Best STP Brokers South Africa – Cheapest Brokers Revealed

Looking for an STP, or straight-thru processing broker, for stock, forex, or cryptocurrency trading? In this guide, we review the 10 best STP brokers in South Africa for 2021.

-

- 1. eToro – Overall Best STP Broker in South Africa

- 2. Capital.com – Best STP Broker for CFD Trading

- 3. Pepperstone – Cheapest STP Broker in South Africa

- 4. Skilling – Best STP Broker for Cryptocurrency Trading

- 5. Plus500 – Best STP Trading Platform for Beginners

- 6. AvaTrade – Best STP Options Trading Broker

- 7. FXTM – Best STP Broker for Execution Speed

- 8. Tickmill – Best STP Forex Broker in South Africa

- 9. Blackstone Futures – Best South African STP Broker

- 10. Libertex – Top Commodities Trading STP Broker

-

- 1. eToro – Overall Best STP Broker in South Africa

- 2. Capital.com – Best STP Broker for CFD Trading

- 3. Pepperstone – Cheapest STP Broker in South Africa

- 4. Skilling – Best STP Broker for Cryptocurrency Trading

- 5. Plus500 – Best STP Trading Platform for Beginners

- 6. AvaTrade – Best STP Options Trading Broker

- 7. FXTM – Best STP Broker for Execution Speed

- 8. Tickmill – Best STP Forex Broker in South Africa

- 9. Blackstone Futures – Best South African STP Broker

- 10. Libertex – Top Commodities Trading STP Broker

Top 10 STP Brokers in South Africa for 2021

Here are the 10 best STP brokers in South Africa for 2021:

- eToro – Overall Best STP Broker in South Africa

- Capital.com – Best STP Broker for CFD Trading

- Pepperstone – Cheapest STP Broker in South Africa

- Skilling – Best STP Broker for Cryptocurrency Trading

- Plus500 – Best STP Trading Platform for Beginners

- AvaTrade – Best MetaTrader 4 STP Broker

- FXTM – Best STP Broker for Execution Speed

- Tickmill – Best STP Forex Broker in South Africa

- Blackstone Futures – Best South African STP Broker

- Libertex – Top Commodities Trading STP Broker

Best STP Brokers in South Africa Reviewed

Let’s dive into detailed reviews of each of the brokers in our top 10 STP broker list.

1. eToro – Overall Best STP Broker in South Africa

If we had to pick one STP broker to recommend in South Africa, it would be eToro. This do-it-all broker offers stock trading, forex trading, commodity trading, and more. Better yet, eToro charges no commissions for stock and ETF trading and the broker’s spreads are typically below the market average.

If we had to pick one STP broker to recommend in South Africa, it would be eToro. This do-it-all broker offers stock trading, forex trading, commodity trading, and more. Better yet, eToro charges no commissions for stock and ETF trading and the broker’s spreads are typically below the market average.The selection of assets on eToro is worth highlighting. With this platform, you can trade over 2,000 stocks and ETFs, either outright or as CFDs. You can also trade foreign exchange (forex) for over 45 currency pairs, as well as over 20 commodities and 16 cryptocurrencies.

