Best Investment in South Africa 2021 – Top Investment Options Compared

If you’ve got a bit of spare money to invest and want to earn more than bank account interest rates pay – you’ve got plenty of options at your disposal.

In fact, there are thousands of investments that you can make online – covering everything from stocks and ETFs to bonds and cryptocurrencies.

To give you a bit of inspiration, this guide will explore the best investments in South Africa for 2021.

We cover a wide variety of asset classes, potential returns, and risks – so be sure to consider what your financial goals are before taking the plunge.

-

- 1. Vanguard Total World Stock ETF – Overall Best Investment in South Africa

- 2. iShares Russell 1000 ETF – Best Investment in South Africa for US Stocks

- 3. JSE Top 40 Index – Best Investment South Africa for JSE-Listed Stocks

- 4. Tesla – Best Investment in South Africa for Growth Stocks

- 5. Renergen – Best Investment South Africa for Domestic Shares

- 6. Bitcoin – Best Investment in South Africa for Huge Upside Potential

- 7. SPDR S&P US Dividend Aristocrats ETF – Best Investment in South Africa for Dividend Stocks

- 8. SPDR Gold ETF – Best Investment in South Africa for Gold

- 9. Vaccine-Med CopyPortfolio – Best Investments South Africa for Vaccine Stocks

- 10. Crude Oil – Best Investment in South Africa for Short-Term Gains

-

- 1. Vanguard Total World Stock ETF – Overall Best Investment in South Africa

- 2. iShares Russell 1000 ETF – Best Investment in South Africa for US Stocks

- 3. JSE Top 40 Index – Best Investment South Africa for JSE-Listed Stocks

- 4. Tesla – Best Investment in South Africa for Growth Stocks

- 5. Renergen – Best Investment South Africa for Domestic Shares

- 6. Bitcoin – Best Investment in South Africa for Huge Upside Potential

- 7. SPDR S&P US Dividend Aristocrats ETF – Best Investment in South Africa for Dividend Stocks

- 8. SPDR Gold ETF – Best Investment in South Africa for Gold

- 9. Vaccine-Med CopyPortfolio – Best Investments South Africa for Vaccine Stocks

- 10. Crude Oil – Best Investment in South Africa for Short-Term Gains

Best Investment in South Africa List

Looking for a list of the best investments in South Africa for 2021? Below you’ll find our top 10 picks. Scroll down for a full analysis of each investment!

- Vanguard Total World Stock ETF – Overall Best Investment in South Africa – Invest Now

- iShares Russell 1000 ETF – Best Investment in South Africa for US Stocks – Invest Now

- JSE Top 40 Index – Best Investment South Africa for JSE-Listed Stocks – Invest Now

- Tesla – Best Investment in South Africa for Growth Stocks

- Renergen – Best Investment South Africa for Domestic Shares

- Bitcoin – Best Investment in South Africa for Huge Upside Potential

- SPDR S&P US Dividend Aristocrats ETF – Best Investment in South Africa for Dividend Stocks

- SPDR Gold ETF – Best Investment in South Africa for Gold

- Vaccine-Med CopyPortfolio – Best Investments South Africa for Vaccine Stocks

- Crude Oil – Best Investment in South Africa for Short-Term Gains

Best Investments South Africa Reviewed

With so many investments to choose from, knowing where to put your hard-earned money can be challenging. After all, you’ve got everything from stocks, ETFs, commodities, bonds, mutual funds, and even digital currencies like Bitcoin.

To help you make an informed decision, below we discuss the best investments South Africa to consider right now. Take note, our findings are in no particular order. Instead, we have covered a variety of investments with varying risks and rewards.

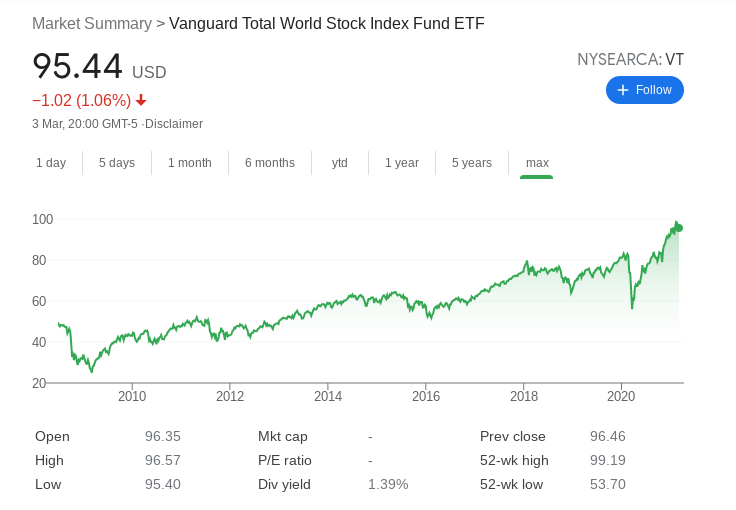

1. Vanguard Total World Stock ETF – Overall Best Investment in South Africa

It can be a daunting task to sift through thousands of potential investments from dozens of different asset classes. With this in mind, if you are based in South Africa and simply looking to create a diversified, long-term investment portfolio – it’s well worth considering the Vanguard Total World Stock ETF.

As the name suggests, this ETF is focused exclusively on stocks and shares. However, rather than sticking with a single exchange or market – the Vanguard Total World Stock ETF covers more than 8,000 stocks from a variety of countries. In fact, this ETF is so broad that you will be investing in companies from every corner of the globe.

For example, 59% of your portfolio will be held in major US stocks. Think along the lines of Apple, Microsoft, Amazon, Facebook, and Tesla. However, you’ll also be gaining access to the emerging markets – with 11% of your portfolio tracking stocks in Asia. This includes the likes of Tencent, Taiwan Semiconductor Manufacturing, and Alibaba.

You will also be gaining exposure to the Middle East, Canada, Australia, and Europe. Perhaps the most attractive aspect of this ETF is that it’s 100% passive. Once you complete the investment, there is nothing more for you to do. This is because Vanguard will regularly rebalance its basket of stocks to ensure it continues to meet the fund’s long-term objectives.

Plus, you are not over-exposed to a single economy, so taking such a diversified approach to investment will mitigate your risks. An additional benefit with the Vanguard Total World Stock ETF is that you can make money via capital gains and dividends. After all, many of the companies held in the ETF are dividend-paying stocks.

Your capital is at risk.

