Best Index Funds South Africa – Invest with Zero Fees

If you’re based in South Africa and looking to build a long-term investment portfolio – consider an index fund.

This will allow you to invest in dozens or even hundreds of stocks through a single trade. Your index fund investment might include stocks from the JSE, NYSE, NASDAQ, LSE, or more – depending on which exchange takes your fancy.

In this guide, we discuss the best index funds South Africa for 2021. We also walk you through the process of making your first index fund investment from the comfort of your home with a top-rated broker.

Best Index Funds South Africa List

Below you will find the 10 best index funds South Africa to consider right now. By scrolling down, you will find a full analysis of each index fund.

- SPDR Dow Jones Industrial Average ETF – Overall Best Index Fund South Africa – Invest Now

- JSE Top40 Index – Overall Best Index Fund to Invest in South African Stocks – Invest Now

- iShares Core FTSE 100 UCITS ETF – Best Index Fund for UK-Listed Stocks – Invest Now

- iShares Core S&P 500 UCITS ETF – Best Index Fund for a Diversified Portfolio of US Stocks

- iShares NASDAQ 100 UCITS ETF – Best Index Fund for a Technology Stocks

- Xtrackers Nikkei 225 UCITS ETF – Best Index Fund for Japanese Stocks

- iShares Russell 2000 ETF – Best Index Fund for Investing in Small US Companies

- Vanguard FTSE Europe ETF – Best Index Fund for European Stocks

- iShares China Large-Cap ETF – Best Index Fund for Investing in the China Stock Market

- Horizons Marijuana Life Sciences Index ETF – Best Index Fund to Invest in the legal Marijuana Industry

Best Index Funds to Invest in South Africa

There are dozens of index funds available to South African traders. Most are located overseas – with the likes of the Dow Jones, S&P 500, and FTSE 100 standing out in terms of long-term performance. There are also a number of index funds that focus on South African stocks, too – such as the JSE Top 40.

To ensure you choose an investment that meets your financial goals – below you will find an overview of the 10 best index funds in South Africa for 2021.

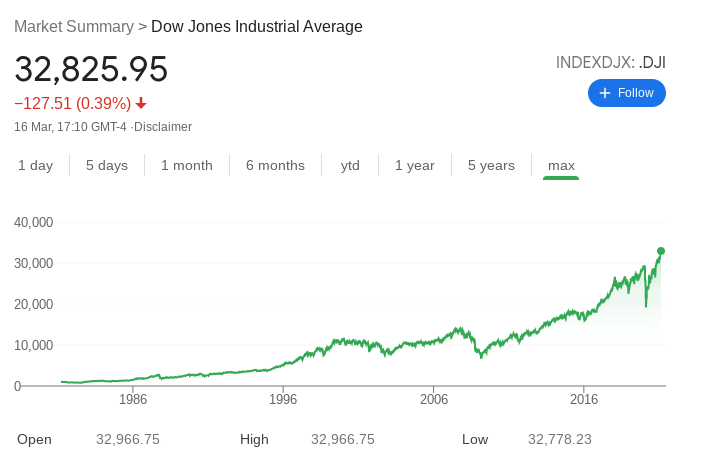

1. SPDR Dow Jones Industrial Average ETF – Overall Best Index Fund South Africa

Perhaps the best-known index fund in South Africa is that of the Dow Jones Industrial Average. This particular index fund consists of 30 major US-stocks from a wide variety of sectors and industries. This includes the likes of Goldman Sachs, Home Depot, UnitedHealth Group, Visa, Microsoft, Caterpillar, Boeing, and McDonald’s.

As you can see, these companies are market leaders in their respective fields – with the index covering food and beverage, healthcare, financials, aerospace, and more. The key attraction with the Dow Jones is that you are investing in the strength of the wider US economy.

That is to say, when the stock markets are performing well – expect the Dow Jones to follow suit. The most interesting thing about the Dow Jones is that unlike most other index funds – it is not weighted based on the market capitalization of each company. For example, at the time of writing, Amgen has a valuation of $138 billion and a Dow Jones weighting of 4.7%.

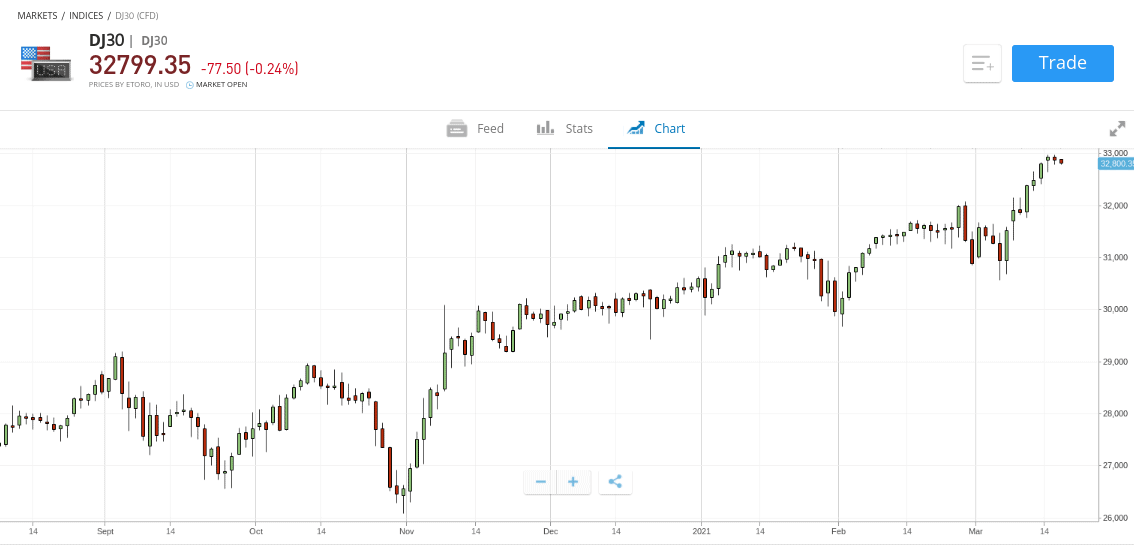

However, although Apple has a market valuation of over $2 trillion, it contributes just 2,4% to the index. Nevertheless, this top-rated index fund has performed very well over the course of time. For example, the Dow Jones was priced at just over 8,200 points in early 2009.