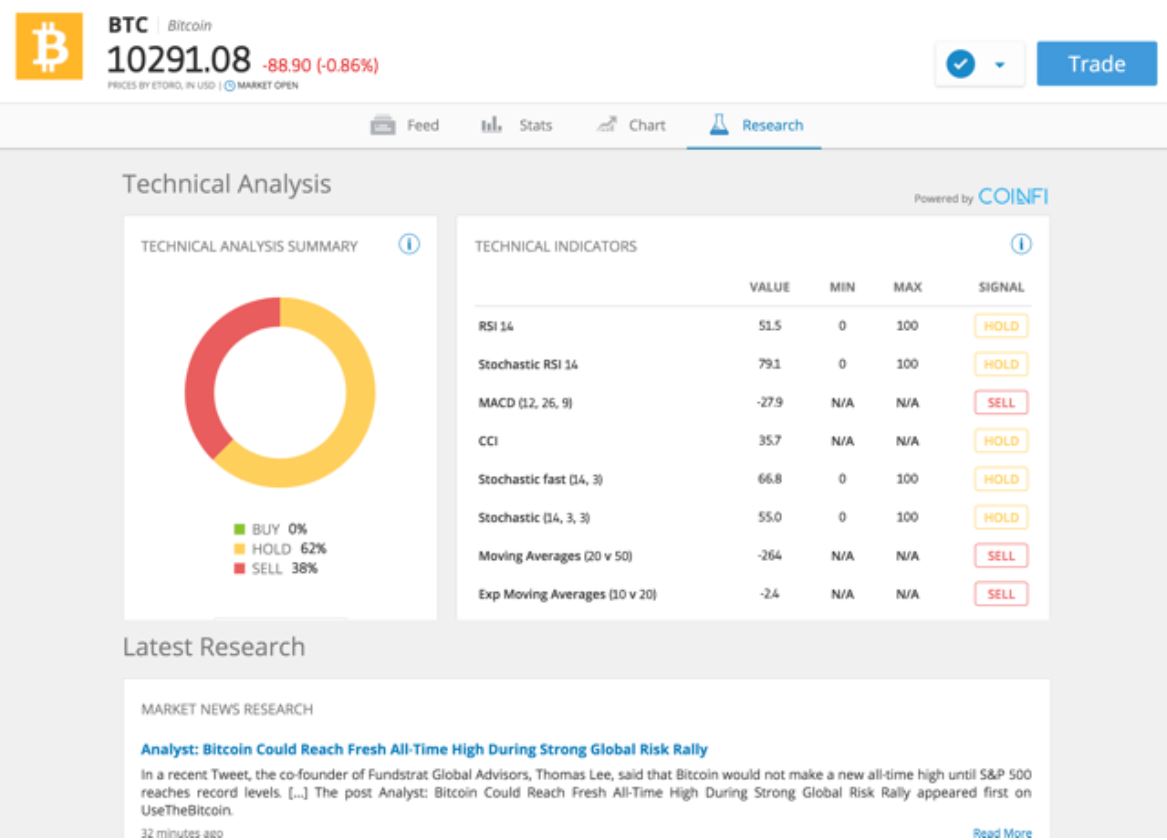

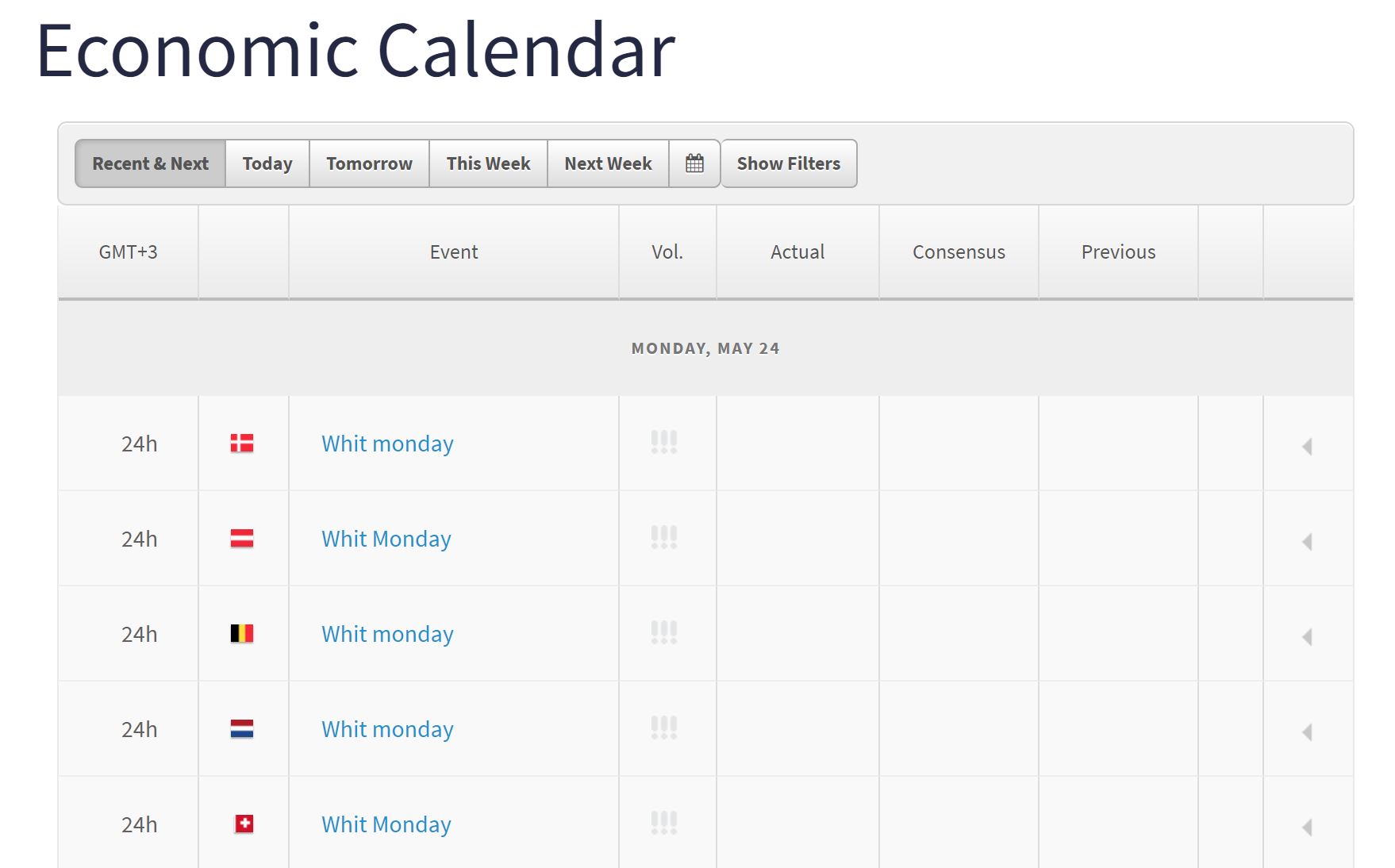

eToro’s custom trading platform is well-designed for new traders and professionals alike. You can easily analyse price movements using over 100 built-in technical studies and drawing tools. In addition, there’s a market news feed, economic calendar, and market sentiment gauge that lets you monitor changes in momentum. The trading platform is available on the web and through a mobile trading app.

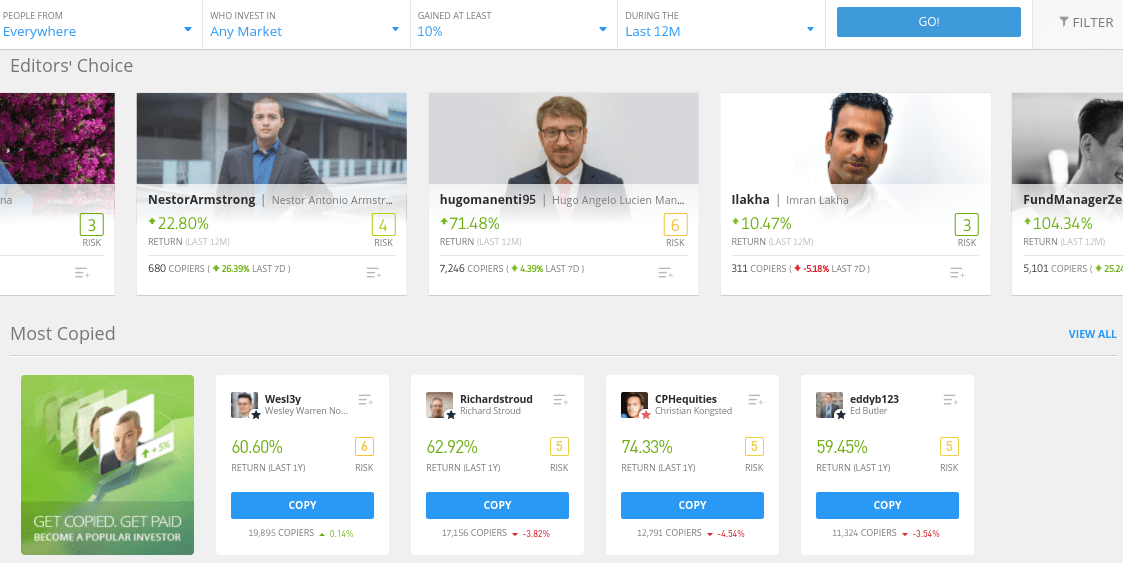

Our favorite thing about eToro is its social trading network. You can follow tens of thousands of fellow traders from around the world to share trade ideas, strategies, and news. Even better, eToro supports copy trading. So, you can automate your portfolio in just a few clicks and leave your returns up to a more experienced trader.

Past performance is not an indicator for future results.

eToro is regulated by the UK Financial Conduct Authority (FCA) and keeps all client funds in segregated accounts. You can open an account with just a $200 (2,700 ZAR) minimum deposit and eToro accepts payment by credit card, debit card, or PayPal. The broker also offers 24/5 customer support, so it’s easy to get in touch if you ever have questions about your account.

Pros:

- No commissions for stock and ETF trading

- Incredibly wide selection of assets to trade

- Custom trading platform for web and mobile

- Social trading network with copy trading

- Regulated by the FCA

- 24/5 customer support

- Accepts credit/debit and PayPal

Cons:

- Small $5 withdrawal fee

- Cannot create custom technical indicators

67% of retail investors lose money trading CFDs at this site.

