Best Bitcoin Brokers in South Africa – Cheapest Brokers Revealed

If you’re interested in investing in Bitcoin in South Africa, one of the most important things you have to do is choose which broker to invest with. However, with so many options on the market, it can seem tricky to decide which one to choose.

Not to worry – in this guide, we explore the Best Bitcoin Brokers in South Africa, discussing each of them in detail and helping you decide which one is best for you.

Best Bitcoin Brokers in South Africa 2022

If you’re looking for a quick rundown of the best Bitcoin brokers in South Africa, then look no further. In the section that follows, we will discuss each of these brokers in detail, helping you choose the right one for your investment circumstances.

- eToro – Overall Best Bitcoin Broker in South Africa – Visit Now

- Libertex – Popular Bitcoin Broker in South Africa with Zero Spreads – Visit Now

- Binance – Low-Cost Bitcoin Broker in South Africa

- Plus500 – Best Bitcoin Broker in South Africa for Leverage

- AvaTrade – Best Bitcoin Broker in South Africa to Invest Quickly

- Coinbase – Best Bitcoin Broker in South Africa for Beginners

- IG – Best Bitcoin Broker in South Africa for Balance Protection

- Capital.com – Best Bitcoin Broker in South Africa for CFD Trading – Visit Now

Best Bitcoin Brokers in South Africa Reviewed

As you can see from the list above, there is a wide variety of Bitcoin brokers available in South Africa. Each one offers something slightly different, which makes choosing the best one for you seem challenging.

In the section below, we dive into each of these brokers in detail, discussing each one’s fee structure and the key information you need to know about their features.

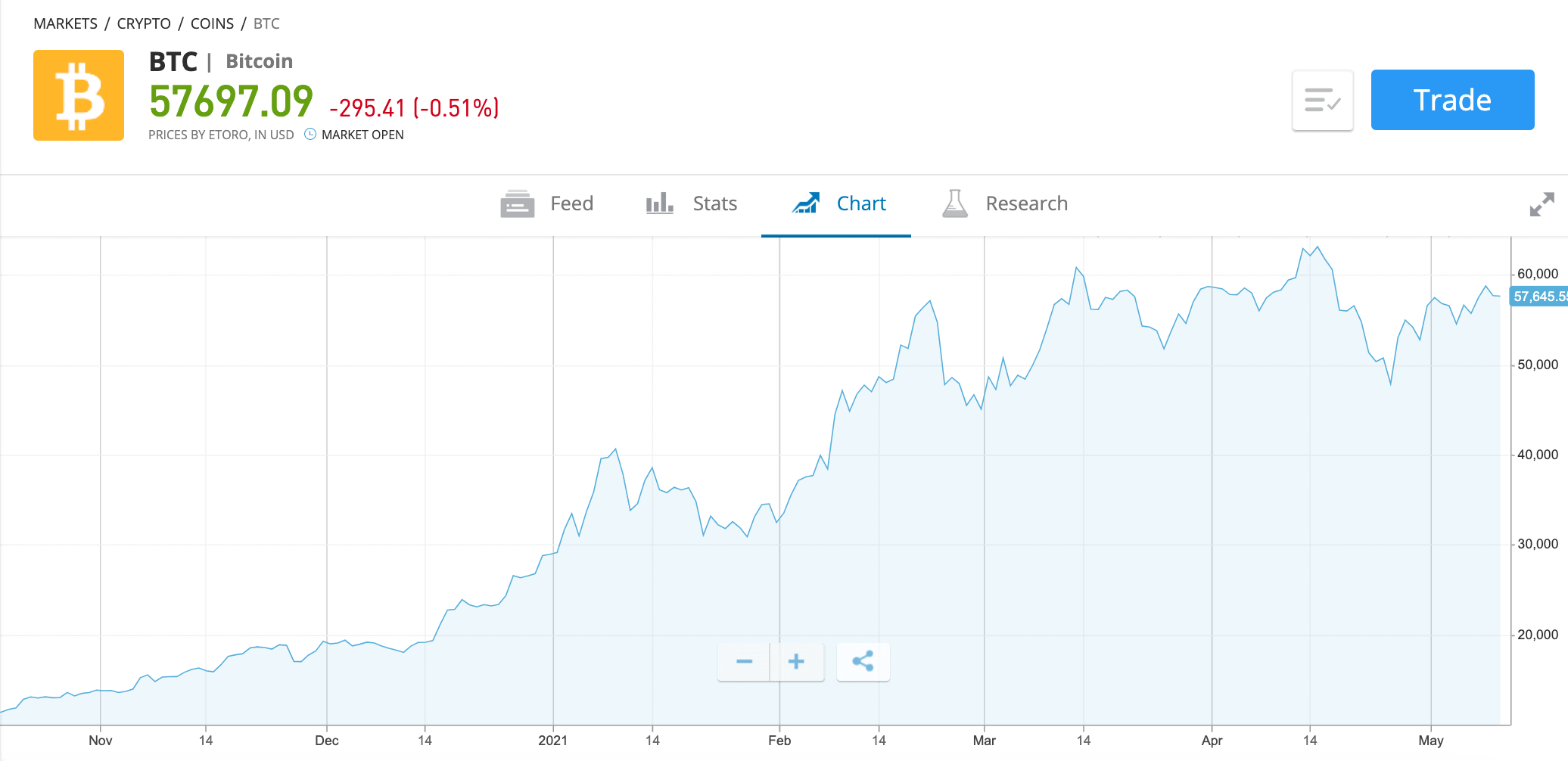

1. eToro – Overall Best Bitcoin Broker in South Africa

Our recommendation for the best Bitcoin broker in South Africa is eToro. eToro is known worldwide as a safe and reliable broker and currently has over 20 million users. In terms of regulation, eToro is supervised by some top regulatory bodies such as the FCA, ASIC, and CySEC.

One of the best things when you buy Bitcoin with eToro is that they do not charge any commissions. Other brokers often charge between 0.1% and 3% commissions when you place a crypto trade – which can accumulate rapidly if you are an active trader. As eToro charge 0% commissions, you get to buy Bitcoin and other cryptocurrencies in a cost-effective manner.