Fast forward to early 2021 and the index has since hit all-time highs of over 32,000 points. This amounts to gains of over 290% in 12 years of trading. This doesn’t include the dividends that the Dow Jones index pays. After all, all 30 companies listed on the Dow pay dividends – so the true growth figure is actually much higher.

There are many providers that give you access to the Dow Jones index fund, albeit, SPDR offers excellent value in terms of its expense ratio. In fact, this stands at 0.16% annually – so a $10,000 investment would amount to fees of just $16 per year. If you like the sound of this index fund – you can invest from just $50 at commission-free broker eToro.

Your capital is at risk.

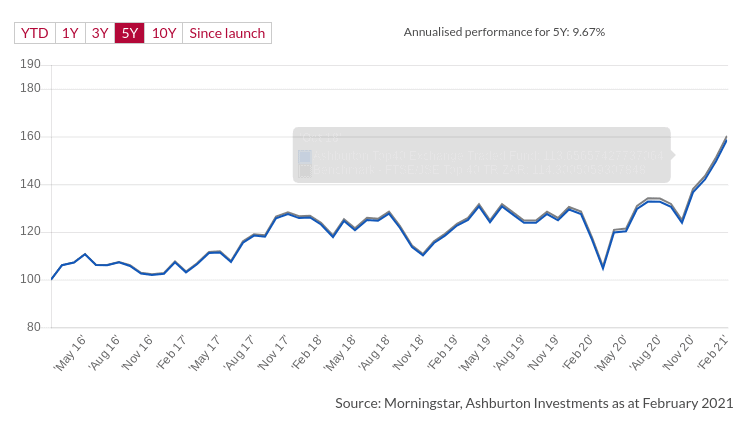

2. JSE Top40 Index – Overall Best Index Fund to Invest in South African Stocks

If you have your heart set on South African-listed stocks – then the best option on the table is the JSE Top40 Index. As the name implies, this will give you access to 40 leading companies that are listed on the Johannesburg Stock Exchange (JSE). Unlike the previously discussed Dow Jones – this index fund is weighted based on market capitalization.

In other words, companies with a higher valuation will contribute more to the index. For example, South African stocks with the largest weighting include the likes of Prosus, Naspers, British American Tobacco, BHP, Glencore, and Anglo. At the other end of the index, you have slightly smaller corporations such as MC Group, Quilter, Remgro, and Pepkor.

In terms of performance, growth has been somewhat sluggish – especially when you compare this to index funds based in the US. For example, the JSE Top40 was priced at just under 48,000 points in the five years prior to writing this page. And today, the same index is valued at 61,600 points.

This means that in five years of trading, the JSE Top40 has grown by 28%. During the same period, the Dow Jones has grown by over 88%. Nevertheless, if you do choose to invest in this South African-centric index fund – you will also be entitled to dividends. This will give you the chance to reinvest your quarterly payments into other assets.

Your capital is at risk.

3. iShares Core FTSE 100 UCITS ETF – Best Index Fund South Africa for UK-Listed Stocks

If you are thinking about investing in the UK stock market – then the FTSE 100 is going to be your best option. This is because the FTSE 100 is an index fund that consists of the 100 largest UK stocks. Much like the JSE Top40, this index is weighted based on market capitalization.

Some of the biggest UK stocks that you will be gaining exposure to include Unilever, Royal Dutch Shell, BP, AstraZeneca, Rio Tinto, Diageo, and HSBC. You will also be purchasing a stake in UK companies with a smaller market capitalization – including the likes of Auto Trader, Severn Trent, Rightmove, and British Land.

All in all, this is an index fund that is well diversified across most UK sectors. In terms of growth, this particular index fund has achieved average annual gains of 4.6% over the past 10 years. This represents good value on your money – as a lot of FTSE 100 companies also pay dividends.

In more recent times, the FTSE 100 index has grown from 5,200 points to 6,800 points over the past 12 months – representing growth of over 30%. With the Brexit saga now behind the UK economy and its vaccine rollout rate one of the best globally – there is a lot of bullish sentiment on the FTSE at present.

Your capital is at risk.

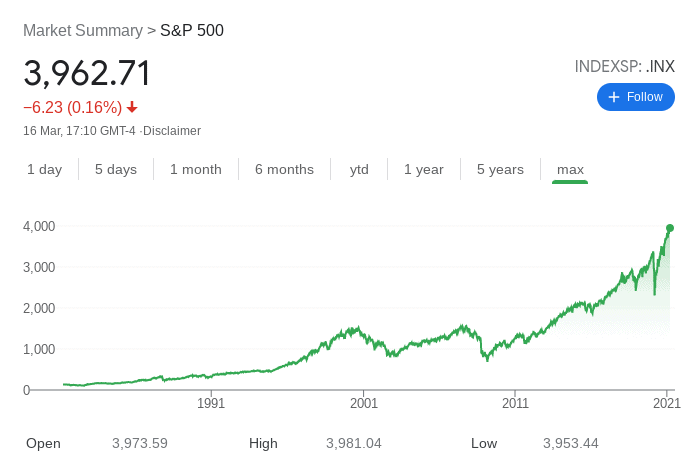

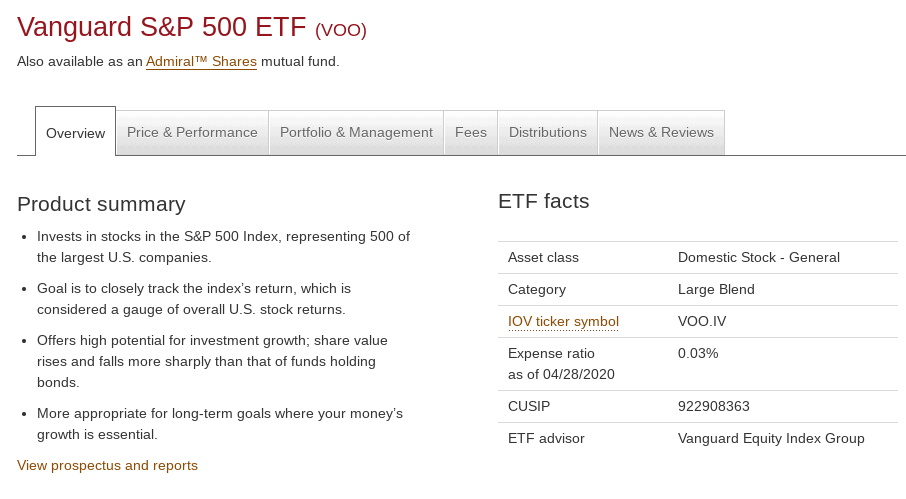

4. iShares Core S&P 500 UCITS ETF – Best Index Fund for a Diversified Portfolio of US Stocks