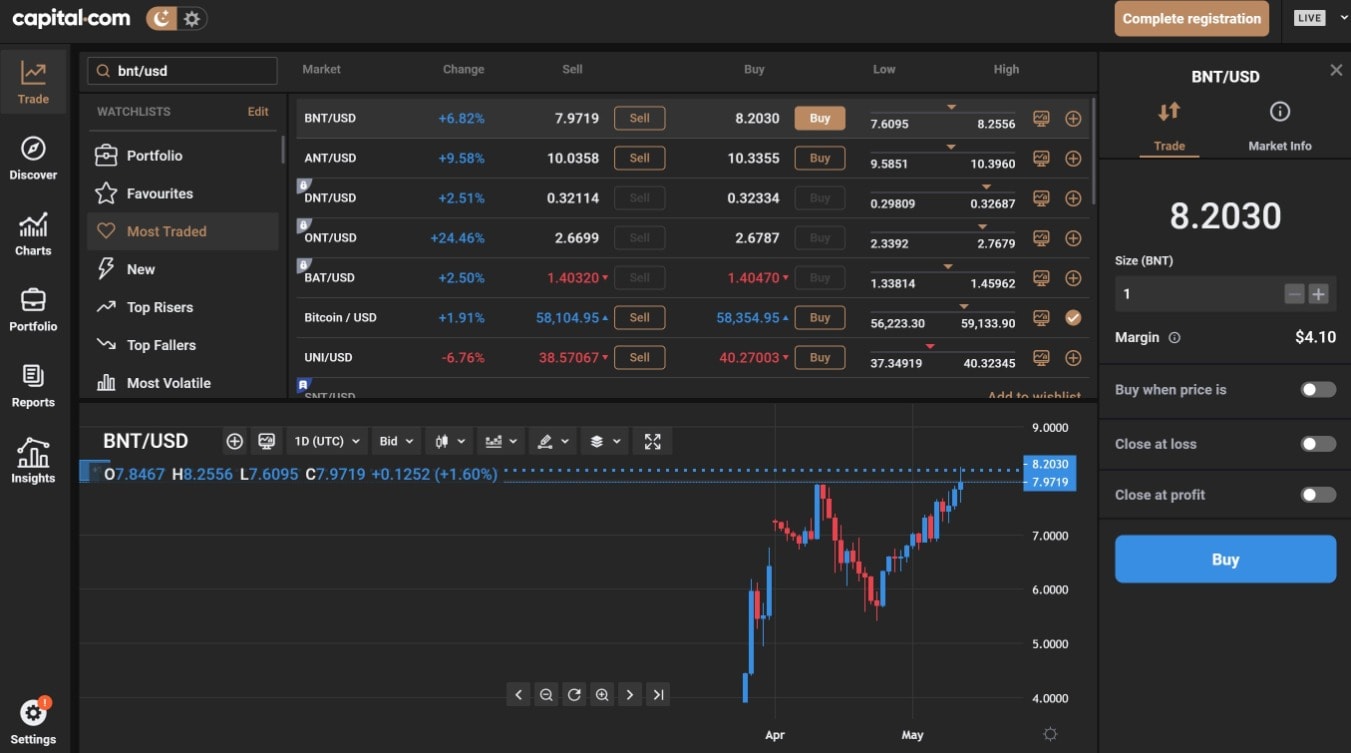

2. Capital.com – Best STP Broker for CFD Trading

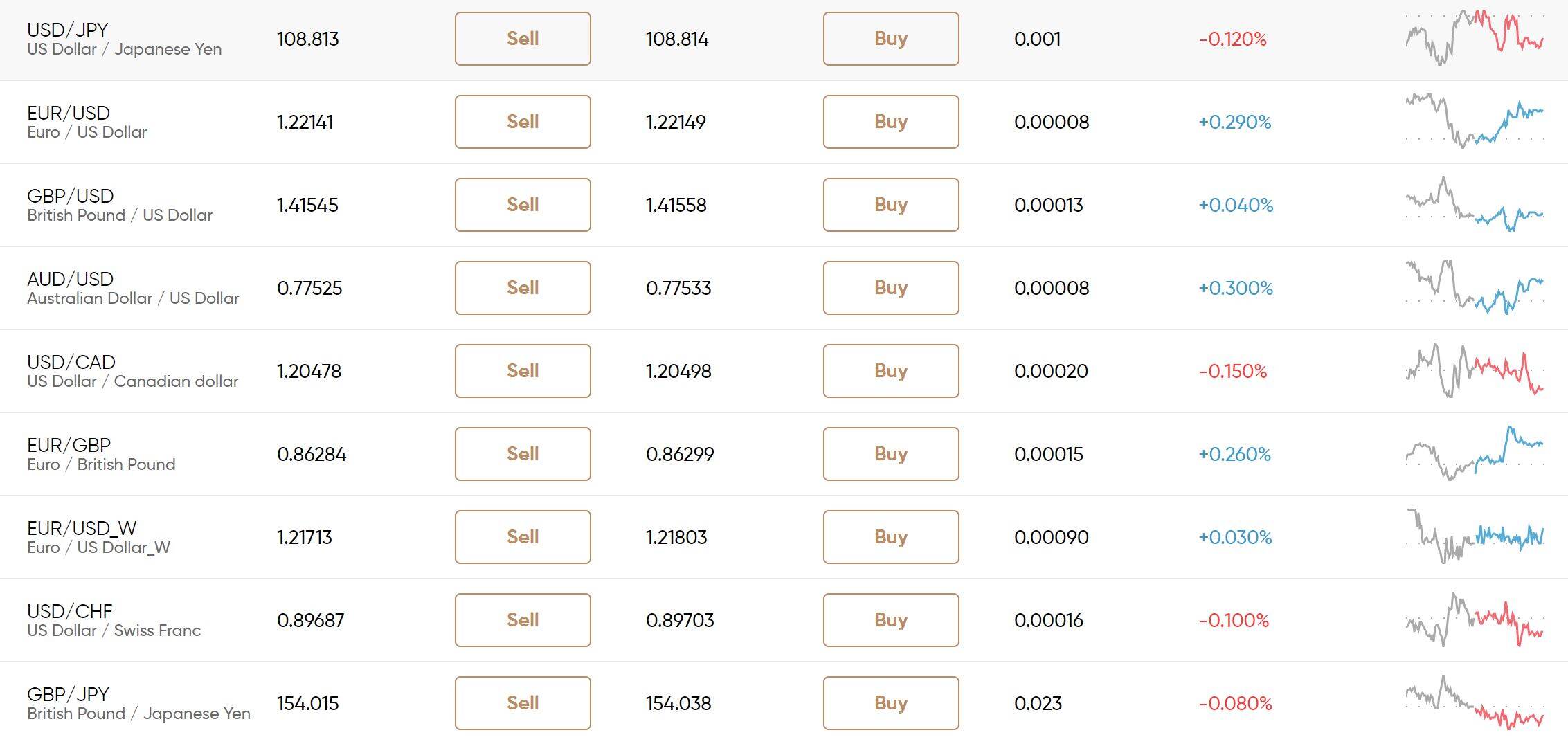

Capital.com is one of the best STP brokers if you’re solely interested in trading CFDs. The broker has an enormous selection of instruments to trade, including over 3,000 stocks, 140 forex pairs, and 80 cryptocurrencies. Capital.com also offers commodity trading and stock index trading.

Another thing we like about Capital.com is that it’s extremely affordable. The broker charges spreads from 0.8 pips for STP forex trading – well below the industry average – and there are no commissions for CFD trading. On top of that, Capital.com doesn’t have deposit, withdrawal, or inactivity fees.

The Capital.com platform isn’t the most advanced trading interface we’ve seen. It supports basic technical charts and built-in indicators, as well as price alerts (on the mobile app only). However, there is no way to backtest a strategy and you cannot use signals for forex trading.

That said, the broker does have a trick up its sleeve. Capital.com’s platform uses AI technology to automatically analyse your trades and identify patterns that correlate with your win rate. So, if most of your profits are coming early in the day or from just a single instrument, the AI will let you know. This can be extremely helpful for improving your profitability over time.

Capital.com is regulated by the FCA and CySEC. The broker offers exceptional 24/7 customer support and you can get in touch by phone, email, or live chat. In addition, you can open a new STP trading account with just a $20 minimum deposit.

Pros:

- Trade over 3,000 stocks and 140 forex pairs

- Spreads from 0.8 pips and no inactivity fee

- AI software helps you improve your trading profits

- Open an account with a $20 minimum deposit

- Regulated by CySEC

Cons:

- Limited technical analysis tools

75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

3. Pepperstone – Cheapest STP Broker in South Africa

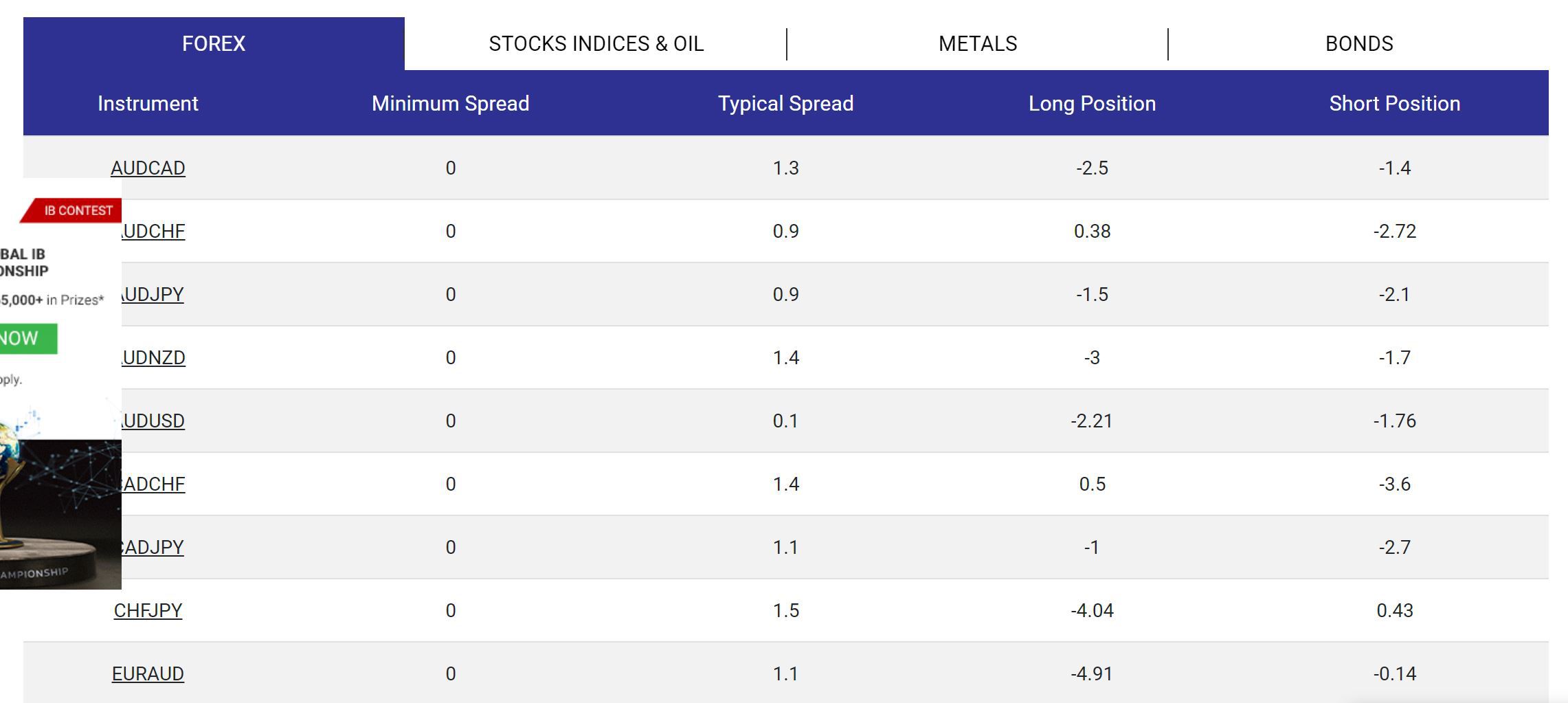

Pepperstone is one of the cheapest true STP brokers available in South Africa. With this broker, you’ll pay no commissions for CFD trading and spreads start at just 0.6 pips for forex trading. There’s no added spread for stock trading, either. As if that weren’t enough, Pepperstone doesn’t charge deposit, withdrawal, or inactivity fees on your account.

Pepperstone has over 700 CFDs available to trade, including hundreds of stocks and dozens of forex pairs. The broker also lets you trade a handful of the most popular cryptocurrencies and offers 3 custom indices that give you exposure to up to 30 altcoins. Most trades are executed in around 60 milliseconds, which is fast even for an STP broker.

The broker gives traders access to in-depth market analysis to help you make trading decisions in the moment. You’ll find detailed articles covering market movements written by Pepperstone analysts, as well as custom trade ideas developed by the broker’s research team. Pepperstone also includes an economic calendar and weekly webinars to help you stay on top of a fast-moving market.

Pepperstone has 3 trading platforms available: MetaTrader 4, MetaTrader 5, and cTrader. cTrader is specifically designed for algorithmic trading with forex signals, so it’s best for scalpers and other experienced traders. In addition, Pepperstone offers integration with Myfxbook and Duplitrade to enable you to copy professional traders through the MetaTrader platforms.

Pepperstone is regulated by the FCA as well as watchdogs in Australia and Dubai. The broker requires a $200 minimum deposit to open an account, although you can try out Pepperstone’s demo account before making any deposit.

Pros:

- No commissions and extremely low CFD spreads

- Trade execution speed around 60 ms

- Detailed market research from in-house analyst team

- Supports algorithmic trading with cTrader

- Copy trading with Myfxbook and Duplitrade

- Regulated in the UK, Australia, and Dubai

Cons:

- Relatively high $200 minimum deposit

Your capital is at risk.