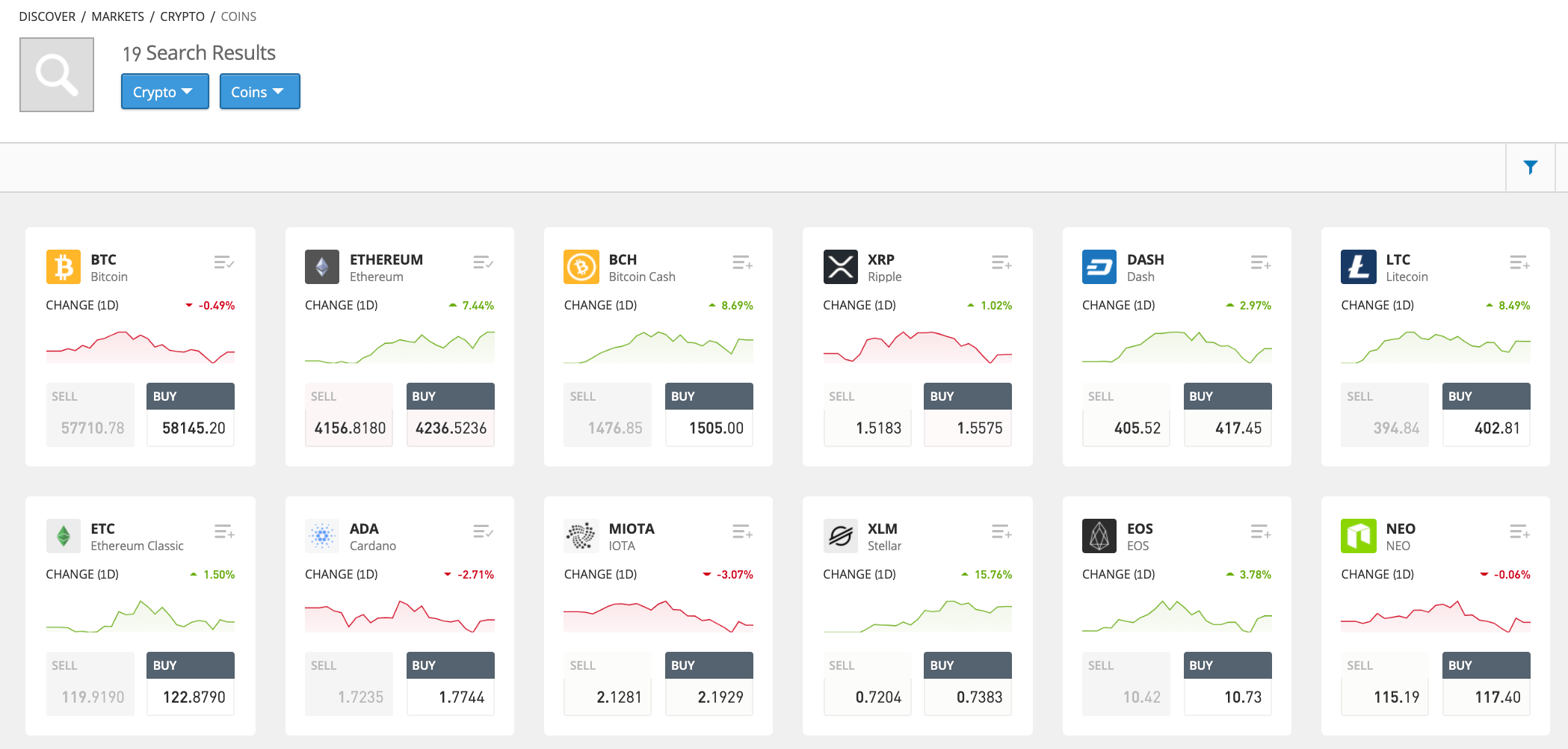

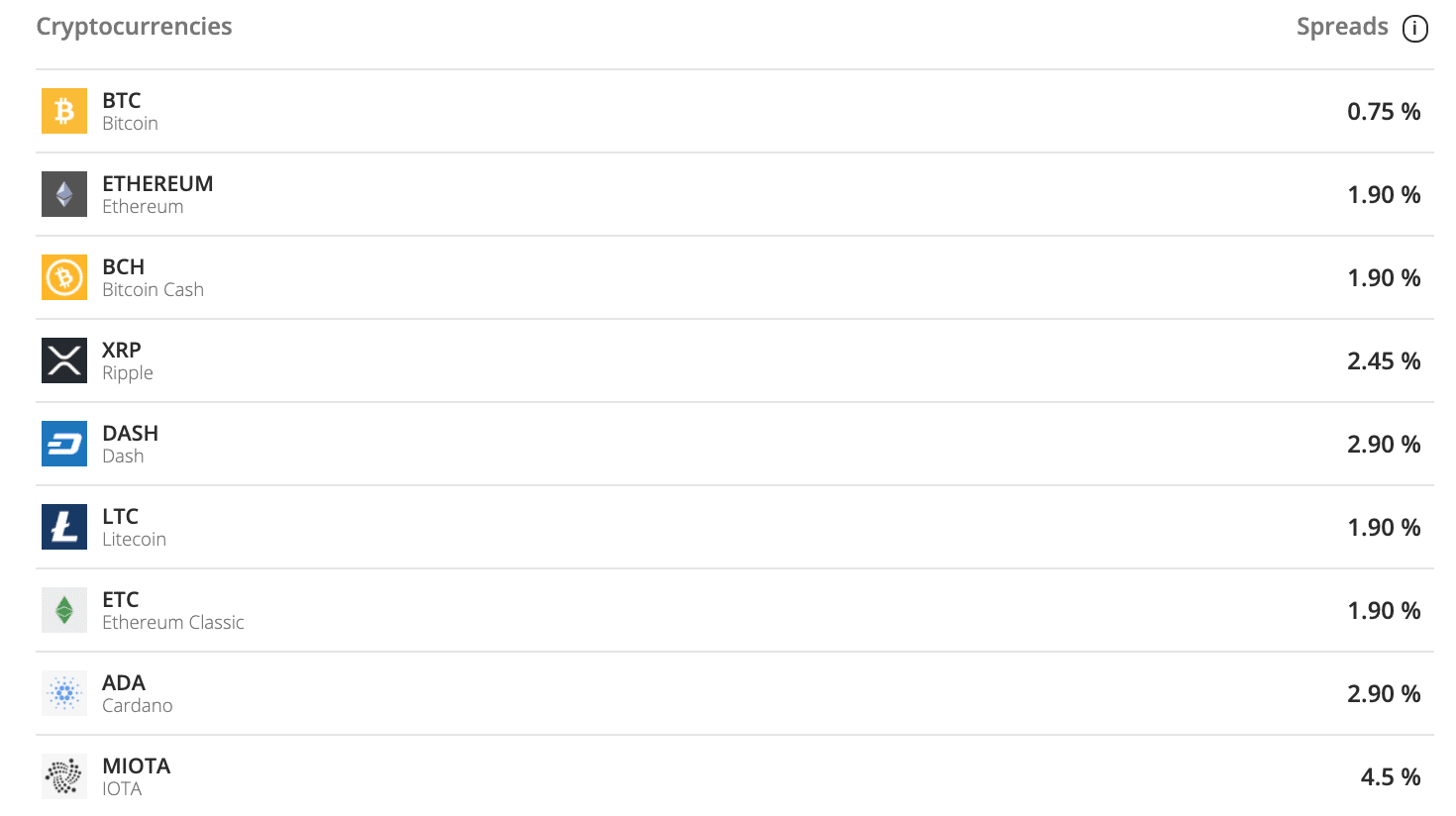

The only fee you’ll have to pay when you buy Bitcoin is the spread, which is defined as the difference between the bid and ask prices of an asset. With eToro, this spread is fixed at 0.75%, ensuring it remains competitive with other brokers and exchanges. If you decide to add some more digital currencies to your portfolio, eToro also offers 17 other coins to trade; furthermore, you can even invest in their innovative ‘CryptoPortfolio’ fund, all without having to pay any management fees.