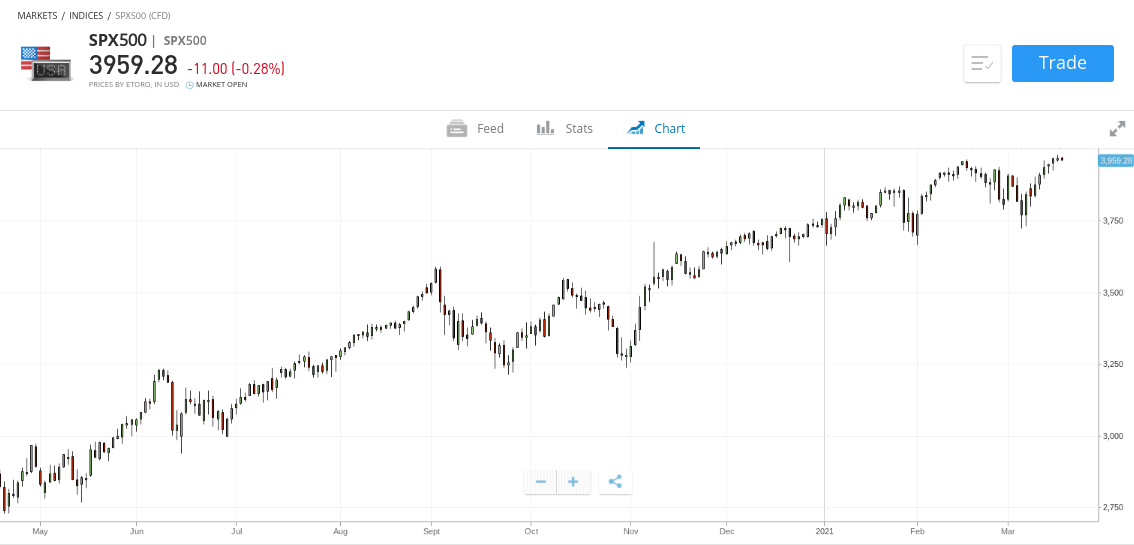

Much like the Dow Jones, the S&P 500 is one of the most liquid index funds globally. With that said, while the Dow gives you access to 30 established American stocks – the S&P contains 500. As the index is weighted by market valuation, you will be investing in some of the biggest companies on the US stock market.

To give you an idea of where your money will be distributed, think along the lines of Amazon, Apple, Tesla, Facebook, Microsoft, IBM, Johnson & Johnson, and Visa. Similarly, you will also be invested in Ford, Disney, Nike, Paypal, MasterCard, and hundreds more. Crucially, if there is a large-cap US stock that interests you – it’s likely that is part of the S&P 500.

If you are a newbie investor and you want to know how to invest money that has long-term financial goals – this is probably the best index fund for you. After all, the S&P 500 has managed average annualized gains of over 10% for almost 100 years. This is an incredible track record to feed on – which is why the S&P 500 is perceived to be a low-risk investment.

This is, however, on the proviso that you are prepared to keep hold of your investment over the course of time. This is because the S&P 500 – like all index funds, have both good and bad years. But, over many decades, the S&P 500 has always moved in an upward trajectory.

An additional risk-management tool that you get with the S&P 500 is that it is rebalanced and reweighted every three months. This means that poor-performing stocks will contribute less to the index – and vise-versa with companies that are doing well. Ultimately, the S&P 500 will allow you to invest in the wider US economy.

Your capital is at risk.

5. iShares NASDAQ 100 UCITS ETF – Best Index Fund for a Technology Stocks

iShares once again makes our list of the best index tracking funds South Africa. This particular index fund tracks the 100-largest stocks on the NASDAQ exchange. For those unaware, the NASDAQ is where the vast majority of tech stocks are listed. This includes the likes of Amazon, Apple, Facebook, Tesla, Google, Microsoft, NVIDIA, and Paypal.

With that said, the NASDAQ 100 is heavily weighted towards its top 3 constituents. For example, Apple (11.2%), Microsoft (9.4%), and Amazon (8.2%) contribute just under 30% – which is huge. With this in mind, the index is a lot more volatile than the likes of the Dow Jones or S&P 500.

Nevertheless, the NASDAQ 100 is still one of the best index funds in South Africa – especially when you look at its performance over the past couple of decades. For example, based on a 10-year period, the NASDAQ has generated average annualized returns of over 19% each year.

Things look even more attractive when you look at the cumulative returns – which stand at over 485% in just 10 years. Perhaps the main drawback with the NASDAQ 100 is that it yields a much lower dividend return. This is because many the stocks on the index do not pay dividends – even those that are highly established.

Your capital is at risk.

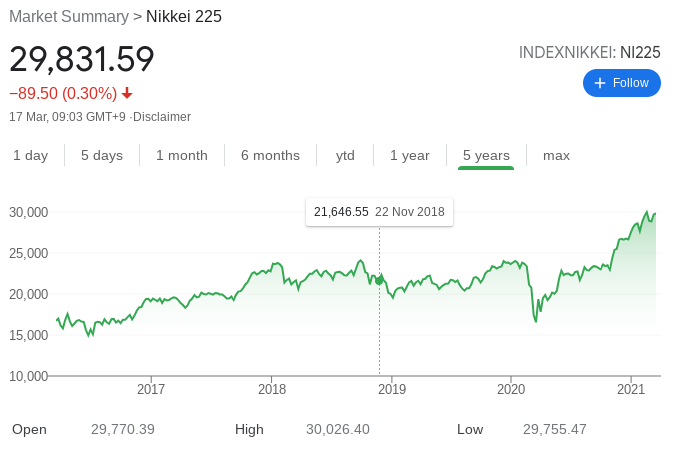

6. Xtrackers Nikkei 225 UCITS ETF – Best Index Fund South Africa for Japanese Stocks

Irrespective of whether you are an inexperienced investor or a seasoned trader – diversification is crucial. You have already taken the first step in this respect by considering the best index funds South Africa. However, it’s worth going one step further by diversifying into other markets and economies.