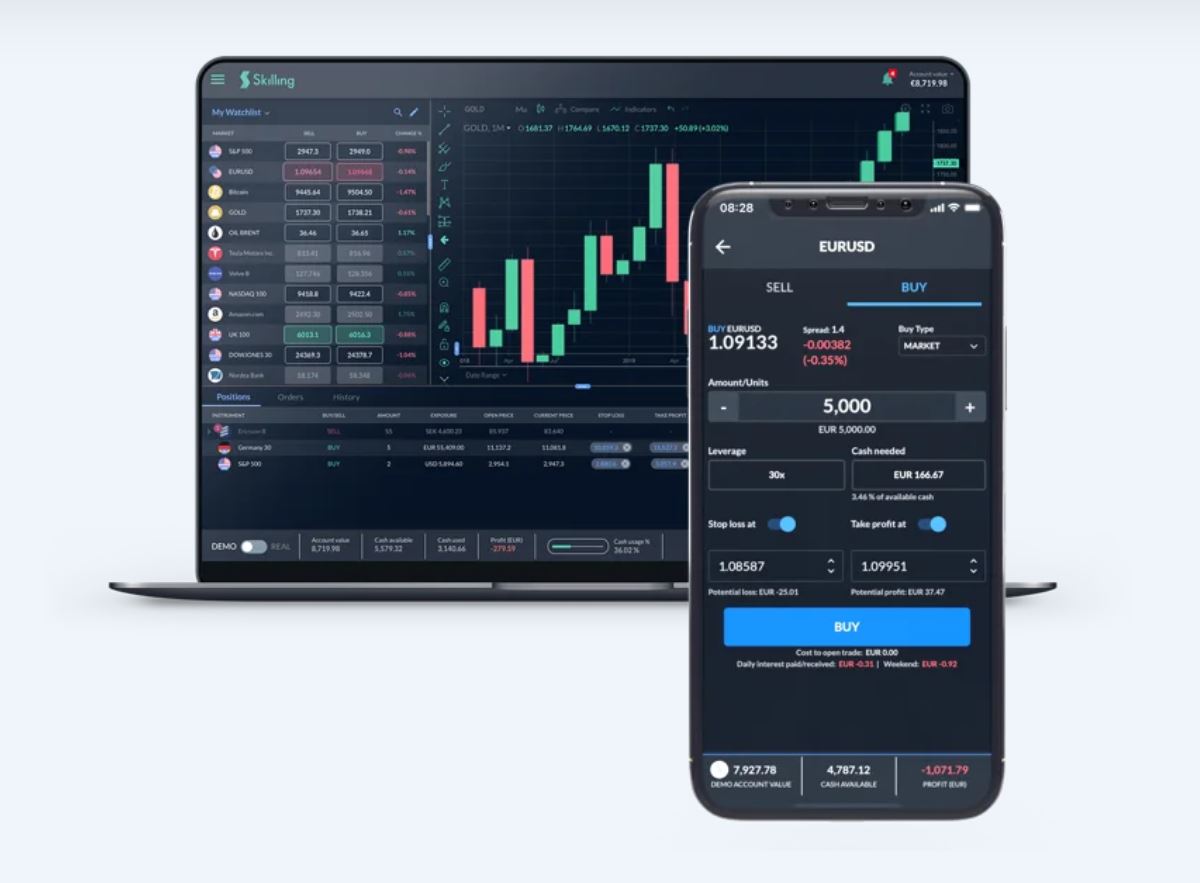

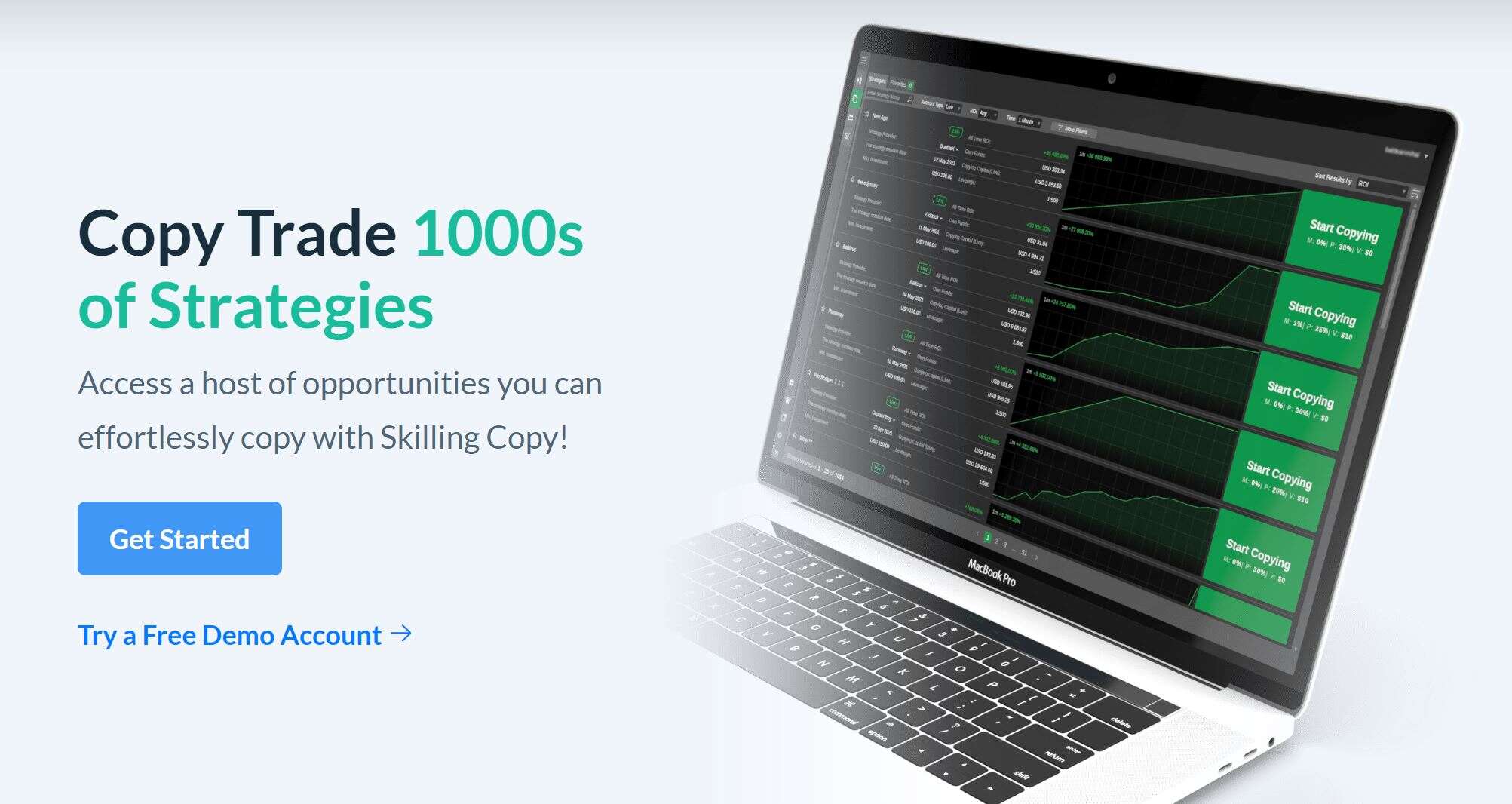

4. Skilling – Best STP Broker for Cryptocurrency Trading

Skilling is one of the top all-around brokers on our STP brokers list for South Africa, and this platform especially stands out for cryptocurrency trading. That’s because Skilling offers more than 25 crypto CFDs. The selection includes several crypto-crypto trading pairs like BTC-ETH, giving you more flexibility to hedge your bets on the crypto market.

Beyond cryptocurrencies, Skilling offers CFDs for over 700 shares and more than 70 currency pairs. All trades with a Standard account are commission-free and spreads start from a very competitive 0.7 pips.

Skilling has several trading platforms available for you to take advantage of its STP market execution. The main platform, Skilling Trader, offers in-depth technical charts with dozens of built-in indicators. We especially like the Skilling Trader mobile app for iOS and Android because it’s easy to use and enables you to tap in a complex trade order in seconds.

Skilling also offers its own cTrader platform, which uses C# programming to enable you to create custom trading algorithms. cTrader also works with Skilling Copy, a copy trading service that includes thousands of experienced traders for you to mimic. In addition, Skilling allows you to integrate your account with MetaTrader 4 if you plan to use forex signals.

This STP broker is regulated by CySEC and by the Financial Services Authority of the Seychelles. You can open an account with a $100 minimum deposit. Notably, Skilling offers negative balance protection to all traders, so you can never lose more money than you have in your account when trading with high leverage.

Pros:

- Over 25 cryptocurrency CFDs

- Commission-free trading with spreads from 0.7 pips

- Powerful Skilling Trader platform available for web and mobile

- Algorithmic trading and copy trading with Skilling cTrader

- Regulated in Cyprus and the Seychelles

- Negative balance protection on all accounts

Cons:

- cTrader platform can be hard for beginners to use

Your capital is at risk.

5. Plus500 – Best STP Trading Platform for Beginners

If you’re new to CFD trading, Plus500 is one of the best true STP brokers on our STP brokers list for beginners. This platform is very user-friendly and offers a demo account to help you get your bearings. In addition, Plus500 offers an online ‘Trader’s Guide,’ which includes 10 videos designed to teach you the basics of STP trading.

Plus500’s custom trading platform for web and mobile devices is also easy to use. Even new traders will have no trouble customising the online dashboard and adding technical studies to charts. The only downside is that Plus500’s platform is slightly limited in how technical you can get, so it may not be the best choice for more experienced traders.

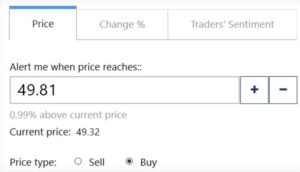

That said, the broker does have some trading tools that every trader will appreciate. For example, you get access to an economic calendar and news feed to help you stay on top of the market. Plus500 also offers price alerts, even when you’re using the web interface on a desktop computer.

Plus500 is fairly affordable. The broker doesn’t charge commissions, deposit fees, or withdrawal fees. Spreads for forex trading start at 1.0 pips, which is just below the market average. Keep an eye out for the inactivity fee, which kicks in after 3 months. However, you just need to log into your account – not necessarily place a trade – to avoid this charge.

This platform is regulated by the UK FCA and offers negative balance protection for all trading accounts. You can get customer support 24/7 by phone or email, and it only takes $100 to open an account.

Pros:

- Video guide for new traders

- Very user-friendly trading platform for web and mobile

- Supports customisable price alerts

- 24/7 customer phone and email support

- Regulated by the UK FCA

Cons:

- Inactivity fee after 3 months

- Technical analysis platform isn’t comprehensive

72% of retail CFD accounts lose money.

6. AvaTrade – Best STP Options Trading Broker

AvaTrade is one of the best STP forex brokers in South Africa for one simple reason: it’s one of the only STP brokers that enables forex options trading. With options trading, you can create complex strategies that hedge your bets as well as speculate on the timing of anticipated price movements in the forex market.

AvaTrade has a dedicated platform for options trading called AvaOptions. It’s impressively comprehensive, offering the ability to quickly analyse profit and loss potential from a wide variety of options strategies. It also includes a number of visualisation tools to help you see how implied volatility is changing over time and how limit orders may change the outcome of your trade.

The brokerage offers options trading and standard foreign exchange trading on 55 currency pairs. In addition, AvaTrade stands out as one of the best high leverage brokers in South Africa because you can trade major currency pairs with 400:1 leverage. Spreads start at just 0.9 pips and there are no commissions for CFD trading.