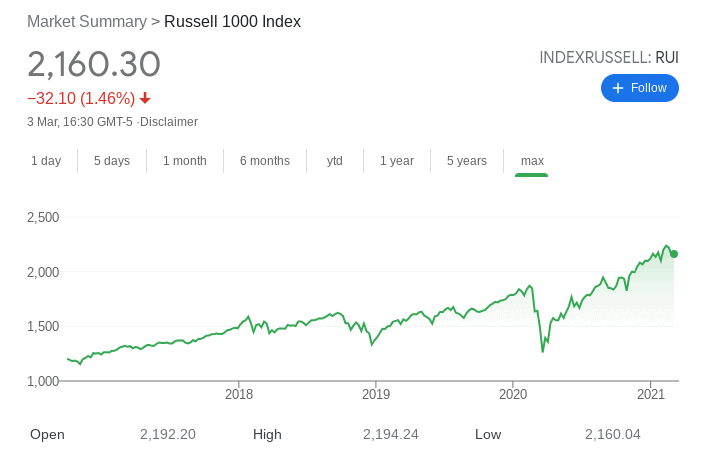

2. iShares Russell 1000 ETF – Best Investment in South Africa for US Stocks

If you are interested in solid and established US stocks, there are many ways you can gain exposure to this market. This includes popular index funds like the S&P 500, Dow Jones, and the NASDAQ Composite. However, if you want to buy over 1,000 American stocks through a single investment – it could be worth considering the iShares Russell 1000 ETF.

As the name implies, this ETF tracks the Russell 1000 index. For those unaware, this particular index tracks the 1,000 largest US stocks that are publicly-listed. This covers both primary exchanges – the NASDAQ and the NYSE. The ETF is weighted to mirror the Russell 1000 like-for-like, meaning that there is a heavy focus on large-cap tech stocks.

This includes Google, Microsoft, Facebook, IBM, and Apple. However, there are heaps of other companies in this ETF from a variety of sectors. For example, you’ll be investing in the likes of General Motors, T Mobile, Duke Energy, US Bankcrop, and Becton Dickinson.

Much like the previously discussed Vanguard Total World Stock ETF, the iShares Russell 1000 ETF allows you to make money from capital gains and dividends. In terms of the former, the index is up almost 80% over the past five years. When you add in the attractive dividend yield that the index pays, the iShares Russell 1000 ETF is ideal for long-term value seekers.

Your capital is at risk.

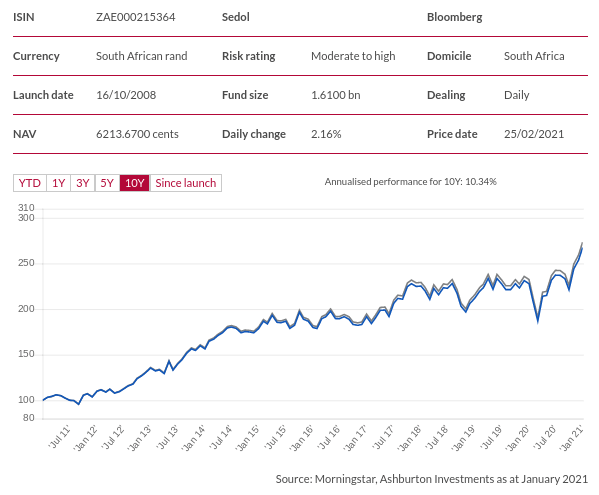

3. JSE Top 40 Index – Best Investment South Africa for JSE-Listed Stocks

If you have your sights set on companies listed on the Johannesburg Stock Exchange (JSE) – then perhaps the best way to approach this is through an index fund. The most prominent in this respect is the JSE Top40 Index. This index will track the 40 largest companies that are listed on the JSE.

This allows you to invest in the wider South African economy as opposed to selecting one or two companies. To give you an idea of how the index is weighted, you’ll be holding 19% in Naspers, 13% in BHP Group, and 10% in both Anglo American and Com Finance Richmont.

Other holdings include the likes of ABSA Group, Old Mutual, British American Tobacco, Prosus, and Mondi. As you can see, the JSE Top 40 Index covers a wide variety of domestic sectors and industries – so you are well diversified. In terms of performance, this index has seen gains of over 30% across the past five years – which is modest in comparison to other global indices.

Your capital is at risk.

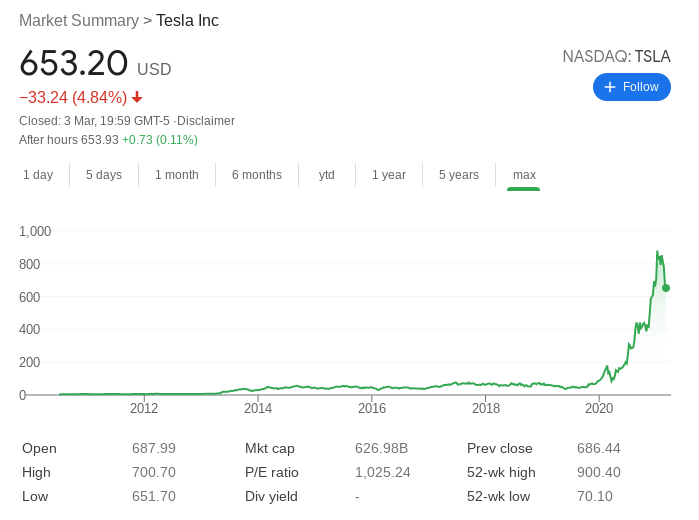

4. Tesla – Best Investment in South Africa for Growth Stocks

If you’re looking to add specific growth stocks to your portfolio for above-average gains, Tesla is likely to be of interest. Although the company first went public over a decade ago, the stock continues to outperform the wider markets by a considerable amount. For example – and taking into account its recent stock split, Tesla shares were priced at just under $4 each in 2020.

Earlier this year, the very same stocks peaked at $900. In simple terms, this means that had you invested in Tesla during its 2010 IPO – you’d be looking at gains of over 22,000%. However, perhaps even more impressive is the fact that Tesla was one of the best-performing stocks in 2020.

While many sectors are yet to get back to pre-pandemic levels, Tesla finished 2020 with gains of over 700%. In terms of what the future holds, it’s important to remember that Tesla’s electric car range is just one segment of the business. Consequently, as the firm is also behind solar and battery technologies – this stock is potentially one to hold for many decades to come.

Your capital is at risk.