One way in which you can do this is to consider investing in an index fund that tracks Japanese stocks. After all, the Tokyo Stock Exchange is one of the largest in terms of market valuation and trading activity. If this sounds of interest, the Xtrackers Nikkei 225 UCITS ETF is a good option.

As the name implies, this index fund will track the Nikkei – which consists of the 225 largest stocks listed in Japan. Some of the main constituents on the index include Softbank, Fast Retailing, Fanuc, M3, KDDI, Daikin Industries, and Tokyo Electron. More notable names that you might have come across from the index include Sony, Olympus, Toyota, Nexon, and Konami.

When it comes to performance, the Nikkei 225 has had somewhat of a rollercoaster ride over the past couple of decades. For example, the index went on a downward trajectory during the 1990s – which continued well into the early 2000s. However, the index has performed well since 2012.

Back then, the Nikkei 225 was priced at just under 10,000 points. At the time of writing in March 2021 – the index is at an all times of over 30,000 points. This is fundamental, as it was more than three decades ago that the Nikkei 225 surpassed 30,000 points – meaning that there is finally something to get excited about with the Japanese stock markets.

Your capital is at risk.

7. iShares Russell 2000 ETF – Best Index Fund for Investing in Small US Companies

While the Dow Jones, NASDAQ 100, and S&P 500 are great for investing in large-cap stocks – some of you might want exposure to smaller US companies. The best index fund in South Africa for this purpose is the Russell 2000. This particular fund will give you access to 2,000 small-cap firms that are listed on the US markets.

On the one hand, the risk associated with small-cap companies is higher. This is because stock prices are much more volatile – not least because trading volumes are smaller. Plus, smaller market capitalizations are much more susceptible to a wider economic decline.

On the other hand, the Russell 2000 index fund is super-diversified. Not only because it consists of 2,000 firms from a variety of sectors and industries – but the largest weighting on the index is just 0.72%. This means that in theory – you won’t feel the impact of a single stock capitulating.

This is because while one company might perform badly, several others might achieve notable growth. To give you an idea of some of the stocks listed on the Russell 2000 – this includes the likes of Plug Power, Novavax, Gamestop, Penn National Gaming, Caesars Entertainments, and Deckers Outdoor.

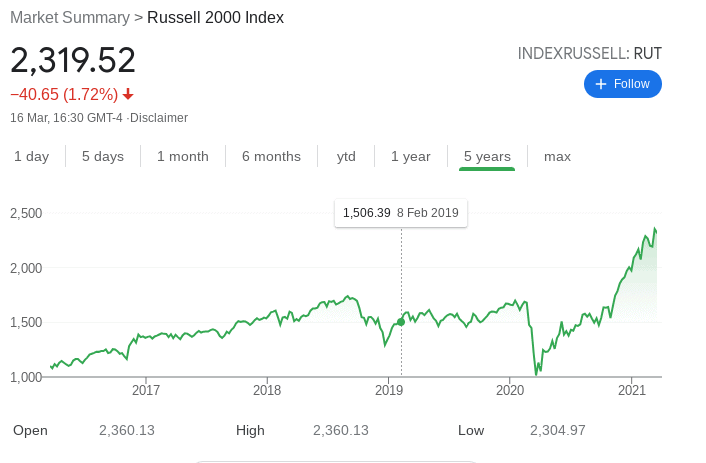

When it comes to the performance of this index fund, the Russel 2000 has gone from 1,100 points to 2,300 in the five years prior to writing this page. This represents growth of over 109%. Had you invested in the index fund 10 years ago via an iShares ETF – you would be looking at average annualized gains of 11.2%.

Your capital is at risk.

8. Vanguard FTSE Europe ETF – Best Index Fund South Africa for European Stocks

Another index fund to consider is that of the Vanguard FTSE Europe. This will get you access to some of the biggest and most established stocks listed in the EU-bloc. In fact, your portfolio will consist of over 1,200 stocks from a variety of European exchanges.

This includes companies based in Germany, France, Finland, the Netherlands, Sweden, Norway, and more. The expense ratio is super-low on this index fund too – with Vanguard charging just 0.08% per year.

In terms of the stocks that you will be gaining access to, this includes Nestle, SAP, Siemens, HSBC, LVMH Moet Hennessy Louis Vuitton, Novartis, and Roche Holdings. The top-10 holdings in the index fund represent over 15% in total weight, which is much more diversified than the likes of the NASDAQ or JSE Top40.

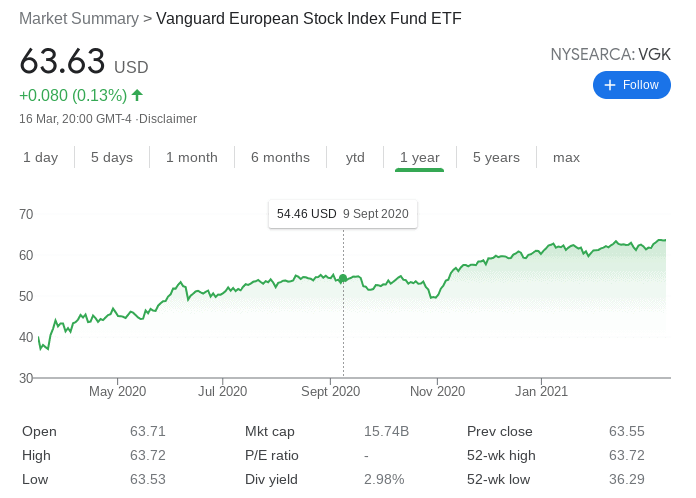

Looking at the past performance of this top-rated index fund, the Vanguard FTSE Europe ETF, has generated averaged annualized gains of 5.08% over the past 10 years. But, over a 5-year period, average annual gains is much higher at 9.5%.

Your capital is at risk.