Finally, eToro provides users with multiple ways to make a deposit, such as through credit/debit card, bank transfer, or various e-wallets. A small fee of 0.5% accompanies deposits for currency conversion purposes; however, this fee is fixed and does not increase with more significant deposits. Once your account has been funded, eToro then let you buy Bitcoin for as little as $25 – which is only around 352 ZAR.

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

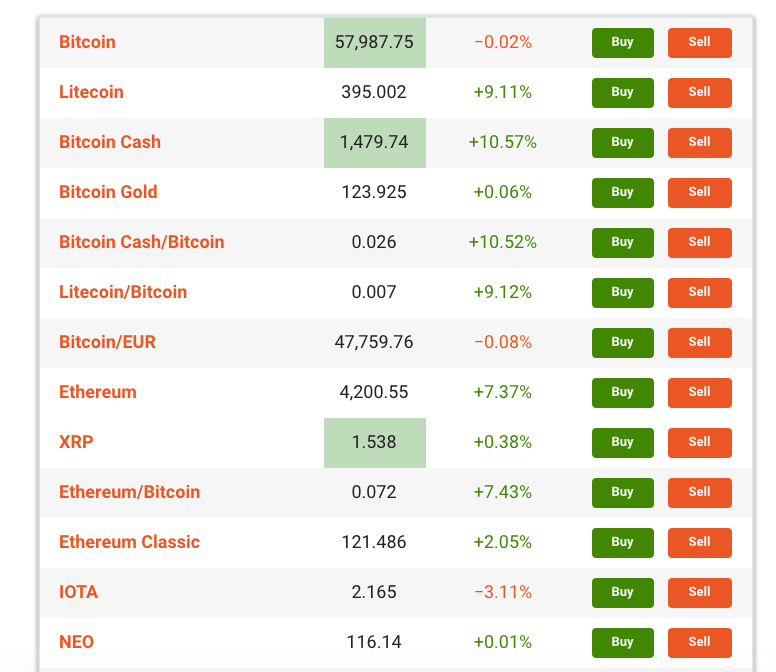

2. Libertex – Popular Bitcoin Broker in South Africa with Zero Spreads

Currently, Libertex offers over 40 different cryptocurrencies and digital tokens to trade – meaning they have one of the most diverse selections on our list. Notably, Libertex operates under a zero spread model, which means there is no difference between their bid and ask prices. Due to this, traders get some of the best rates available, regardless of market conditions. However, Libertex does charge a small commission when you place a trade. This commission tends to range between 0.1% and 1%, depending on the crypto and the current market conditions.

When you create a Libertex account, you’re able to fund it from as little as €10 – which equates to around 170 ZAR. As one of the best regulated Bitcoin brokers, Libertex allows you to deposit safely via credit/debit card, bank transfer, and various e-wallets such as Skrill, Neteller, and Trustly.

Finally, Libertex also caters to new traders with its demo trading feature, allowing users to get acquainted with their platform and practice their skills before entering the markets for real. In addition to this, Libertex also offers various educational materials that can help beginners trade Bitcoin more effectively.

Pros:

Cons:

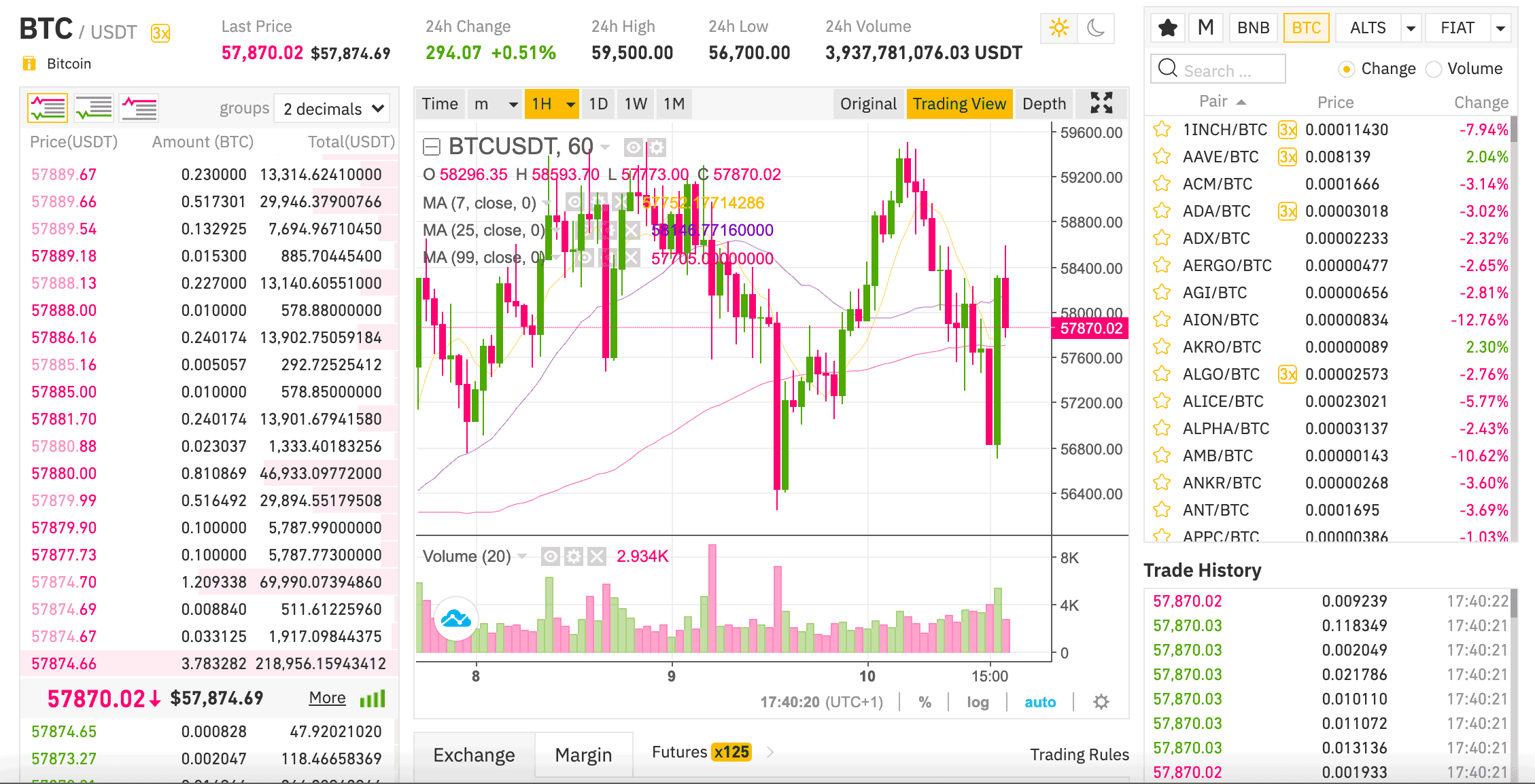

75.3% of retail investor accounts lose money when trading CFDs with this provider. A further addition to our Bitcoin brokers list is Binance. Binance is currently the world’s largest crypto exchange by volume, with over $65 billion worth of trades conducted every 24 hours. One of the main reasons Binance is the go-to platform for Bitcoin traders is their diverse asset range – they offer over 52 different cryptos to choose from, ranging from top currencies to smaller altcoins. Binance is considered one of the best Bitcoin brokers in South Africa because they offer incredibly low commissions when trading crypto. If you use their basic account (which the vast majority of retail traders will), commissions are only 0.1% of your trade size. To put this into perspective, if you were to invest 1500 ZAR in Bitcoin, you’d only have to pay 1.50 ZAR in fees! Another reason to use Binance is that they offer one of the best Bitcoin wallets on the market. Their Trust Wallet feature allows users to store their Bitcoin safely and securely. It even provides various useful features, such as the ability to exchange one crypto for another directly within the wallet’s app. Furthermore, the wallet itself is free to download and use. Finally, Binance does not charge any fees to make a deposit, regardless of what method you use. They also allow you to buy Bitcoin directly with a credit card – without even making a deposit. However, this does come with a 3% transaction fee attached, so if you wish to save some money, it’s wise to deposit first. Pros Cons

