74.63 billion. Furthermore, this revenue figure has been growing year on year, highlighting how well Tencent has been performing as a company.

71.2% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Digging a little deeper into the numbers, it’s also a good idea to look at earnings per share (EPS) and price to earnings ratio (P/E). These metrics help to provide insight into a company’s profitability and overall value. Tencent’s EPS was $0.92 as of December 2020. This was nearly triple the company’s EPS figure from December 2019 and shows just how profitable the company has become.

In terms of the P/E ratio, this metric helps to value a company against its competition. As of the time of writing, Tencent’s P/E ratio is 31.79, according to data from YCharts. This has declined in recent months thanks to the decrease in the company’s share price – although a figure of 31.79 is still pretty high, especially for a company of Tencent’s size. Furthermore, the P/E ratio is higher than one of Tencent’s competitors in China, HUYA Inc. This highlights just how valuable the company is and how established it is in the Asian market.

Overall, the company is in an excellent position financially – even though the Tencent share price has fallen in recent weeks. Q1 figures have been exceptional, with the company generating $7.42 billion in profit – a 65% rise from the previous year. Much of this was driven by revenue increases from online gaming, with this section of the business rising by 17%. All of this has been accomplished during the COVID-19 pandemic, showcasing how solid the company’s business model is overall.

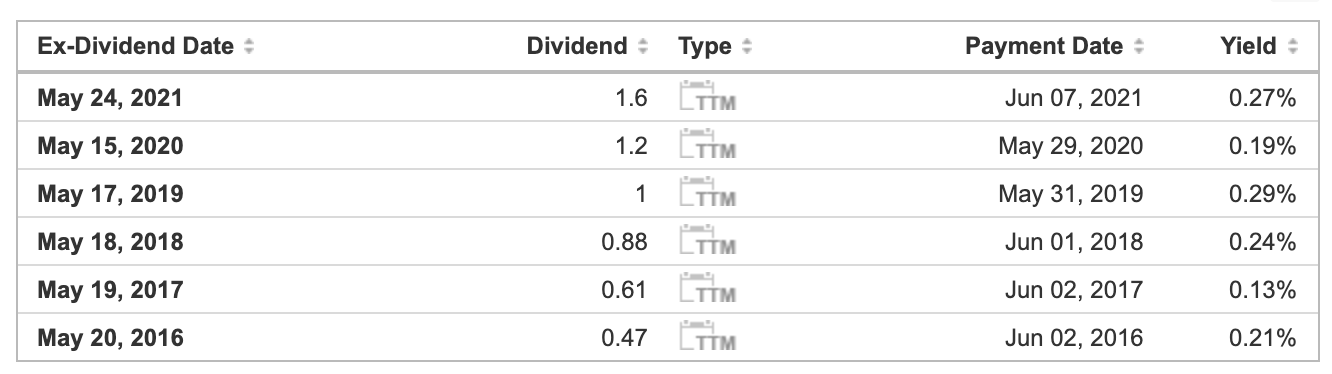

Tencent Shares Dividends

If you are wondering how to invest money to generate a passive income stream, then investing in dividend-paying stocks is one way to do so. Tencent is one of these stocks, as the company pays an annual dividend to shareholders. This dividend payment tends to be made in either May or June of each year, with the most recent payment being made on the 7th June 2021.

Tencent’s yields aren’t the highest, though. As you can see from the table above, yields tend to fluctuate from 0.13% to 0.29%. This is in contrast to some other companies that pay yields of 3% or higher. However, it’s important to note that Tencent’s business model revolves around investing profits into subsidiaries to generate more profits in future. Their dividend payments are not as significant because most of the profits are being reinvested. Therefore, although the company does pay a consistent annual dividend, yields will never be as high as some other firms.

Are Tencent Shares a Good Buy?

Now that you have a good understanding of Tencent and its current situation, let’s put it all together and determine whether it’s a good idea to buy Tencent shares in South Africa. The headings below will explore some key things to note when considering a Tencent investment this year.

Solid and Consistent Growth

As you can probably imagine, Tencent has done a stellar job in recent years of increasing revenues and generating substantial profits. Q1 figures increased across the board, with fintech and business services revenue rising by a remarkable 47%. Total Q1 revenue grew by 25% – even against the backdrop of regulatory concerns within China.