AvaTrade also offers a number of tools to help you trade forex options. For example, the broker allows you to integrate your trading account with MetaTrader 4 and 5 so that you can build and backtest custom trading strategies. You can also access MQL5, a forex signals service that integrates with the MT4 and MT5 platforms.

AvaTrade is regulated in South Africa by the Financial Services Conduct Authority (FSCA). It’s also regulated in Australia, Japan, and several other countries. Note that in order to open an options trading account, you’ll need a $1,000 (14,000 ZAR) minimum deposit. The broker offers 24/5 customer support by phone, email, and live chat.

Pros:

- Options trading on 55 currency pairs

- AvaOptions platform for options analysis

- Trade forex CFDs with 400:1 leverage

- Supports MetaTrader with MQL5 forex signals

- Regulated in South Africa

- 24/5 customer support

Cons:

- $1,000 minimum deposit for options trading

Your capital is at risk.

7. FXTM – Best STP Broker for Execution Speed

If you’re on the hunt for the fastest STP broker in South Africa, consider FXTM. This broker’s Standard accounts boast an order execution speed of under 125 milliseconds. Even more impressive, Pro accounts can execute orders in as little as 50 milliseconds. Standard accounts require a $100 minimum deposit, while Pro accounts require $5,000.

The broker uses this speed to trade a wide variety of assets. You’ll find CFDs for dozens of forex pairs and hundreds of US and UK stocks, as well as commodities like gold and silver. With a Standard account, you can access leverage up to 2,000:1. Just note that FXTM doesn’t offer trading on cryptocurrencies at this time.

FXTM has its own trading platform called FXTM Trader. We found it to be easy to use and very flexible. We especially loved the interactive dashboard, which enables you to monitor your account balance, open positions, and market movers all at the same time. However, FXTM Trader is only available for mobile devices.If you’re trading on a desktop, you can use MetaTrader 4 or MetaTrader 5 for trading. FXTM offers pivot points analysis, custom indicators, and trading signals, all of which can be important into the MetaTrader platforms. These tools are especially helpful for more advanced traders who want to use the broker’s execution speed to beat the market.

FXTM is regulated by South Africa’s FSCA and CySEC. The broker charges somewhat above average spreads, starting from 1.3 pips. However, there are no commissions for CFD trading with most account types.

Pros:

- STP execution speeds as fast as 50 ms

- Trade forex with leverage up to 2,000:1

- Versatile FXTM Trader app for iOS and Android

- Includes pivot points analysis and forex signals

- Regulated in South Africa

Cons:

- Above-average spreads

- Ultra-fast Pro account requires $5,000 minimum deposit

Your capital is at risk.

8. Tickmill – Best STP Forex Broker in South Africa

Tickmill is one of the best STP forex brokers in South Africa. It offers incredibly fast STP order execution. The brokerage offers over 60 currency pairs and lets you trade with leverage up to 500:1, so it’s particularly ideal for forex trading. Of course, Tickmill also lets you trade stocks, commodities, and more.

The broker doesn’t charge commissions for STP trading. Spreads start at 1.6 pips, so it’s slightly more expensive than competitors in South Africa. However, Tickmill makes up for that by offering trade execution speeds of just 150 milliseconds.

Tickmill also offers a no-deposit welcome bonus of $30, which is a great enticement to try out this brokerage. Any profits you make trading with the bonus money is yours to keep and there’s no risk if you lose the money while trading.

This STP broker offers the MetaTrader 4 trading platform and includes a handful of tools to go with it. For example, you get access to Autochartist to get automated insight into technical charting patterns. You can also take advantage of copy trading with Myfxbook or stay on top of the market with an economic calendar.

Tickmill is regulated in the Seychelles, which doesn’t have the strictest rules around trading. That said, the broker keeps client funds in segregated accounts and is widely considered trustworthy.

Pros:

- Trade 60 currency pairs

- Leverage up to 500:1

- Execution speeds as low as 150 ms

- $30 no-deposit welcome bonus

- Includes copy trading with Myfxbook

Cons:

- Loosely regulated in the Seychelles

Your capital is at risk.

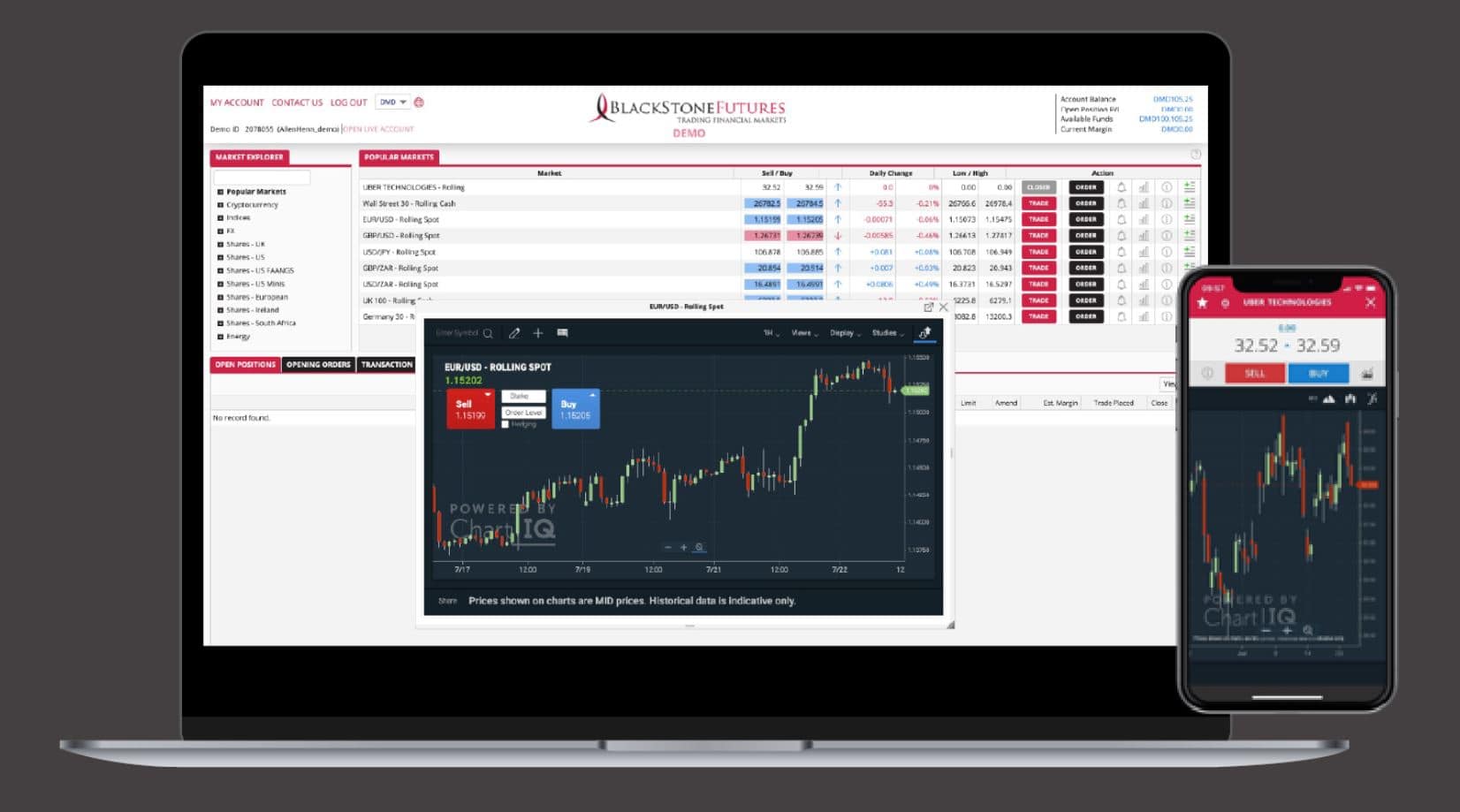

9. Blackstone Futures – Best South African STP Broker

Blackstone Futures is one of the only true STP brokers based in South Africa. For South African traders, that has a few advantages. First, the company is regulated in South Africa by the FSCA. In addition, you can get 24/5 customer support by phone or email from agents within South Africa.