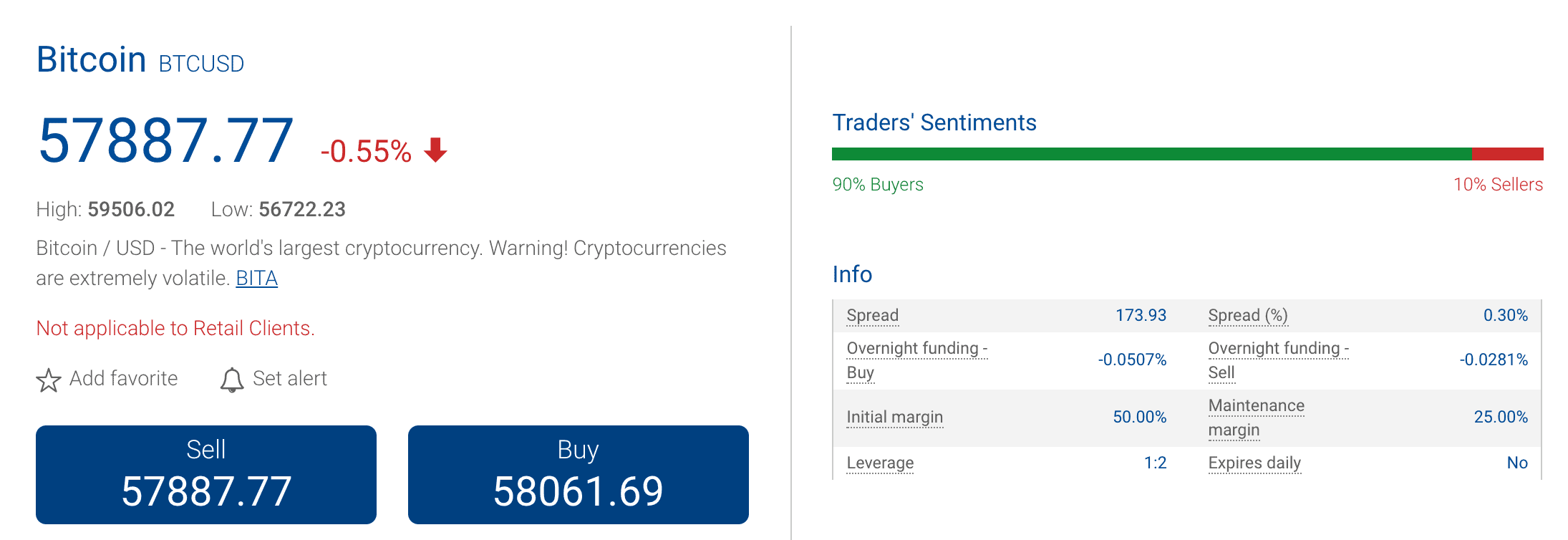

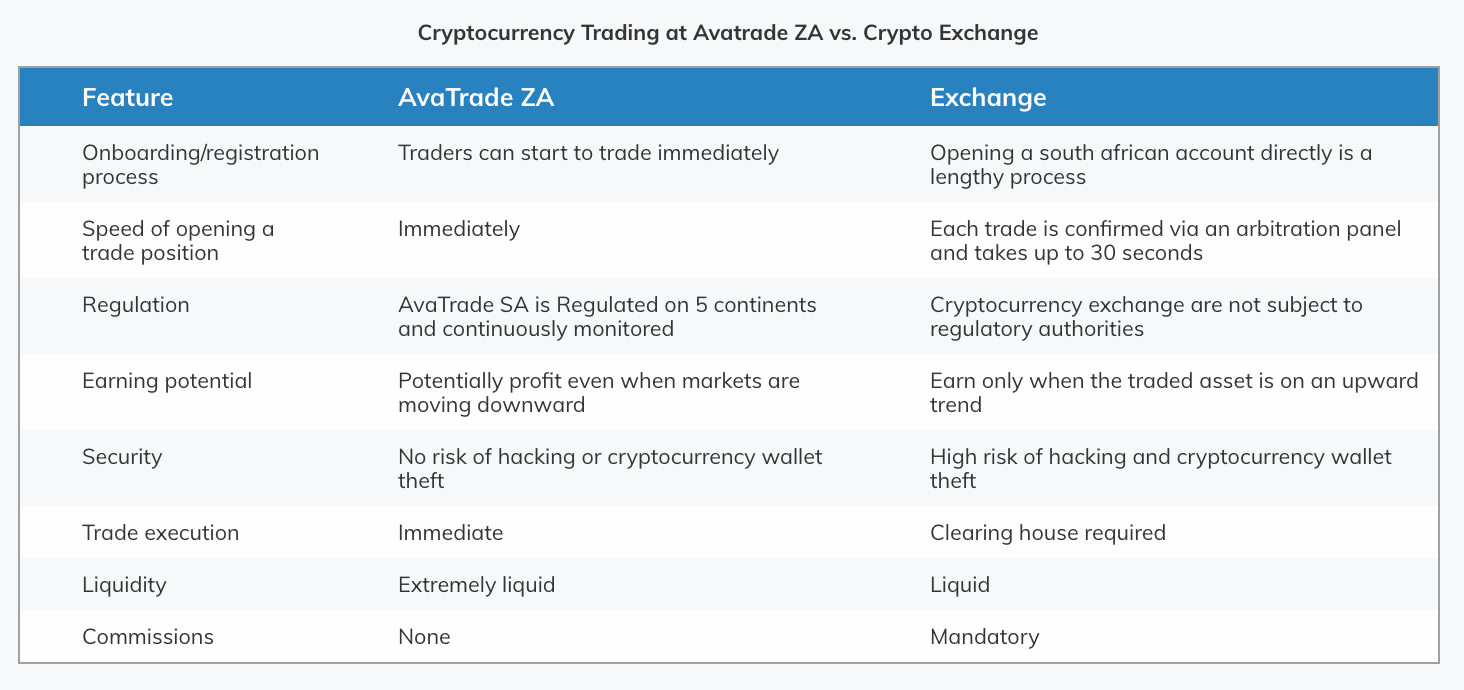

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. If you’re looking to buy cryptocurrency with leverage, then an excellent option for you might be Plus500. Regulated by the FCA and ASIC and listed on the London Stock Exchange, Plus500 is a safe and reliable broker to buy Bitcoin in South Africa. Like some other brokers on our list, Plus500 primarily offers CFD trading services. This means that you will not own the Bitcoin you buy but instead will own a contract based on Bitcoin’s price. Currently, Plus500 offers 12 different digital currencies to trade, including top cryptos such as Bitcoin, Ripple, Ethereum, and Litecoin. Plus500 also use a spread instead of a commission, which can range from 0.02% to 2%, depending on the asset and market conditions. Typically, Bitcoin’s spread is usually around the 0.3% mark. Additionally, you can trade Bitcoin with up to 1:2 leverage – which is excellent if you are looking to increase your position size and boost potential profits. Finally, Plus500 require a minimum deposit of $100, which equates to around 1400 ZAR. Although slightly higher than other brokers, Plus500 does not charge any deposit fees whatsoever, and users can make deposits via credit/debit card, bank transfer, or e-wallets such as Skrill and PayPal. Pros: Cons: 76.4% of retail investor accounts lose money when trading CFDs with this provider. If you are looking to get up and running as fast as possible, it might be worth checking out AvaTrade. Founded in 2006, AvaTrade has established itself as a straightforward and reliable Bitcoin broker to trade with and is regulated by respected entities such as ASIC and FSCA. Notably, AvaTrade does not charge any commissions when you trade the 17 cryptocurrencies they offer. Instead, they charge a spread – which is very low in comparison to other brokers. Interestingly, AvaTrade offer leverage of 1:2 when crypto trading; however, for Bitcoin specifically, they offer up to 1:20 leverage. This means that if you invested 1000 ZAR, and you used the maximum leverage on offer, then your position size would essentially equate to 20,000 ZAR! One of the best things about AvaTrade is how fast you can be up and running. The account opening process is super quick and can be completed on the same day. Once opened, you are free to deposit via credit/debit card, bank transfer, or e-wallet – all completely free. However, AvaTrade does charge an inactivity fee of $50 (around 700 ZAR) if you go three months without placing a trade, so make sure to remain active if you wish to avoid this charge. Pros: Cons:

73.05% of retail investors lose money when trading CFDs at this site One of the best cryptocurrency trading platforms available in South Africa is Coinbase. Currently the second-largest crypto exchange in the world by market cap, Coinbase are well-known for their user-friendly platform that is great for beginners. If you are entering the crypto market for the first time, it can seem daunting due to the different terminology and diverse assets on offer – yet Coinbase ensures your trading journey is as smooth as possible. Coinbase offers 64 different coins to trade (including Bitcoin) across 207 different markets. When it comes to fees, Coinbase is slightly more expensive than its peers. Users have to pay a combination of a spread and a flat fee, which can vary based on trading volume. Typically, this spread is around 0.5%, although it can change depending on market conditions. The flat-fee aspect ranges from $0.99 to $2.99 (14 ZAR to 42 ZAR) depending on position size. Although these fees might seem high, they are more than worth it for the ease of use of Coinbase’s platform. Trades can be placed across all of your devices, ensuring you can always manage your holdings on the go. Finally, Coinbase also offers a user-friendly crypto wallet to store your Bitcoin. You can access this either through the web or your smartphone. The smartphone wallet is non-custodial – which means you are the only person with access to your private keys. The great thing is, Coinbase allow you to send and receive Bitcoin (and other cryptos) using just your username, removing the need to note down your wallet address each time you’re sending digital currencies. Pros Cons

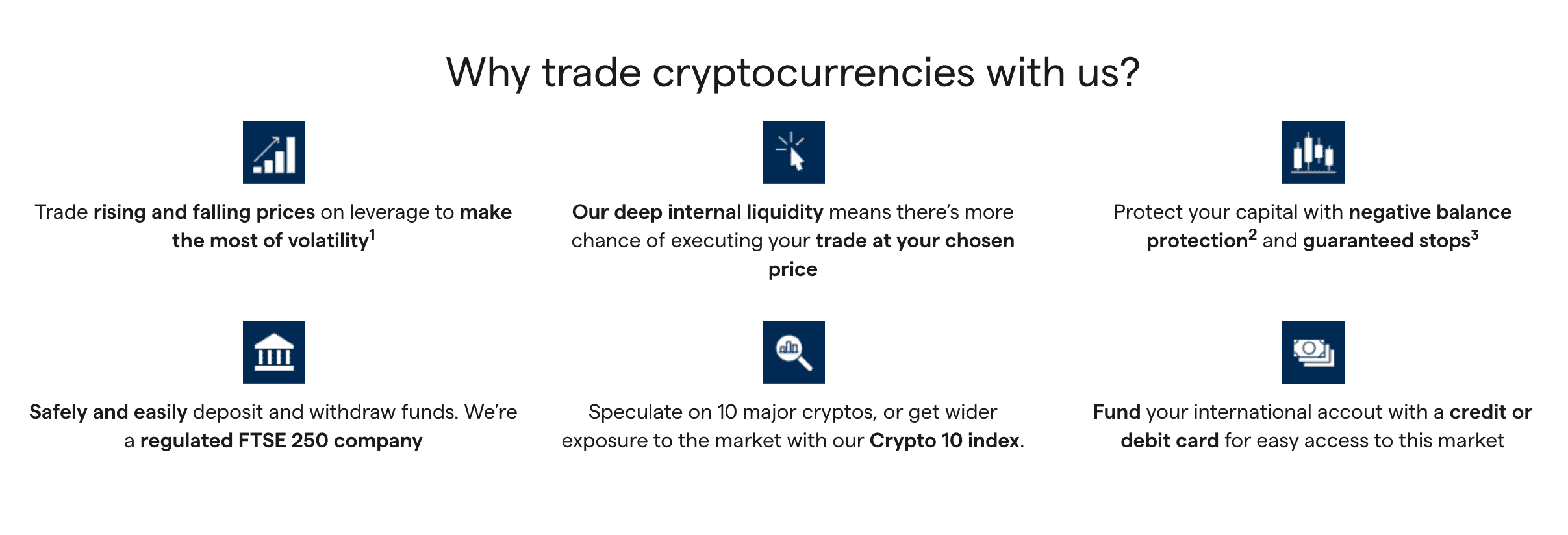

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. The final Bitcoin broker we will discuss in this guide is IG. IG is one of the largest brokers in the world and is one of the best FSCA regulated brokers. Designed for both beginner and experienced traders, IG ensures their platform is easy to use and includes integration with top trading software such as MT4 and L2 Dealer. IG offers seven cryptocurrencies to choose from – however, these cryptos are only available to be traded in South Africa by professional traders on the international account. International accounts are automatically offered when you sign up to IG, as you get one alongside your domestic account. However, to be classed as a professional trader by IG, you have to have averaged ten leveraged transactions per quarter over the last year or have a portfolio worth over €500,000 (around 8,500,000 ZAR). Assuming you can get access to IG’s crypto markets, you can trade CFDs on major digital currencies such as Bitcoin, Litecoin, and Ethereum. IG utilise a spread-based structure, which means that instead of charging a commission, they make their money through the difference between the bid and ask prices of an asset. Typically with IG, these spreads are pretty tight because the broker offers deep internal liquidity when crypto trading. A great feature of IG when it comes to crypto trading is that they offer guaranteed stops on your orders. This means that your stop-loss will always be executed at the level you specified – meaning that traders don’t need to worry about slippage caused by rapid price movements. This feature ensures that traders do not lose significant amounts of money in times of extreme price volatility. Pros Cons