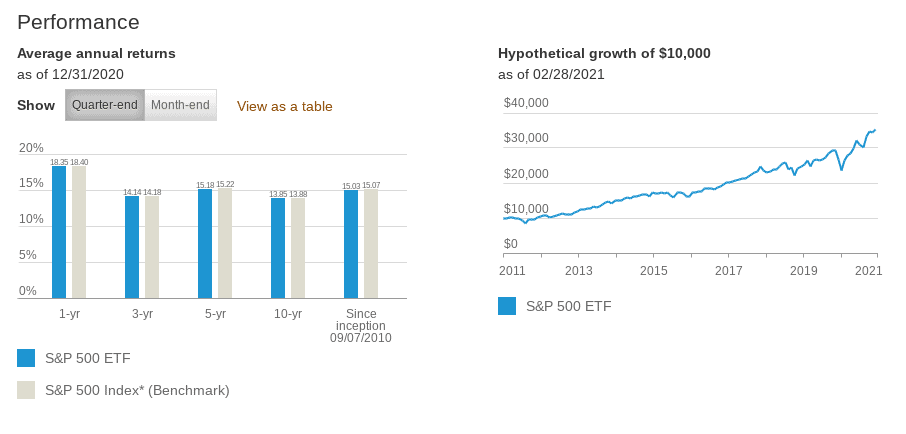

9. iShares China Large-Cap ETF – Best Index Fund South Africa for Investing in the China Stock Market

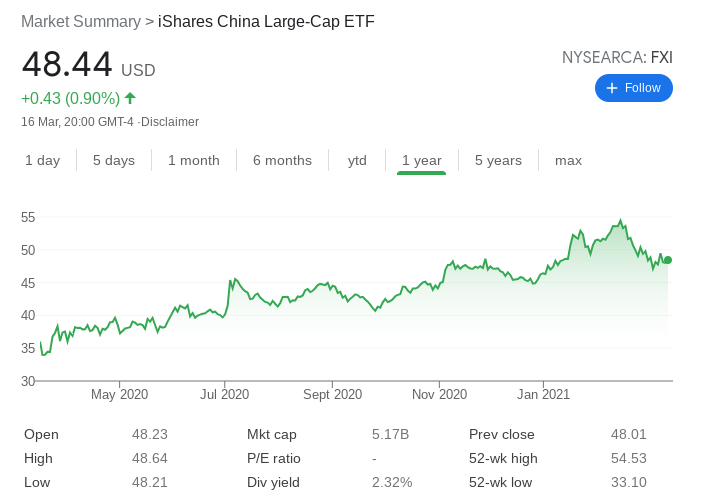

Make no mistake about it – China is still home to some of the largest GDP growth levels globally. If you wish to gain access to the Chinese stock markets from the comfort of your home – consider the iShares China Large-Cap ETF. This particular index fund consists of 50 leading China companies from a variety of sectors.

Some of the largest holdings include Alibaba, Tencent, Meituan, DJ.com, China Construction Bank, Bank of China, and Ping An Insurance. There is somewhat of a heavy focus on banking and consumer discretionary, albeit, these two sectors dominate the Chinese economy.

As such, the index fund gives you the best chance of replicating the growth of the country’s domestic marketplace. At 0.74% annually, the expense ratio is a lot higher than the other index funds we have discussed today. But, this is often the case when you attempt to invest in the emerging markets – so expect to pay a slight premium.

Your capital is at risk.

10. Horizons Marijuana Life Sciences Index ETF – Best Index Fund to Invest in the Legal Marijuana Industry

This particular index fund will suit those of you that wish to invest in an industry that is still in its infancy – marijuana. Launched in 2017, this index fund is the best way to gain exposure to the global marijuana industry. This is because it consists of 28 different public companies that are actively involved in this space.

This includes marijuana growers, distributors, dispensers, and those manufacturing goods to support production. The most influential companies in this index fund include Aphria, Canopy Growth, and GW Pharmaceuticals. Collectively, these three stocks contribute an index fund weighting of almost 45%.

Other companies that you will be investing in include Tilray, Cronos, Scotts Miracle, and Village Farms. We should note that the Horizons Marijuana Life Sciences Index ETF has had a slow start to corporate life – at least in terms of growth. This is because the index fund has gone from an initial listing price of $10 to just $13 in early 2021.

However, legal marijuana is still very much a sleeping giant. For example, just two countries (Canada and Uruguay) – plus a selection of US states, have fully legalized recreational usage of marijuana. But, dozens of countries around the world have legalized medical usage – so it’s simply a case of waiting for other jurisdictions to relax recreational-based laws.

Your capital is at risk.

What are Index Funds?

Index funds are designed to track a specific marketplace in the financial arena. The most popular type of index fund are those that track a collection of stocks from a particular exchange or region. For example, the S&P 500 is an index fund that tracks 500 large-cap companies in the US. This consists of stocks from both the NYSE and NASDAQ.

The FTSE 100, on the other hand, will only track the 100-largest companies from the London Stock Exchange. Similarly, the NASDAQ 100 will focus on the largest 100 stocks from the exchange of the same name. With that said, there are also index funds that track bonds.

A prime example of this is the Vanguard Total Bond Market Index. This particular index fund tracks the value of thousands of US-issued bonds from both the governmental and corporate spaces. All in all, the best index funds South Africa allow you to build a diversified portfolio of stocks or bonds via a single trade.

Why Invest in Index Funds?

Index funds are often seen as the best way to invest money in the wider financial markets. After all, you don’t need to worry about investing on a DIY basis – as everything is taken care of by the respective provider.

If you’re still not sure whether index funds are right for you – check out the many investor benefits discussed below.

Diversification

Perhaps the most obvious benefit of investing in the best index tracking funds South Africa is that you will be well-diversified. This is crucial, as building a diversified portfolio of stocks or bonds will ensure that you are not over-exposed to a single asset.

For example, if you were to invest in the Russell 2000 – you are essentially buying a stake in 2,000 different stocks from the US markets. This is achieved through a single trade – meaning that you don’t need to personally place 2,000 different orders at various amounts.

There will always be a number of companies on your chosen index fund that don’t quite perform as well as you had hoped. But, as long as there are more winners than losers – you will always see growth over the course of time. In addition to holding dozens, hundreds, or even thousands of individual assets – index funds also allow you to diversify into different markets.

For example, the Dow Jones consists of 30 companies from different sectors – covering the likes of banking, food and beverage, retail, technology, and telecommunications. Then you have the Vanguard FTSE Europe ETF – which gives you access to a wide selection of EU-based stock exchanges.

Perfect for Beginners

Another key benefit of investing in the best index funds South Africa is that they are ideal for newbies. In fact, all you need to do is decide which index fund to invest in and how much capital to allocate.

After that, there is nothing more for you to do. That is to say, the best performing index funds are regularly rebalanced and reweighted. This means that the respective provider will ensure that the index fund continuously represents the market that it seeks to track.

- A recent example of this was when the Dow Jones decided to replace Exxon Mobil with Salesforce.

- The reason the index provider did this is that Exxon Mobil – like the rest of the global oil industry, has seen a huge slump since the pandemic began.