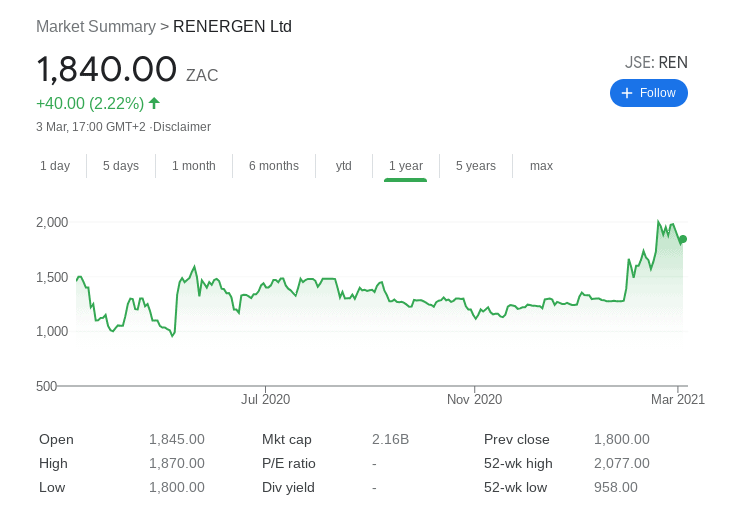

5. Renergen – Best Investment South Africa for Domestic Shares

If you want to invest in South African companies, then the most risk-averse way of doing this is through the previously discussed JSE Top 40 Index. However, that isn’t to say that you can’t also add a couple of value stocks to your portfolio – especially when it comes to Renergen.

This South African company is primarily involved in helium and natural gas – with the firm having sole rights to domestic production in South Africa. Furthermore, and perhaps most pertinently, Renergen is behind an innovative logistics network that is primed to facilitate vaccine deliveries – not only on home soil but in other parts of Africa and several Asian countries.

Its fleet of vehicles is specifically designed to keep vaccines at ultra-cold conditions for up to a month. The underlying technology is directly related to its helium capabilities – which is what Renergen does well. This positive outlook on the firm has since resulted in an upward stock trajectory that does not appear to be ending any time soon.

For example, had you entered the market back in May 2020 – you would have paid a stock price of just 958 ZAC. Just 9 months later, the same stocks hit highs of 2,077 ZAC – representing gains of over 115%. This is more than Renergen has ever been worth – illustrating that there’s plenty of long-term upside in the making.

Your capital is at risk.

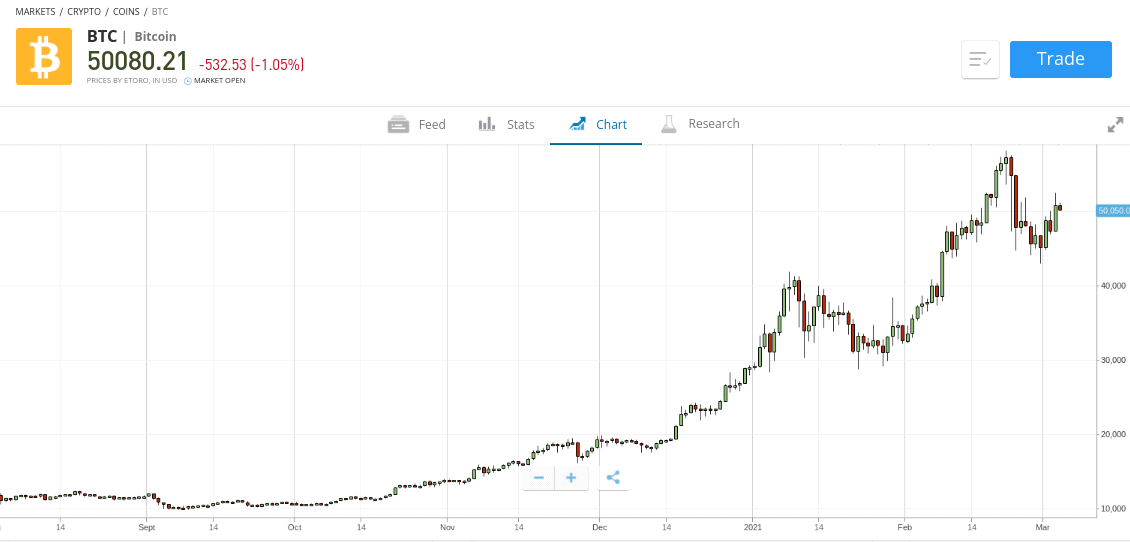

6. Bitcoin – Best Investment in South Africa for Huge Upside Potential

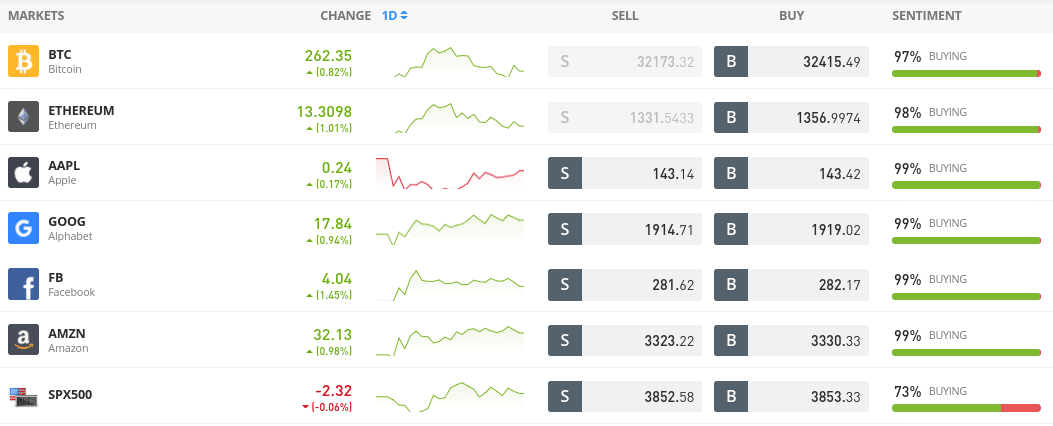

We noted earlier that this guide on the best investments in South Africa, that we would look to discuss a broad range of assets with varying risks and rewards. At the upper end of the scale is Bitcoin – which is the best performing asset class of the past decade. Equally, this digital currency is also speculative and volatile.

Before we get to that, we should note that Bitcoin was worth just a few rands 10 years ago. In early 2021, this digital asset hit highs of $58,000. This means that had you invested a decade earlier, you’d be staring at financial gains of over 5 million percent. In the past 12 months alone Bitcoin has risen in value by over 1,000% – which is huge.