Fintech and business services could be the next big thing for Tencent as the company develops electronic payments systems and cloud-based tech. These two areas have the potential to generate vast amounts of revenue for Tencent in the coming years. Aside from this area, the company is still growing in the video game sector and has used the data gathered to optimise marketing efforts – leading to more in-app purchases in Fortnite and PUBG. Finally, Tencent is even investing in employees and infrastructure, which can only mean further establishing themselves in the market as we proceed.

Diversified Portfolio of Companies

Another reason to buy Tencent shares in South Africa is the diversified nature of Tencent’s companies. As has been highlighted in this article, Tencent operates in numerous sectors, including video gaming, healthcare, e-commerce, and many more. The fact that they are this diversified means that if one sector is experiencing a downturn, another industry will pick up the slack. In turn, this makes Tencent’s business model pretty solid and ensures the company has a very low chance of suffering financially.

Tencent is continually investing in companies worldwide, which means they have a constant stream of revenue from their investment arm. Tencent’s investment portfolio includes companies such as Tesla and Sea Ltd, with investments totalling over $213 billion. Again, these investments are smart for the long-term and help hedge against any revenue decreases.

Taking this into consideration, Tencent appears to be a solid buy at present. The Tencent share price has decreased in recent times, although this can perhaps be seen as an opportunity rather than a negative. We feel that Tencent would make a solid addition to many investors’ portfolios for years to come.

Open an Account & Buy Shares

If you’ve decided you’d like to buy shares in Tencent, then you’ll need to create an account with a reputable broker who can facilitate your investment. We’ve found that Capital.com offer the best trading platform for South African investors – so, by following the five steps below, you’ll be able to complete a commission-free investment in Tencent.

Step 1: Open a Capital.com Account

Head to Capital.com’s homepage and click ‘Trade Now’. Enter your email address and choose a password to create your account. You can also complete this step through Capital.com’s app on your smartphone.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Step 2: Verify your Account

As Capital.com are a heavily regulated broker, new customers must complete some KYC checks and verify themselves. Luckily this is very simple to do and only takes a few minutes. Simply upload proof of ID (a copy of your passport or driver’s license) and proof of address (a copy of a bank statement or utility bill). These documents will then be verified, which tends only to take moments.

Step 3: Fund your Account

Capital.com require an initial deposit of only $20 – this equates to roughly 286 ZAR. To make this deposit, here are some of the options available to you:

- Credit card

- Debit card

- Bank transfer

- iDeal

- Giropay

- WebMoney

- ApplePay

- Trustly

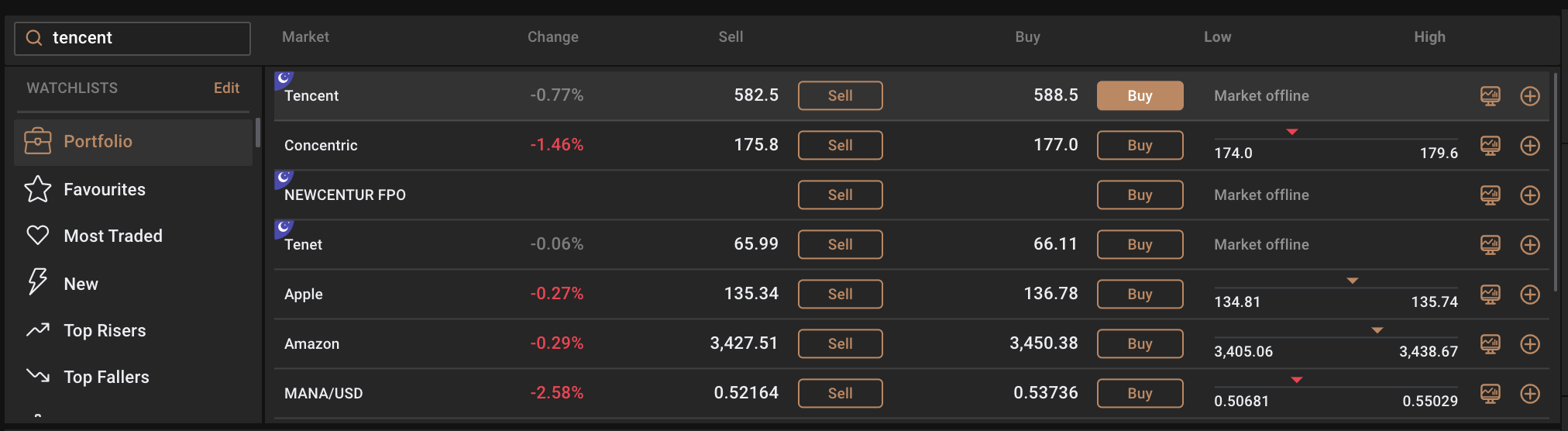

Step 4: Search for Tencent Shares

On Capital.com’s trading platform, click into the search bar at the top left and type in ‘Tencent’. Then, click the ‘Buy’ button next to Tencent in the search results section.