In terms of re-weighting, this is also important. This will see the index fund provider change the weighting of each stock within its portfolio to mirror the actual performance and strength of its constituents.

For example, if Apple is performing well but Tesla is struggling (in terms of market capitalization) – the S&P 500 will be updated accordingly. Crucially, index funds allow you to invest passively – so you don’t need to do anything until you decide to cash out.

Long-Term Performance

Over the course of time, the best performing index funds have generated some sizable returns for investors. This will, of course, vary depending on the respective index fund. But, to give you an idea – the S&P 500 index was first incepted in 1926.

Through its almost 100-year existence – the index has gone through many ups and downs. With that said, the S&P has generated average annualized returns of over 10% since it was launched – which is huge.

The key point is that when you invest in a stock market index fund – you are backing the wider economy. For example, the S&P 500 contains 500 of the strongest and most valuable stocks in America.

In other words, as long as the US stock markets continue to grow – which they always have, the long-term risks are somewhat low. This makes index funds the best investments for the long-term. The most important thing is that you consider investing in your chosen index fund over many, many years. In doing so, you will be able to ride out market waves.

Dividends

When discussing the performance of the best South African index funds, we typically focus on capital gains. That is to say, if the JSE Top40 index goes from 40,000 points to 50,000 points – that amounts to capital gains of 25%. However, it is also important to remember that many stocks listed on an index fund will always generate dividends.

For example, all 30 companies on the Dow Jones pay dividends – which gets you an extra source of income. Hundreds of stocks listed on the S&P 500 also pay dividends, as do dozens of companies from the FTSE 100. The best thing about this is that you can create a long-term investment plan by instantly reinvesting your dividends back into the respective index.

This will allow you to benefit from compound growth – which allows you to speed up the rate at which your investment increases in value. In other words, every time you reinvest a dividend, you will own a slightly higher amount of the index fund.

Difficult-to-Reach Markets

Buying individual stocks is a relatively simple process when opting for a popular marketplace. For example, there are many stock brokers in South Africa that allow you to buy shares listed on the JSE. This is also the case when buying stocks in the US, UK, and Europe.

However, if you have an appetite for stocks listed in the emerging markets – such as those located in Asia or South America, things get a bit more challenging. This is because very few stock trading platforms in South Africa give retail clients access to these economies.

The good news is that index funds allow you to bypass these restrictions – as your money is pooled together with other investors. For example, the iShares China Large-Cap ETF allows you to buy shares in 50 Chinese stocks at the click of a button. But, attempting to buy these stocks on a DIY basis would not be as easy.

Low Fees and Minimums

Many inexperienced investors in South Africa wrongly believe that index funds are expensive. However, this couldn’t be further from the truth. On the contrary, the best index funds in South Africa cost just a small fraction of a percentage point.

For example, although the Vanguard FTSE Europe ETF is an index fund that consists of over 1,200 EU-based stocks – the expense ratio is just 0.16%. This means that a $1,000 invested would cost you just $1.60 per year in fees!

Even index funds that give you access to the emerging markets are competitively-priced. For example, the previously mentioned iShares China Large-Cap ETF – although deemed expensive at 0.74%, would cost you the equivalent of $7.60 per year on a $1,000 investment.

Index Funds vs ETFs

There is often great confusion with newbie investors when it comes to index funds and ETFs being mentioned in the same sentence.

The main concept is as follows:

- An ‘index fund’ is the underlying mechanism that tracks a particular market. For example, the Dow Jones is an index that tracks the performance of 30 US-listed companies at a specific weight.

- The index will determine the fundamentals – such as how much weight to give to each stock – and when to add or remove a company.

- In order to invest in your chosen index fund – the easiest way to do this is via an ETF (exchange-traded fund).

- ETFs are operated by large-scale providers and they are tasked with mirroring the underlying index like-for-like. Leaders in this market include iShares, Vanguard, and SPDR.

- For example, if you wanted to invest in the Dow Jones, the SPDR Dow Jones Industrial Average ETF would allow you to do this.

- SPDR would personally buy shares in 30 companies that represent the Dow Jones – at the correct weight

So, to conclude – unless you opt for a mutual fund or investment trust – in order to invest in an index fund you will need to do this through an ETF provider. This is why the best index funds South Africa that we have discussed today are all pin-pointed to a specific ETF – which ensures you can invest in the most cost-effective way possible!

Best Index Funds Brokers South Africa

Once you have done your homework on which index fund(s) is best suited for your financial goals – you then need to find a suitable broker.

As index funds are one of the most popular asset classes with retail investors – it makes sense that the vast bulk of leading brokerage sites give you access. With this in mind, you also need to determine which broker offers the best service in terms of fees, index fund variety, payments, and customer support.

To fast-track the process for you, below we discuss a selection of regulated brokers that allow you to buy the best performing index funds in South Africa.