However, Bitcoin is also prone to large downward swings in a very short period of time. As such, this is by far the biggest risk investment on our list. Nevertheless, if you do want to buy Bitcoin in South Africa, you can do so commission-free at regulated broker eToro. The minimum investment is just $25 (about 370 rands) too, so you can keep your stakes conservative.

Your capital is at risk.

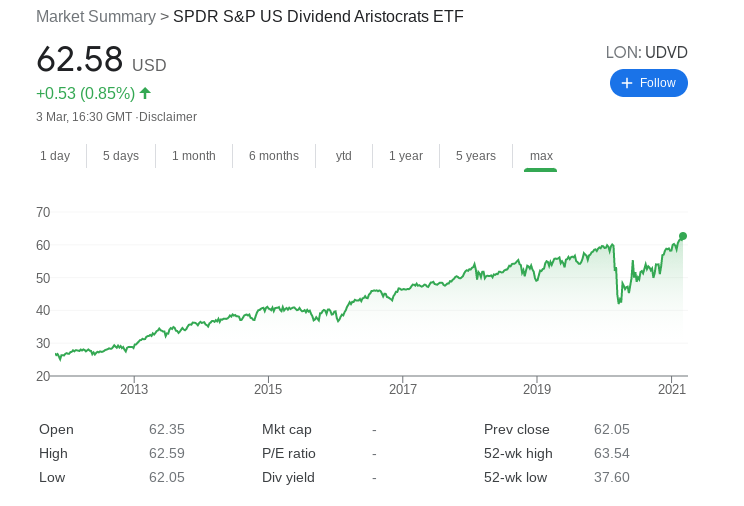

7. SPDR S&P US Dividend Aristocrats ETF – Best Investment in South Africa for Dividend Stocks

Many investors in South Africa like to add a basket of dividend stocks to their portfolio – as this paves the way for a stable and consistent investment plan. While there are many options on the table in this respect, perhaps the best is that of the SPDR S&P US Dividend Aristocrats ETF.

As the name suggests, this ETF focuses exclusively on Dividend Aristocrats. For those unaware, this term refers to companies that have increased the size of their dividend payment every quarter for at least 25 consecutive years. In this ETF, you will be investing in 60 such companies – all of which are listed in the US.

To give you an idea of which dividend stocks you will be buying – this includes Walgreens Boots Alliance, Federal Realty Investment Trust, Exxon Mobil Corp, AT&T Inc, Chevron Corp, and IBM. You’ll also be holding stocks in National Retail Properties, AbbVie, and Franklin Resources.

Your capital is at risk.

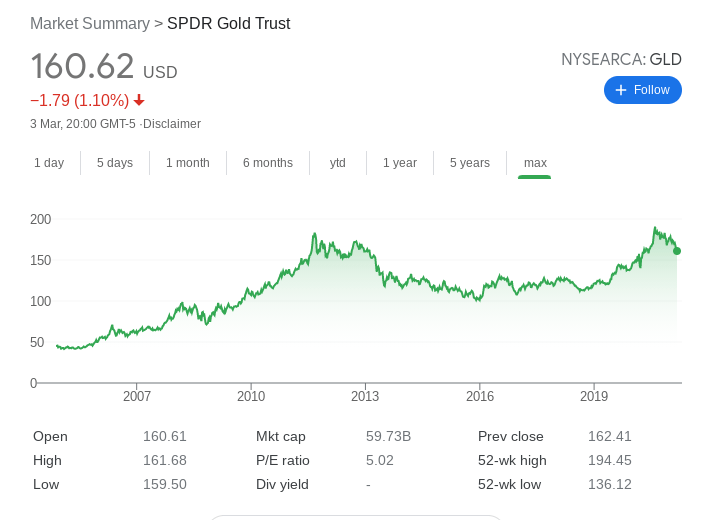

8. SPDR Gold ETF – Best Investment in South Africa for Gold

South Africa is one the largest gold-producing countries globally – so it makes sense that this precious metal is a popular investment with domestic traders. There are many ways in which you can invest in gold, albeit, the most cost-effective and convenient is to consider an ETF.

Your chosen ETF provider will be backed by physical gold bars, so the value of your investment will rise and fall in line with global prices. Plus, you never need to touch the gold itself to gain exposure to the market. Rather, you simply need to invest in the ETF with a commission-free broker like eToro.

The largest physically-backed gold ETF is offered by SPDR – which entered this marketplace in 2007. Back then, the price of this ETF was just $44 per share. Fast forward to early 2021 and the SPDR Gold ETF has since breached $190. This means that in a little over 14 years of trading – the ETF has increased in value by over 330%.

In terms of the specifics, the ETF itself is listed on the NYSE Arca – so it’s traded during standard hours just like a stock. This means that you can cash out your gold investment any time during the week – straight back to rands. Plus, the minimum investment is just $50 at eToro – making it perfect for a long-term dollar-cost averaging strategy.

Your capital is at risk.

9. Vaccine-Med CopyPortfolio – Best Investments South Africa for Vaccine Stocks

If there is one industry in particular that shrewd South African investors are keeping an eye on – its vaccine stocks related to the COVID pandemic. As you likely know, Johnson & Johnson’s single-dose vaccine was recently given the green light in South Africa – with the rollout starting in mid-February.

However, there are many other vaccine producers that have since had their vaccine approved in other regions – namely Oxford-AstraZeneca, Pfizer, and Moderna. The key point here is that if you wish to take a diversified approach to vaccine-related stocks – it’s worth considering a full basket of relevant companies.