Another reason to use Blackstone Futures is that it’s incredibly affordable. The broker charges no commissions, no deposit fees, and no withdrawal fees. Spreads for forex trading with CFDs start at just 0.6 pips and you can leverage your trades at 400:1.

The broker offers around 750 CFDs to trade, so it’s a diverse selection if not the widest of the platforms we reviewed. One thing that stands out is that Blackstone Futures has a handful of shares from the Johannesburg Stock Exchange, so you can trade companies based in South Africa.

Blackstone Futures offers 2 trading platforms: MetaTrader4 and CloudTrade. CloudTrade is a custom platform built by Blackstone Futures and offers a very comprehensive set of tools. For example, you can use forex signals and apply dozens of technical studies within the platform. We also like that it’s available for both desktop and mobile devices.

Blackstone Futures offers free same-day withdrawals, which makes it easier to control the money in your trading account. In addition, all trading accounts come with negative balance protection. So, you can never lose more than the amount you have deposited in your trading account if a trade goes against you.

Pros:

- Based and regulated in South Africa

- Spreads as low as 0.6 pips

- Trade forex with 400:1 leverage

- Free same-day withdrawals

- Integrates with MetaTrader 4

- 24/5 customer support

Cons:

- Limited selection of assets to trade

Your capital is at risk.

10. Libertex – Top Commodities Trading STP Broker

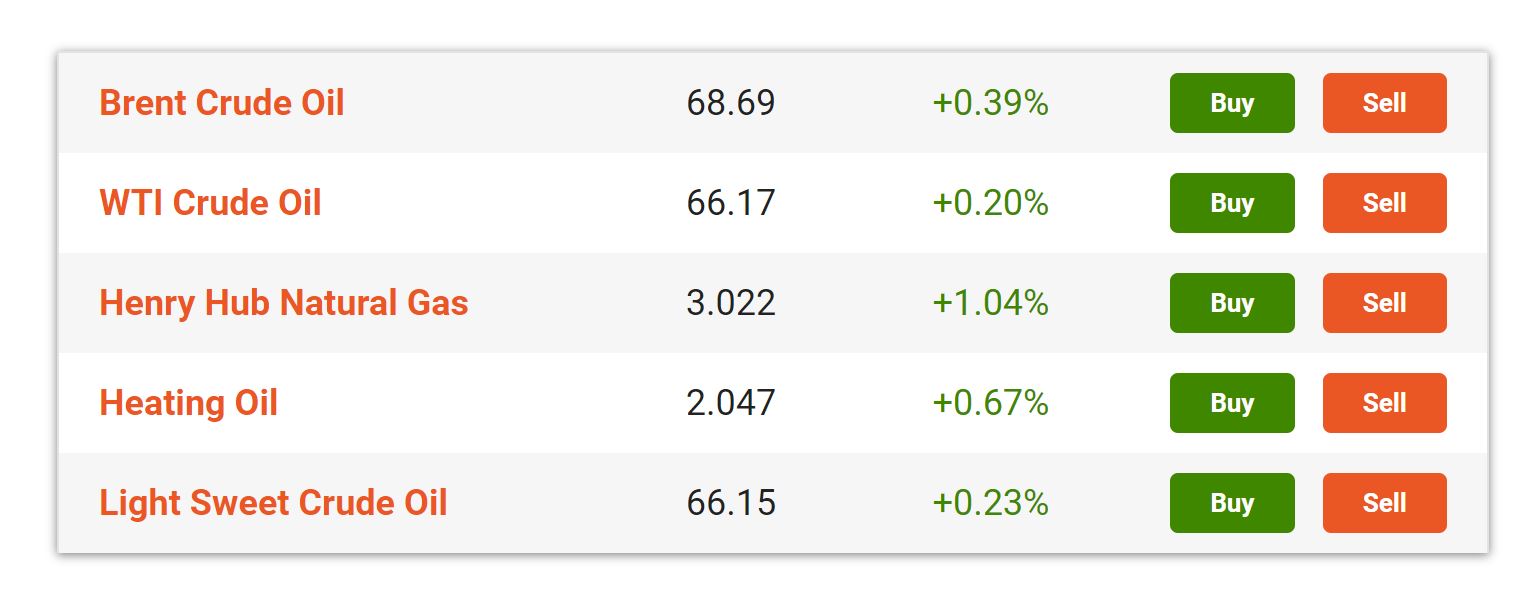

Libertex is another one of the best true STP brokers in South Africa. What stands out first about this platform is that it has a different fee structure than most other STP brokers. Libertex charges commissions that essentially work like a fixed spread. So, you always know what you’re going to pay to trade with this broker.

Libertex doesn’t have as wide a selection of assets as some of the other brokers on our STP brokers list. But the platform does allow you to trade CFDs for 18 different commodities, including Brent and WTI crude oil, agricultural products, and metals like gold and silver. Ultra-fast commodity CFD execution and tight spreads for gold trading make Libertex one of the best brokers for commodity trading in South Africa.

Another nice thing about Libertex is that it offers 3 different trading platforms. You can use the broker’s custom trading platform (for web and mobile) or use MetaTrader 4 or MetaTrader 5. The MetaTrader platforms are widely used by forex and commodity traders and enable you to create your own forex signals for rapid trading.

The Libertex platform is easy to use, especially if you’re new to trading. You can monitor price activity with dozens of technical studies, as well as stay on top of the market with an economic calendar and news feed. Libertex typically executes trades in a fraction of a second, so you never have to worry about delays hurting your profitability.

Libertex is regulated by the Cyprus Securities and Exchange Commission (CySEC). The broker is widely trusted and only requires $10 (135 ZAR) to open a new account. You can pay by credit card, debit card, or bank transfer.

Pros:

- Fixed commissions instead of variable spreads

- Wide variety of commodity CFDs

- Integrates with MetaTrader 4 and 5 for forex signals support

- $10 minimum deposit to open account

- Regulated by CySEC

Cons:

- Limited selection of stock and ETF CFDs

74% of retail investors lose money trading CFDs at this site.

What is an STP Broker?

An STP broker, or straight-thru processing broker, is a trading platform that executes your orders without delay.

At a typical broker, your order has to go through a trading desk or dealing desk. This enables the broker to match your order with other orders coming in from their clients. It’s better for the broker since they can efficiently match orders in-house, but it means that your order execution is slowed down while a match is made.

At an STP broker, there’s no dealing desk. Your order is passed directly to market liquidity pools, where it can be executed instantly. So, STP brokers essentially remove the middleman when it comes to executing your trades.

Benefits of Choosing an STP Broker

The most significant advantage to using an STP broker is that your orders are executed faster than with a traditional broker. Instead of your order being filled in seconds, the best STP brokers can execute your trade in milliseconds. FXTM, for example, offers execution speeds as fast as 50 ms.

That extra speed can be very important if you’re day trading. In a fast-changing market, the seconds it takes to execute your buy and sell orders can mean the difference between a winning and losing trade. STP brokers are especially useful for scalping traders and forex traders, who depend on locking in the price they see when they execute a trade.

Another important benefit to using an STP broker is that your orders will experience less slippage and fewer re-quotes. This is because your broker isn’t giving you quotes based on in-house market making, but rather showing you the current price in a major liquidity pool. So, you can have more confidence when you place an order that the quoted price is the price you’ll receive.

STP Brokers Fees Comparison

Now that you know more about the best true STP brokers in South Africa, let’s see how their fees stack up against one another.