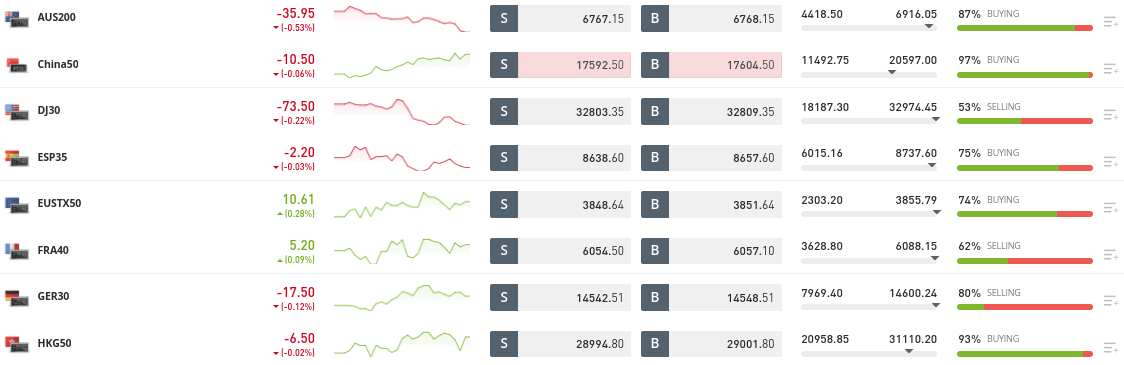

1. eToro – Best Index Fund Broker in South Africa – 0% Commission

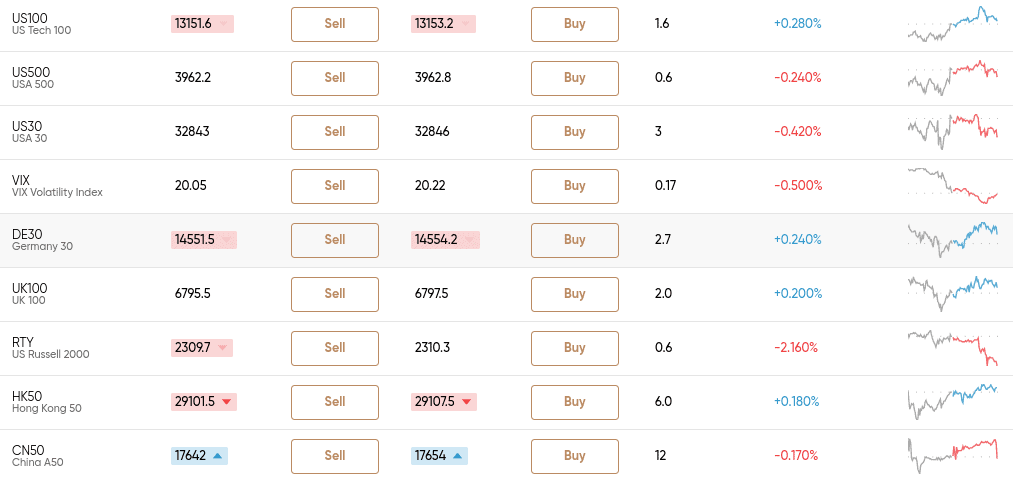

In terms of its support for index funds, eToro offers most of the investments that we discussed on this page. This means that you can invest in the likes of the Dow Jones, S&P 500, NASDAQ 100, Russell 2000, FTSE 100, and more. Best of all, regardless of which index fund you decide to invest in, eToro offers a commission-free service.

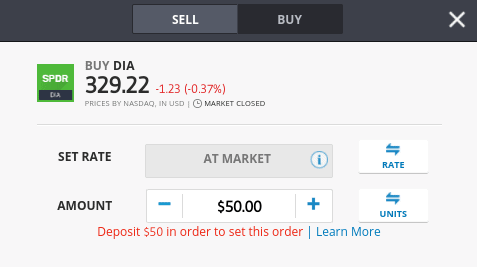

This means that you won’t pay a fee when you enter your index fund position, nor when you cash out. There are no ongoing platform fees either – so it’s only the expense ratio that you need to consider. Don’t forget – this is charged by the ETF provider and not eToro itself. What we also like about the index funds offered by eToro is that you can invest at a minimum of just $50 (about 750 rands) This is unusual, as when you go direct with an ETF provider the minimum is often at least 10 times this.

Nevertheless, when you invest in an index fund at eToro, you will also be entitled to your share of dividends. As soon as the respective ETF provider makes a distribution, this will be reflected in your eToro account. Outside of index funds, eToro also offers a broad range of other financial instruments. For example, you can buy shares in over 2,400 different companies and invest in all the best ETFs. This covers markets in the US, Germany, UK, Hong Kong, France, Greece, and more.

You can also buy cryptocurrency and trade commodities, forex, and indices. In terms of getting started, eToro accounts can be opened in minutes and the broker supports South African bank transfers, debit/credit cards, and e-wallets. In terms of safety, you are protected by three reputable financial bodies at eToro. This includes the FCA (UK), ASIC (Australia), and CySEC (Cyprus). Finally, eToro also offers a mobile stock app – so you can buy and sell on the move.

Pros:

- Buy shares and index funds without paying any commission or dealing charges

- 2,400+ shares listed on 17 international markets

- More than 20 million clients

- Perfect for beginners

- Social and copy trading

- Mobile trading app

- Regulated by the FCA, CySEC, and ASIC

Cons:

- Not suitable for advanced traders that like to perform technical analysis

67% of retail investors lose money trading CFDs at this site

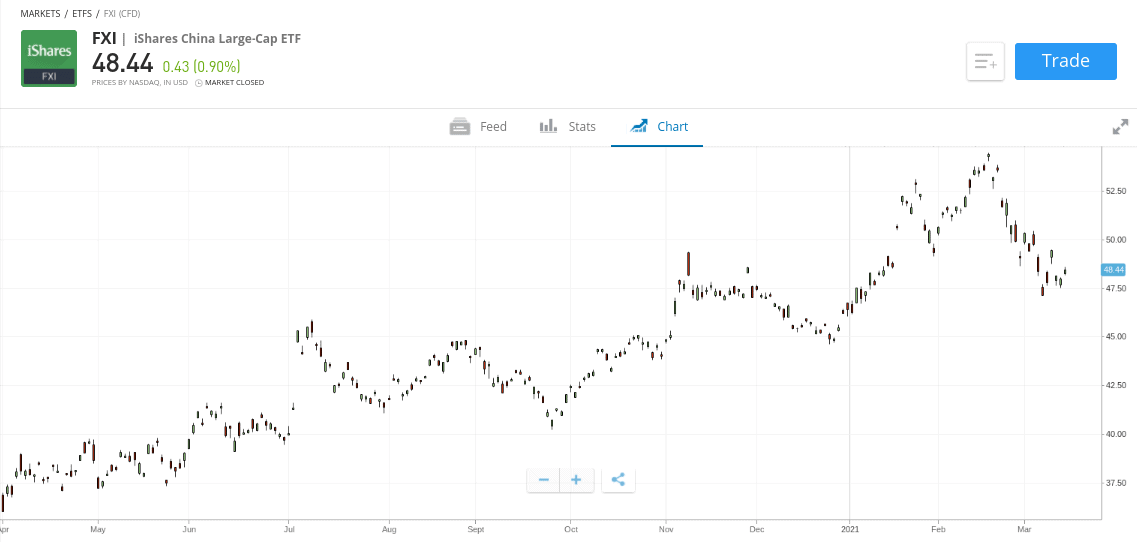

2. Capital.com – Trade Index Funds With Leverage Commission-Free

For example, Capital.com allows you to trade index fund CFDs on a 0% commission basis and spreads are wafer-thin. Additionally, CFDs at Capital.com allow you to trade index funds with leverage. This means that you can trade with much more than you have in your account.