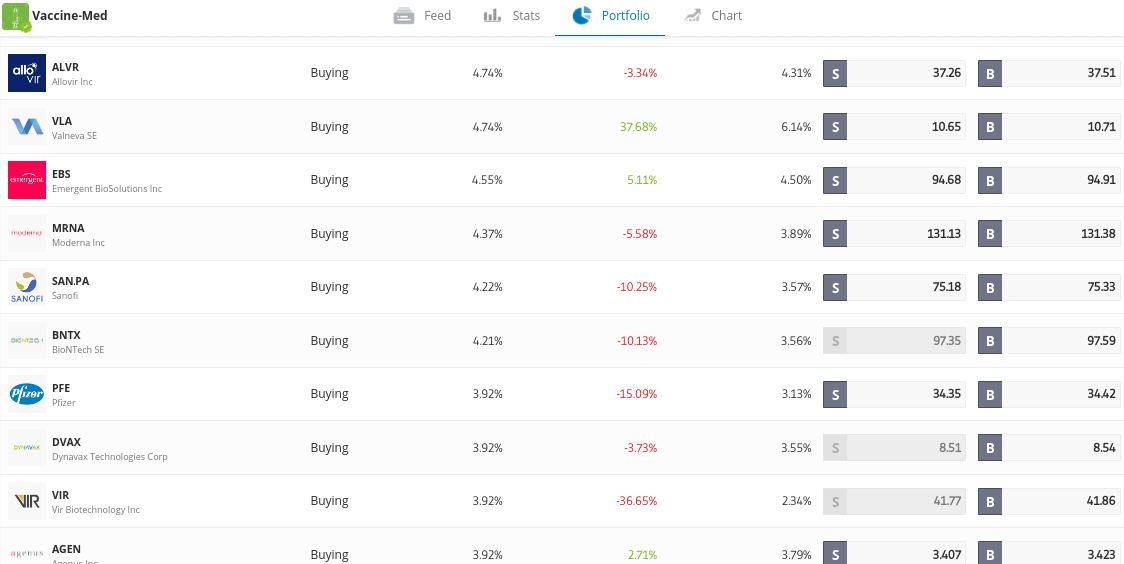

The best investment product that we came across in this respect is the Vaccine-Med CopyPortfolio offered by regulated broker eToro. In a nutshell, this professionally-managed portfolio will get you access to 20 different vaccine stocks. Not only does this include biotechnology and pharmaceutical companies behind a vaccine, but also those involved in related products and services.

For example, some of the companies in the portfolio cover testing facilities and kits, as well as vaccine storage and distribution. On top of the aforementioned stocks, the Vaccine-Med CopyPortfolio also contains the likes of CureVac, Merck, GlaxoSmithKline, Vir Biotechnology, AlloVir, Sanofi, and Valneva.

In terms of performance, this CopyPortfolio only hit the eToro platform recently. But, in the first two months of 2021 alone, gains of just under 23% have been realized. There are no commissions or fees to invest in the Vaccine-Med CopyPortfolio. You will, however, need to meet a minimum investment of $1,000 – or about 15,000 rands.

Your capital is at risk.

10. Crude Oil – Best Investment in South Africa for Short-Term Gains

While the vast majority of the best investments in South Africa that we have discussed today have focused on long-term assets – some of you might be interested in making some short term investments. If this sounds like you, it’s well worth thinking outside the box by considering crude oil.

The most consumed commodity globally – crude oil can be an awfully volatile asset class. After all, its price is dictated by global demand and supply – alongside factors like interest rates, the strength of the US dollar, production levels, and wider geo-politcal events.

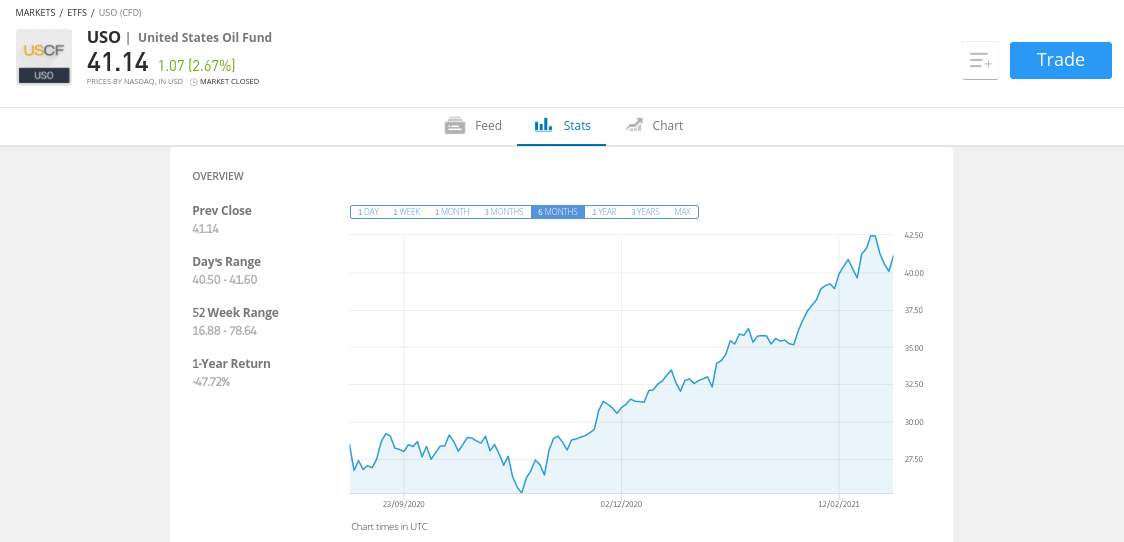

As you likely know, crude oil hit record lows in the midst of the pandemic in early 2020 – falling below the $20 per barrel level. However, there has been no stopping the price of oil since April 2020 – with global prices now surpassing $60 per barrel. This means that in just under a year, oil has increased by over 200%.

If you’re wondering how to invest in oil – the good news is that there is no requirement to take delivery of physical barrels. Instead, the easiest route to the market is via an ETF. For example, the United States Oil Fund ETF will closely track the WTI Crude Oil Benchmark through futures and swaps. Naturally, the value of the ETF will closely align with the current price of oil.

Your capital is at risk.

Choosing the Best Investments for You

As you will have noticed from the 10 investments discussed above – we have covered every asset class and marketplace imaginable. Whether you’re interested in domestic or international stocks, ETFs, Bitcoin, gold, or dividend shares – we’ve covered all potential bases.

With that said, the investments that we have discussed are just a drop in the ocean. This is because there are tens of thousands of other financial instruments that may be closely aligned with your financial goals.

To ensure you have the ability to make an informed decision, below we discuss the key metrics to consider in your search for the best investments to make money.

- Markets: Firstly, think about which markets you wish to gain access to. For example, are you looking for the best investment in South Africa specifically, or are you aiming to go further afield? Crucially, markets in the US have outperformed the JSE by some distance over the past couple of decades – so this is something worth considering.

- Assets: On top of the specific market or economy, which assets are you looking to add to your portfolio? For example, if you’re interested in stocks – you might decide to buy individual shares or an ETF that tracks an index like Dow Jones. Alternatively, you also have the likes of bonds, mutual funds, commodities, cryptocurrencies, and futures.

- Risk: All investments in South Africa come with an element of risk – even assets that are deemed strong and stable. At the lower end of the spectrum, you’ve got the likes of government bonds, high-interest savings accounts, and blue-chip stocks. If you have a higher appetite for risk, then you will be more suited for commodities, cryptocurrencies, and low-cap stocks.