Trade Commission Spreads From Deposit/Withdrawal Fees Inactivity Fees eToro None 1 pip $5 per withdrawal $10 per month after 12 months Libertex From 0.008% None None $5 per month after 6 months Capital.com None 0.8 pips None None Pepperstone None 0.6 pips None None Skilling None 0.7 pips None None Plus500 None 1.0 pip None $10 per month after 3 months AvaTrade None 0.9 pips None $50 per quarter after 3 months FXTM None 1.3 pips None $5 per month after 6 months Tickmill None 1.6 pips None None Blackstone Futures None 0.6 pips None None ECN / STP Brokers

ECN – Electronic Communication Network – and STP brokers have a lot in common. Both pass your orders directly to liquidity pools to speed up your trade execution. In fact, many STP brokers also offer ECN accounts.

That said, there are some differences between ECN and STP accounts at true ECN/STP brokers. ECN brokers allow you to send your trade directly to the market, so your broker doesn’t even have to pass it to the liquidity pool. That means that ECN accounts can often provide even faster order execution than STP accounts.

The downside to ECN trading, however, is that it typically comes with commissions. Whereas most of the best STP brokers we reviewed are commission-free, their ECN accounts charge a commission of up to several dollars per trade.

How to Get Started with a STP Broker

Ready to start trading with one of the best STP brokers in South Africa? We’ll show you how to get started with eToro, which offers a wide range of markets, fast execution, and a built-in social trading network.

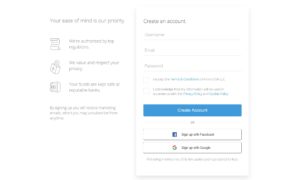

Step 1: Open a Trading Account

To open a new trading account with eToro, head to the broker’s website and click ‘Join Now.’ Enter your email and a new password for your account. You can also sign up using your Google or Facebook login information.

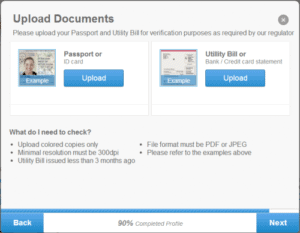

Step 2: Verify Your Identity

eToro requires you to verify your identity before you can start trading. Simply upload a copy of your driver’s license or passport and a copy of a recent utility bill or bank statement that shows your address.

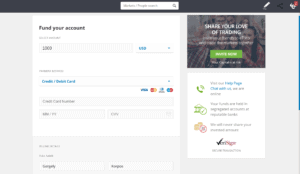

Step 3: Deposit Funds

Next, it’s time to fund your trading account. eToro requires a minimum deposit of $200 (2,800 ZAR). You can pay by credit card, debit card, bank transfer, PayPal, Neteller, or Skrill.

Step 4: Start Trading

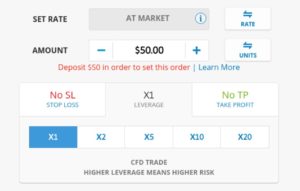

Now you’re ready to start trading with eToro. Search for a stock, currency pair, cryptocurrency, or commodity you want to trade and click ‘Trade’ when it appears in the search menu.

In the order form, enter the amount of money you want to invest. Then you can choose whether you want to use leverage for your order and whether you want to add a stop-loss or take-profit order with your trade.

Once you’re ready, click ‘Open Trade’ to place your order for STP execution.

eToro – Best STP Broker in South Africa 2021

The best STP brokers enable you to trade a wide range of assets with low spreads and ultra-fast execution. For day traders especially, STP brokers can give you an edge on the market and ensure that you’re always receiving the price you see when you place a trade.

Ready to start trading with one of the best STP brokers in South Africa? Click the link below to sign up for an eToro account today!

67% of retail investors lose money trading CFDs at this site

FAQs

What is an STP broker?

STP stands for straight-thru processing. An STP broker sends your orders directly to the market for execution without first holding them at the dealing desk.

Are STP brokers and ECNs different?

STP and ECN trading accounts are slightly different. STP accounts are usually commission-free and require your broker to pass your order to the market. ECN accounts send your order directly to the market, but they usually have a commission.

Do I need an STP broker?

Choosing an STP broker can be important if you are day trading or high-frequency trading. If you have a longer trading timeframe - hours to days - then you may not need an STP broker.

Can I use forex signals with an STP broker?

Most STP brokers in South Africa allow you to trade with forex signals. Check the broker’s trading platform. MetaTrader 4, which many brokers offer, supports signals trading.

How much money do I need to trade with an STP broker?

You don’t need much money to get started with an STP broker. Our top-rated broker, eToro, requires a $200 (2,800 ZAR) minimum deposit. Libertex, another top STP broker, requires just a $10 (140 ZAR) minimum deposit.

Michael Graw

Michael Graw

Michael Graw is a freelance journalist based in Bellingham, Washington. He covers finance, trading, and technology. His work has been published on numerous high-profile websites that cover the intersection of markets, global news, and emerging tech.View all posts by Michael GrawLatest News

Hvordan spille poker og Norgescsino

For tiden er det mange mennesker som ønsker å lære å spille poker og norgescsino. Dette er fordi spillene er veldig morsomme og folk kan få mye penger fra dem. Det er imidlertid et par ting du bør huske på når du skal lære å spille poker og norgescsino. Disse tingene inkluderer RNG, Cashback og...

Lär dig grunderna för kasinobordsspel

Om du har funderat på att prova på kasinot kanske du undrar vilka spel du ska spela. Bordsspel inkluderar Blackjack, Poker och Craps. Om du vill lära dig mer om dessa spel, läs vidare. Här är några grunder om dessa spel. Du kommer att kunna välja det bästa spelet att spela baserat på dina personliga...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

BuyShares.co.uk © 2026.

All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

Pepperstone

Pepperstone

Skilling is one of the top all-around brokers on our STP brokers list for South Africa, and this platform especially stands out for

Skilling is one of the top all-around brokers on our STP brokers list for South Africa, and this platform especially stands out for

If you’re new to CFD trading, Plus500 is one of the best true STP brokers on our STP brokers list for beginners. This platform is very user-friendly and offers a demo account to help you get your bearings. In addition, Plus500 offers an online ‘Trader’s Guide,’ which includes 10 videos designed to teach you the basics of STP trading.

If you’re new to CFD trading, Plus500 is one of the best true STP brokers on our STP brokers list for beginners. This platform is very user-friendly and offers a demo account to help you get your bearings. In addition, Plus500 offers an online ‘Trader’s Guide,’ which includes 10 videos designed to teach you the basics of STP trading.

If you’re on the hunt for the fastest STP broker in South Africa, consider

If you’re on the hunt for the fastest STP broker in South Africa, consider

Tickmill is one of the best STP forex brokers in South Africa. It offers incredibly fast STP order execution. The brokerage offers over 60 currency pairs and lets you trade with leverage up to 500:1, so it’s particularly ideal for forex trading. Of course, Tickmill also lets you trade stocks, commodities, and more.

Tickmill is one of the best STP forex brokers in South Africa. It offers incredibly fast STP order execution. The brokerage offers over 60 currency pairs and lets you trade with leverage up to 500:1, so it’s particularly ideal for forex trading. Of course, Tickmill also lets you trade stocks, commodities, and more.

Blackstone Futures is one of the only true STP brokers based in South Africa. For South African traders, that has a few advantages. First, the company is regulated in South Africa by the FSCA. In addition, you can get 24/5 customer support by phone or email from agents within South Africa.

Blackstone Futures is one of the only true STP brokers based in South Africa. For South African traders, that has a few advantages. First, the company is regulated in South Africa by the FSCA. In addition, you can get 24/5 customer support by phone or email from agents within South Africa.

Libertex is another one of the best true STP brokers in South Africa. What stands out first about this platform is that it has a different fee structure than most other STP brokers. Libertex charges commissions that essentially work like a fixed spread. So, you always know what you’re going to pay to trade with this broker.

Libertex is another one of the best true STP brokers in South Africa. What stands out first about this platform is that it has a different fee structure than most other STP brokers. Libertex charges commissions that essentially work like a fixed spread. So, you always know what you’re going to pay to trade with this broker.