At Capital.com, this stands at up to 1:200 on major index markets. As such, a $100 balance would allow you to trade an index fund at a maximum stake of $20,000. An additional advantage of trading index fund CFDs at Captial.com is that you can engage in short-selling. This means that you can make gains in the event you think an index fund is due to go down in value. This can be achieved at the click of a button by placing a sell order.

In terms of supported index fund markets, Capital.com covers heaps of instruments. Major markets include the Dow Jones, S&P 500, NASDAQ 100, and FTSE 100. There are also index markets from Hong Kong, China, Germany, France, Italy, Singapore, Spain, and more. In terms of getting started at Capital.com, the broker requires a minimum deposit of just $20 – or about 300 rands. The regulated platform supports South African debit/credit cards, bank wires, and a number of e-wallets.

Pros:

Cons:

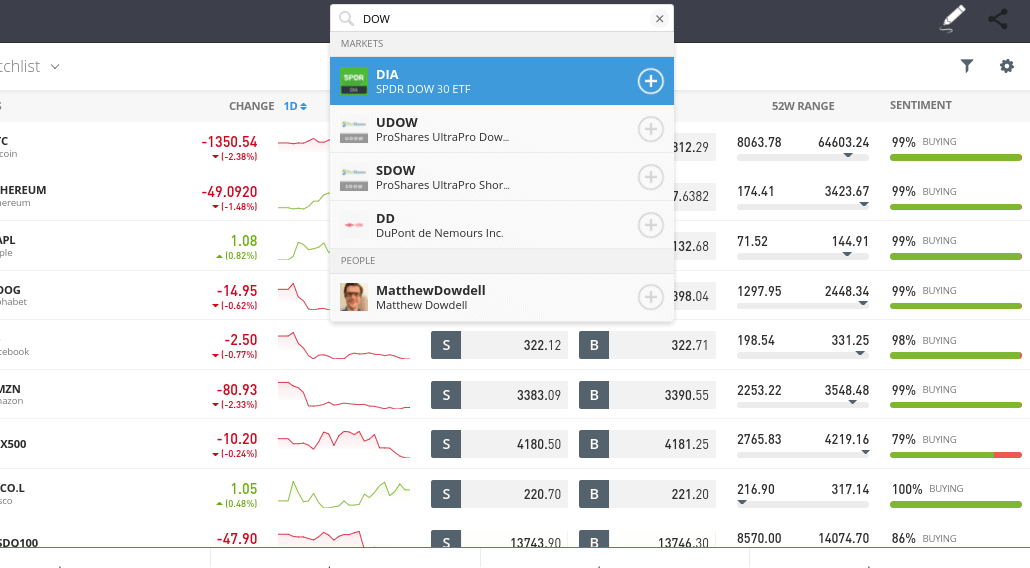

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. If you have read our guide on the best index funds South Africa up to this point, you should now have: All that is left you to do now is open an account with your chosen broker, deposit some funds, and invest in the index fund that takes your fancy. If this is your first time investing in an index fund online – we are now going to walk you through the process with commission-free broker eToro. To get the index fund investment process started, visit the eToro website, click on ‘Join Now’, and follow the on-screen instructions. You will be asked to provide your personal information and contact details, and you’ll need to choose a username and password. After confirming your email address and mobile number – you will then be asked to upload a couple of verification documents. For ID purposes, you can choose from a passport or driver’s license. To prove your home address, eToro supports a recently-issued utility bill or bank account statement. Once you have uploaded the aforementioned documents – eToro should be able to verify your account in a couple of minutes. Then, you will be able to deposit some funds. If you want to invest in your chosen index fund straightaway – consider using your debit/credit card or an e-wallet like Paypal. These payment methods are processed instantly by eToro. If you elect to transfer funds from your South African bank account, this will delay the investment process by a couple of days. You should now have a verified and fully-funded eToro investment account. Now you can search for the index fund that you wish to invest in. In our example, we are searching for the ‘Dow’. In doing so, we can see the SPDR Dow Jones Industrial Average ETF pop-up – so we then click on the ‘Trade’ button. This will take us straight to the investment page where we can complete your order. You will now see an order box like in the image below. To complete your investment, you need to enter the amount that you wish to allocate into the index fund. This needs to be entered in US dollars (minimum $50). Finally, click on the ‘Open Trade’ button to complete your commission-free index fund investment at eToro! In summary, the best South African index funds take away the stress of buying and selling individual assets. Instead, you can invest in the wider stock markets – with some index fund containing hundreds of different equities. This gives you the best chance possible of building a diversified long-term investment plan. If you’re ready to invest in your chosen index fund right now – consider completing the process with eToro. This heavily regulated brokerage site allows you to invest without paying any dealing fees or commissions. The minimum investment is just $50 per index fund and you can open an account in minutes! 75% of retail investor accounts lose money when trading CFDs with this provider.

The best performing index fund over the course of time is the S&P 500. This US-based index fund is super popular with South African investors - as, over a period of almost 100 years, it has generated average annualized returns of 10%.

Put simply, index funds track stocks or bonds from a particular exchange or market. For example, the JSE Top40 index fund tracks 40 large companies that are listed in South Africa. To invest in an index fund, this is easily achieved by going through an ETF. If the index fund increases in value, so will your investment. You will also be entitled to your share of dividends that are paid by the companies listed on the index fund.

If you're interested in an index fund that gives you access to the bond market - consider the Vanguard Total Bond Market Index. This index fund tracks thousands of bonds issued in the US - including both the government and corporate markets.

By shorting an index fund, you believe that it is likely to go down in value. You can do this easily by using an online broker that supports index funds in the form of CFDs. eToro, for example, allows you to short index funds at the click of a button via a sell order.

Perhaps the best performing index fund for dividends is the Dow Jones. This is because all 30 companies within the index pay dividends.

When you invest in an index fund, you often need to meet an account minimum of at least $500 (about 7,500 rands). Fortunately, brokers like eToro have much a lower minimum - which stands at just $50 (about 750 rands) per index fund investment.

How to Invest in Index Funds on eToro Tutorial

Step 1: Open an Investment Account

Step 2: Deposit Funds

Step 3: Search for Index Fund

Step 4: Invest in an Index Fund (Commission-Free)

Best Index Funds South Africa – Conclusion

eToro – Buy Investment Funds With Zero Commission

FAQs

What is the best performing index fund in South Africa?

How do index funds work?

What is the best index fund for bonds?

Can you short an index fund?

What is the best index fund for dividends?

What is the minimum index fund investment in South Africa?