- Potential Returns: Where there is risk there is a potential financial reward. It goes without saying that the higher the risk, the more you should expect to make. For example, while Bitcoin is highly speculative, it has generated returns of over 1,000% in just one year of trading. US government bonds, on the other hand, will yield less than 1-2% annually.

- Income or Growth: You also need to think about how your investment will generate growth. For example, if you invest in bonds, you’ll only make money from quarterly/bi-annual coupon payments. In the case of stocks, you can earn both dividends and capital growth.

There are many other factors to consider in your search for the best investment in South Africa. As such, just make sure you do lots of homework before parting with your money.

Best Investment Platforms

Finding an investment that meets your financial goals and tolerance to risk is only half the battle. This is because you also need to find suitable online stock brokers or a trading site. Not only does the provider need to offer the investment class you wish to access, but competitive fees and commissions.

To save you countless hours of research, below we discuss the best online investment platforms in South Africa

1. eToro – Overall Best Investment Platform in South Africa

eToro is often the go-to investment platform for South Africans – not least because the broker allows you to buy and sell assets on a 100% commission-free basis. This covers a variety of different investments – including over 2,600 stocks and ETFs.

The broker supports 17 international marketplaces – such as the US, UK, Hong Kong, Germany, France, and Sweden. eToro also allows you to invest in 18 different cryptocurrencies – including Bitcoin, Ethereum, and Litecoin.

Then you have the platform’s commodity department, where you will find everything from gold and silver to wheat and oil. On top of this, eToro also gives you access to forex and indices. eToro is also a great option if you want to invest with small amounts. This is because the provider offers a fractional investment tool – which essentially allows you to buy a ‘fraction’ of an asset.

For example, you can invest in digital currencies from just $25, and stocks and ETFs from $50. eToro is also the provider of our previously discussed Vaccine-Med CopyPortfolio. As we mentioned earlier, this allows you to invest in a basket of 20 different stocks that are behind or working on COVID-19 solutions.

There are dozens of other CopyPortfolio strategies too – such as those that track cryptocurrencies, e-commerce companies, and renewable energy stocks. When it comes to safety and security, eToro is authorized and regulated by three different bodies. This includes the FCA (UK), CySEC (Cyprus), and ASIC (Australia) – all of which offer a range of investor protections.

Getting money into and out of eToro is also super convenient. For example, you can deposit funds with a South African debit card, credit card, Paypal, Neteller, Skrill, or bank wire. As you will be using a payment method denominated in rands, you’ll need to pay a 0.5% FX fee. This is more than reasonable when you consider you’ll be making investments commission-free!

Pros:

- Commission-free broker

- Invest in stocks, ETFs, and cryptocurrencies

- Trade commodities, forex, and indices

- Low stock spreads

- Supports social trading and copy trading

- Accepts debit/credit cards, bank accounts, and e-wallets

- Heavily regulated

- Easy-to-use

Cons:- All accounts denominated in US dollars

75% of retail investor accounts lose money when trading CFDs with this provider.

2. Libertex – Trade CFDs With Zero Spreads

Unlike eToro, Libertex isn’t suitable for long-term buy and hold portfolios. Instead, this hugely popular platform allows you to trade CFDs. In simple terms, this means that you will be speculating on the short-term rise and fall of your chosen asset without taking ownership.

This is particularly useful if you wish to trade difficult-to-access instruments like oil, gold, and silver. Additionally, by trading CFDs at Libertex, you can profit from both bullish and bearish markets. This is because you can go long and short on all supported assets.

Additionally, and perhaps most importantly, Libertex offers some of the best trading fees in the market. Not only will you be trading with zero spreads, but many assets are commission-free. If a commission is charged, this is usually a fraction of 0.1%.

Libertex is also a good option if you want to trade with leverage. As a retail client, you can get up to 1:30 – so that’s 30 times your account balance. If you fall under the umbrella of a professional-client, then this increases to a limit of 1:600. Either way, Libertex allows you to trade directly on its website, or you can do so via the third-party platform MT4.

If you haven’t previously heard of Libertex, you should know that it’s actually one of the oldest online trading sites in existence. Launched over two decades, close to 3 million traders now use Libertex. And of course, the platform is completely safe to use, not least because Libertex Pty is regulated by the Financial Sector Conduct (FSP Number: 47381).

Pros:

- Trade share CFDs with zero spreads

- Set commission so you know what you pay each time

- Great range of markets

- Accepts debit/credit cards, bank accounts, and e-wallets

- Licensed and regulated in South Africa

- Beginner-friendly

Cons:- Only offers CFDs

74% of retail investor accounts lose money when trading CFDs with this provider.

3. Capital.com – Best Trading Platform in South Africa for Beginners

If you like the sound of trading CFDs, but you have little to no experience in this marketplace, it could be worth trying Capital.com. This is because the platform is specifically aimed at newbie traders.

For example, once you register an account, you will be able to trade in a risk-free environment via the demo facility. This mirrors the real-world financial markets, so you can get a feel of how trading works before risking your own money.

Capital.com is also favored by newbie South African traders as it comes packed with educational guides, learning resources, and mini-courses. Once you are ready to start buying and selling CFD instruments with real rands, the minimum deposit starts at just $20.

You can fund your account instantly with a debit/credit card or e-wallet. When it comes to the trading arena itself, Capital.com offers thousands of CFD markets across several asset classes. This includes the likes of indices, forex, stocks, commodities, and cryptocurrencies.

In a similar nature to eToro, Capital.com doesn’t charge any trading commissions – as all fees are built into the spread. The specific spread will vary from market to market, but to give you an idea – commodities like oil can be traded from 0.06 pips and the FTSE 100 at just 1.3 points. Stocks can be traded from a spread of just 0.1% upwards.

Pros:- AI integration suggests ways to improve your win rate

- Education-focused mobile app

- Mobile trading platform

- Leverage of up to 1:100

- No commissions and tight spreads

Cons:

- No social trading network

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

How to Invest in the Best Investments in South Africa Today

If you’ve read our guide up to this point, you should now know how to invest money in South Africa and which investments meet your financial goals. You should also know whether you’re more suited for a long-term or short-term trading strategy – and which investment platform you like the look of.

To conclude, we are now going to walk you through the process of making an investment with top-rated broker eToro.