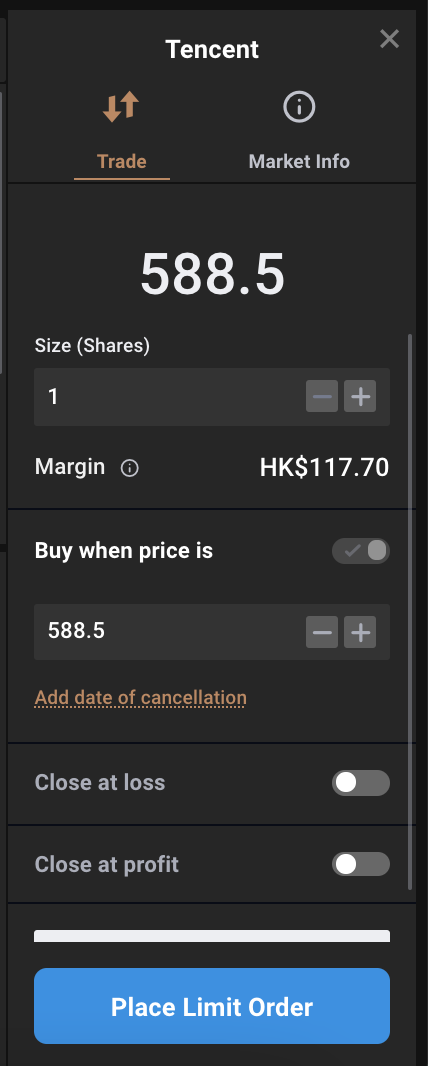

Step 5: Buy Tencent Shares in South Africa

In the order box on the right-hand side of the screen, simply enter the number of shares you’d like to purchase. You can also set a stop-loss level or utilise leverage if you wish. Once you are happy with everything, click ‘Place Order’.

And that’s it! You’ve officially invested in Tencent – without paying any commissions whatsoever!

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Tencent Shares Buy or Sell?

Overall, are Tencent shares a buy or a selling opportunity? Through our research, we believe the former. Tencent looks like a fantastic opportunity for investors to gain exposure to various sectors through one particular investment. This is a very valuable feature, as due to Tencent’s diversified nature, the company is shielded against revenue decreases from certain parts of the business.

As noted earlier, Tencent is performing very well in terms of financials. The company is growing in almost all areas, and its investment portfolio holds some of the most promising companies worldwide. Furthermore, Tencent continues to expand its infrastructure and employee base, ensuring the company can keep up with their rapid growth.

Cloud-based infrastructure is one area that Tencent focuses on massively, and it’s clear to see why. The global cloud computing market has been estimated to exceed a valuation of $330 billion last year – showing just how large this market is. Many companies are scrambling to be the first-move to establish themselves, as this technology could lead the way in the future.

So, overall, we feel Tencent would be an excellent way to invest some capital at present. The Tencent share price has experienced a pullback in recent weeks, which means it is now at an attractive price to buy-in. Furthermore, if the company continues to grow at current rates, there’s every chance price could head back to all-time highs – and perhaps even beyond.

How to Buy Tencent Shares in South Africa – Conclusion

In conclusion, Tencent shares offer a solid opportunity to generate some capital growth in the months and years to come. The company is well established in China and has a substantial portfolio of diversified subsidiaries. With the company’s financials continuing to strengthen, now might be a fantastic time to add Tencent to your investment portfolio.

If you’re interested in investing right away, we’d recommend opening an account with Capital.com. Account opening only takes around ten minutes to complete, and Capital.com only require a minimum deposit of $20 (approximately 283 ZAR). On top of this, Capital.com does not charge any commissions when you place a trade – meaning you avoid hefty fees charged by some other brokers.

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

FAQs

Should I buy Tencent Shares?

Does Tencent pay a dividend?

Who owns Tencent?

What is the best way to buy Tencent shares in South Africa?

Where is Tencent based?