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. Another of the best Bitcoin brokers in South Africa is Capital.com. Capital.com are primarily a CFD trading broker, which means that users can speculate on the prices of various cryptocurrencies quickly and easily. With Capital.com, users can trade these CFDs safely as the broker is well known for its trustworthy reputation and is currently regulated by the FCA. As Capital.com offers CFDs rather than the actual asset, traders can use leverage when Bitcoin trading. Capital.com offers 1:2 leverage when trading crypto – which essentially doubles your position size and therefore doubles your potential returns. Although using leverage increases the overall risk, it provides a much faster way to make money with Bitcoin. As Capital.com does not charge any commissions, the only fee you’ll have to worry about when placing a trade is the spread. This spread fluctuates depending on market conditions but usually remains tight on liquid assets such as Bitcoin. Finally, as one of the most trusted Bitcoin brokers, Capital.com offers users various ways to fund their account, including bank transfer, credit/debit card, or e-wallet. Notably, the minimum deposit amount is higher if you opt to use a bank transfer – so if you want to invest a smaller amount initially, then it’s best to use one of the other options. Pros: Cons:

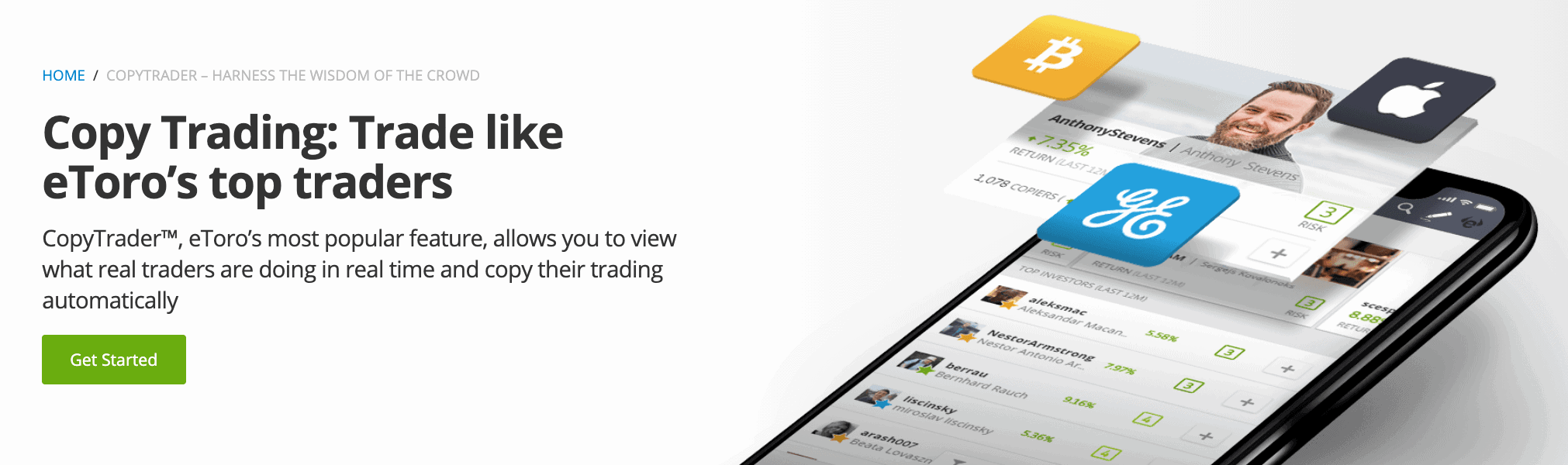

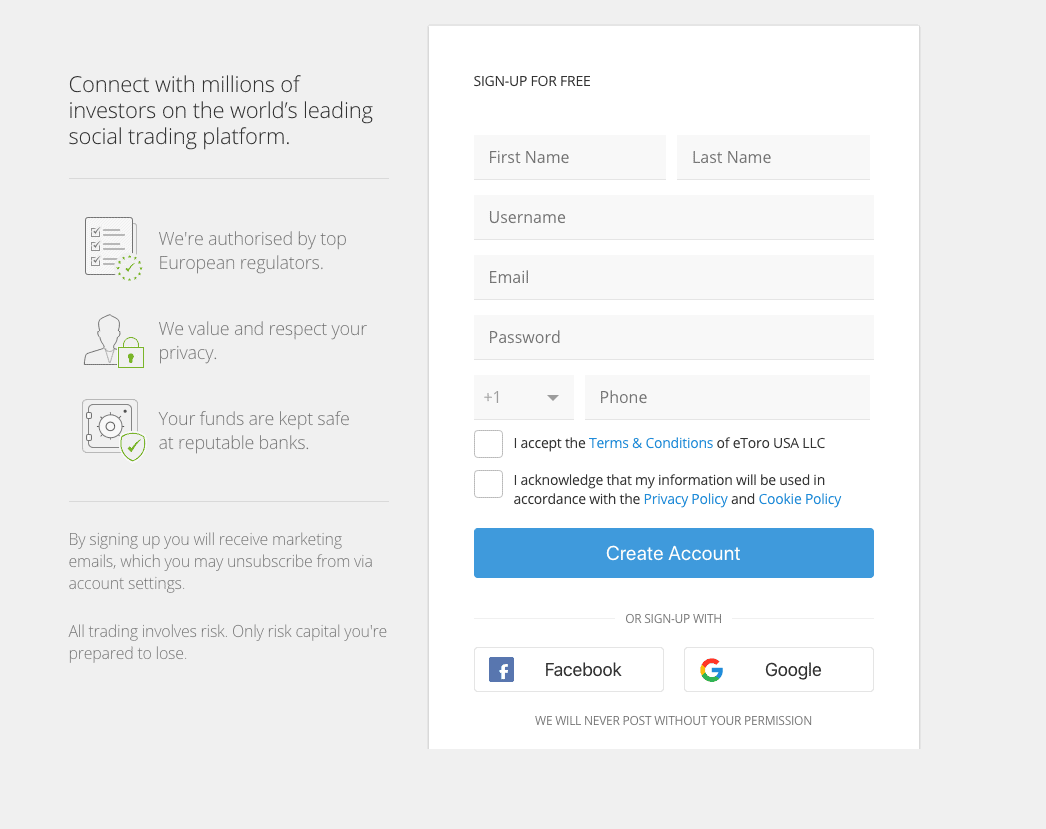

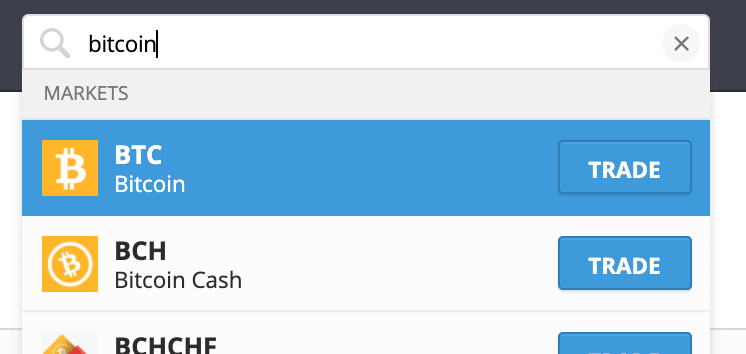

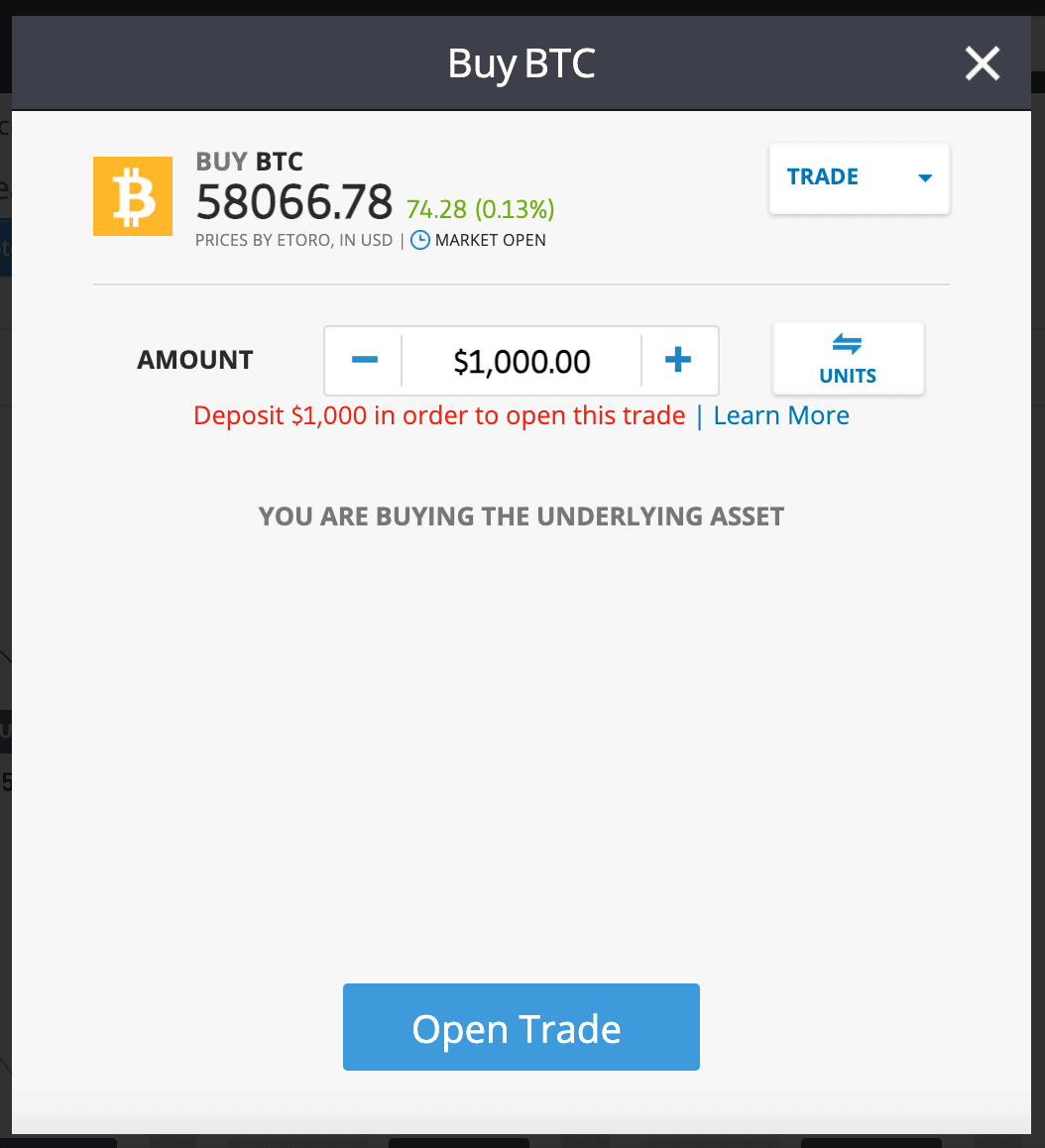

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. The best Bitcoin brokers in South Africa provide a streamlined way for you to buy and sell Bitcoin from the comfort of your own home. Regulated Bitcoin brokers such as eToro act as intermediaries in the Bitcoin market, pairing buyers and sellers together in a cost-effective and straightforward manner. As you can see from our Bitcoin brokers list earlier in the guide, there is a diverse selection of brokers available in South Africa to choose from. Due to the competitive nature of the market, each broker offers its own fee structure and set of features that attempt to make them the most attractive proposition. Due to this, you must examine all the options available to make the best decision for you. As mentioned, these brokers facilitate buy and sell orders for Bitcoin from traders. Typically what happens is you will create an account, make a deposit, and then simply place a trade on the broker’s platform. Depending on whether the broker focuses on CFD trading or not, you will either own some Bitcoin or you will own a CFD based on the price of Bitcoin. Another great feature of the best Bitcoin brokers in South Africa is the crypto wallets that they offer. Thanks to Bitcoin being a digital asset, there is no way to store your Bitcoin holdings in a physical location. Instead, special software known as a crypto wallet is used to hold your Bitcoin (and other cryptos), keeping your investment safe from hackers. According to Statista, over 70 million people store their Bitcoin in these crypto wallets. Most wallets do this through the use of advanced security features such as two-factor authentication and standardisation protocols. Finally, as the best Bitcoin brokers allow you to buy and sell Bitcoin from your computer or smartphone, you’re able to fund your account using various methods. The most popular methods are using a credit/debit card, bank transfer, or e-wallets. Depending on the broker, deposits are sometimes accompanied by a small fee – so be wary of this when choosing a trading platform. When it comes to the best regulated Bitcoin brokers, each one offers a slightly different fee structure. Some brokers (such as eToro) offer 0% commissions when trading cryptocurrency, whereas others can charge up to 3% commission per trade. Alternatively, some brokers utilise a spread-based structure, with the difference between the bid and ask price being taken as a sort of ‘commission’ for the broker. Other fees to be aware of when choosing the best Bitcoin broker are concerning deposits and withdrawals. Many share trading platforms will charge a fee for making a deposit or a withdrawal – this can either be a percentage of the value or a flat fee. Finally, there are other non-trading fees to note, such as inactivity fees and monthly account fees. Some Bitcoin brokers will charge these, and some will not, so it’s important to research beforehand to double-check. Also, many brokers will provide a crypto wallet to their users to store their Bitcoin holdings – most brokers (including eToro) provide this service for free; however, it’s always wise to ensure this is the case. The table below presents a fee breakdown for three of the best Bitcoin brokers in South Africa, ensuring you know exactly what you’ll need to pay if you partner with one of them to trade Bitcoin. As you can imagine, with the rise of cryptocurrency trading, there is a large volume of Bitcoin brokers available in the market these days. Thanks to this, choosing which one to trade with is no easy task. To help you along in this, the section below explores three of the critical areas you need to pay attention to when choosing a Bitcoin broker in South Africa. In addition, as Bitcoin is a digital currency, it’s wise to consider brokers that offer a crypto-wallet as part of their services. Many trading platforms (such as eToro) will provide users with a wallet for free, allowing you to store your Bitcoin holdings safely. Furthermore, these wallets are usually packed with valuable features, such as crypto exchange or peer-to-peer sending. You should also pay attention to the variety of features that a broker offers. As most brokers essentially do the same thing (pair buyers and sellers together), they differentiate themselves through useful additions to their services. For example, Binance offers a feature called ‘Binance Academy’, an online education portal designed to teach new crypto traders how to safely and effectively navigate the market. Another exciting feature to note is eToro’s CopyTrader feature. This innovative service allows traders to copy other, experienced traders on the platform – removing all of the guesswork from trading. Through