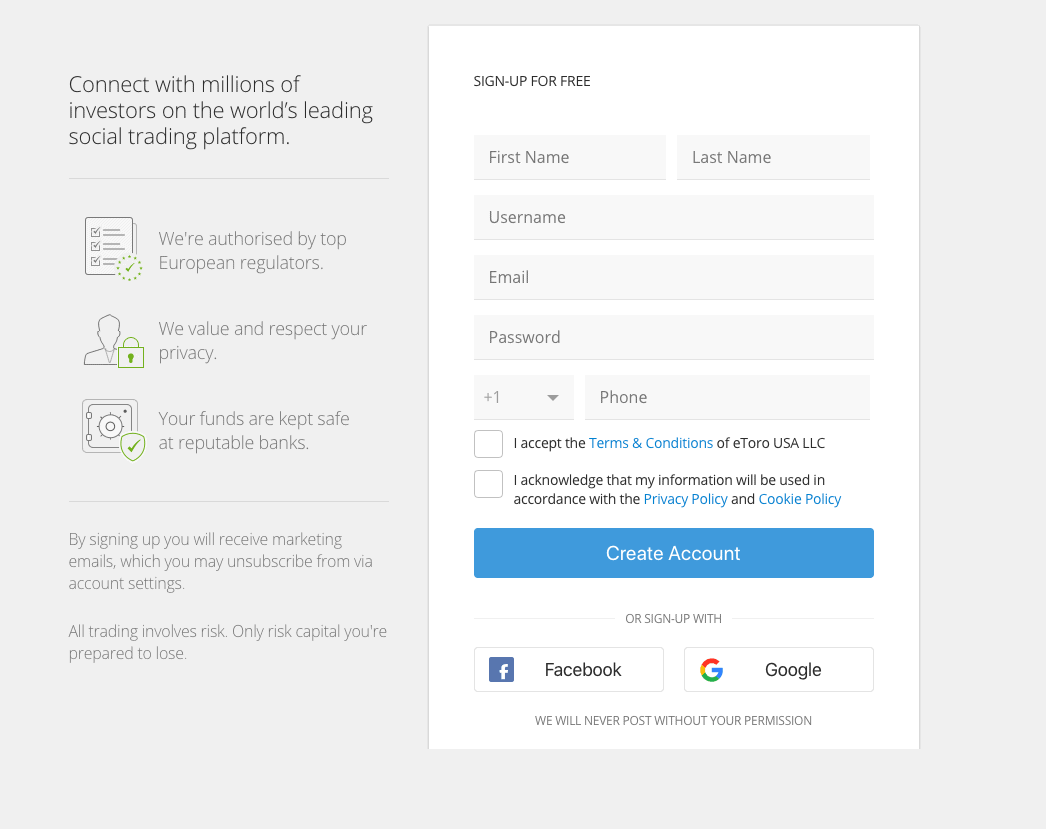

Step 1. Open an Investment Account

Before you can make investments on a regulated platform like eToro, you’ll first need to register. This takes less than 5 minutes and you can complete the process online or via your phone.

As is standard practice, you’ll need to provide details like your name, home address, date of birth, email, and telephone number. You also need to create a username and a strong password.

Step 2. Upload ID

All new clients at eToro must upload a copy of their passport or driver’s license. This is to ensure that eToro complies with its three license issuers – the FCA, ASIC, and CySEC. In most cases, your account will be verified a couple of minutes after uploading your ID.

Step 3. Deposit Funds

Unless you are planning to start off with the eToro demo account, you will need to make a deposit before you start investing. If you want to invest right now, opt for a debit/credit card or an e-wallet payment. If the only option you have is a bank transfer, this is supported, too. But, expect to wait a couple of days before the funds are credited to your account.

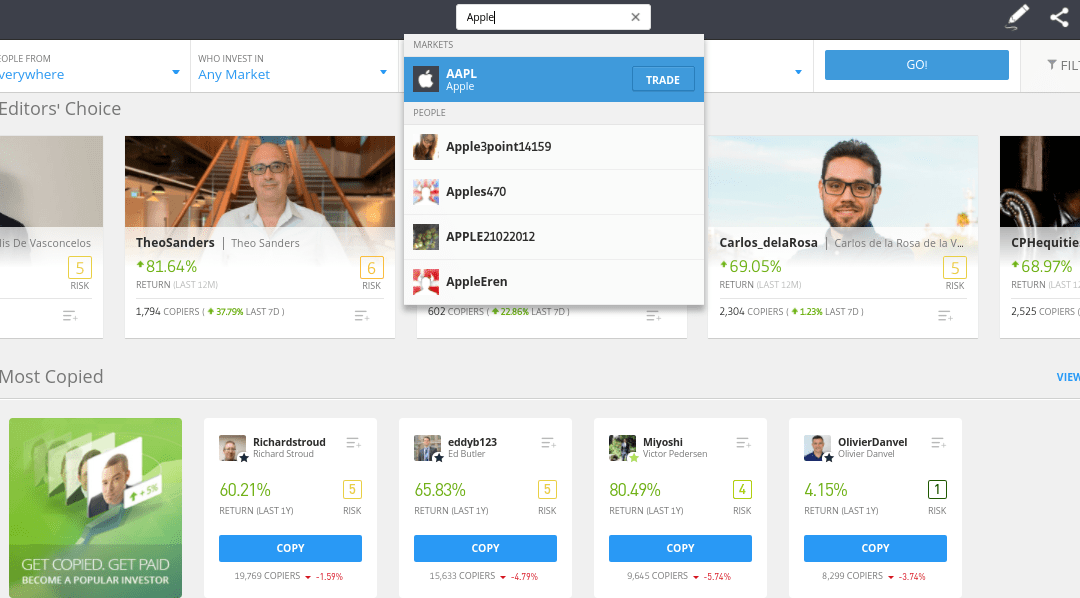

Step 4. Search for Investments

As we noted earlier, eToro covers thousands of markets – such as stocks, forex, ETFs, cryptocurrencies, and commodities. As such, it’s best to click on the ‘Trade Markets’ button so that you can see what investments are available.

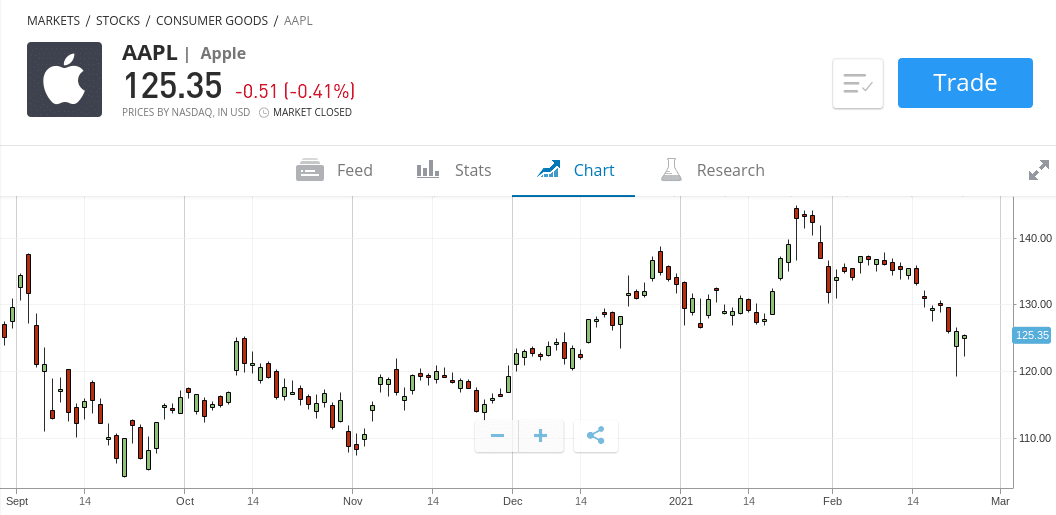

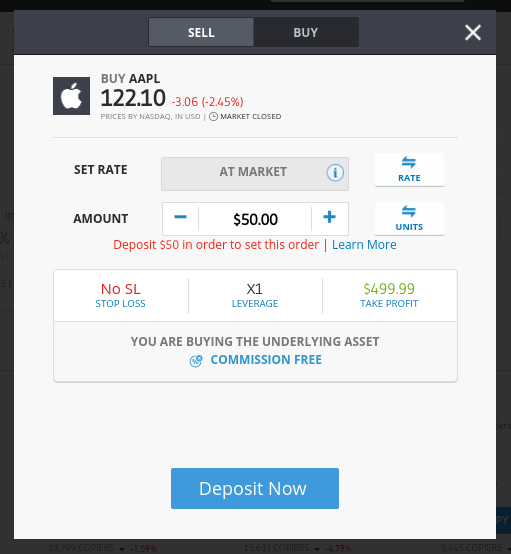

Alternatively, if you already know which investment you wish to make – you can simply search for the asset. In our example above, we are searching for ‘Apple’ stocks.

Step 5. Complete Commission-Free Investment

When you click on the ‘Trade’ button next to the asset you wish to invest in, an order box will appear. All you need to do here is enter the amount that you wish to invest in the asset – in US dollars. To recap, the minimum on stocks and ETFs is $50 and cryptocurrencies require a stake of just $25.

To complete your commission-free investment, hit the ‘Open Trade’ button.

Note: If you’re investing in an asset outside of standard market hours, click on the ‘Set Order’ button instead. eToro will execute your investment when the market reopens.

Best Investment South Africa – Conclusion

This guide has covered a variety of the best investment opportunities in South Africa. We have carefully selected 10 investments to suit traders of all shapes and sizes.

This includes everything from dividend stocks and index funds to Bitcoin and gold. The most important thing to take away is that no-two investments are the same – so you need to select assets that align with your financial goals.

And of course, you also need to carefully choose a trusted online brokerage. If you’re looking to explore the best investment opportunities in South Africa right now, eToro allows you to buy and sell thousands of assets commission-free.

It takes just minutes to open an investment account and you can instantly deposit funds with your South African debit/credit card or e-wallet!

eToro – Best Investment Platform South Africa with 0% Commission

67% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

What are the best investments to make money in South Africa?

All investments have a shared primary goal - to make money. However, the potential risks and rewards will vary quite considerably depending on which assets you buy. For example, if you are prepared to take lots of risks, you'll be suited for low-cap stocks and even Bitcoin. However, if you are a conservative investor, it's best to stick with solid blue-chip stocks and index funds.

How much do you need to invest in South Africa?

This depends on the investment platform that you decide to use. For example, eToro has a minimum investment of $50 on stocks and ETFs, which is great for getting started with a small amount of money. If you are interested in short-term trading, Capital.com is even lower with a minimum deposit requirement of just $20.

How do you invest in the JSE?

This depends on what you mean. If you want to invest in the company behind the Johannesburg Stock Exchange - JSE Limited - you'll find it listed on the exchange of the same name. However, if you want to broadly invest in the wider JSE, you might want to consider the JSE Top 40 Index. Through a single investment, you'll be buying shares in 40 of the largest companies listed on the JSE.

What is the best investment platform South Africa?

If you're looking for the perfect balance between low fees, safety, and user-friendliness - eToro is worth considering. The investment platform allows you to trade commission-free, is simple to use, and is regulated by three financial bodies. .

What is the best investment in South Africa?

This depends on how much money you wish to make and how much risk you are prepared to take to get there. With that said, if you are a complete newbie in the investment world and are happy to keep hold of your assets for many years, it might be best to stick with a diversified stock market ETF. One such example is the Vanguard Total World Stock ETF - which gets you access to over 8,000 companies from dozens of markets.

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane PepiLatest News

Hvordan spille poker og Norgescsino

For tiden er det mange mennesker som ønsker å lære å spille poker og norgescsino. Dette er fordi spillene er veldig morsomme og folk kan få mye penger fra dem. Det er imidlertid et par ting du bør huske på når du skal lære å spille poker og norgescsino. Disse tingene inkluderer RNG, Cashback og...

Lär dig grunderna för kasinobordsspel

Om du har funderat på att prova på kasinot kanske du undrar vilka spel du ska spela. Bordsspel inkluderar Blackjack, Poker och Craps. Om du vill lära dig mer om dessa spel, läs vidare. Här är några grunder om dessa spel. Du kommer att kunna välja det bästa spelet att spela baserat på dina personliga...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

BuyShares.co.uk © 2026.

All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

Unlike eToro, Libertex isn’t suitable for long-term buy and hold portfolios. Instead, this hugely popular platform allows you to trade CFDs. In simple terms, this means that you will be speculating on the short-term rise and fall of your chosen asset without taking ownership.

Unlike eToro, Libertex isn’t suitable for long-term buy and hold portfolios. Instead, this hugely popular platform allows you to trade CFDs. In simple terms, this means that you will be speculating on the short-term rise and fall of your chosen asset without taking ownership.

If you like the sound of trading CFDs, but you have little to no experience in this marketplace, it could be worth trying Capital.com. This is because the platform is specifically aimed at newbie traders.

If you like the sound of trading CFDs, but you have little to no experience in this marketplace, it could be worth trying Capital.com. This is because the platform is specifically aimed at newbie traders.

To complete your commission-free investment, hit the ‘Open Trade’ button.

To complete your commission-free investment, hit the ‘Open Trade’ button.