this feature, newcomers to the crypto market can emulate the trades from an advanced crypto trader and generate returns right off the bat. Fees are another thing that you should research when choosing a broker. As you have seen from the list earlier in the guide, each broker uses a slightly different fee structure – so it can get quite confusing. The most important fee to keep an eye out for is commissions, as these can build up fast. However, some brokers (such as eToro) offer 0% commissions when trading – providing a low-cost way to enter the markets. Other fees to note are deposit fees, withdrawal fees, and monthly account fees. These are referred to as ‘non-trading fees’ and are generated indirectly. Some brokers will charge these, and some won’t, so make sure you double-check when choosing a broker. Finally, some brokers will also charge an ‘inactivity fee’ if you have an account but do not place a trade for a while – these fees can sneak up on you, so be wary of this when entering the market. Now that you have an idea of what the best Bitcoin brokers in South Africa are, it’s time to discuss the actual process of signing up with one. In the steps below, we will show you how to sign up with heavily-regulated broker eToro – all in under ten minutes. The first thing you have to do is sign up for an eToro account. This is super easy to do and can be completed online. Head over to eToro’s website and click ‘Join Now’ in the top right – you can also do this step through their mobile app if you wish. On the page that follows, enter your email address and choose a username and password. Due to eToro’s high levels of security, new users must verify themselves before buying Bitcoin. To do this, upload proof of ID (a copy of your driver’s license or passport) and proof of address (a copy of a bank statement or utility bill). eToro will then verify the documents, which usually only takes a few minutes. Next, you’ll have to deposit into your account. You can do this via credit/debit card, bank transfer, or e-wallet. As noted earlier in the guide, a currency conversion fee of 0.5% will be charged when you make a deposit. Once you have funded your account, click into the search bar at the top of the screen and type in ‘Bitcoin’ – you can also type in Bitcoin’s ticker symbol. ‘BTC’. Then, click the ‘Trade’ button on the top option in the drop-down menu. In the order box that follows, all you have to do is enter the amount you’d like to invest in Bitcoin – eToro requires a minimum investment of only $25 (around 352 ZAR). After this, double-check everything is correct, and click ‘Open Trade’. Congratulations! You’ve just invested in Bitcoin with one of the top brokers in South Africa – all without paying any commissions! To wrap up, this guide has explored some of the best Bitcoin brokers in South Africa, providing insight into the options available on the market and touching on key factors you need to pay attention to. Using this guide, you’ll be sure to make the right decision when choosing a Bitcoin broker, ensuring your cryptocurrency trading is as effective as possible. However, if you’re looking to invest with one of the best brokers right away, then we’d recommend using eToro. eToro offers commission-free trading on all of their cryptocurrencies (including Bitcoin), meaning that crypto investing is as inexpensive as possible. What’s more, you’re even able to invest in Bitcoin from as little as $25 – which is only around 352 ZAR! 67% of retail investor accounts lose money when trading CFDs with this provider. Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

We've found that eToro is the best Bitcoin broker for South African traders through countless hours of research and user-testing. This is because eToro offer commission-free investing on Bitcoin (and all the other cryptos they offer). In addition, they’re heavily regulated worldwide, and users can invest in Bitcoin from as little as $25 (around 352 ZAR).

One of the most straightforward ways to buy Bitcoin in South Africa is to use a top broker such as eToro. Once you have registered and funded your account, you can easily purchase Bitcoin through their online platform – commission-free!

This depends on which broker or exchange you decide to invest with. Some brokers will require larger initial investments, whereas others (such as eToro) will allow you to invest using smaller sums of money.

Many of the best Bitcoin brokers on our list are regulated by top regulatory bodies such as the FCA, ASIC, and CySEC. Through these regulations, brokers must abide by the strictest security guidelines, ensuring their users are safe.

The main fees you need to look out for are commissions and deposit fees. Commissions refer to the cost associated with placing a trade, whilst deposit fees refer to the charge related to making a deposit. Some brokers (such as eToro) offer 0% commissions when trading crypto – ensuring the process is as low-cost as possible.

3. Binance – Low-Cost Bitcoin Broker in South Africa

4. Plus500 – Best Bitcoin Broker in South Africa for Leverage

5. AvaTrade – Best Bitcoin Broker in South Africa to Invest Quickly

6. Coinbase – Best Bitcoin Broker in South Africa for Beginners

7. IG – Best Bitcoin Broker in South Africa for Balance Protection

8. Capital.com – Best Bitcoin Broker in South Africa for CFD Trading

What is a Bitcoin Broker?

Bitcoin Brokers Fees Comparison

eToro

Capital.com

Libertex

Commissions

0%

0%

0.1% – 1%

Spread

0.75%

Varies

0%

Deposits

FREE

FREE

FREE

Withdrawals

70 ZAR

FREE

17 ZAR – 170 ZAR*

Crypto Wallet

FREE

N/A

N/A

Monthly Account Fee

NO

NO

NO

*Depending on the withdrawal method used and the amount withdrawn.

How to Choose the Best Bitcoin Broker for You

Security

Features

Fees

How to Get Started with a Bitcoin Broker

Step 1: Open an eToro Account

Step 2: Verify your ID and Address

Step 3: Fund your Account

Step 4: Search for Bitcoin

Step 5: Buy Bitcoin

eToro – Best Bitcoin Broker South Africa

FAQs

What is the best Bitcoin broker in South Africa?

How can I buy Bitcoin in South Africa?

What is the minimum Bitcoin investment in South Africa?

Are the best South African Bitcoin brokers safe?

How much do the best Bitcoin brokers in South Africa cost?